Abstract: The sharp drop in the growth of retail sales of consumer goods since the second half of 2021 is blamed for hindering China’s economic recovery. In this paper, the author probes into the reasons for the weak consumption and offers suggestions on how to boost consumption and bolster economic growth.

I. CONSUMPTION MOMENTUM REMAINS WEAK, AND MAINTAINING CONSUMPTION GROWTH IN 2022 FACES PRESSURE

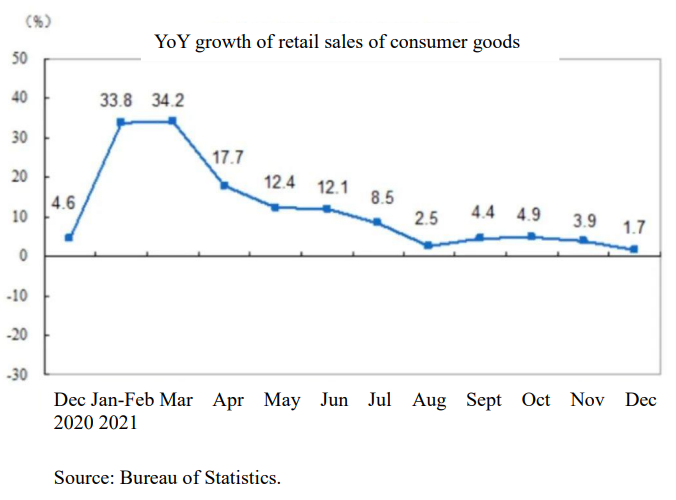

The year-on-year growth of China’s retail sales of consumer goods has dropped since the second half of 2021, and even plummeted in the fourth quarter. At present, more than 20 provinces, autonomous regions and municipalities across the country have announced their targets for retail sales of consumer goods in 2022, most of which remain the same or are down from previous years, which reflects the cautious outlook of local governments.

That the consumption data in the fourth quarter hit a new low indicates that weak consumption has become a major problem hindering China’s economic recovery.

Below is an analysis of major causes of this situation:

First, many service industries have seen a considerable contraction of both supply and demand due to the pandemic. Currently, covid cases are being reported in different places across the country. Many consumption activities especially those requiring human contact such as culture and entertainment have reduced significantly. Even during the holidays, the year-on-year growth, compared with two years ago, of the number of travelers and catering businesses has not yet turned positive.

Among them, the tourism industry has been severely affected. The data in 2021 did not show any significant improvement from 2020, nor did it recover to the 2019 level.

Second, different income groups have felt different impacts from the pandemic and are at different stages of recovery. The latest data show that the national per capita disposable income of residents reached 35,128 yuan in 2021, an actual increase of 8.1% over 2020. However, from a structural perspective, we can see that the income growth of low- and middle-income groups is significantly lower than the average level.

It should be noted that the actual growth of transfer payments to the low-income group in 2021 is significantly lower than the nominal growth of China’s GDP, as well as the growth of operating income and investment income. The fact is that the pandemic has left a significant impact on the income of the middle- and low-income groups, which has greatly affected their future income expectations and spending confidence. Given that groups at the lower end of the income distribution are often those with a higher marginal propensity to consume, below-expectation growth of their earnings is a major cause for concern.

Third, a future full of uncertainties has weakened the expectations of residents, leading to an increase in precautionary savings and subsequently insufficient consumption.

Fourth, some key industries affected by the supply chain shock also witnessed weak consumption. Taking the automobile industry as an example, due to the shortage of chips, automobile production in China decreased by 1.5-2 million in 2021, and the total sales also declined to a certain extent.

The 2022 Government Work Report stated that "China will continue to support the consumption of new energy vehicles", which reflects the importance of the new energy vehicle industry to the recovery of the domestic auto market and GDP growth. I believe that new energy vehicles are an important part of consumption. It should be noted that although the production and sales of new energy vehicles have risen sharply, the sector has also suffered from supply bottlenecks during the transition of automobile consumption structure.

In addition, it has been observed that consumption of luxury goods by middle- and high-income groups is also lower than expected.

The weak consumption can be attributed to the premature withdrawal of stimulus policies. In 2020, a number of extraordinary measures were introduced in China to stimulate consumption, but many of them were withdrawn when consumption increased sharply in the first quarter of 2021 and optimism started to spread.

II. GROWTH OF CONSUMPTION MAY REBOUND IN THE THIRD QUARTER WITH THE INTRODUCTION OF PROACTIVE POLICY

In the face of the weaker-than-expected consumption, the 2022 Government Work Report proposes the following measures to promote its recovery:

The first is to promote the recovery of service consumption; the second is to steadily increase bulk consumption, including supporting the consumption of new energy vehicles, and bolstering the consumption of green and smart home appliances in rural areas and the replacement of old home appliances; the third is to boost consumption at community as well as the county and township levels, including increasing the construction of service facilities for urban communities, strengthening the commercial systems in counties, and developing e-commerce and logistics in rural areas.

