Abstract: Amid mounting pressure from contracted demand, supply shock and weakened expectation, China’s economic recovery is losing momentum. Among the challenges, impeded policy transmission via the credit channel was expected; a bit unexpected was the impaired income of both businesses and households which diminished the effect of tax reduction and refund policies; and totally unexpected was the difficulties with infrastructure projects despite the reinforced support from special bond issuance. Boosting logistics and resuming production and people’s normal life remain the top priority for China to stabilize its economy. To this end, this article suggests to focus more on households with future support measures, make debt funds more disposable for local governments to shore up infrastructure investment, and better coordinate fiscal and monetary, macro-control and state-owned asset management policies.

The State Council meeting on May 11 noted that the Chinese economy is facing new downward pressure amid new Covid resurgences and changes in the global landscape. Recent data from the National Bureau of Statistics also shows that the economy is losing vitality with strains mounting from contracted demand, supply shock and weakened expectation.

Against such backdrop, impeded transmission of monetary policy via the credit channel is something within expectation. It would be most desirable to give bigger roles to fiscal policy which has modest crowding out effect, more proactive expenditure, and bigger multiplier effect. In contrast, a bit more unexpected has been the impeded policy transmission as a result of crippled logistics and stagnant economic activities in many places across the country which have taken a bite out of both business and household income, reducing the actual effect of fiscal policies including tax reduction and refund. Worse still, the delay of many construction projects has directly weakened the effect of special bond issuance and fiscal support for infrastructure, and the consequent impediment to policy transmission has been totally unexpected. Many businesses have said frankly that the problem with infrastructure now is not a lack of money, but disrupted construction. In view of these, reviving logistics remains the top priority to stabilize the Chinese economy, or fiscal policy would face the same predicament of “pushing on the string” that is troubling monetary policy.

In addition, to boost market expectation and promote policy transmission, policymakers need to explore new ways of macro control: first, focus more on households in formulating future support measures, and a considerable move here is to provide direct subsidies to low-income groups; second, make funds raised from bond issuance more disposable for local governments to enhance their roles in boosting infrastructure and growth; and third, better coordinate fiscal and monetary, macro-control and state-owned asset management policies.

I. THE CHINESE ECONOMY FACES MOUNTING DOWNWARD PRESSURE

The Ukraine crisis has significantly added to the external uncertainties facing the Chinese economy since its outbreak earlier this year, dealing huge supply-side blows to markets of commodities including food and energy, further worsening global growth expectation while pushing up inflation worldwide. It has forced developed economies to accelerate monetary tightening and increased stagflation risks. The turbulence has also put more capital outflow pressure on emerging markets, intensifying debt risks and further eroding their economy.

In addition, some of the low-income economies could face the combination of multiple risks including food shortage and inflation. The International Monetary Fund (IMF) has pared down its forecast of global economic growth in 2022 in the latest World Economic Outlook to 3.5% by 0.9 percentage points.

