Abstract: Recent COVID-19 resurgences in China have taken a toll on both the demand and supply sides. Policies should be employed to stabilize the economic growth, with a prudent monetary policy to reverse the credit cycle and a fiscal policy to boost spending and investment.

COVID-19 has relapsed in Guangdong, Shanghai, Shandong, Jilin, and Beijing China since March. The Yangtze River Delta and the Pearl River Delta, the most economically active regions in China, are also two of the more severe regions in the current round of the pandemic recurrence. The virus is a hard blow not only to consumers but also to logistics, production, supply chain, export, as well as the service sector by aggravating cash flow pressure on businesses.

The pandemic influences both the supply and demand side.

On the supply side, industrial production and freight logistics both tumbled in April. Industrial value-added above the national scale fell by 2.9% YoY in April, down 7.9 percentage points from March, and fell by 7.1% QoQ. In addition to the reduction and suspension of production in areas where the pandemic was severe, the industrial sector was also affected to varying degrees by declining efficiency in cross-provincial logistics. The official manufacturing PMI was 47.4 in April, below the threshold and down to a new low level since March 2020.

On the demand side, consumption, investment, and net exports all weakened marginally in April. Total retail sales of consumer goods fell by 11.1% YoY in April, while sales of automobiles fell by 31.6% YoY. Among them, service consumption, represented by restaurant revenue, was hit hard, falling to -22.7% in April YoY.

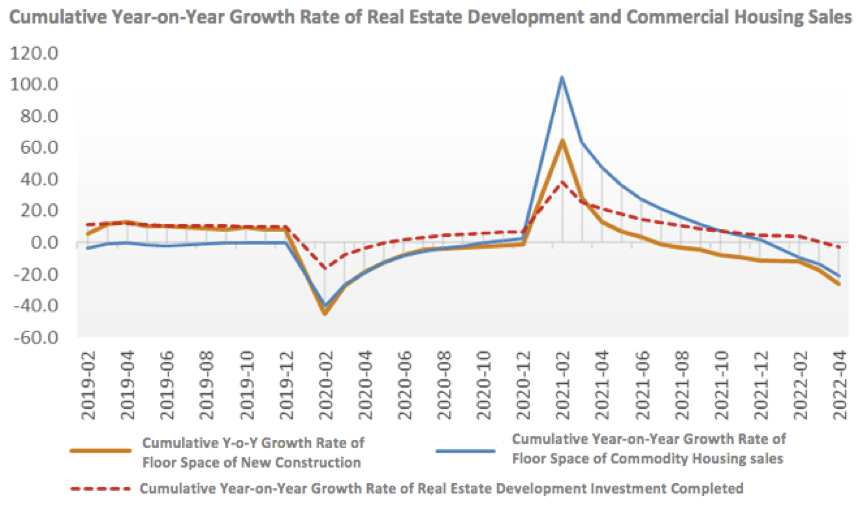

Fixed asset investment slowed, with sluggish real estate sales constraining the recovery of the real estate market. From January to April, national fixed asset investment grew at a cumulative 6.8% YoY, down 2.5 percentage points compared with that from January to March. In April, real estate development investment fell by 10% YoY, with the floor space of both new construction and commodity housing sales falling sharply by -44% and -39% respectively. New residential mortgage loans decreased by RMB 60.5 billion in April, turning negative growth again after February this year, a new low since the data became available. This indicates that residents are less willing to purchase homes and market sentiment remains pessimistic. The difficulty of recovery in the real estate market could not be underestimated.

Export growth continued to slow, and the support role of foreign demand for China's economy began to weaken. The value of China's exports in US dollar terms grew by 3.9% YoY in April, down 10.8 percentage points from March and 28.2 percentage points from a year earlier. The global economic slowdown will make it difficult to maintain the high growth rate of exports.

Sources: National Bureau of Statistics; Wind.

With demand and supply both sluggish, price remained low, while the unemployment rate surged, indicating that the pandemic has dealt bigger blows to demand than to supply. Covid resurgences in different parts of the country have severely impacted the economy, and the low core CPI and the labor market strain showed that the lack of demand remained the biggest bottleneck to China’s economic growth. Its core CPI today rose by an accumulated 1.7% from the end of 2019; CPI, by an accumulated 3.0%; and PPI, by an accumulated 12.1%. Specifically, the main factor driving up the PPI has been the Ukraine crisis which pushed up the global commodity prices, resulting in price hikes in China’s domestic energy and chemical industries. Core CPI excluding food and energy prices is regarded as a more genuine reflection of the actual inflation, and its 1.7% growth is pretty modest.

