Abstract: China’s individual pension account system can safeguard the country and its people from population aging. To smooth out the problems in social security, the residential and employee pension endowment insurance should be connected to the individual pension system. The system also needs the subsistence allowances system for the elderly to make a bottom line and conditional incentives to participants.

I have been interested in pension systems for a long time. When I was an undergraduate, my teacher suggested that I study the Swedish pension system. Nearly four decades later, my interest in this topic remains undiminished.

On April 21,2022, the General Office of the State Council issued the Opinions on Promoting the Development of Individual Pensions (hereinafter referred to as "Opinions"), which have three main principles – government policy support, individual voluntary participation, and market-based operation. The highlight of the Opinions, I think, is that it stresses the private property attributes of individual pensions.

The attributes of private property are mainly reflected in four aspects:

1. The right of possession is stated as that the “individual pension system employs individual accounts that the payment is entirely borne by the participants and fully accumulated. “Individual account" is the key.

2. The right to benefit is reflected in the account’s "closed operation; the rights and interests belong to the participants, and cannot be withdrawn in advance unless otherwise stipulated." In addition, participants can use the money in the account to buy bank wealth management or savings products, and fund or investment products at their own risk.

3. The right of disposition lies in that the funds in the individual pension account can be transferred to other investment institutions and other accounts. This is a breakthrough because such operations were not allowed before.

4. The right to use. When one meets the age requirement, the money accumulated in the individual pension account is only for the individual’s use.

In my opinion, individual pensions are not 100% private property but very close to. Except for the article "not to be withdrawn in advance unless otherwise stipulated", the other parts are already equivalent to private property.

The Opinions also clarify that the individual pension system is "connected with the basic pension insurance and enterprise (occupational) annuities as a supplement of the pension insurance." China’s pension system already has two pillars: basic pension insurance (including urban working group pension insurance and rural and non-working urban resident pension insurance) and supplementary enterprise pension insurance (only available in large institutions with good benefits).

I believe the significance of the individual pension system is not limited to the supplement of the first and second pension insurance pillars.

Ⅰ. CHALLENGES TO CHINA'S PENSION SYSTEM

Chinese President Xi Jinping published the article On the High-Quality and Sustainable Development of Chinese Social Security" in Qiushi Journal on April 16 this year, paying close attention to the challenges faced by China's pension system and social security system.

With the changes in China’s principal contradiction, the accelerated urbanization, aging population, and diversified employment, four deficiencies have been exposed in China’s underdeveloped social security system.

1. Deficiencies in the connection of the social security system, the system integration, and the smooth transfer among systems.

2. Imbalance of revenue and expenditure among different regions, with some facing risks “bottom-through” for social security funds.

3. Some migrant workers, people with flexible employment, and people employed in new businesses either are not included in or dropped out of the social security system.

4. Unreasonable differences in benefits between urban and rural areas, regions, and groups.

The above can be seen as the foundation for the introduction of the individual pension system. Because of these problems, China introduced a system of individual pension accounts.

Next, I will discuss the challenges in China’s pension system.

1. Challenges in transfer and connection brought about by fragmented policies.

China’s employee endowment insurance system and the resident endowment insurance system are separated from each other, each under localized management without connections between different regions. Over the years, we have been hoping to improve the connection between the two pension insurance systems. At present, the provincial-level connection of employee endowment insurance has been realized and we are now advancing to the national connection. Resident endowment insurance, which starts from county-level units, is moving towards the city-level connection.

China has 334 prefecture-level administrative units. A simple calculation will tell you that there are at least 33 employee endowment insurance fund pools and more than 300 for rural and non-working urban residential endowment insurance. Population mobility and labor mobility have become a major trend in society, so a person may transfer from residential endowment insurance to employee pension insurance, or vice versa, or flow across regions. Transfer with mobility has been convenient within the scope of employee endowment insurance but not for the residential endowment insurance. The transfer flow between employee and residential endowment insurance has not yet been realized. We found some solutions before, but none were the best deal for the participants.

2. The pension pressure varies greatly in different regions.

The term “endowment insurance dependency ratio" means the ratio of the number of retirees who receive pensions to the number of working people who are paying premiums. The ratio is 9:1 in the province of Guangdong, so 9 working enterprise employees bear the pension of 1 retiree. In Jilin and Heilongjiang, however,1.2people are responsible for 1 retiree, each with huge pension pressure.

This is undoubtedly the result of labor mobility. The 2020 census shows where the labor force is going. For example, advanced provinces, such as Guangdong, have a net inflow of population. I don't think the regional differences in pension pressures are due to differences in fertility rates, but rather uneven economic development that causes people to leave low-income regions and go to high-income regions. The consequence is that provinces with large population outflows face the risk of “bottom-through” social security fund deficits.

Therefore, the solution mentioned in the Opinion is a good one. In my opinion, such deficit risk should not be solved by each province independently but should be coordinated across the country. For example, the deficit in Heilongjiang should not be fully borne by the province, of which many young people here have gone to Guangdong.

