Abstract: As Q2 data show, before the private sector could substantially regain its momentum, the government could play a decisive role in stabilizing investment and growth. The level of government support, represented by general fiscal spending, is expected to be the “determinant” of China’s macroeconomic operation in the second half of 2022.

In the second quarter of 2022, the key feature of China’s economy is that while the private sector is losing steam, the government steps in and plays a decisive role in stabilizing growth by increasing infrastructure investment and general fiscal spending. Before the private sector substantially regains its momentum, government support for investment and growth is particularly important. However, dragged down by various factors, general fiscal revenue needs to take in another 3 trillion yuan through various channels.

When fiscal expenditure is determined by revenue, if the revenue is not replenished in time, fiscal spending will have to be cut for better budget balance. If fiscal revenue can be replenished, with the recovery of the private sector and the support of the government, even if external demand weakens, internal demand alone can make up for the gap and help achieve a new round of steady recovery. In either case, fiscal finances will be the “determinant” of China’s macroeconomic operation in the second half of 2022.

I. THE GOVERNMENT PLAYED A DECISIVE ROLE IN STABILIZING GROWTH IN Q2 2022

Due to the Covid-19 shocks, China’s Q2 macroeconomic performance moved in a v-shaped trajectory. The unexpected resurgence of Covid-19 cases in April hit both the supply and demand sides. Thereafter, the supply side, including production and logistics, rebounded rapidly. In contrast, recovery of demand is slower in general. In addition to the gap between supply and demand, macroeconomic gap is also present between the private and public sectors.

On the one hand, demand related to the private sector remains weak. The economic vitality in the household sector has declined sharply. The recovery of household consumption is clearly sluggish; the real estate sector is still dipping, with no material improvement in land purchase, investment, new construction, and sales. Amid mounting pressure of export decline, manufacturing investment has also started to slow down.

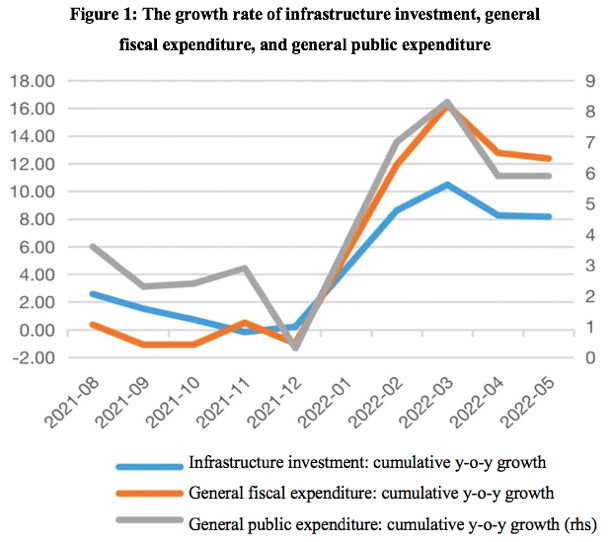

On the other hand, the government has stepped up efforts to counter the downward pressure on the economy and played an essential role in stabilizing growth and credit expansion. First (Figure 1), infrastructure investment since the beginning of 2022 has fared well. In May, the cumulative yoy growth of infrastructure investment reached 8.2%, far beyond the average level of the past five years, making it an important force to stabilize investment and boost aggregate demand. Second, the growth of general public expenditure and general fiscal expenditure including government-managed funds has maintained relatively high levels. Lastly, government-related financing has accounted for a larger share of total social financing.

