Abstract: Regardless of the type of measures, consensus on key issues, such as the reasons for the rapid growth of debts in the past and the asset quality of the local government debts, should come first, and clear ideas and solutions should be developed. Only in this way will local government debt risks be resolved. It is better to solve local government debt problems sooner rather than later. Once the opportunity is missed, the local government risk may escalate to a systemic risk.

I. CHINA’S LOCAL GOVERNMENT DEBTS CONTINUE TO EXPAND

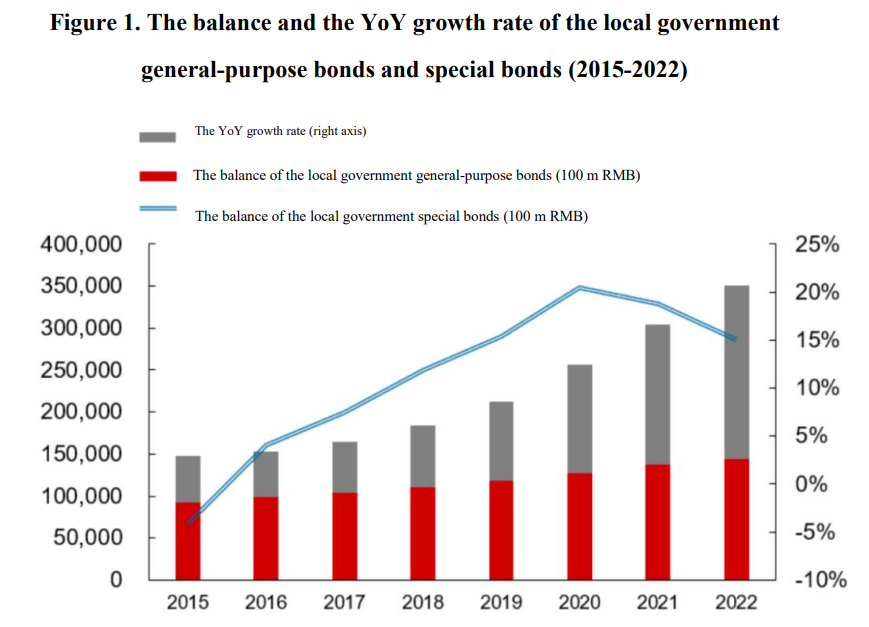

Since 2015, China’s local government debts have continued to increase, with local government special debt as the major source of growth. At the end of 2022, the balance of general-purpose bonds was 14.39 trillion yuan, and the balance of special bonds was 20.67 trillion yuan, a total of about 35 trillion yuan, up 55.4% and 276.2%, respectively, over 2015. In particular, since 2019, the year-on-year growth rate has maintained above 15%, three times the GDP growth rate. Moreover, the balance and the growth rate of local financing platform debt are impressive.

What is worth pondering here is that if an economy relies mainly on substantial debts for economic growth, then, on a side note, the endogenous power of its economic growth is declining. In this case, do we need to set a high economic growth target?

