Abstract: In this paper, the author analyzed the outlook of China’s economic recovery in 2023 and the implications of China’s reopening for the global economy. The author estimated that China’s 2023 economic growth might exceed previous market expectations. China’s demand for consumption and property is expected to recover, and inflation will pick up mildly. As for the spillover effects of China’s reopening, China’s demand rebound does not necessarily reduce global inflation but may add some marginal inflationary pressure to some sectors, and a pickup of China’s inflation might lead to higher or more persistent inflation in the rest of the world.

I. CHINA’S 2023 ECONOMIC GROWTH MIGHT EXCEED EXPECTATIONS

In terms of the outlook for China's economic growth in 2023, although there may be some "scarring effect" in the short term and it may be difficult for China’s economy to return to its pre-pandemic trend line, China’s economic growth in 2023 is likely to exceed the current market expectations given rapid peaking of Covid cases since last December coupled with policy support and lower base effect.

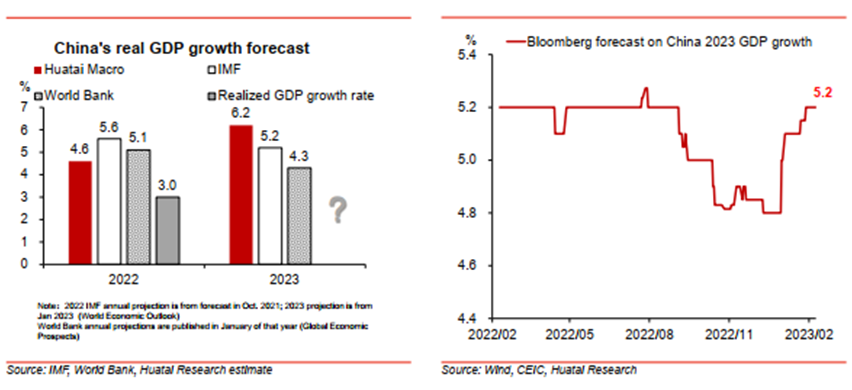

In late 2022, the market generally maintained low expectations for China’s economic growth in 2023. But since optimizing the pandemic control policy in December 2022, China has passed the peak of infection in just over a month, two months faster than the market had anticipated. Therefore, within just two to three months, the Bloomberg consensus estimate shows an upward revision in market expectations for China's economic growth from 4.7% to 5.2%.

Figure 1: Estimated China’s GDP growth

By region, provinces with lower performance bases might fare better than last year, like Beijing, Tianjin, Shanghai, Sichuan, Chongqing, and the northeast region. But major foreign trade provinces may be affected by the fall in export orders, such as some factories in Guangdong that have not yet recovered to full production capacity.