In April, the surveyed unemployment rate in 31 big cities climbed up to 6.1%, 0.3 percentage points higher from a month ago, hitting historical high for two consecutive months ever since the release of the statistics. Young people faced especially rigorous challenges in finding jobs, with the surveyed unemployment rate for those aged 16-24 at 18.2%, 2.7 percentage points up from March, and significantly higher than both the pre-pandemic level at 11% in 2018-19 and the post-pandemic level in 2020-21 at 14%. Covid has lowered the ability of job creation of the labor-intensive service sector which now involves a lot of uncertainties, adding to the employment market strain. Figures for employment under the PMI of the service sector have been on a continuous downward ride, falling to 45.8 in April, much lower than that under the manufacturing PMI at 47.2 in the same period.

Sources: National Bureau of Statistics (NBS); Wind

From a cash flow perspective, Chinese households had relatively stable cash flows, while the situation for businesses significantly worsened, especially for the real estate and service sectors such as catering and retailing.

For households, the per-capita disposable income of urban households in Q1 increased 5.4% year on year, lower than both a year ago at 12.2% and the pre-pandemic average at 8.0% during 2017-19. The decrease in household income was not mainly because of lower wage payments by employers which only shrank slightly, but because of the higher unemployment rate. At the same time, household consumption and house purchase were slashed. In April, the year-on-year growth of retail sales declined to -9.7%, that of catering revenue, to -22.7%, and that of retail sales of consumer goods other than automobiles, to -8.4%. During the first four months of the year, individual mortgage loans fell year on year by 25.1%, while the deposit and prepayment reduced year on year by an accumulated 37%. These results show that income has dropped less than expenditure for the household sector, without significant deterioration in the cash flows.

For the corporate sector, especially the real estate industry and the various service industries such as catering and retail, the sharp contraction in household consumption and house purchase will lead to severe deterioration of corporate cash flow. Household payments upon house purchase are the main source for real estate development. Personal prepaid deposits and mortgage loans account for about 50% of the total real estate development funds. The lack of demand for houses of the residential sector has brought serious cash flow pressure to real estate companies. The implementation of strict pandemic prevention and control measures across the country will cause considerable damage to service industries such as catering, entertainment, tourism, and aviation. Corporate cash flow is faced with risks.

In summary, the sharp fall in April’s macro data is closely related to the resurgence of the pandemic. As the impact of the pandemic gradually subsides in the future, various macro indicators will recover in terms of year-on-year growth. However, the recovery will mainly be based on a month-on month comparative effect, which is not able to indicate an easing of the current downward pressure on the economy. In the next few quarters, China's economy will still encounter greater challenges. In the face of multiple pressures at home and abroad, it will be all the more difficult to achieve the growth target of 5.5% this year.

It is particularly important to ensure economic growth, protect market entities and secure employment. At present, all levels of governments must firmly implement what was put forward at the meeting of the Central Political Bureau of the CPC on April 29, "increasing macroeconomic adjustment policies and solidly stabilizing the economy". The policy of stabilizing growth must be formulated in time and implemented as soon as possible so as to maintain the stability and consistency of policy expectations.

First, a prudent monetary policy should be allowed to play an active role to respond to the current situation and reverse the credit cycle. The benchmark interest rate should be reduced as soon as possible to drive an overall decline in market interest rates, so as to reduce the operating costs of business entities, and show resolve to stabilize growth to the market. More work should be done to promote credit expansion, stimulate financing needs of the private sector, and bolster investment confidence of enterprises and the market.

Second, in terms of fiscal policy, it is necessary to speed up spending, improve the efficiency of special bonds, and step up efforts to encourage investment. It’s essential to improve the structure of fiscal budget, for example, increasing the proportion of general public budget to support infrastructure investment, increasing transfer payment to local governments, and providing discount loans for infrastructure investment. In addition, public funds can be used to compensate market entities damaged by epidemic prevention and control measures, to issue coupons for consumption and to support enterprises to resume operations.

The article was first published in CF40's WeChat Blog on Mar 16, 2022. It is translated by CF40 and has not been reviewed by the author. The views expressed herewith are the author’s own and do not represent those of CF40 or other organizations.