Abstract: This paper demonstrates that damaged balance sheets will stifle China’s economic expansion under the influence of multiple factors such as COVID resurgence, asset revaluation in some industries, and the transformation of medium and long-term growth model. By reviewing lessons learned from other countries, the paper points out that when balance sheets are damaged, the economy will face greater and longer-lasting downward pressure, sometimes in tandem with financial crises, limiting the effectiveness of conventional macroeconomic policies. The paper emphasizes the importance to step up counter-cyclical adjustments, and proposes specific policy options against a possible balance sheet recession.

Keywords: balance sheet, fiscal policy, monetary policy

China's economy is facing challenges posed by the COVID resurgence, the war in Ukraine, and the Fed’s accelerated monetary tightening. When coping with these unforeseen developments, previous experience may offer little guidance, nor can we rely on linear extrapolation or the assumption of mean reversion to provide the foundation for formulating macroeconomic policies. At present, impaired balance sheets may have weakened the growth prospect of China's macro economy. To achieve progress and stabilize the economic fundamentals, the macro policy must be imaginative and creative.

Ⅰ. CHINA’S POTENTIALLY IMPAIRED BALANCE SHEETS

Balance sheets are impaired when a large proportion of economic agents experience a significant slowdown or decline in the growth of their assets, with assets not growing as fast as liabilities or even becoming insolvent. The economic agent with an impaired balance sheet will cut its expenditure, invest less, or even deleverage—a behavioral pattern quite different from that of economic agents with healthy balance sheets. Changes in the behavioral patterns of microeconomic agents will also affect the transmission mechanism and effectiveness of macroeconomic policies, making traditional monetary and fiscal policies less effective, and thereby necessitating a more imaginative policy mix.

China’s impaired balance sheets can be explained in several ways:

The prime culprit is the resurgence of the coronavirus. As the pandemic evolves from a temporary setback to a protracted crisis, many economic players find themselves faced with balance sheet problems.

On the one hand, the sectors most directly affected by the pandemic, represented by tourism, performing arts, and contact services, have long had negative cash flow. They could rely on their funds or bank loans in the short term, but when the pandemic persists for a third year, the ongoing cash flow problem has eventually transformed into a balance sheet problem. Many economic agents have already been insolvent.

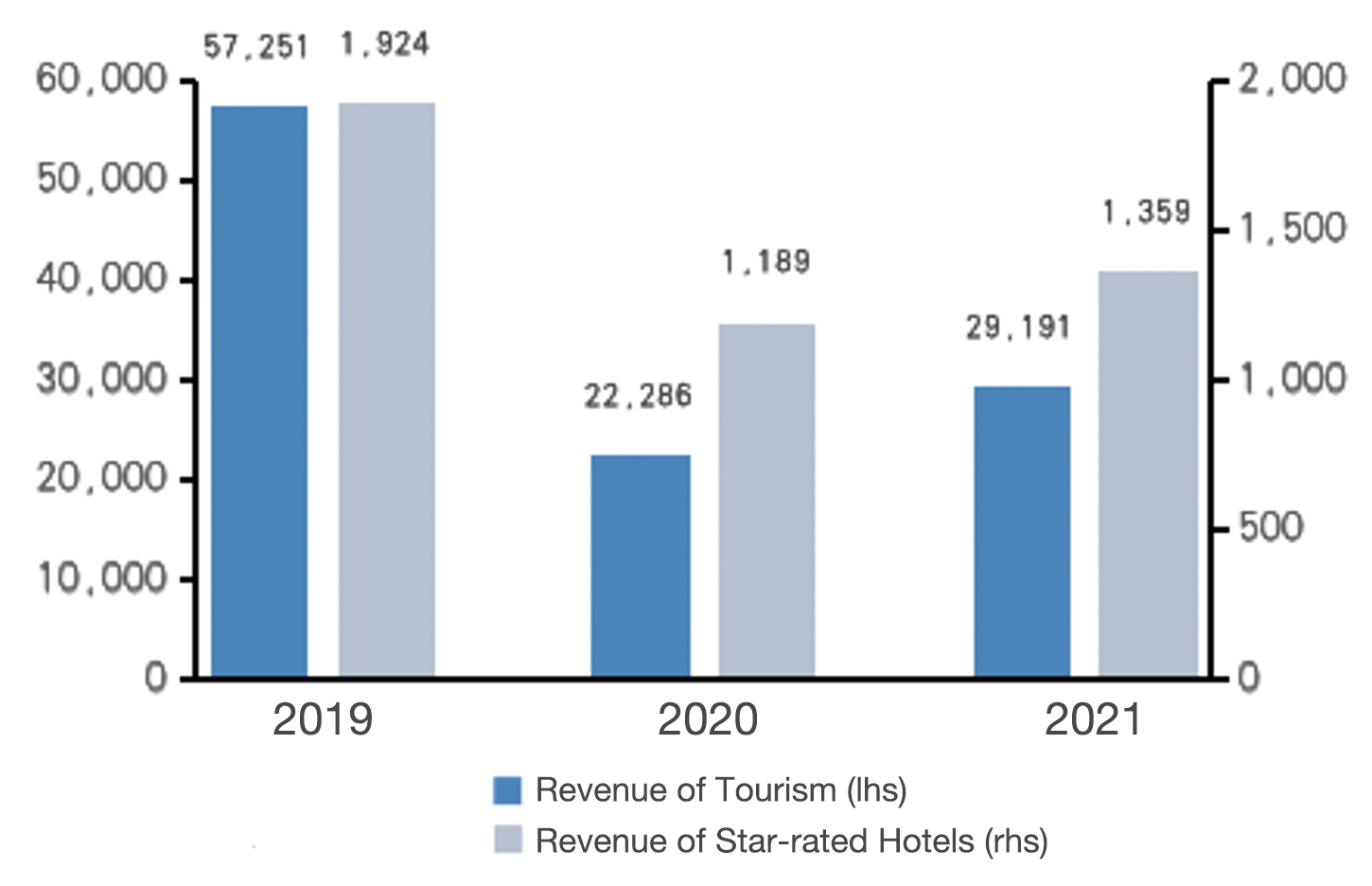

For example, domestic tourism revenue was 5.73 trillion yuan in 2019, and the number was reduced to 2.23 in 2020 and 2.92 in 2021, with revenue in 2021 recovering to only half of what it was in 2019. The operating revenue of star-rated hotels was 192.4 billion, 118.9 billion, and 135.9 billion yuan in 2019-2021, and the rebound in 2021 only brought the figure back to 71% of the 2019 level (Figure 1).

Figure 1: Revenues of tourism and star-rated hotels (100 million yuan)

Source: WIND.

On the other hand, changes to production and lifestyle brought about by the pandemic will be profound and lasting, with remote working, the digital economy, food delivery, and group buying accelerating the replacement of many offline services.

