Abstract: Financial opening can improve the efficiency of resource allocation and sustain economic innovation. However, how to keep the economic and financial order stable while expanding the openness is a policy challenge that must be faced. To this end, China is pursuing a "twin-pillar macro-control policy framework" that properly combines monetary policy and macroprudential policy. It is a meaningful attempt.

I. Financial openness should be accompanied by macroeconomic and financial stability

To start with, financial opening is very important to China's economic development. However, we must put in place policies and mechanisms to ensure the stability of our economic and financial systems while we open wider. Financial opening can elevate the economic efficiency, but it could also result in mounting financial volatilities, which may do great harm and even lead to financial crisis if not well contained. We've seen enough of such occasions to understand that the uncertainties should be safeguarded against in the process of financial opening.

Two issues need to be explored in-depth about financial opening.

First, the global financial crisis was preceded by a period of "the Great Moderation" in the global economy, when monetary policies were believed to be effective in maintaining stability in the economic and financial systems. But when we looked back after the crisis, we realized that monetary policies may have only curbed the inflation, but did not effectively contain financial risks. Thus, is remains to be probed into whether monetary policies can maintain both macroeconomic and financial stabilities.

Second, after the breakout of the global economic crisis, many developed countries implemented quantitative easing programmes, which have played an effective role in stabilizing the economic and financial systems of those developed countries. However, many emerging market economies have suffered from the (negative) externalities of these programmes. To explain further, when developed countries implemented quantitative easing programmes, liquidity in the emerging market countries also became abundant. However, while developed countries turned to monetary tightening policies, the monetary policy and economic environment in the emerging market economies also experienced a particularly pronounced contraction which has led to some undesirable results. There is no doubt that China will continue to open up, but how to maintain economic and financial stability in the process of opening up is also a topic worthy of further discussion.

II. Design a policy mechanism combining monetary policy with macroprudential policy

Since 2009, the People's Bank of China has begun to study macroprudential policies. In 2010, the PBoC explicitly proposed "the construction of a counter-cyclical financial macroprudential management system framework" (Zhou Xiaochuan, 2011). In 2019, the PBoC has established the Macroprudential Policy Bureau, and created the synergy between the Monetary Policy Department and the Macroprudential Policy Bureau, to collectively establish and improve a "twin-pillar macro-control policy framework", thus jointly maintaining the macro-economic stability through the combination of two policies. This policy is not unique to China. Many international organizations, including the Financial Stability Board), Bank for International Settlements, and International Monetary Fund, have conducted a lot of research in this area; so does the academia.

