I. CHINA’S MACROECONOMIC PERFORMANCE IN JULY

? The Chinese economy plunged back into downturn. July recorded a manufacturing PMI of 49.0, 1.2 percentage points lower than in June. Large-sized manufacturers’ PMI was 49.8, 0.4 percentage points down from a month ago; and the numbers are 48.5/47.9 and 2.8/0.7 percentage points for medium- and small-sized manufacturers respectively.

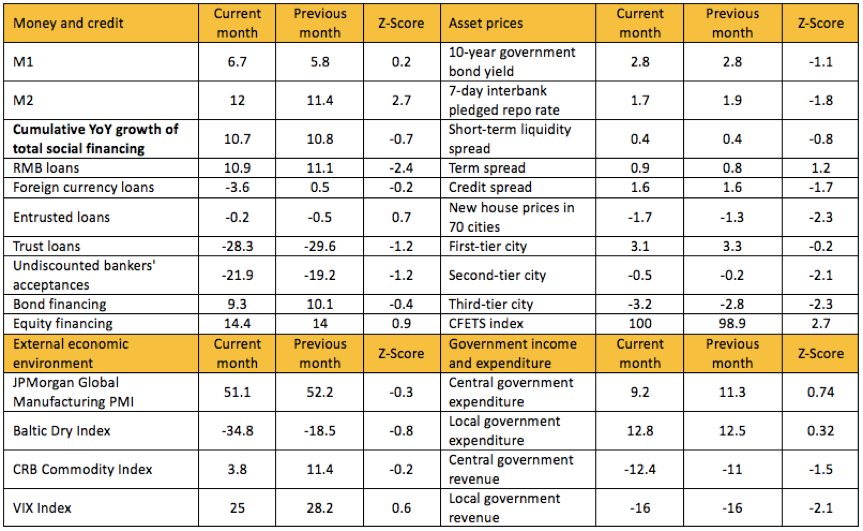

? Industrial production stabilized but edged down slightly. In July, value added of industries above designated scale rose year on year by 3.8%, 0.1 percentage points lower than in June. Specifically, value added of manufacturing grew year on year by 2.7%; that of mining, 8.1%; that of power, heat, gas and water supply, 9.5%; and that of high-tech manufacturing, 5.9%. During the first half of 2022, total profit of industries above designated scale climbed up by 1.0% year on year.

? Export growth remained high with expanding trade surplus. In July, USD-denominated export increased year on year by 18.0%, 0.1 percentage points up from June; import rose year on year by 2.3%, 1.3 percentage points up from June. China pocketed a monthly trade surplus of 101.27 billion USD, 3.33 billion USD higher than in June.

? Consumption came down. In July, China’s total retail sales of consumer goods picked up year on year by 2.7%, 0.4 percentage points down from June but 0.3% up on a quarter-by-quarter basis. Specifically, retail sales of goods rose year on year by 3.2%, 0.7 percentage points down from June; revenue of catering services slid year on year by 1.5%, the decrease narrower than in June by 2.5 percentage points. Automobile sales grew year on year by 9.7%, 4.2 percentage points down from June. During January and July, total online retail sales nationwide increased year on year by 3.2%; online sales of physical goods, accounting for 25.6% in total retail sales of consumer goods, ascended year on year by 5.7%.

? Fixed asset investment slowed down and real estate investment continued to decline. From January to July, the national fixed asset investment increased by 5.7% year on year, down 0.4 percentage points from that of January to June. The cumulative year-on-year growth rate of private sector fixed asset investment from January to July was 2.7%, down 0.8 percentage points from that of January to June. Among them, investment in manufacturing saw a year-on-year growth of 9.9%; infrastructure investment in the tertiary industry 7.4%; investment in real estate development decreased by 6.4% year on year, down 1.0 percentage points from that of January to June. From January to July, the cumulative sales area of commercial housing fell by 23.1% year on year, a drop of 0.9 percentage points from that of January to June; the cumulative area of new construction decreased by 36.1% year on year, a decrease of 1.7 percentage points from January to June.

? Core CPI still remains at a low level and PPI has fallen. The CPI increased by 2.7% year on year in July, up 0.2 percentage points from June. Among them, non-food prices increased by 1.9% year on year, down 0.6 percentage points from June; food prices increased by 6.3% year on year, up 3.4 percentage points from June. The core CPI, excluding food and energy, rose 0.8 percent year on year, down 0.2 percentage points from June. The PPI recorded a year-on-year growth rate of 4.2% in July, down 1.9 percentage points from June.

