Abstract: The booming digital economy is fundamentally different from the industrial economy, with a new paradigm. As a result, the halo effect has emerged with traditional theories, and their explanatory and predictive power have abated. The basic assertion that maximization of economic value is the ultimate pursuit of a liberal market economy is also being challenged. In other words, there has been a certain extent of deviation of traditional theories from current economic realities. As China introduces new development strategies such as dual circulation, the market should conduct in-depth analysis of these moves and explore new investment opportunities while paying attention not to go against the policy direction. In addition, investors need to closely follow emerging trends and means of investment amid the digital economy boom.

The Chinese economy is in constant changes. With new information and events popping up at all times, we need in-depth research and candid exchange when trying to depict the future trend of investment in China.

I. DEVIATION OF TRADITIONAL THEORIES FROM ECONOMIC REALITIES

Amid the current digital economy boom, there has been deviation to a certain extent of traditional economic theories from economic realities.

Traditional theories were absolutely applicable to the time when they were proposed; otherwise they would never have become classics. However, the economy today has evolved to the point that they no longer totally fit.

This can be seen mainly in four dimensions. First, the digital economy differs fundamentally from the traditional industrial economy, with a new paradigm and covering a new scope. Second, the “halo effect” has emerged with the traditional theories, as many of them can no longer meet empirical statistics. Third, the theoretical explanatory power and practical predictive power of empirical rules have significantly abated. Fourth, the fundamental theory on liberal market economy is being challenged.

To be specific, first, the digital economy is booming. Its share in China’s national economy has been on a continuous upward ride in recent years, and it is profoundly reshaping the three main sectors of agriculture, industry and services, pushing the industrial economy toward digitalization in big strides. While still at a quantitative accumulation stage, it will eventually bring fundamental changes and a new economic paradigm.

Figure 1: The digital economy is fundamentally different from the industrial economy with a new paradigm

Second, the halo effect has emerged with classical theories given the changes in economic realities. The birth of any theory must be put in the context of its time based on corresponding historical data. However, the economic conditions, statistics, assumptions or even the essence and structure of the economy now are all different from before, and as a result, many theories cannot totally fit in today’s world any longer. Such deviation will gradually reveal itself across various aspects.

Besides, the halo effect is not specific to traditional theories. New classical theories are just as vulnerable.

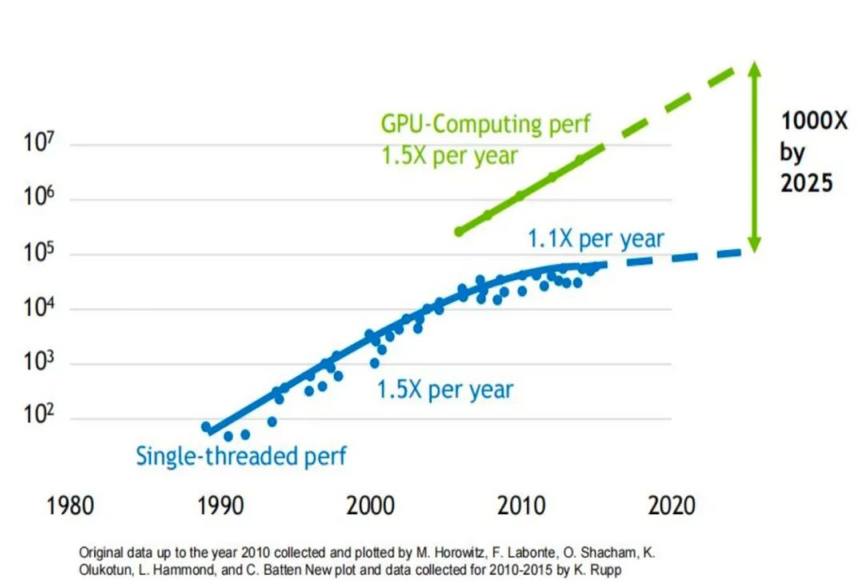

Take the Moore’s Law for example. Calculation following this law concludes that the number of transistors integrated on each unit area of chips doubles every 18 months; in other words, the processing speed of chips is expected increase to 1.5 times that in the previous year.

