I. CHINA’S MACROECONOMIC PERFORMANCE

? China’s economy was contracting, with PMI lower than 50. July recorded a manufacturing PMI of 49.4, 0.4 percentage points higher than in July. Large-sized manufacturers’ PMI was 50.5, 0.7 percentage points up from July; that of medium-sized manufacturers was 48.9, 0.4 percentage points higher than in July; and that of small ones, 47.6, 0.3 percentage points down from July.

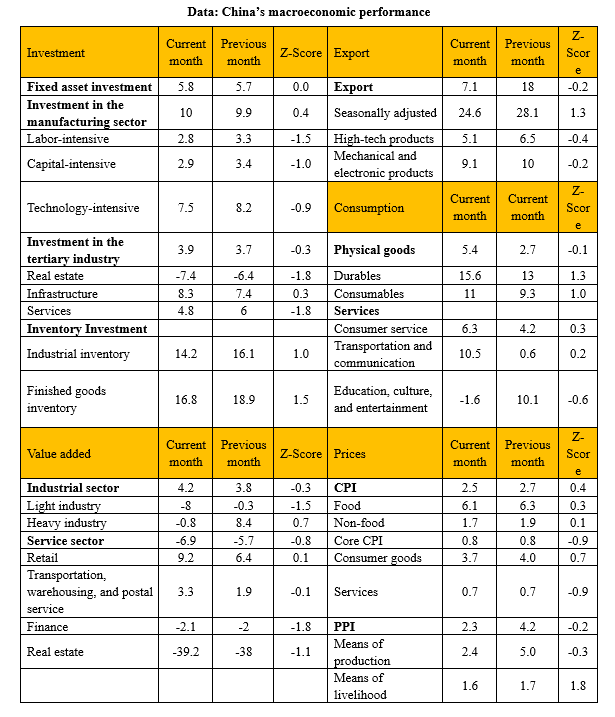

? Industrial production rebounded. In August, the value added of industries above designated scale nationwide grew by 4.2% year on year, 0.4 percentage points higher than in July, and 0.3% month on month. Specifically, value added by manufacturing increased by 3.1% year on year; that of mining, by 5.3%; that of power, heat, gas and water suppliers, by 13.6%; that of equipment manufacturers, by 9.5%; and that of high-tech manufacturers, by 4.6%. From January to July, total profit of industries above designated scale decreased by 1.1% year on year.

? Import and export both slowed down. In August, USD-denominated export increased year on year by 7.1%, 10.9 percentage points down from July; import rose year on year by 0.3%, 2.0 percentage points down from July. China pocketed a monthly trade surplus of 79.4 billion USD, 2.19 billion USD lower than in July.

? Consumption improved. In August, China’s total retail sales of consumer goods picked up year on year by 5.4%, 2.7 percentage points up from July. Specifically, retail sales of goods rose year on year by 5.1%, 1.9 percentage points up from July; revenue of catering services ascended year on year by 8.4%, 9.9 percentage points higher than in July. Automobile sales grew year on year by 15.9%, 6.2 percentage points up from July. During January and August, total online retail sales nationwide increased year on year by 3.7%; online sales of physical goods, accounting for 25.6% in total retail sales of consumer goods, climbed year on year by 5.8%.

? Fixed asset investment slowed, and real estate investment continued the downturn. During January-August, China’s total fixed asset investment recorded a cumulative year-on-year growth of 5.8%, 0.1 percentage points higher than that over the first 7 months of the year. Cumulative growth of private fixed asset investment was 2.3%, 0.4 percentage points down from the number for January-July. Specifically, cumulative growth of manufacturing investment was 10.0%; the figure for infrastructure investment in the tertiary industry stood at 8.3%; investment in real estate development declined year on year by 7.4%, 1.0 percentage points higher than that for January-July. From January to August, commercial housing sales area dipped 23.0% yoy, 0.1 percentage points lower than the decline over the first seven months; the floor space of newly built homes declined 37.2% yoy, 1.1 percentage points higher than the fall during January - July.

? Core CPI remained low with PPI falling back. August witnessed a year-on-year CPI growth of 2.5%, 0.2 percentage points lower than a month ago. Specifically, non-food price grew year on year by 1.7%, 0.2 percentage points down from July; food price, by 6.1%, also 0.2 percentage points down from a month ago. Core CPI excluding food and energy prices increased year on year by 0.8%, same as in July. In August, China’s PPI rose year on year by 2.3%, 1.9 percentage points narrower than the increase in July.