II. MACROECONOMIC ENVIRONMENT

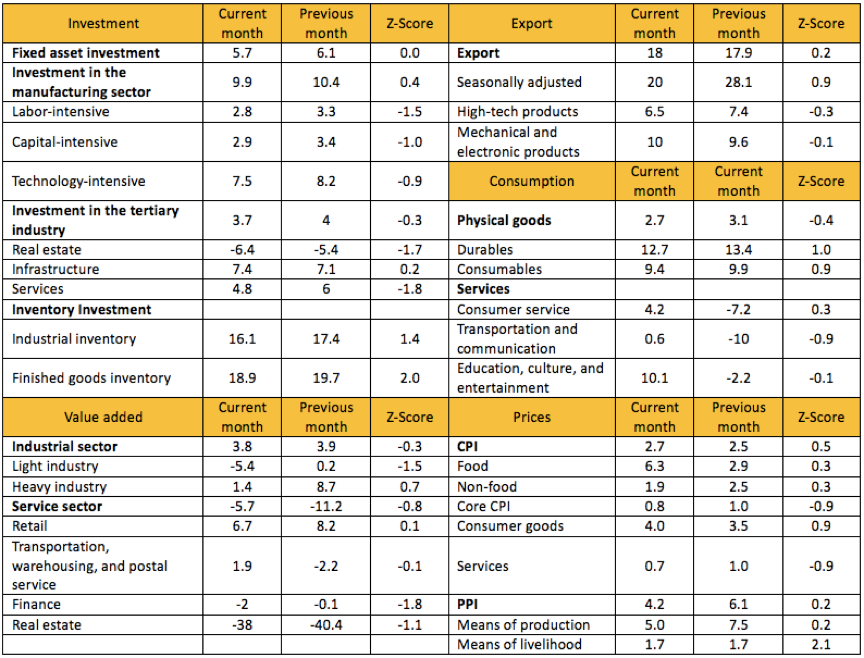

? The degree of external economic prosperity declined. The JPMorgan Global Composite PMI stood at 50.8 in July, down 2.7 percentage points from June; the JPMorgan Global Manufacturing PMI 51.1, down 1.1 percentage points from June. The US manufacturing PMI fell from 53.0 in June to 52.8 in July, the Eurozone’s manufacturing PMI fell from 52.1 in June to 49.8 in July, and the Japan’s manufacturing PMI fell from 52.7 in June to 52.1 in July. The spot market price index CRB Commodity Index fell 6.3% month on month.

? Growth of total social financing (TSF) slowed. July recorded a year-on-year growth in M1 of 6.7%, 0.9 percentage points higher than in June; that of M2 was 12.0%, 0.6 percentage points higher than in June. TSF grew year on year by 10.7%, 0.1 percentage points lower than in June. In July, new social financing of 0.8 trillion yuan was added, 4.4 trillion yuan down from June, including new government debt (government bonds + local government bonds + special bonds) of 0.4 trillion yuan, 1.2 trillion yuan lower than in June, new corporate debt of 0.2 trillion yuan (including those of local financing vehicles), 2.5 trillion yuan down from June, and new household debt of 0.1 trillion yuan, 0.7 trillion yuan down from June.

? The 7-day repo rate fell. The 7-day interbank pledged repo rate averaged at 1.66% in July, 20 bps lower than in June. The short-term liquidity spread represented by the difference between the 3-month Shanghai Interbank Offered Rate (SHIBOR) and 3-month government bond yield dropped 6 bps to 0.36% from June; the term spread represented by the difference between the 10-year government bond yield and 1-year government bond yield rebounded 10 bps to 0.88% from June; and the credit spread represented by the difference between 1-year AA-grade bond yield and 10-year government bond yield declined to 1.60% by 1 bps from June.

III. NEAR-TERM ECONOMIC OUTLOOK AND POTENTIAL RISKS

1. Covid-19 resurgences across the country will continue to cripple the economy and increase downward pressure;

2. Excessive downward trend of the real estate market will drag total credit expansion and weaken domestic demand;

3. Financial risks will mount as the economy goes down;

4. Changes in external environment will put pressure on export.

VI. POLICY SUGGESTIONS

1. Reduce the interest rate by 25 bps each time until the employment target and the economic growth goal are reached.

2. Provide fiscally subsidized, new types of bonds and policy loans to boost investment in the public goods and quasi-public goods infrastructure projects with limited returns. Aim at annual growth in infrastructure investment of not lower than 10%.

3. Establish real estate funds to stabilize normal financing for real estate companies. Boost market-based competition on mortgage rates, so as to reduce households’ debt burdens; collect transaction taxes temporarily based on local conditions to avoid excessive house price hikes in some cities. Convert some of the developers’ housing stock into subsidized rental housing, to reduce the developers’ debt burdens.

4. Establish special funds to help market entities battered during the pandemic get back on their feet.

Data: China’s macroeconomic performance

Data: China’s macroeconomic environment