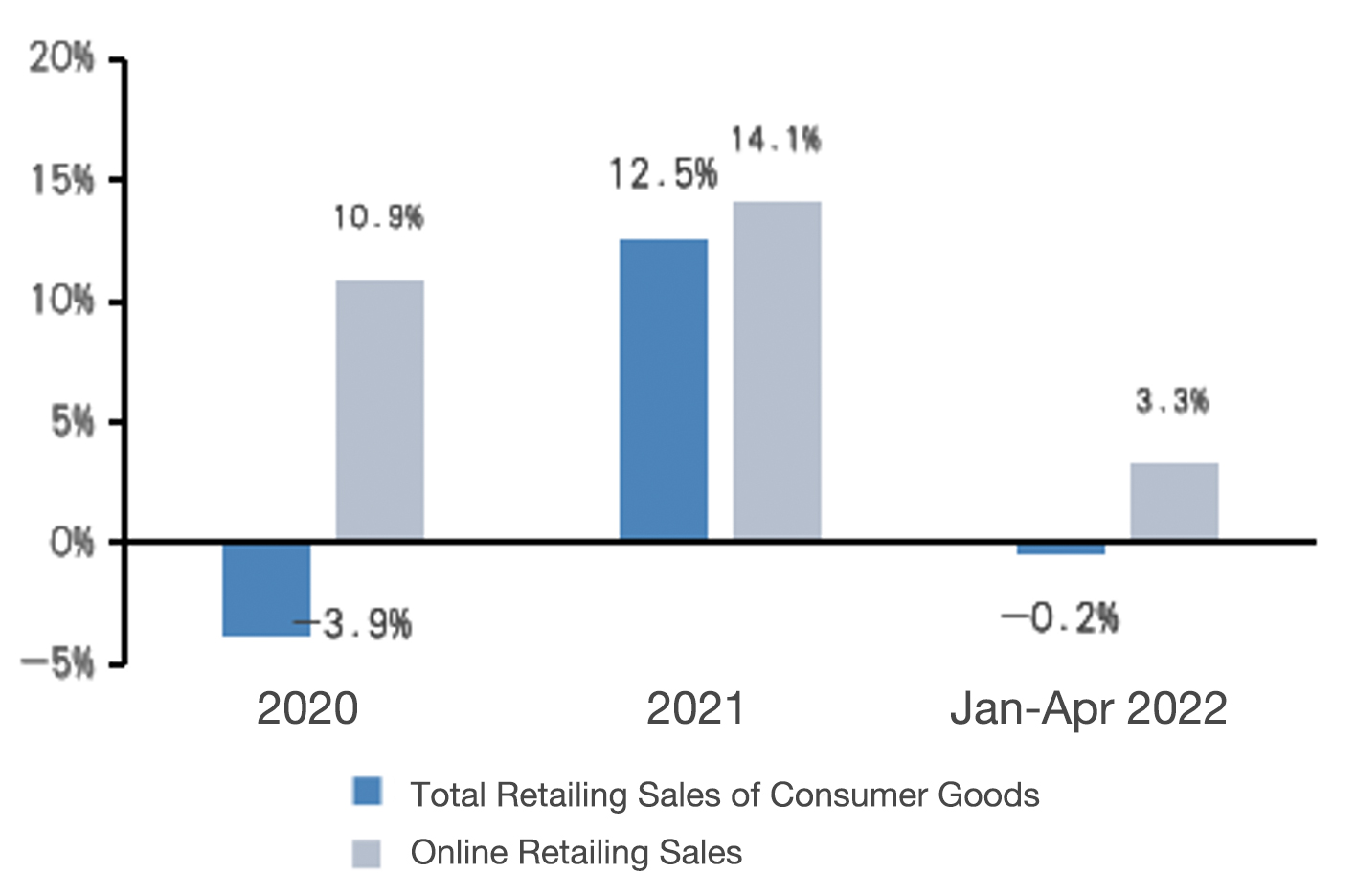

For example, the pandemic has accelerated the shift of traditional retailing to e-tailing. In 2021, total retail sales of consumer goods grew at a two-year average rate of 4.0%, while online retail sales grew at a two-year average of 12.5% over the same period. This trend has continued to date. While the first four months of 2022 saw a total sales growth of -0.2% YoY, online sales went up by 3.3% YoY, of which the share of physical goods rose from 20.7% at the end of 2019 to 23.8% in April 2022 (Figure 2).

Figure 2: YoY growth rate of the total retailing sales of consumer goods and online retailing sales

Source: WIND.

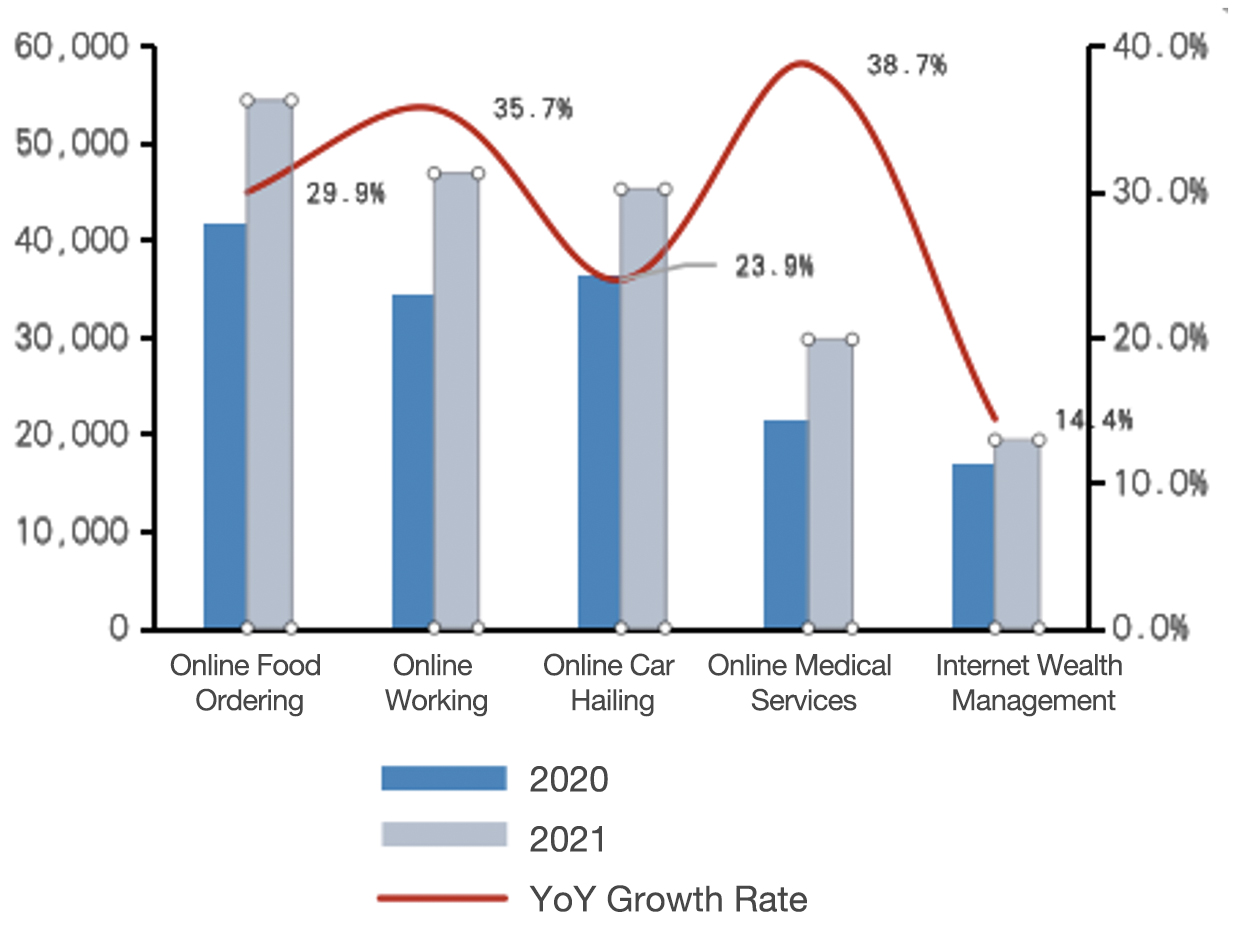

Another example is the significant growth of the online economy. The numbers of users of online food ordering, online working, online car-hailing, online medical services, and internet wealth management respectively reached 544.16 million, 468.84 million, 452.61 million, 297.88 million, and 194.27 million in 2021, representing YoY growth of 29.9%, 35.7%, 23.9%, 38.7% and 14.4% (Figure 3). Even if COVID-19 subsides, it will be difficult to reverse the shift in such business models. Companies unable to keep up with the digital transformation will face immediate balance sheet problems or even collapse. A large reduction in the value of their assets (e.g. commercial real estate) could also affect the balance sheets of other economic agents.