The idea of overall planning was proposed in the late 1990s. Three decades later, we are still working hard to realize the final step. So you can see how difficult it is.

What are the difficulties?

First, local interests constitute huge resistance. Provinces like Heilongjiang may be happy to see the overall planning policy implemented, but it is not good news for provinces with large population inflow, such as Guangdong, Zhejiang, Shanghai, and Beijing.

The second is moral hazard. Once the policy is implemented, those provinces that already have deficits will hope to have money in their accounts in the short term to make up for the deficits. There has been a policy that allowed uninsured people to pay tens of thousands of yuan in social security fees so that they can receive pensions for decades after retirement. This policy has been suspended due to moral hazard implications.

3. Some people either are not covered by or dropped out of the pension system.

New economic formats and flexible employment are increasing. Flexible employment has reached 200 million in China, accounting for more than a quarter of its working population. There are as many as 84 million flexible employees on platforms, such as takeaway riders, who are closely related to our lives, accounting for one-tenth of the national labor force, and the number is increasing.

The vast majority of these people who are flexibly employed through the platform are not involved in occupational pension insurance, which is also a hot topic on the Internet. A few years ago, social security fees started to be collected by tax authorities instead of social security authorities, adding pressure on many enterprises to insure their employees. Under the new situation, compulsory insurance is no longer effective. The pushy taxation department cannot guarantee the flexible employees of the platforms participate in the occupational pension insurance. A large number of people are therefore excluded from the social pension insurance. The consequence is that people will not have pension security, especially young people.

In my opinion, the original intention of the individual pension system is to help these uninsured people and prevent them from being missed out on insurance, not to protect those high-income groups.

