Abstract: US inflation has largely peaked and its economy is expected to grow more slowly. The US federal funds interest rate is still very low compared to historical levels, and given that US inflation is currently above 8%, its real interest rate is even lower. There is no need to overestimate how the Fed's rate increases will affect the US economy. For China, it should stay committed to its macroeconomic policy objective of steady growth, with expansionary fiscal and monetary policies, floating exchange rate and effective management of cross-border capital flows.

Inflation in the United States has mostly peaked, and while it may fluctuate in the future, it will not worsen much. The US economy is likely to slow further, but it should avoid a severe slump, with the economy developing at a slower rate than the average from 2008 to the recent past.

While demand is manageable, many supply-side shocks are hard to control. As a result, meeting the 2% inflation objective may be challenging. In general, the inflation rate in the United States will be higher than 2%, while the economic growth rate will be lower than 2%. These are my observations on the US economy. I don't think it will undergo any significant changes shortly.

I. FEDERAL FUNDS RATE REMAINS LOW.

1. U.S. real interest rates remain low compared to historical levels.

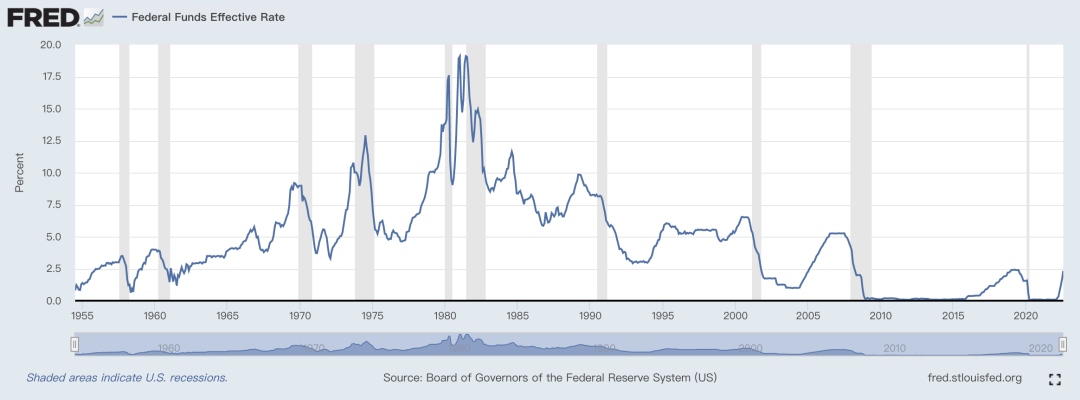

Figure 1: US federal funds rate since the 1950s

Since 2022, the Fed has lifted interest rates four times. However, as compared to historical levels, the US federal funds interest rate remains quite low. Given that the current US inflation rate is above 8%, the real interest rate is lower.

So far, the impact of the Fed's rate hikes on the US economy need not be overestimated.

2. Changes in the federal funds rate affect a series of interest rates

In theory, if the federal funds rate changes, so would other important interest rates. However, the relationship between changes in the federal funds rate and changes in other interest rates can become rather complicated in practice.

For example, changes in the one-year Treasury yield have a strong correlation with changes in the federal funds rate, but changes in the 10-year Treasury yield are less correlated with changes in the federal funds rate. Greenspan once said that the flattening of US Treasury yields was caused by the purchase of US Treasury bonds by China and other countries because the Fed can affect short-term interest rates but not long-term interest rates.

First, the long-term interest rate will increase if the market anticipates a rise in the federal funds rate. Second, different market interest rates are modified in line with projections of the rising federal funds rate, so they won't change much on the day that the federal funds interest rate (target) is officially hiked. Third, in the year when the federal funds rate is increased, the short-term rate often alters more than the long-term rate due to expectations.

With the increase in the federal funds interest rate, Ameribor (American interbank offered rate) and SOFR (Secured Overnight Financing Rate) rise. Ameribor is the interest rate calculated based on the unsecured, short-term loan transactions conducted by the American Financial Exchange (AFX); SOFR is the interest rate calculated based on the repurchase transactions conducted in the Treasury bill repurchase market. Both are important market benchmark interest rates in the United States. SOFR is more well-known in China because it is about to replace LIBOR. With the rise in the federal funds rate, other significant market interest rates increased as well, including the 10-year Treasury yield (despite an inversion) and the U.S. prime loan rate.

