Abstract: The debt crisis in developing countries has put the global economy in jeopardy. As the world's second-largest economy and one of the largest creditor countries, China will need to explore a market-oriented and internationalized toolbox for debt treatment for the international community with a shared future for mankind.

The pandemic, the disrupted global supply chain tensions, the Fed's monetary policy change, and the conflict between Russia and Ukraine have followed one by one since the beginning of 2020, causing economic chaos in several emerging countries. The weakening currency and rising commodity prices pushed Turkey's inflation rate to 60% in March. In April, Lebanon as a state and its central bank has gone bankrupt. Sri Lanka, which is also experiencing an economic crisis, proclaimed a state of emergency and announced plans to restructure its external debt. In Peru, soaring prices have sparked massive protests and social unrest.

Debt-service burdens in middle-income countries are at 30-year highs, according to the IMF. In addition, as of the end of March 2022, 8 low-income nations (LICs) were in debt distress and 30 were in high-risk status, representing 55% of all 69 LICs. The debt crisis in developing countries has put the global economy in jeopardy this year.

As the world's second-largest economy and one of the largest creditor countries, China may suffer from resulting vises in trade, investment, and finance. This article tries to give technical solutions from the perspective of a community with a shared future for mankind.

Ⅰ. DEBT PRESSURE IN DEVELOPING COUNTRIES

Debt pressures have been mounting since the onset of COVID-19. The Fed’s policy shift and the Russia-Ukraine conflict in 2H21 even made it even worse.

Against this backdrop, some developing countries that rely on the import of food, energy, and other commodities, as well as tourism and remittance income, have been in or on the verge of a debt crisis, particularly those that already have a persistent current account deficit and are heavily indebted. The IMF had categorized 38 LICs as high risk or in a debt crisis as of the end of March 2022.

In addition to domestic concerns, the debt condition in heavily indebted poor countries, or HIPCs, is extremely subject to interest rate and exchange rate volatility.

On the one hand, variable-rate debt accounts for a high proportion of the total debt of these countries, reaching 31% in 2020, far exceeding the historical average of 15%.

On the other hand, foreign currency debt accounts for a bigger portion of these countries. Dollars and euros accounted for 51% of their total external debt in 2000, rising to 72% in 2020.

This means that if the global interest rate center rises or the local currency depreciates, these countries' debt repayment burden will skyrocket. With global inflation rates on the rise, monetary policies in the U.S. and Europe hastening policy shift, and the dollar's strong cycle striking, developing nations will confront challenges to their debt management and foreign exchange acquisition.

The Russia-Ukraine conflict takes another heavy toll on the debt burden. Risk aversion in global financial markets has increased since the start of the conflict. According to JP Morgan’s Emerging Markets Bond Index (EMBI), bond spreads in African countries climbed by an average of 20 bps at the end of March, among which Ghana rose by 90 bps, Ethiopia up 200 bps – external financing costs are growing across Africa.

As previously said, some middle- and low-income developing countries are experiencing economic and debt crises; the situation is even worse in LICs. In late March, Marcello Estev?o, the Global Director of the World Bank Group's Macroeconomics, Trade and Investment Global Practice, predicts that more than a dozen developing countries would default on their debts in the following year. This is not enough to generate a worldwide systemic danger at the moment and the impact will be less than the Latin American debt crisis of the 1980s, but it might nevertheless be the largest debt crisis to hit developing countries since the mid-1990s.

Ⅱ. A DEBT SOLUTION PLAN FROM THE PERSPECTIVE OF A COMMUNITY WITH A SHARED FUTURE FOR MANKIND

Our shared destiny has been self-evident since the pandemic. No country could be immune from the economic complexity and global challenges.

In 2021, the G20 developed a Common Framework for Debt Treatment beyond Debt Service Suspension Initiative (DSSI) and Common Framework (CF) to alleviate debt distress in LICs, but with a protracted debt restructuring process and limited advantages, only three countries filed for application. Many are concerned that applying to DSSI and CF may result in a downgrading of the country’s sovereign credit rating and, consequently, an inability to access other sources of financing in international financial markets. The international community has yet to develop a pragmatic response to the growing debt pressure on developing countries.

At the same time, the real and potential obstacles facing China's overseas lending have become more acute in recent years, while the West has one-sidedly accused China of having various problems with its external debt.