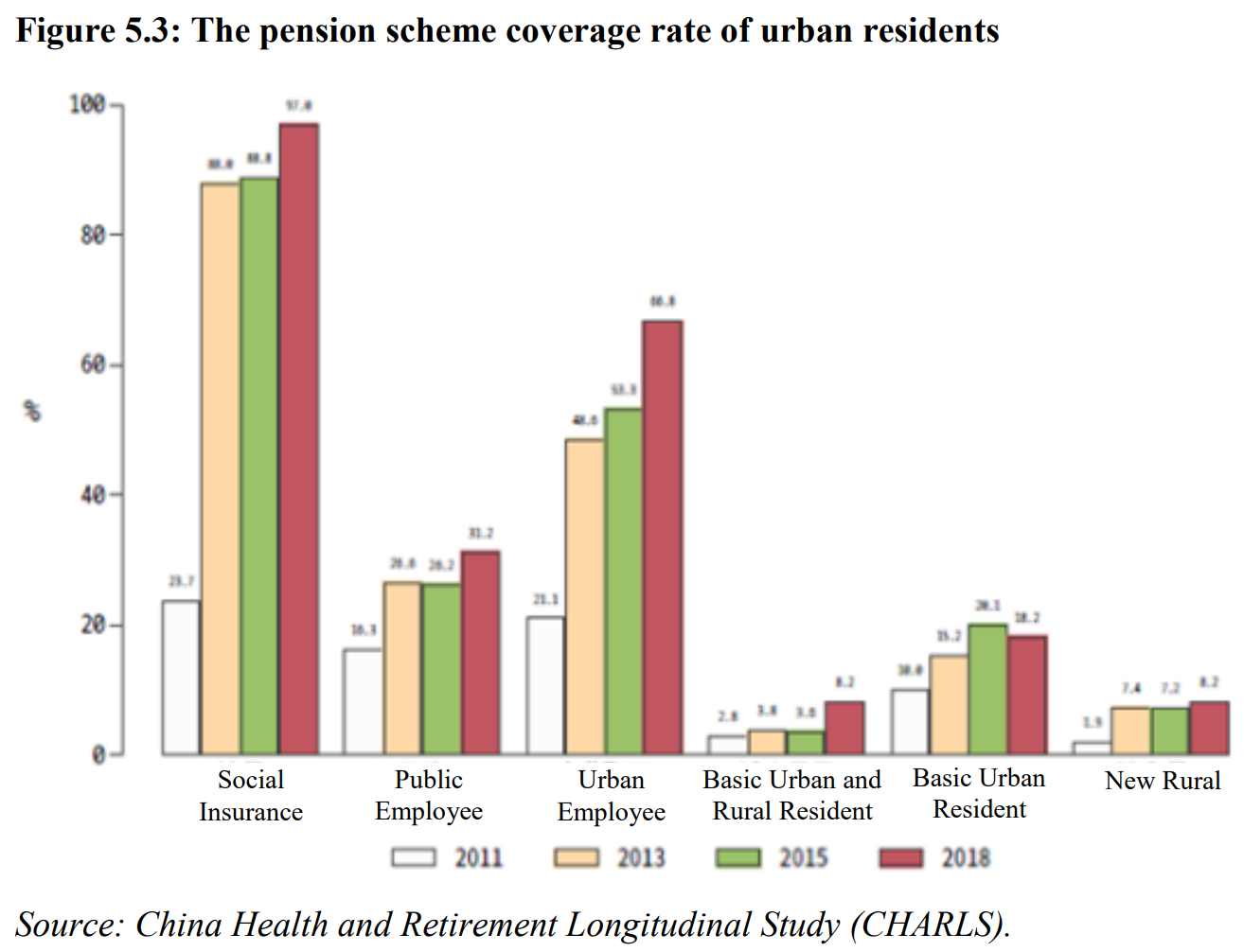

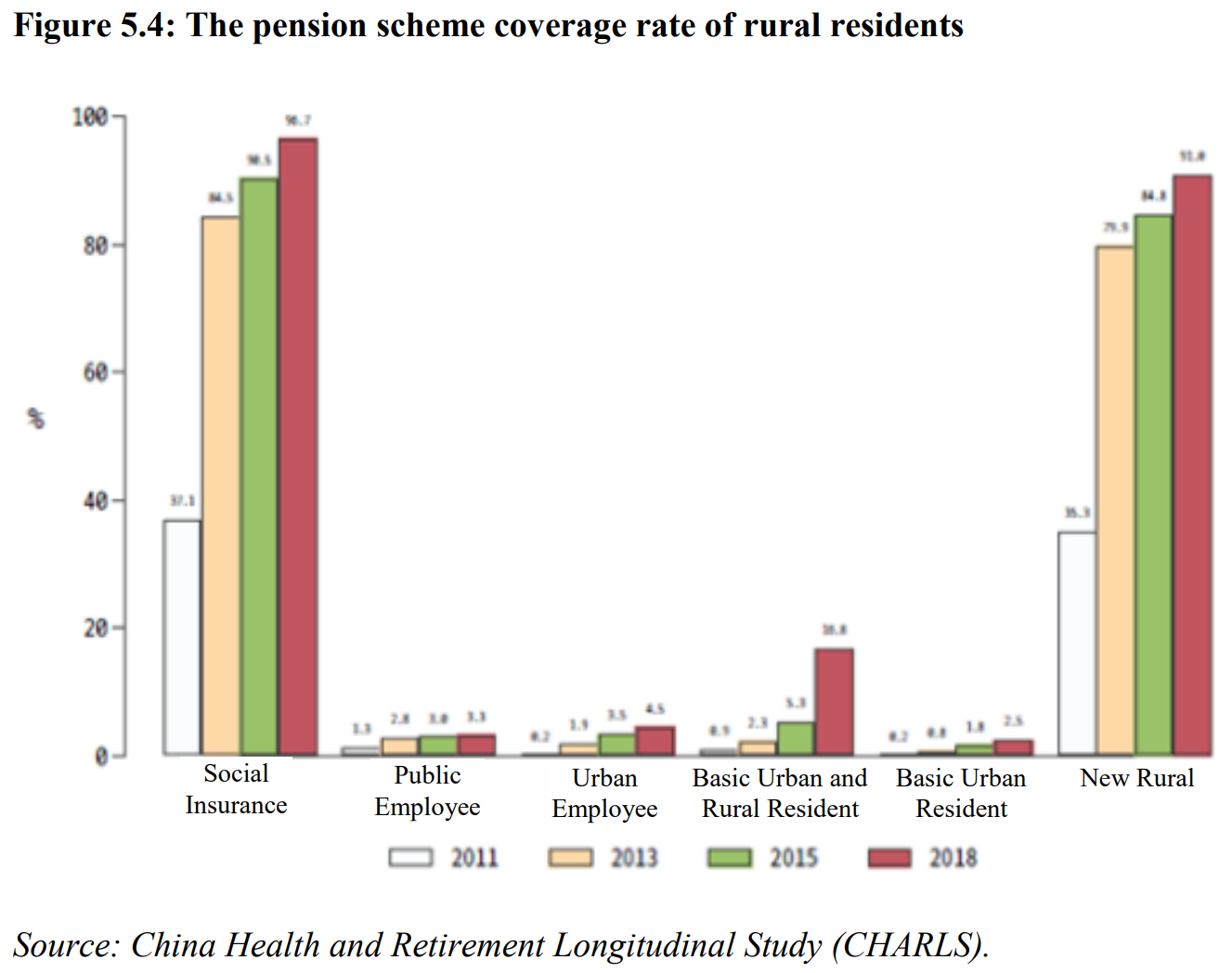

In the graph below, the horizontal axis represents different types of social insurance and the vertical axis represents the coverage rate; the bar in different colors stands for data from 2011 to 2018. It can be seen that the social insurance has covered all the residents with urban or rural household registration. But urban residents mainly enroll in employee pension scheme with a coverage rate of 66.8%. Rural residents are mainly covered by the New Rural Pension Scheme (NRPS).

