Abstract: As shown by changes in the saving and borrowing behaviors, households in China may have started to adjust their balance sheets, entering a deleveraging phase. Experience of developed economies shows that such a trend would have prolonged impacts on economic growth. Policymakers should act now to reverse the trend of household deleveraging.

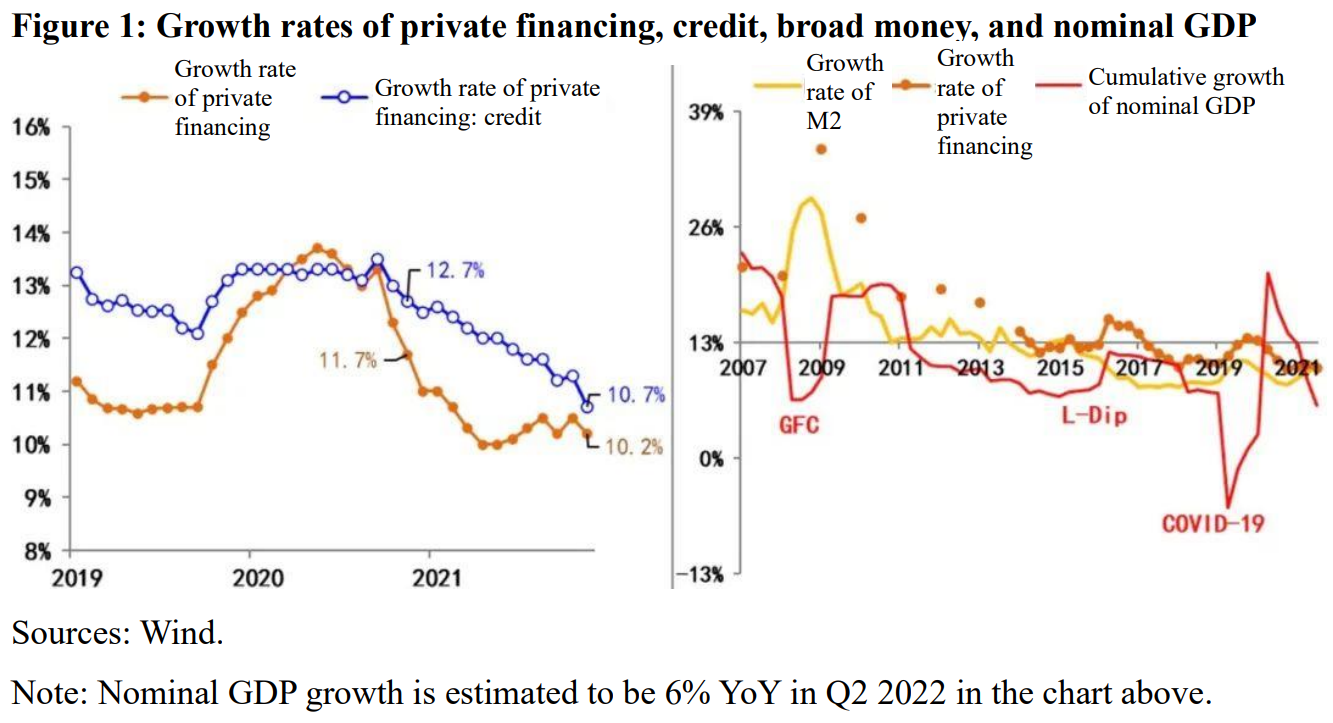

Given the Covid lockdown in Shanghai and its impact on the Yangtze River Delta region, a sharp fall in credit in April was inevitable, and the recent release of macroeconomic data has further confirmed the huge impact of recent covid outbreaks on economic performance.

For example, the growth rate of industrial value-added above designated scale in April fell by 2.9% YoY; the index of services production dropped by 6.1%; total retail sales of consumer goods fell by 11.1%; and real estate development investment in the first four months fell by 2.7% YoY, of which residential investment fell by 2.1%.