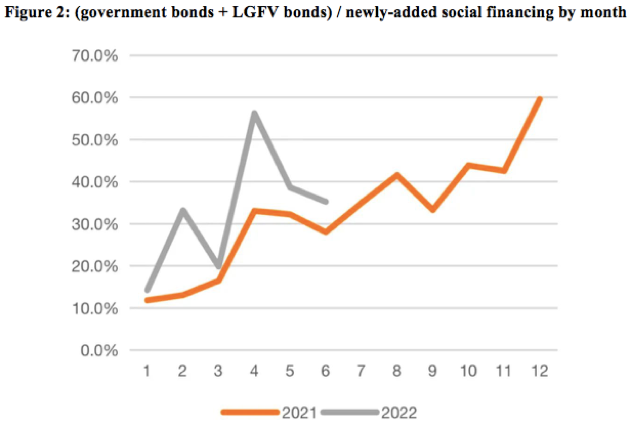

As shown in Figure 2, the share of government bonds from April to June (including central government bonds, local government bonds, and special bonds) and LGFV bonds in monthly social financing is much higher than that in the same period last year, reaching 38% (versus 30% in the same period of last year). In terms of growth, total new social financing in the first half of 2022 has increased by 3.2 trillion yuan compared with the same period a year ago, 2.2 trillion of which comes from new issuance of government bonds. If we take into account the fact that a large amount of loans are granted to urban construction investment platforms, the government’s contribution to the growth of social financing is obviously much higher.

It should be noted that the connection between infrastructure investment and general fiscal spending has become much stronger. Before, there isn’t any fixed relationship between general fiscal spending and infrastructure investment. The former is not a necessary condition, let alone a sufficient condition for the latter. As shown in Figure 3, between 2013 and 2017, the annual average growth of infrastructure investment reached 17.3%, while that of general fiscal spending was only 10% (in certain years the figure was less than half of infrastructure investment growth). Between 2018 and 2020, the annual average growth of infrastructure investment was only 2.8%, whereas that of general fiscal expenditure stood at 11.3%.

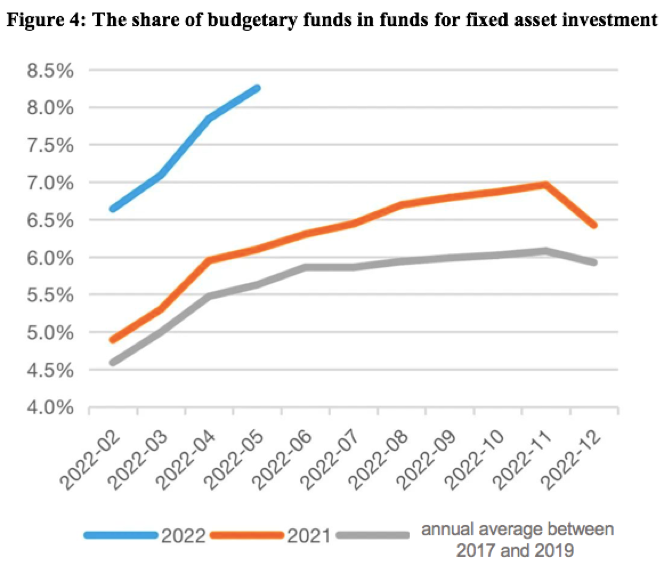

Since 2021, general fiscal spending seems to have had a stronger association with infrastructure investment. A direct evidence is that budgetary funds have accounted for a much larger share of funds for fixed asset investment over the past 5 years. As illustrated in Figure 4, since the beginning of 2022, the share of budgetary funds in funds for fixed asset investment has systematically increased by 2.5 percentage points. Of all investments, infrastructure investment is supported more by budgetary funds. If the newly-added budgetary funds are mainly used to finance infrastructure investment, based on an assumed proportion of 25%, the share of budgetary funds in funds for infrastructure investment has systematically risen by 10 percentage points.

In summary, the government has made major contributions to investment growth in Q2; the sharp increase in general fiscal spending has directly supported the expansion of infrastructure investment and made up for the demand gap in the private sector. Looking forward, the recovery of the private sector still faces many obstacles. The slow improvement of household income inhibits the recovery of consumption demand; weakening external demand will drive exports down and have an impact on manufacturing investment; the debt problem facing real estate developers would prolong the bottoming out of the entire sector.

Before the private sector substantially regains its momentum, government support for investment and growth is particularly important, which is reflected in the data of Q2, 2022. In the second half of this year, the level of government support, represented by general fiscal spending, is expected to be the “determinant” of China’s macroeconomic operation. Therefore, it is necessary to take a close look at the general fiscal revenue and expenditure from the perspective of the whole year, so as to assess the sustainability of government support.

