Abstract: In this paper, the author calls for more expansionary fiscal policy to help achieve the GDP growth target of 5.5%, and points out that infrastructure investment is an important means. He further suggests that the government adjust the existing financing structure of infrastructure projects, increase the contribution of budgetary expenditure to infrastructure financing, increase the deficit ratio and expand the scale of national debt issuance.

According to the government work report reviewed at the Fifth Session of the 13th National People's Congress, the gross domestic product (GDP) in 2022 is expected to grow by about 5.5%. Previously, the 2020 government work report did not set a GDP growth target, and the 2021 government work report set the GDP growth target at more than 6%, which was a range. From the lack of a target to setting a target, from a range target to a concrete one, this is a major progress, which reflects the determination of the government and will help boost the market.

I. HOW SHOULD FISCAL POLICY SUPPORT THE 5.5% GROWTH TARGET?

How to achieve the 5.5% growth target? Here is an analysis on how fiscal policy can contribute.

According to the Report on the Implementation of the Central and Local Budgets in 2021 and the Draft Central and Local Budgets in 2022 released by the Ministry of Finance, the 2022 budget deficit is 3.37 trillion yuan, 200 billion yuan less than the figure of 2021.

It seems that fiscal policy support for economic growth has weakened, but it is not the case. By analyzing the budget table, we found that we need to distinguish two concepts: first, the scale of fiscal revenue and expenditure, and the gap between revenue and expenditure; second, the degree of stimulus effect of fiscal policy on the economy.

Generally speaking, increasing fiscal revenue can cause the economy to shrink, while boosting fiscal spending can expand the economy. If the government's fiscal revenue equals fiscal expenditure, without considering its marginal expenditure propensity, the stimulating effects of the two factors on the economy can offset each other in theory. But in fact, the stimulus effects of the two on the economy are not the same. By analyzing the budgetary revenue and expenditure, we found that the government does not seem to be short of funds this year, so there is no need to issue more bonds. The stimulus effect of fiscal policy on the real economy has enhanced significantly compared with last year, and I will not discuss this issue here.

Under the current conditions, China does need to invest in infrastructure to drive economic growth. At present, the growth rate of residents' income is not high, so Chinese residents have weak expectations and consumption confidence, a phenomenon that can be attributed to the country’s low economic growth rate. Infrastructure investment can boost economic growth and help the country achieve a GDP growth rate of 5.5%. In the next year, China can aim for a higher growth rate. Following this trend, China will be able to resolve its problems of all kinds, or will have a solid foundation to address its problems.

There is no doubt that China has the ability to achieve high growth in infrastructure investment. However, three important issues need to be addressed to enable infrastructure investment to play its role.

? First, whether China has sufficient projects;

? Second, whether the local government has the initiative to invest in infrastructure construction;

? The third is whether there is sufficient financial support.

If these three problems cannot be solved, the expansionary fiscal policy cannot be implemented, making it impossible to truly promote China's economic growth through the expansionary policy.

There are plenty of projects available in China for investment, with no sign of investment saturation. The most critical issue is whether local governments have the initiative to invest. In 2020, local governments issued 3.75 trillion yuan of special bonds. However, the actual revenue of local governments exceeded budgetary revenue by 1.98 trillion yuan, which shows that local governments are not very enthusiastic about infrastructure investment.

There seem to be two reasons behind the phenomenon: first, local governments are under great pressure to repay their debts. Their top priority is to reduce leverage, so more and more funds are used to repay the principal and interest, rather than used for infrastructure investment; second, the lifelong accountability system makes local government officials reluctant to risk investment failure.

Regarding the funding issue, I think that there is a fundamental contradiction in infrastructure financing:

On the one hand, during the economic downturn, investors are reluctant to invest because they want to pursue maximum profits, so the government has to launch a "stimulus plan" to create a crowding-in effect by increasing infrastructure investment.