Figure 3: The online economy grows significantly.

Source: The 49th Statistical Report on China’s Internet Development published by China Internet Network Information Center.

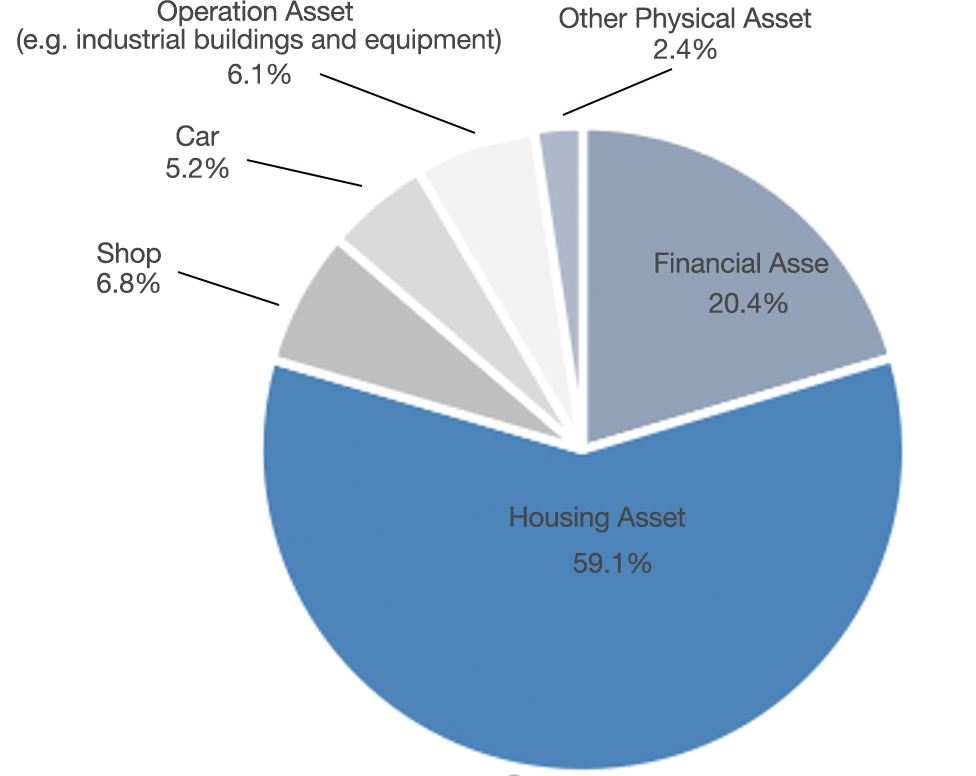

Shifts in development patterns in some key sectors have led to asset revaluations and consequently balance sheet adjustments. Balance sheet shocks from real estate market adjustments have hurt the economy in countries such as the United States, Japan, and Spain. Real estate and land is one of the major asset classes in China, and real estate is the most important way for Chinese households to store wealth. According to the Survey on the Assets and Liabilities of China’s Urban Households in 2019 (hereinafter referred to as “the Survey”) published by the Statistics and Analysis Department of the People's Bank of China (PBC), the share of real estate in household wealth was about 60% in 2019 (Figure 4). The data of China’s national balance sheet, compiled by the Chinese Academy of Social Sciences (CASS), show that housing assets account for about 40% of the total assets of the residential sector in 2019.

Figure 4: Asset Composition of China’s Urban Households in 2019

Source: Survey on the Assets and Liabilities of China’s Urban Households in 2019 published by the Statistics and Analysis Department of the PBC.

