Abstract: The PBC's "benign neglect," an indirect policy tool devised in 2022 to influence the value of the RMB, was quite successful. It allows the market to determine the exchange rate while retaining capital controls as a last resort. It should be the most effective currency strategy for China's central bank.

I. ANALYSIS OF RMB EXCHANGE RATE MOVEMENTS AFTER 2015

First, I'd like to go over the history of RMB exchange rate movements since 2015. Before 2015, China was concerned that the RMB was appreciating too quickly, whereas, after 2015, China was concerned that the RMB was depreciating too quickly. Despite this, China has kept its current account in surplus.

However, due to capital outflows, the RMB has been under pressure to depreciate. From August 2015 to the end of 2016, the People's Bank of China used approximately US$1 trillion in foreign exchange reserves to keep the RMB exchange rate stable. With the benefit of hindsight, the reasons for the RMB's depreciation pressure due to capital outflows can be broadly classified into three categories: 1) the overall domestic economic downturn, 2) non-economic factors, and 3) the impact of short-term activities like arbitrage.

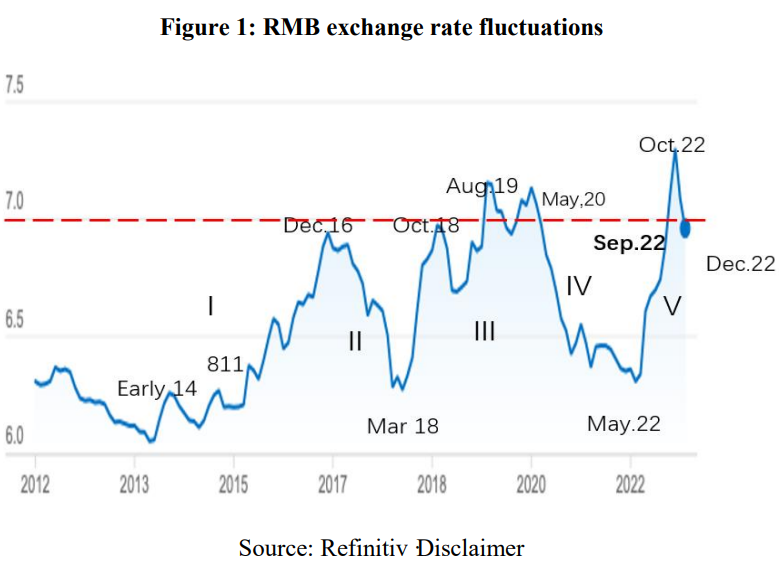

These points of view can be illustrated by the trajectory of RMB exchange rate movements since 2015. Figure 1 depicts some of its critical points.

The RMB exchange rate was depreciating in early 2014, but this was intentional on the part of the PBC to combat speculators betting on RMB appreciation. What no one expected was for the RMB to depreciate from around October 2014 onwards due to changes in fundamentals.

On August 11, 2015, the PBC launched an exchange rate reform in an attempt to make the RMB more flexible, but the pressure on the RMB to depreciate rose sharply. I believe the reform was bold and necessary, but it came at the wrong time, as 2015 was the Chinese economy's most difficult year in many years.

From June 15 to July 9, 2015, China suffered a severe stock market crash. The Shanghai Composite Index fell 34.8% from 5,174 to 3,373 points. The Shenzhen Stock Exchange Index fell 40.3% from 18,182 to 10,850 points, and real estate investment growth fell to 1% from 10.5% in 2014.

China's economy was in turmoil in 2015, with GDP growth reaching a 25-year low and sparking the so-called "China panic" abroad. 2015 was already a year of rising RMB devaluation expectations, which were reinforced by the exchange rate reform. Subsequent foreign exchange market interventions prevented the exchange rate from acting as an automatic stabilizer through devaluation, and capital continued to flow out. The central bank maintained depreciation pressure on the RMB until the end of 2016, depleting nearly $1 trillion in foreign exchange reserves.

But the RMB broke into a sudden rise at the end of 2016, and the appreciation continued until March 2018. The Chinese economy did rather well in 2017, with GDP growth of 6.9%, the first rally since 2011.

2018 saw RMB depreciate again which was partly attributed to the China-U.S. trade war, which was to a certain extent a non-economic factor. The currency moved toward 7 against the USD and passed the threshold several times. The depreciation pressure did not go away until May 2020, when China’s Covid management helped push the RMB up again.

The next depreciation happened in May 2022, mainly caused by the Federal Reserve’s rate hikes which elevated the actual interest rate and the level of short-term arbitrage activities on the USD.