On the other hand, the central government encourages local governments to raise funds for infrastructure investment from banks and capital markets due to its reluctance to expand fiscal deficit and issue additional government debt. The providers of credit and funds are precisely those market-oriented investors who are reluctant to invest due to the economic downturn, low expected investment returns and high risks. In order to attract investors to invest in infrastructure that is public good in nature and does not generate cash flows, fundraisers must increase the rate of return, and must use government credit to convince the market that these corporate bonds are implicitly guaranteed by the government.

In this way, although the fiscal risk of the central government can be avoided, the risks for local government and businesses have increased. In order to curb these risks, the government imposed various restrictions on the issuance and purchase of special bonds, bank loans and urban investment bonds, negatively impacting economic growth.

Obviously, the government has to find a balance between preventing risks and stabilizing growth. To me, the balance was too skewed towards risk aversion in the past. But at present, the balance has been tilted in the direction of stabilizing growth which has become the priority of China's macroeconomic policy.

At this stage, it is necessary to pay special attention to the investment and financing structure of infrastructure projects. Now we see a strange phenomenon. The funds with lower financing costs usually come in small amount, while that with higher costs are more easily obtained and used more often. For example, the cheapest fund to finance infrastructure is central general public budget, but infrastructure investment often go beyond tens of trillions yuan, and the central government budget can only contribute tens of billions yuan, which is a very small proportion. Relatively, the local government budget is about 1 trillion yuan, and special bonds are about 3.5 trillion yuan. And urban investment bonds, the most expensive financing method, can reach about 6.2 trillion yuan. These are the rough figures for last year. This needs to be corrected, and the government needs to make full use of low-cost funds to support infrastructure investment, instead of relying too much on the high-cost financing methods for the purpose of avoiding risks.

In order to achieve a growth rate of 5.5%, we need to make some adjustments to the financing structure for infrastructure:

? First, adjust the structure of the fiscal budget. It is necessary to enhance the support of the general public budget for infrastructure investment, and increase the proportion of the general budgetary expenditure in infrastructure financing.

? Second, increase transfer payments from the central government to local governments to replace the issuance of special bonds and urban investment bonds. In addition, subsidized loans for infrastructure could also be considered.

? Third, gradually increase the central government general public budget deficit and raise the deficit ratio.

? Fourth, relax restrictions on the issuance of special bonds. Strengthen the review of projects, but relax financing requirements, reduce red tapes, and improve the efficiency of the use of special bonds.

? Fifth, moderately relax restrictions on the purchase of urban investment bonds by banks and other investors, and give financial institutions, especially commercial banks, greater autonomy.

? Sixth, open up new channels for infrastructure financing through financial innovation.

? Seventh, further lower interest rates and reduce financing costs associated with infrastructure construction to support expansionary fiscal policy.

It is hoped that while China can achieve its GDP growth target of 5.5% in 2022, it will reverse the gradual decline in the economic growth rate since 2016 and boost national confidence.

II. THE FED MAY HAVE TO INCREASE INTEREST RATES MORE SHARPLY UNDER THE RUSSIA-UKRIANE CONFLICT

The impact of the Russia-Ukraine conflict on China is mainly reflected in the supply of energy, strategic materials and food.

Among them, we have to especially care about the global food supply. At present, Ukraine has entered the planting season, and the ongoing conflict will greatly affect food production. Since the food supply from Russia and Ukraine accounts for one third of the world's total, the rising food prices will lead to higher inflation.

Although the Fed is trying to downplay the impact of the Ukrainian crisis on the US economy and inflation, it will have to raise interest rates more sharply if rising food and oil prices exacerbate inflation. When interest rate exceeds 2% or even higher, it may cause a decline in economic growth and increase the risk of deflation.