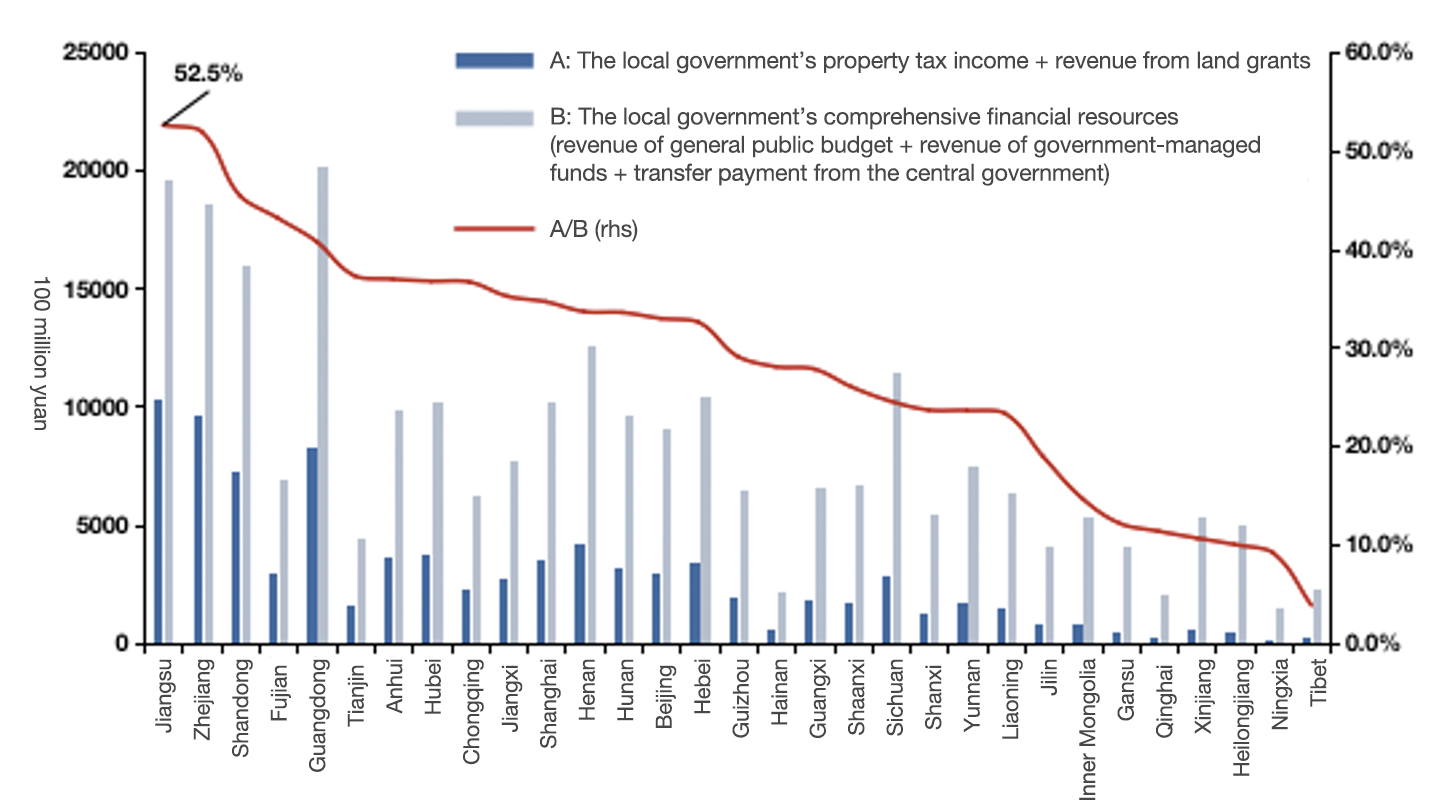

Direct and indirect revenue generated by real estate is also an important source of revenue for all levels of government. In 2020, 16.2% of tax revenue 2020 came from the real estate sector and over 90% of land grant revenue came from real estate land grants. The combined revenue from taxation and land concessions related to the real estate sector nationwide accounted for 36% of the combined general public and government fund budget revenue. The rate of dependency on the real estate sector for financial resources was estimated to be above 30% for nearly half of the provincial (municipal) governments in 2019. Two provinces, Jiangsu and Zhejiang, had a rate exceeding 50% (Figure 5).

Figure 5: The dependence of provincial governments’ comprehensive financial resources on real estate development in 2019

Sources: Provincial fiscal authorities.

Notes on Estimation: (1) As land grant revenue derived from the sales of land use rights for real estate development is not available in any province, considering that land for real estate use contributes over 90% of land grant revenue, the land grant revenue in each province is all considered to be real estate-related here. (2) As Inner Mongolia, Shanxi and Tibet did not disclose their land grant revenue in 2019, their revenue is estimated by multiplying the provincial revenue of government-managed fund in 2019 by the proportion of national land grant revenue in the national government-managed fund revenue (85.9%).

In addition, because many firms consider real estate property and land as important high-quality assets, they have become the main forms of collateral and the credit base for China's financial sector. As a result, the adjustments that have occurred in the real estate market over the past year will not only affect the balance sheets of real estate companies, but also those of governments, households, and businesses.

In recent years, China has toughened regulation on internet platforms and private education industry to curb monopoly, ensure data security and strengthen financial regulation, aiming for more stable and sustainable development of these industries. However, the crackdowns also changed the market's expectation of the growth prospects of these industries, which was reflected in the stock prices of the companies. For example, the Hang Seng Technology Index, which contains the stocks of many Chinese platform companies, retreated by more than 60% from its high point in February 2021; the private education stocks retraced by more than 90%, well above the average level of contraction in the stock market. Rapidly shrinking assets combined with liabilities incurred based on previous growth assumptions have led to a drastic deterioration of the balance sheets in these sectors, similar to what would happen when a stock market bubble bursts.

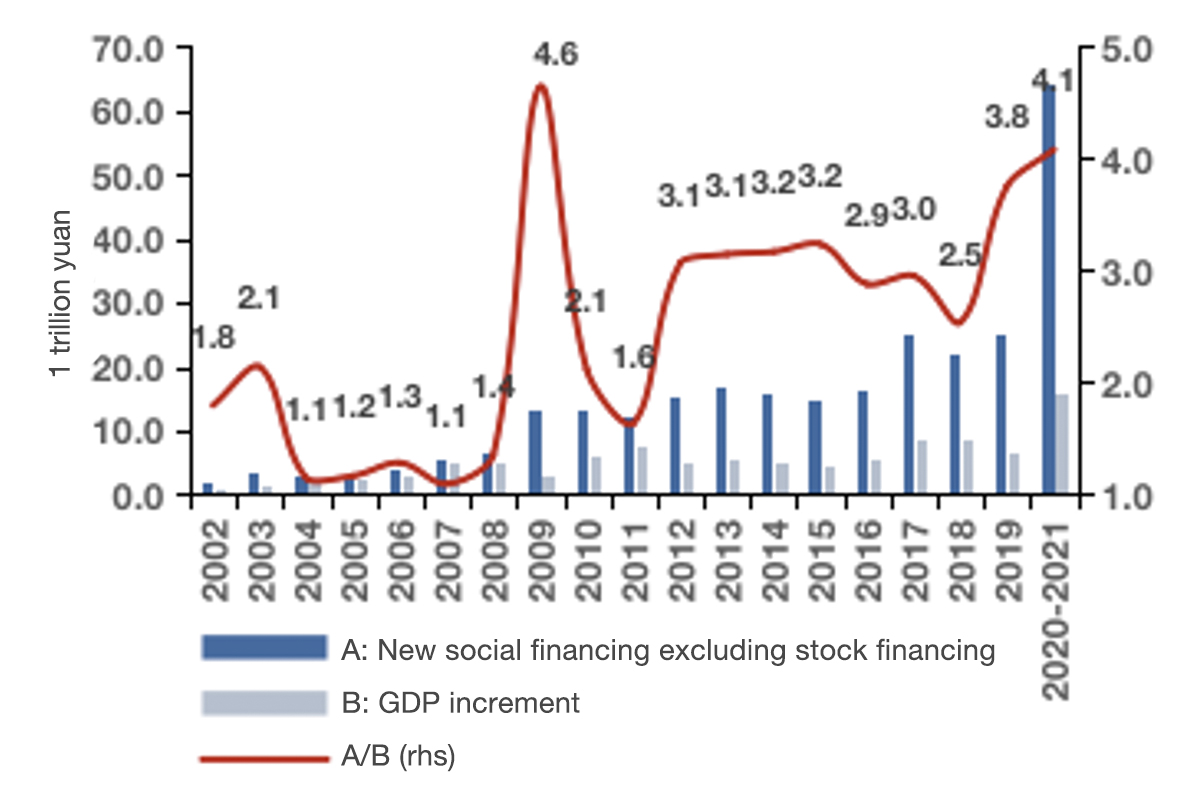

A balance sheet adjustment occurs when the medium to long-term growth pattern shifts. China's economic growth has shifted from a high-growth to a high-quality growth phase, but debt continues to drive the country's growth, therefore the debt growth rate remains high. A basic indication is the rise in debt per unit of GDP increment. Before the global financial crisis, each additional yuan of GDP required only a little more than 1 yuan of new debt funding. In response to the global financial crisis, China adopted an expansive fiscal and monetary policy in 2009, when a one-yuan rise in GDP necessitated 4.6-yuan new debt financing. The per-unit demand for debt stabilized at roughly 3 yuan once macroeconomic policies returned to normal in 2010-2011, more than twice the level before the global financial crisis. However, the two-year average increased to 4.1 yuan due to the COVID-19 shocks in 2020-2021 (Figure 6). There is a possibility that this figure will rise further in 2022.

Figure 6: Debt needed for per-unit GDP increment

Source: WIND.

Because of the change in the growth model, debt accumulated early on based on overly optimistic predictions may have payback issues. The debt load that future revenue and cash flow can support may not be as large as in the past, which means that many entities will have to deleverage.

It is the combination of the above factors that impaired the balance sheets of China’s business, household, and government sector.

In terms of corporate balance sheets, according to the above analysis, companies with at least one of the following three characteristics are likely to face balance sheet impairment: 1) hit by the pandemic, 2) undergoing a profound change in growth model, and 3) excessively indebted with limited grow potentials.