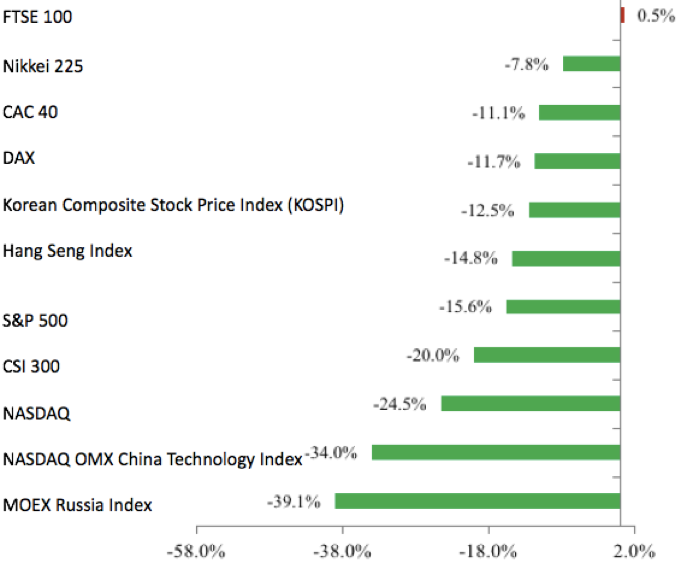

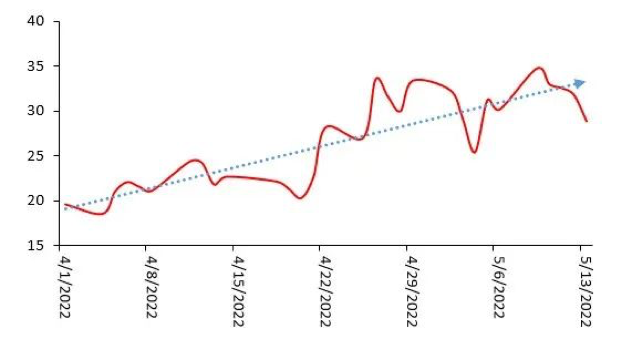

The bleak landscape is also evidenced by the global financial turmoil. Most of the stock markets around the world have slumped since the start of the year (Figure 1); entering April, the VIX (COBE Volatility Index), an index that depicts market expectation of future fluctuation based on the S&P 500 option price, surged (Figure 2), which indicates weakened investor expectation and mounting fear.

Figure 1: Major stock indexes (2022)

Source: Wind

Figure 2: VIX (COBE Volatility Index)

Source: Wind

Covid resurgences have continued to haunt the Chinese economy. The highly infectious Omicron variant has pierced the defense net across the country, with Tibet being the only province with no new cases since March. Big, densely inhabited cities including Shenzhen, Guangzhou, Shanghai, Beijing and Tianjin have suffered violent resurgences crippling local economic activities. According to research, in April, only two in the 45 big cities across the country (with a GDP of over 500 billion yuan in 2019), Yangzhou and Shijiazhuang, have managed to prevent severe outbreaks. That has significantly disrupted economic activities, further exacerbating the triple pressure from contracted demand, supply shock and weakened expectations.

On expectation: Businesses still lack the will to invest. Their mid- to long-term loans increased in April by 26.52 billion yuan, 39.53 billion yuan less than a year ago. This has been accompanied by lower household credits: in April, Chinese households cut their loans by 21.7 billion yuan, bringing the monthly growth figure into the negative territory again after February this year, significantly lower than a month ago (an increase of 75.39 billion yuan) and a year ago (an increase of 52.83 billion yuan). This could indicate shaken expectation and intensified risk aversion sentiment in general.

On demand, first, household consumption has weakened. Because of reduced expected income and constrained spending scenarios, in April, total retail sales dropped by 11.1% year on year, with catering slashed by 22.7% and continuing the negative growth started a month ago. Second, in April, real estate investment and sales faced mutually-corroborating predicaments, increasing year on year by -10.1% and -46.6% respectively. Third, manufacturing investment and infrastructure investment maintained positive year-on-year growth in April, but such growth was 5.5 and 7.5 percentage points lower than in March, respectively, which is a remarkable decrease. Finally, external demand has become sluggish, as evidenced by the slide of export year-on-year growth in April to 3.9%, 10.8 percentage points down from a month ago.

Supply side: Currently, the movement of people and goods is restricted in some regions. Cross-regional movement difficulties and supply chain disruptions have largely increased transportation cost and seriously restrained online consumption. In China, the logistics sector is dominated by road transportation which accounts for more than 70% of the total freight volume. However, road transportation has been greatly affected by the pandemic control measures. For example, cross-regional coordination is especially difficult at the moment. In this context, the highly integrated manufacturing sector featuring complex supply chains and widely distributed production networks is facing even more challenges. Among the three major industrial categories, mining, as well as electricity, heating and gas, and water production and supply both maintained positive growth in April, but the added value of manufacturing enterprises above designated size fell by 4.6%, of which automobile manufacturing fell by 31.8%. In addition, due to disrupted logistics, online retail sales of physical goods fell by 1% year on year in April, and the growth rate was even lower than that in February 2020. Meanwhile, high-frequency data also shows that express delivery throughput has also fallen significantly since the beginning of April, with a year-on-year drop of about 40%.

The intensification of the triple pressures directly builds up employment pressure. In April, the surveyed urban unemployment rate, the surveyed unemployment rate of local and non-local employees, and the unemployment rate of the population aged 16-24 all rose, which were 0.3, 0.1, 0.6 and 2.2 percentage points higher than that in March respectively. The unemployment rate of the later three groups reached the highest level since data were available (Figure 3). In addition, a considerable number of workers who have temporarily suspended work for 1-2 months due to the pandemic control policy are not included in the unemployment statistics. Therefore, if temporary cessation of work is also taken into consideration in addition to unemployment pressure, the damage to residents' income will be even more severe. Whether it is the decline in current income, or income expectations brought about by unemployment and temporary cessation of work, it will significantly affect the consumption behavior of residents. At this stage, it is necessary to adopt straightforward and powerful policies to avoid a self-reinforcing cycle of "employment pressure - income damage - sluggish consumption - insufficient demand - employment pressure”.