Ⅱ. COMPARISON OF INTEREST RATE REGULATION BETWEEN CHINA AND THE UNITED STATES

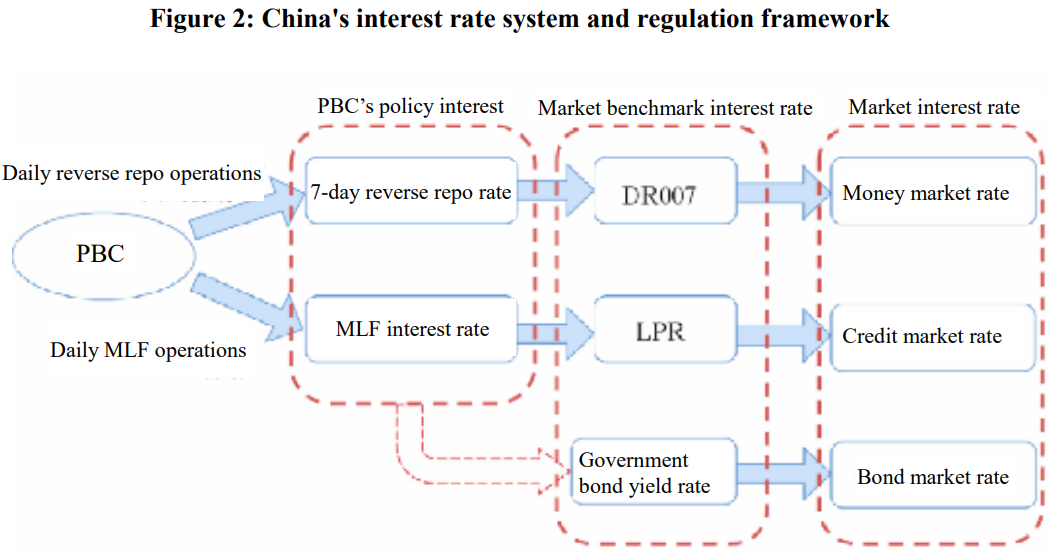

According to Governor Yi Gang, China's interest rate system and regulatory framework are shown in Figure 2.

Xiao Lisheng and Luan Xi, two of my colleagues, noted that although China's money market interest rate is entirely market-based, it is more volatile than developed money markets and frequently deviates from the center of interest rate corridor. The current 7-day reverse repo rate of the central bank is 2%, while the average weekly interest rate of DR007 in August decreased to 1.3%-1.45%, which is much less than the reverse repo rate.

This is a bit strange, because in the United States, the federal funds rate is the lowest market interest rate. All other rates are higher, out of various reasons. But China’s market benchmark rate is lower than the policy rate. They have actually raised the question of whether it’s the market that follows the central bank, or otherwise, or they go separate ways. I believe it should be the market following the central bank, but it seems they are going separate ways at the moment. Commercial banks determine the market rate taking into account various constraints and their own objective functions, but the rate they eventually set is usually divorced from the target policy rate.

What exactly is the problem here? Is there any flaw with the interest rate control system of the central bank? Or is it that the commercial banks and other financial institutions face excessive constraints? If there are only five variables but ten equations, how to determine the five variables? It takes two points to draw a line, but what if there are three or four points that we have to pass through?

III. THE INTERPLAY BETWEEN THE USD INDEX AND FED RATE HIKES IS COMPLICATED

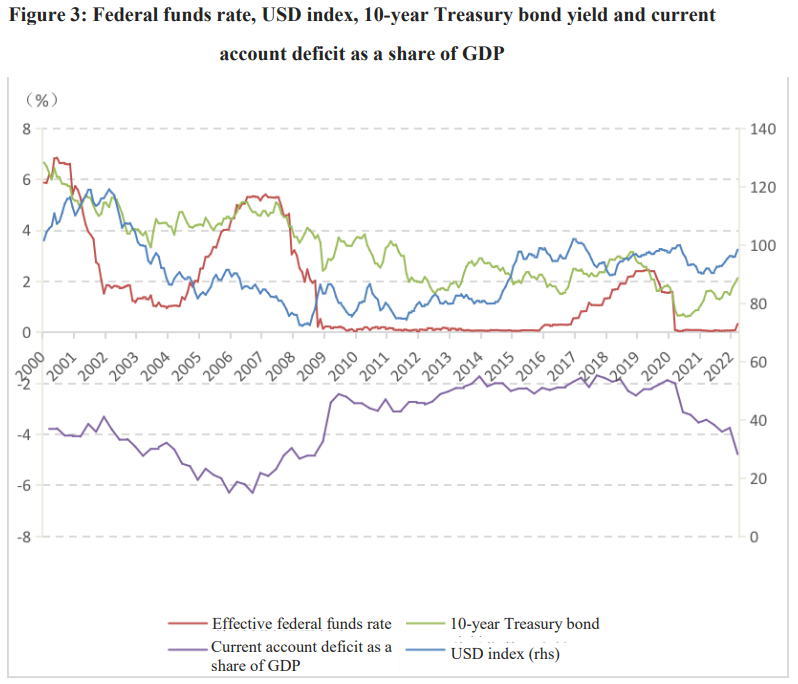

Fed rate hikes is generally believed to be accompanied by rising USD index. But this has not always been the case in history; sometimes it was even the contrary, as the examples below indicate.

? Example 1: During February 2002 and June 2008, Federal funds rate rose while the USD index weakened.