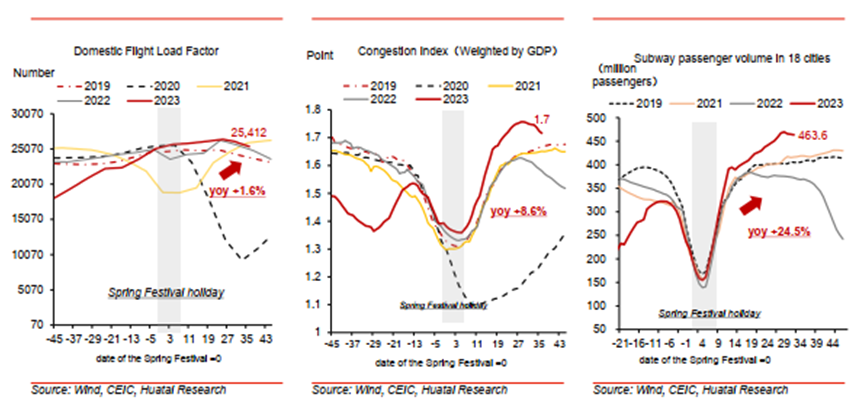

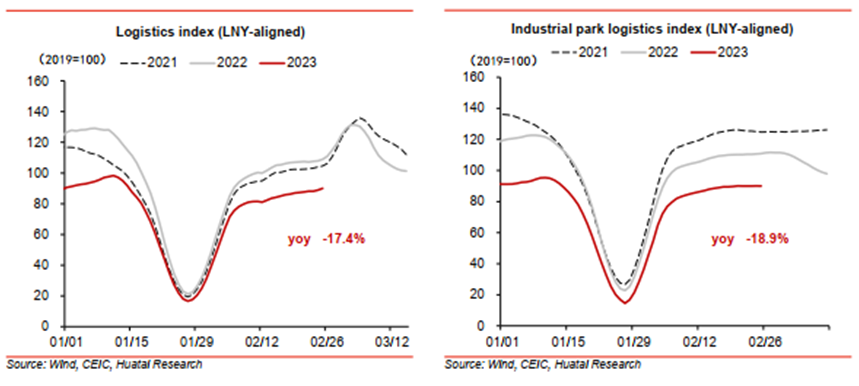

By sector, the demand side is performing well as the pent-up demand for travel and consumption is being released, with domestic flight load factor, traffic congestion index, and subway ridership all exceeding last year’s levels. However, the production side shows mixed results among different sectors. Part of the reason is that the willingness of enterprises to invest is not strong enough, which is more directly related to the weakening of the global manufacturing cycle, the decline in external demand, and the contraction of some industries caused by the decline in exports.

Figure 2: Indicators of China’s travel and consumption are rising rapidly

Figure 3: Indicators of China’s production and logistics are weaker than last year

II. DEMAND FOR CONSUMPTION AND PROPERTY IS EXPECTED TO RECOVER, AND INFLATION WILL PICK UP MILDLY

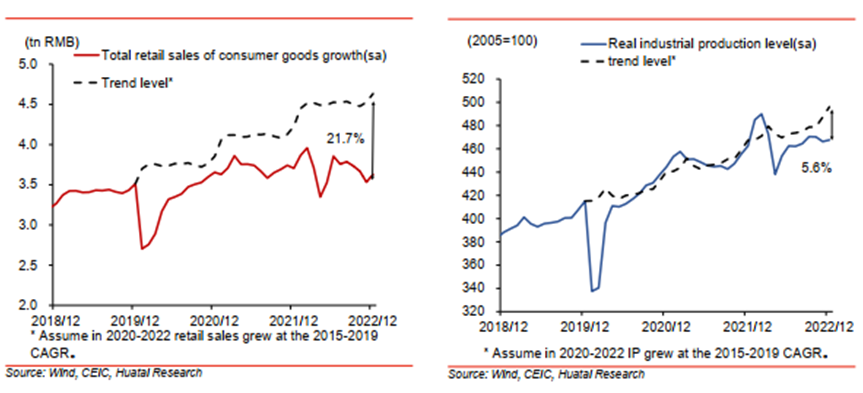

Over the past three years, Chinese households’ propensity to consume has declined significantly, with the average propensity to consume plummeting by about 3-4 percentage points. In terms of total retail sales of consumer goods, as of December 2022, there is still a gap of about 20% from the pre-pandemic trend line. At the same time, it may be difficult to fully "normalize" the propensity of residents to consume, a rebound in the propensity to consume, even if partially "normalized," will enable consumption recovery to grow faster than the economic recovery.