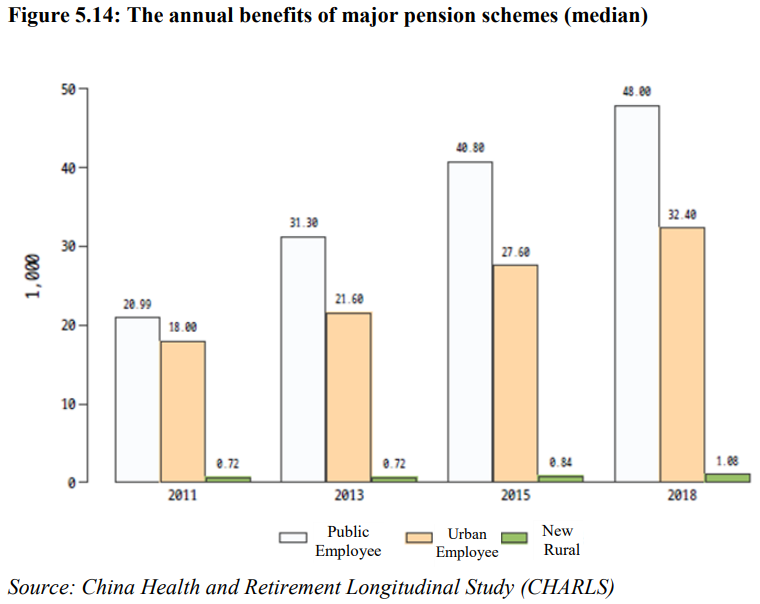

The resident schemes can only provide very limited money. Overall, the annual benefits of major pension schemes vary significantly.

In Figure 5.14, the orange bar on the far right represents the median annual benefits of the urban employee pension scheme in 2018 (around 32,000 yuan). The small green bar stands for the median annual benefits of the rural resident pension scheme (around 1,000 yuan). The wide benefit disparity between the two schemes is due to the fact that they are different types of insurance.

Is the level of pensions sufficient for life after retirement? The table below shows a simplified estimate we made in 2015. We selected a sample of people aged between 50 and 60 years old who are not yet retired.

We first reckoned their current wealth, discounted the expected pension benefits provided by social insurance back to the present value, and then used the poverty line as a benchmark to measure whether the pension can ensure their living standards above the poverty line if they no longer work after retirement. The result is that some 88% of the rural residents will live in poverty after retirement if they only live on the pension provided by social insurance. The figure decreases when other types of wealth are included. Even so, there are still some 38% of rural residents who will live in poverty after retirement. This means that for the population who is approaching the retirement age, pensions alone are not enough to get by, which is a big problem. If by the time today’s young people retire and they still haven’t saved enough in social security, they will face the same problem. Without sufficient pensions, the elderly will have no choice but to work to earn a living.

II. THE DEVELOPMENT OF CHINA’S PENSION SYSTEM

The basic pension insurance for urban employees was launched in the 1950s and went through a round of reform in the 1980s that separated the scheme for employees in enterprises from the scheme for civil servants and public institutions employees. In 2015, the public employee scheme was merged into the basic pension insurance for urban employees.

The basic pension insurance for residents was introduced in 2009. Since 2009, the New Rural Pension Scheme has started to cover rural residents. In 2012, the basic pension insurance for urban residents was launched and quickly covered urban residents with no social security and unemployed people. In 2014, the merger of the schemes for urban and rural residents began and was completed in 2020. From then on, all Chinese residents can have access to at least one basic pension insurance if they want.

1. The system design of the basic pension insurance for employees

Nevertheless, the system design of the basic pension insurance for employees has great defects. From the 1960s to 1986, employers pay the contributions. But with the bankruptcy of state-owned and collectively-owned enterprises, the society has to pay the bill.

From 1986 onwards, SOEs started to make overall planning for the basic pension insurance including at the industrial and regional levels. From 1991 onwards, employees began to pay contributions to the pension scheme.

In 1997, the Decision of the State Council on Establishing a Unified Basic Pension Insurance System was released, which reached the consensus that social pooling and individual pension account would be combined and set up the formula for contribution and claim for pension benefits. As for the “social pooling” part that is paid by employers, the highest contribution rate was 20%, and now the figure drops to 16%; in some regions, the contribution rate for employers is 14% and that for employees is 8%.

2. The purpose of combining social pooling and personal account

The combination of social pooling and personal account was intended to strengthen the incentives for participation through the creation of personal account. But personal accounts are not personal assets as they run on an empty account with no accumulated funds, and individuals have no right to benefit and cannot transfer the funds. In addition, based on the system design, 20% of the pension funds will be pooled together and decoupled from personal interests. I think this is the key reason why the motivation for participation is so low.

The incentives for participation are critical to pension insurance, and we have done research on it early on. Professor Xu Jianguo and I published two papers back in 1999 that pointed out “the current transitional model did not address the problem of incentives for contributions, leading to considerable refusals and evasions”. At that time, we proposed a market-based approach. Specifically, measures include defining the implicit debt of pensions and allocating them to individual accounts; transforming the pension accounts into real accounts to be managed by the market. This is actually what the new personal account system can do.

