Abstract: China delivered higher-than-expected macroeconomic performance for the first two months of this year, behind which is a combination of various factors including the resilient external demand, the remarkable expansion in total social financing, and the base effect from a depressed service sector early last year. Going forward, China will face multiple challenges in sustaining the momentum, including blows from the Ukraine crisis, the COVID-19 situation, and a heavily indebted real estate sector. This article suggests that China should remain independent with its monetary policy and work to boost confidence, and step up fiscal expenditure and support for investment to stabilize total demand and sustain high-quality growth.

The Chinese economy has been facing an increasingly complicated environment at home and abroad since the fourth quarter of 2021, bearing mounting downward pressure. According to the National Bureau of Statistics (NBS), China managed to deliver macroeconomic performance that was much higher than expected in the first two months of 2022, with many aspects showing signs of recovery including investment and service consumption.

Behind the beyond-expectation data was a combination of various factors. With resilient external demand, China has managed to sustain a sound level of export on the strength of its complete domestic supply chain; and the significant expansion in total social financing (TSF) in January has helped businesses maintain their cash flows. In addition, its depressed service sector at the start of last year as a result of people staying put during the Spring Festival has created the base effect bolstering a strong recovery in service consumption in the first two months of this year.

The progress toward recovery has been hard-earned. Going forward, the Chinese economy could find itself amid grave risks and challenges that call for more proactive macroeconomic policy supports. First is the Ukraine crisis which could significantly add to global economic and political uncertainties by pushing up inflation, curbing the recovery of the emerging market economies, and threatening food security, putting the Chinese economy in a more challenging environment. Second is the highly uncertain Covid-19 pandemic situation. Covid control remains the top priority for the country, which could arrest the recovery of some of its economic sectors in the near term. Third is the mounting debt risks facing the real estate sector which can hardly be resolved in the short run, with sluggish demand among home buyers and hampered credit expansion.

Indicators on industrial production has been picking up in January and February. Value added by industrial businesses above designated size rose by 7.5% year-on-year (y-o-y), 3.2 percentage points higher than that back in December last year and 2.2 percentage points higher than the same period in 2019. The recovery has been owed to three major factors:

First, marginal ease in supply constraints. As China strives to secure a reasonable level of energy supply in order to stabilize the price, during the first two months of the year, it produced a total of 687 million tons of raw coal, with an accumulated y-o-y growth of 10.3% which was 5.6 percentage points higher than last year. The increase in coal supply helped to release a proportion of the production capacity. In addition, supply of car chips has also showed signs of picking up. During January and February, China recorded a total of 4.266 million cars manufactured, 411,000 more than a year ago at a growth rate of 11.1% which was 6.3 percentage points higher than last year.

Second, resilient external demands. During January and February, RMB-priced exports grew at an impressive 13.6%. While the price effect as a result of the commodity price hike has played a part, the resilience also exhibited China’s indispensable role in global supply chain. While western economies gradually open up with rising production and demand, the Ukraine crisis and its impact on the global supply chain have sustained China’s advantageous position in global supply and the export boom.

Third, the real economy received strong credit support at the start of the year. Monthly newly issued RMB loans in January hit a historical high at 4.2 trillion yuan, which, despite some decline in February, injected ample liquidity into the real economy, improving their balance sheets and reviving production.