Figure 3: Unemployment rates of different groups of people

Source: Wind

II. Impeded transmission of the expansionary policies

1. Things expected: sluggish credit demand and ineffective monetary transmission mechanism

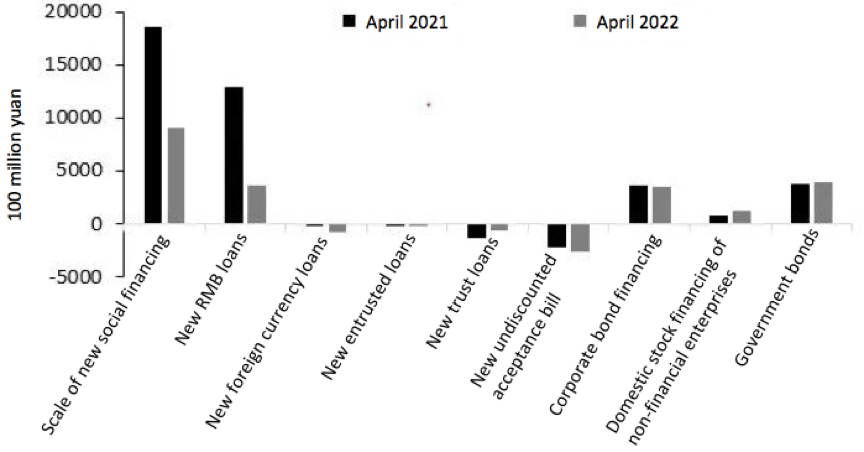

In the face of the increased pressures, the result of an ineffective monetary transmission mechanism is in line with theoretical expectations to a certain extent. The scale of new social financing in April was 910.2 billion yuan, recording a year-on-year decline of 946.8 billion yuan, and the main drag was the fall in credit (Figure 4). In terms of social financing data, new RMB loans was 361.6 billion yuan in April, a year-on-year decrease of 922.4 billion yuan. Credit expansion has been held back mainly by constrained demand for credit (Figure 5). In April, medium and long-term loans of enterprises and institutions increased by 265.2 billion yuan, a decrease of 395.3 billion yuan year on year, reflecting the sluggish medium and long-term capital expenditure of enterprises and the decline in risk appetite of the household sector. It indicates a tendency of avoiding leveraging or even deleveraging. Residential sector loans decreased by 217 billion yuan in April.

Figure 4: New social financing and its sub-items

Figure 5: New RMB loans and its sub-items

Source: Wind

Moreover, year-on-year growth of bill financing increased by 243.7 billion yuan in April, while the discount rate of bills fell. This may indicate that the actual credit demand of the real economy is small, and banks are more inclined to meet the requirements of policy easing with bills. Generally speaking, when the credit demand of the real economy is strong, discount interest rate of bills usually rises. It is because at such times, banks may be more willing to issue medium and long-term loans to households and enterprises, and are less willing to engage in bill discounting. On the contrary, under the current situation, when the financing demand of business entities is weak, and the regulator wants the bank to increase lending, banks naturally choose to issue short-term loans and conduct bill discounting to meet regulatory requirements. As the demand for bills rises, discount rates bills fall to a low level.

Figure 6: Rediscounting rate of national banker’s acceptance: 6 months

Source: Wind

2. Things unexpected: corporate sector is not able to bring in revenue, income of the residents is damaged, and tax reduction and rebate is insufficient

Though tax reduction and rebate policies have played an important role in the current situation, their support for economic growth is rather limited.

The value-added tax (VAT) credit refund worth around 1.5 trillion yuan is extremely effective in improving the cash flow of some companies, but has limited effect on alleviating the impact of the pandemic. Business cash flow can be significantly improved by centrally refunding VAT credits. However, it should also be noted that this policy is structural: first, the policy is launched only for enterprises; second, it only works with VAT; finally, the policy is most effective with the enterprises that have accumulated a large amount of tax credits in the early stage.