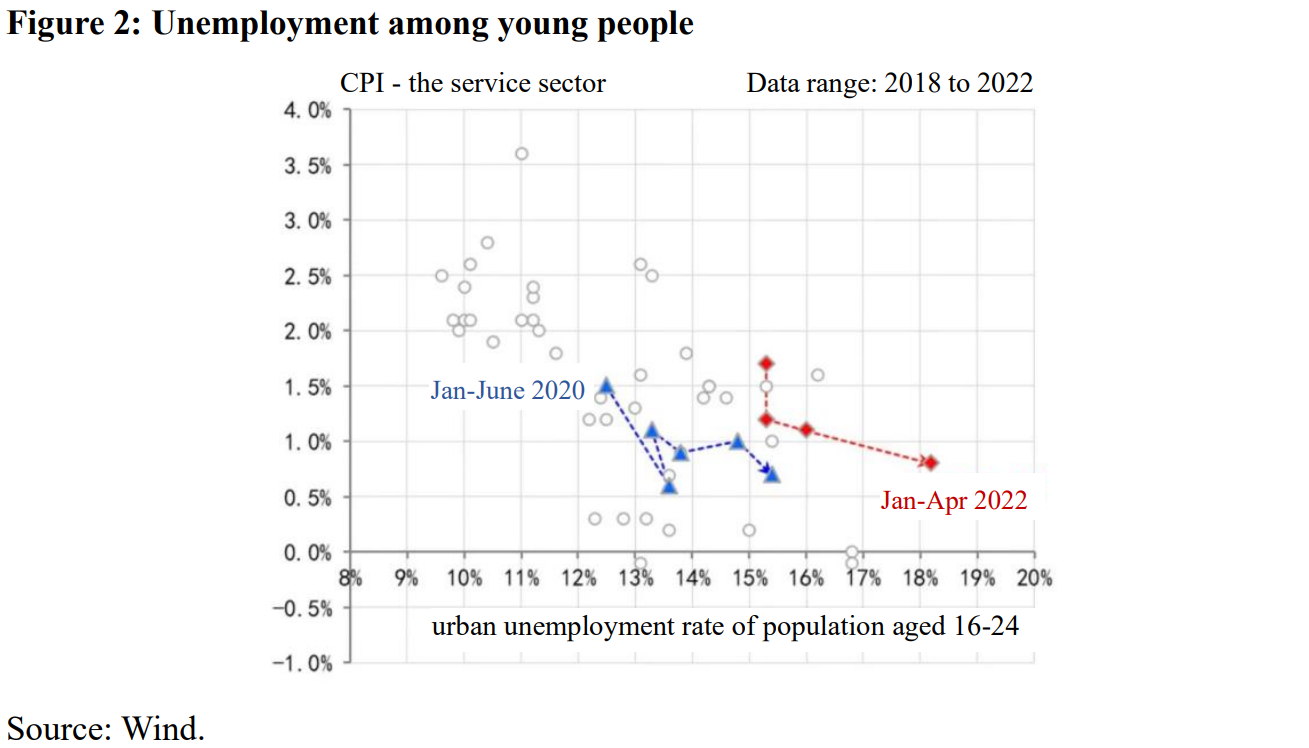

Deterioration in the job market is a bigger cause for alarm than the above-mentioned macroeconomic data. As of the end of April, the surveyed urban unemployment rate was 6.1%, indicating an unemployed population of more than 28.53 million, a new high since February 2020. The surveyed urban unemployment rate in 31 major cities was 6.7%, the highest since data were available. The average working hours fell to 46.2 hours per week, a new low since May 2020. What should not be underestimated is that the surveyed unemployment rate of young people aged 16-24 has reached 18.2%, and the proportion of the population in this age group is 10.8%, that is over 150 million people.

Data alone show that today’s job market is significantly worse than that in early 2020 when the pandemic had just broken out. The persistent deterioration of the job market will inevitably impact income expectation, which in turn will force households to make corresponding hedging arrangements.