The USD experienced a prolonged period of depreciation after 2002, with the USD index declining from 120 in early 2002 to 73 in June 2008. Particularly, from March 2004 to July 2007, the Federal funds rate climbed up from 1% to 5.4%, but it failed to prevent a plunge of the USD index as the United States’ balance of payments kept deteriorating.

? Example 2: During mid-2007 and April 2009, the Fed slashed the interest rate, but the USD index was on a continuous upward ride.

In mid-2007, the Federal Reserve began to slash the interest rate to prevent asset bubble burst that could potentially trigger financial and economic crises. In early 2009, the Federal funds rate stood as low as 0.2%, but the USD index kept rising from mid-2008 to April 2009, which we believe is mainly a result of the safe haven effect amid crises.

The strong USD index today is, without doubt, a result of the Fed’s interest rate hikes. But at the time, it should be noted that this round of USD upsurge was already underway in June 2021. Back then, the Fed did not signal any monetary policy adjustment, while its balance of payments kept worsening.

IV. CHINA’S MACROECONOMIC POLICY

Faced with external complexities, China should remain dedicated to its goal of stabilizing growth and keep expansionary fiscal and monetary policy in place, while persisting with the floating exchange rate regime despite Fed rate hikes and managing cross-border capital flows effectively.

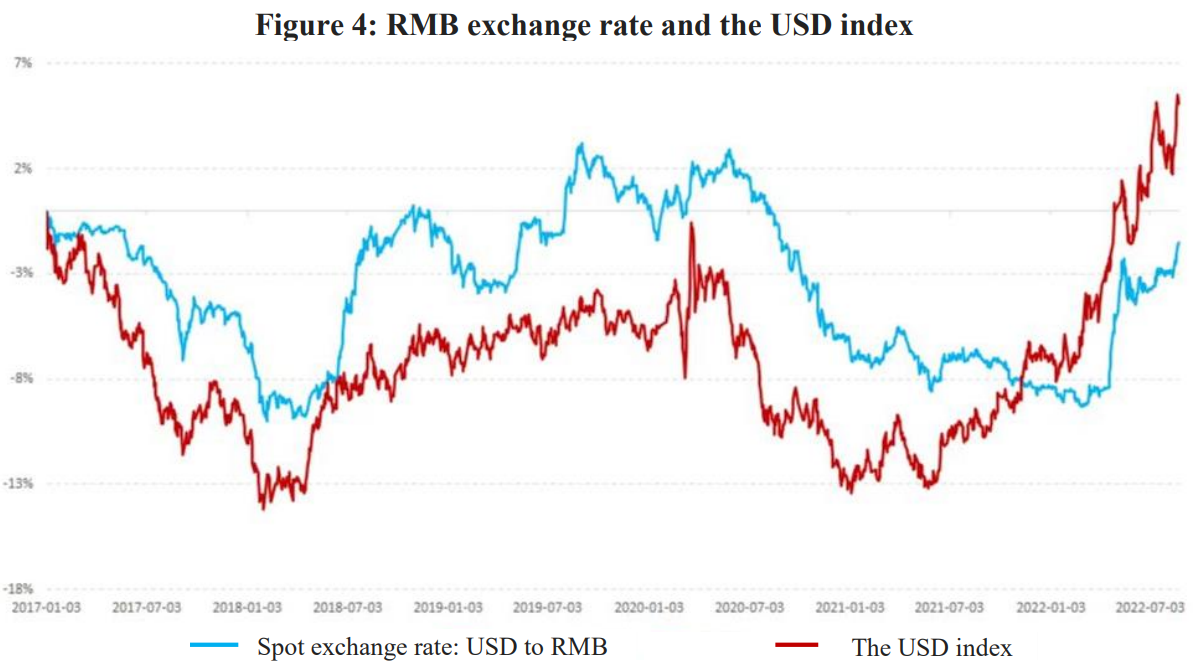

Figure 4 shows that while RMB has depreciated against the greenback, it has remained resilient against most of the other currencies because of China’s strong export. The current USD appreciation, especially against the RMB, is expected to be short-lived. There is no threshold that’s worth special attention such as 7. Betting on the short-term strength of the USD is risky; so is that on USD-RMB exchange rate.

The thing China needs to do remains the same: maintain flexible RMB exchange rate, and keep up sound management of cross-border capital flow. Yuan’s depreciation against the USD is a coin with two sides, and we do not need to worry too much about it. There is the possibility of intensified capital outflow, though not necessarily immediately obvious from statistics, but it’s hard to say by how much. To address this issue, China must continue to deepen institutional reforms, and until that, it cannot turn to a hands-off approach to cross-border capital flows. Fed hikes have no doubt made things harder for China’s macroeconomic management, but the most fundamental challenge still lies within.

This is the transcript of the author's speech at the CMF Symposium on Macroeconomic Hot Issues (No. 52). The views expressed herewith are the author’s own and do not represent those of CF40 or other organizations. It is translated by CF40 and has not been subject to the review of the author.