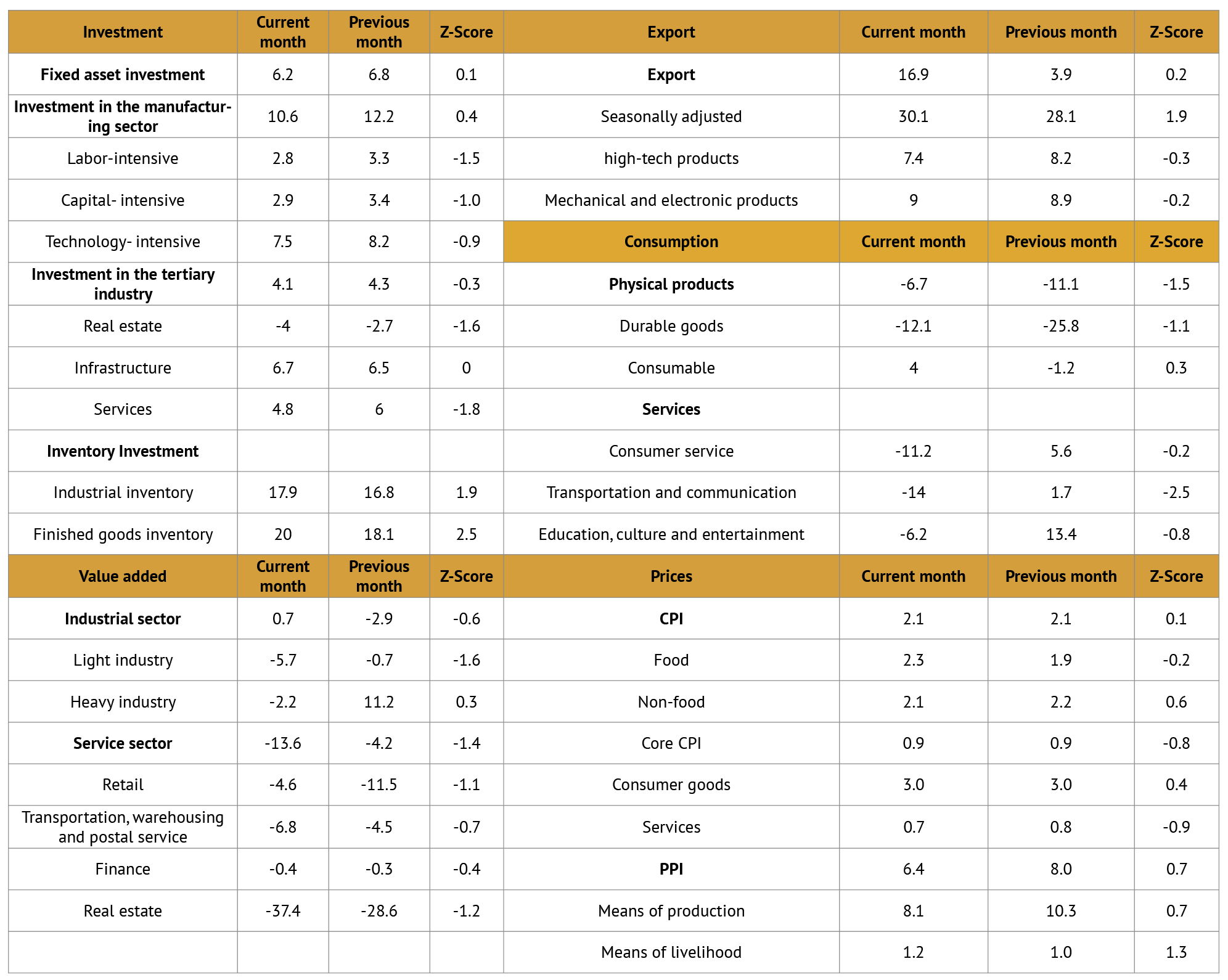

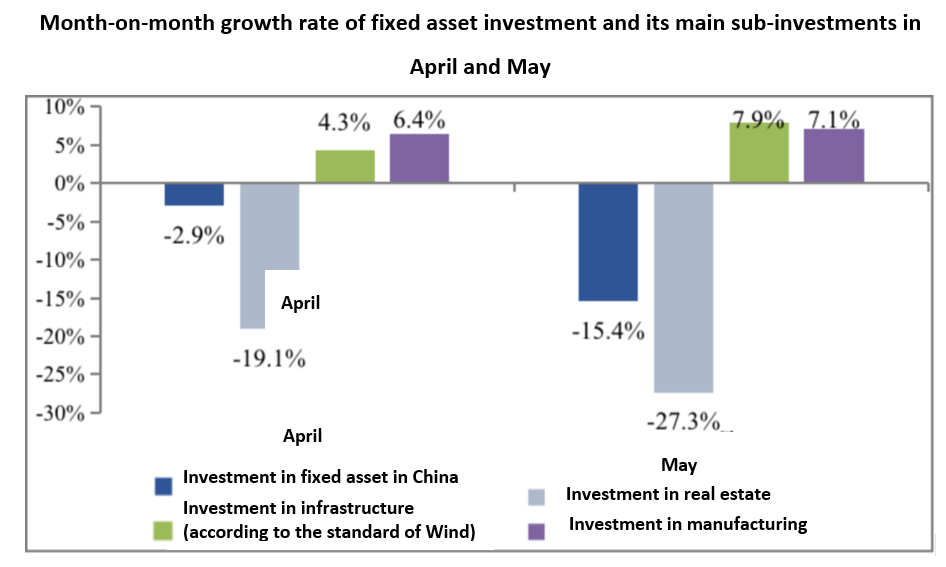

Abstract: The improvement of China’s macroeconomic readings in May is more of a marginal rebound from the previous fall caused by the pandemic. Covid resurgences have yet to be fully brought under control, and will continue to cripple the economy and the supply chains. After excluding Covid-related factors, it’s clear that sluggish demand remains the major roadblock restraining China’s economic recovery, with structural changes in the financial statistics showing insufficient demand for financing from the real economy. This article suggests that policymakers remain focused on stimulating aggregate demand to narrow the output gap, and calls for stronger policies to boost growth and stabilize the socio-economy.

As China gradually brought Covid resurgences under control in May, some of the macroeconomic indicators have begun to improve marginally. In terms of production, Jilin, Jiangsu and Guangdong among other places that have been battered by the pandemic have picked up pace reviving local production, followed by Shanghai which is also getting back on its feet. Producers have had their machines run at full throttle to deliver orders accumulated, pulling the monthly year-on-year (y-o-y) growth of value- added by industries above designated scale in May out of the negative territory to 0.7%, 3.6 percentage points up from a month ago; the manufacturing sector has had especially remarkable improvement, its value-added increasing y-o-y by 0.1%, up by 4.7 percentage points.

