Abstract: In this paper, the authors systematically analyzed the evolving meanings of common prosperity, paths to achieving it, design of goals, and implications for the economy and industries from both qualitative and quantitative perspectives.

Common prosperity has drawn much attention recently. On August 17, 2021, the Central Economic and Financial and Affairs Commission outlined the vision for common prosperity. Meanwhile, regulatory measures targeting the education, health care, and Internet sectors have been rolled out in rapid succession, which are thought to be part of China’s drive towards common prosperity. Against this background, this paper aims to systematically analyze the evolving meanings of common prosperity, paths to achieve it, design of goals, and its implications for the economy and industries from both qualitative and quantitative perspectives.

I. MEANINGS OF COMMON PROSPERITY: PERSPECTIVES BASED ON HISTORICAL EVOLVEMENT AND POLICY ORIENTATION

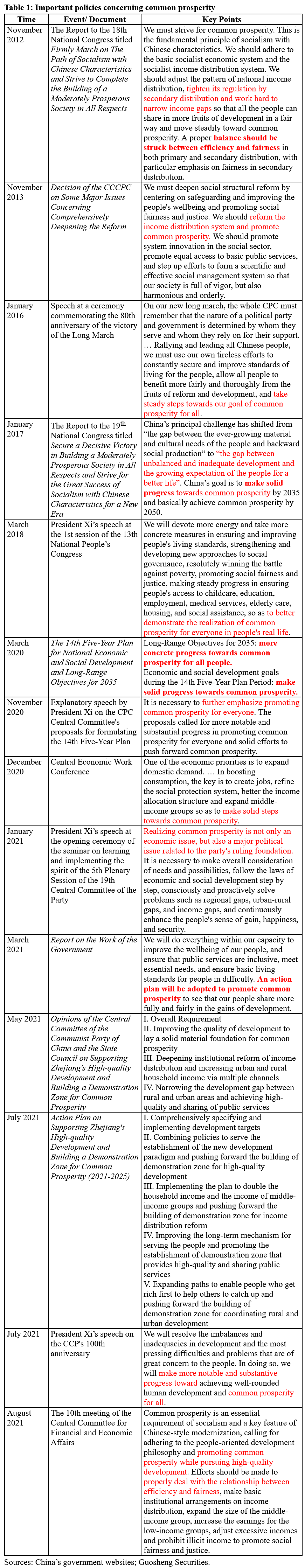

Common prosperity is China’s long-term objective. Since 2020, efforts have been stepped up in order to achieve it 10 years ahead of schedule. As the timeline (Figure 1) shows, common prosperity was first put forward in 1953 when the People’s Republic of China was just founded. Then in 1992, Deng Xiaoping pointed out in a speech during his south China tour that “the essence of socialism is to liberate and develop productivity, eliminate exploitation and polarization, and ultimately to achieve common prosperity”. Afterwards, each Party Congress held every five years mentioned common prosperity: the 18th National Congress in 2012 clearly defined common prosperity as the fundamental principle of socialism; the 19th National Congress in 2017 marked the shift of principle challenges in China and put forward the goal to “achieve solid progress towards common prosperity” by 2035; the 5th Plenary Session of 19th CPC Central Committee in 2020 proposed to “achieve solid progress” by 2025 and “achieve more concrete progress” by 2035.

From a historical perspective, China tilted the balance in favor of efficiency or fairness at different stages. The current drive towards common prosperity emphasizes fairness and distribution.

? In the beginning of the reform and opening up, policies prioritized efficiency to improve productivity. The 6th Plenary Session of the 11th CPC Central Committee in 1981 pointed out that the main challenge of China’s society is “the gap between the ever-growing material and cultural needs of the people and backward social production”. In 1993, Decision on Several Issues Concerning the Establishment of a Socialist Market Economic System set the goal to “build an income distribution system that distributes income mainly according to labor contribution, prioritizes efficiency while improving equity”.

? Over the past decade, as the wealth gap widens, China’s policies has been increasingly tilting towards fairness. In 2005, the 5th Plenary Session of 16th CPC Central Committee for the first time pointed out that policies should “emphasize social equity and step up efforts on income distribution”; in 2007, the Report to the 17th National Congress pointed out that “primary distribution and redistribution should both balance efficiency and fairness while redistribution should focus more on fairness”; in 2012, the Report to the 18th National Congress proposed to “step up efforts on income redistribution and focus on solving the problem of large income gap”; in 2017, in the Report to the 19th National Congress, China’s focus is shifted from efficiency and growth to distribution, meaning that China’s principal challenge have shifted from “the gap between the ever-growing material and cultural needs of the people and backward social production” to “the gap between unbalanced and inadequate development and the growing expectation of the people for a better life”; on August 17, 2021, the meeting of the Central Committee for Financial and Economic Affairs put forward the goal to “promote common prosperity while pursuing high-quality development and properly handle the relation between efficiency and fairness”.

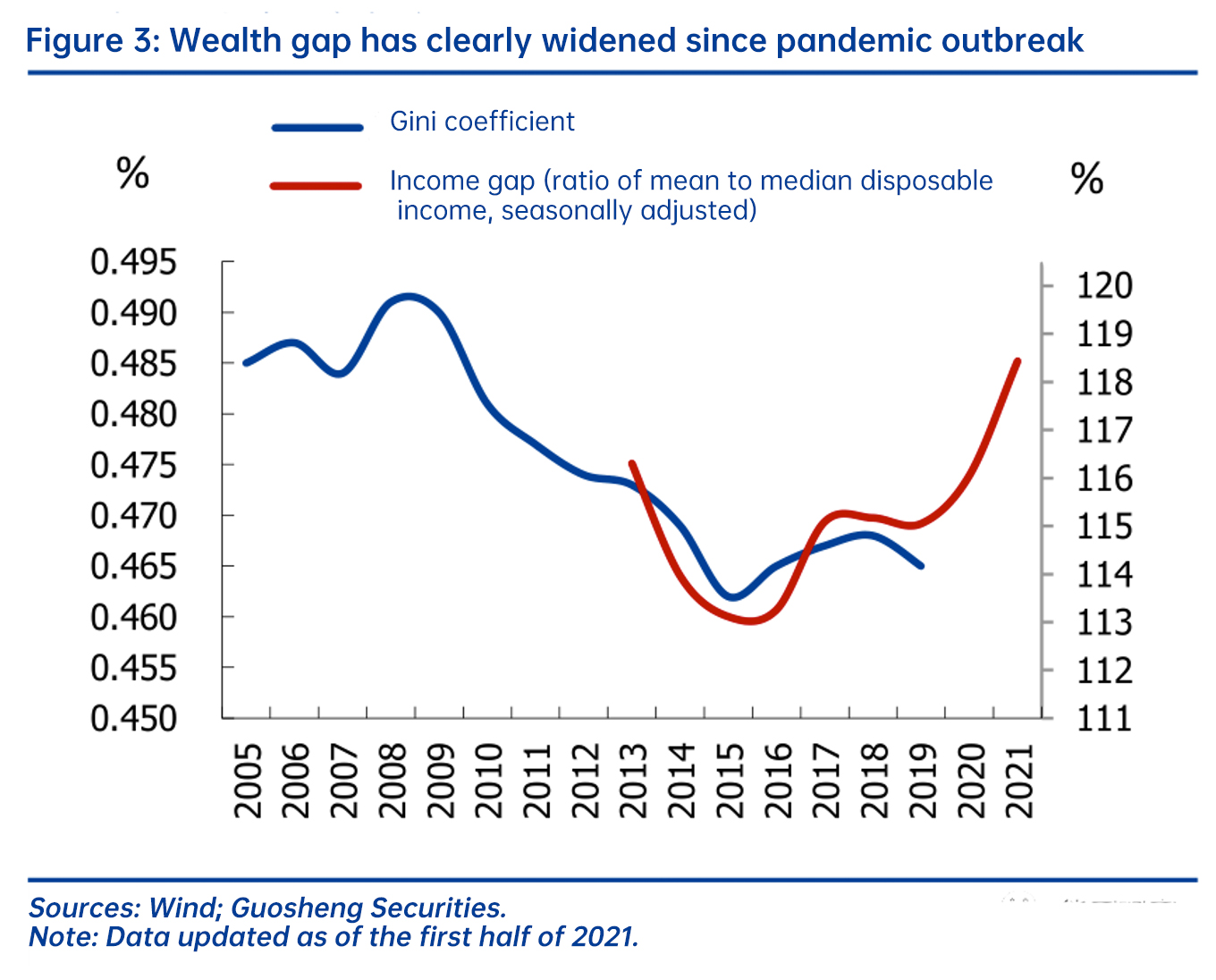

The focus of “common prosperity” is to address “three major gaps”, which have widened since the Covid-19 pandemic, leading to heightened drive towards common prosperity.

To realize common prosperity, the focus is to tackle “three major gaps”, i.e., income gap, regional gap and urban-rural gap. In January 2021, President Xi pointed out that “realizing common prosperity not only concerns economic issues but also main political issues related to the Party’s ruling foundation; we should actively tackle the regional, rural-urban and income gaps”; in May 2021, the guideline on supporting high-quality development of Zhejiang to build it into a demonstration zone of common prosperity released by the Communist Party of China Central Committee and the State Council reiterated that “the main policy should focus on addressing the regional, urban-rural and income gaps”.