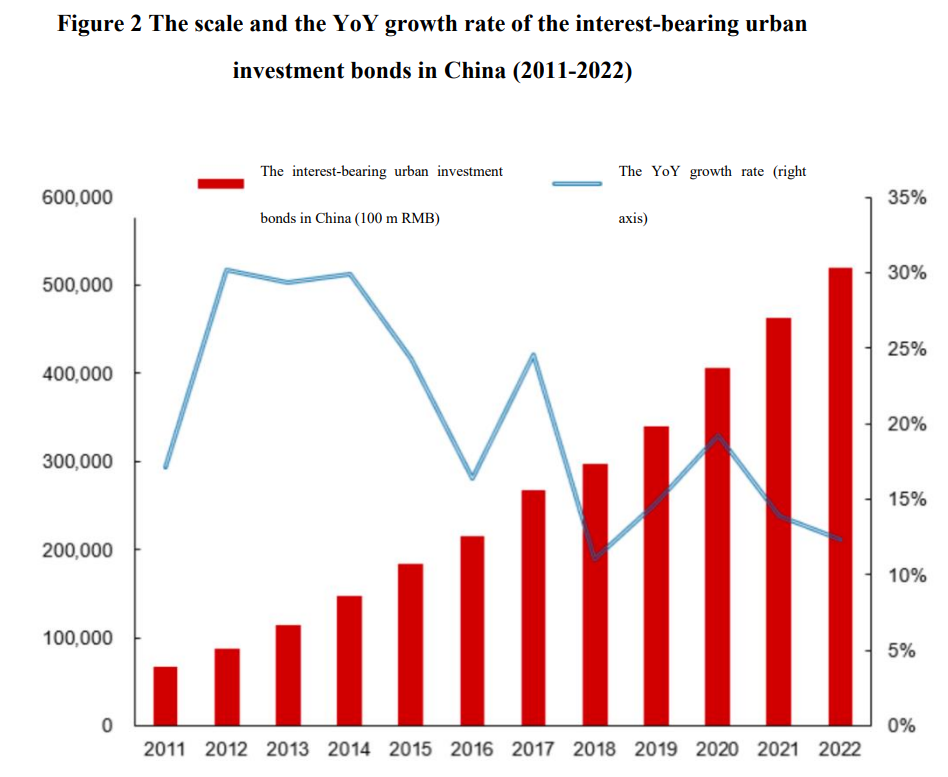

Furthermore, the scale of China’s interest-bearing urban investment bonds is expanding rapidly, with an annual growth rate of over 10%. At the end of 2022, the interest-bearing urban investment bonds in China totaled 51.96 trillion yuan, an increase of 6.7 times over 6.8 trillion yuan in 2011. It is difficult to secure an accurate estimate of the scale and the growth rate of interest-bearing debt. Still, based on the estimates of various investment institutions, the overall scale was not small.

The decline in manufacturing and real estate investments has increased the pressure on local government debt service

From a macro perspective, the rapid and significant expansion of local government debts reveals an old and long-standing problem, namely, the mismatch between the ministerial power and the financial power, specifically, the fact that the local government’s financial capability is weak while institutional power is strong.

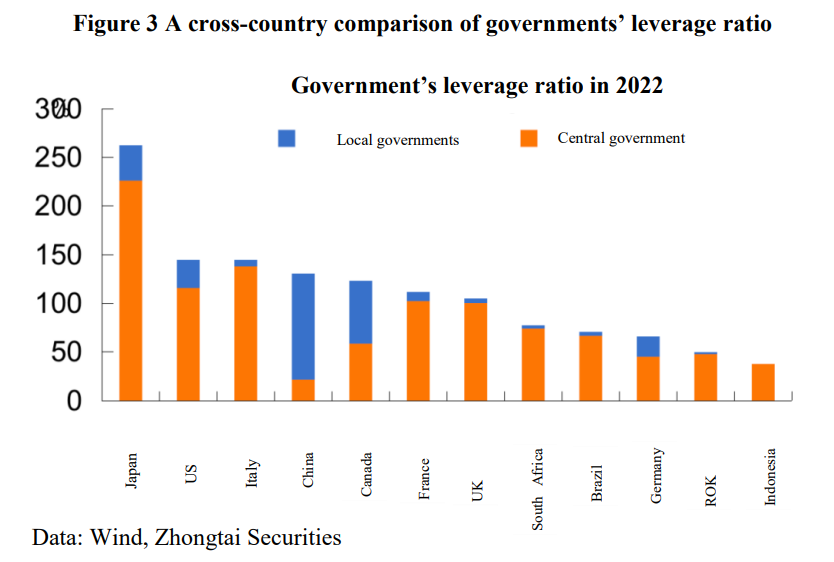

What are the consequences of the mismatch between local government’s financial and ministerial powers? The most prominent one is that the overall financing cost of China’s government is significantly higher than that of other economies. As shown in Figure 3, the blue part represents local government debts, including both implicit and explicit debts, and the orange part represents the central government debt, i.e., the national debt. As can be seen, China’s local government debts (including implicit ones) account for 74%, perhaps the highest in the world. The percentage of local government debts is low in the overwhelming majority of economies, such as the United States, Japan, Italy, France, and the United Kingdom. The debt of these countries is mainly national debt, the sovereign debt with the endorsement of the central government, with naturally the best creditworthiness, so its financing cost is much lower than other debt financing methods.