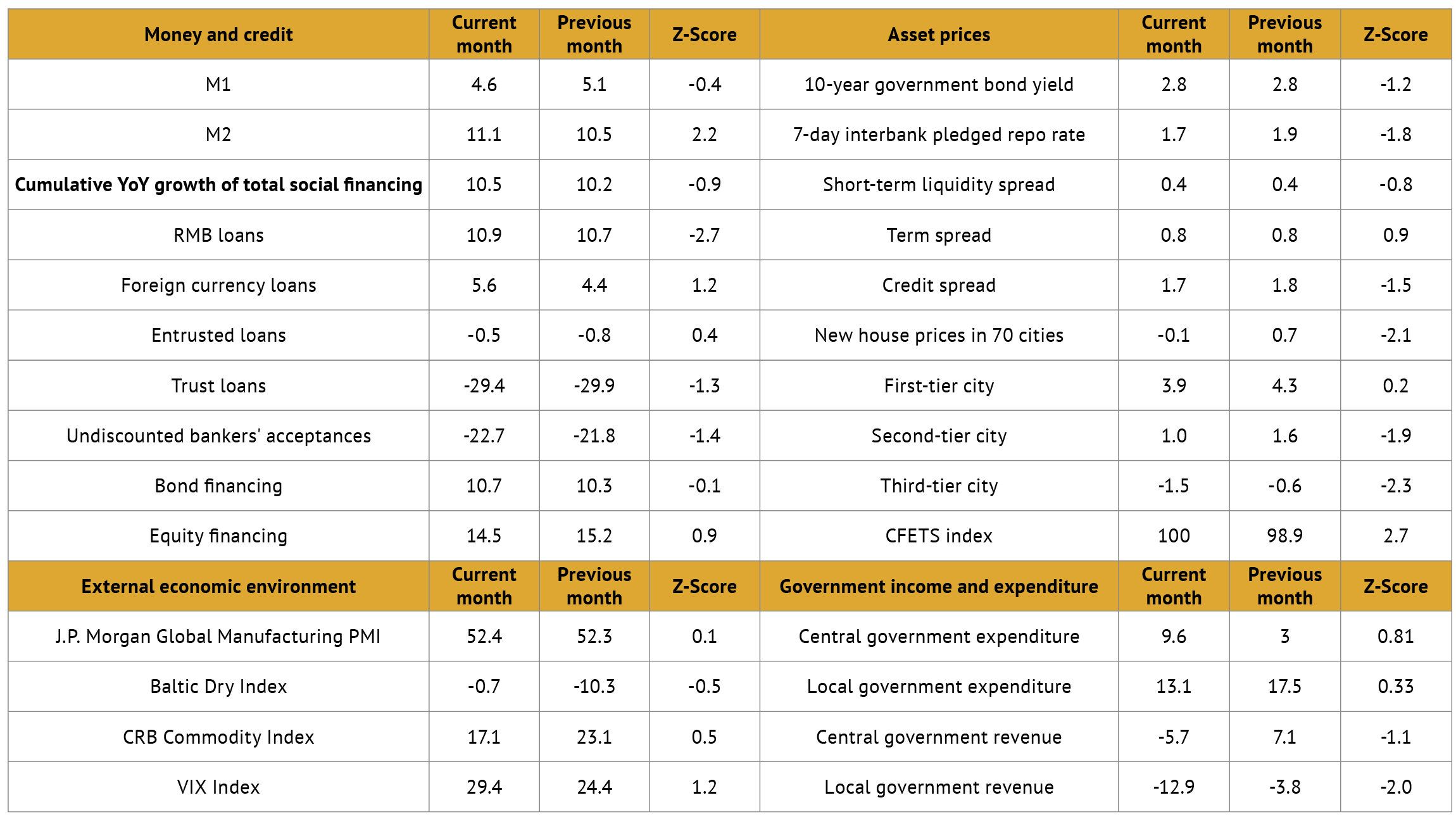

In terms of demand, the monthly y-o-y drop in total retail sales of consumer goods in May was 4.4 percentage points narrower than a month ago; as production picks up, manufacturing investment has also recovered some of its lost ground, with its monthly y-o-y growth improving by 0.7 percentage points to 7.1%; with construction projects resumed and special bonds issued at a faster pace, infrastructure investment (by Wind’s statistical standards) recorded a monthly y-o-y growth of 7.9%, up 3.6 percentage points from last month; finally back at work, exporters have been running at full pace to deliver the accumulated orders, contributing to beyond-expectation monthly export readings: China’s total USD-denominated export in May grew y-o-y by 16.9% which was 13 percentage points higher than that in April. With improvements in both production and domestic and external demand, there was less employment pressure in May, with the surveyed urban unemployment rate edging down month on month by 0.2% to 5.9%

Despite the marginal improvements, China should be soberly aware that the lack of domestic demand remains an unaddressed problem, and the impacts of Covid and supply chain bottlenecks still linger. The boost in its macroeconomic data in May had a very limited scope, and there is still a lot of room for further and more in-depth improvements.

On household consumption, the positive signal we saw in May was that the decline in total social retail sales was narrowing, although its monthly y-o-y growth (-6.7%) was still far from returning positive. In addition, the marginal improvement in this number was mainly contributed by increased sales of goods, the monthly y-o-y reduction of which narrowed by 4.7 percentage points compared with April. Besides, China’s logistics index rallied from a month ago by 6.4 percentage points, and online retail sales of goods and services which is not subject to scenario restrictions grew in May by 2.9%, jumping out of the negative territory.

However, the recovery of offline services such as catering beyond basic needs has been rather slow. Due to the loss of current income and lowered income expectations of the household sector, a lot of consumer demand has been systematically suppressed for a long time. Let’s take a look at the covid cases and the data performance of catering revenue and see their relations. When the number of local covid infections surged sharply in March and April, the year-on-year growth rate of catering revenue plummeted from 8.9% in February to -16.4% and -22.7% in March and April; but when the number of new infections in May dropped by nearly 90% month on month, the year-on-year growth rate of catering revenue was -21.1%, which was only 1.6 percentage points lower than the previous month, not much improvement. From this, it can be seen that the consumption of offline services such as catering is difficult to recover, and there has been no significant improvement yet. This may indicate that impact of the pandemic cannot fully explain the sluggish consumption of offline services such as catering, rather the loss of income and lowered income expectations are important reasons for insufficient consumer demand.

