Abstract: Over the past three years, the pandemic caused different mid-term and long-term impacts between developed countries and emerging economies. China’s economic performance is close to the general pattern of emerging markets, with a slow decline in the excess savings rate, a rise in the labor force participation rate, and a strong de-risking behavior of households. Despite the uncertainties surrounding the economic double-dip, given the government’s capability of responding to crises, and its political will and determination to prevent extreme events, it’s rather unlikely to witness crises, and the room for a double-dip is limited.

I. CHINA’S POST-COVID ECONOMIC AND MARKET CONDITIONS

China’s economic activities won’t return to normality until the third or fourth quarter due to the impacts of the unleashing of pent-up demands in the first quarter. Against this backdrop, we observe China’s situation as much as possible by analyzing two main sets of data.

1. The excess savings rate of Chinese residents remains relatively high in the post-pandemic era

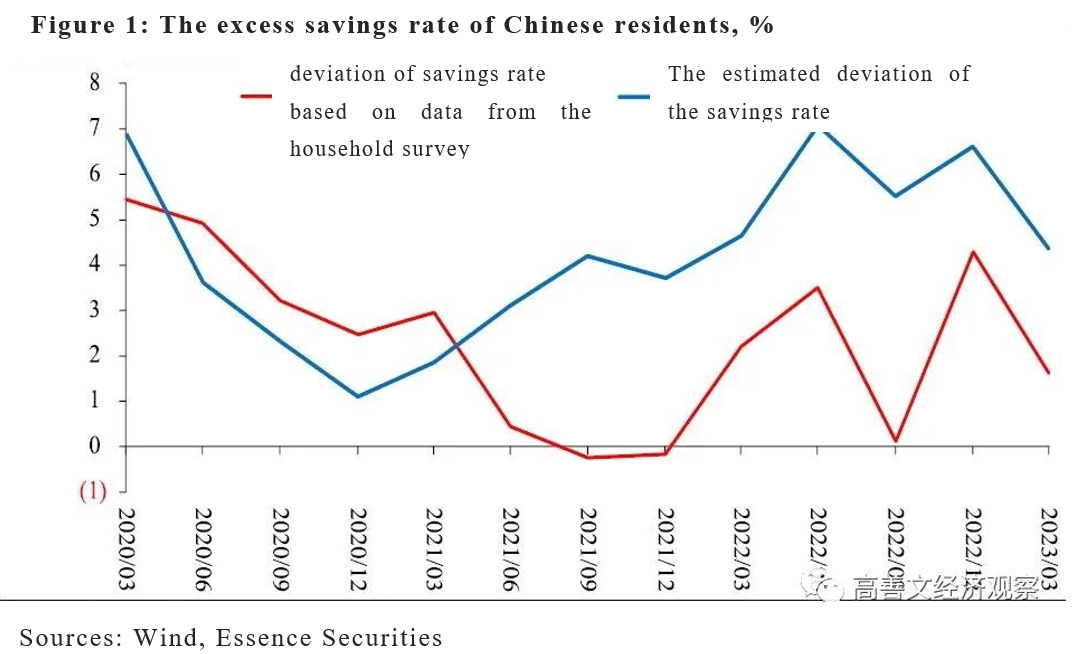

One set of data worth attention is the excess savings rate in China. As shown in Figure 1, the red line represents the data from the household survey, and the blue one represents the estimates based on retail sales of social consumer goods. The trends in these two data are close, but the magnitudes differ significantly. The true picture may lie somewhere between these two data.

In this context, the excess savings rate at the end of last year was undoubtedly extremely high, just below that of the severe panic during the pandemic. Although the first quarter has witnessed a decline in the excess savings rate, we still need to consider the impacts of the unleashing of pent-up demands.

In other words, the excess savings rate may rebound again in the second quarter of this year. If the second quarter remains at the same level as the first quarter or even higher, the current excess savings rate will be higher than that during the middle of the pandemic.

2. The overall level of labor force participation in China rate rose significantly after the pandemic

Another set of data worth mentioning is from the labor market. Since China does not officially publish data on the labor force participation rate, we observe some proxy indicators.