However, with the blow of the resurgence of the pandemic, the majority of enterprises are facing sluggish demand and shrinking orders, and tax rebates have limited effect to resolve such difficulties. In addition, many enterprises, construction sites, and individual industrial and commercial businesses have stopped operation, a situation that has seriously depleted a considerable part of residents' income, while tax rebates for enterprises cannot benefit households.

The tax cuts for small and medium-sized enterprises worth of one trillion yuan is unlikely to have an incremental effect under the premise of lack of orders, loss of revenue, and difficulties in making profits. The specific measures to cut tax mainly include: phased exemption of value-added tax for small-scale taxpayers, halving corporate income tax on the basis of the current preferential policies for small and micro enterprises that meet the requirements; continuing the tax and fee reduction policies for manufacturing, small and micro enterprises and individual industrial and commercial businesses and increase the rate of tax reduction and exemption. These tax cuts are mainly aimed at enterprises as well and do not benefit the residential sector. In addition, the basis of VAT reduction and corporate income tax cut is that enterprises can produce revenue and profits.

At present, a large number of small and medium-sized enterprises lack orders, cannot operate, suffer losses in revenue, and are not able to make profits at all, which has greatly weakened the basis on which tax reduction can play a role.

3. Unexpected: hindered constructions constrained the speedy issuance of special bonds to support infrastructure expansion.

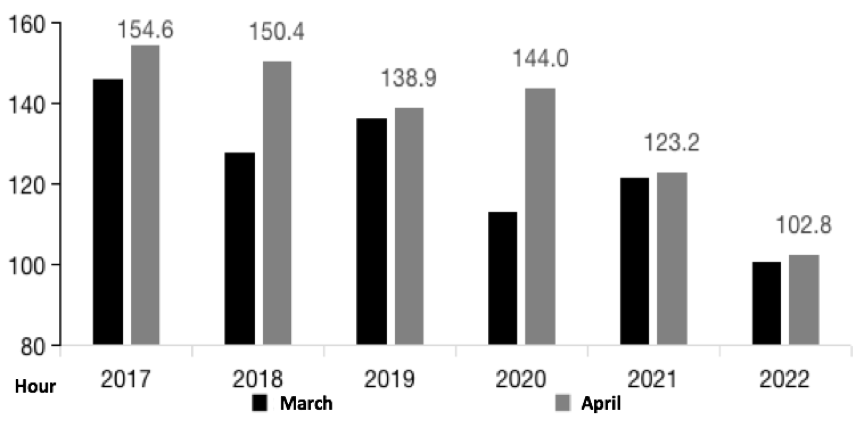

Local government special bonds are one of the key sources of infrastructure funding, which is expected to stabilize the economic growth in 2022 against the backdrop of a slow consumption recovery and a real estate transformation. Since late 2021, policies have been actively employed for the issuance, use, and physical investment of local government special bonds at the earliest. In the process of issuing part of the new quota ahead of schedule (RMB 1.46 trillion in December 2021) and the full-year quota of RMB 3.65 trillion, the issuance of special bonds greatly accelerated from January to April 2022, with cumulative issuance progress at 12.1%, 21.7%, 34.2% and 38.2% each month (Figure 7). However, the 38.2% issuance progress in the first four months is much higher than not only in 2021 (6.4%) but also in 2019 (33.9%) and 2020 (30.7%).

Figure 7: Cumulative monthly progress of new special debt issuance in recent years

Sources: Wind; Ministry of Finance, China.

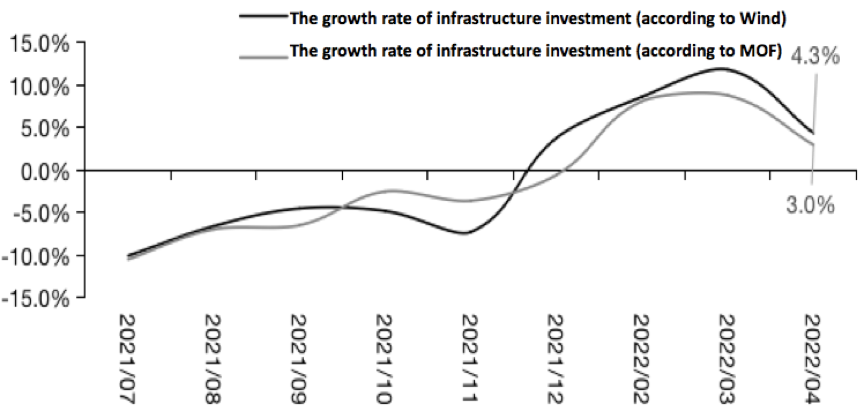

The acceleration of special bonds issuance was a significant support to infrastructure From January to March, with the growth rate of infrastructure investment (according to the Wind) accumulating to 10.5%, reaching 11.8% YoY in March, a shift from the sluggish trend since 1H2021 (Figure 8). However, while the issuance of special bonds continued to gain momentum in April, the growth rate of infrastructure investment fell sharply, from 11.8% to 4.3% mom, a drop of 7.5 percentage points.

