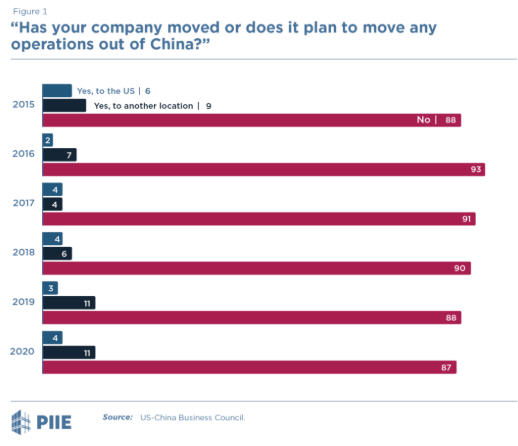

I want to turn to the first slide page two, and begin a discussion about a decoupling in the real economy, that is, in cross-border investment. In some respects, this is the most prominent aspect of decoupling.

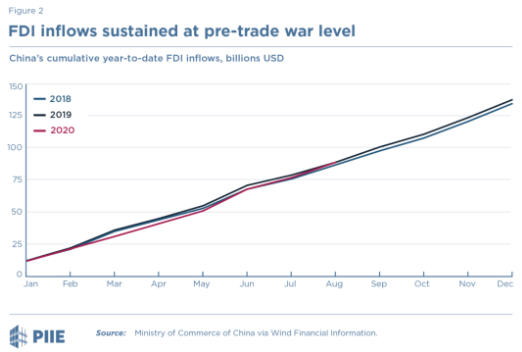

I want to look more broadly at FDI inflows into China. And they also seem to be unaffected by either the bilateral trade war with the United States that began a couple of years ago, or affected by the COVID-19 pandemic. This diagram is a little bit hard to see, because it's showing us year to date in 2018,2019 And 2020.

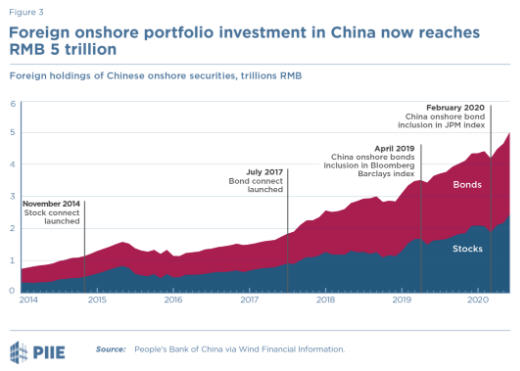

Now, the next diagram, I want to start talking about the second aspect in more detail, and that is, financial integration between China and the rest of the world.

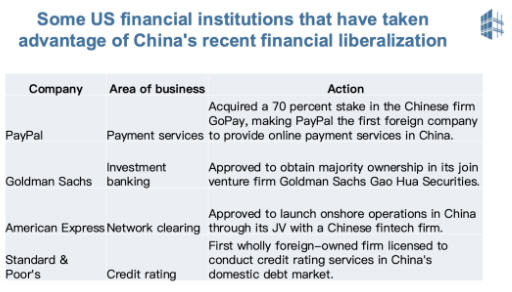

Now for my final slide, the next slide, I want to talk about the institutional reforms that have occurred in China over the last couple of years, that are allowing foreign financial institutions to increase their presence and their role in China's domestic financial market.

未收藏

未收藏