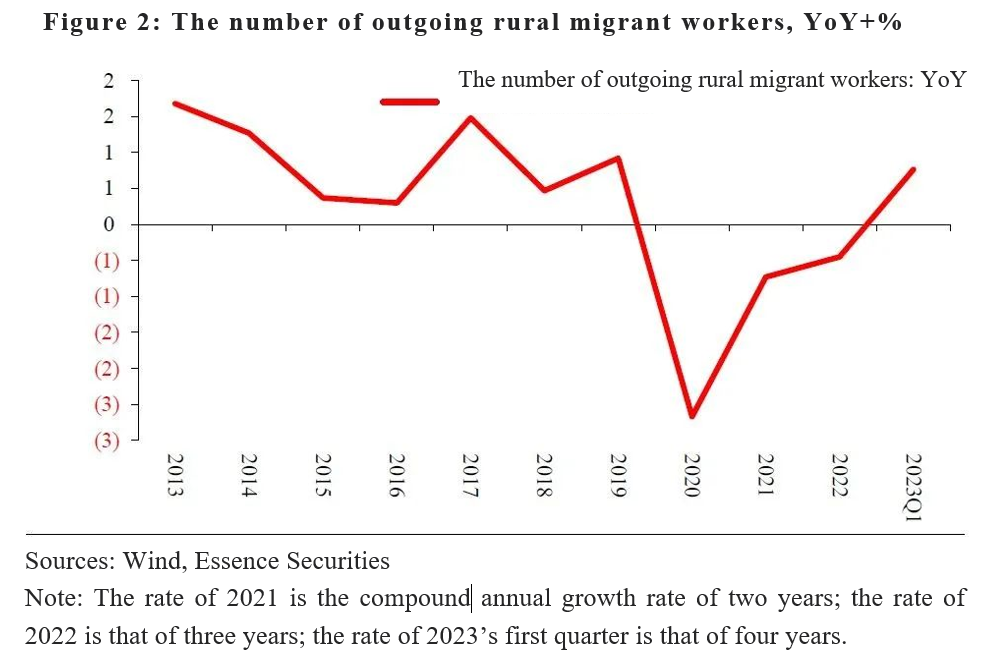

The first one is the number of outgoing rural migrant workers in China. The number is closely related to the ups and downs of economic activities. As shown in Figure 19, from 2015 to before the pandemic, the trend growth rate of the number was 0.7%, rising when the economy was doing well, falling when the economy was doing poorly, and generally fluctuating around this trend level.

After the pandemic, the number of outgoing rural migrant workers resumed growth. By the end of the first quarter, the cumulative SAAR of outgoing rural migrant workers was 0.75%, higher than the previous trend level of 0.7%.

Historically, the number of outgoing rural migrant workers has been determined by economic ups and downs. Over the past three years, the cumulative economic growth rate was undoubtedly substantially below the trend. However, under such conditions, the growth rate of outgoing rural migrant workers exceeded the trend level.

