Abstract: First, policy focus not only affects the choice of policies but also their effects, so a level of flexibility should be introduced given the many uncertainties invovled. Second, change in context necessitates the adjustment of macro policy in terms of policy path, but we should watch closely the direct and spillover effects after the policy paths are adjusted. Third, the forward-looking policies have not made a real impact on the market, which means policy transmission has affected the policy effect. We should eliminate the policy expectation gap as much as possible so as to achieve the goals of macro control as scheduled.

In response to the downward pressure, policymakers have rolled out various policies. On May 23, 2022, the executive meeting of the State Council further announced a package of targeted measures to keep major economic indicators within an appropriate range, which include 33 policy measures covering 6 aspects of China’s economic fundamentals. The move to refocus on “range-based regulation” after many years indicates that macro policy has started to balance the goal of stabilizing growth and other potential pressures like price hikes, further attesting to the complexity of current economic situation. The idea of “range-based regulation” was put forward in 2013, meaning that macro policy should specify the appropriate range, or the “floor” and “ceiling”, for economic operation. Currently, the floor for the range-based control is no doubt stable growth and stable employment while the ceiling is stable prices.

Given the many uncertainties facing the Chinese economy, it is increasingly difficult to stabilize growth, employment, and prices, which requires policies to change to play a better role. To this end, taking account of measures and mechanisms adopted by other countries during the pandemic, the paper analyzes the shifts in focus, paths, and expectation gaps of policies, based on the understanding of China’s existing macro measures and mechanisms.

I. SHIFT IN POLICY FOCUS

Since last December when the Central Economic Work Conference stated that “China’s economy is facing the triple pressures of contracted demand, supply shock and weakened expectations”, more macro-control efforts have been put into stabilizing growth. In the first quarter of 2022, the Politburo's meeting further emphasized that “the environment for China’s economic development is becoming more complex, severe, and uncertain, which poses new challenges to the goals of stable growth, employment, and prices”. As a result, at the macro level, policy efforts have been strengthened to stabilize the fundamentals of the economy, and meanwhile, policy focus has been further narrowed down. For example, since the Central Economic Work Conference, the State Council has held 17 executive meetings, in which words such as market entities (especially small- and micro- enterprises and self-employed individuals) and employment have been frequently mentioned; in terms of macroeconomic policies, tax refund and tax cut are the high-frequency words; key areas such as manufacturing, energy, supply, logistics, and food have also been mentioned many times. From the frequency of keywords found in the official press releases about the 17 executive meetings, micro economic entities are given the most attention. Therefore, the focus of the policy package must be on the micro entities.

Figure 1. The distribution of macro policy focus

Frequency of keywords found in the press releases about the 17 executive meetings of the State Council after the last Central Economic Work Conference

Source: Gov.cn

Although micro entities have been the policy focus, different policy arrangements will still have different effects.

Take financial policy for example. Measures like delaying debt payments and increasing low-interest financing are more about providing liquidity for micro entities, as all financial support falls under the category of debt financing support, meaning that the entities will need to pay back the principal and interests eventually. However, when micro entities face greater strains on their cash flow, financial support measures may not be effective, thus requiring more fiscal support to provide the safety net.

Fiscal support like subsidies, increased unemployment benefits, and tax refunds will directly improve the cash flow of micro entities, as fiscal funds do not need to be repaid. Although tax cut and tax deferral will also improve the cash flow of micro entities, these policies need certain conditions to take effect. When the entities’ tax base shrinks, they will have no effect.

For another example, financial and fiscal support targeting firms aim to help the resumption of business operation. But if the workers couldn’t return to their positions, the effect of such policies will be undermined. Only when businesses can reopen and workers can resume work simultaneously, can the policies achieve desired effects. Therefore, when the resumption of work and that of business operation are out of sync, it is more effective for policies to target individual employees.

In addition, the choice of policy mechanisms directly affects policy focus. For example, in response to mutated viruses that spread faster, only with concerted actions by the whole society can pandemic control measures be more efficient and effective, since everyone’s behavior has great externality. As for how to coordinate society-wide actions, it depends to a great extent on the capacity of national public services, including nucleic acid testing and vaccination. Given the national nature of these public services, funds that support their supply should come from the central government. If the burden of funding falls on local governments, the difference in each region’s fiscal resources may lead to structural shortage due to the regional imbalance in public services, or undermine the coordination of nation-wide pandemic control actions. Besides, it is also important to bring in social capital through market-based mechanisms. All these require thorough arrangements via policy mechanisms.

The four examples above are to illustrate that the choice of focus determines whether the policy will be effective and how effective it could be. Given the many uncertainties invovled, future policy focus should be more flexible and the policy effects should be carefully evaluated.

II. SHIFT IN POLICY PATHS

Compared with 2020 when the pandemic first broke out, current environment has changed dramatically. This, coupled with the evolving geopolitical landscape, changing financial conditions, repeated outbreaks of Covid-19, and progress of economic recovery to date, requires more flexible and targeted policies to address the challenges. Hence it is a must to adjust the policy path. But we should watch closely the direct impact and spillover effects of the adjustment, and policymaking departments will certainly assess the implications of such changes.