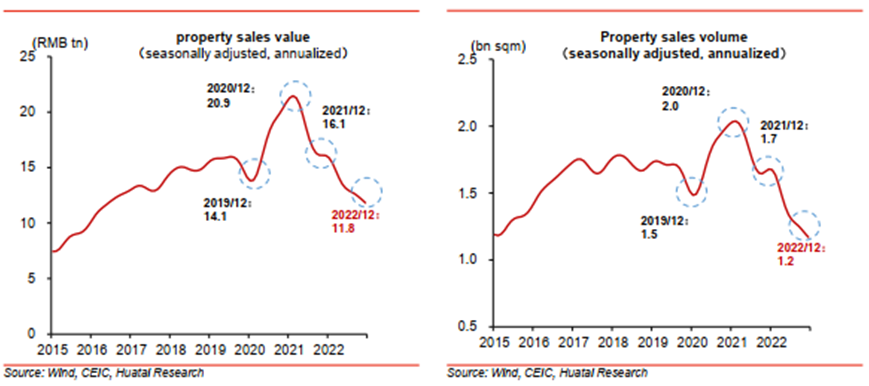

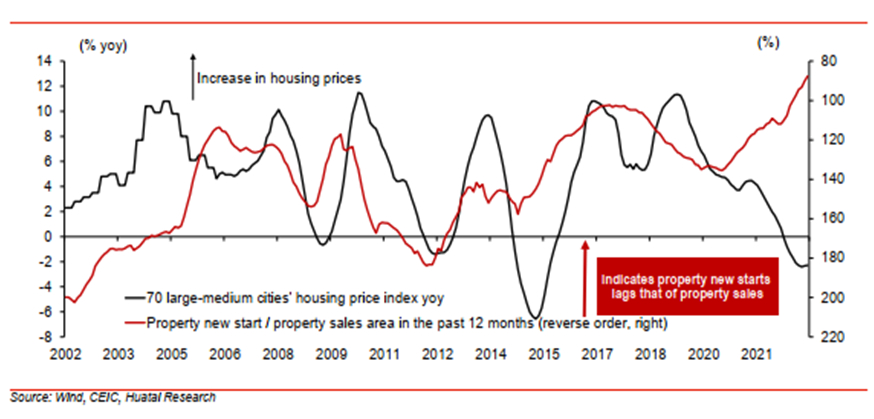

Figure 4: Sales of property in late 2022 plummeted by about 40% (annualize)

In addition, although multiple factors, such as deleveraging and the pandemic, still have a “l(fā)asting” restrictive effect on housing prices, property demand may also bounce back compared with late 2022. Last year, the real estate sector faced multiple pressure, with annualized sales of about 12 trillion square meters in December 2022, down by nearly 40% from the peak of 2021, which is likely to hit the bottom. From the perspective of asset pricing, property will become relatively more attractive in households’ asset allocation as expectations of income growth expectations are revised upward, and mortgage rates decline. From the perspective of a discounted cash flow model, the value of property depends on the discounted future rent (numerator), which is highly related to nominal GDP growth, and the discount rate (denominator), which depends on the level of real mortgage rates. Since last November, nominal GDP/income growth is expected to move upward. The weighted average mortgage rate may have started to move downward earlier, with a cumulative pullback of perhaps 200 basis points or more. Changes in both the numerator and denominator support the recovery of the attractiveness of real estate assets on a month-on-month basis, at least in some cities.

In the past, the bottoming out of the real estate cycle usually lagged behind leading economic performance indicators for more than a quarter. It is partly due to the greater inertia in the expectations of real estate prices. In addition, real estate demand is also affected by its inherent cycle, such as the off-season during the Spring Festival. For example, after the financial crisis in 2008, credit expanded in November, and the cyclical indicators reached the bottom, but real estate sales hit the bottom only in the second quarter of the following year. However, it is worth noting that the newly added area of real estate construction fell more than sales, with a nearly 60% drop as of December 2022 than the peak in 2021. In first-tier cities, the inventory ratio is still low; if demand picks up faster, housing prices in these areas might face upward pressure.

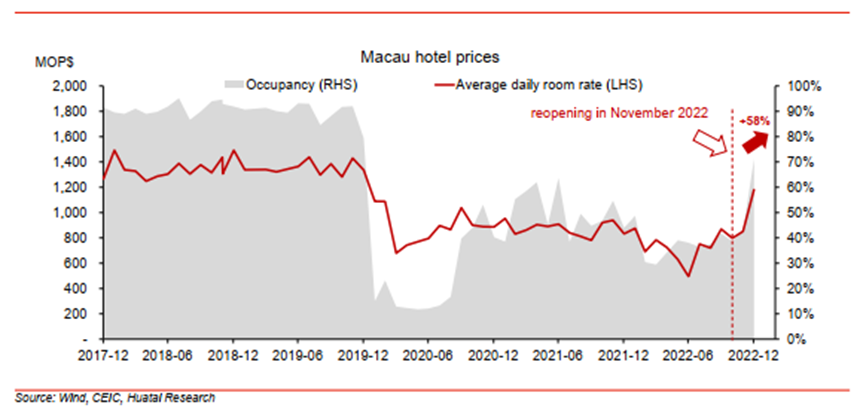

China still has a long way to go in opening up and needs to keep an eye on inflationary risks during economic recovery - early inflation signals are already emerging in certain sectors when demand is picking up rapidly. Currently, the passenger load factor of international flights only recovered to less than 30% of the average in 2019, with more pent-up demand to release. On the other hand, prices are rising in sectors like hospitality and airline. Take Macau as an example. In just half a month after reopening, Macau has witnessed a price rise by an average of 58% among hotels. But for now, the rebound in inflation does not pose a threat in the short term and can be regarded to some extent as an incentive for the labor force and production capacity to re-enter the market.