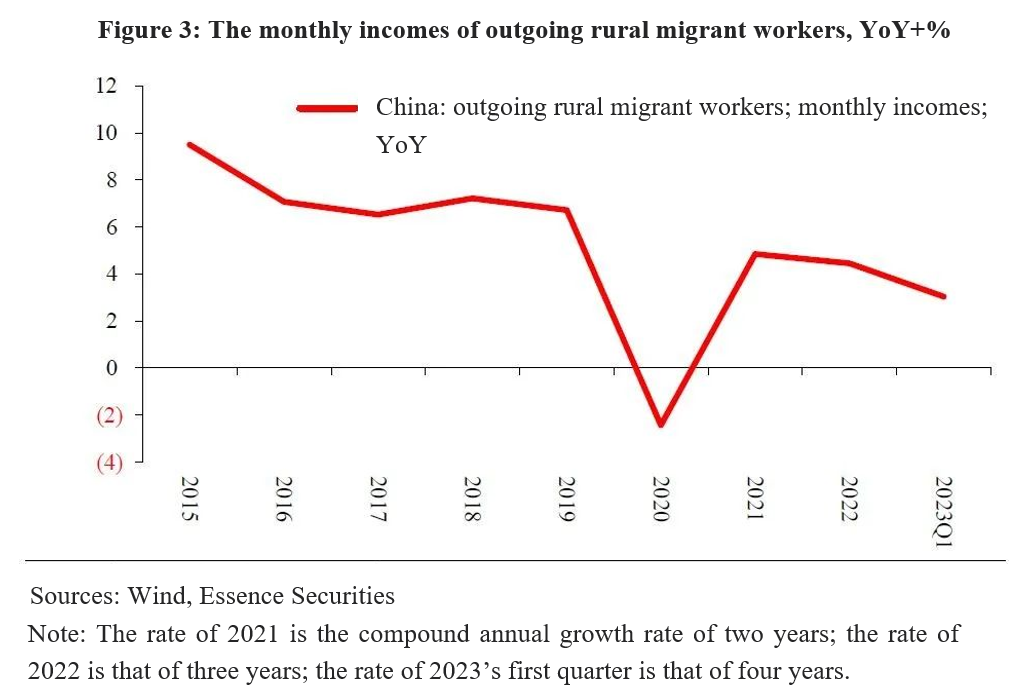

Now let’s analyze the incomes of migrant workers. As shown in Figure 3, the growth rate of incomes averaged 6% to 7% before the pandemic and experienced a significant drop and a gradual rebound during the pandemic. By the end of the first quarter, by geometrically averaging the wage growth rate from 2020 to the first quarter of 2023, we find that the growth rate of migrant workers’ incomes is significantly lower than the pre-COVID trend level.

The number of outgoing rural migrant workers and their incomes imply that after the pandemic, China’s labor force participation rate may be rising, which is consistent with the situation in other emerging economies.

3. The market is further absorbing the impacts of the recent expectation gap

The unleashing of pent-up demands is among the factors leading to the high economic growth in the first quarter of this year. Nevertheless, since the beginning of April, people’s expectations have become weaker and economic expectations were revised downward. The rise in the labor force participation rate and the slowdown of the decline in the excess savings rate may be part of the reasons, and they harmed the growth in price and income, and to some extent, they may further affect the economy.

4. The real estate market and the pandemic have produced dual pressure

As is known to all, in the recent two years, besides the pandemic, the adjustment of the real estate market is another key factor that has had a significant negative impact on economic activities and the market.

The pandemic and the decline of the real estate sector were supposed to be independent events. In the second half of 2021, when the real estate problem started to emerge, people didn’t expect another outbreak of Covid-19 cases in 2022. Instead, most people thought that China had survived the pandemic and things were getting back on track.

But throughout 2022, the pandemic hit China again, which dealt another heavy blow to the real estate sector as well as the whole economy and market.

In 2022, we witnessed the mutual impacts of the pandemic and the real estate slides, and these factors are still lingering today. Although the pandemic is over, the real estate sector is still in decline. The weakening of economic activities adds to the downward pressure on the real estate sector. In turn, the delisting of real estate companies and the falling housing prices in many cities further exacerbate the economic downturn.

