Abstract: In this paper, the author attempts to explain the current impressive growth of exports by breaking down the growth rate of export value into price effect and quantity effect. The author concludes that the rapid growth of exports since July can be attributed to the factor of price to a considerable degree, which mainly comes from higher cost instead of higher price due to stronger demand.

Since May, 2021, PMI for new export orders and total export value have obviously diverged, with PMI for new export orders declining but growth of export value remaining resilient. This divergence confuses the market.

The author has conducted several interviews with some export companies in the Yangtze River Delta and Pearl River Delta. They reported that “the recent months are tough”, which is quite different from the situation in the second half of last year.

Macro-level index and micro-level feeling have diverged markedly.

This leads us to ask whether export is performing well or not. If the answer is yes, then why PMI for new export orders and the sense of gain of export companies are falling? If the answer is no, then why export growth remains so high?

I. TWO BASIC FACTORS OF EXPORT EXPANSION: QUANTITY AND PRICE

The expansion of export value can be explained by two factors: quantity and price, i.e., larger volume or higher price or both.

When the demand is high, quantity and price will both rise.

But when the demand is low, if production cost is high enough, price will not be beaten down, which can logically sustain the growth of export value. Or when the demand remains stable, if the price hikes due to some causes, change of price itself will lead to increase of export value.

What’s the point in distinguishing between quantity and price?

For manufacturing sector, cash flows are the most important while profits are secondary. To ensure the stability of cash flows, the key lies in scale instead of unit price.

Consider the case where increase of production cost raises the export price, which leads to expansion of export value.

In this case, on the micro level, companies’ cash flows are not essentially improved since the production scale reflected by orders does not change; meanwhile, their profits might be reduced as increase of production cost does not necessarily add on to the price of end products. When this happens, expansion of export contrasts with the actual feeling of companies, which means export expansion does not improve the operation of export companies.

Next, this paper will follow the previous logic by breaking down the YoY growth rate of export value into price effect and quantity effect in order to understand the current state of exports.

II. INTRODUCTION OF THE BREAKDOWN LOGIC

In breaking down the growth of export into quantity and price, the high heterogeneity among goods makes it difficult to find a unified indicator to measure the quantity of export. Therefore, this paper adopts a “bottom-up” method by starting with a breakdown of a single category of product and then a non-residual breakdown of the overall growth rate of export.

First, for a single product, given the known average unit price of exported goods, the growth rate of export value can be split into three parts presented in the following equation:

Growth rate of export value = a. growth rate of export volume + b. YoY growth rate of export unit price + c. growth rate of export volume * YoY growth rate of export unit price

The first part reflects the quantity effect, the second part price effect, and the third part the combined effect of quantity and price. Under normal circumstances, the last part is an order of magnitude smaller, making it negligible in principle. But when there is major adjustment of quantity and price, the last part becomes important, making it necessary to distinguish whether the effect comes from changes in price or quantity.

Then, a non-residual breakdown of the growth rate of export value can be realized by multiplying the proportion of N products’ last-year export value in the overall export value by the value effect, price effect, and combined effect respectively.

Take steel as an example. In August 2021, the export volume of steel was 5.05 million tons, with a YoY increase of 37.2%. The export value was 7.29 billion US dollars, with a YoY increase of 119%. Then we use the data in August 2020 and 2021 to calculate the YoY growth rate of the unit price of steel, which is around 60%. This shows that at least 50% of the YoY growth of the export value of steel in August comes from rise in price while 30% from increase in volume. As both the quantity and price increase significantly, the combined effect can explain 15% of the expansion in export scale.

Furthermore, in August 2020, steel export accounted for 1.41% of the total export value, which is not large. But due to the high growth rate, steel export in August 2021 alone contributed to an increase of 1.68 percentage points in total export growth. Moreover, the price hike of steel alone raised the national export growth by 0.84 percentage point. If some of the combined effect is taken into account, then the price hike alone contributed to one percentage point of the 25-percentage-point rise in national export growth in August YoY, with a 4% explanatory power.