However, statistics in recent years have indicated that the growth of processing speed has slowed down, reducing the rate from 1.5 times to 1.1 times. That means the Moore’s Law has failed within certain range.

Then, can we take the slowed growth in the theoretical performance of chips as a sign of slowdown in technological innovation? No. On the contrary, innovation is still picking up pace among graphics chip developers.

So, even a young theory like the Moore’s Law could be challenged by the constantly changing landscape in AI, big data and cloud computing, among other emerging fields. Similarly, the Metcalfe’s Law is also experiencing constant revision, with the original “n2” replaced by “n * log n” to estimate network value. The same applies to William H. Davidow’s theory.

Figure 2: GPU / CPU performance improvement curves

Source: Nvidia

To quote a famous line from Johann Wolfgang von Goethe, “Grau, teurer Freund, ist alle Theorie und grün des Lebens goldner Baum.”

All assumptions and conclusions of classic theories need to be creatively renewed to accommodate new realities. This will help extend the boundary of innovation as an important engine driving economic growth. As regards empirical laws, it’s particularly important that the inheritance of methodologies and the renewal of conclusions go hand in hand.

Third, in the economic sphere, the theoretical explanatory power and practical predictive power of empirical laws have significantly abated, which is especially evident with Okun’s Law and the Phillips curve.

Okun’s Law indicates that rise in the unemployment rate will be accompanied by fall in real GDP, with an equation illustrating the correlation between the two. But in fact, empirical data over the past decade just does not support this equation. This is no ground for asserting that the Law is wrong, though, because logically speaking, unemployment rate and GDP are negatively correlated.

But it’s safe to say that the equation is no longer valid, as the quantitative relationship between the two has remarkably changed.

The same is true with the Phillips curve. The original Phillips curve was meant to explain the relationship between unemployment rate and inflation, which, however, has become quite unstable today. In the current economic circumstances, there has not been a stable negative correlation between the two variables. This was already the case before COVID-19 broke out, and has only become more so after that.

This means that the explanatory power and the predictive power of classical theories and laws have both declined significantly. However, personally, I believe that economic theories can be seen as having already well served their roles when they can explain current situations and offer relatively clear clues as to the future. It’s just too difficult to tell the future.

Figure 3: Relationship among the unemployment rate, GDP and inflation is no longer stable

Source: Trading economics

The explanatory power of the Malthusian Trap theory is also fading.

According to this theory, when productivity growth can no longer serve the need of a ballooning population, we must act proactively to curb population growth to avoid famines, wars, and other disasters. However, if we look at the curves since 1961, it’s clear that food production has surged while population growth has winded its way down. In other words, as time goes by, the trap has already been addressed as a matter of course.

In addition, we have noted that people focus on different aspects of labor at different times. Back in Malthus’ time, more emphasis was placed on the “mouth” of laborers, namely how many resources they consume; entering the second half of the industrial economy era, more attention was paid to their “hands”, or the value they created; while in the era of digital economy, we set store by their “brains”, or their technological innovation. The Malthusian Trap has been resolved as technology advances and people become less willing to have children. This is another proof of the decline in the explanatory and predictive power of empirical laws.

Figure 4: Changes in global population growth and food production (1961-2018)

Source: United Nations

Finally, Milton Friedman’s assertion that maximization of economic values is the ultimate goal in a liberal market economy is now being undermined.