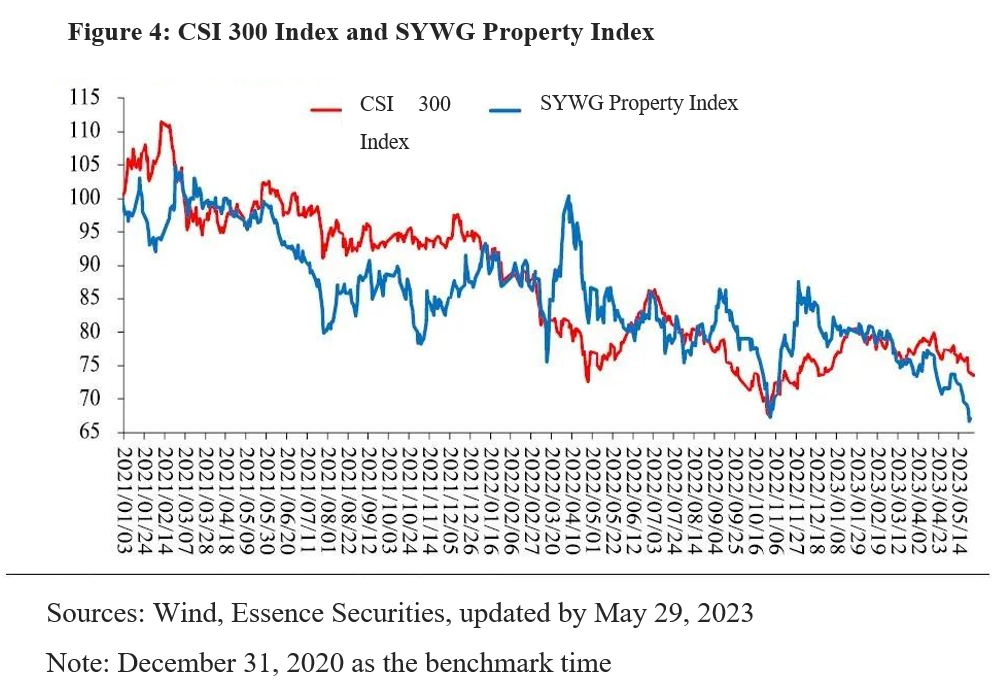

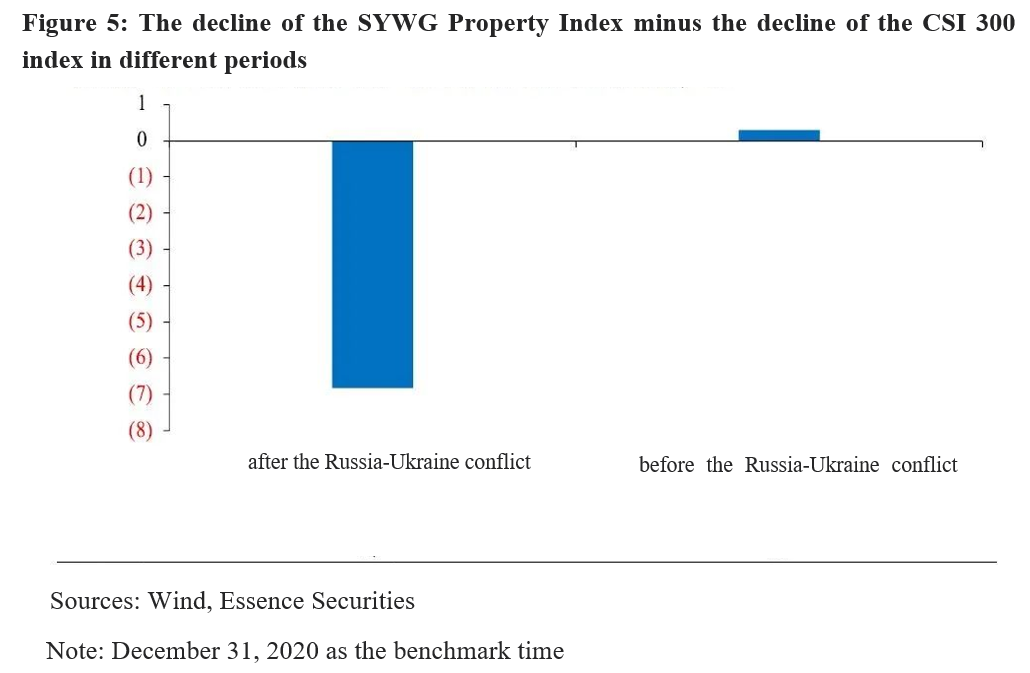

As shown in Figure 4 and Figure 5, prior to the Russia-Ukraine conflict, the real estate index was roughly flat relative to the CSI 300 index. After the Russia-Ukraine conflict, the real estate sector index significantly underperformed the CSI 300 index, demonstrating the impact of the accelerated real estate market decline and suggesting that this change may be related to the re-emergence of the pandemic.