It will be rather difficult to reverse the trend of weak consumption in the short term once it’s established, but China has attached great importance to the issue, and the introduction of consumption boosting policies will play a role.

First, forceful macro policies will help reverse the pessimistic expectations for economic growth. The 2022 Government Work Report attached more importance to stabilizing growth, stating that the economic work this year should prioritize stability while pursuing progress. Improved income expectations and consumer confidence will drive the consumption to improve. The downward trend in consumption growth may bottom out in the first quarter, then consumption could stabilize in the second quarter, and rebound in the third quarter.

Second, multiple measures should be taken at both supply and demand sides to boost consumption. At present, China has taken certain measures targeting special consumer groups such as minors, the elderly, the disabled, and low-income groups, and has rolled out various stimulating measures, including providing consumer subsidies for low-income groups, and offering support for industries seriously affected by the pandemic. At the same time, China will step up efforts to overcome bottlenecks in supply chains. All these measures will help boost consumption.

Third, policies can stabilize real estate-related consumption. China has launched a series of consumer credit policies to maintain the stability of the real estate sector, such as providing consumer credit for the purchase of furniture and home appliances, which could help stabilize real estate-related consumption.

On the whole, overall consumption in 2022 may not fully return to the level in the normal period, but the stimulus policy will gradually come into play, and we may be able to see consumption stabilize.

III. IT IS ESSENTIAL TO SOLVE THE PROBLEM OF HOUSEHOLD DEBT RESULTED FROM MORTGAGE LOANS

According to a survey released by the Statistics and Analysis Department of the People's Bank of China in 2021, the proportion of households burdened with debt in China is 56.5%, and the average debt per household is 512,000 yuan. Some think that 70% of household debt is mortgage loans, and this structural feature is prominent, which has affected final consumer demand. Since the outbreak of the pandemic, the income and expenditure structure as well as the debt structure of Chinese residents have also deteriorated.

Since 2008, China’s personal debt, mainly in the form of mortgage loans and consumer credit, has been increasing sharply. As a result, the household debt to GDP ratio surged to 60% in 2021, and household debt as a percentage of disposable income exceeded 100%. The bulk of household income was spent on housing, which squeezed consumption of other types as real estate purchase is an investment rather than consumption. Meanwhile, a large amount of money was used to purchase real estate-related durable goods, which would also lead to insufficient consumption in other areas. Thus the issue needs to be taken seriously.

The high household debt ratio is also attributed to another problem—high rates on loans or the heavy interest burden on the residents.

Therefore, the key to easing the household debt burden and boosting household consumption is to solve the problem with the structure of household’s balance sheet.

First, house prices should be stabilized. It should be made clear that housing is for living in, not for speculation. So it is necessary to regulate the real estate market so as to stabilize the prices.

Second, the “visible hand” should play a bigger role in meeting the housing demand of low- and middle-income groups. Efforts should be stepped up to improve the housing supply system that mainly provides public rental houses, government-subsidized rental houses, and houses with shared ownership, to let low- and middle-income groups have access to subsidized housing at relatively low prices and thereby have extra money for other consumption.

Third, mortgage rates need to be maintained at appropriate or low levels so as to reduce the debt service burden of households.

Overall, the establishment of a long-term mechanism for the real estate market will help ease the debt burden on Chinese households.

The 2022 Government Work Report also required that “people’s housing demand should continue to be met”. The Report pointed out that China should uphold the principle that housing is for living in, not for speculation, explore new development model, encourage both housing purchase and renting, accelerate the development of the long-term rental housing market, provide more government-subsidized housing, support the commercial housing market in better meeting the reasonable demand of home buyers, stabilize the prices of land and housing as well as market expectations, adopt city-specific policies to boost the virtuous cycle and healthy development of the real estate sector.

IV. FISCAL AND MONETARY POLICIES SHOULD TARGET CREATING NEW FORMS OF CONSUMPTION

As for the intermittent local outbreaks of the pandemic, the 2022 Government Work Report mentioned that China “will continue its routine Covid-19 control measures”, and “roll out targeted and scientific measures to deal with local outbreaks to maintain the normal order of work and life.”

If the pandemic continues to break out sporadically, it will have systematic impacts on economic recovery in the medium term and drag down the potential growth. More importantly, the pandemic has added to the people’s psychological burden and their expectation of uncertainty. Household expenditure is determined not only by people’s assessment of future income but also by their judgment about the future environment. The more uncertain the future is, the more precautionary savings people will hold, which will inevitably reduce consumer spending.