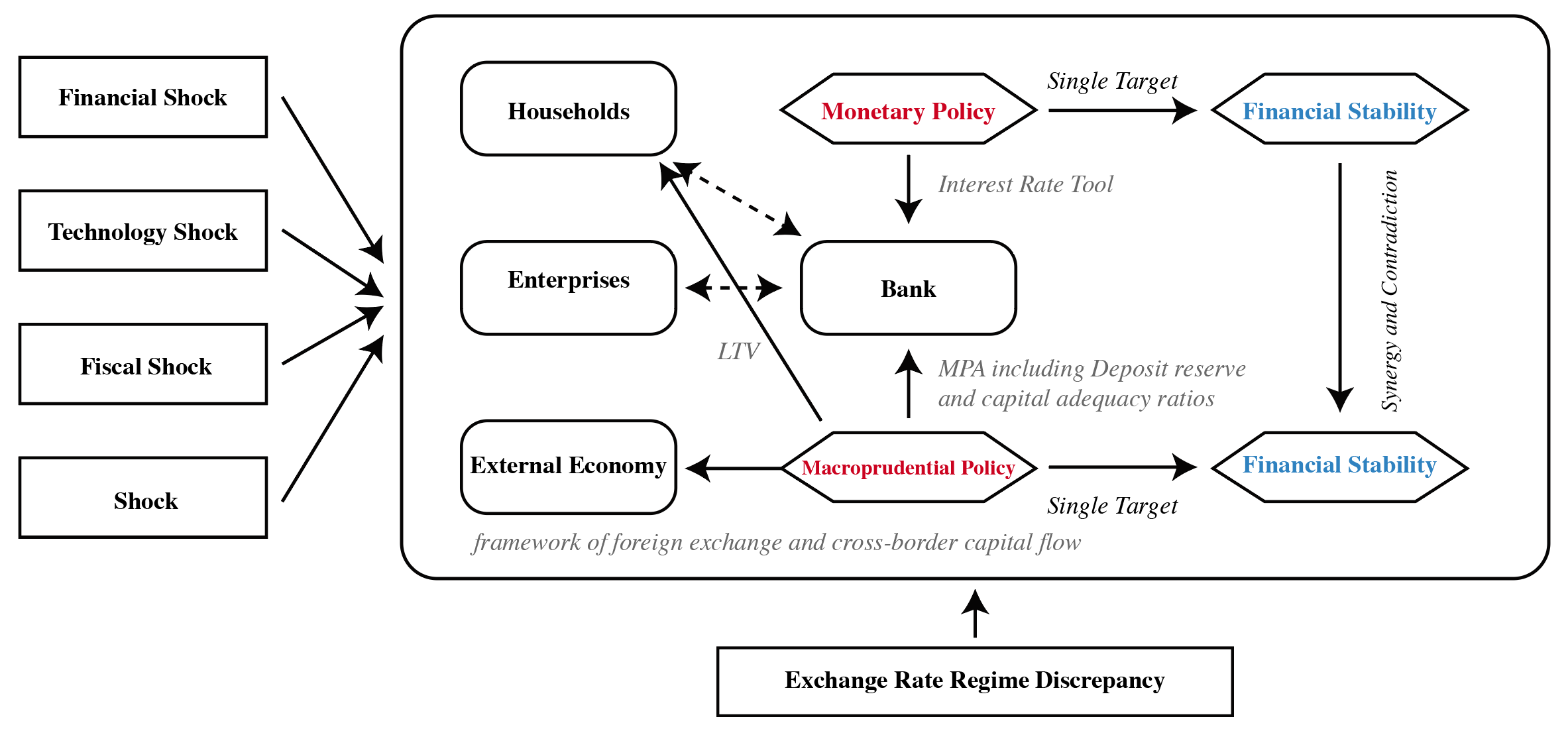

Figure 1: Macro-control Policy Framework with Twin Pillars

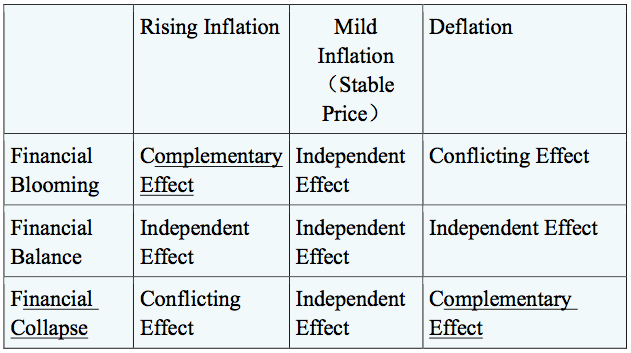

In theory, monetary policy and macroprudential policy can cooperate with each other to contribute to economic and financial development. However, in some scenarios, the roles of the above two policies are not consistent. Therefore, we need them to cooperate with each other as well as work independently. In short, the ultimate goal of both policies is to maintain the stability of macro-economy.

Table 1: Contradiction Matrix of Monetary Policy and Macroprudential Policy

A study I recently participated in was to examine the effects of different policy mechanisms on "sudden stop of flows" (Cao Yujing etc.)[endnote 1], using a two-country dynamic general equilibrium model. We use a simplified model (e.g. China and the United States) to explore the policies that are most conducive to China's economic stability, taking trade and financial channels in foreign exchange into consideration as well. From the perspective of the relative impacts of financial channels and trade channels, trade channels show that currency depreciation can increase exports and output, and is conducive to economic growth. But we gradually find that the importance of financial channels cannot be ignored. Currency depreciation is likely to encourage capital outflows, which will not facilitate domestic economic growth and financial stability. Therefore, in the process of analyzing policy impacts, we need to take the impact of both channels into count.