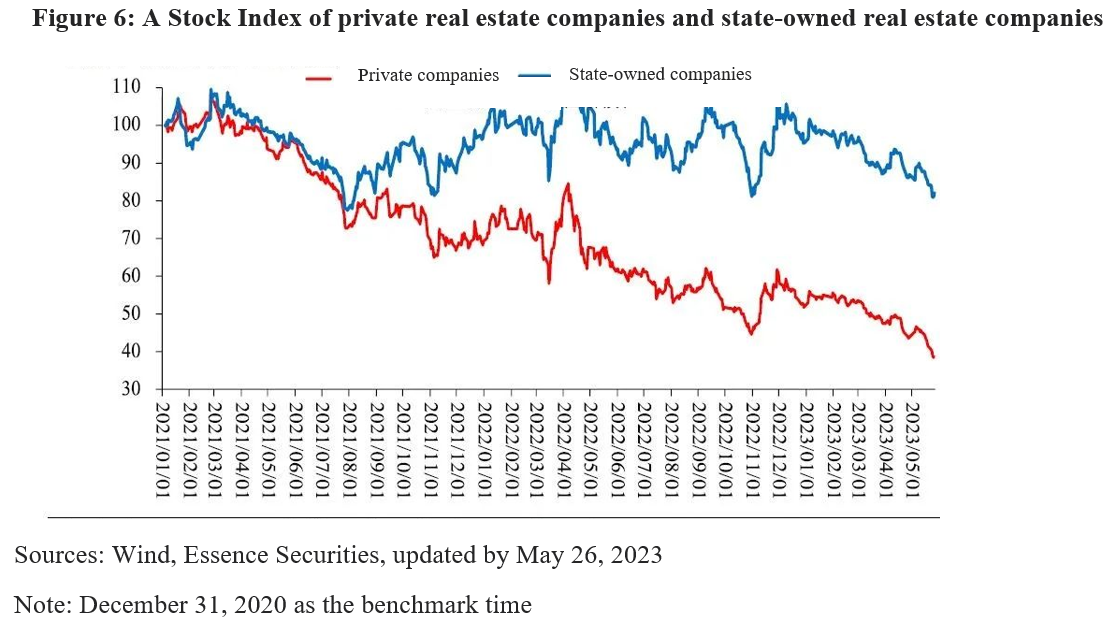

If we look at the situations of different real estate companies, as shown in Figure 6, all companies witnessed a decline in stock prices. Still, private companies experienced a sharper fall, indicating an internal structural reason that caused the slide in the real estate sector.

5. Limited Space for a second plunge

Under this condition, the market starts to worry about the occurrence of another crisis. If real estate companies, local governments, and small and medium financial institutions default on their debt, coupled with the economic slowdown and geopolitical risks, China might witness a black swan event.

There are many uncertainties in this process. But given the government's ability to respond to a crisis, as well as its political will and determination to prevent extreme events, the probability of a crisis scenario should be small, and there is limited room for a second plunge in the market.

In terms of the intrinsic mechanism, the real estate sector decline in the past few years mainly affected overseas Chinese-issued U.S. dollar bonds market, trust market, wealth management market, etc. On the other hand, most of the investors in these markets are high-income groups that can tolerate high risks. The real estate slump only had a limited impact on the on-balance sheet assets of banks and would not undermine the financial system’s ability to create money and credit.

The real estate sector has already experienced a significant drop in new construction projects and investment last year. Even if there is a further decline this year, the impact is confined to the real economy. Under the condition of such low transaction volume last year, there should be limited space for another sharp fall in the transaction volume of the real estate sector this year relative to last year.

II. CONCLUSION

China’s economic performance is close to the general pattern of emerging markets, with a slow decline in excess savings, an increase in the labor force participation rate, and households’ strong tendency to de-risk. Since this April, with the decline of pent-up demand, slowing economic growth after re-opening, and faster drop in the real estate sector, the market is becoming increasingly bearish about the economy.

Although there are many uncertainties about the second slump of the economy and vulnerabilities in the local markets, local government debt, and balance sheets of small and medium financial institutions, given the government’s ability to cope with crisis and its will and determination to prevent extreme events, we tend to believe that the probability of a crisis in China is small and there is limited space for another round of market plunge.

This is the speech made by the author at the interim strategy conference of Essence Securities on June 7, 2023. It is translated by CF40 and has not been reviewed by the authors. The views expressed herewith are the authors ‘own and do not represent those of CF40 or other organizations.