Milton Friedman believed that maximizing economic values is the ultimate pursuit of all market entities, which obviously no longer applies today. Any market entity rests in certain social environments. If social forces challenge the excessive pursuit of market entities of economic values, it would lead to social instabilities that will in turn affect the economic entities and their sustainability. Thus, maximizing economic values is no longer the only goal. For example, at the 2019 Business Roundtable, 181 CEOs of major corporations signed “Purpose of a Corporation,” asserting that their business objectives include not only the dimension of economic values, but also ESG and social equity among others.

In one word, we need to adjust or even reset existing economic theories and try to charter some new courses for theoretical explorations which could underpin future development of new economy and digital economy.

II. SEIZING NEW INVESTMENT OPPORTUNITIES

Introduction of new policies usually forebode new investment opportunities. In recent years, China has rolled out many major policies behind which have been emerging investment opportunities.

1.Under the dual circulation paradigm, there are many potential long-term stable demands, rigid demands and new demands to explore in China.

Dual circulation is not a makeshift choice amid Covid-induced supply chain disruptions. Instead, it is an important, long-term national strategy for China to achieve high-quality growth based on its enormous economy.

Small economies do not have dual circulations because they do not have internal circulations. Few companies would design any major product specially for small economies with low populations, because their domestic markets cannot produce enough demand to cover the development costs. Dual circulation is based on the large scale of the Chinese economy.

Figure 5: Dual circulation

China takes the domestic circulation as the mainstay, and so going forward export will become less of an engine driving economic growth; instead, domestic demand will become the key to high-quality economic development. Consumption growth is the mirror of demand. Higher demand indicates higher consumption, and as a result of more spending, the economy will go through structural adjustments.

Figure 6: Share of total import and export in GDP (%, 2000-2020)

Source: Wind

Figure 7: Export, consumption and investment as a share of GDP in China (%, 2000-2020)

Sources: NBS; Wind

Domestic demand is the ultimate goal of supply-side structural reform.

The reform is necessary because of the imbalances and inadequacies in supply and demand, and it is precisely demand that decides the economic momentum, speed of growth and quality. Without a refreshed demand there can be no economic restructuring, let alone quality development. The United States has done a remarkable job in this regard, with consumption accounting for over 70% of its GDP. Supply creates demand and demand pulls supply. Demand plays an important role in the contradictory relationship between supply and demand.

Therefore, we should be determined to boost consumption in the rollout of supply-side reform, even if it would take generations of efforts and trials.

In the dual circulation, there are a few areas of investment worth noticing.