As a matter of fact, since the launch of the DSSI and CF in 2020, China has actively supported the G20 debt-related initiatives, taking on more than 60% of the debt relief on its own, securing its external debt and cushioning against a sovereign debt crisis.

However, China is still under pressure in the following negotiations on debt rules, especially now that the international community is focusing on debt information transparency, which places higher demands on China’s participation in mechanism design and multilateral coordination. Furthermore, existing debt solutions are insufficient to alleviate developing countries’ debt distress, and their debt-servicing capacity will face greater hurdles in the coming two to three years.

A debt crisis in developing nations would not only have a significant impact on global financial markets and economic growth, but it would also put China's abroad assets at risk.

For a community with a shared future, China will also need to explore a market-oriented and internationalized toolbox for debt treatment, a step that will encourage convergence between China and international debt coordination at the margins, as well as domestic reform of coordination mechanisms.

The international community is continually concerned about developing countries’ debt difficulties. On the top of the IMF's allocation of US$650 billion SDRs last year, the G20 Finance Ministers and Central Bank Governors Meeting in Jakarta, Indonesia in February 2022 expressed their hope that the IMF would promote the SDR Voluntary Trading Arrangements (VTA) asap, and welcoming countries to make voluntary donations totaling US$100 billion SDRs for the fight against COVID-19; they hoped that the IMF and the World Bank would establish the Resilience and Sustainability Trust (RST) by the 2022 annual meeting and encourage members to donate for Poverty Reduction and Growth Trust (PRGT).

In light of this, the international community has devised plans for debt treatment. China should also seize the opportunity to cooperate and align with international rules, as well as to innovate a Chinese solution to debt treatment from the perspectives of multilateralism and a shared future.

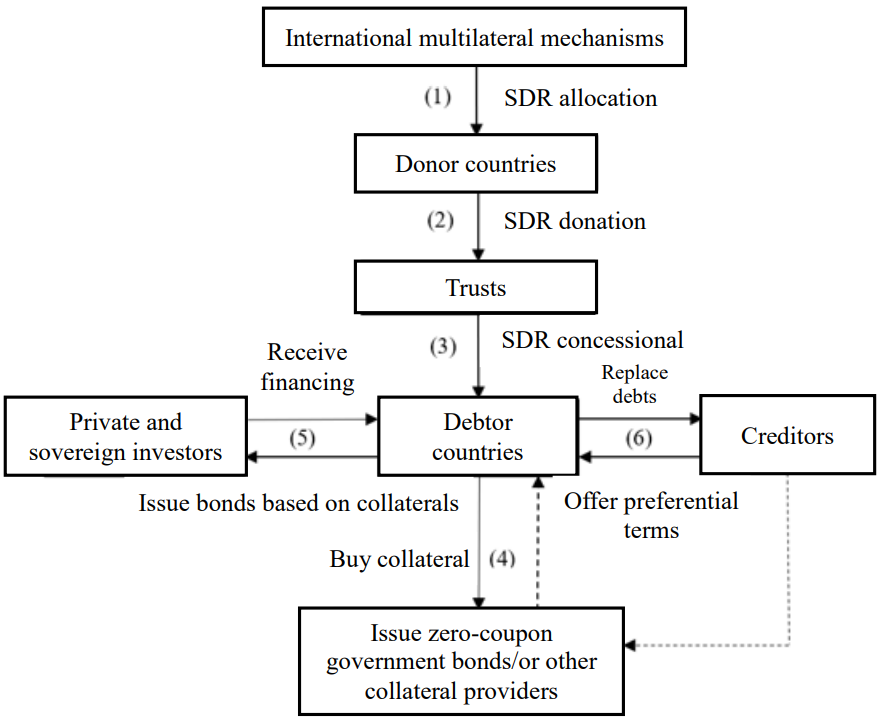

Specifically, here is the benchmark scheme we would like to propose. The IMF uses SDR to offer concessional financing to debtor countries to provide support through credit enhancement. On this basis, debtor countries can obtain financing through newly issued bonds which can be used to replace existing loans from commercial bank. The debtor-creditor relationships defined by this scheme can apply to bilateral debtor-creditor relationships of all countries, rather than being exclusive to China. At the same time, the scheme takes into account the incentives of various participating parties, and allows a number of adaptations. While attempting to solve the current debt predicament of developing countries, the scheme can also promote China's domestic reforms in related fields and help it align with international rules.