II. GENERAL FISCAL REVENUE AND EXPENDITURE AMID A COMPLEX ENVIRONMENT

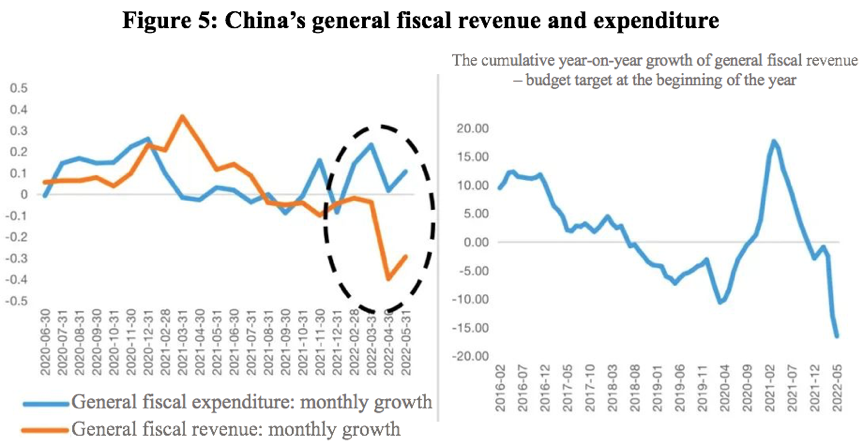

According to the target put forward by the Ministry of Finance in the budget report at the beginning of the year, general budget revenue will grow at a pace of 2.8%, and general fiscal expenditure 12.8% in 2022. As shown in Figure 5, the year-to-date general fiscal expenditure is roughly in line with the budget target, while the growth of general fiscal revenue is far from reaching the target. A large gap between fiscal revenue and expenditure has emerged.

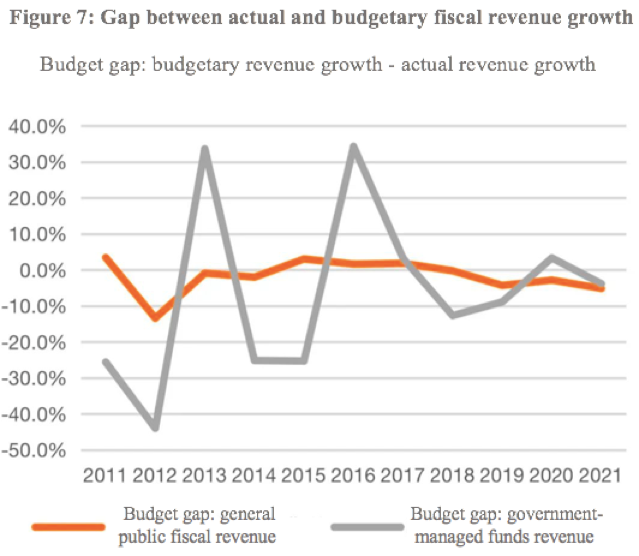

Specifically, the decline in general fiscal revenue was mainly due to the decrease in the revenue from the sale of land, which is part of the budget revenue of local government-managed funds. As shown in Figure 6, from January to May 2022, the revenue from land sale has remained lower than the level of the same period last year, with a cumulative decline of 29%. According to the experience of the past ten years (Figure 7), the gap between general public budget revenue and actual revenue is rather stable, with only a few years exceeding 10%, and for most of the time not exceeding 5%. The budget gap in government-managed funds revenue is obviously more volatile; at the time when the actual revenue hit the lowest level, it can be 40% lower than the budget target. Therefore, even if the whole year’s growth of local government-managed funds revenue remains at today’s level, which is significantly lower than the budget target, it can be taken as a normal phenomenon.

According to our estimates, if this situation continues, a large gap between general fiscal revenue and expenditure may emerge, which will require additional sources of revenue. In terms of local government-managed funds, with the revenue target of 9.442 trillion yuan and the revenue growth of -30% already set, there will be a revenue gap of 2.83 trillion yuan for the whole year.