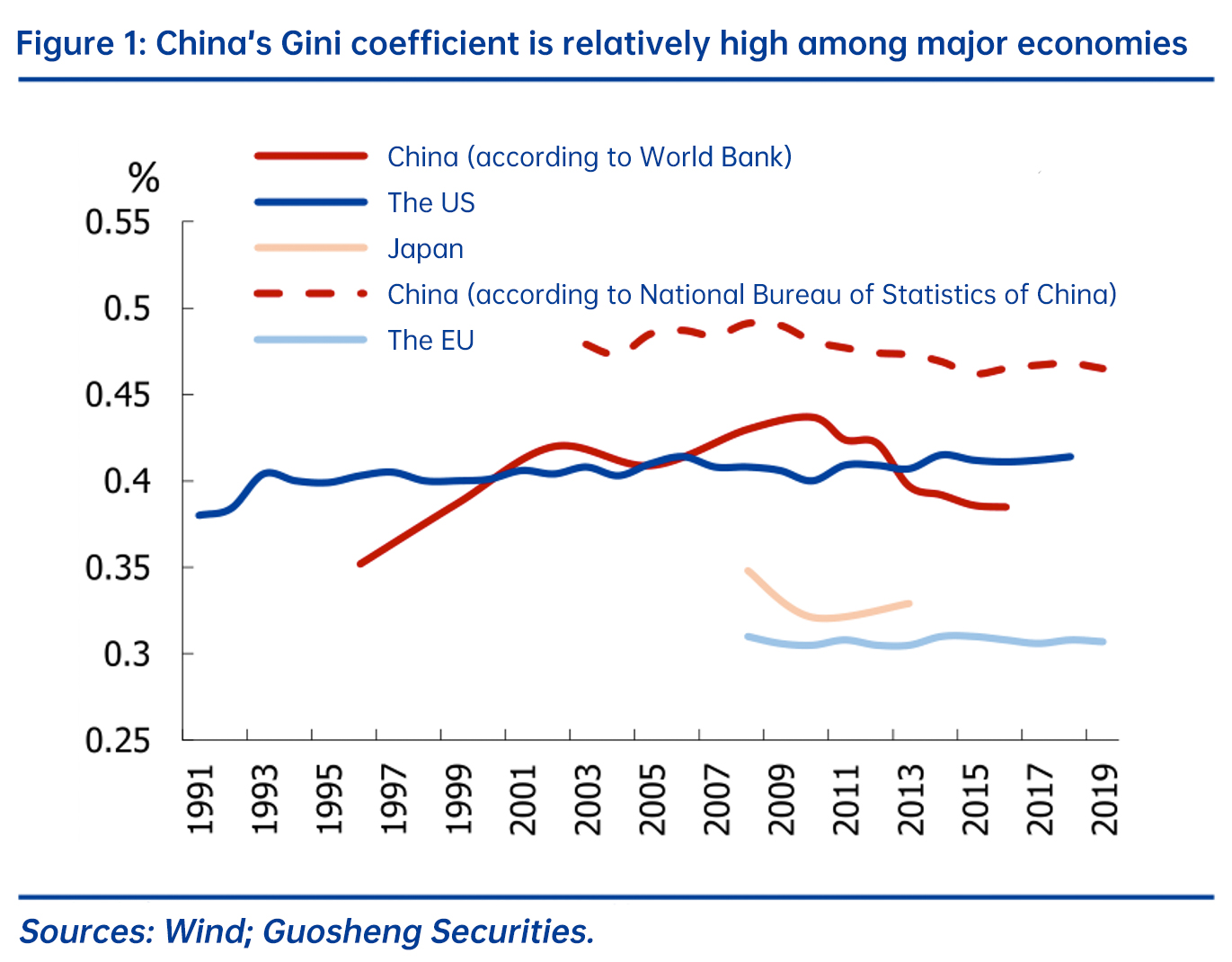

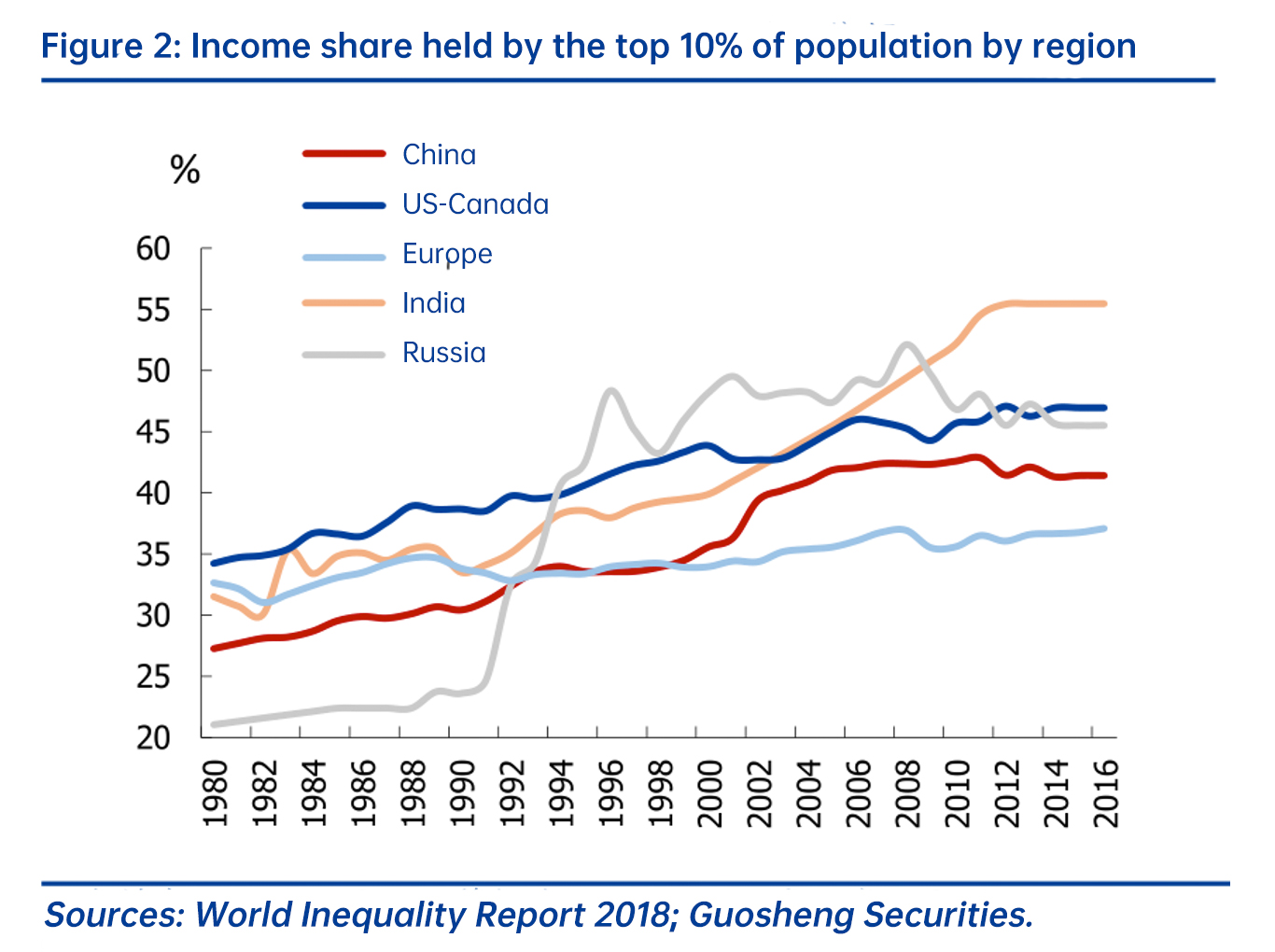

Since the reform and opening up, China’s wealth gap has significantly widened, larger than Europe and Japan while smaller than the US and India. After the reform and opening up, with the establishment of market economy, the income gap among Chinese residents has been growing rapidly. Although the expansion has slowed down in recent years, the gap is still quite large.

? From the perspective of the Gini coefficient, according to World Bank, China’s Gini coefficient rose from 0.32 in 1990 to a record high of 0.44 in 2010. Although it then started to fell, the number still stood at 0.39 in 2016, much higher than that of European countries and Japan, slightly lower than that of the US. If we refer to the data from the National Bureau of Statistics of China, China’s Gini coefficient was 0.47 in 2019, far higher than the level of the US, Europe, and Japan.

? In terms of income share held by the top 10% of population, the World Inequality Report 2018 found that from 1980 to 2016, China’s income share held by the highest 10% rose from 27% to 41%, an increase of 14 percentage points, close to the increase of the US (about 13 percentage points), much higher than that of Europe (around 4 percentage points), and lower than that of Russian and India (about 24 percentage points).