II. MACROECONOMIC ENVIRONMENT

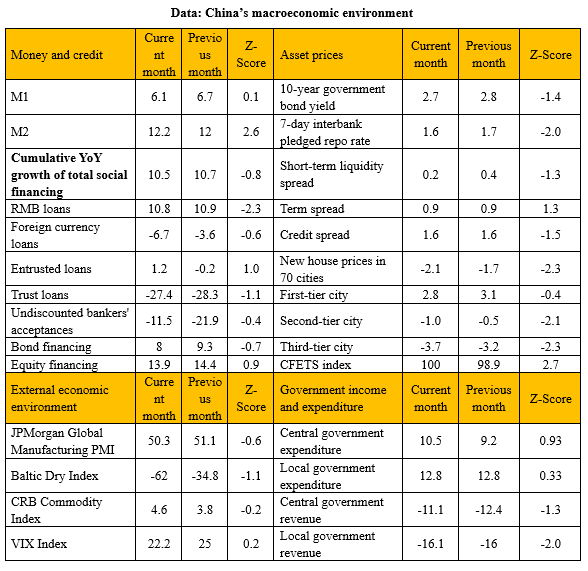

? The global economy suffered a setback. The J.P. Morgan Global Composite PMI came in at 49.3 in August, 1.5 percentage points down from July; J.P. Morgan Global Manufacturing PMI stood at 50.3, 0.8 percentage points down from a month ago. Manufacturing PMI in the United States stood as the same in July at 52.8, while that in the Eurozone fell back to 49.6 from 49.8 in July, and that in Japan, from 52.1 to 51.5. CRB commodity prices elevated by 1.3% month on month.

? The growth of social financing slowed down. The year-on-year growth rate of M1 in August was 6.1%, down 0.6 percentage points from July; that of M2 was 12.2%, up 0.2 percentage points from July. The growth of social financing was 10.5% year on year, down 0.2 percentage points from July. August recorded newly formed social financing of 2.4 trillion yuan, an increase of 1.7 trillion yuan from July. Among them, newly issued government bonds (Treasury bonds + local government bonds + special bonds) was 0.3 trillion yuan, down 0.1 trillion yuan from July; newly issued corporate bonds stood at 1.7 trillion yuan (LGFVs included), up 1.4 trillion yuan from July; new debt of the household sector was 0.5 trillion yuan, up 0.3 trillion from July.

? The 7-day repo rate fell. The 7-day interbank pledged repo rate averaged 1.56% in August, down 11 basis points from July. The short-term liquidity spread represented by the difference between the 3-month SHIBOR and the 3-month Treasury bond yield fell by 17 basis points from July to 0.20%. The term spread represented by the difference between the 10-year Treasury bond yield and the one-year Treasury bond yield increased by three basis points from July to 0.91%; the credit spread represented by the difference between the 10-year AA-rated bond yield and the 10-year Treasury bond yield rose by 1 basis point from July to 1.61%.

III. NEAR-TERM OUTLOOK AND RISK WARNING

1. Resurgences of the pandemic all over the country exerts an impact on the economic operation and may intensify the downward pressure on the economy.

2. The downturn in the real estate market is a drag on overall credit expansion, and demand remains weak.

3. It is necessary to watch out for the impact of economic downturn on financial risks.

4. It is necessary to watch closely changes in the international environment and the pandemic situation at home, and the pressure they bring on export.

IV. POLICY SUGGESTIONS

1. Sustain the resilience of the exchange rate.

2. Reduce the interest rate by 25 bps each time until the employment and growth targets are reached.

3. Provide fiscally subsidized, new types of bonds and policy loans to boost investment in the public goods and quasi-public goods infrastructure projects with limited returns. Aim at annual growth in infrastructure investment of not lower than 10%.

4. Establish real estate funds to stabilize normal financing for real estate companies. Boost market-based competition on mortgage rates, so as to reduce households’ debt burdens; collect transaction taxes temporarily based on local conditions to avoid excessive house price hikes in some cities. Convert some of the developers’ housing stock into subsidized rental housing, to reduce the developers’ debt burdens.

5. Establish special funds to help market entities battered during the pandemic get back on their feet.