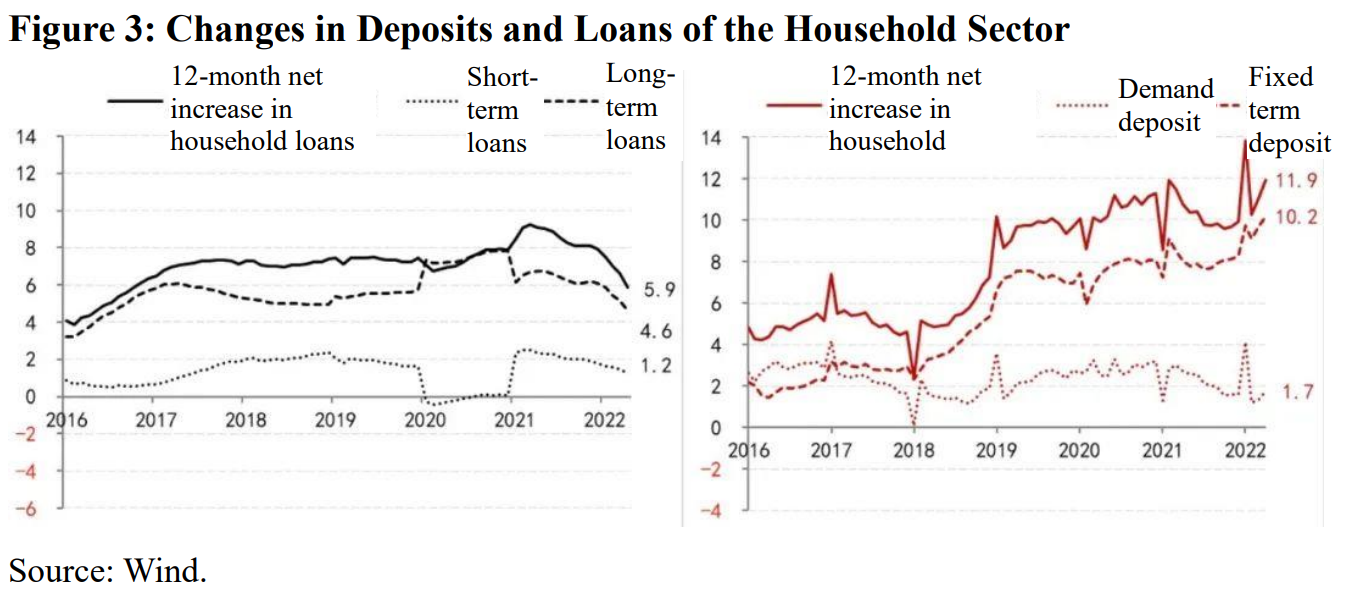

There has been a growing tendency among residents to pursue stable returns on existing financial assets, and the resultant trend changes of balance sheets in the household sector deserve special attention. According to the latest statistics released in April, the growth of household loans at the end of April was 5.9 trillion yuan per year, down by 3.2 trillion yuan per year from the same period last year. Among them, the growth of long-term loans fell to 4.6 trillion yuan per year, down by 2.1 trillion; that of short-term loans dropped to 1.2 trillion yuan per year, down by 1.1 trillion. The pace of deleveraging of the household sector accelerated further from the previous month.

In addition, household savings continued to grow. At the end of April, the growth of household deposits rose to 11.9 trillion yuan per year, up by 1.2 trillion yuan per year compared with the same period last year. Specifically, growth of fixed deposits rose to 10.2 trillion yuan per year, up by 2.2 trillion; but the growth of short-term deposits fell to 1.7 trillion yuan per year, down by 1 trillion. The household sector has been increasing the proportion of risk-free financial assets.