In 2001, we issued another paper that delved into the problems of the incentive mechanism. Based on careful calculations, we concluded that “the key to designing the incentive mechanism is to reduce the “absolute egalitarian” practice, put the contributions of enterprises and employees into personal accounts, and let professional investment institutions manage the accounts to yield reasonable returns that are low-risk and no less than individual investment returns.” “Based on rational assumptions, 1% of GDP can be used to pay off the current pension debt in just 50 years, which is equivalent to a 5.6% payroll tax. If 10.2% of wages are contributed to personal accounts, the accounts can achieve full accumulation and provide pensions with a replacement rate of 60%. These two items together only account for 15.8% of wages.” This shows the importance of participation incentives.

Unlike employee pension scheme, resident pension scheme is based on a personal account system with fund accumulation at the outset. All the money, including individual’s own contributions and government subsidies to attract contributions, goes into the personal accounts. However, the personal account system is still fundamentally different from the one we are talking about today. Residents cannot control their own accounts as they cannot choose investment institutions, and the interest rate is determined by the government, plus the accounts cannot be carried. Therefore, though the resident pension scheme is based on personal account and fund accumulation that seems to allow people to check the balance, the incentives to participate are insufficient. In my view, the lack of incentives is mainly because individuals are not given enough control and sense of security over their own accounts, thus undermining people’s trust in the resident pension scheme.

3. Under the new situation, incentives for contributions are more important

With the booming of the new economy, it is more important to strengthen incentives for pension contributions. As the proportion of flexible employment and platform employment increases, a large number of young people are outside of the social security system for employees. Meanwhile, the system already has considerable retirees in it, which requires continued contributions from the young people to cover the pensions for the elderly.

Currently, China has about 84 million flexibly employed workers in the platform economy, accounting for 10% of the total labor force. If many young people turn to flexible employment and leave the social security system, who will support the seniors? By then, the deficit of pension funds will grow, putting more pressure on the sustainability of the whole pension system.

At the same time, as for young people, if they do not save enough for their retirement when they earn the most and do not have social insurance after retirement, they will feel extremely insecure.

Moreover, overwhelmed social security will also lead to more informal employment. Policy contributions to social security cover pension, medical care, unemployment, and maternity insurance, accounting for some 36.8%, and the contribution rate of the housing provident fund ranges between a minimum of 10% and a maximum of 24%. These items combined account for 46.8%. If enterprises pay contributions according to the rules, the labor cost would be very large. This means every 1,000 yuan of salary paid by enterprises comes with 400 yuan of social insurance.

The situation is leading to more informal employment. Platforms could have had formal contracts with workers. But due to the excessive pressure of social security contributions, they have to employ informal workers. As a result, the actual contribution rate of enterprises is far lower than the policy contribution rate, and enterprises reduce their contributions on purpose by lowering the number of workers and their wages. The behavior will ultimately drive out enterprises and workers who abide by the regulations and laws. To address the issue, stricter regulation and audits would not work. Instead, we must consider strengthening the incentives for social security participation. Human beings are rational and self-interested. So we should make the participants feel that this is a good deal and thus motivate them to contribute. This is one of the most powerful laws in economies.

III. CHOICE OF PENSION SCHEMES

There are two types of pension schemes: DB (defined benefit) and DC (defined contribution). DB features fixed income, where the contributor knows how much he or she will get monthly after retirement; while DC features fixed input, where the contributor knows how much in total he or she will have to put in the scheme with the actual return after retirement uncertain. DC falls under the individual account system.

DB and DC systems can be further divided into two types: that with and without fund accumulation. DB without fund accumulation resembles the pay-as-you-go system, with no pension accumulation until retirement. The needed money when one retires is paid by those still working.

The individual account system also has two subcategories: the nominal account and the actual account. An amount deposited in the nominal account would be immediately paid to the already retired people, and so the money does not really stay on the account book, despite that the account still shows a balance; while with an actual account, the money stays there.

1. Things to consider when choosing a scheme

China needs to consider several things when choosing the pension scheme:

First, which one is better for coping with population ageing. Population ageing is an important reason why China needs to transform its pension system, where there is an implied risk of changing age structure. Another factor to consider is whether delayed retirement should be encouraged.

Second, which is more attractive to investors. This is something that many countries have not considered when they implement pension schemes on a voluntary basis, be it pay-as-you-go or fund accumulation. But a ground for promoting compulsory contribution is to prevent shortsightedness. Many people only see what is right in front of them, which could plunge them into old-age poverty, and it’s the society that will have to pay the price. Some even take advantage of this because they know that the government will not let them starve after they retire. However, making it compulsory could be very difficult.

Third, which caters more to the common prosperity goal without widening the wealth gap.