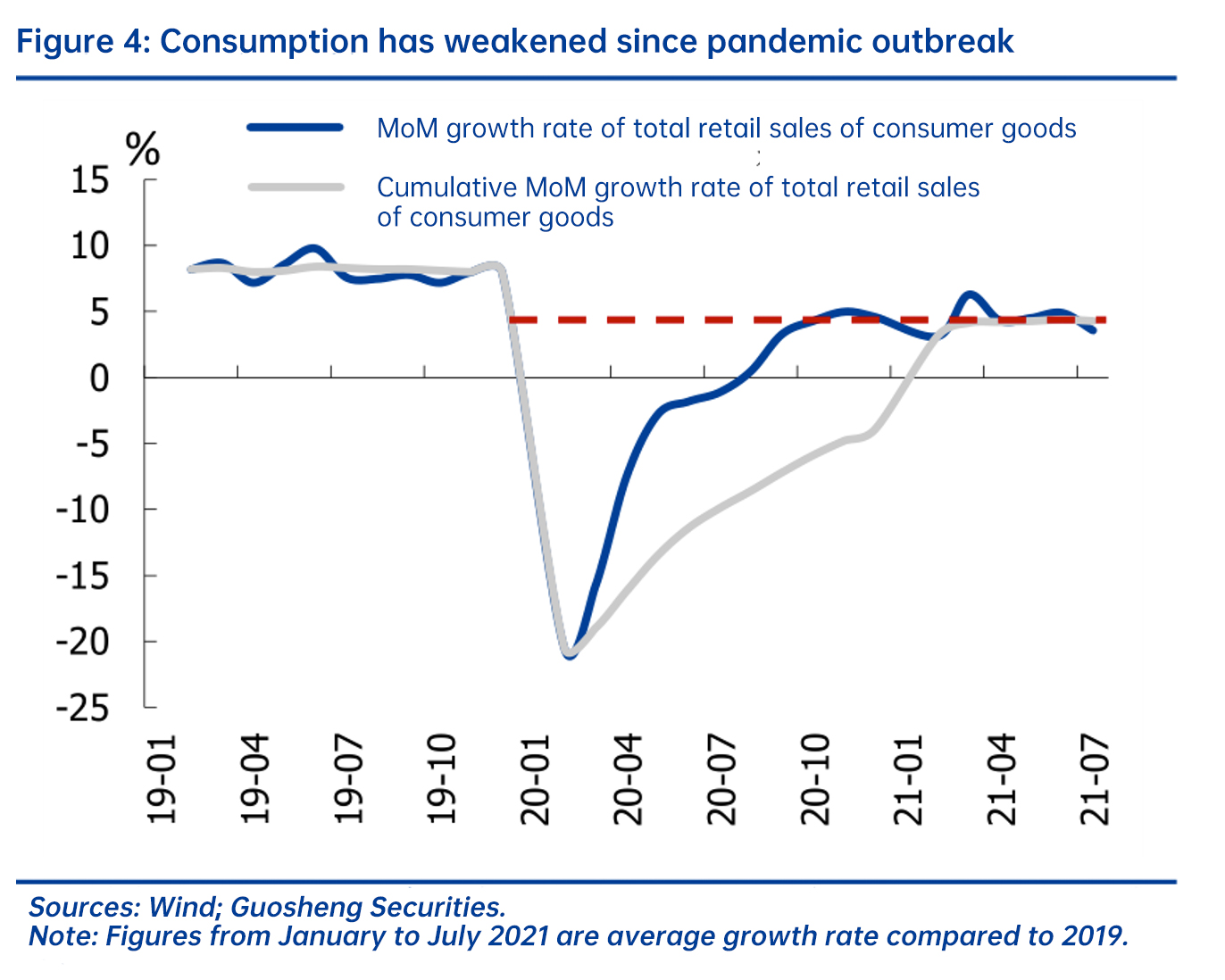

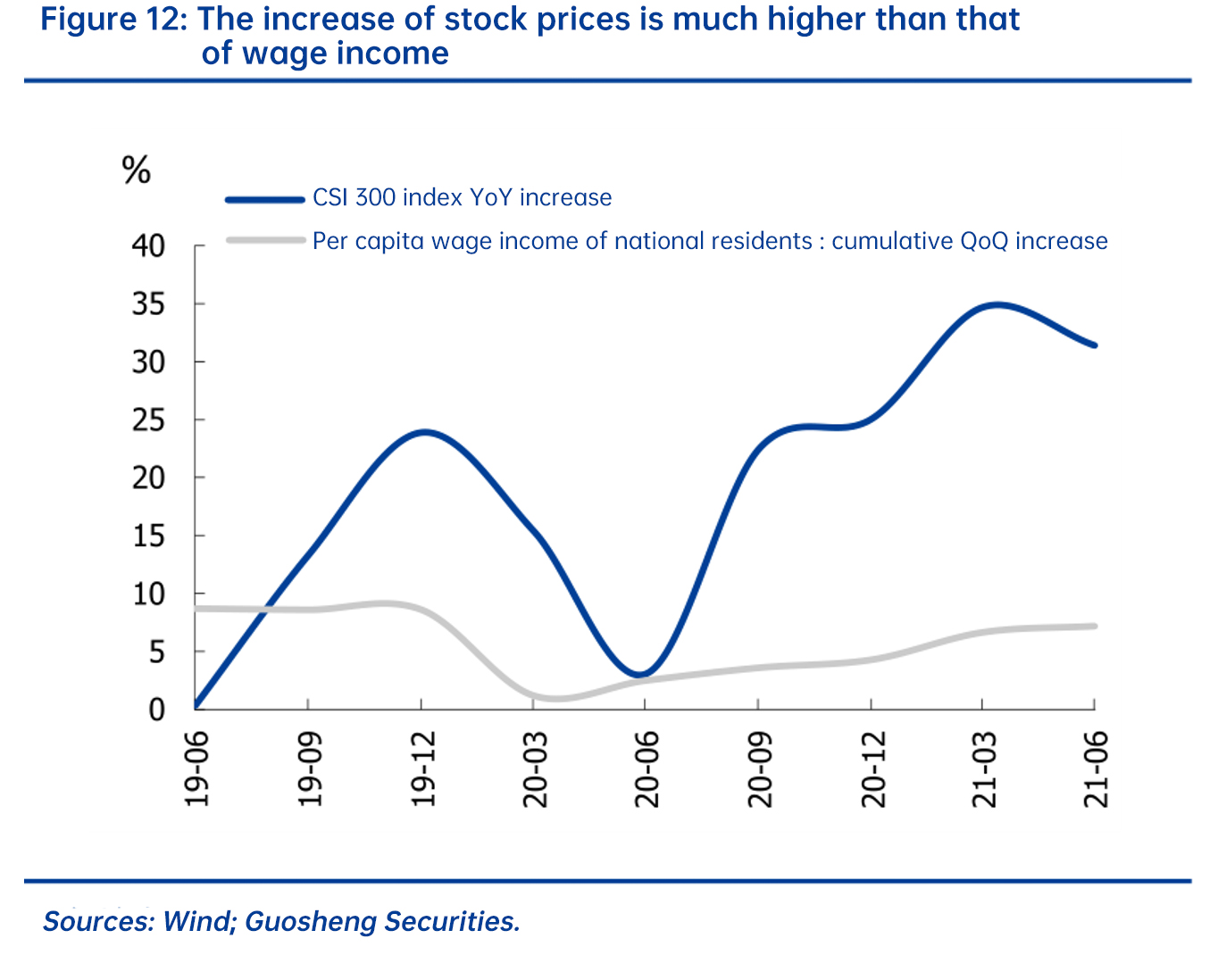

Since the pandemic, China’s wealth gap has been increasing more rapidly, which spurred the heightened pursuit of common prosperity. From the ratio of mean to median disposable income, the increasing wealth gap is also an important reason for the weakness of current consumption.

II. PATHS TO COMMON PROSPERITY: “MAKING A BIGGER PIE” AND MORE IMPORTANTLY “DISTRIBUTING THE PIE”

Common prosperity not only entails “making a bigger pie” (high quality development; efficiency”), but more importantly “distributing the pie” (third distribution; fairness).

As previously analyzed, China gives more weight to efficiency or fairness at different stages of development. At the current stage, policies tilt towards equity and income distribution (“distributing the pie”) under the theme of common prosperity. On the one hand, the meeting of the Central Committee for Financial and Economic Affairs on August 17 pointed out that “we should promote common prosperity in the process of high-quality development; we should encourage people to create wealth through hard work and innovation, and ensure and improve people’s livelihood in the process of development; we should allow a part of the population to get rich first and let them help others to become better off afterwards, with a focus on encouraging those who are hardworking, law abiding and willing to take risks to start a business to lead in wealth creation.” On the other hand, the meeting also stated that “we should properly deal with the relationship between efficiency and fairness, make basic institutional arrangements to coordinate primary distribution, redistribution, and third distribution”.

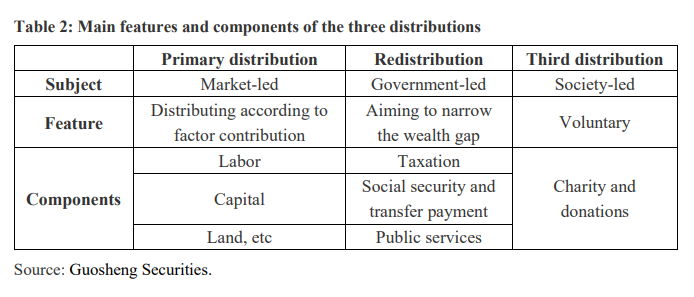

The key measures to achieve common prosperity are “primary distribution, redistribution, and third distribution”, which aim to close the “three major gaps”. The meeting of the Central Committee for Financial and Economic Affairs on August 17 put forward the plan to “establish basic institutional arrangements to coordinate “primary distribution, redistribution, and third distribution”, which was already mentioned earlier in the 5th Plenary Session of 19th CPC Central Committee and the article wrote by the Minister of Finance late last year. In this arrangement, primary distribution is led by the market based on contribution of production factors (like labor remuneration) and the principle of efficiency first. Redistribution is led by the government following the principle of stressing both fairness and efficiency with a tilt toward fairness. Main measures include taxation, expenditure on social security, etc. Third distribution is society-led and driven by moral forces to encourage voluntary donations and charity by the rich, which is a complement to redistribution.

Among the “three major gaps”, the income gap is more encompassing and has larger implication than the other two gaps. Measures to narrow the income gap can be mainly summarized as “increasing the income of low-income groups, expanding the proportion of middle-income groups, and adjusting excessively high incomes”, with “adjusting excessively high incomes” being a big challenge. Income gap is a common problem found between rural and urban areas as well as between different regions. To some extent, income gap can be the root cause of the rural-urban divide and regional disparity. The meeting of the Central Committee for Financial and Economic Affairs on August 17 outlined three main measures to close the income gap: increasing the income of low-income groups, expanding the proportion of middle-income groups, and rationally adjusting excessively high incomes. It is not hard to find that the first two measures are related to development while the third measure to promoting fairness, which is more difficult to achieve.

Based on past practice and the meeting on August 17, there are three ways to “adjust high incomes”: 1) Strengthening tax collection and administration, including “eliminating and regulating unreasonable income, restructuring income distribution and banning illicit income”. For example, tax evasion and grey income have been clamped down on in recent years. 2) Introduce new types of tax that target the rich, in particular, property tax, inheritance tax, and capital-gains tax. Property tax should be the priority since there are no laws about property tax and it is difficult to be fully implemented. But it is likely to be adopted in more pilot cities based on trials in Chongqing and Shanghai. 3) Guiding the third distribution by encouraging the rich to donate money. In 2019, the 4th Plenary Session of 19th CPC Central Committee mentioned that “third distribution should play an important role and social public services like charity should be promoted”. The meeting on August 17 encouraged high-income groups and enterprises to give back to society. Based on the guideline on building Zhejiang province into a demonstration zone for common prosperity, specific measures might include developing charity, expanding donation channels, setting up charitable trusts, and designing preferential tax policies regarding public welfare donations, and improving the reward system to incentivize charity.

Specifically, “primary distribution, redistribution, and third distribution” involve the following measures:

1. Primary distribution: The focus should be on reforming the factor market including labor, capital, and land. Key measures include sticking to the employment-first policy, improving the labor income share, stepping up reform of the hukou system, promoting new people-oriented urbanization, improving upward social mobility, breaking capital monopoly, and conducting land and fiscal reforms.

1) Labor

Hukou reform is expected to accelerate, aiming to promote new people-oriented urbanization and improve upward social mobility. The meeting on August 17 pointed out that “upward social mobility should be improved”. In April 2020, the guideline on improving the market-based allocation mechanism of production factors suggested that “Megacities shall be encouraged to adjust and improve the points-based household registration policy, and explorations shall be made into supporting the Yangtze River Delta, the Pearl River Delta, and other city clusters in taking the lead in intra-city mutual recognition of the accumulative number of years for household registration. A mechanism of allowing permanent urban residents to enjoy basic public services such as education, employment, business startups, and healthcare shall be established.” The guideline on achieving common prosperity in Zhejiang province also mentioned that “new people-oriented urbanization should be promoted” and introduced concrete action plans to achieve that.