In addition, we employed an empirical analysis method based on the impulse response function. The background is that after the opening-up of financial markets, the biggest difficulty encountered by many emerging market economies is the "sudden stop of flows." In an open capital market, the inflow and outflow of capital in a country is normal, but sometimes some special events can cause a country's financial risks to rise sharply, capital inflows to suddenly stop, leading to deterioration of balance sheet, eventually triggering a financial crisis. This means we need to properly manage potential risks while being open.

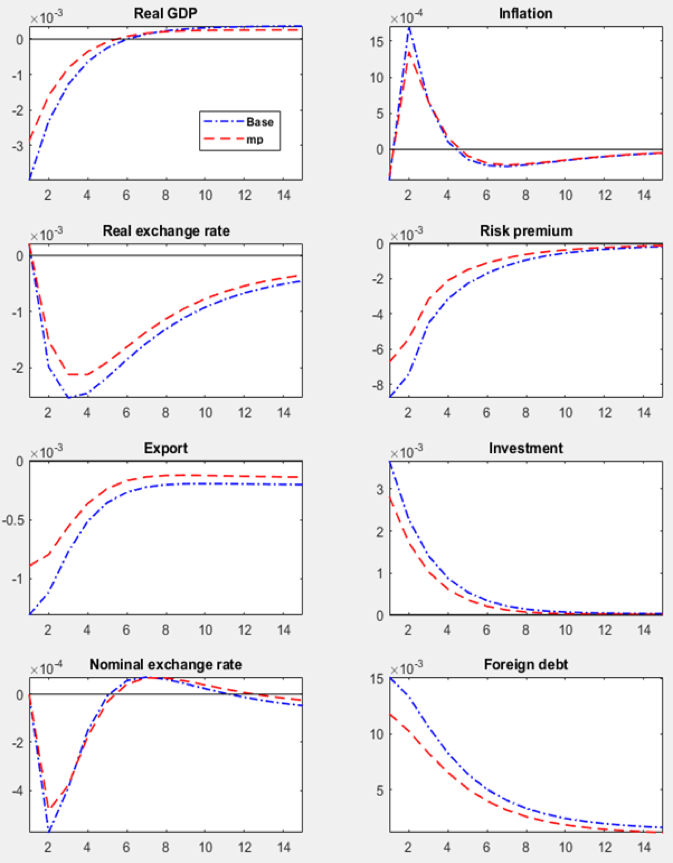

In Figure 2 below, the blue lines represent the change in a range of macro variables in a country when only monetary policy is used to respond to external shocks. The red lines represent changes in the country's macroeconomic variables when monetary policy is combined with macroprudential policy.

Figure 2: Results of Impulse Response Analysis

Source: Cao Yujing, Huang Yiping, Tao Kunyu and Yu Changhua, How Monetary Policy and Macroprudential Policy Support Macroeconomic Stability (2019) has been accepted for publication by Journal of Financial Research.

It can be concluded from the figures that when the inflow of external capital suddenly stops, some domestic macro variables will adjust sharply. Monetary policy can help cushion the adjustment process because it can make countercyclical adjustment. But if we combine monetary policy with macroprudential policy, we can further improve domestic macroeconomic stability. In addition, if China's RMB exchange rate policy shifts from a less flexible fixed exchange rate to a more flexible floating exchange rate, it could further improve macroeconomic stability. In short, while supporting financial openness, a "twin-pillar macro-control policy framework" of monetary and macroprudential policies needs to be designed to maintain macroeconomic and financial stability.

Endnote:

1. Cao Yujing, Huang Yiping, Tao Kunyu and Yu Changhua, How Monetary Policy and Macroprudential Policy Support Macroeconomic Stability (2019) has been accepted for publication by Journal of Financial Research.