2. Which scheme is more resilient against population ageing?

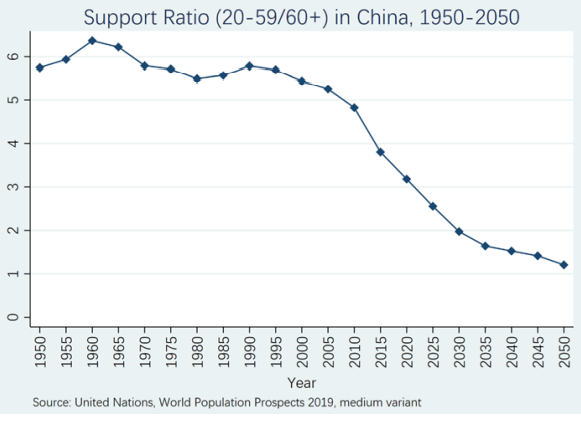

Under the pay-as-you-go system, pensions for the retired are totally paid by the young, and when the support ratio rises, young people will shoulder heavier burdens. Below is a depiction of China’s support ratio over the years that looks at how many people aged between 20-59 is needed to support one person aged 60 and above. It’s clear that the support pressure is mounting at a faster pace. Back in 2000, the ratio was 5.5:1; in 2020, it rose to 3:1, and in 2050 it is projected to reach 1.2:1.

Hence, assuming that the pay-as-you-go system is adopted and the retirement age is 60, half of the amount paid by young people would actually be used to support the old. This is very unsustainable and far from encouraging.

Under the individual account system, if the nominal account is applied, it would be essentially the same as pay-as-you-go because the money does not stay in the account; but if the fund accumulation system is chosen, the elderly would live on their own savings rather than the young people’s contribution. Therefore, fund accumulation would be a more preferable choice for an ageing society. I believe this is also why many places in China are promoting this regime.

3. Which scheme can better promote delayed retirement?

A country must begin to consider delaying retirement when its population is expected to live much longer; otherwise, the support ratio would soon reach 1:1 assuming the retirement age is 60, which is unsustainable. Assuming that life expectancy reaches 90 years, and retirement is delayed to 70 years old, the support ratio would rise rapidly. This is also the major strategy adopted by most countries to cope with population ageing.

Under the pay-as-you-go system, contributors would deem pensions as their “entitlements” and any change in the middle course as “breaking the promise,” and thus resist delaying retirement. But the situation would be a lot different if the individual account system is used. The individual account is a private asset, and retiring early would mean using the money accumulated in the account to support longer elderly life, and so the money available for each year on average would reduce; delayed retirement would mean higher annual income upon retirement. Thus, people may be more willing to delay retirement if life is longer. The individual account system is better from this viewpoint.

Most of the developed countries have chosen pay-as-you-go. Amid the shocks from population ageing, they are recording huge fiscal deficits. However, when these countries first designed their pension system, they did not face the problem of population ageing, and so did not take into account the host of problems resulting from it. Today, they find every step toward delaying retirement difficult, with political forces of all kinds declaring against delaying retirement and pledging to guarantee the welfare of the retired people. There are enough lessons to learn from them with the pay-as-you-go system.

Today, the second pillar of business pension has risen above the first pillar, social security, as the backbone of the pension system in the Unites States, partly owing to the country’s efforts in boosting supplementary insurance. The U.S. also seeks reform, over which Democrats and Republicans have had long disputes, to realize privatized social security. While this goal has not been achieved yet, the U.S. has already significantly transformed its pension system by strengthening the third pillar.

4. Which scheme creates stronger incentives for contribution?

Under the pay-as-you-go system, contributors aim at access to entitlement. They will not get more by contributing more; instead, pension funds will fall safely in their pockets as long as they contribute to the system for long enough. Obviously, such system is easily taken advantage of because it leads people to contribute the least possible amount, with the money from those contributing more used to subsidize those contributing less. This system could attract more contributors, but not necessarily more contribution.

In comparison, under the individual account system, the account is a private asset, and more contribution translates into more gains, thus maximizing the incentives for people to contribute more.

5. Which scheme better serves the common prosperity goal?

At first glance, pay-as-you-go seems to be the right thing. It has the redistribution function, and can subsidize those with lower income. The individual account system does not have such function. However, since many people don’t find pay-as-you-go attractive or only contribute the minimum amount, the actual accumulation could be lower. As a result, people either don’t contribute and get nothing in return, or only get the minimum level of pension. That would actually increase poverty.

The individual account system, while not perfect, could be supplemented by supporting measures in order to fully play its role:

First, it must go with incentives that could arouse as much participation as possible in order to prevent old-age poverty. Encourage all to contribute despite their varying income. That would put everyone under protection.

Second, provide targeted support for lifetime low income earners. This, however, must be clearly distinguished from the first measure. In other words, such targeted support should not twist the incentives for pension contribution.

VI. WHY IS INDIVIDUAL PENSION ACCOUNT ATTRACTIVE?

The individual account system, if well designed and implemented, could actually help reduce poverty. This assertion is grounded on the fact that “everyone has the natural tendency to save.” As one gets old, he/she earns less and spends more; there will be one day when the income cannot cover spending, and that’s why one has to save.