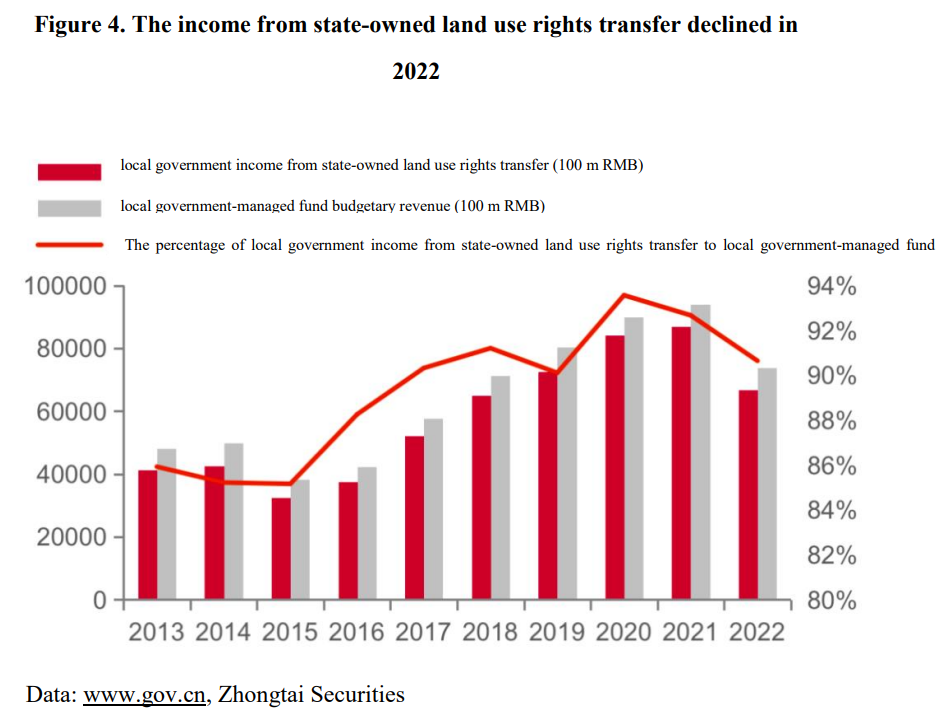

When China’s economy is in the real estate upturn cycle, due to the continuous appreciation of the land, local governments gain relatively abundant cash flows from land, so the local government debt problem is not so serious. However, as long as the local revenue derived from land drops significantly, the local government debt servicing problem comes to the fore.

At present, the coverage of interest on government debts by land-transferring fees has been less than 100% in some provinces, such as Liaoning, Guizhou, Guangxi, Chongqing, Inner Mongolia, Xinjiang, Qinghai, Tianjin, Gansu, Jilin, Yunnan, Heilongjiang, and Tibet. As the return on capital (ROIC) of urban investment platforms decreases, i.e., the overall median drops from 3.1% in 2011 to 1.3% in 2021, the pressure on government debt service increases. Furthermore, it should be noted that debt repayment is an important reason for expanding social finance, which leads to a widening gap between nominal GDP and M2 growth rate and weakening effects of monetary policy, so liquidity traps must be avoided.

Local government debt pressure is often relieved by the increase in tax revenue and land-transfer fees from economic growth, but with the decline in manufacturing and real estate investments, combined with the excessive infrastructure investment, local governments face increasing pressure to service their debts.

The next problem is excessive infrastructure investment. Take the highway, a high-quality local government asset, as an example. At the end of 2022, the total highway mileage of Guizhou reached 8,331 km, while Japan, the third largest economy in the world, had a highway mileage of only 7,800 km. However, Guizhou’s GDP was less than one-fifteenth of Japan’s in 2022. Moreover, car ownership per kilometer of highway in China was about 1,422 in 2020, while in the United States was 1,830 (including over 7,000 in Japan and over 4,000 in ROK). It can be seen that China has not only a longer total mileage of highways but also a lower traffic volume of highways than the United States.

Let's talk about the down cycle of the real estate market. Land finance may be difficult to sustain. The acceleration of China's population aging and the slowdown of urbanization indicates that the real estate market has entered a down cycle. Correspondingly, the aging population and the real estate downturn mean that land finance will be difficult to sustain while the proportion of rigid expenditures is expanding. Especially against the backdrop of high levels of local government debt, the biggest problem facing us is how to solve the problem of local government's inability to balance revenue and expenditure because the proportion of rigid expenditures in future finance will continue to increase, which requires new sources of income to make up for the shortfall caused by the decline in land finance.