Figure 8: Accumulative Issuance of Monthly New Special Bonds

Sources: Wind; Ministry of Finance, China.

The pullback in infrastructure in April was mainly due to the pandemic-induced shutdown of constructions. Especially since April, the pandemic has affected economic activity in the Yangtze River Delta, the Pearl River Delta, Beijing-Tianjin-Hebei, and the Northeast, which are important regions in China's economic system. In March, Shanghai's investment in "urban infrastructure" grew at a negative rate of -5.3% YoY and could be even lower given the greater Covid impact in April. The corresponding growth rate for April is likely to be even lower. At the national level, excavator working hours in March and April were 17.4% and 16.6% lower YoY (Figure 9), the lowest level since the data were available. Key companies complained that although money is available for infrastructure projects, the primary problem at present is the inability to start work or generate physical workload.

Figure 9: Working Hour: Excavators: China: Monthly

Sources: Wind; Ministry of Finance, China.

Another reason is the inherent problem of special debt, i.e., "money waiting for projects". It has been alleviated but somewhat still exists. When determining the debt limit for each local government, the "provincial fiscal authorities propose to increase the borrowing of special debt and arrange public welfare capital expenditure projects for the following year", a step where subordinate governments merely report the estimated amount of special debt instead of reviewing the projects to be undertaken in their jurisdictions. To obtain more funds for special debt, some local governments do not give enough consideration during the application, so after obtaining the funds, they may encounter problems in assessing environmental protection, land use, and planning, which may strand the projects so that money has to wait for projects to be started. In addition, projects that apply for special debt have to meet strict requirements on return and financial performance evaluation that very few projects can do, which constrains the use of funds. Relevant authorities have been addressing the problem by allowing moderate changes in use since 2020 and promoting the earliest physical investment of special debt funds since 2022. But without an overhaul of the special debt management system, it will be hard for the policy accelerator to the physical investment to be sustainable.

III. UNBLOCK POLICY TRANSMISSION FOR ECONOMIC STABILITY

The current external situation is complex and volatile, and the domestic economy is challenged by the pandemic with triple pressures intensifying. In this context, it is in line with expectations that the credit transmission mechanism of monetary policy is not smooth. At this time, fiscal policy should have been actively employed in tax rebates and reduction and the investment in infrastructure, when the crowding-out effect is small and the multiplier effect is large. However, the unexpected obstacles to the transmission mechanism of fiscal policy, such as blocked logistics and the suspension of production and livelihoods due to the Covid, have dampened the effects of easing policies. Therefore, the priority for economic stability should be the orderly restoration of logistics and recovery of production and livelihoods.

To enhance market expectations and unblock the policy transmission mechanism, macro-control needs to be further broadened:

First, the relief policy should focus more on protecting households and provide anti-pandemic subsidies to low-income groups. China’s existing bailout policies focus on enterprises, intending to protect employment and income, thereby also protecting residents. However, the current round of the Covid relapse causes direct and harder damage to residents' income and expectations:

For one, the pandemic caused the long-lasting suspension of work and production in wider regions and industries, during which; some people lost their income during the shutdown period. A considerable number of workers are taking "gig jobs", "working a day and earning a day's money". In the infrastructure industry, for example, the construction workers are now "gig workers" with daily wages. Taking one city as an example, its suspended working days, conservatively estimated, have reached 50 days, which is equivalent to 20%-25% of the working days in the past year, which should mean a corresponding decline in annual income.

Then, the resumption of work and production of SMEs and individual businesses in some areas may not be as fast as in early 2020 when businesses were more confident about the future and the recovery came fast despite short-term difficulties. The cash flow of the small, medium, and micro-entities has been tight before and after the pandemic. It will be hard for the employment and income recovery of residents under the worse impact of this round of pandemic to be faster than that of the beginning of 2020.