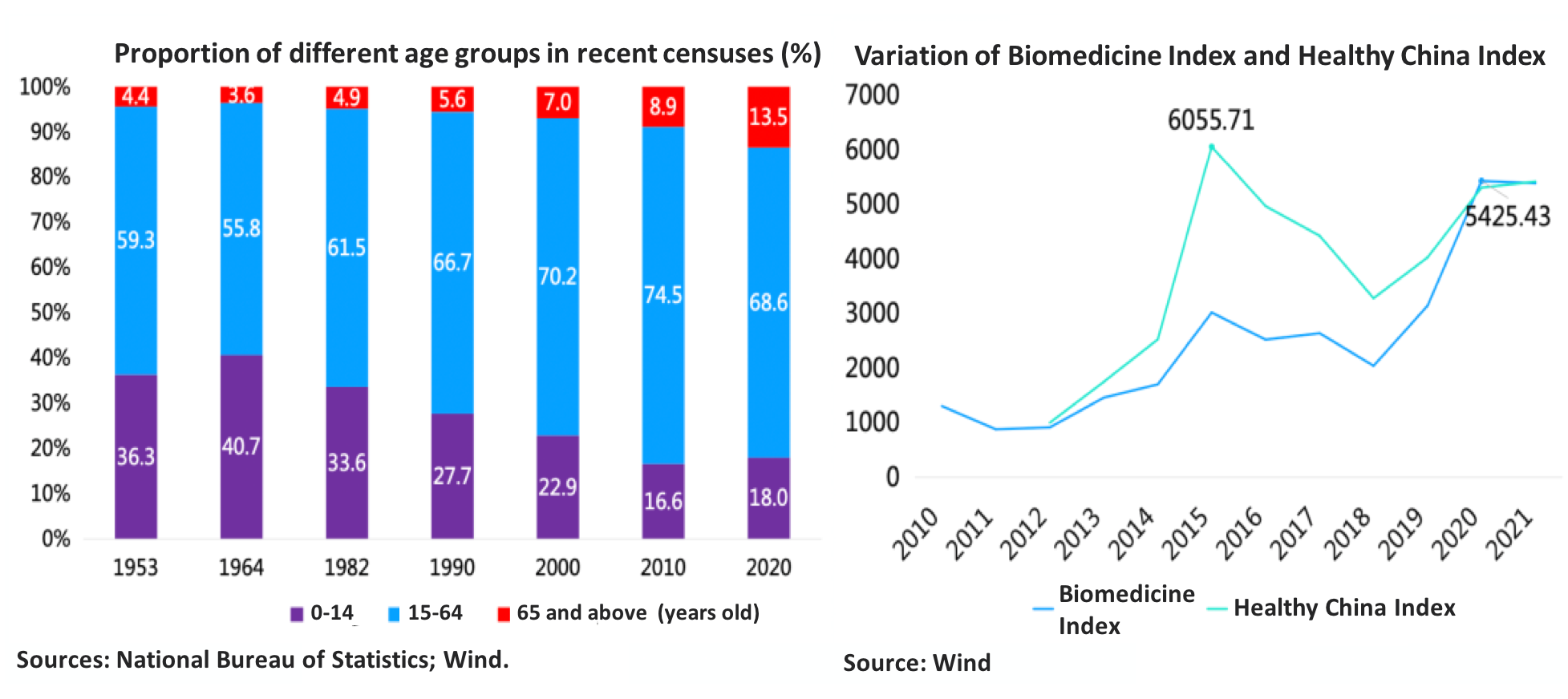

The first choice would be those with long-term stable demand. We may consider investing in biopharmaceutical or health companies or listed ones that target their products and markets to long-term stable demand. Of course, valuation and price need to be considered on top of this, which determines better returns.

Figure 8: Long-term stable demand brings continuous investment opportunities (in the case of biomedicine and healthy China)