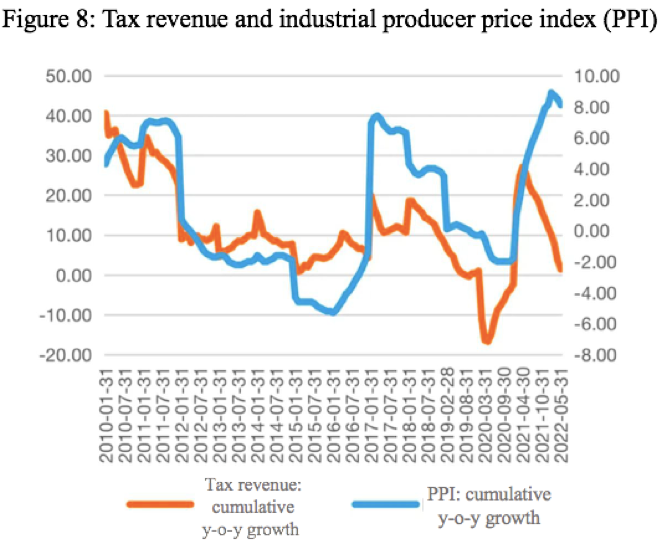

General public budget revenue also its uncertainties. As shown in Figure 8, the cumulative growth of tax revenue in the past ten years has a close correlation with the year-on-year change in the producer price index (PPI), which is because China’s current taxation system is dominated by turnover tax (value-added tax). Higher prices of industrial products often correspond to an increase in the total turnover volume, that is, an increase in the tax base and therefore a rise in tax revenue.

In 2021, due to the base effect, although the cumulative year-on-year growth of tax revenue kept falling throughout the year, the annual growth rate reached 11.9%, hitting a record high since 2013, and even exceeding the growth rate in 2017. This shows that although there seems to be some deviation between the tax revenue and the PPI in 2021, after excluding the base effect, tax revenue in 2021 basically corresponds to the historical high level of the PPI. If the PPI can remain at a high level in the future, tax revenue will be secured; otherwise tax revenue may also fall to a level lower than expected. Tax revenue accounts for 85% of the national public fiscal revenue, and every one percentage point decrease in the growth rate roughly corresponds to a revenue gap of 180 billion to 200 billion yuan.

III. THE PROSPECT OF FISCAL SUPPORT UNDER THE LOGIC OF DETERMINING EXPENDITURE BASED ON REVENUE

Now at this stage, it can be seen that the sustained efforts of the government since the beginning of the year have filled a large part of the demand gap of the private sector and cushioned the impact of the sudden resurgence of the pandemic. In other words, had it not been hit by pandemic resurgences, the Chinese economy might have witnessed a more impressive performance.

However, the fiscal support in the first half of the year is not merely an emergency response, but is implemented in accordance with established goals and plans. As of June, a total of 4.65 trillion yuan of central government bonds, local government general bonds and special bonds had been issued, of which special bonds directly related to infrastructure investment stood at a total of 3.4 trillion yuan, basically meeting the whole year’s target. Considering the pace of bond issuance this year, the support of government bonds to social financing in the first half of the year is likely to become a drag in the second half of the year.

Under the earn-and-spend approach, the general fiscal revenue and expenditure may eventually converge at some point within the year, a phenomenon that requires full attention. As shown in Figure 9, whether it is a general public budget or a government-managed fund budget, the budget gap of expenditure is highly consistent with that of revenue, indicating that both are arranged in accordance with the earn-and-spend logic. Therefore, if there is a revenue gap of 3 trillion yuan in general fiscal revenue this year, then there are only two possibilities: revenue converges to expenditure, or vice versa.

Next, there is a high probability that the interest rate hikes around the globe will lead to declining economic vitality around the world, so China is facing the pressure of weakening external demand, making it even more crucial to boost domestic demand. Measures must be taken to support fiscal expenditure, whether it is to issue next year's bond quota in advance, to issue additional special bonds, or to establish infrastructure investment funds. Only in this way, can the government continue to support steady growth, and growth be more secure in the second half of the year.

The article was first published in CF40's WeChat Blog on July 14, 2022. It is translated by CF40 and has not been reviewed by the author. The views expressed herewith are the author’s own and do not represent those of CF40 or other organizations.