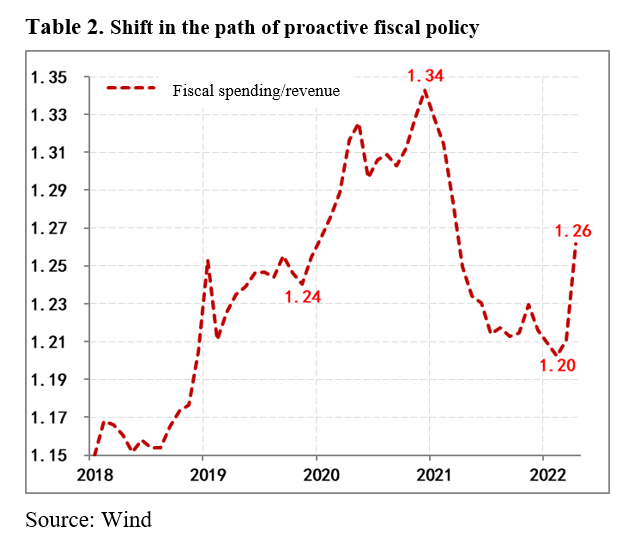

Take proactive fiscal policy as an example. At the beginning of the Covid-19 outbreak in 2020, increasing government spending was the main policy tool. In 2020, the annual growth rate of fiscal spending surged to 1.34 times that of the fiscal revenue, 0.1 times higher than the pre-pandemic level. To make up for the fiscal gap, fiscal deficit in 2020 rose to 3.57 trillion yuan, an increase of 1 trillion yuan from the previous year, and the fiscal deficit to GDP ratio jumped to over 3.6%; in addition, 1 trillion yuan of special government bonds and 1.6 trillion yuan of local government special bonds were issued to cope with the pandemic. Afterwards, when the outbreak was stabilized, policy exited from the path of extraordinary fiscal spending, and the ratio of fiscal spending to revenue gradually fell to 1.2, a decrease of 0.14 times compared with late 2020.

After the spring festival of 2022, fiscal spending sped up to be more forward-looking as required. As a result, the ratio of fiscal spending to revenue started to rise again. With the rollout of a package of tax refunds and tax cuts, the scale of such measures will reach 2.64 trillion yuan. Thus the growth rate of fiscal spending to revenue will return to a steeper curve, but the change will rely more on the decrease of the fiscal revenue, unlike that in 2020 which relied on the increase of fiscal spending. It can be seen that despite similar curves, the policy path has changed significantly—leveraging the multiplier effect of fiscal spending was the main path to respond to the pandemic shocks in 2020, whereas in 2022 the multiplier effect of tax reduction is utilized more to keep economic operation within an appropriate range. This will lead to huge differences in policy effects.

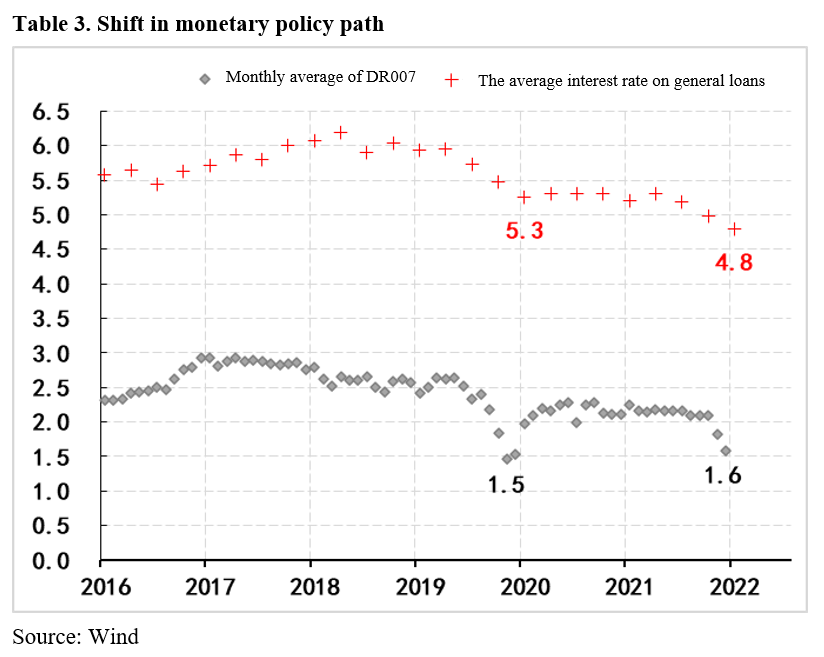

Similar to fiscal policy, the path of monetary policy has also been adjusted significantly. For example, to cope with the initial outbreak of Covid-19 in 2020, the central bank lowered the short-term and medium-term policy rates both by 30 bps and injected more-than-expected liquidity. As a result, interest rates dropped sharply. The monthly average of 7-day repo rates between depository institutions with government-backed bonds as the collateral in the interbank market (DR007) once fell to below 1.5%, a decrease of over 1 percentage point compared with the pre-pandemic period, which drove the weighted interest rate on loans to brick-and-mortar businesses down to below 5.3%. When the pandemic stabilized, the central bank adjusted its liquidity provision, thereby pushing up the interest rates of financial institutions back to the level of the short-term policy rate.