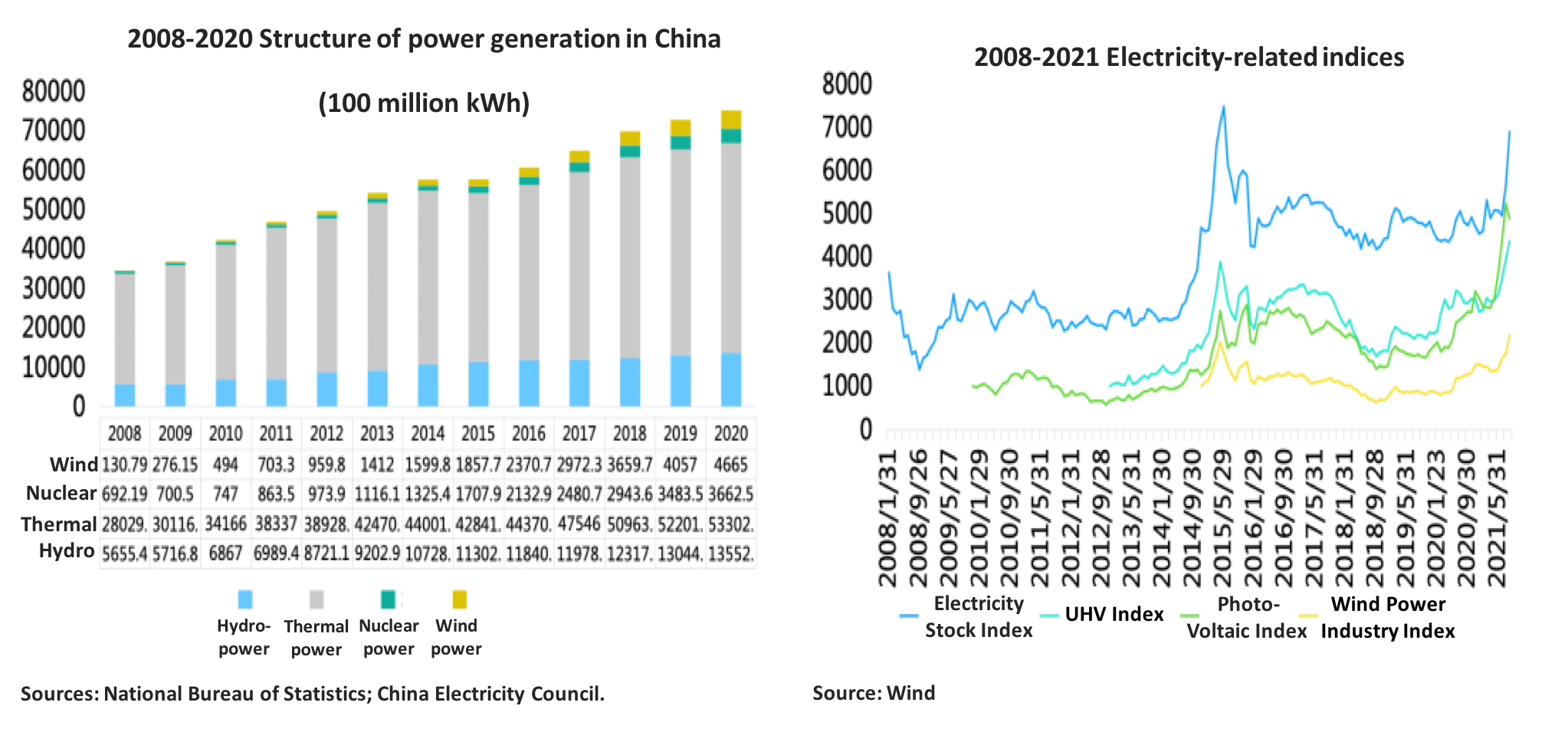

Then, inelastic demand. In allocating a portfolio, you need to consider the defensive part that inevitably comes from inelastic demand instead of the elastic. Being elastic means that it can be easily replaced by new demands or new products, so you should be wary of such investment. For example, the electricity demand is inelastic, and the government "pulled the plug" just because the demand could not be met and could only be reduced by coercive means.

Figure 9: Inelastic demand brings defensive investment opportunities (in the case of the electricity industry)

Finally, there are new demands. New demands are highly related to people's habits, their lifestyles, and how they see the future. There won’t be any demand without changes in lifestyles and social demands. However, once there are, and the new demands manage to fulfil the pursuit of human nature, then they must be good demands and must lead to high investment returns. In the aftermath of the pandemic, for example, the demand for all types of home office systems, platforms and network equipment is growing, bringing tremendous investment value.

Figure 10: China in the global economic circulation (2006-2019)

2. Investment opportunities from the green economy under the “30/60” goal.

The "30/60" target is a solemn commitment made by President Xi in September 2020 to build a global community of shared future, so the target-related industries are worthy of attention.

In reality, however, the timeline for achieving carbon neutrality varies among nations. Some countries have already achieved carbon neutrality, such as Bhutan and Suriname, but have small global economic influence; some have legislated for this target; others only take a policy pledge, a soft binding without any practice.

All in all, the green economy under the “30/60” target is worthy of attention, but the uneven distribution and development of the green economy in China also requires extra attention.

Figure 11: Uneven green GDP growth in China

3. Investment opportunities brought by disintermediation and coal removal despite increased cost constraints for high-quality economic transformation.