III. SOURCE OF DATA AND CALCULATION RESULTS

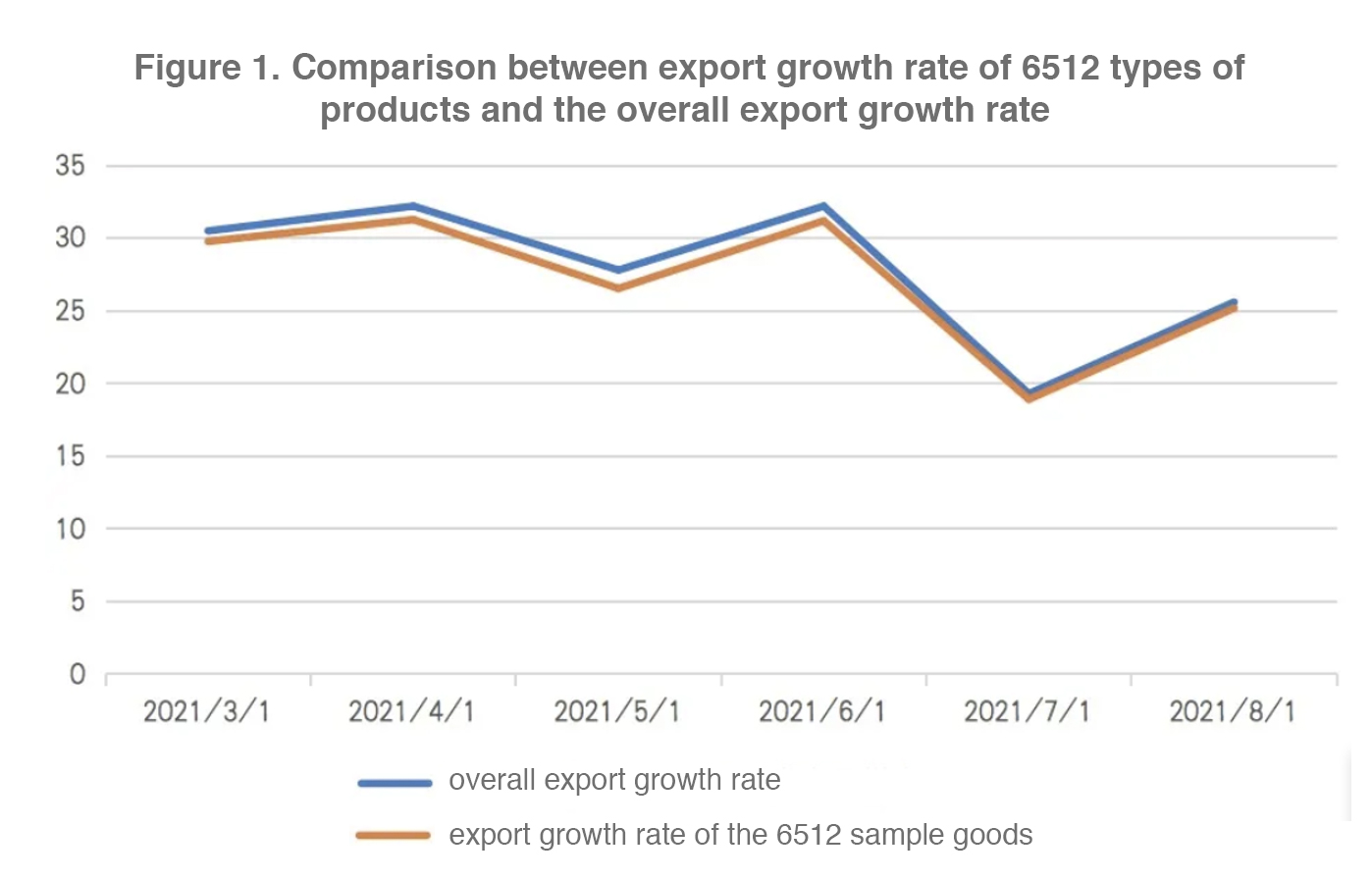

This paper’s data is based on the detailed statistics of the export products with eight-digit code released by the General Administration of Customs (mainly including the export value and volume of each type of goods) while excluding a few with missing data. In the end, 6512 types of products are selected. The export value of these products accounts for over 98% of the total, and as shown in Figure 1, the discrepancy between the growth rate of export of these products and the actual overall export growth rate is very small.