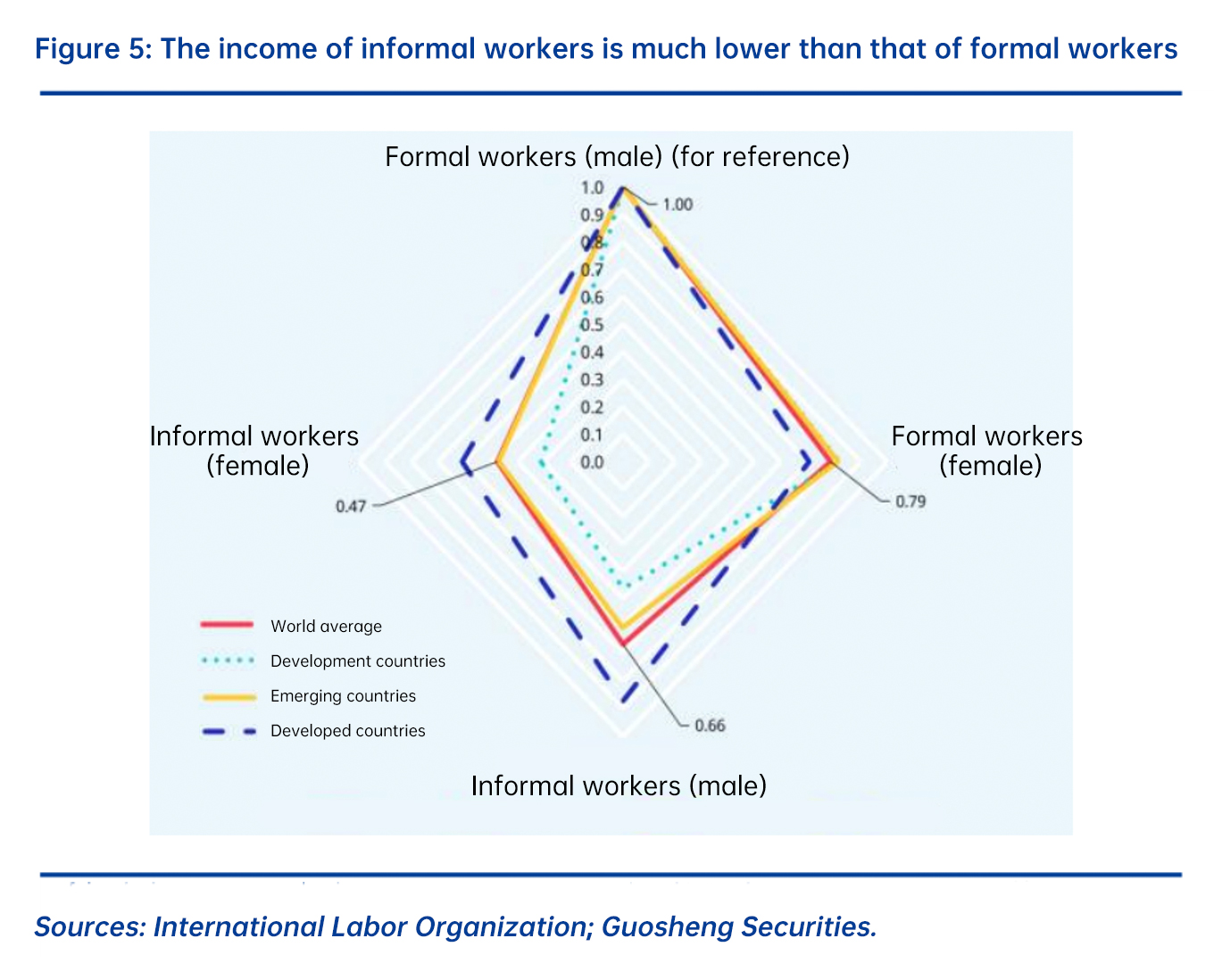

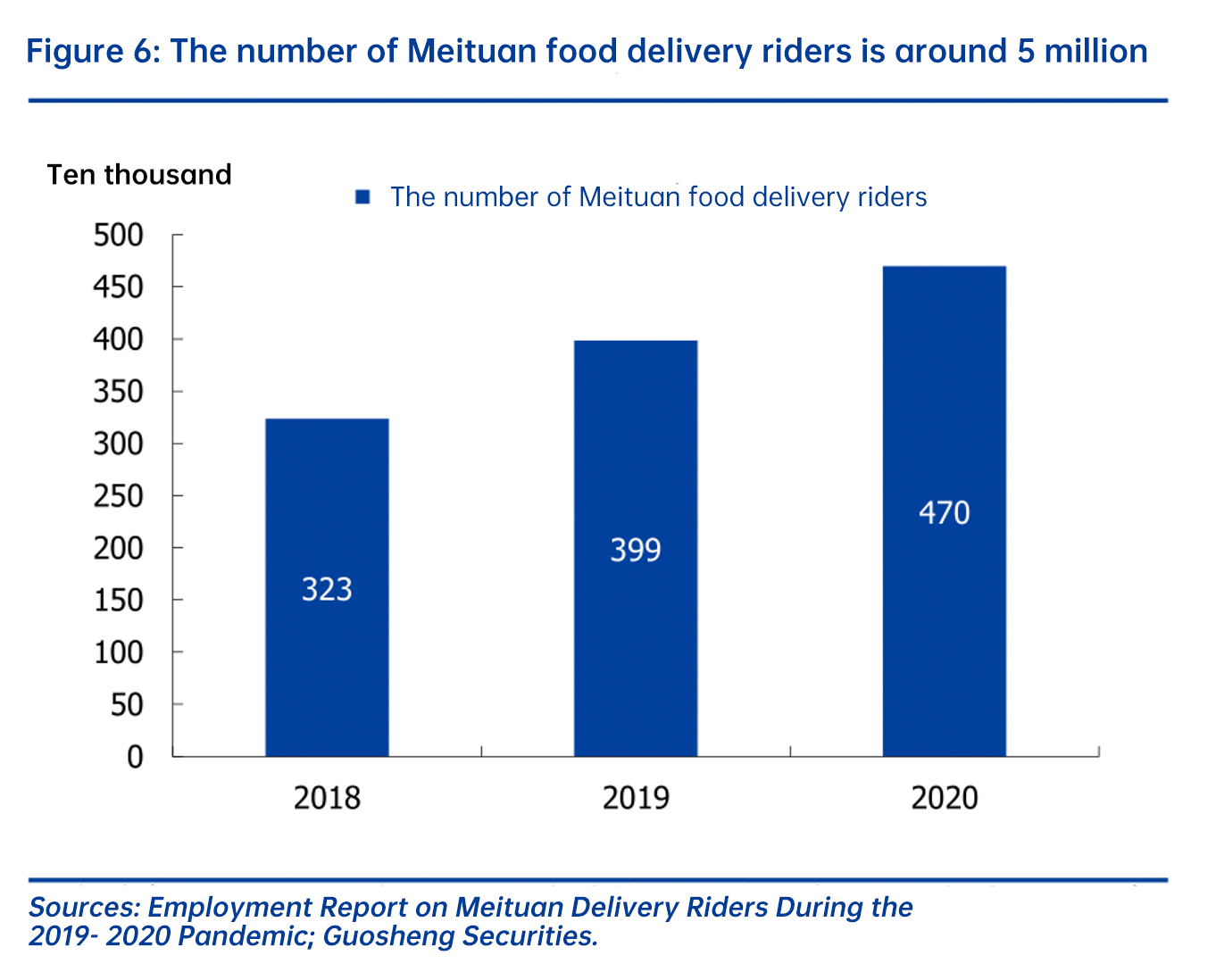

Putting employment first, improving labor security mechanism, and better protecting people in flexible employment. On August 23, 2021, the 14th Five-Year Plan for Employment Protection released by China’s State Council clearly pointed out that employment is the top livelihood issue and the foundation for economic development. During the 14th Five-Year Plan (FYP) period, achieving more and better quality employment is the basis for promoting common prosperity. According to the plan, by 2025, China aims to add over 55 million new urban jobs, expand employment capacity, limit the surveyed urban unemployment rate to lower than 5.5%, and stabilize the employment of key groups. In May 2021, the Ministry of Human Resources and Social Security stated that about 200 million people have been involved in flexible employment, accounting for one fourth of the total employed population. Compared to traditional employment, flexible employment tends to offer lower income. Globally, the income of informally employed workers is 62% that of formal employees; in addition, due to unclear labor relations, these informal workers usually lack labor protection and social security. Thus they are more vulnerable to external shocks, which further widens the income gap between formal and informal employment. Therefore, strengthening protection for people who do flexible work and improving the labor security mechanism is an important measure to narrow the income gap.