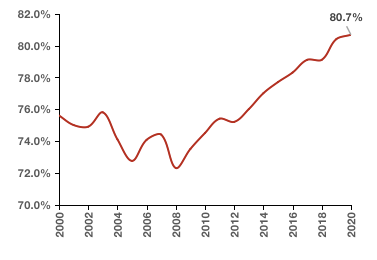

The real estate sector has all three of these characteristics, and that is why many developers are facing serious balance sheet problems. According to the National Bureau of Statistics, debt in the real estate sector rose rapidly after 2010, with the debt-to-asset ratio reaching 80.7% in 2020 (Figure 7).

Figure 7: Debt-to-asset ratio of China’s real estate developers

Sources: WIND; CF40 Macroeconomic Policy Report for Q1 2022 authored by Zhang Bin et al.

The ratio of listed developers (A-shares and Hong Kong-listed companies whose main business is in China’s mainland) was the highest among all non-financial sectors in 2020, at 79.3%, 6.2 percentage points higher than the second-ranked capital goods sector and 17 to 40 percentage points higher than other sectors (Figure 8).

Figure 8: Debt-to-asset ratio of China’s listed sectors

Sources: National Bureau of Statistics, China; CF40 Macroeconomic Policy Report for Q1 2022 authored by Zhang Bin et al.

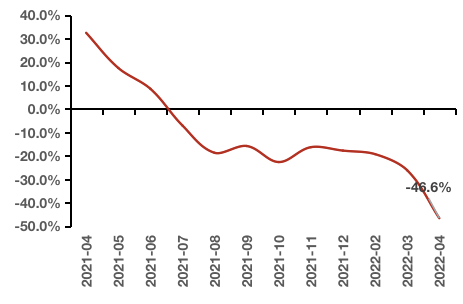

What’s more, the real estate sector could have large off-balance-sheet debts. The sector has entered an in-depth adjustment of growth model since 2021. From April 2021 to April 2022, the MoM growth rate of commercial house sales fell from 32.5% to -46.6%, a drop of almost 80 percentage points (Figure 9). A significant number of developers have defaulted on substantial debts, if not on the verge of it. On December 3, 2021, China’s Evergrande Group declared default on 1.65 billion yuan worth of outstanding debts. Data show that a total of 26 offshore US dollar bonds of 14 real estate companies were in material default in 2021. According to the Shanghai Commercial Paper Exchange, 968 real estate companies as note acceptors had delayed payments more than three times in the previous six months as of the end of Q1 2022, including the well-known Shimao Group and Sunac China. In China, impairment to the balance sheet is not limited to the real estate sector, although developers suffer the most and have a broader impact.

Figure 9: MoM growth rate of commercial house sales

Source: National Bureau of Statistics, China.

There has not been a balance sheet problem for China’s households, as the high savings rate keeps the assets higher than liabilities on average. According to the balance sheet data compiled by CASS, the total assets of China’s residential sector were close to 575 trillion yuan and the total liabilities were about 62 trillion yuan in 2019, resulting in a positive net asset position of 513 trillion yuan. The Survey reports a 9.1% average debt-to-asset ratio.

Although there are no problems in the average sense, it does not mean that there are no problems for certain groups. The debt ratio of China’s lower-income households is high, and they are also more vulnerable to the pandemic’s economic fallout. According to the PBC, in 2019, the average debt-to-asset ratio of the indebted households among low-asset households (with assets of less than 100,000 yuan) was 111%; their household assets could not cover their debts. According to A Report on China Household Leverage Ratio and Consumer Credit Usage by the Southwestern University of Finance and Economics, in 2019, the total debt-to-income ratio of households with the lowest income was 1140.5%. Such debt risks cannot be ignored.

For most Chinese households, real estate property and human capital (and their future income) are the most important assets. Housing market corrections substantially dampened expectations for continued appreciation of house values. The resurgence of the pandemic and its economic impact, rising unemployment rate, and adjustments in certain industries added to the uncertainties of family income and necessitated a reassessment of households’ future income flow. Under the combined effect of these changes, household assets will no longer grow as they did in the past, if not decline. Accordingly, households must adjust their liabilities, either by borrowing less or reducing existing debts. It has been proved in recent data: in Q1 2022, China’s household leverage ratio was 62.1%, a decrease of 0.1 percentage points from the previous quarter; medium and long-term household loans increased by 1.07 trillion yuan, down 46.0% (910 billion yuan) YoY; in April, medium and long-term loans dropped by 31.4 billion yuan, a decrease of 523.2 billion yuan YoY.