In terms of investment, the real estate sector continued to decline, dragging down the overall investment. As mentioned earlier, infrastructure and manufacturing investments both improved marginally in May. However, the year-on-year growth rate of fixed asset investment in the whole society in May further dropped to -15.4% compared with the previous month, which was mainly caused by the continued fall in real estate investment, whose year-on-year growth stood at -19.1% and -27.3% respectively in April and May. According to the data released by the National Bureau of Statistics, the completion and construction area of the real estate industry registered a year-on-year fall by 31.3% and 39.7% respectively in May, and the decline was 17.1 and 1 percentage points higher than the previous month. Although the year-on-year decline in commercial housing sales narrowed, the sales still fell by 37.7%.

Furthermore, logistics and supply chains have bigger room for improvement. The manufacturing PMI was 49.6% in May, up 2.2 percentage points from the previous month, but logistics is the weakest link among the PMI's five sub-components. The supply of manufacturing raw materials remained delayed, with the PMI supplier delivery time index at 44.1 percent in May. According to the high-frequency data, logistics should be a top concern for future economic recovery. According to the G7 Road Freight Index, the national freight flow index was -18% YoY in May, down from -27 percent in April, but still far below normal. Metro passenger flow in 18 cities across China has only recovered to roughly 60% of the same period in 2021 due to underperformance in Shanghai and Beijing.

In a financial sense, the above limits represent the need to enhance real-economy financing, the still shaky expectations, and the fact that corporate loans are mostly increased by bills and short-term loans. In May, enterprise and institutional loans increased 1.53 trillion yuan, up 729.1 billion yuan year on year. Short-term loans climbed by 264.2 billion yuan, a 328.6 billion yuan rise YoY; bill financing increased by 712.9 billion yuan, a 559.1 billion yuan rise YoY; and medium- and long-term loans increased by 555.1 billion yuan, a 97.7 billion yuan decrease YoY. The increase in medium- and long-term loans to businesses accounts for 36.3% of the total increase in loans to businesses, down from 45.9% last month.

In terms of employment, despite the decline in the overall unemployment rate, unemployment in 31 big cities and youth unemployment in May continued to hit record highs at 6.9% and 18.4% respectively, both up by 0.2 percentage point from the previous month.

In sum, the improvement in macro data of May is more like a momentum rebound after shocks, and a marginal enhancement, or a base effect at a month-on-month level. Its duration is closely related to the ease of Covid-19 outbreaks. As China’s economy was hit again by the pandemic in April and May, either a momentum rebound or an increasingly aggressive stimulus policy in the coming quarter will generate a temporary month-on-month recovery. It can be anticipated that in the next 1-2 months, many macro indicators, including that of the real estate sector, will keep improving at a month-on-month level. But whether the economy can return to a post-pandemic trajectory of recovery or even to the pre-pandemic growth level still requires us to closely track and watch relevant data.

If we don’t take into account the pandemic-induced shocks in April and May, the problem of insufficient domestic demand still has not been systematically solved, and the structural changes in financial data reflect that the real economy still has weak financing demand. The month-on-month rebound alone cannot completely stabilize the foundation of economic growth. The recovery of the macro economy has remained sluggish. With weak resumption of household consumption and the real estate sector still in the process of bottoming out, inadequate domestic demand will continue to constrain China’s economic recovery. The primary goal of China’s macroeconomic policy is still to boost aggregate demand to speed up the narrowing of the output gap. In order to strengthen and sustain the marginal improvement in the economy, stabilize economic growth and ensure smooth operation of the society, stronger macro policies are needed.

China Macro Doctor (CMD):

Diagnosis of China’s macroeconomy, May 2022

ZHANG Bin

CF40 Nonresident Senior Fellow

ZHANG Jiajia

CF40 Research Associate

POLICY SUGGESTIONS

1. Reduce the interest rate by 25 base points each time until the employment target and the economic growth goal are reached.

2. Provide fiscally subsidized, new types of bonds and policy loans to boost investment in public good and quasi-public good infrastructure projects with limited returns. Aim at an annual growth in infrastructure investment of not lower than 10%.

3. Boost market-based competition on the interest rate of mortgage loans, so as to reduce households’ debt burdens; collect transaction taxes on a temporary basis based on local conditions to avoid excessive house price hikes in some of the cities.

4. Transform some of the developers’ housing stock into subsidized rental housing, to reduce the developers’ debt burdens.

5. Establish special bonds to help market entities battered during the pandemic get back on their feet.

6. Provide temporary, preferably 1-year income subsidies for low-income groups, the elderly and infants and young children.