Financial disintermediation has largely been a destined trend, while the real economy faces the challenge of transforming to renewable energy and clean energy. The investment opportunities, especially the mismatched ones, emerging from these two highly overlapping processes, will be very surprising.

Figure 12: China energy investment (categorized by energy types) under BRI (2013-2021H1)

4. New opportunities in the third distribution.

4. New opportunities in the third distribution.

The third distribution is highly compatible: the more uneven the primary and secondary distribution, the greater the potential for the third distribution, and vice versa. The future of the so-called “Globalization 2.0” will certainly see a transition from a focus on production to a balance between production and distribution.

5. Investment opportunities related to common prosperity and people's livelihoods under the childbirth boosting policy and the so-called "double reduction" policy.

When I was at CIC, I dismissed a large investment project in an education and training institution. The logic is that it would eventually be recognized that it was highly inappropriate to implement education-related reforms through an integrated, spillover-rich private platform. The industrialization of education should be approached with great caution, as education is a public good, and the public good is hard to be completely industrialized. The two policies will have an impact on the common prosperity and livelihoods in China but also generate greater investment opportunities.

6. Investment risks that should be avoided amid regulations on platform economy.

Back in the industrial economy, monopoly issues were mostly related to institutions, but nowadays they were more about platforms and ecologies. To solve the problem of platforms is essential to solving the problem of ecology, that is, how to effectively control the platform ecosystem to prevent it from forming a monopoly; it used to be an institutional monopoly, but today it is an ecological monopoly.

From another perspective, anti-monopoly used to be about price, but now it is about comprehensive rights and interests. Whereas monopolies used to be about high pricing, today's monopolies are about whether data is secure, whether rights are guaranteed, and whether a good experience can be provided. Further, whereas monopolies used to affect more the rights of consumers, now they are about the rights of users. In other words, the concept of a consumer can no longer be used to refer to the user of a product in the digital economy.

In addition, the subject matter of monopolistic behavior is different from before. Whereas before it was products, now it is information data and digital rights; whereas before it was based on law, now it is based on law, digital taxes, taxation agreements and big data technology, etc. This also relates to a paradox about data, namely that data that exists on an individual basis is worthless, data that is developed secondarily is slightly valuable, data that is developed in depth is more valuable, and integrated big data is most valuable. Therefore, users cannot just keep data in their own hands and simply emphasize ownership of data. Data must be shared to generate value, but in the process of sharing, it is more important to keep the underlying data private and protect privacy well.