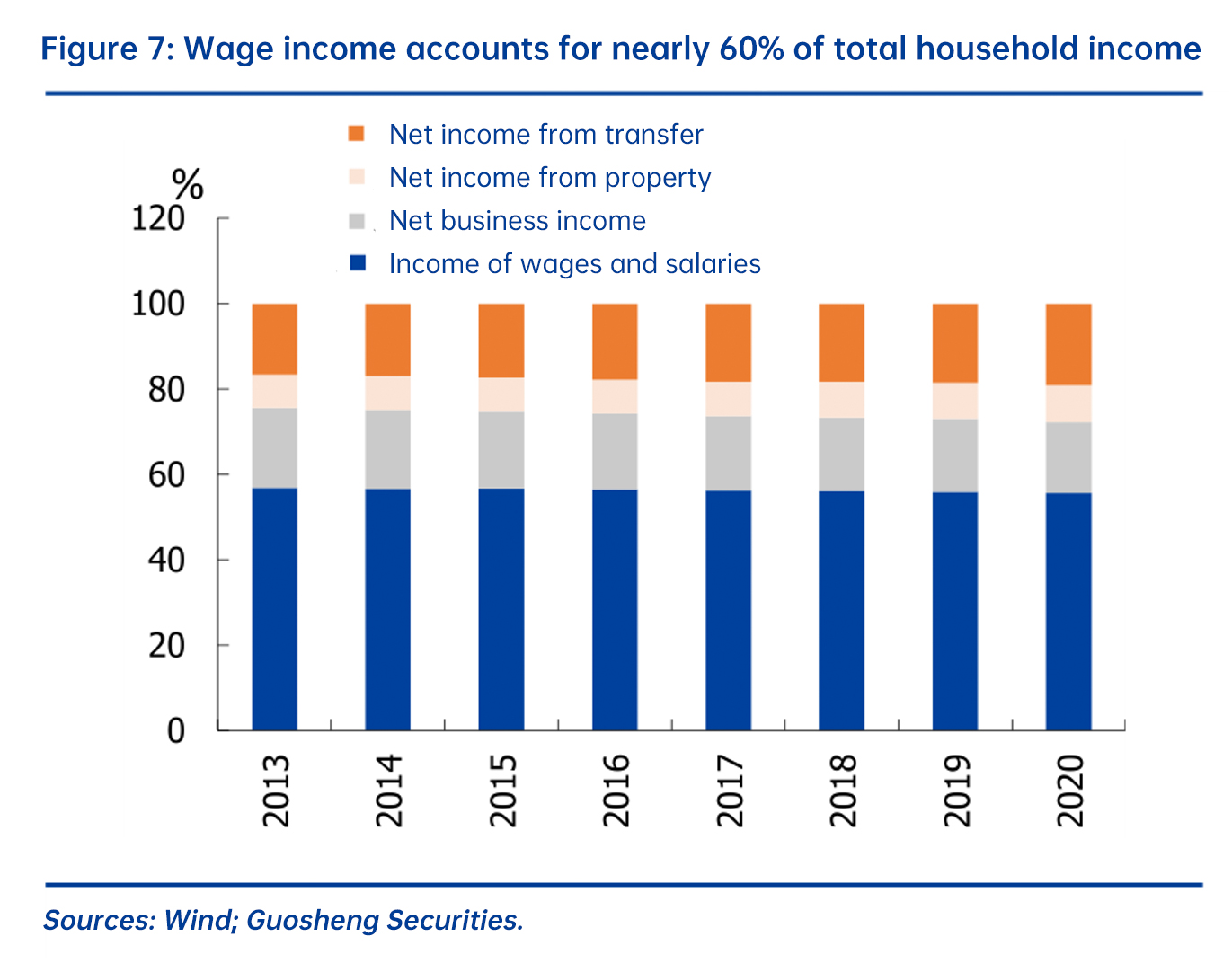

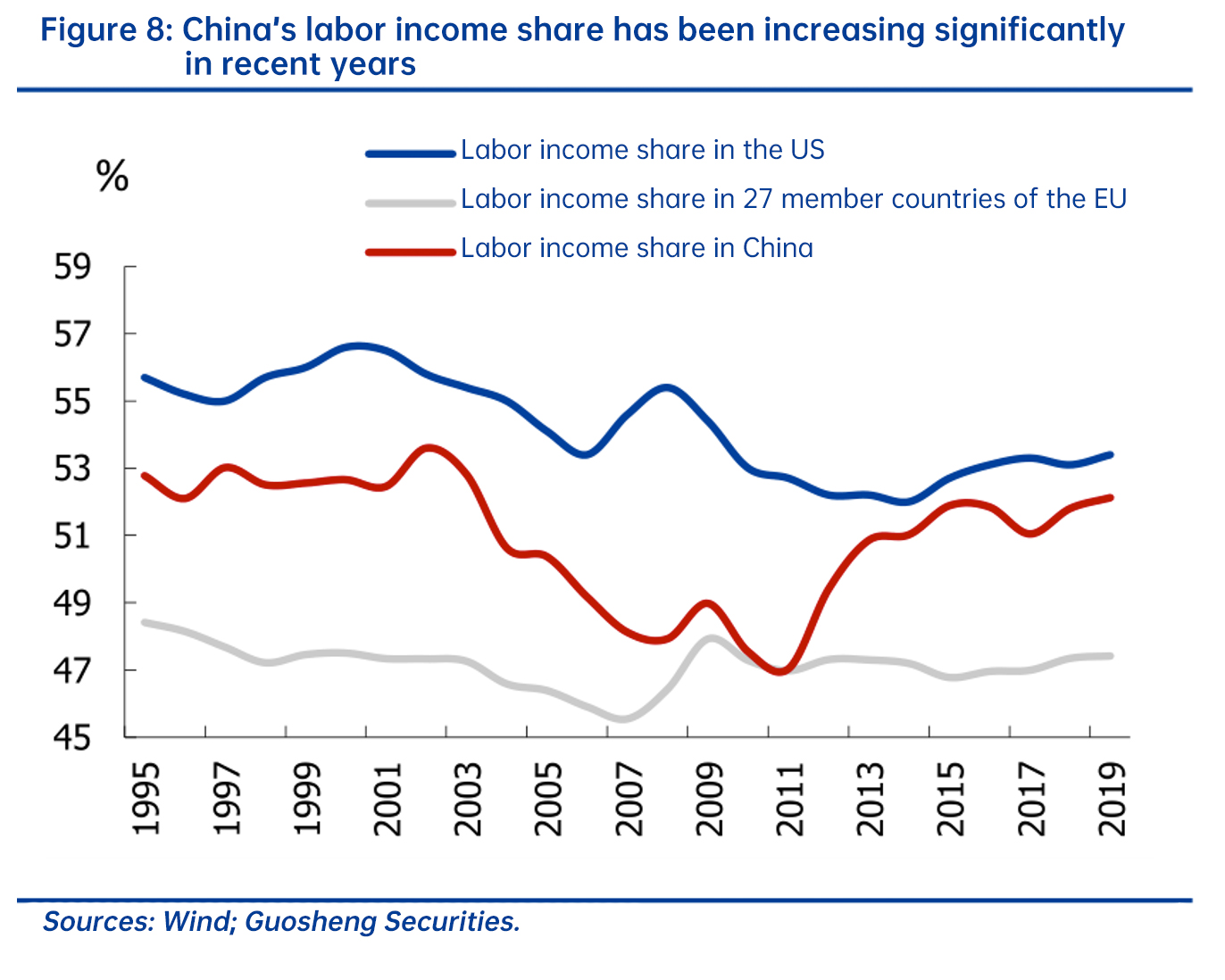

Increasing the labor income share. The 14th FYP proposed to “adhere to distribution according to work as the main form with multiples modes of distribution coexisting, and increase the share of labor income in the primary distribution”. The meeting of the Central Committee for Financial and Economic Affairs on August 17 also suggested to “encourage people to create wealth through hard work and innovation, and ensure and improve people’s livelihood in the process of development…with a focus on encouraging those who are hardworking, law abiding and willing to take risks to start a business to lead in wealth creation.” In fact, from 2011 to 2019, China’s share of labor income has increased from 47% to 52.1%, very close to that of the US. But we should be clear that such an increase is relative and compensatory since the share in the past was rather low, and the share of household disposable income is still quite low. Thus there is room for increasing in the share of labor income and household disposable income.

