Abstract: In this article, the author explores the close relationship between the real estate sector and the financial sector by analyzing cases of China and Japan. He then points out that the upward trend of the real estate sector in China may have come to an end, a fact that will bring huge impact on the financial sector and accelerate the transformation and innovation of the latter. It will create huge household demand for wealth management, and in turn boost the growth of the financial sector and bring changes to its profit models.

Thirty years ago, China had a small economy and even smaller financial sector, but its M2 expanded rapidly. The phenomenon sparked widespread speculation in the market about whether the over 300 billion yuan household savings would rush out on a buying spree like a tiger out of the cage, leading to bank runs and hyperinflation.

Today, the savings of the household sector in China has exceeded 100 trillion yuan, but consumption recorded negative growth in the first half of the year. At the same time, the M2 has reached 258 trillion yuan, ranking first in the world; in the first half of the year, the added value of the financial sector accounted for 8.7% of GDP, the highest level among major countries in the world.

In summary, China’s financial sector is veritable “big finance”, with the banking sector being especially large. However, as the real estate investment started to see negative growth, monetary expansion in China would inevitably slow down. What is the trend of big finance and how will its structure change in the future?

I. THE DEEP-SEATED REASONS FOR THE “BIGNESS” OF BIG FINANCE

China’s financial sector used to be small and sluggish before the 1990s. With the large inflow of foreign capital and the substantial increase in exports since 1990, the central bank has infused a large amount of base currency into the economy through the foreign exchange settlement system in the form of funds outstanding for foreign exchange. China’s monetary expansion started since then. Later, during the country’s transition from a big agricultural country to a manufacturing giant, massive credits were required to support infrastructure investment and industrialization, leading to skyrocketing bank loans. The boom of the real estate sector and the associated land capitalization after 2000 has further expanded the financial sector.

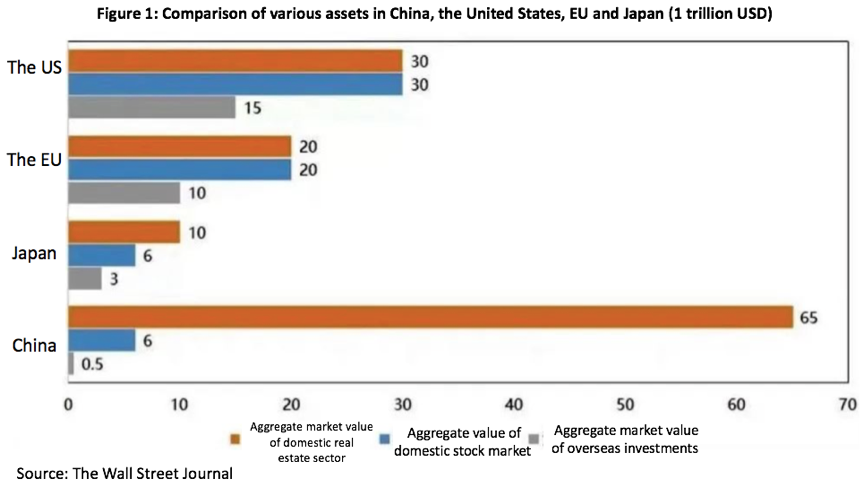

Today, the total market value of the real estate sector in China is rather huge. According to an estimate by The Wall Street Journal at the beginning of 2020, the size of China’s real estate sector exceeds the sum of the United States, the EU and Japan, reaching 65 trillion US dollars, which is about 4 times China’s GDP, which explains why China’s M2 is close to that of the United States and the EU combined.