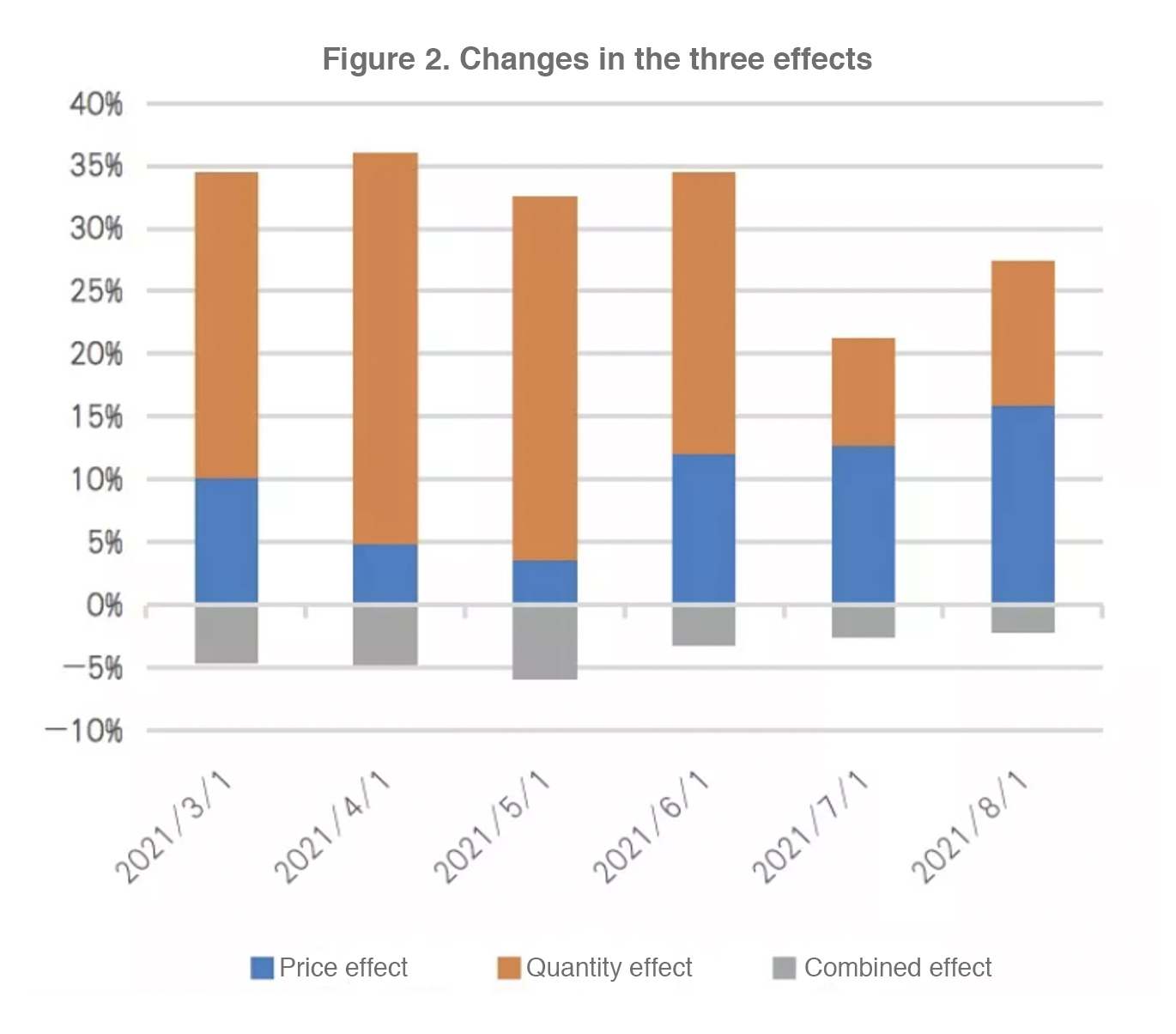

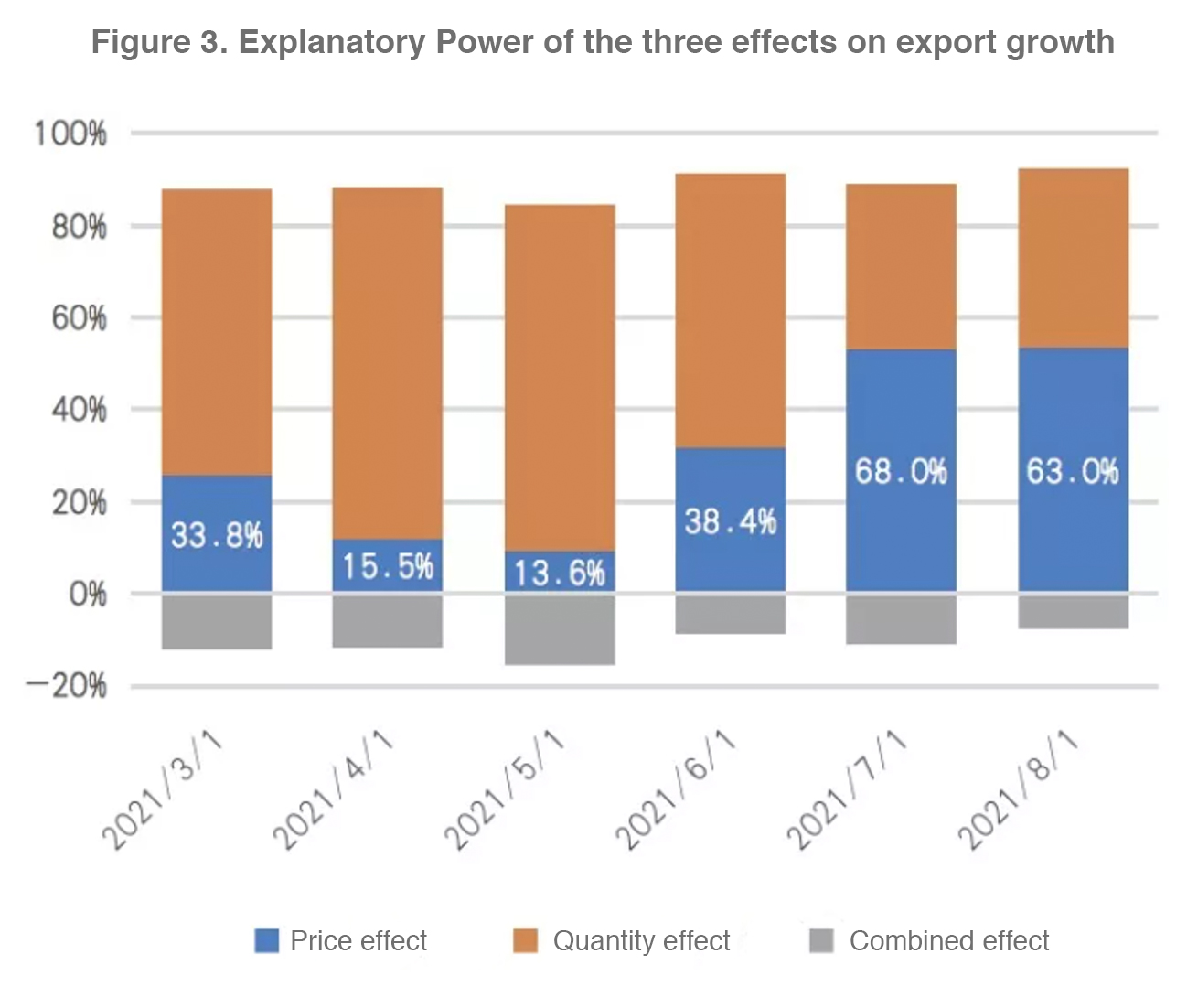

Based on the aforementioned breakdown method, the export growth rate of the 6512 sample products in March 2021 is also split into three parts and the results are presented in Figure 2 and 3.

As the figures show, since March 2021, price effect is gradually increasing with a significant rise in July and August, while quantity effect changes in the opposite way.

It is estimated that 15 percentage points of the 25 percent export growth in August actually come from rise in price. From the perspective of explanatory power for the growth rate (effect/actual growth rate), the explanatory power of price effect increased abruptly in July and surpassed 60% in July and August.

IV. CONCLUSION

The calculations above demonstrate that the turning point of export scale might have already occurred in June, only to be masked by the factor of price. The quantity effect is declining rapidly after June, indicating that the price effect does not come from strong demand but from rapid increase of cost. This is consistent with the price hike of upstream products since early this year.

Despite rising price of upstream products, profits do not turn for the better since the quantity does not increase. As the example mentioned above, with such a large rise of steel price, the growth rate of profits YoY in the sector in July was only 10%, meaning that a large part of the price hike comes from higher cost. Given that steel still belongs to the midstream sector, downstream sector might face a much severe situation.

In addition to increase of production cost, shipping cost might also play an important role. Whether the shipping cost is shown in the export value depends on foreign importers’ choice in finding their own shipping agent or paying the money directly to the domestic exporters. It is not known how much shipping cost can be reflected in the export value. But even if it only accounts for 2% of the export value (which might be significantly lower than the actual proportion), its pulling effect on the growth of total export value is considerable since the shipping cost has increased by 2 to 3 times YoY. After all, such an unusual spike in shipping cost this year has not been seen in the last decade.

In summary, the impressive growth of export since July can be attributed to the factor of price to a considerable degree, some of which mainly comes from higher cost instead of higher price due to stronger demand. Furthermore, part of the increased cost comes from rising production cost while part of it comes from rising shipping cost, both of which are closely related to the respective supply disruptions and again are not factors that can be explained from the demand side.