Abstract: Successful economic growth entails two major economic structural transitions, from agricultural to industrial and then to a service-based economy. At the stage of industrialization, economic growth highly depends on capital accumulation; after the peak of industrialization, economic growth relies on human capital accumulation through better education, health care, and social security, more open market, stronger stimulus mechanism, and more specialized division of labor. China can learn a lot from other advanced economies that have experienced similar structural transitions and industrial policy transformations. However, China is facing a tougher geopolitical environment. The author suggested that China should minimize the impacts of geopolitical conflicts while adopting some interim arrangements to help the industrial transition.

I.SUCCESSFUL ECONOMIC GROWTH ENTAILS TWO ECONOMIC TRANSFORMATIONS

The ultimate purpose of formulating industrial policy is to serve industrial development. With the constant changes in industrial structure, industrial policy needs to be adjusted accordingly so that it can better serve industrial development.

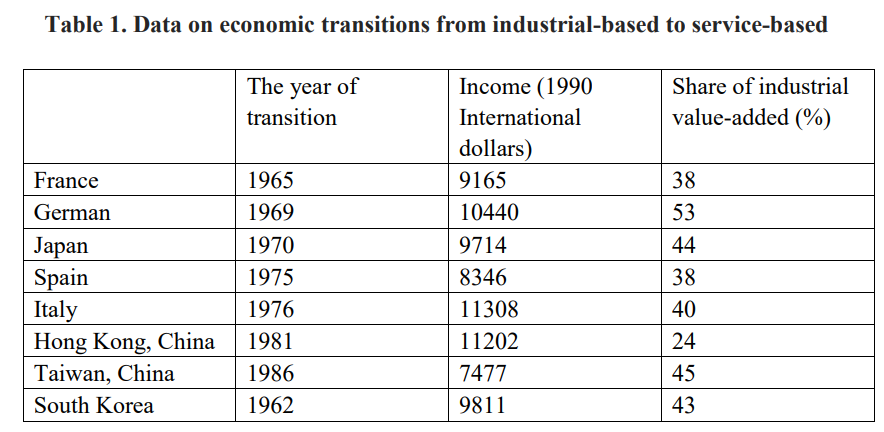

Successful economic growth entails two major structural economic transitions. The first transition is from an agricultural economy to an industrial economy, and the second transition is from an industrial-based to a service-based economy. Based on other countries’ experience, the second transition in many countries shows a highly similar pattern: the structural transition from industry to service begins to take place when a country's per capita income reaches the threshold of 8,000-10,000 international dollars, and the industrial value-added/GDP share reaches a peak of about 40 percent.

In terms of timing, Western European countries and Japan were the earliest to transition from an industrial-based to a service-based economy after World War II, with per capita income close to 10,000 US dollars and the share of industrial value-added hitting 35-40% in the late 1960s and early 1970s; in the mid-1970s, Southern European countries like Italy and Spain began to transition; in the 1980s, Hong Kong and Taiwan of China started the process; in the 1990s, South Korea embarked on the journey. From the late 1960s and early 1970s to the early 1990s, many successful economic growth underwent such transitions.

China's structural transition from a manufacturing-based to a service-based economy took place around 2012. Various data, including China's per capita income, the share of industrial value-added, the share of employment in the industrial sector, and the share of service sector consumption show that this transition occurred at the end of the first decade of the 21st century, which is around 2010-2012.

The changes in the share of industrial value-added and the highest share of manufacturing value-added corresponding to China's structural transition are consistent with those of the European countries, Japan, South Korea, and Taiwan of China, so are the changes in the income level and the industrial structure, and drivers of the transition: the starting point of the shift of economic activities from industry to services is to better serve people’s life and to better satisfy the upgrading of consumption and industry.

II.AT THE STAGE OF INDUSTRIALIZATION, ECONOMIC GROWTH HIGHLY DEPENDS ON CAPITAL ACCUMULATION

At the stage of industrialization, especially at the peak of industrialization, the important driving force of economic growth is to learn from the advanced countries regarding new management experiences, technological levels, organizational patterns, and division of labor. A very important way of learning is through investment or capital accumulation. Capital is the most scarce factor in the industrialization stage. The process of capital accumulation not only brings capital but also imports large quantities of machinery, equipment, and technology, which is also a learning process; in other words, investment not only leads to higher capital (K) but also boosts total factor productivity (TFP), thereby bolstering economic growth.

The gap between developing and developed countries is mainly in sectors such as agriculture, industry, and construction. In terms of the "learning through investment" method to support economic growth, there is greater room for TFP improvement in these sectors, which are more tangible ones and relatively easy to learn from.