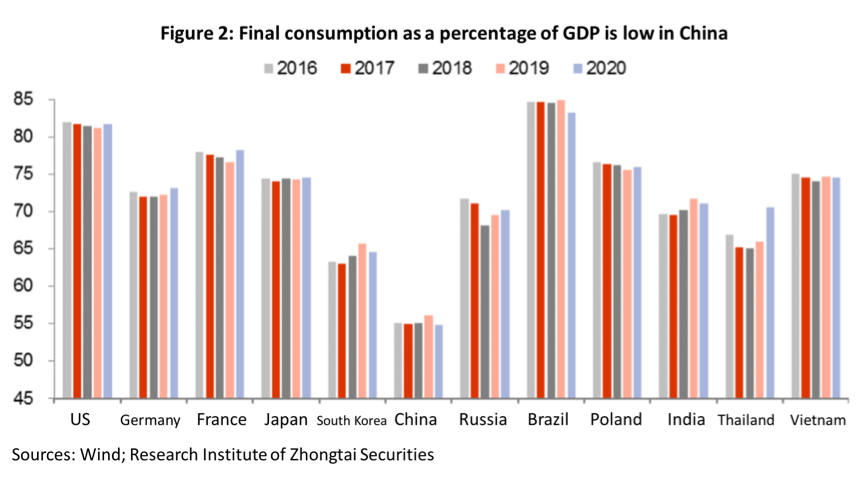

China's economic growth is significantly different from that of Western countries as the contribution of investment (capital formation) to GDP in China is around 40%, a very high level and about twice the global average, while the contribution of consumption is of a rather low level. Investment requires financing, which has led to the huge and still expanding size of China’s financial sector. So far, the growth rate of M2 has remained above 10%, while the GDP growth rate in the first half of the year was only 2.5%.

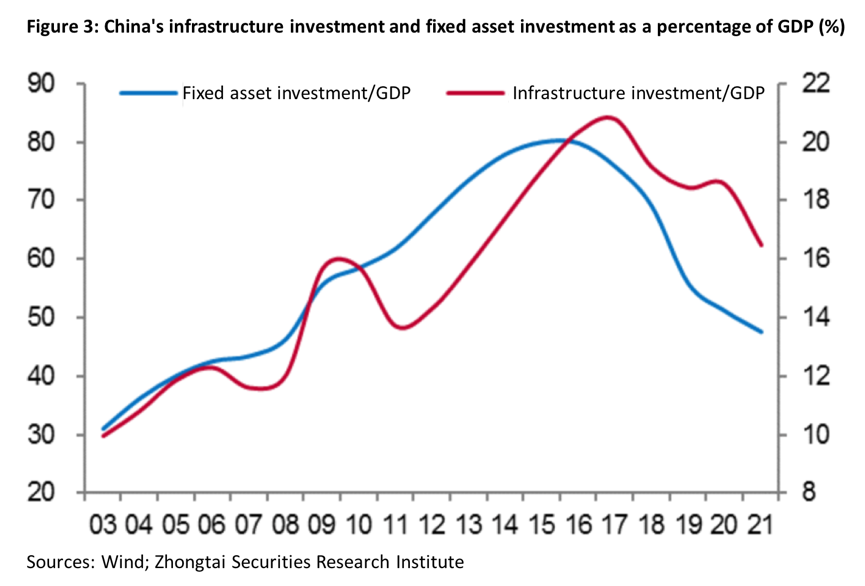

From 2015 to 2016, fixed asset investment accounted for 80% of GDP in China, more than twice the level of Japan before its real estate bubble burst in 1991. However, both fixed asset investment and infrastructure investment have declined since 2017, indicating a weakening economic growth momentum driven by investment.

In addition to the fact that China has the world's largest scale of indirect financing, the country has also seen a large scale of direct financing over the years. Taking equity financing in the securities market as an example, the total amount of initial public offerings (IPOs) and refinancing amounted to 5.2 trillion yuan from 2017 to 2021, of which 1.5 trillion yuan was raised in 2021, ranking first in the world. The scale of equity financing in China has already surpassed that of the US though the proportion of direct financing in China is far less than that in the US. This is a result of the progress in the registration-based IPO system, which has made it easier for companies to go public and thereby boosted the scale of direct financing.

II. THE UPWARD TREND OF THE REAL ESTATE SECTOR MAY HAVE COME TO AN END, AFFECTING THE SCALE AND STRUCTURE OF THE FINANCIAL SECTOR