Figure 5: Long-term concern of credit expansion in the property sector: inventory cannot support an excessive rebound in trading volume

Figure 6: Hotel prices have risen rapidly in Macau since 2023

II. IMPLICATIONS OF CHINA’S REOPENING FOR THE GLOBAL ECONOMY

First, from the perspective of aggregate demand, amid the uncertain global macro environment, China’s demand pickup might boost global demand to a certain degree. But from the perspective of overall inflation, China’s demand rebound does not necessarily reduce global inflation but may add some marginal inflationary pressure to some sectors.

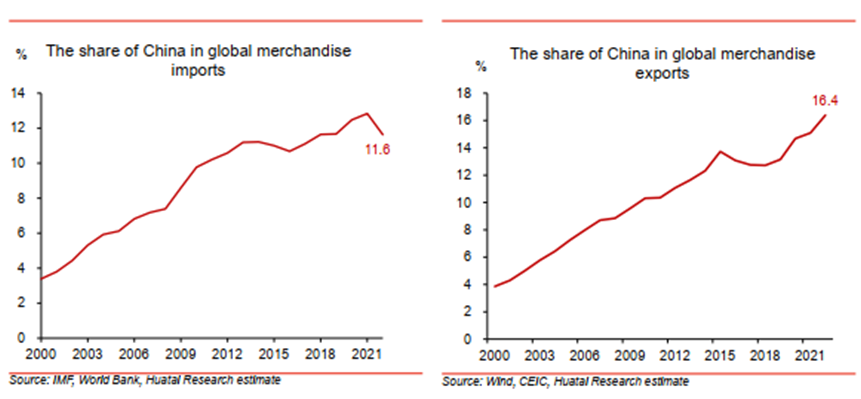

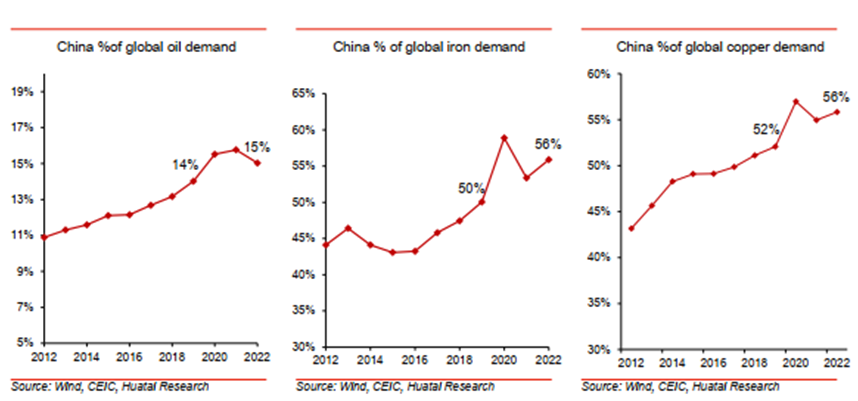

Though China is now the world's second-largest importer, the decline of its imports exceeded exports during 2020-2023. At the same time, China is also the world's largest consumer and importer of raw materials/commodities. Despite a bull market for commodities in 2022, China's demand for raw materials/commodities fell significantly in 2022, making a negative marginal contribution to the global market, a situation that could be reversed this year. In addition, China has become one of the major buyers of consumer goods, like automobiles, appliances, smartphones, and luxury goods. Therefore, the return of Chinese consumers might bolster the demand for global consumption to some extent.