Since the beginning of this year, the central bank has lowered the short-term policy rate by another 10 bps. But the market rate has not gone down to the low level in 2020, while the financing costs of brick-and-mortar businesses keep falling. It is estimated that the weighted interest rate on business loans has dropped to lower than 5%, and the data released by the central bank show that the average interest rate on new business loans was 4.39% in April, the lowest since such data became available.

Therefore, with the implementation of new measures, we should keep a close eye on whether the path of monetary policy will adjust significantly and whether it will return to or even be more aggressive than that in the initial stage of Covid-19 in 2020, since different policy paths will have hugely different impacts on the financial market.

III. SHIFT IN POLICY EXPECTATION GAP

Whenever the economic operation is facing great turbulence, market expectations tend to diverge, thus generating more demand for policy. Meanwhile, due to the time lag between the rollout of a policy and the realization of its effect, it is easy to have policy expectation gaps, meaning that the market always feels that the policy is not as strong as expected.

Since last December when the Central Economic Work Conference made clear that fiscal, monetary, and other policies should be forward-looking, policymaking departments have communicated with the market many times that they will implement the requirement thoroughly. However, the market feels the policy is not strong enough as indicated by its performance. For example, despite stable prices and ample market liquidity since the beginning of the year, the 10-year government bond yield has not fallen but stood at around 2.8% most of the time. Meanwhile, the A-share stock market has continued to go downward, with the Shanghai Composite Stock Index once dipping below 3,000 points to 2863.65 points. These market conditions reflect a large gap between the policies rolled out and market expectation.

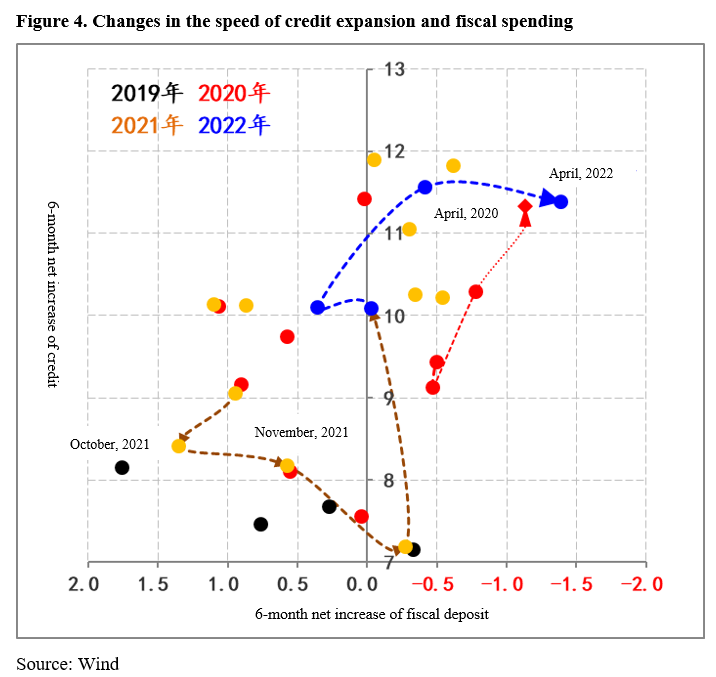

Nevertheless, if we look at the changes in the 6-month rolling fiscal expenditure and credit data, by the end of April, both indicators have surpassed the levels in April 2020, indicating that the current fiscal and monetary policies are as strong as the same period in 2020 in absolute terms. Yet the marginal changes of these policies are smaller than those in 2020. As is shown in Figure 4, the red curve is steeper than the blue curve. This is the reason why the market feels that the policy is not forward-looking enough, but this factor alone cannot lead to a large policy expectation gap.

What are the causes for the large expectation gap? The explanation could be two-fold:

First, the market believes that current downward pressure on the economy has exceeded that in 2020 when the Covid-19 first broke out, thus requiring policies of larger scale to cope with the shocks. However, a similar package of policies have just been rolled out, which is obviously a response to market demand. The impact of this factor on the expectation gap is expected to weaken afterwards.

Second, the forward-looking policies have not made a real impact on the market, which means policy transmission has undermined the policy effect. Recently, China’s top decision makers have held a series of meetings on stabilizing the economy. Various policy departments and local governments have also accelerated the implemention of the spirit of the meetings, which means the authorities at all levels have started to focus more on the transmission of policies.

Therefore, extra attention needs to be paid to whether these changes will be recognized and amplified by the market. In addition, we should eliminate the policy expectation gap as much as possible and guide market expectations, which is important to the achievement of macro control goals as scheduled.

This article was first published on CF40’s WeChat blog on May 29, 2022. It is translated by CF40 and has not been reviewed by the authors. The views expressed herewith are the authors’ own and do not represent those of CF40 or other organizations.