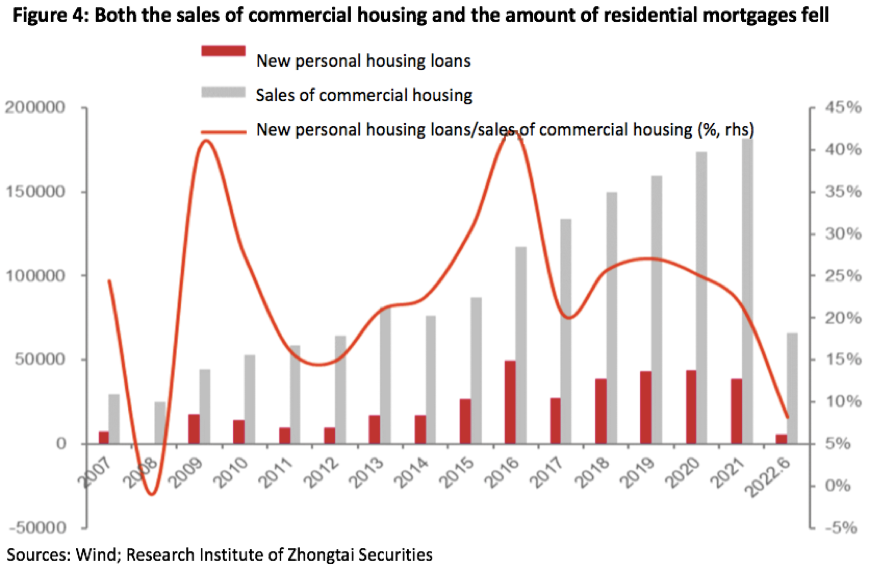

The real estate data in the first half of the year is very discouraging. Real estate investment, a main driving force for economic growth in the past, records negative growth of -5.4%, making a negative contribution today. Along with the sharp drop in the sales of commercial housing, land area purchased and new floor area constructed have also experienced a dramatic fall. The scale of new housing loans to residents in the first half of the year is close to zero.

Real estate investment, new floor area constructed and commercial housing sales have all recorded negative growth. Will it be temporary or reflect a long-term trend? The proportion of young people (20-49 years old) and the level of urbanization both have declined. For example, urbanization rate in 2021 increased by 0.82 percentage points, showing a visible slowdown. At the same time, the ratio of young people to the total population has started to decline as early as a decade ago. That is to say, the fundamentals that have supported the real estate sector are no longer able to sustain the rise in house prices. Of course, there are other supporting factors.

Policies for the real estate sector have been relaxed since the fourth quarter of last year. But no significant effect was produced, which may indicate that policy relaxation can only change the slope but not the trend. Fortunately, the overall trend of China’s housing prices remains relatively stable, meaning that the policy has at least succeeded in “stabilizing housing prices, land prices and expectations”.

Real estate, as a quasi-financial asset, accounts for about 30% of the bank's total assets, and real estate-related loans account for about 30% of the bank's loan balance. Many bank wealth management products or trust products are related to real estate. The contraction of the real estate sector will have a significant impact on the scale and structure of the financial sector.

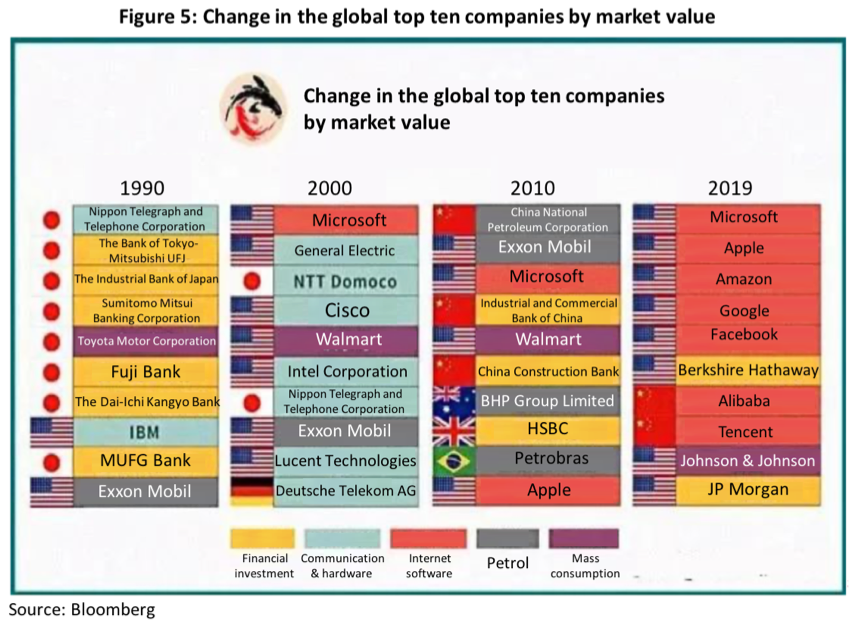

In the case of Japan, in the heyday of real estate in 1990, six of the world's top ten listed companies were Japanese banks, and two of the remaining four were Japanese companies too. Only ten years later, by 2000, there were no Japanese banks in the world’s top ten companies by market value. Fast forwarding to 2010, when the development of China's heavy and chemical industries and real estate sector reached their prime, Industrial and Commercial Bank of China and China Construction Bank entered the rank of the world's top ten by market value.