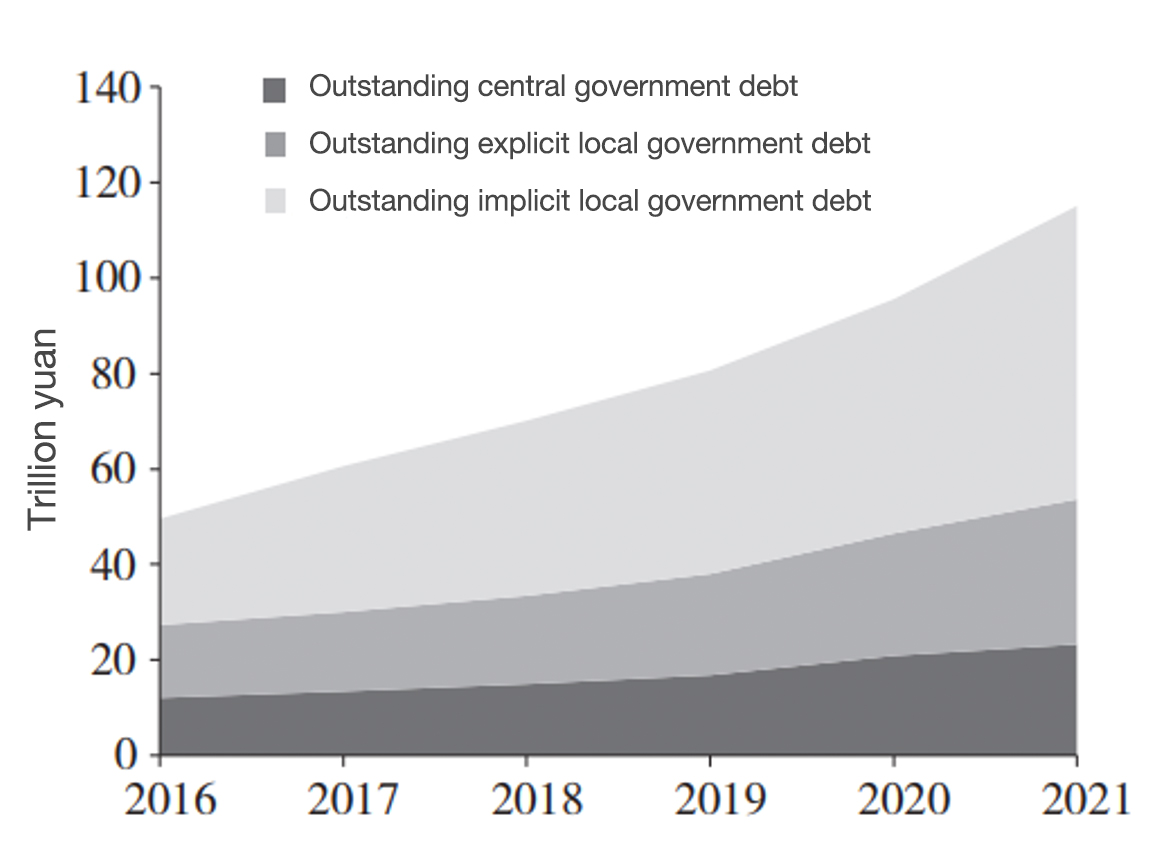

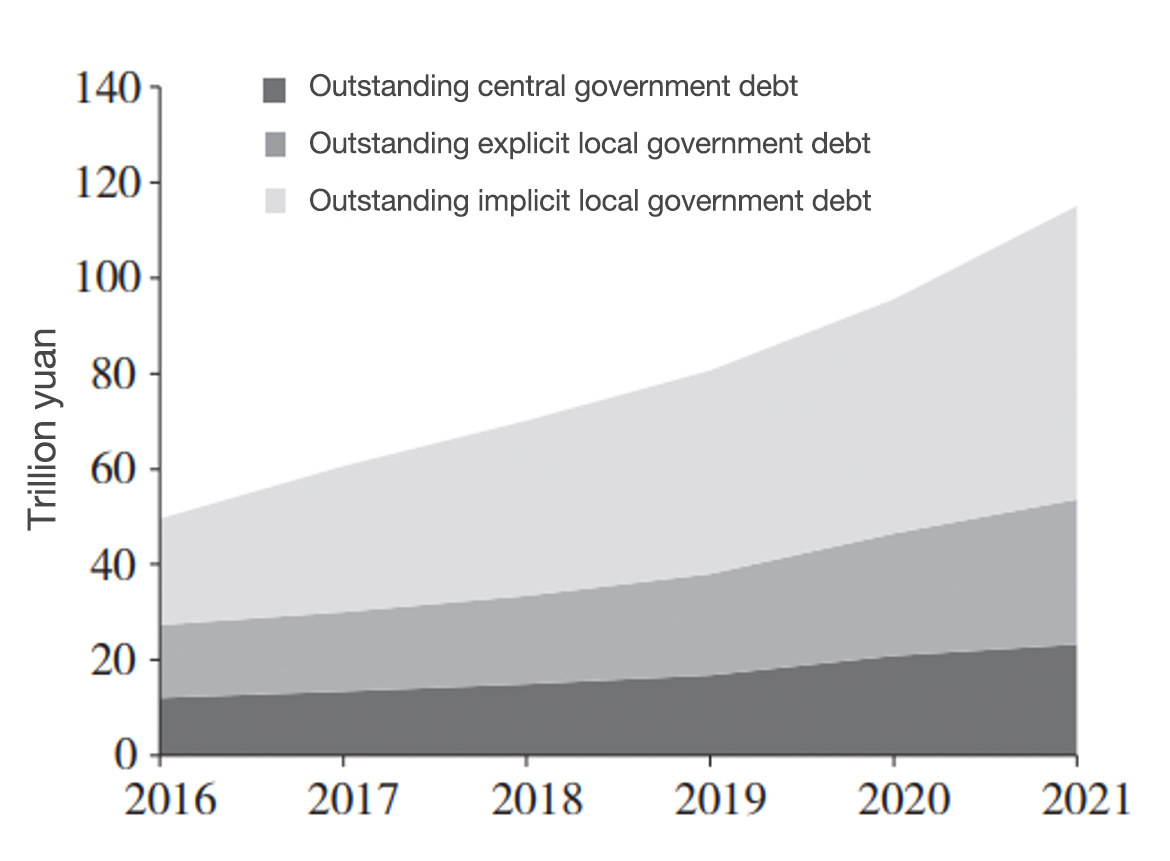

In terms of government balance sheets, the outstanding explicit debt of governments of all levels in 2021 (including central government bond, local government general bond, and local government special bond) stood at 53.7 trillion yuan, with a debt ratio of 47%; in addition, based on the IMF’s estimate, if we take into account the implicit local debt that the government is obliged to repay or take responsibility for (61.4 trillion yuan in 2021), the debt ratio would be 100.7%.

Specifically, the central government still had a relatively low debt ratio and the scale of its debt was 23.3 trillion yuan, representing 20.2% of the total government debt (including implicit debt) and 20.3% of China’s GDP.

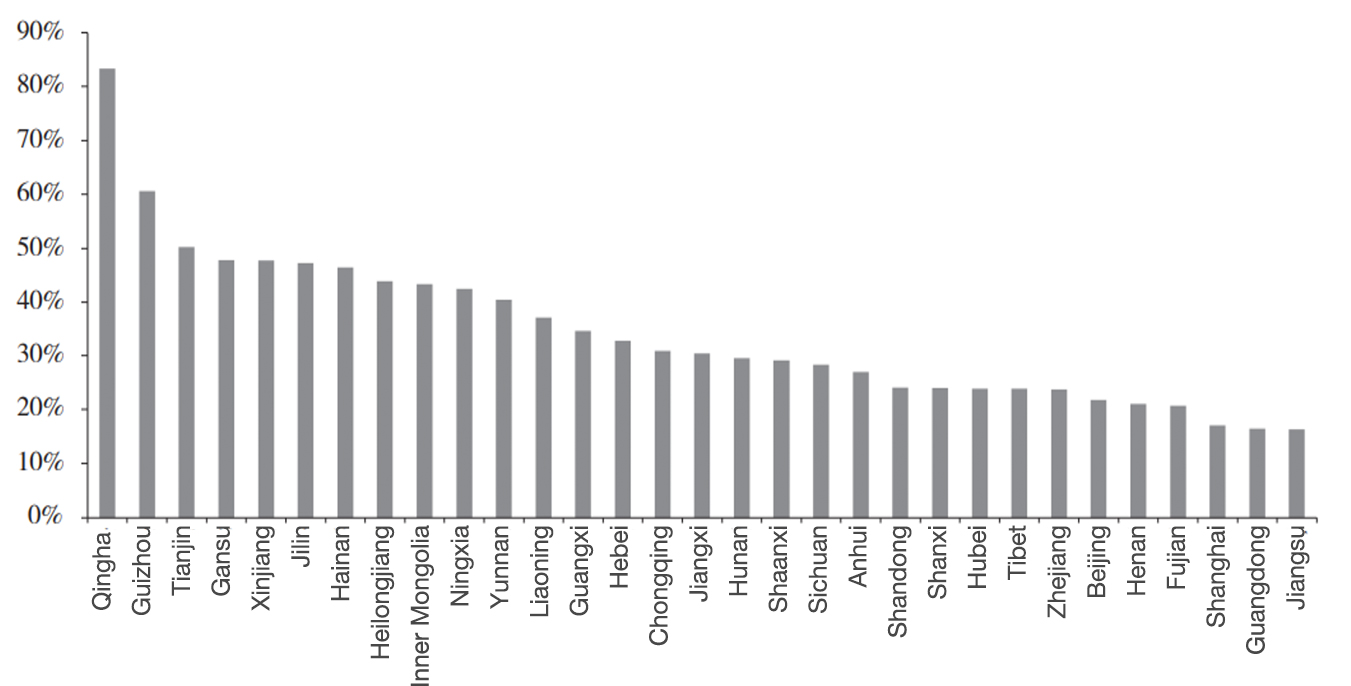

The balance sheets of local governments, however, are more imbalanced. On the one hand, local government debt, including implicit debt, may exceed 90 trillion yuan, equivalent to 80% of China’s GDP (Figure 10). Even if implicit debt is excluded, many local governments already had high levels of indebtedness. For example, the explicit debt ratio of Qinghai, Guizhou, and Tianjin governments in 2021 stood at 83.3%, 60.6% and 50.2% respectively (Figure 12).