III. NEW INVESTMENT TRENDS IN THE DIGITAL ECONOMY

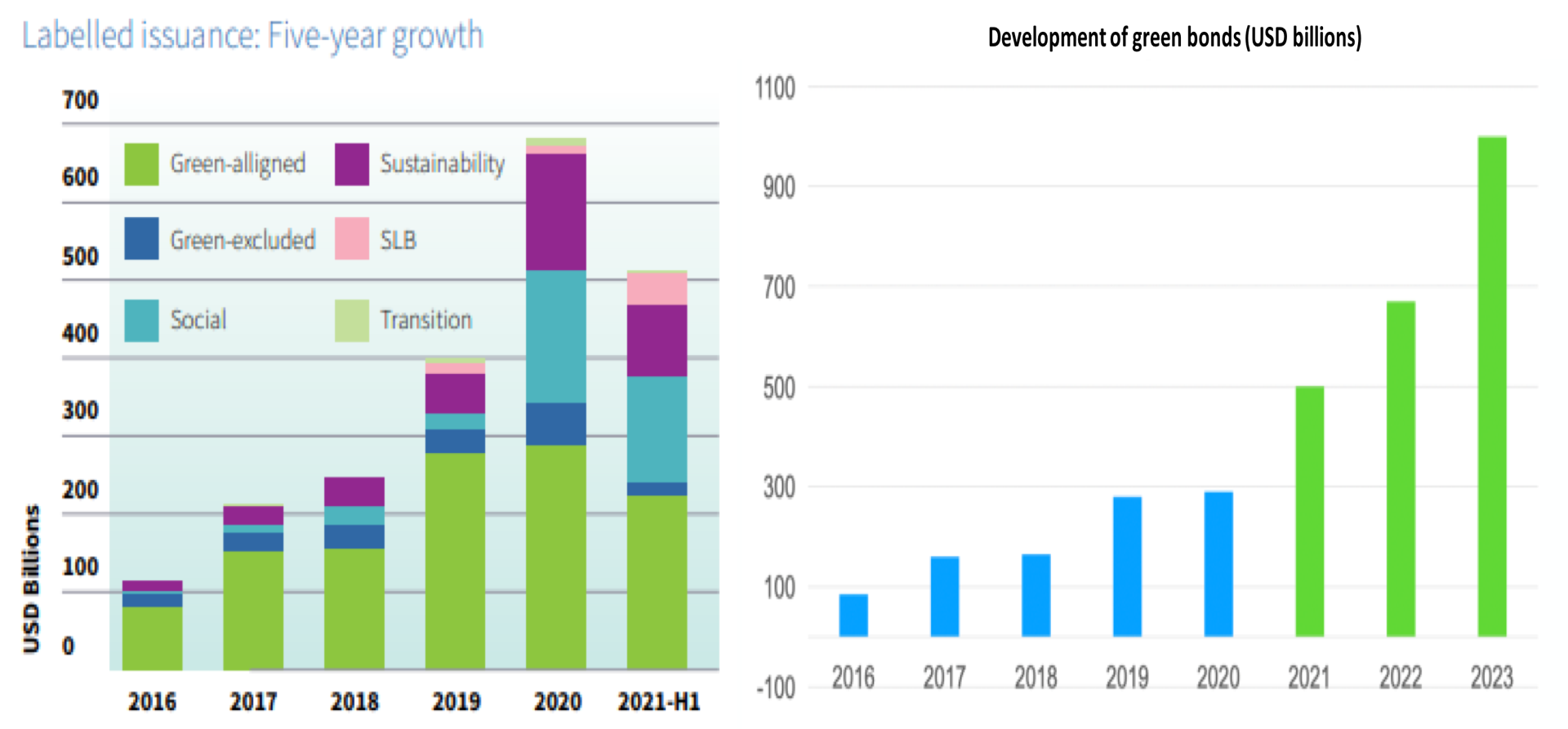

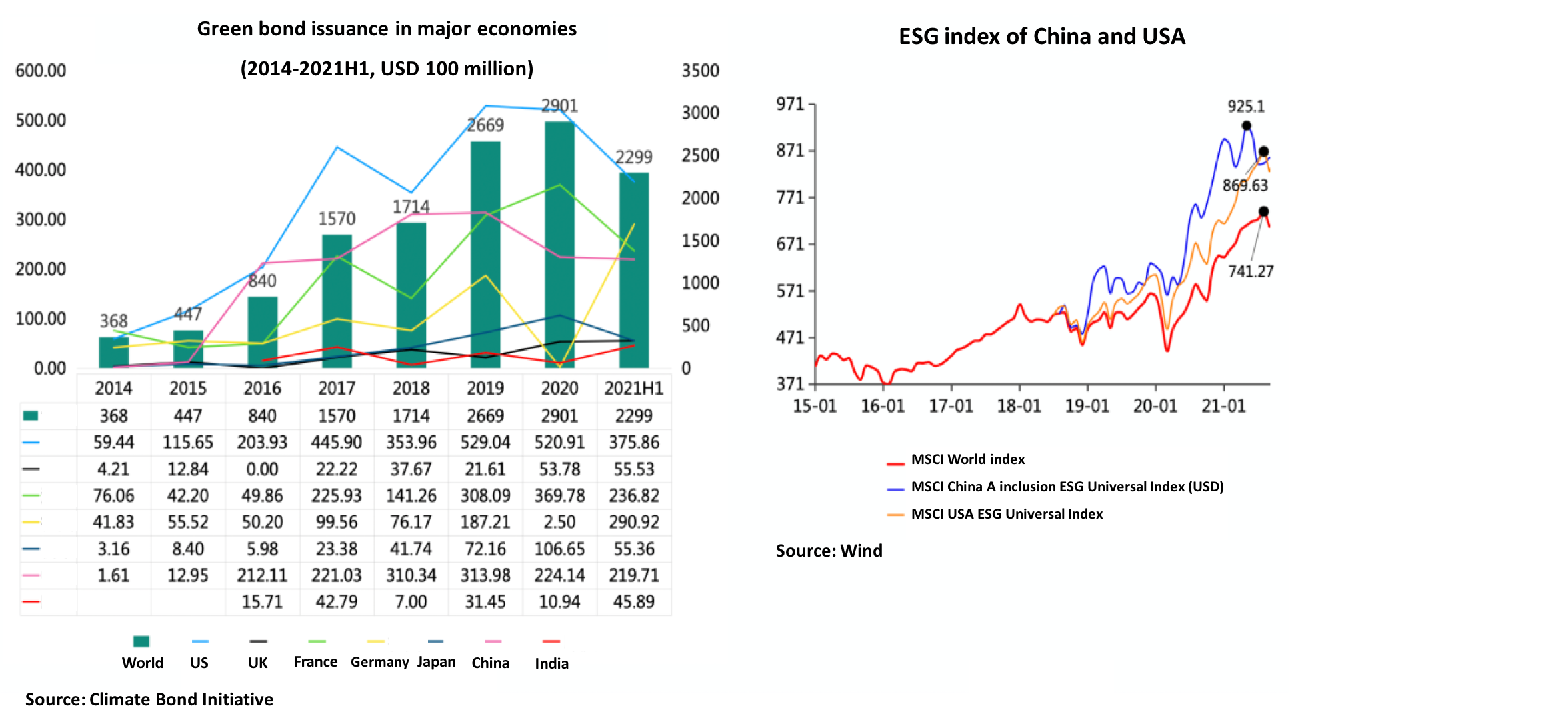

Climate change has made ESG investment a must-answer question that needs to be reiterated and invested in.

Empirical data has shown that ESG investment can deliver positive returns, in which regard Europe and the US have been effective. As a result, 75% of global respondents acknowledge the importance of ESG investment and indicate that they will incorporate ESG into their investment practices. China should also step up investment in this area.

Figure 13: Green development, ESG and other sustainability-themed investments are growing.

Source: Climate Bond Initiative, 2021.

In addition, there are emerging means of investment that are worthy of attention.

One is SPAC investment. It is a new form of fundraising, a reverse listing, similar to shell listing, but with a higher market-based degree. Although regulations on SPACs have now been tightened, the platform is still playing an irreplaceable role.

The second is the Direct Listing investment. It skips the intermediary securities firm and removes the position of a financial adviser, placing existing shares directly on the market. Instead of raising new capital, this approach makes the otherwise illiquid shares liquid and tradable. The rise of such investment methods will further reduce the intermediary role of financial institutions.

Third, through their ecology, tech giants could function as a capital market. Some tech giants could act like stock exchanges, absorbing upstream and downstream technologies and integrating them in their ecosystems. In this way, small tech companies no longer need to go public for funds; they can be acquired if they are seen by these tech giants who will not allow competitions from the upstream and downstream companies – it is "buy or bury".

There are other worth-noting investment options such as meme stocks on Robinhood.

This is the speech made by the author at the closed-door Wanliutang Asset Management Roundtable themed “Changing Landscape of Global Asset Management: New Trends, New Thinking and New Planning” at the 3rd Bund Summit on Oct 24. The views expressed herein are the author’s own and do not represent those of CF40 or other organizations.