III. BENCHMARK SCHEME: ISSUING INTERNATIONAL ANTI-PANDEMIC BONDS TO PROMOTE DEBT REPLACEMENT

China should start from the perspective of building a community with a shared future for mankind, and actively explore innovative models of debt disposal. On the one hand, China can achieve win-win cooperation with debtor countries, and help developing debtor countries to tide over difficulties while safeguarding the interests of overseas creditors. On the other hand, this process can respond to the criticism from western countries and promote China’s domestic reform and compliance with international rules. China can even lead the formulation of rules of international creditor's rights.

Content of the benchmark scheme:

In the first step, international multilateral mechanisms, such as the IMF, use SDR to provide concessional financing to debtor countries.

First, the IMF raises an SDR fund, which can be from interest-free loans granted by member countries, with a term that matches future bond financing (borrowing member countries agree to share contingent losses). The IMF then injects SDR funds into existing trusts (such as PRGTs) or newly established trusts and lends them to countries in need to help them restructure their debts. All creditor and debtor countries can conduct bilateral or multilateral consultations and apply for loans denominated in SDR from the IMF in accordance with the principles of openness, transparency and marketization.

The mentioned loans can be interest-free or apply a very low interest rate. In terms of loan term, they can be matched with the debt issuance plan of the debtor countries, and a longer loan term can be given based on the particularity of this scheme. Bond issuance relies on market financing, but since the process of credit enhancement, issuance, replacement, and withdrawal of newly issued bonds involves a series of coordination processes, the debtor country usually chooses to finance in the original creditor country.

During the application process, multilateral organizations such as the IMF should cooperate with creditor countries and relevant departments of debtor countries to establish and improve the data reporting mechanism involved in bond issuance, so as to enhance the marketization and transparency of debt disposal. Taking the joint application by China and debtor countries as an example, after the issuance plan is approved, the IMF trust fund provides concessional loans denominated in SDR to debtor countries.

In the second step, the debtor country obtains credit enhancement on the basis of collateral to issue new debt.

Taking China as a creditor country as an example, the debtor country converts the SDR it has obtained into RMB to purchase special zero-coupon government bonds (or CDB bonds) issued by China. Debtor countries use their zero-coupon government bonds as collateral to issue RMB-denominated "international anti-pandemic bonds" in China's onshore and offshore bond markets to replace selected debts.

With high-quality collateral, the bonds issued by debtor countries can be rated higher and recognized by international investors, allowing access to relatively low-cost bond financing. According to the experience of the panda bond market, investors can also obtain credit risk protection and better interest margin returns at the same time. Other creditor and debtor countries can issue bonds in markets such as the United States and Europe in a similar way.

The third step is to replace the funds obtained from the newly issued bonds with existing loans.

Before the replacement, China and other relevant parties should refer to the principles of the G20 and the IMF, and reach an agreement with the debtor countries on the terms and interest rates involved in the replacement, optimize the debt structure, and reduce their overall debt principal and interest payment burden. During the process, the dollar bonds originally offered by Chinese financial institutions to debtor countries can be converted into RMB-denominated bonds. The RMB repayment can be realized through relevant agreements or the IMF's SDR fund.

IV. ADAPTATION OF THE BENCHMARK SCHEME

Considering the practical difficulty of domestic and international coordination, and the different nature of debt repayment difficulties, the above-mentioned benchmark scheme can be adapted in the following ways:

? Main bodies of participation: Multilateral mechanisms can include the IMF, as well as multilateral development institutions such as the African Development Bank and the AIIB. Creditors include not only China, but all creditors have the same opportunity to participate. Similar to the operation of the IMF's Poverty Reduction and Growth Trust (PRGT), donor countries can provide long-term interest-free loans denominated in SDR to PRGT, or they can offer interest concessions involved in the scheme.

? Bond issuing plans: Under the benchmark scheme, creditor and debtor countries jointly apply to the IMF for bond issuance, which can be changed as the debtor country can apply to the IMF alone, and then discuss plans with creditor countries. The scope of the IMF's power differs in the two scenarios, depending on the wishes of the parties. Bonds can be issued in various countries and currencies. As for China, it can also expand to the offshore RMB market, and the bonds can be denominated in SDR. China has a special advantage in this regard as it is the only country that has successfully issued SDR-denominated bonds in the past 30 years.