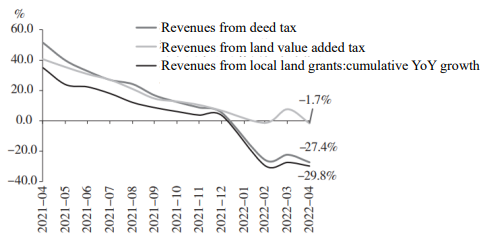

On the other hand, due to the impacts of the economic downturn and the correction of the real estate market, the revenue of local governments has declined sharply, while the need to maintain government spending remains strong, which might further widen budgetary deficits. The combined revenue from taxes on the real estate sector and land grants accounts for about 36% of combined revenue from general public budget and government-managed fund budget. The downward trend in the real estate sector has brought huge negative impacts on government revenue. From January to April 2022, deed taxes and value-added taxes, which are closely related to the transactions of real estate properties, witnessed a cumulative YoY fall of 27.4% and 1.7% respectively; land grant revenue of local governments dropped by a cumulative 29.8% YoY (Figure 11).

Meanwhile, as government spending cannot be reduced randomly, the declining revenue from the real estate sector will pose a greater challenge to the already strained balance sheet of local governments. Take the debt service expense of local government general bonds included in the general public budget as an example. In 2021, revenues in the general public budget of Qinghai Province and the Tibet Autonomous Region could not even fully cover the debt service expense of general bonds; the debt service expense of general bonds accounted for 88.7% of the general public budget revenue of the Ningxia Hui Autonomous Region. After taking into account central government transfers, more than half of the provinces still spent over 10% of their general public budget revenues (provincial revenues + budgetary transfers from the central government) on servicing general bonds; the percentage is the highest for Ningxia, Qinghai, Inner Mongolia, and Liaoning Province, at 30.3%, 25.4%, 23.5%, and 21.5%, respectively.

Figure 10: Outstanding government debt between 2016 and 2021

Sources: Ministry of Finance (explicit central government and local government debt); the International Monetary Fund (implicit local government debt).

Figure 11: Monthly cumulative YoY growth rate of revenues from deed tax, land value added tax, and local land grants

Sources: Ministry of Finance; National Bureau of Statistics.

Figure 12: Explicit government debt ratio by provincial-level administrative regions, 2021

Sources: Ministry of Finance; National Bureau of Statistics.

In sum, due to the impacts of multiple factors, the balance sheets of a large proportion of businesses, some households, and many local governments are impaired in various degrees. If a considerable number of microeconomic agents suffer balance sheet damage, their behavior will have implications on the macro economy. Lessons from other countries show that, on the one hand, microeconomic agents would reduce their spending to pay down debt, thus causing a contractionary effect on the macro economy; on the other hand, the role of conventional macroeconomic policies is limited in response to the recession triggered by balance sheet issues.

II. LESSONS FROM BALANCE SHEET RECESSIONS OF OTHER COUNTRIES

Given the macro impact of and response to impaired balance sheets, it is necessary to review the lessons learned from other countries’ balance sheet recessions.

The concept of balance sheet recession was put forward by economist Richard Koo in 2003. The name derives from an accounting equation of balance sheet: assets = liabilities + equity. If asset prices fall below the value of the debt, then the equity must be negative, meaning the business or household is insolvent. To regain solvency, the business or household must increase savings. A balance sheet recession is a particular type of recession attributed to severe balance sheet impairment of businesses and households that forces them to save more while consume and invest less to pay down debt and deleverage.

In contrast to balance sheet recession is the concept of ordinary recession. An ordinary recession is triggered by fluctuations in supply or demand, which is a part of the regular economic cycle. In an ordinary economic recession, businesses and households are not insolvent on their balance sheets. Whether they raise or reduce debt, and leverage or deleverage, it is considered normal economic decisions influenced by factors like interest rates. In a balance sheet recession, as assets are worth less than liabilities, microeconomic agents have no choice but to pay down debt and deleverage while the effect of factors like interest rates is not important anymore.

A typical cause of balance sheet recessions is the bursting of asset bubbles after excessive borrowing. It usually starts with an excessive borrowing of businesses and households, which is then invested in a certain type of asset (the most common one in history is real estate as well as stocks), leading to a surge in asset prices and the formation of asset bubbles. After the bubbles burst, prices of assets held by businesses and households shrink significantly below the value of debt. The insolvent businesses and households thus have to increase savings and reduce spending to pay down debt, thereby driving the economy into a recession.

In recent years, the most typical examples of balance sheet recessions occurred in Japan after the bursting of the real estate bubble in 1990 and the US after the subprime mortgage crisis in 2007. Both of the balance sheet recessions are caused by the bursting of the real estate bubble after excessive borrowing. After the bubble burst in Japan in 1990, commercial real estate prices plunged by 87% from the peak, and housing prices dropped by around 50%. After the outbreak of the 2007 subprime mortgage crisis, housing prices in the US fell by around 20%. The bursting of the real estate bubbles in Japan and the US turned the value of many businesses and households’ assets from positive to negative, resulting in a typical balance sheet recession.

The damage caused by a balance sheet recession is far greater than an ordinary recession, and thus is harder to cope with. It is characterized by:

Long duration. The duration of a balance sheet recession depends in principle on how long it takes for businesses and households to repair their balance sheets. The sharper fall of asset prices and higher levels of debt, the more time it takes to repair the balance sheet, which could make the recession last for years. The Japanese recession after 1990 is generally considered to have lasted for about 15 years. After the 2007 subprime mortgage crisis, although the US economy had started to recover since 2009, the recovery remained weak for years.

Accompanying financial crisis. The deteriorating asset prices and asset quality, and economic recession coupled with credit crunch due to deleveraging will put huge pressure on the financial sector. Historically, countries that experienced balance sheet recessions tended to witness an accompanying financial crisis. In 1990, Japan experienced a banking crisis. In 2007, the US encountered a shadow banking crisis. Balance sheet recession and financial crisis often come together and reinforce each other.

Deep recession. To repair balance sheets, businesses and households will slash spending to increase savings, which will sharply reduce the aggregate demand and trigger a deep recession. The accompanying financial crisis will further exacerbate the depth of the recession. As the recession and financial crisis can reinforce each other, without a strong and appropriate policy response, the depth of the recession can be close to that of the Great Depression. In fact, Richard Koo believes that the Great Depression is a balance sheet recession triggered by the bursting of the stock market bubble.

Failure in the traditional transmission mechanism of monetary policies. Traditionally, monetary policies affect changes in the following way: the central bank eases monetary policies (lowering interest rates or increasing the base money supply) to expand credit in the financial system and raise liabilities of businesses and households, which pushes up aggregate demand and realize economic recovery. During a balance sheet recession, the transmission mechanism cannot take effect. The reason is that when insolvent businesses and households need to pay down debt to repair their balance sheets, a loose monetary policy would not persuade them to borrow more even if interest rates are extremely low. In addition, debt repayment by businesses and households is a process of credit contraction, or a process of reducing balance sheets from the real economy to the financial sectors.

From the above review, it can be seen that when balance sheets are impaired, conventional macroeconomic policies, especially monetary policies, are not adequate to cope with the downward pressure on the economy, and an economic downturn triggered by improper response will have severe long-term fallouts.