Therefore, support measures need to focus more on increasing household income and shoring up household confidence. Measures like direct subsidies can be adopted, instead of issuing coupons or cutting taxes for individuals. The reason is that coupon will only have limited implications because of its small scale, complex forms, and multiple constraints; and tax relief is even more limited to cover the vast number of low-income groups, because for some of them, their income has not reached the exemption limit, and some work for non-standard business organizations (such as engineering teams) and thus do not pay individual income tax.

As for income subsidies to low and middle-income groups, the overall magnitude is “bearable” and these people also have a higher marginal propensity to consume. There can be three types of subsidies:

1) subsidies to workers who suffer income loss due to the suspension of work during the pandemic. For example, in 2021, among 46.36 million migrant workers who work in the eastern region, around 37% of them serve in sectors affected by business shutdown, including construction, catering, residential service, and other service sectors. Hence, a rough estimate of the number of subsidized groups is up to 17.25 million. If each one is granted 1,000 yuan, then the overall scale of the subsidy is 17.2 billion yuan, which is equivalent to 0.06% of the 2022 general public budget expenditure plan.

2) subsidies to the low-income group who receive subsistence allowances across the country. By the end of 2021, China had 41.12 million subsistence allowance recipients. If each one of them is granted 1,000 yuan, the total amount would be 42.1 billion yuan, equivalent to 0.2% of the 2022 general public budget expenditure plan.

3) expanded subsidies that cover the poorest 20% of households, roughly involving 280 million people. If each of them is granted 1,000 yuan, the total amount is 282.5 billion yuan, equivalent to 1.1% of the 2022 general public budget expenditure plan. In fact, in 2020, the annual per capita disposable income of the bottom 20% of households was 7,869 yuan. A subsidy of 1,000 yuan per person is about 13% of their annual income. So the policy effect will be very significant.

Second, local governments should have more discretionary power to utilize debt funds to enhance their ability to stabilize growth. As mentioned above, special debt could have played a greater role in expanding effective investment and stabilizing growth for local governments. However, due to the management system, the phenomenon of “money waiting for projects” always exists, and the debt funds that “wait for projects” also have interests to be paid, which leads to a great waste of resources. Therefore, local governments should have more discretionary power to use the debt funds, and there are two ways to be considered: first, be realistic about the fact that a large part of local infrastructure projects cannot generate stable returns, and lower the requirement for financial returns and the performance of the projects; second, expand the scale of general debt or issue special government bonds to replace some of the demand for infrastructure funds, which means to increase the support of the general public budget for infrastructure investment under the current budget management system.

Third, the coordination between fiscal and monetary policies, as well as macro policies and state-owned asset management policies should be strengthened. Currently, the relief policy encounters the challenge of “where to get the money” while expansionary fiscal policy always faces the triangular paradox of revenue decline, expenditure increase, and debt crisis control.

To address the paradox, it is necessary to coordinate different policy departments. From the perspective of monetary policy, rate cuts can be adopted to reduce the government’s debt burden and generate more space for fiscal support measures. From 2015 to 2020, the average growth rate of interest payment expenditure on all of China’s explicit government debt was above 20%; the scale of interest payment rose from 355.2 billion yuan to 1.35 trillion yuan, and the share of it in the government’s overall expenditure (including general public budget and government fund budget) increased from 1.6% to 3.7%; given regional differences in government’s financial strength, some local governments are under greater pressure to service debt. At present, rate cuts can not only reduce the burden of interest payment on government debt, but also shore up market confidence and lower the financing cost for households and market entities, thus having larger policy implications.

From the perspective of the coordination between macro-control policies and state-owned asset management policies, the share of profits handed over by the state-owned enterprises to the central government can be slightly increased so as to provide funds for the support measures. In 2013, the 3rd plenary session of the 18th Central Committee of the CPC put forward the requirement of “increasing the share of revenue generated by state-owned capital to be handed over to public finance to 30%”. Take non-financial SOEs as an example. In 2021, the total profits of non-financial SOEs stood at 4.5 trillion yuan, and the revenue for state capital operations budget was 518 billion yuan, accounting for 11.5% of the total profits. Although the calculation method does not take into account the detailed state-owned capital revenue distribution system, at least it shows that there is considerable policy space for SOEs to hand over more profits.

This article was first published on CF40’s WeChat blog on May 19. It is translated by CF40 and has not been reviewed by the authors themselves.