? Positioning of debt replacement program: The current benchmark scheme is positioned to help debtor countries improve liquidity so as to revolve debt crises. Therefore, it is not contradictory to, or even complementary with the Paris Club mechanism and the G20 common framework mechanism which focus on debt crisis resolution. For countries that mainly suffer from liquidity crises, the benchmark scheme without principal write-down can be implemented. For countries facing liquidity crises and debt crises, an adapted plan can include principal write-down (haircut) and net increase in new financing plans.

? The benchmark scheme can be extended to new debt financing plans: To solve the debt problem in the long run, it is necessary to meet the financing needs of developing countries to contain the pandemic and achieve sustainable economic development. New financing tools can be designed specifically for vaccine promotion and other anti-epidemic needs based on the SDR credit enhancement structure as well as referring to the experience of green debt replacement and social impact bonds issuance. It is also suggested to launch financing tools to support green development, address climate change, and promote sustainable infrastructure construction by drawing lessons from innovations in green financing tools boasting carbon emission reduction and sustainable development such as Sustainable Development Linked Notes (SLN).

V. INCENTIVE OF THE SCHEME FROM THE VIEW OF BUILDING A COMMUNITY OF COMMON DESTINY

First of all, the scheme is based on the values of building a community with a shared future for mankind, conforms to the trend of multilateralism and sustainable development, and is in line with international practices and financial market rules.

This solution innovatively connects debt disposal with green development, and helps international multilateral mechanisms to leverage commercial bank creditors and financial market investors to actively participate in debt resolution. Creditors of developed countries may also benefit from it, so they are willing to promote all parties to jointly solve the problem in a win-win way.

In addition, the international community is calling for the improvement of debt data reporting mechanism and database construction. China and other developing countries have negotiated with multilateral organizations such as the IMF through specific cases, and explored the construction of debt data transparency mechanisms, a move that can promote the debt transparency reform of developing countries, and also help international multilateral institutions to play a more flexible, fair and effective role.

Second, the benchmark scheme is based on debt replacement, which avoids the moral hazard of default by debtor countries and safeguards China's interests as a creditor.

Meanwhile, through rollovers, lower interest rates of replacement, and tailored disposal plans for countries with liquidity crisis and debt crisis, this scheme will help debtor countries alleviate debt pressure and enhance their debt sustainability.

In addition, as China has not joined the Paris Club, and meanwhile, the G20 debt relief initiative and its common framework may lead to downgrades of debtor countries and cannot solve the problem of new financing. The proposed new approach would allow creditor and debtor countries to have more compatible options beyond the above-mentioned frameworks.

Again, the new program may help reduce reliance on the dollar.

Developing countries can swap their existing debt for debt denominated in RMB or SDR, thereby reducing the use of the dollar. Especially in the issuance of SDR-denominated bonds, China is the only country that has successfully issued SDR bonds in the past 30 years, so it has certain advantages in this regard.

To a certain extent, the plan also helps to promote RMB internationalization from the demand side of bonds, that is, from the perspective of asset allocation. For one thing, the European and American economies are seeing rising inflations, while China's inflation level remains stable, which increases the attractiveness of RMB assets. For another, more international institutions now wish to invest in RMB assets to diversify risks and obtain stable returns. If the debtor countries convert the SDR they obtained into RMB to purchase special zero-coupon government bonds (or CDB bonds) issued by China, it will accelerate the pace of RMB internationalization.

Finally, the scheme can help China promote domestic reforms and align with international rules.

Replacing part of the existing debt with bonds can help China gradually improve the transparency of creditor's rights and align with international rules. During the replacement process, bilateral loans between China and developing countries will be replaced with bonds publicly issued in the international financial market. In addition to increasing transparency, this process can also respond to the disputes over the nature of some of China's foreign loans. Through the replacement, the nature of the loans can be further clarified as creditor’s rights held by investors in the international bond market, which will better protect the interests of China's overseas creditors.

The views expressed herewith are the authors’ own and do not represent those of CF40 or other organizations. It is translated by CF40 and has not been reviewed by the authors.