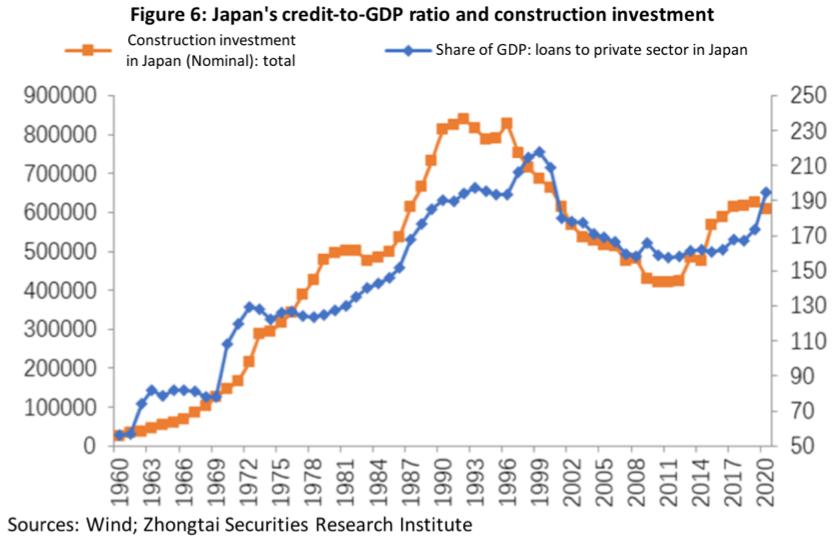

Credit data of both the US and Japan show that the increase of credit has a significant and positive correlation with real estate, indicating that the proportion of indirect financing is greatly correlated with the real estate cycle. During the time when real estate and asset-heavy industries are booming, indirect financing (bank loans) is more efficient as assets such as land and real estate as collateral have natural advantages.

On the other hand, emerging high-tech industries usually feature high risk, high return and light assets in the early stage of development. In this case, direct financing, especially equity financing, is more suitable than indirect financing. Therefore, among the top ten companies by global market value in 2021, eight of them are US companies, all of which are high-tech and Internet companies. TSMC is one of them, too.

The valuation of Chinese banks has been falling since over a decade ago, and the stock price has dropped from an average of about 3 times price-to-book value (PB) (net assets per share) to less than 1 times PB for 80% of bank stocks today. The fundamentals behind it are the slowdown of China's economic growth and decrease in the return on equity of banks since 2010, which had fallen from an average of more than 20% in 2010 to about 10% in 2021.

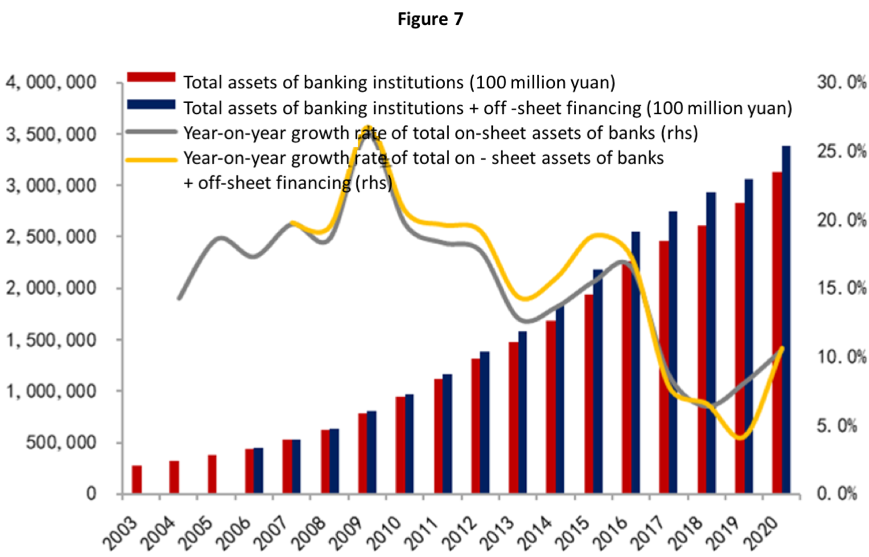

By the end of 2021, the total assets of the banking industry were 344.7 trillion yuan. Although the total assets of the banking industry have kept rising significantly in recent years, the growth rate is declining from a trend perspective. As mentioned earlier, more than 30% of the bank's total assets are real estate, so the contraction of the latter will probably lead to the shrinkage of the bank's total assets.