But why would people put their money in a government account since they have their own savings account? This is because personal savings return less, while investment institutions running pensions have the expertise to reap the maximum level of returns. The problem is that such institutions usually set a minimum threshold for investment which low income earners cannot meet. Therefore, most normal people would have to rely on the bank for wealth management. Under the individual account system, there will be more small-amount contributions to institutional investors for professional management that generates higher returns. This is the most attractive thing about individual account.

1. Why is there old-age poverty?

Old-age poverty could be a main reason behind the individual account system’s failure. Lifetime low income earners are more easily to plunge into old-age poverty. Their old-age life lacks support even if they contribute on time. I think government relief, instead of pension, should finance the old-age life of this group of people. Singapore has this program of Workfare that seeks to subsidize low-income groups while encouraging their employment. Those proactively seek employment would earn more subsidies, a large proportion of which directly enters the individual account in support of their old-age life.

To me, this is a very good arrangement. Those who do not contribute to the pension system for their whole life are generally the one that are "neglected" by the social security system, and most of them are self-employed workers. This group of people is not covered by compulsory insurance because it is difficult to determine their income and ask them to contribute. In contrast, the self-employment population in developed countries accounts for a smaller proportion, so it is easier for developed countries to implement compulsory social insurance. However, in low- and middle-income countries, the number of self-employed people is rather large, including peasants. How to increase participation of the self-employed? This is a very important question. Chile and Singapore adopted two different approaches and witnessed very different outcomes.

2. Pension scheme in Chile

Chile implemented its mandatory individual retirement accounts system in 1981. It replaced the previous pay-as-you-go system that was already in crisis. In 1971, Chile's pension expenditure accounted for as high as 17% of its GDP. At that time, there were more than 100 capital pools, and the complex interest relations made it impossible to carry out reform. Under this condition, the Chilean government increased the savings rate, developed the financial market, and realized economic growth.

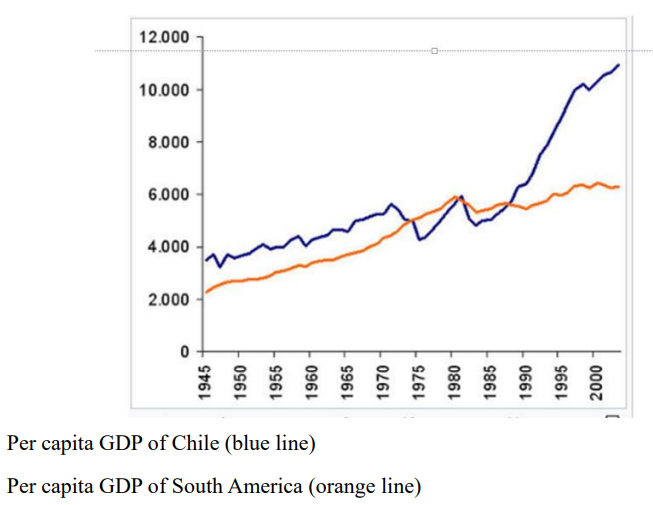

The blue line in the figure below represents Chile's per capita GDP, and the yellow line per capita GDP of South America. It is easy to see that since the reform in the 1980s, Chile made an economic miracle and achieved enormous economic growth, leaving the rest of Latin American countries far behind it. Chile’s success was promoted as a model by the World Bank.

In the 1990s, many countries, including Argentina, Peru, Colombia, Uruguay, Mexico, Poland, Russia and India, adopted the same pension scheme as Chile. It is undeniable that the Chilean system was indeed successful at the time and became a model for pension reformers around the world.

It now appears, however, that the Chilean system has two major design flaws. First, the participation rate is low. South American countries have a large number of self-employed people, with more than one-third of people engaged in flexible employment. These people are not covered by the compulsory social security system and are not required to contribute to pension accounts. More than 20 years later, the Chilean government found that almost half of the population did not participate in the pension system. As for those who did, half chose a low-level pension plan and many did not make continuous contributions. Many people found that the pension they received after retirement was very small.

Then in 2008, Chile set up the Solidarity pension to provide a minimum pension to individuals without other pensions or with pensions of the lowest level. This pension plan covers nearly 60% of the population. So, this is not to help the poor, but to use the money of the contributors to improve social welfare. In 2015, Chile once again boosted social security benefits, far exceeding the poverty line. Such a move seriously dampened the enthusiasm of the contributors, and more and more people are reluctant to contribute to retirement accounts, because doing so may lead to no entitlement.

During the pandemic, a large number of the insured people in Chile asked the government to return the retirement premiums they had contributed. The Chilean government has also repeatedly allowed contributors to withdraw cash. There is no doubt that once the money is withdrawn, it will never come back to the retirement accounts.

Chile's individual retirement account system is about to fail, as are many Latin American countries. Most Latin American countries gave up the individual retirement accounts system and returned to the pay-as-you-go system.