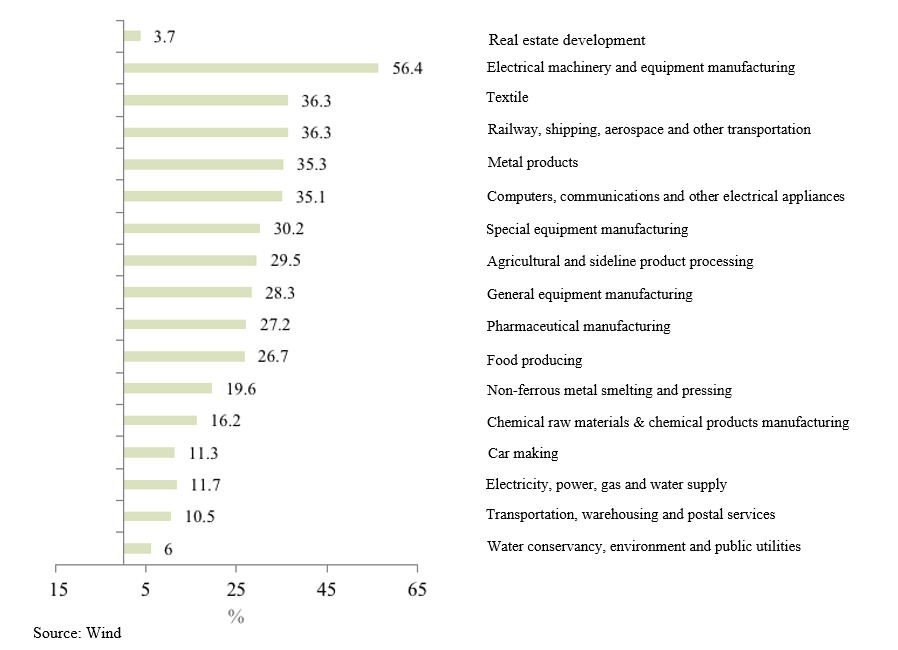

With production well toward recovery and supportive policies rolled out, growth of investment in fixed assets went back up remarkably in January and February at an accumulated y-o-y rate of 12.2%, 7.3 percentage points higher than the annual growth in 2021. Structurally, the manufacturing sector has been driving the recovery in total investment. The whopping 20.9% growth of manufacturing investment in the first two months may have been owed to production revival and cash flow improvement at the start of the year.

Of particular note, infrastructure investment has been growing at 8.6%, driving investment in manufacturing equipment and electrical machineries. The upswing in infrastructure investment has fully demonstrated the effect of policies aimed at sustaining growth. China now has pooled rather abundant funds for infrastructure. The special bond quotas issued in advance at the end of 2021 were used at a fast pace during the first two months of this year. The ahead-of-time issuance will play an important role enabling tangible outcomes in the first quarter of this year, especially considering the laggard pace of issuance last year. In addition, many of the major infrastructure projects across the country have started earlier than in previous years, which, on top of the sufficient funding, has driven the recovery of infrastructure investment in the first two months of this year.

Besides, real estate investment is also coming back to life, edging up by 3.7% in the first two months of the year and leaving the negative territory that it had been in for 4 consecutive months at the end of 2021. But at the same time, newly started projects as well as new sales and land purchases are declining significantly, indicating the sustained downward pressure on the sector.

Figure 1: Investment in real estate development, manufacturing and infrastructure: Accumulated y-o-y growth (Jan-Feb, 2022)

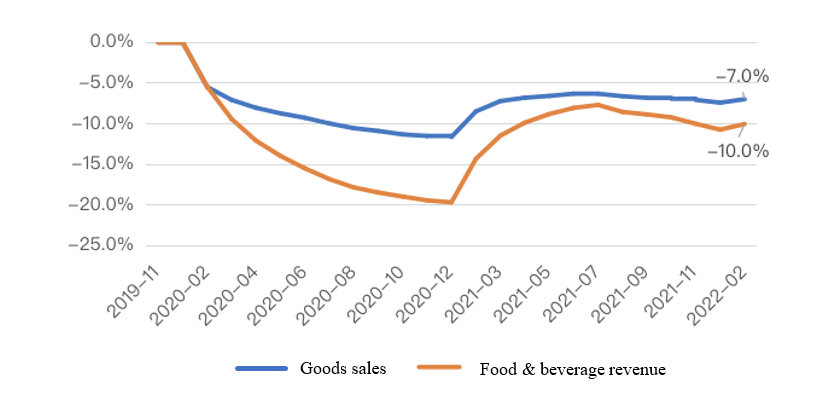

Consumption recovery has also picked up pace in addition to production and investment, although still lagging behind and far from the pre-pandemic level. Retail sales of consumer goods in China increased by 6.7% y-o-y in January and February, reversing the decline for 9 consecutive months before that and 5.0 percentage points higher than the monthly growth in December 2021, yet it was still 1.5 percentage points lower than the same period in 2019. More importantly, consumption has been nowhere near the trend level during 2011-19; sales of goods excluding cars were still 7% short of the trend level, while service consumption represented by the revenue of the food & beverage sector fell short by 10%.