III. MACROECONOMIC POLICIES IN THE FACE OF IMPAIRED BALANCE SHEETS

Currently, China’s macro economy is likely to experience a weak expansion in the face of balance sheet damage, and the recent lack of momentum in credit growth is an obvious manifestation. Under this circumstance, not only a strong counter-cyclical adjustment is needed, targeted and creative policy should also be adopted based on the actual state of impaired balance sheets. Only in this way can we achieve a steady growth and stabilize the fundamentals of the economy.

The role of conventional macroeconomic policies in counter-cyclical adjustment should be given full play to deal with the short-term downward pressure on the economy.

First, a proactive fiscal policy is needed to increase spending and deficit levels. The sudden resurgence of the pandemic this year is a natural disaster that was not anticipated when the budget was formulated at the beginning of the year, so it is necessary to arrange new funds to deal with the shock. Basically, it is recommended to increase the scale of expenditure by about 1 trillion yuan on the basis of the existing budget, and target the expenditure to low-income groups, and businesses and households that have been most severely affected by the pandemic to increase the income of the residential sector, boost consumption, and stabilize aggregate demand. Considering the limited fiscal space of local governments, the central government is suggested to issue additional government bonds and special government bonds to fill in the fiscal gap. Only by stabilizing the economy can the deficit ratio and debt scale be prevented from plummeting. Therefore, this year, China should adopt a more pragmatic attitude towards the deficit ratio and debt scale.

Second, as for a prudent monetary policy, it is necessary to adopt aggregate tools such as lowering interest rates. There is still room for interest rate cuts by 100-200 basis points, which should be boldly exploited as the economy is facing serious downward pressure. Cutting interest rates can serve multiple purposes: first, reducing financing costs, marginally increasing financing demand, and boosting total demand; second, reducing interest expenditure of the whole society by more than 2.5 trillion yuan when interest rate is lowered by 100 basis points; third, supporting the prices of various assets and alleviating the risk brought by balance sheet recession. China used to adopt a rather prudent monetary policy, which leaves more room for the introduction of policy tools amid emergency situations. When the economy is stabilized, more monetary tools will be available for use.

Targeted policies need to be devised to deal with the damaged balance sheets. Balance sheet recessions are essentially a fallacy of composition, and there is nothing wrong with companies and households repairing their balance sheets, but the aggregate macro result is a collapse in demand and a contraction in credit in the entire economy. At present, only the balance sheets of the central government and central bank are relatively healthy and have the room for maneuver. Faced with the needs of enterprises, households and local governments to repair their balance sheets, it is necessary to check whether the central finance and the central bank have policy tools to respond. Discussed below are a number of the fiscal and monetary policy options, some of which are conventional tools and many are unconventional. Unconventional tools are bound to be controversial and come with side effects. They are listed here for discussion only.

First, the central government should take the initiative to repair the impaired balance sheets. The following policy design should be considered: First, increase leverage. When companies and households are reducing debt, the government needs to increase leverage appropriately to avoid a rapid decline in aggregate demand and leverage ratio. The second is to replace and restructure existing local debts. While strictly following fiscal discipline, it is necessary to reduce the existing debt burden and interest expenses of some local governments. The third is to take on losses. The shock brought by the COVID-19 pandemic is similar to natural disasters. If the related losses are borne by microeconomic agents, it will be too heavy for many enterprises and households to bear. The balance sheets of low-income households in some Western countries have improved after the pandemic outbreak. This phenomenon and the policy behind it deserve more research. The fourth is to inject capital. In the case of a damaged balance sheet, many institutions will be short of capital. Timely capital injection with fiscal funds can reduce risks and avoid passive deleveraging. The fifth is to acquire non-performing assets and debts of enterprises as well as financial institutions, provided that they have affected macro stability.

Among the mentioned policy options, the more conventional practice is to increase leverage, which can be introduced without much delay. China has some experience in replacing and restructuring existing local debts, and is recommended to further improve the policy design and operational procedures so as to put them into use when needed. Practices such as undertaking losses, injecting capital, and acquiring non-performing assets and debts can be highly controversial, and may encounter many problems when put into practice. However, these measures have been adopted by a number of countries during the pandemic and financial crisis. Their experience can be adopted and adapted in preparation for an expeditious rollout when the need arises.

Second, the central bank should turn to unconventional tools in the face of balance sheet damage. Traditional policy tools and transmission mechanisms can hardly deal with a balance sheet recession, but this does not mean that the central bank has its hands tied. To repair the balance sheet, the central bank has to adopt extraordinary policy tools. Generally speaking, there are three kinds of policy tools to use. The first is tools that help maintain asset prices. For example, the central bank purchases assets directly or encouraging financial institutions to do so. The second is tools to help reduce debt. The central bank can buy some of the debt of other sectors. The third is the practice where the central bank expands its balance sheet to repair the balance sheet of other sectors. During the global financial crisis, the Federal Reserve acquired a large number of non-performing assets of financial institutions by establishing the special purpose vehicle (SPV) and injected liquidity at the same time. In essence, this is a practice where the central bank increases its own balance sheet so as to repair the balance sheet of financial institutions. These unconventional monetary tools may be more controversial than fiscal policy, and the side effects are also obvious. But it usually takes less time for monetary tools to take effect than fiscal policy. As for China, the PBC once helped repair the balance sheet of commercial banks at the expense of its own balance sheet. Foreign central banks can also provide some lessons for China to learn from. It is necessary to plan ahead so that such tools can be rolled out promptly when needed.

It must be pointed out that the above-mentioned fiscal and monetary policies cannot work alone, and coordination between the two is strictly necessary. Without the coordination of the central bank, fiscal policy will fall short because of the crowding-out effect; in the absence of corresponding fiscal policy, many unconventional monetary policies will be difficult to implement.

The third is to strengthen the resilience of the financial system to prevent the occurrence of systemic risks. Lessons can be drawn from foreign countries that a balance sheet recession can be devastating when it is accompanied by a financial crisis. This is usually because the balance sheet problems of the real economy are transferred into the financial system, and the financial sector magnifies risks due to reasons such as a high leverage ratio and insufficient capital. Once a systemic financial risk occurs, it will in turn seriously affect the operation of the real economy. Financial risks are usually more complex, more likely to spillover to other sectors, and more costly to deal with. Therefore, an important work in the future is to prevent the risk from transferring to financial institutions, resolve any problems that occur with financial institutions in a timely manner, and ensure healthy balance sheets of financial institutions.

The fourth is to establish a market-oriented clearing mechanism under the rule of law. Not all businesses can survive when balance sheets are damaged. Now a large number of zombie companies have hindered market clearing, and long-term stagnation will be the price of short-term stability. China should learn lessons from Japan and establish a market-oriented clearing mechanism under the rule of law so as to dispose of troubled assets of enterprises and financial institutions.

The fifth is to stabilize medium and long-term policy expectations. Currently, some assets are being revaluated, a phenomenon that is mainly caused by shaken market confidence. Increased uncertainty has made investors feel less optimistic about future growth prospects. In fact, the economic fundamentals for medium and long-term development have not changed. Providing more stable medium and long-term policy expectations will help reduce uncertainty, thereby boosting confidence and unlocking growth potential. When the value of assets is restored, the damage to the balance sheet will be substantially repaired.

This working paper was first published by the New Finance Review on June 1, 2022.