Therefore, we can assume that if the real estate market enters a downward cycle, the overly large share of value added of the real estate sector in GDP will also change.

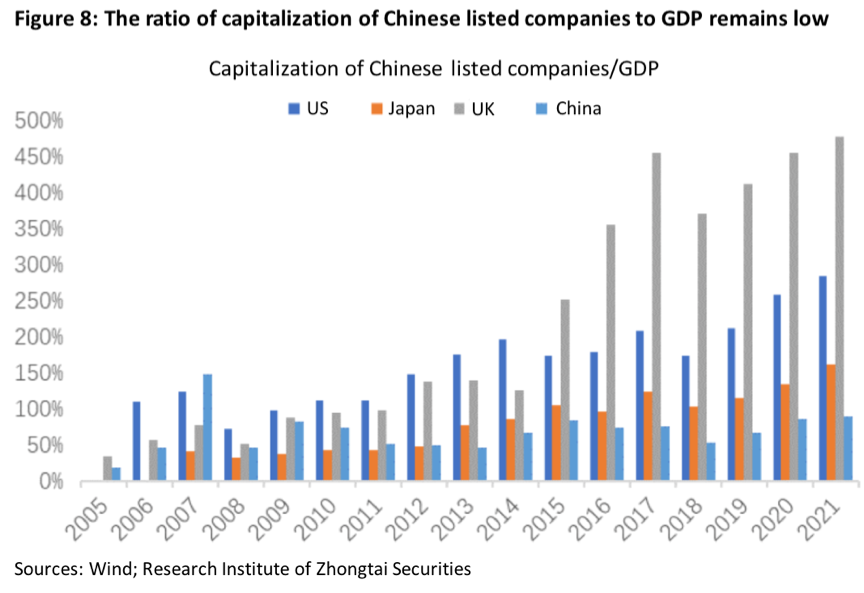

If bank-dominated indirect financing accounts for a smaller share of China’s financial sector, direct financing should represent a larger share. Based on China’s economic structure, the transformation has just started. In terms of securitization ratio, the A-share market capitalization-to-GDP ratio is much lower than that of developed economies such as the US, Japan and the UK. Therefore, there is much room to improve China's direct financing (especially the equity market).

In recent years, although the number and value of China’s IPOs have hit record highs, the A-share market does not face much financing pressure. The newly raised capital from public funds alone exceeds the total financing amount of A-shares (including refinancing). With the expansion of social security insurance and pension funds into the market, along with further opening of the capital market, foreign investment has large space to flow into the A-share market. Then the share of direct financing will continue to rise, and the non-bank financial sector will also have huge room to develop.

III. CHINA’S FINANCIAL SECTOR: TO BE LARGER, BUT MORE IMPORTANTLY, STRONGER

China's economy is the second largest in the world. Accordingly, China ranks first in terms of the number of companies listed on the latest Fortune Global 500, 143 in total. Among the Global 500 companies, there are 31 US financial firms and 36 Chinese financial firms. But the ranking is measured by revenue, reflecting the size instead of the strength of these companies.