Figure 2: Consumption still falling short of the pre-pandemic trend level

Factors dragging consumption growth other than Covid control include sluggish household income recovery and unstable income expectations. The underlying logic here is that pandemic control mainly affects service consumption, and so if it can explain the most part of sluggish demand, then it means there would be a remarkable structural divergence between consumption of goods and that of services. Such divergence has already been observed in the United States. But in China, there remains a 7% gap from the trend level in the consumption of goods which can’t be explained by Covid control alone. The 3% difference between the gap in consumption of goods and that of services could be taken as a net effect of Covid control policies, while the rest is mainly a result of the income effect, that is, slower-than-expected recovery of household disposable income holding back consumption from recovering to the pre-pandemic trend level. Considering that consumption of goods and services each accounts for around half of total household spending, Covid control is estimated to explain at most 15-20% of the decline in spending, with the rest owed to the income effect.

In conclusion, there are many complicated factors at play behind China’s higher-than-expected macroeconomic data. With resilient external demand, China has managed to sustain a sound level of export on the strength of its complete domestic supply chain; and the significant expansion in TSF in January has helped businesses maintain their cash flows. In addition, its depressed service sector early last year as a result of people staying put during the Spring Festival has created the base effect underpinning a strong recovery in service consumption in the first two months of 2022.

Following that, China's economy may face greater challenges.

First, the situation in Russia and Ukraine may exacerbate the international economic and political uncertainties by boosting inflation, stifling emerging market recovery, and jeopardizing food security, and the external position of China's economic operation may deteriorate. Russia and Ukraine are major exporters of energy and agricultural products, and the broad sanctions on Russia might have a more detrimental impact on the global supply chain.

The conflict between Russia and Ukraine may set off a chain reaction through indirect channels:

1. The military conflict and the sanction-induced supply constraints may keep commodity prices high. Higher inflationary expectations will force the US and EU to tighten their policies faster, increasing "stagflation" risks in developed economies.

2. Commodity price increases, damage to global supply chains, and interest rate hikes in the EU and the US will worsen the balance of payments, capital outflows, and external debt risks of emerging markets, putting their economic and financial operations at risk and slowing their economic recovery.

3. Reduced food production, shipping restrictions, and higher costs are predicted to be threats to global food security, which may intensify social conflicts in food-deficit low- and middle-income countries and lead to social unrests.

Second, the risks in the real estate sector are difficult to resolve in the short term, which could hamper credit expansion. Although there are signs of recovery in real estate development investment at the beginning of this year, commodity housing sales are still on the slide. Weak demand is also shown in February when new credit of medium and long-term home loans hit a new low. Real estate enterprises might be struggling with cash flow in the next phase. Given certain developers’ debt burdens, constrained cash flow could affect not only their debt risks but also the return of money of upstream and downstream firms. Credit may be hampered if the liquidity base of the real estate and related businesses is tightened.

Expansionary macro policies should be implemented asap to safeguard the hard-earned recovery.

Monetary policy should be self-focused, releasing a firm determination to stabilize growth through a clear trajectory of interest rate adjustments to stabilize business and market investment confidence; and it should support credit expansion and lower real-estate operation expenses. The signal of stable growth should be broadcast asap.

Fiscal policy should expedite expenditure, improve the efficiency of the use of funds from special bond issuance, and stabilize investment to ensure that China's economy and society can still strongly guarantee the stability of demand and high-quality development in the face of enormous external uncertainty.

Against the backdrop of commodity price hikes, consumption subsidies should be provided for the mid-and low-income groups for their basic livelihoods. Structural policy arrangements should be made to alleviate the pressure on SMEs’ profitability in the face of high commodity prices.

This article first appeared on CF40’s WeChat blog on March 15, 2022.