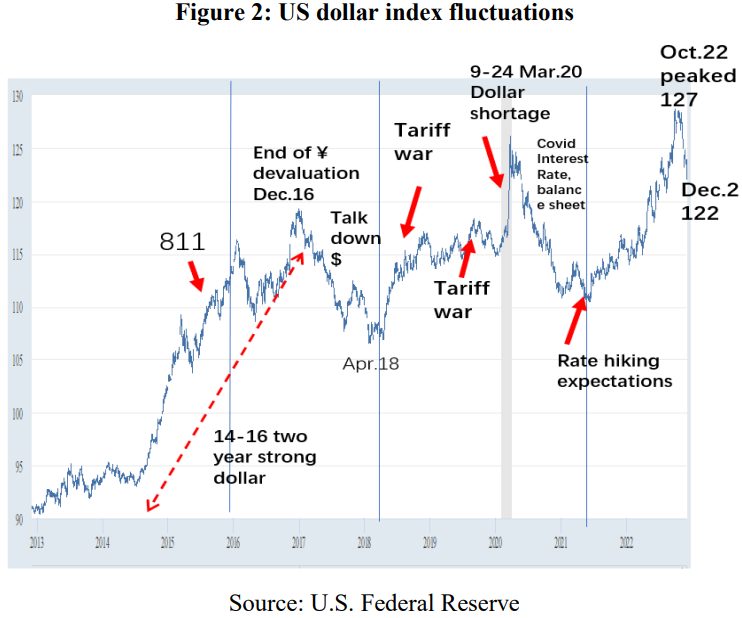

Hence, the RMB exchange rate is related to both domestic factors and the trajectory of the US dollar index.

The RMB rose rapidly in 2015-2016; during 2014-2016, the dollar index also saw significant growth. Yuan’s appreciation in early 2017 also coincided with the weakening of the dollar index, which was associated with then President Donald Trump’s policies. As a matter of fact, the USD depreciated against most currencies when Donald Trump took office in January 2017.

If China had not used nearly 1 trillion USD worth of foreign exchange reserves to intervene in RMB’s exchange rate during 2014-16, the yuan would have picked up in 2017, or at least very likely so. In this sense, I believe it was a waste of foreign exchange reserves when China tried to intervene and prevent the RMB from depreciating back then. Historically, the RMB and the dollar index moved oppositely (Figure 2).

Therefore, when the PBC considers whether to intervene in the foreign exchange market or not, it should pay attention to both the exchange rate between the RMB and the USD and the dollar index movements. The relationship between the two currencies mirrors not only the bilateral economic relation but also the ties between the U.S. and the world economy.

II. THE PBC SHOULD CONTINUE TO IMPLEMENT THE “BENIGN NEGLECT” EXCHANGE RATE POLICY

I think the PBC has implemented a very successful exchange rate policy in dealing with the recent situations, and that is the policy of “benign neglect”.

The PBC did not intervene significantly this time. Many studies including that of the U.S. Treasury show the PBC cut its treasury holdings by around 100 billion USD in the first half of 2022.

I do not know if the number is accurate. But I tend to believe the PBC has not spent much of its foreign exchange reserves on stabilizing the RMB.

To my mind, China reduced its treasury holdings for two reasons. First, to diversify its asset portfolio. This started years ago; any reduction in U.S. treasury bonds in 2022 should have been part of that diversification strategy, and much of the disposal should have been upon maturity. Second, revaluation. Higher yields on U.S. treasury bonds dilute their value. But it’s hard to estimate how much this has contributed to the decrease in China’s treasury holdings.

Any use of its foreign exchange reserves by the PBC for intervention purposes should have been on a limited scale.

Having been used to yuan fluctuations, the PBC and the market are now calmer facing exchange rate changes, and it will no longer get on their nerve when the RMB moves beyond 7 against the USD.

The PBC may also use other means to influence the RMB exchange rate with some other indirect means, such as lowering the foreign exchange reserve ratio of commercial banks when facing depreciation pressure.

I do not think the central bank should keep its hands off the exchange rate market at all times. But businesses should not count on the central bank to cope with all foreign exchange risks. China should improve the foreign exchange market, and provide adequate derivatives for businesses to choose from to hedge against the risks.

In conclusion, I think the PBC has been right to affect the RMB exchange rate with indirect means without major direct intervention amid depreciation pressure.

According to experience, “benign neglect” could be the best possible strategy for the PBC whether the RMB moves upward or downward in the future. China should maintain a floating exchange rate regime to bring out its role as an automatic stabilizer while maintaining necessary capital control as the last resort. The ultimate goal of the central bank’s monetary policy should be economic growth (full employment) and price stability, and the yuan’s exchange rate should be for the market to decide.

This article is the transcript of the author’s speech at the 10th CF40-PIIE Young Economists Forum on Exchange Rate Fluctuations and International Policy Coordination held on December 20, 2022. The views expressed herewith are the author’s own and do not represent those of CF40 or any other organizations. It is translated by CF40 and has not been reviewed by the author.