Whether it is Europe or East Asia, successful industrialization has all been supported by government-led industrial policies. Because the most important factor of industrialization is capital, countries in Europe and East Asia adopted many industrial policies at the peak of industrialization from the 1950s to the 1970s. These policies mainly include the formulation of development plans, credit rationing, and restrictions on the import and export of some commodities so that limited resources could be used in the industrial sector and infrastructure to promote domestic investment and capital accumulation and improve technological capacity and productivity. These policies might be regarded as distortive at that time, but experience shows that successful economic growth after World War II was invariably accompanied by industrial policies that supported investment and industrial development in the early stage.

III. ECONOMIC GROWTH NOW RELIES MORE ON HUMAN CAPITAL ACCUMULATION AS INDUSTRIALIZATION PASSED ITS GOLDEN PERIOD

The focus of economic activities has shifted to the service sector as industrialization passed its golden period, at which stage the marginal contribution of "learning from investment" to economic growth has gradually declined. Economic growth now has relied heavily on the accumulation of human capital, or in other words, the intangible but most relevant elements in human capital, such as knowledge and management skills.

Human capital accumulation is different from physical capital accumulation, requiring support from more complex systems. It is only with human capital accumulation that better education, medical care, sports, recreation, and culture can become available to meet the needs of consumption upgrading, and higher-quality scientific research, business services, and intellectual property protection to meet the needs of industrial upgrading. In short, both consumption and industrial upgrading rely more on human capital than on capital itself.

Market research shows that the toughest difficulties facing manufacturing enterprises and the biggest constraints to their upgrading are insufficient protection of intellectual property rights, inadequate support for technological research and development, and difficulties in obtaining venture capital. The key to these difficulties does not lie in the manufacturing or industrial sector but in the service sector. Therefore, it is crucial to improve the quality of services for industrial development.

As economic growth relies more on human capital accumulation after the peak of industrialization, industrial policy has to go through adjustments accordingly. Efforts can be made in the following four ways to accumulate human capital,.

One is to provide better education, health care, and social security, focusing on the people themselves;

The second is to open the market wider. Only through more open markets can we learn more from foreign countries and participate deeply in the international divisions of labor;

The third is to offer stronger incentives. Traditional credit financing tools can hardly achieve innovation; it is crucial to develop capital markets;

Fourth, to form a finer division of labour and specialization. Only a market environment with fair competition allows for a finer division of labour and specialization, which is an important source of knowledge and innovation.

With regard to industrial policy, history can teach us many lessons. The industrial policy adjustments made by Europe, Japan, and many of the successful economies mentioned earlier have commonalities, such as: eliminating economic development plans and reducing or even lifting government subsidies; lowering tariffs and non-tariff barriers, and promoting trade and investment liberalization; decreasing foreign exchange market intervention, and encouraging financial liberalization; implementing anti-monopoly measures, and enhancing fair market competition; boosting basic scientific research and education, and formulating scientific development plans, etc. Instead of investing more resources to directly support the development of the industrial sector, efforts have been shifted to strengthen fair market competition at the level of institutional improvement so as to better fit in the new environment.

IV. TWO SUGGESTIONS FOR CHINA’S ECONOMIC TRANSFORMATION AND REFORM OF INDUSTRIAL POLICY

China has continued to promote economic structural transformation and industrial policy reform over a long period of time. Currently, there are both good news and bad news for China. The good news is that China is embarking on a path that many countries, including Europe and Japan, have traveled before. Hence we could learn from the experience of other economies. The bad news is that China is facing a severe geopolitical condition. The aforementioned countries have also encountered some geopolitical conflicts, but not as big as the current one facing China.

As an economist, I would like to propose two suggestions:

First, we should control the impacts of geopolitical conflicts and minimize the implications of geopolitical risks.

Second, the process of transforming the economic structure and industrial policy might not be very smooth. When the development of the capital market is not sufficient to support equity investment, it is necessary to cautiously consider whether to exit the fiscal support for high-risk projects with long-term investment value. If there is an established and developed venture capital market like the United States, exiting the government financial support may not have any impact because there are enough risky assets in the market willing to participate in the investment; however, at present, China's capital market is not mature enough, and there is no definitive answer to how the government should decide. During the transition stage, a vacuum in industrial policy may not be the best, and some temporary arrangements may be needed to help realize the policy transition.

This is the speech made by the author at the Panel the New Role and Outlook of Industrial Policies of the 14th CF40-NRI Finance Roundtable Exploring the Post-Pandemic Economic Growth and Cooperation of China and Japan on July 1st, 2023. It is translated by CF40 and has not been reviewed by the author. The views expressed herewith are the author’s own and do not represent those of CF40 or other organizations.