3. Pension scheme in Singapore

Singapore established its own pension system, the Central Provident Fund in 1955 when the country was under British rule. The United Kingdom did not want to take on the pension problem of the colonial people, so it left the problem to the colonial people.

Judging from the current situation, the Singaporean pension scheme is rather robust. It still works well today and is not much affected by population ageing.

The core of this system is the mandatory contribution of employees, fully funded personal accounts. The participants can independently decide the investment institution or choose the risk-free investment guaranteed by the government. In the 1950s, Singapore also had a large self-employed population. The Singapore government didn’t force the low-income or self-employed people to join the pension scheme, but attracted these people to participate with interest subsidies. According to the data I researched recently, as long as S$60,000 is saved in an individual retirement account, the government will increase interest rate by 1%. At the same time, the government encouraged young people to pay for their low-income parents with means such as tax exemption.

In addition, the Singapore government will only come forward to help those elderly people who have no one to depend on and receive a low income for their whole life. For those who have someone to rely on, the government stresses the responsibility and obligation of young people to take care of their parents. Government assistance is not simply giving out money, but providing medical care and free schooling for children. To me, the success of the Singaporean pension scheme is that it emphasizes individual and family responsibilities; the smart system design enables the government to act at the last minute.

4. What are the advantages of the individual retirement account system?

Taken together, the individual retirement account system can improve the overall level of social security, connect different systems, addressing regional imbalances, and treatment differences.

For example, if the pension entitlements accumulated in the history are transferred into individual retirement accounts, and the central social security institution is given the right to manage these accounts, then individual retirement accounts will no longer be controlled by local governments.

Meanwhile, the balance of the pension insurance for rural and non-working urban residents can be directly transferred to the individual retirement account as the balance is very clearly defined. In this way, the balance will no longer be under the control of the local government.

When the above-mentioned issues are resolved, transfer won’t be a problem. As for the difference in pension entitlement, it is mainly caused by different contributions so it is the individuals themselves who have to be responsible for this.

To sum up, the individual retirement account system is not simply a third pillar, but a system with potentially revolutionary significance.

V. SUMMARY

The individual pension account system can minimize risks associated with population aging and strengthen pension security by emphasizing personal responsibility for pension commitment. If it runs smoothly in the first few years, it can lay a solid foundation for the next step to set up a unified national system of individual pension accounts.

When the individual pension account system is introduced, the pension insurance for rural and non-working urban population is the most suitable to be merged as soon as possible. If the pension insurance for urban employees can also be gradually incorporated, long-term problems such as account transfer and continuity, overall planning, and participation willingness can be resolved at one time.

A principle that needs to be underlined is that the individual pension account system has to depend on the system of subsistence allowances ultimately. However, it involves a risk of hidden debt, another thorny issue that needs the government’s utmost attention.

I think additional incentives must be put in place. The individual pension account system is designed mainly for flexible employees who are not covered by the existing pension system or those are entitled to a very low-level pension plan. However, due to the lack of investment options, this group of people does not have much money to deposit in the individual pension account. The current pension insurance for rural and non-working urban residents provides contribution subsidies. In some places, when one deposit an amount of 1,500 yuan, s/he can receive a subsidy up to 100 yuan and additional interest. These gains combined together well exceed the interest paid for a three-year term deposit.

When transferred to individual pension accounts, it is recommended to provide interest subsidies instead of giving out cash. We can refer to Singapore's practice and offer subsidies for a longer period of time. For example, when 100,000 yuan is deposited in an individual pension account, the government is suggested to offer subsidies for this investment. In this way, people can have a fixed account balance of 100,000 to 150,000 yuan to protect their basic life after retirement. In addition, high-income people should be allowed to contribute for their low-income family members, such as one’s spouse and parents who are not employed, and enjoy tax benefits.

Finally, while encouraging participation, the government must be strict with several essential conditions, most notably transparency of information. It is recommended that the Ministry of Human Resources and Social Security set up a platform to provide investment records of fund management institutions that investors can choose from, so that they have knowledge about the different types of risk-return combinations and make their own choices. For the individual pension account, account holders should be allowed to check the balance and investment return at any time, preferably on the mobile phone.

At present, there are still details waiting to be nailed down. For instance, how to reduce management fees, how to regulate the frequency of account transfer, how to effectively control the risk of fund management companies, and how to provide people with low risk tolerance the priority to buy government bonds, etc. These are the problems that are worthy of further consideration.

Efforts should also be put to spread investment knowledge. Individual pension account is an optimal investment option, and people need knowledge about how to benefit from this system and manage risks.

This article was compiled based on Professor Zhao Yaohui’s speech at the 156th “Langrun?Gezheng”, an event held by the National Development School of Peking University. The article only represents the author's individual opinion, not the position of CF40. The views expressed herewith are the author’s own and do not represent those of CF40 or other organizations. It is translated by CF40 and has not been reviewed by the author.