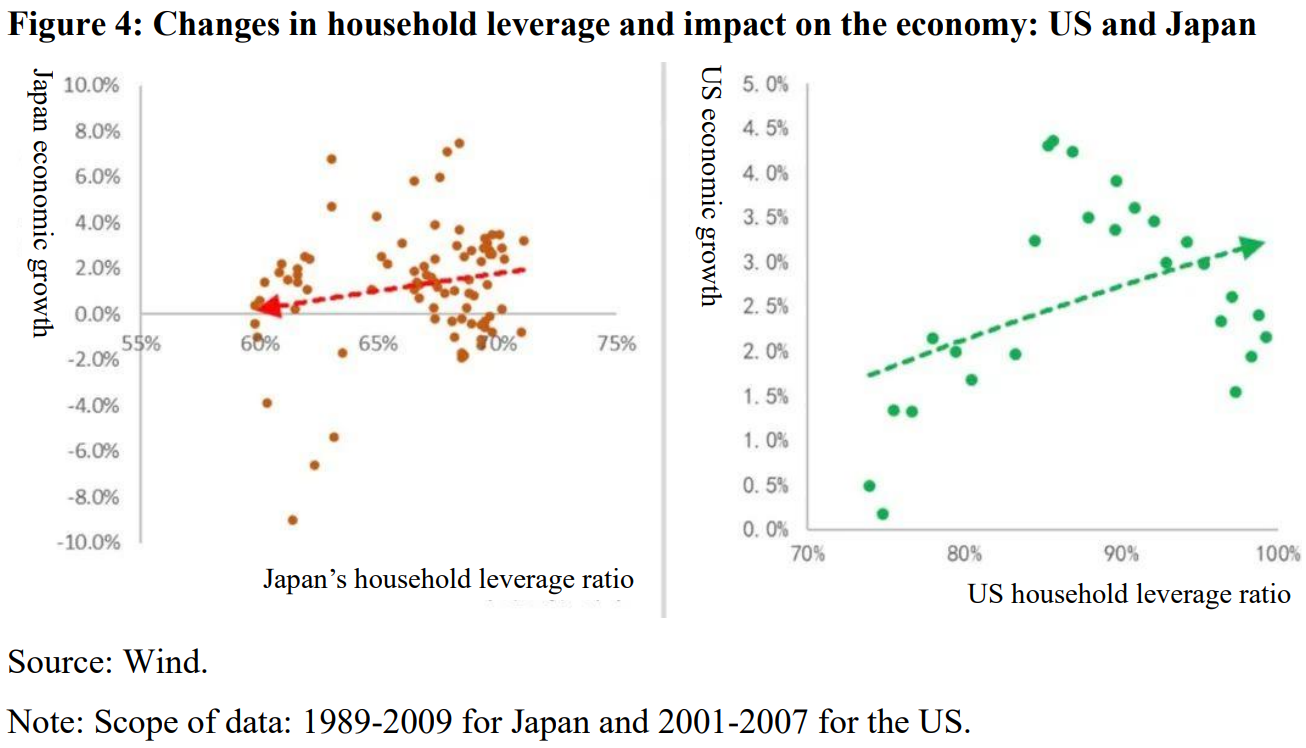

Continuous changes in the savings and borrowing behaviors of households indicate a trend where micro economic entities have begun to adjust their balance sheets and deleverage. Experience of developed economies shows that such a trend would have prolonged impact on economic growth. For example, the 1990s saw massive deleveraging of Japanese households; as a result, their leverage ratio reduced from 70% to 59% in 2015, and during this period, the Japanese economy was stuck in zero growth.

A contrary trend where households add leverage, however, would be a boost to economic growth. For example, during 2000-2007, household leverage in the US rose from 70% to almost 100%, and the average economic growth increased by over 3 percentage points. Of course, excessive leverage could add to financial risks. After that, the subprime crisis broke out, and household leverage fell back to 75%. In order to sustain the economy, the US Treasury and the Federal Reserve tried almost every tool in their policy arsenal.

Another thing of particular note is that household deleveraging in both Japan and the US started with the burst of the real estate bubble which evolved into severe economic crises, forcing the two governments to introduce unprecedented countercyclical measures, including rapidly elevating government leverage, slashing the policy rate to zero or even below, while rolling out several rounds of quantitative easing. However, the exit from such stimulus has also been so costly that neither country has managed to shake off the hangovers even today.

In view of both the actual economic situation and international experience, China needs to introduce policies to reverse the massive deleveraging by its household sector as soon as possible.

This article was first published on CF40’s WeChat blog on May 17, 2022. It is translated by CF40 and has not been reviewed by the authors. The views expressed herewith are the authors’ own and do not represent those of CF40 or other organizations.