2) Capital

2) Capital

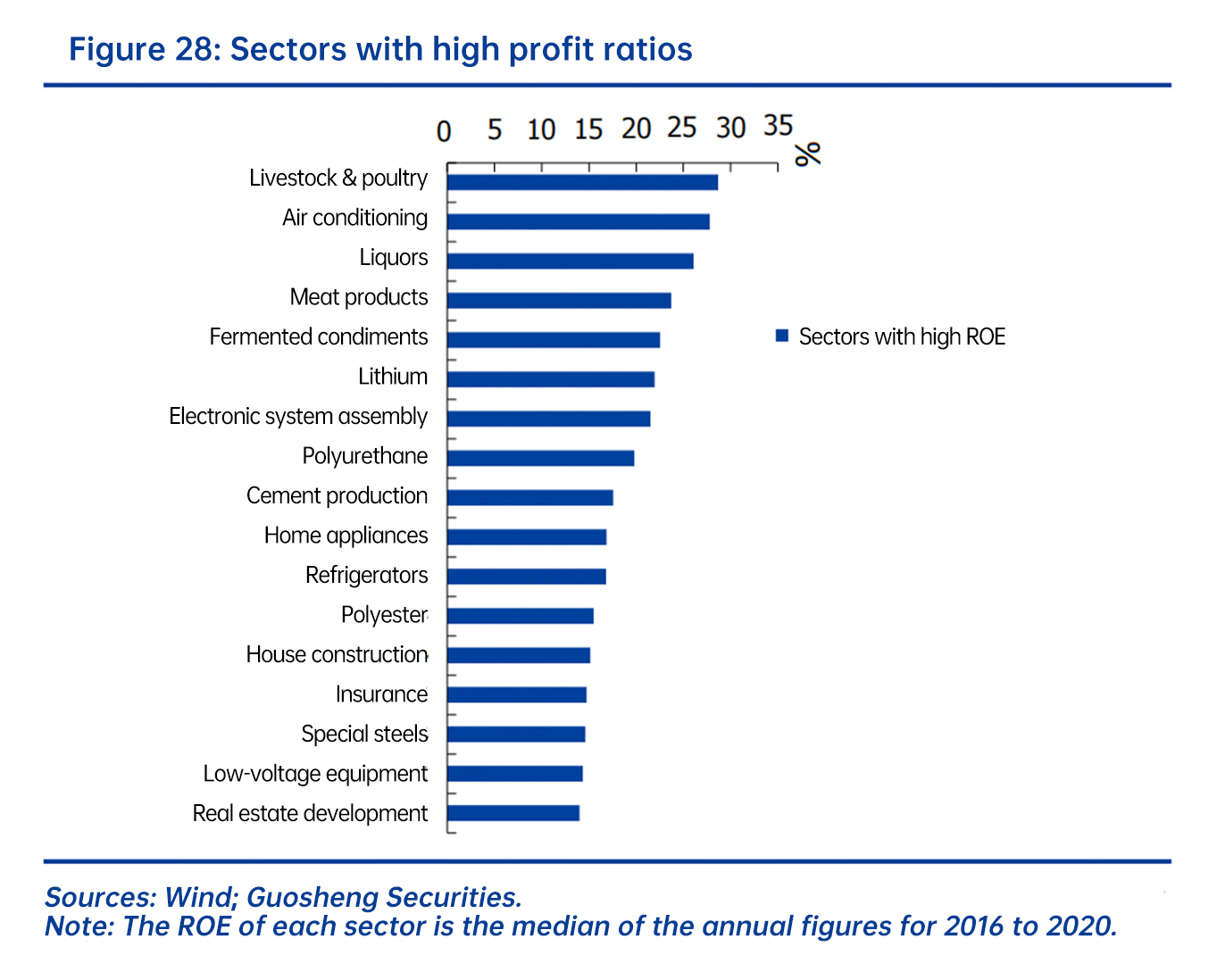

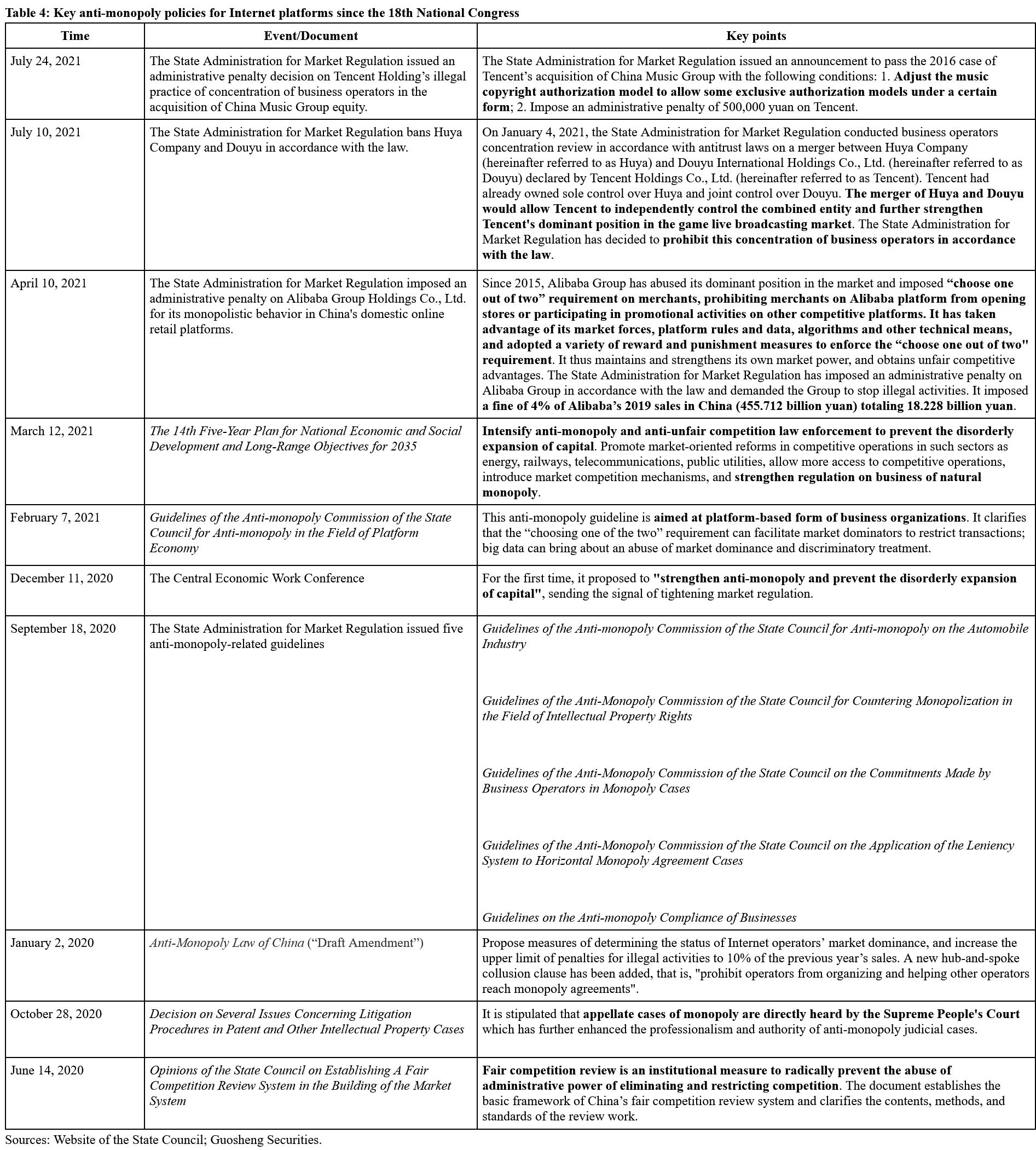

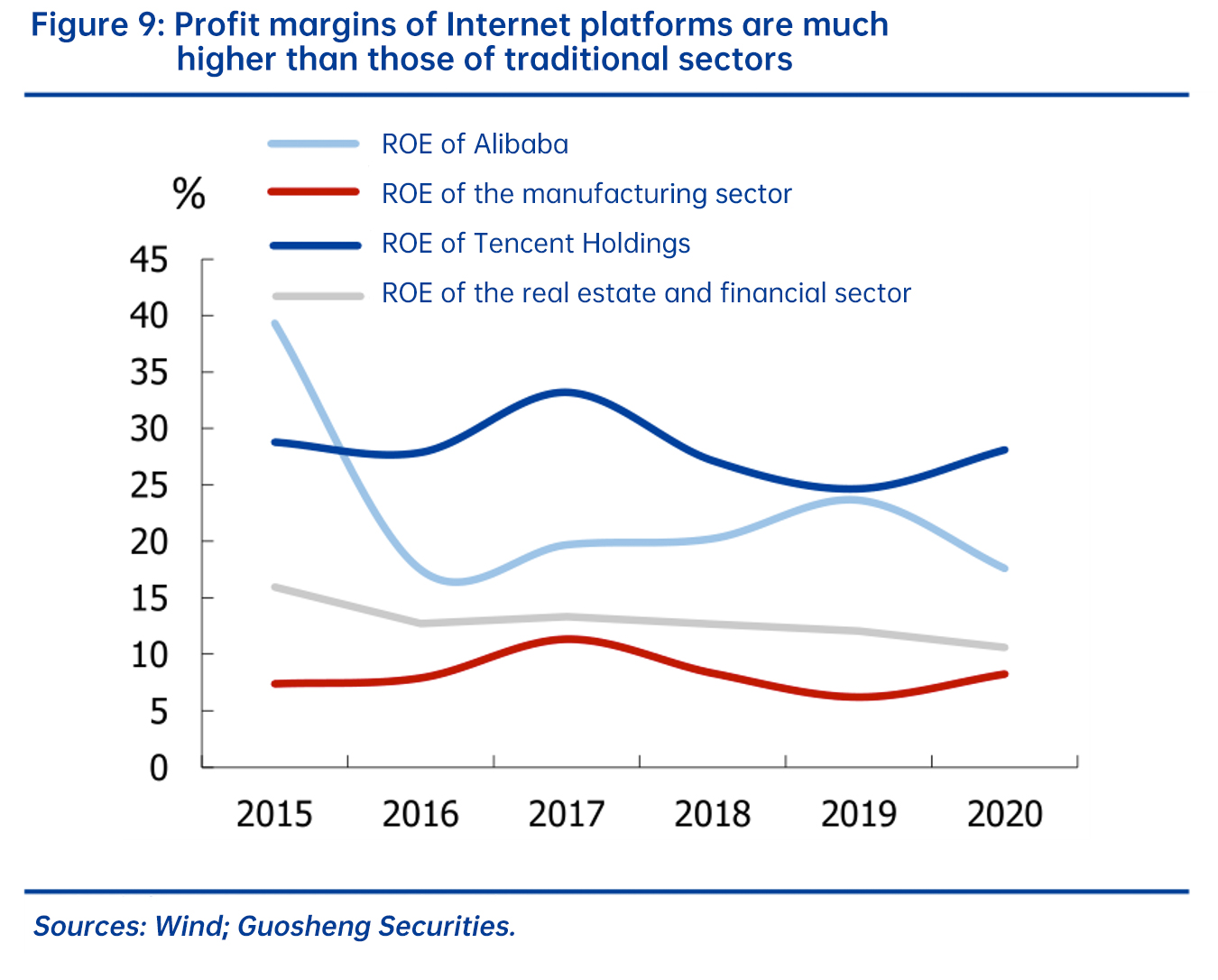

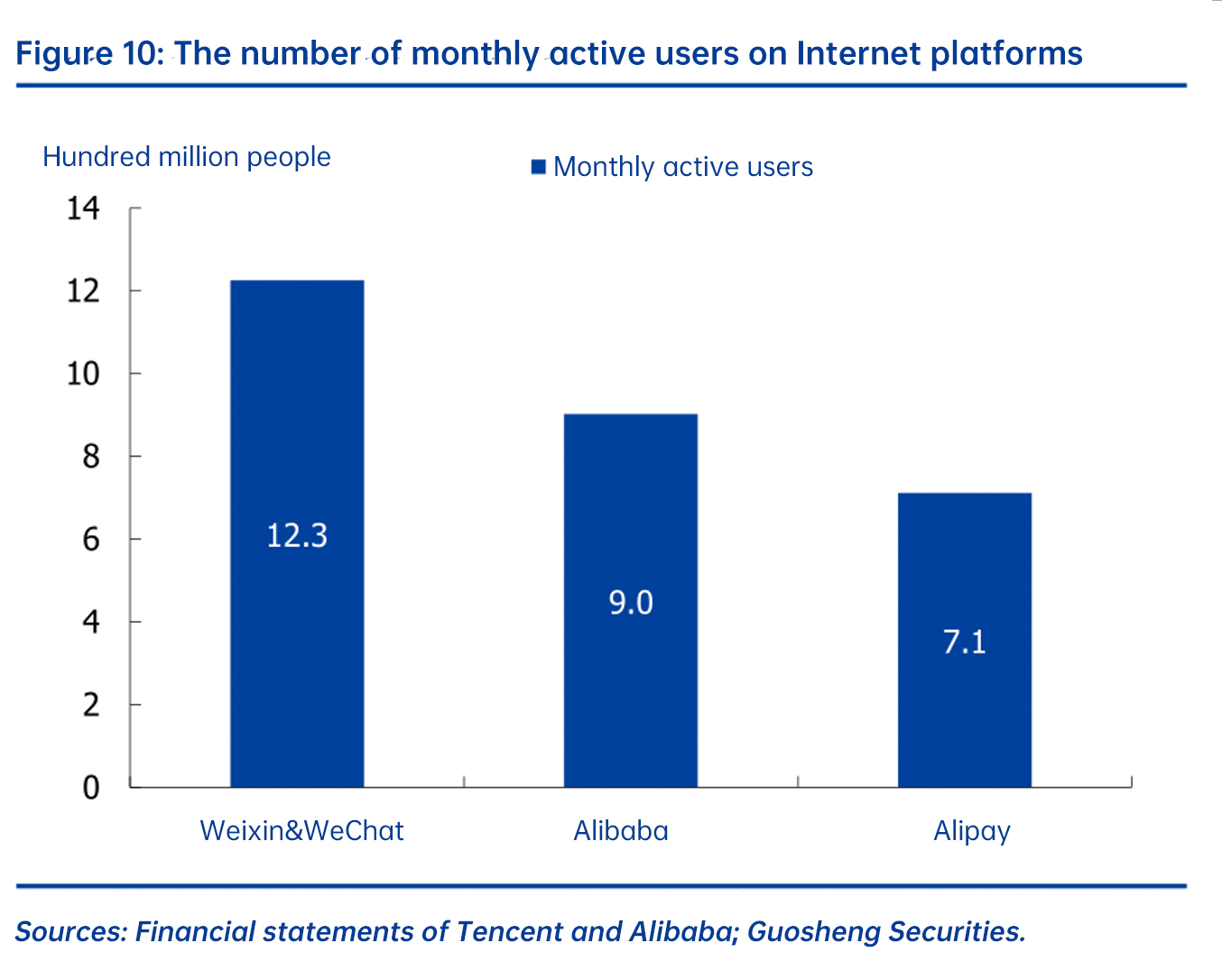

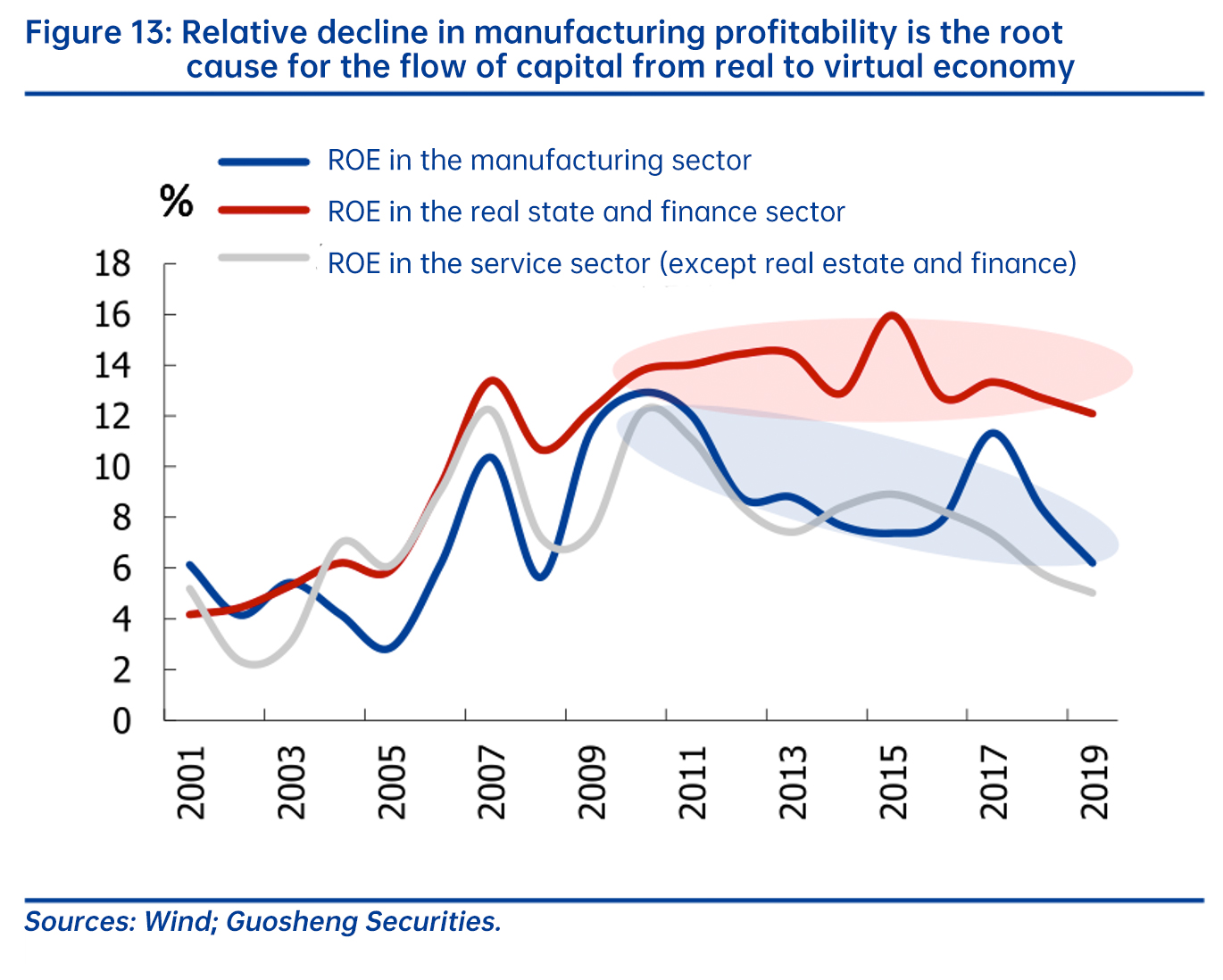

China is taking multiple measures to curb disorderly expansion of capital and strengthen anti-monopoly efforts. Since last year, anti-monopoly regulation of Internet platforms has been significantly tightened. In January 2020, China's State Administration for Market Regulation issued a draft amendment to the Anti-Monopoly Law for consultation, which adds provisions to define dominant market position of Internet operators and raise the penalty ceiling for violations to 10% of sales in the previous year. The 2020 Central Economic Work Conference and the 9th meeting of the Central Finance and Economics Committee on March 15 both stressed that anti-monopoly efforts should be strengthened and disorderly expansion of capital should be prevented. Statistics show that the profit margins of Alibaba and Tencent between 2015 and 2020 are 20% and 28% respectively, much higher than those of listed manufacturing companies (around 8%) and real estate and financial companies (around 13%).