In this context, we need to take unconventional measures. Firstly, it is necessary to improve the quality and efficiency of fiscal expenditure. However, in the face of reality, we need to avoid credit risks. Specifically, the redemption of publicly issued urban investment bonds should still be linked to the credit of local governments because it’s the lesser of two evils. Once a default occurs, it will lead to a significant increase in local government financing costs and often affect a larger scope, resulting in more serious consequences.

Five suggestions for effectively reducing local debt risk:

The past problems have historical reasons, but our focus should be on making the economy run smoothly and lowering the interest costs of the entire government sector as much as possible. One potential solution could be for the central government to issue special national bonds annually to replace local debts in batches. To develop specific measures, we need to reach a consensus on the basic concept that the current priority is to reduce the financing costs of the entire government quickly.

Here are a few specific solutions for reference:

First, reduce debt costs. For example, the Ministry of Finance could issue special national bonds or allow local governments to issue refinancing bonds. Policy or commercial banks could provide low-interest funds to local governments to reduce debt costs. Overall, China's government leverage ratio is not too high. The most controversial point at present is how large local governments’ hidden debt level is. I estimate that the overall leverage ratio of the Chinese government, including all kinds of hidden debts of local governments (deducting corporate sector debt accordingly), is roughly between 100-120%, which is not high. Compared with 145% of the United States, and 260% of Japan, China's leverage ratio is significantly lower and also lower than that of Italy, Canada, France, and the United Kingdom.

China currently has a "big government", whereas the EU, Japan, and the United States have typical "small governments". "Small government" refers to governments with relatively small assets, while the Chinese government has relatively large assets. From this perspective, China's leverage ratio is actually much lower than that of Western countries, which provides some space for gradually expanding our leverage ratio in the future. The core issue is how to increase the leverage ratio at a lower cost. If we attempt to accomplish this by lowering interest rates through the central bank, it must be based on our reasonable estimate of China's potential economic growth rate. If the potential growth rate is lower than expected, the space for lowering interest rates will be greater.

Second, extend the debt maturity. Non-bond debt extensions, such as the bank loan extension of Zunyi Road and Bridge Construction Group Limited, are available. For urban investment bonds, the key is to be able to borrow new debt to pay off old debt. As long as interest payments can be ensured and refinancing capacity is stable, the risk of short-term liquidity issues is not significant.

Third, activate state-owned equity. The model should shift from the current land finance to equity finance. State-owned equity in some non-basic and strategic industries can be reduced, which is compatible with the goal of the modern industrial system. Encouraging private capital to participate in state-owned enterprise reform can improve the liquidity of social capital and local government.

Fourth, expand the space of local debt limit. As mentioned earlier, China's overall government leverage ratio is not high. The space for local special bonds in 2022 is only 1.1 trillion yuan, and the space for general bonds is 1.4 trillion yuan, which can be further expanded.

Fifth, in accordance with the requirements of improving the quality and efficiency of national finance, the use of special bonds must be strictly limited, especially in railway, highway, and infrastructure. We need to ensure that special bonds are used in people's livelihood, such as consumption, pension, and other related areas, or in high investment return fields related to new infrastructure.

Regardless of which policy is adopted, the premise is to reach a consensus based on our assessment of key issues, such as the reason for rapid debt growth in the past and the asset quality corresponding to local government debt. Once a consensus is reached, finding a solution will become easier. The core objective is not to be completely constrained by existing debts but rather to reduce local government financing costs and enhance their own vitality. This can be achieved by reducing debt costs, extending debt maturity, giving time for space, or increasing the local government debt limit. From the central government’s perspective, regulations should be imposed on local governments.

We are currently at a critical moment. Solving the issue of local government debt should be a priority, as delaying it could cause local risks to become systemic risks. In summary, we need a clear concept and solution to address the problem of local government debt in order to improve market expectations and avoid a negative cycle caused by negative expectations.

This article is the keynote speech made by the author at the 162nd CF40 Youth Forum biweekly closed-door seminar themed “Risk Outlook and Impacts of Urban Investment Bonds” on June 15th, 2023. The article only represents the author’s personal opinion and does not represent the position of CF40 or the author's institution.