Therefore, pandemic control measures should be science-based and targeted, which is a prerequisite for sustained economic recovery and income growth. China should leverage its institutional strengths to coordinate scientific pandemic control and economic recovery.

In terms of fiscal policy, policy support should favor areas hit hard by the pandemic, and fiscal funds should be directly transferred to local governments facing tight fiscal conditions. Many subsidies rely on national policy, but the policy varies from region to region, which requires special arrangements.

Monetary policy should coordinate with fiscal policy to adjust residents’ interest burden. It is critical to further reduce the cost of consumer credit, which also calls for adjustment of monetary policy.

The 2022 Government Work Report proposed that monetary policy needs to “encourage financial institutions to lower real loan interest rates and cut fees, so as to truly make it easier for market entities to access financing and achieve a considerable drop in overall financing costs”, which indicated the requirement that loan rates need to be lowered to satisfy more credit demand.

China needs to set up a package of measures to boost consumption in accordance with the strategy to expand domestic demand. These measures will take time to implement and should span the entire 14th five-year plan period. For example, income subsidies to special groups, regional distribution of consumption vouchers, as well as policies to promote spending on large home appliances in rural areas and support rural consumption, could all be included in the policy toolbox to serve the national strategy of expanding domestic demand.

These measures need to be fully supported by fiscal and monetary policies. We can see that many local governments are good at making investments but poor at boosting consumption. Therefore, the policy toolbox needs to be innovated; the policy transmission channel needs to be unblocked; so that governments at all levels could effectively expand consumption rather than simply launching bigger projects.

New forms, models, and scenarios of consumption should be developed to enable the overall consumption model to withstand the impacts of the pandemic. For example, services like home delivery through online orders and unmanned supermarkets will help return consumption to normal.

V. IMPROVING THE STRUCTURE OF INCOME DISTRIBUTION TO PROMOTE COMMON PROSPERITY

Taking into account the long-term goal of common prosperity, the policy of adjusting income distribution is the most fundamental measure to expand domestic demand and consumption.

First, primary distribution should benefit the workers rather than the capital. The key is to enhance the wages and benefit packages of workers.

China’s low consumption is due to the small scale of national consumption fund, which is closely related to China’s income distribution pattern that generates “poor residents, rich enterprises, and strong government”. At present, China’s household income only accounts for 46-47% of GDP, lower than the world average; yet the retained profits of China’s enterprises account for around 20% of GDP. Such a high ratio means that a large portion of listed companies’ profits are not paid out as dividends and a large number of state-owned enterprises’ profits are not converted into national consumption fund but into investment fund. Therefore, it is essential to better handle corporates’ profit sharing and make state-owned enterprises hand over their profits to the central government.

Second, in the process of redistribution, the tax structure should shift from turnover tax-based toward income tax and property tax-based.

Currently, the overall tax burden is quite high during the process of redistribution. And because of the turnover tax based system, the tax burden ultimately falls on consumers instead of high-income people or people with large wealth. Therefore, it is important to change the tax structure.

Third, we should establish a third distribution system that is based on rule of law and guided by social, moral, and cultural norms, so as to significantly increase the proportion of consumption fund of the whole society.

Another reason it is difficult to release resident consumption potentials is that they still have many concerns about housing, medical care, pensions, education, and so on. The Report also suggests to "improving the systems for providing basic public services to people in places of their permanent residence." How should we expand public services and improve the consumption environment in the future?

Inadequate public services have led to the unavailability of medical care, schooling and elderly care. China will have to make efforts on the supply side to improve the quality of education and healthcare, as well as the availability and affordability of elderly care services.

A large number of low-income groups' housing needs have not been met. Many residents can meet their housing needs through rental services during real estate market adjustment, but the rental housing market in China is currently much unregulated, and tapping the consumption potential in this area depends on promoting structural reforms on the supply side and vigorously increasing the supply of subsidized rental housing.

However, it should be noted that many public services are semi-public goods. On the one hand, the government must increase fiscal spending on public services; on the other hand, institutional innovation is required to leverage market means to increase the supply of semi-public goods. This is a challenge to China's supply-side structural reform and income distribution reform.

Concerning China's consumption potential, there is still a lack of services for mid- and high-end consumption needs, as well as a supply shortage in the elderly healthcare industry. With technological advancements, particularly the popularization of 5G and 6G, the new forms, models, and products that can be generated on the consumption end may be beyond imagination. Some capitals should be allowed to explore in relevant frontier areas.

This article is compiled from an interview with the author, and was published on CF40 WeChat blog on Mar 9th. The views expressed herein are the author’s own and do not represent those of CF40 or other organizations.