Figure 7: The decline of China’s imports exceeded exports during the pandemic

Figure 8: China is the “price setter” of many commodities

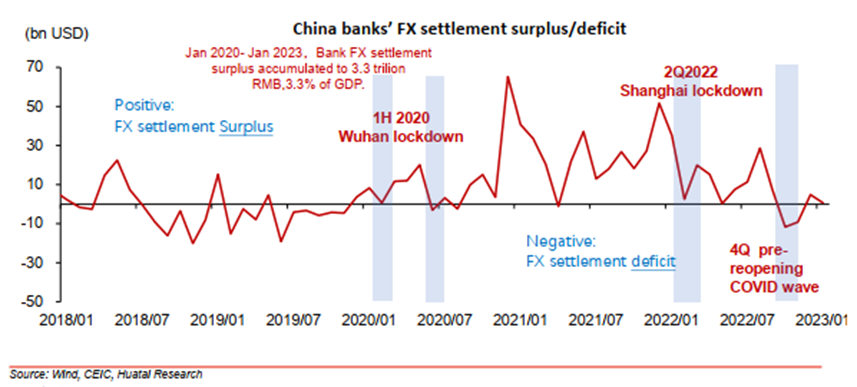

Second, while a rebound in China's services trade imports may reduce the current account surplus, there is still potential for RMB appreciation. China also makes a large contribution to global services trade, with China's total current account services trade (credits + debits) standing at $750 billion in 2019, accounting for about 9% of the total global services trade. Although the rebound in service trade imports may reduce the current account surplus, the real effective exchange rate is still mainly driven by the relative efficiency of the real economy and the return on investment, and the difference in economic growth rates between China and other countries is perhaps the more critical variable in determining capital inflows. Meanwhile, foreign exchange settlement data from banks since 2018 can also show that capital flows influence the changes in the RMB exchange rate during the pandemic more than the current account. Since December, when the pandemic-induced disruption subsided, RMB has appreciated by 6.3% against the US dollar; however, given the “inflation difference,” the real exchange rate of RMB may not have appreciated much. Therefore, the reopening of the Chinese economy may be beneficial to capital inflows, and RMB still has the potential to strengthen.

Figure 9: Capital outflows in the last three years were somewhat affected by the pandemic-induced shock

Figure 10: Comparison of trend level between total retail sales and actual industrial production in China

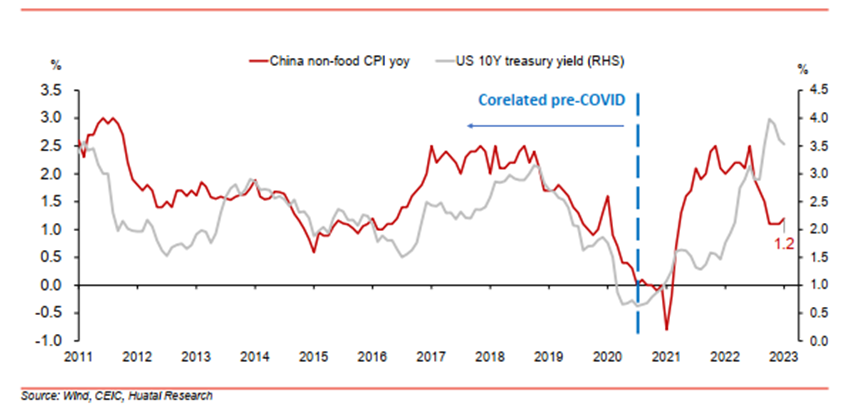

Figure 11: China's non-food CPI had a strong association with US bond rate movements before the pandemic

Finally, the rebound of demand and inflation from a low level is a “timely blessing” for domestic enterprises but a “mixed news” for European and US economies which are suffering surging inflation. From 2020 to 2022, China’s impact on demand for global goods and services surpassed its impact on supply. In contrast, compared with retail sales (-22%), China's industrial production (5.6%) is closer to its pre-epidemic trend level. A pickup in Chinese consumer demand may raise China’s inflation from a low level, which would be a "blessing" for domestic enterprises and help companies repair profits and increase investment. However, it may add inflationary pressure on the US and European countries. China’s inflation or imports are an important driver of US inflation expectations and marginal changes in US interest rates. Before the pandemic, China's non-food CPI (core CPI) was highly associated with US Treasury yields. A rebound of China’s inflation might lead to higher or more persistent inflation in the rest of the world.

The article is based on the author’s keynote speech at the 11th CF40-PIIE Young Economists Forum themed China’s Reopening and What it Means for the Chinese and Global Economy on February 28, 2023. The views expressed herewith are the author’s own and do not represent those of CF40 or other organizations. It is translated by CF40 and has not been reviewed by the author.