III. ADJUST THE STRUCTURE OF CHINA’S OVERSEAS ASSETS TO ENSURE SAFETY OF THE ASSETS

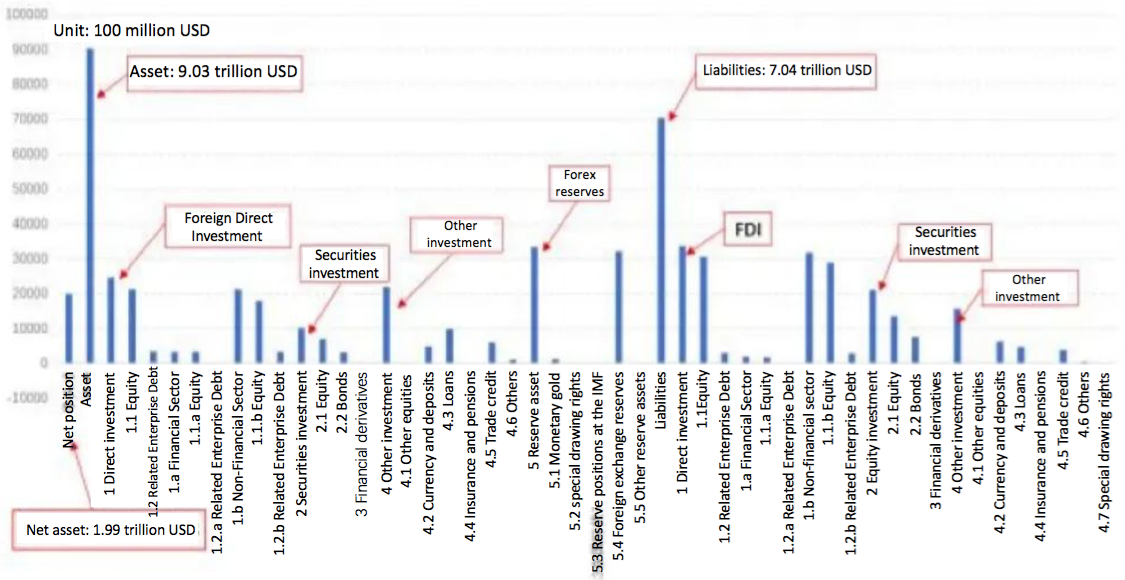

The safety of China's overseas assets also deserves attention. At present, China has a huge amount of overseas assets and liabilities, with a net asset of about 2 trillion dollars.

China's overseas assets and liabilities, as of the end of June 2021

By definition, net foreign assets are equal to the sum of annual current account surplus. Although each year China records a current account surplus of hundreds of billions of dollars on average, China’s net foreign assets in 2021 were only about the same as in 2014 (around 2 trillion dollars), which is very abnormal. It can be understood as a situation where a person has been depositing money in a bank account for 7 or 8 years but finds that the principal does not increase at all. I think we need to make a clear calculation. Since China is the largest creditor of the United States, under normal circumstances, we are concerned about the depreciation of the “dollar IOU”. The US national debt reached $28 trillion, including $15.4 trillion foreign debt. The M2 money supply in the US rose by 112% from 2008 to 2019, while GDP only increased by 45%. At some point, it is possible that inflation would spiral out of control in the US and the dollar would depreciate sharply.

Even without the geopolitical conflicts, China should already need to worry about its overseas assets, including its foreign exchange reserves. The financial sanctions imposed by the US on Russia should make us even more alert.

In 2013, Martin Wolf said that “if open conflict (between China and the US) arrived, the US could cut off the world’s trade with China. It could also sequester a good part of China’s liquid foreign assets…”. Though the measure would hurt the US itself, it would cause greater damage to China. The US has already made a careful calculation. Have we done so too?

As a country with a high savings rate, China should fully leverage its domestic savings and allocate more resources to domestic consumption and investment. We need balance of payments and balance of foreign assets and liabilities. In particular, China should not hold too many dollar assets, but rather should have the ability to take countermeasures and not simply be a net creditor. It is risky for China to be the creditor of other countries as well. We should thus waste no time in thoroughly assessing the safety of China’s foreign assets and making necessary adjustments.

This is the speech made by the author at a CF40 Youth Forum. The views expressed herewith are the author’s own and do not represent those of CF40 or other organizations. It is translated by CF40 and has not been reviewed by the author himself.