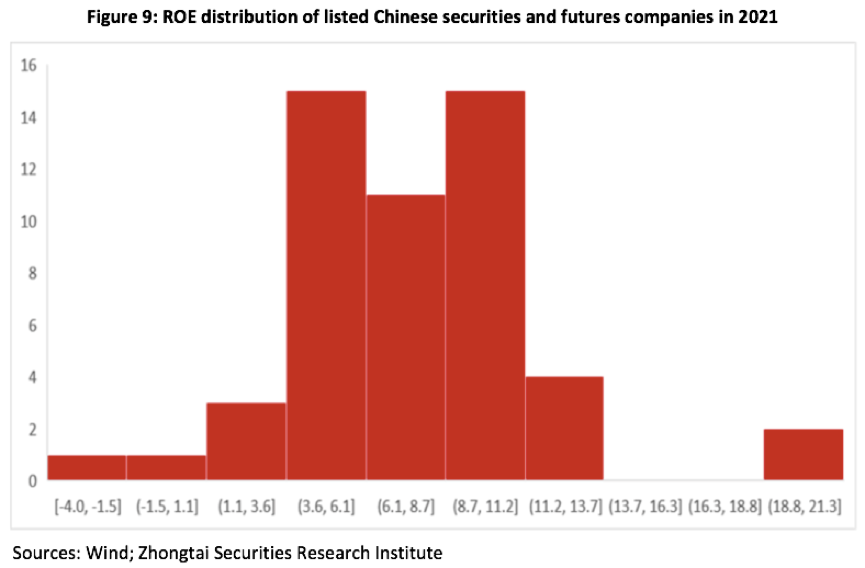

China's securities industry is plagued by excessive homogeneity of business models. Leading companies have similar overall strength, while small firms are squeezed by large ones, as shown in the long-tailed distribution of their ROEs.

Compared with the highly open and competitive manufacturing sector, China’s financial sector clearly lags behind, both in terms of openness and international competitiveness. China’s manufacturing sector has long been open to the world with a low entry barrier. But China is still not a manufacturing powerhouse, even if the scale of the sector equals that of the US and EU combined; in the global industrial chain, China’s manufacturing sector is mainly at the low- and middle-end.

The problem of “l(fā)arge but not strong” is even more prominent in the financial sector.

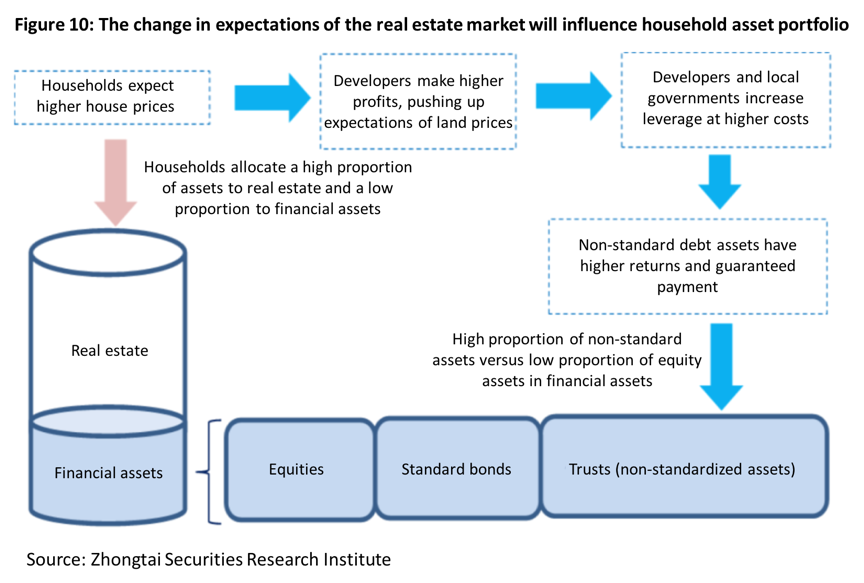

As the real estate market falls into a downward cycle, the asset portfolio of Chinese households will change dramatically, i.e., from house-dominated to financial asset-dominated. Currently, houses account for more than 60% of the household asset portfolio, while financial assets only consist of a small proportion, despite the fact that the bank savings account balance of Chinese households has exceeded 100 trillion yuan, up by more than 10 trillion yuan in the first half of this year alone.

Currently, as China’s new regulations on asset management enforce a net value-based management method, products that can satisfy the need of conservative investors are inadequate and banks are “short of good assets”. This provides huge opportunities for the rise of China’s wealth management institutions. By the end of 2021, the scale of public funds exceeded 25 trillion yuan, and that of private funds reached 19.76 trillion yuan, up by 3.79 trillion yuan compared with 2020. The high level of marketization of private equity funds will lead to the market’s rapid growth in the future.

In summary, as the 20-year upward cycle of the real estate market may come to an end, this will have far-reaching impacts on the financial sector, and promote the transformation and innovation of financial institutions, which will create huge household demand for wealth management, and in turn boost the growth of the financial sector and change profit models. Currently, China’s financial institutions are large but not strong, with dominance in the domestic market but a weak presence in the international market; and the phenomena of homogeneous business models and local monopolies are quite prominent. But going forward, highly market-based, smart, and innovative financial institutions as well as several internationally renowned multinational financial institutions will for sure emerge in China.

The article is translated by CF40 and has not been reviewed by the authors. The views expressed herewith are the author’s own and do not represent those of CF40 or other organizations.