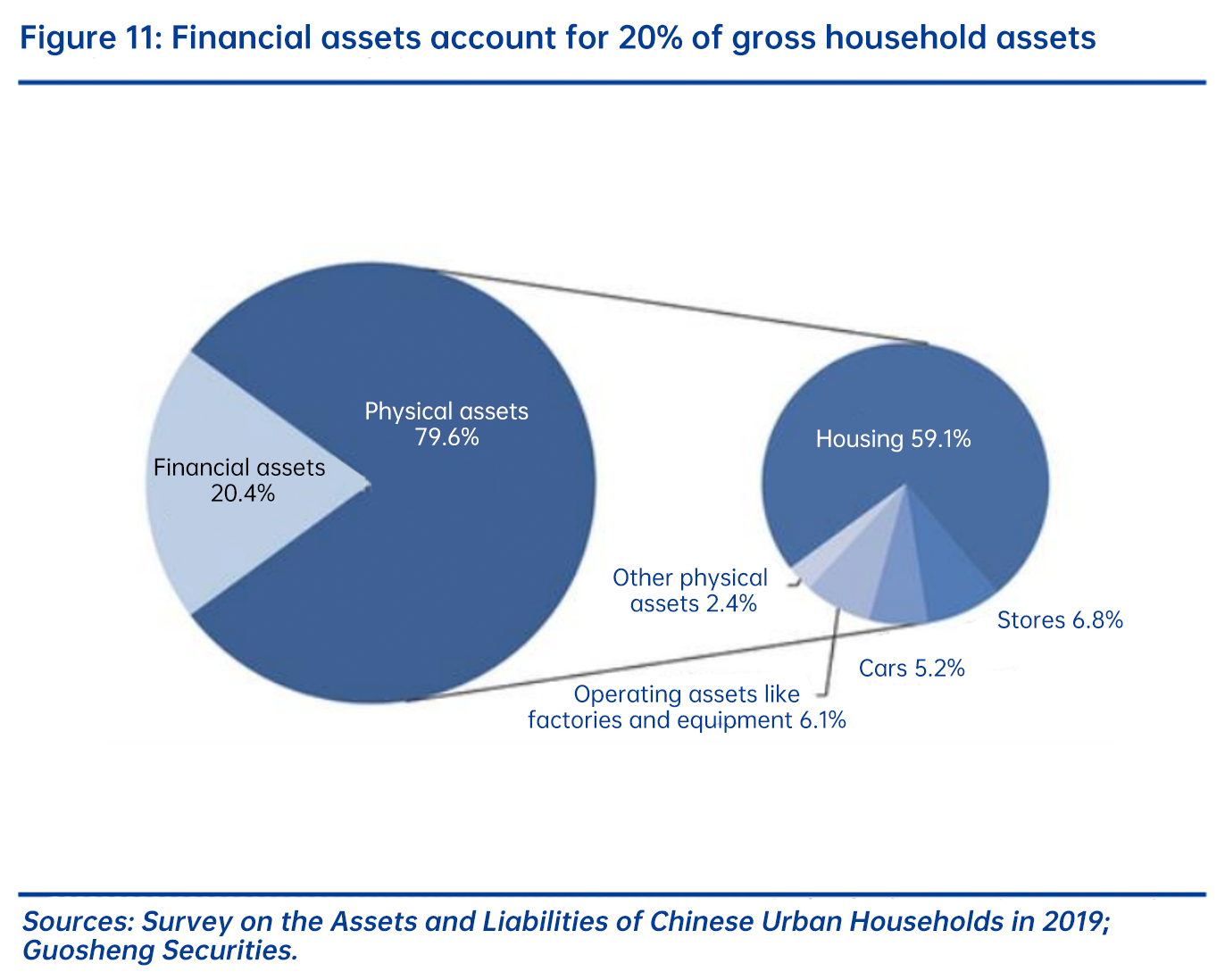

Increasing property income is an important way to “expand the proportion of the middle-income groups”. Specifically, measures involve expanding and strengthening the capital market, encouraging listed companies to pay cash dividends and adopt employee stock ownership, and enhance the investor protection system. Property income refers to income obtained from household movable property (such as bank deposits, securities, vehicles, etc.) and real estate (such as houses, etc.), which accounts for only 9% of household disposable income in 2020. The low share of financial assets is an important reason for the low level of property income. According to a survey by People’s Bank of China on the assets and liabilities of Chinese urban households in 2019, financial assets account for only 20% of Chinese gross household assets, 22.1 percentage points lower than the US, and over half of the financial assets are risk-free ones like bank deposits. Such a low share of financial assets means that low-income households are unable to enjoy the benefits of asset appreciation. In particular, in the current context of downward interest rates and high inflation rate, the gap between returns on financial assets and those from physical assets will become larger, further widening the wealth gap between rich and poor. Based on the 2020 guideline on improving the market-based allocation mechanism of production factors and the guideline on promoting common prosperity in Zhejiang province, measures to increase property income include encouraging and guiding listed companies to pay cash dividends, improving investor protection system, and encouraging companies to adopt employee stock ownership.

3) Land

3) Land

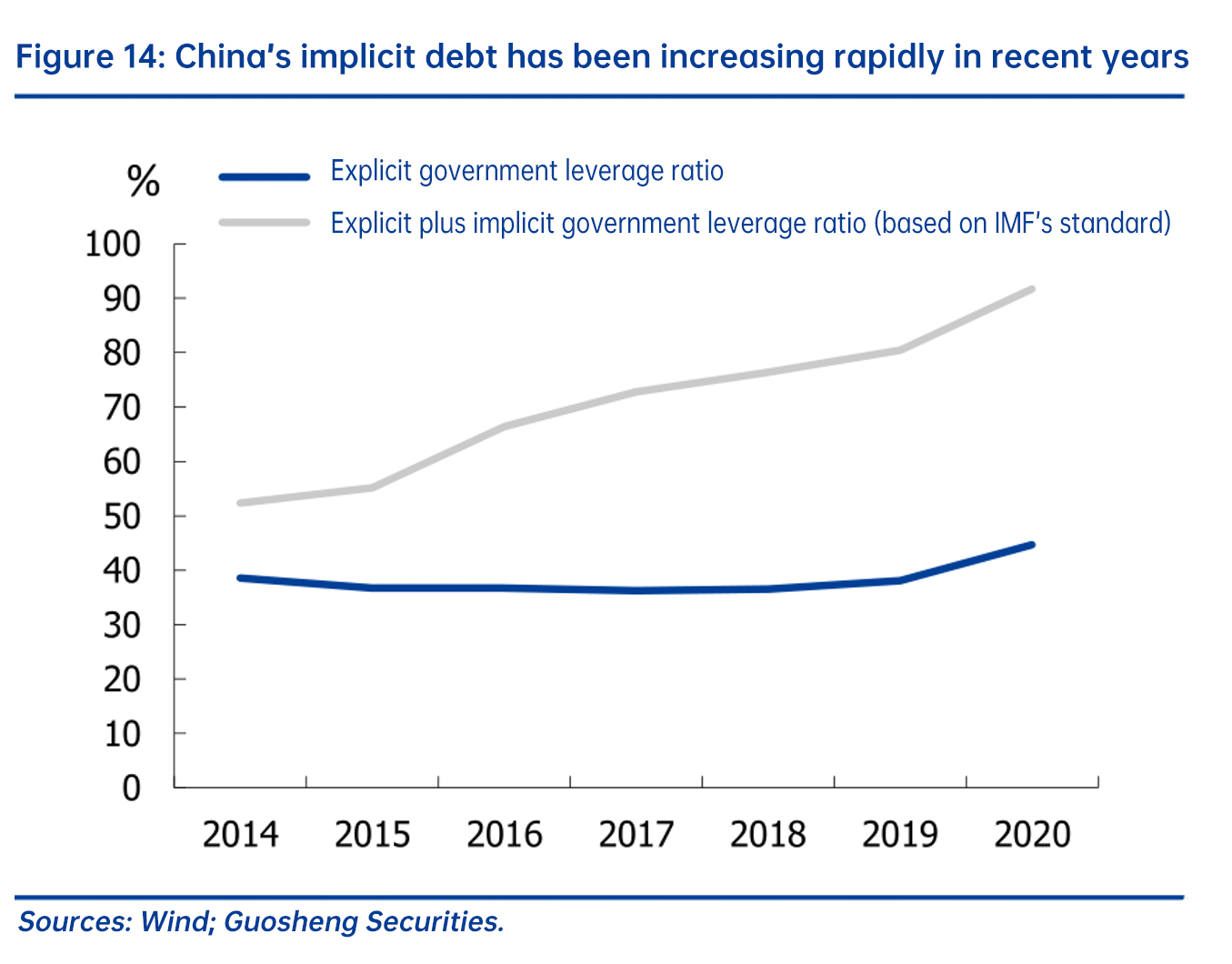

Land reform is expected to accelerate significantly and land finance is in urgent need of a “breakthrough”. Land finance contributed a lot to the high-speed growth of China’s economy in the past. But it has also driven up housing prices, constrained consumption, diverted funds away from the real economy, and shored up local debt risk. Moreover, land finance is one of the causes for the widening “three major gaps”. For example, the surging local government debt in recent years, especially the implicit debt, is closely related to land finance. Based on IMF’s standard, the scale of China’s local government implicit debt in 2020 reached 50 trillion yuan, twice the amount of local explicit debt. In recent years, land reform is speeding up through measures like centralized land auctions.

2. Redistribution: the focus should be on taxation, social security, and transfer payment. Key measures involve gradually introducing property taxes like housing property tax and inheritance tax, optimizing the supply of public services, reducing livelihood costs for education, health care, pension, and housing, and improving the social security system.

1) Taxation

There are two main deficiencies in our tax structure:

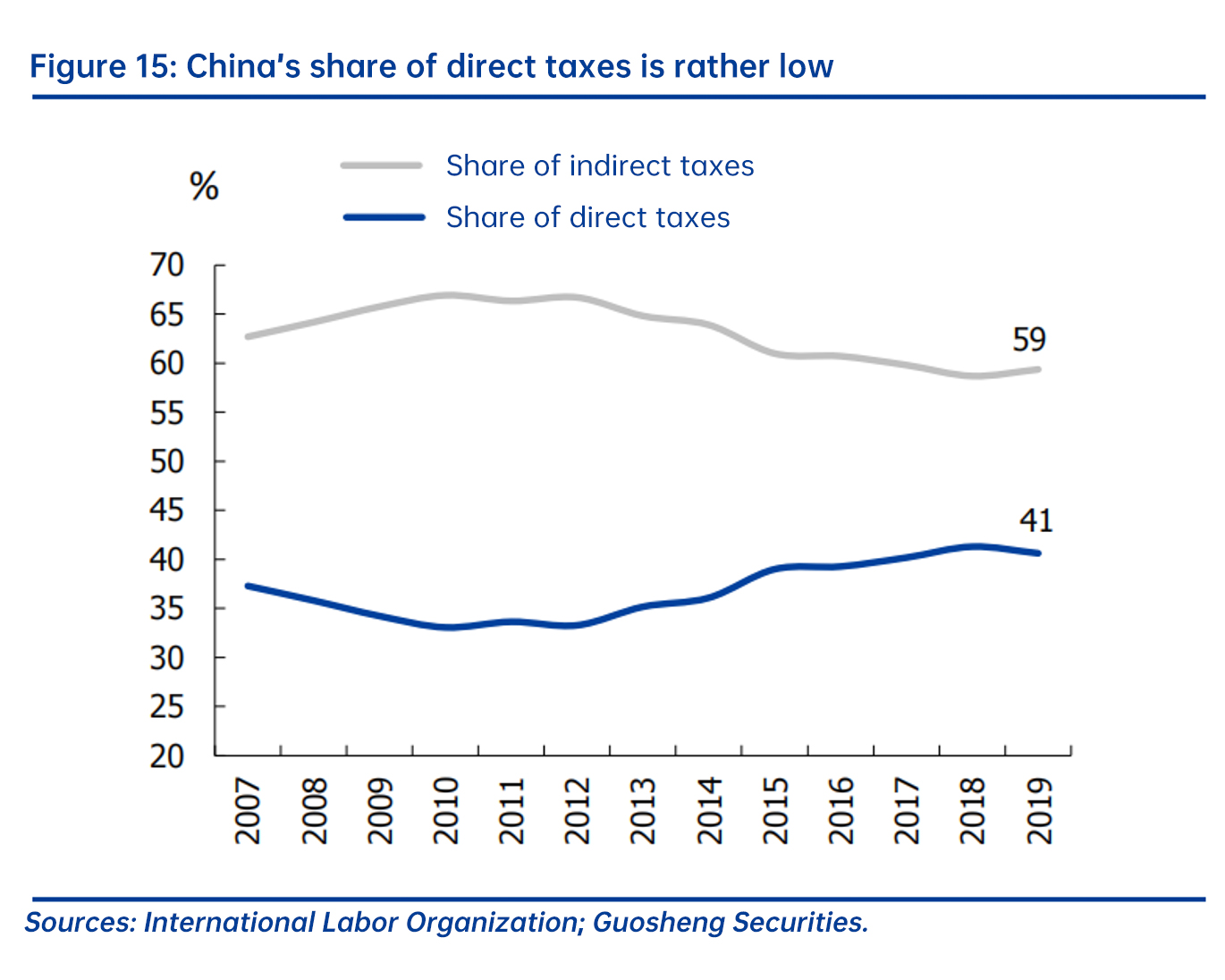

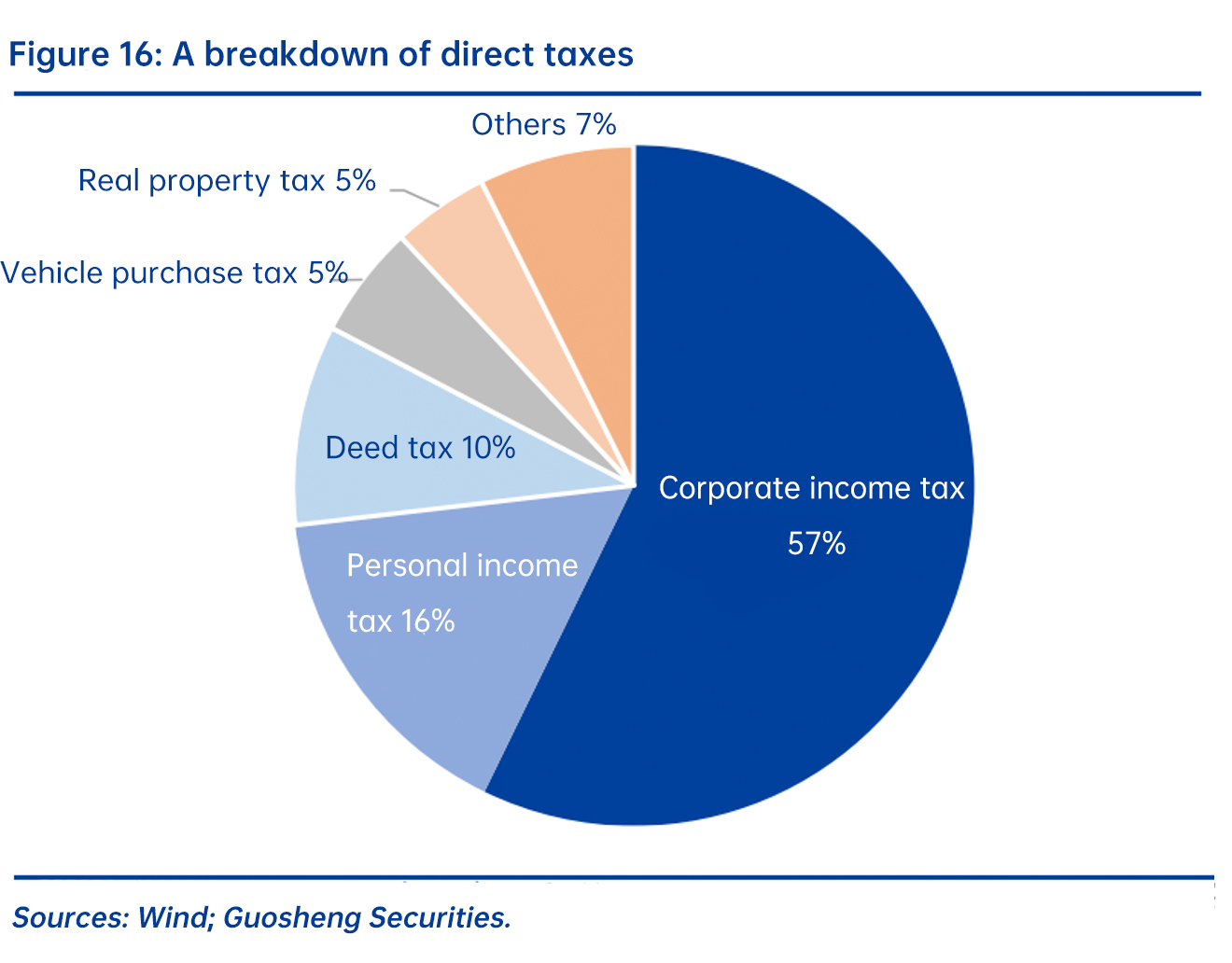

? Imbalance between the share of indirect and direct taxes: taxes can be divided into direct taxes (such as income tax, property tax, etc.) and indirect taxes (such as value-added tax, consumption tax, etc.). In 2019, China’s direct tax accounts for 41% and indirect tax 59%. The share of direct tax is much lower than the level of European countries and the US (60%-80%). It is generally believed that a tax structure dominated by indirect taxes is regressive, meaning that the tax burden of taxpayers decreases with the increase of income, which might worsen the income distribution of households to a certain extent. Given this, the 14th FYP calls for "improving the tax system dominated by direct tax and appropriately increasing the proportion of direct taxes".

? Imbalance between income tax and property tax: from the internal structure of direct taxes, corporate income tax and personal income tax constitute the main part, accounting for 57% and 16% respectively, whereas property tax accounts for a very low percentage. Since most of the income of China's households is still lower than the income-tax threshold (in 2018, Vice Minister of Finance Cheng Lihua said that "the proportion of taxpayers of personal income tax to urban employed population will be reduced from the current 44% to 15% after the amendment", equivalent to about 64 million personal taxpayers), the role of personal income tax in adjusting income gap is limited.

In the future, the fiscal and taxation system reform should focus on the following issues:

? Reduce individual income tax rate and broaden tax base: The 14th FYP pointed out that it is necessary to "improve the individual income tax system, expand the scope of taxable comprehensive income, and optimize the tax rate structure." 1) In terms of the tax base, the current comprehensive income includes only four items: wages, reward for personal services, authors’ remuneration, and royalties. To broaden the currently narrow tax base, property income and capital income are likely to be consolidated into comprehensive income in the future; 2) In terms of tax rate, the current highest marginal tax rate of individual income tax in China is 45%, which is at a relatively high level compared to the rest of the world (37% in the United States, 40% in France, 45% in Germany, Britain and Japan). To a certain extent, this will foster tax avoidance and discourage the enthusiasm of high-end talents.

? Increase property tax: The 14th FYP points out that it is necessary to "optimize the structure of the tax system, improve the direct tax system, and appropriately increase the proportion of direct tax...press ahead with real estate tax legislation". As mentioned above, property taxes including real estate tax, inheritance tax, and gift tax, account for a very low share of total tax revenue. Gradually pushing up property tax is the future trend.

? Reform luxury goods consumption tax: The 14th FYP pointed out that it is necessary to "adjust and optimize the tax base and tax rate of consumption tax, shift the collection of the tax from the production/import stage to the wholesale/retail stage, and allocate more tax revenue to local governments". At present, China’s consumption tax rate for luxury goods (such as precious jewelry, luxury cars and yachts, etc.) is about 5-10%, featuring a slow tax rate and narrow tax base. In the future, China is expected to carry out further reforms of the consumption tax system.

2) Social security: Social security offers the bottom line protection for low-income families. China has made great progress in improving social security system in recent years, but overall there are two major shortcomings:

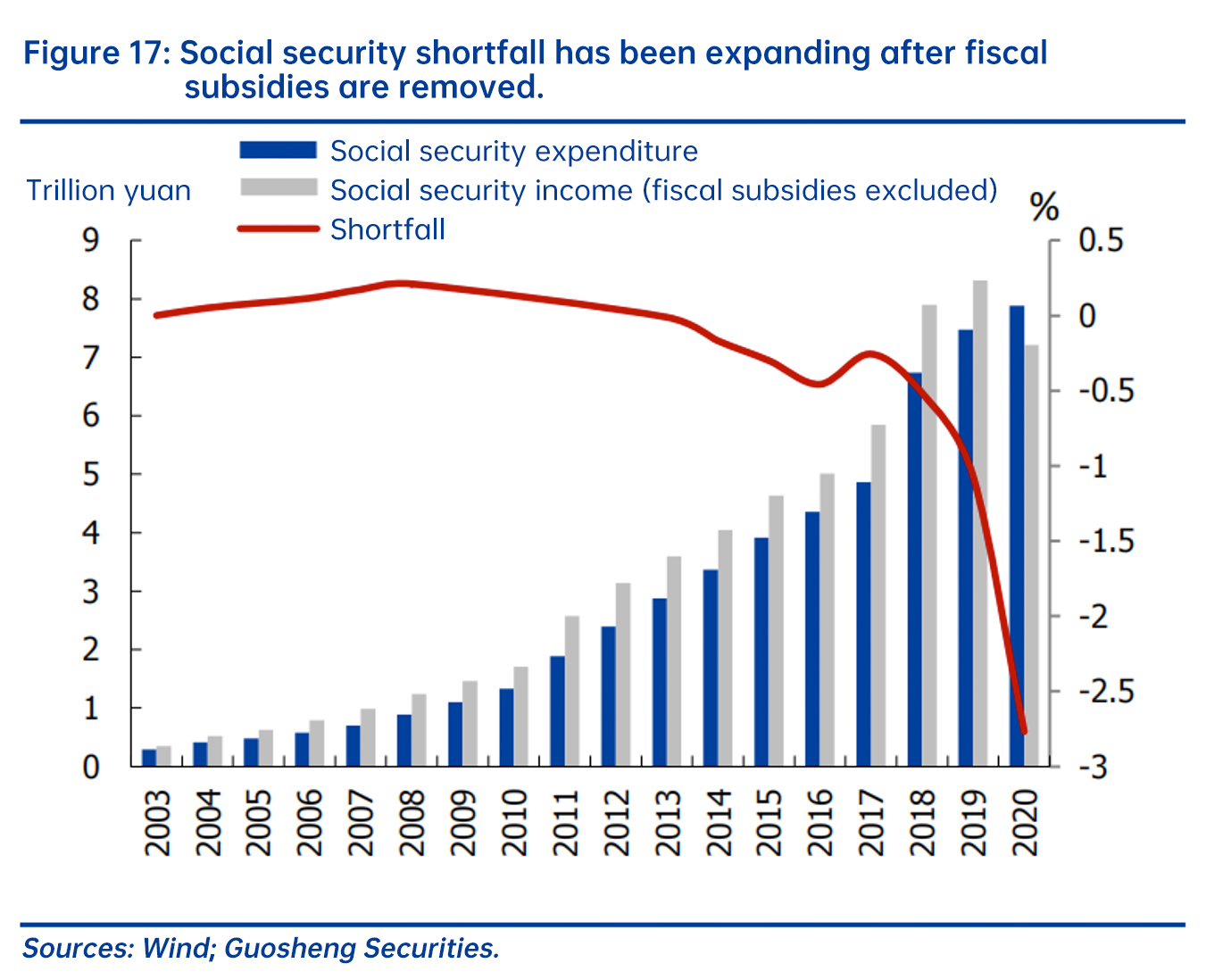

? The financing mechanism needs to be improved: China’s social security shortfall has expanded rapidly after 2013 due to accelerated population aging and lower actual payment ratio. With the blow of the pandemic in 2020, the deficit after subsidies are removed is as high as 2.8 trillion yuan.

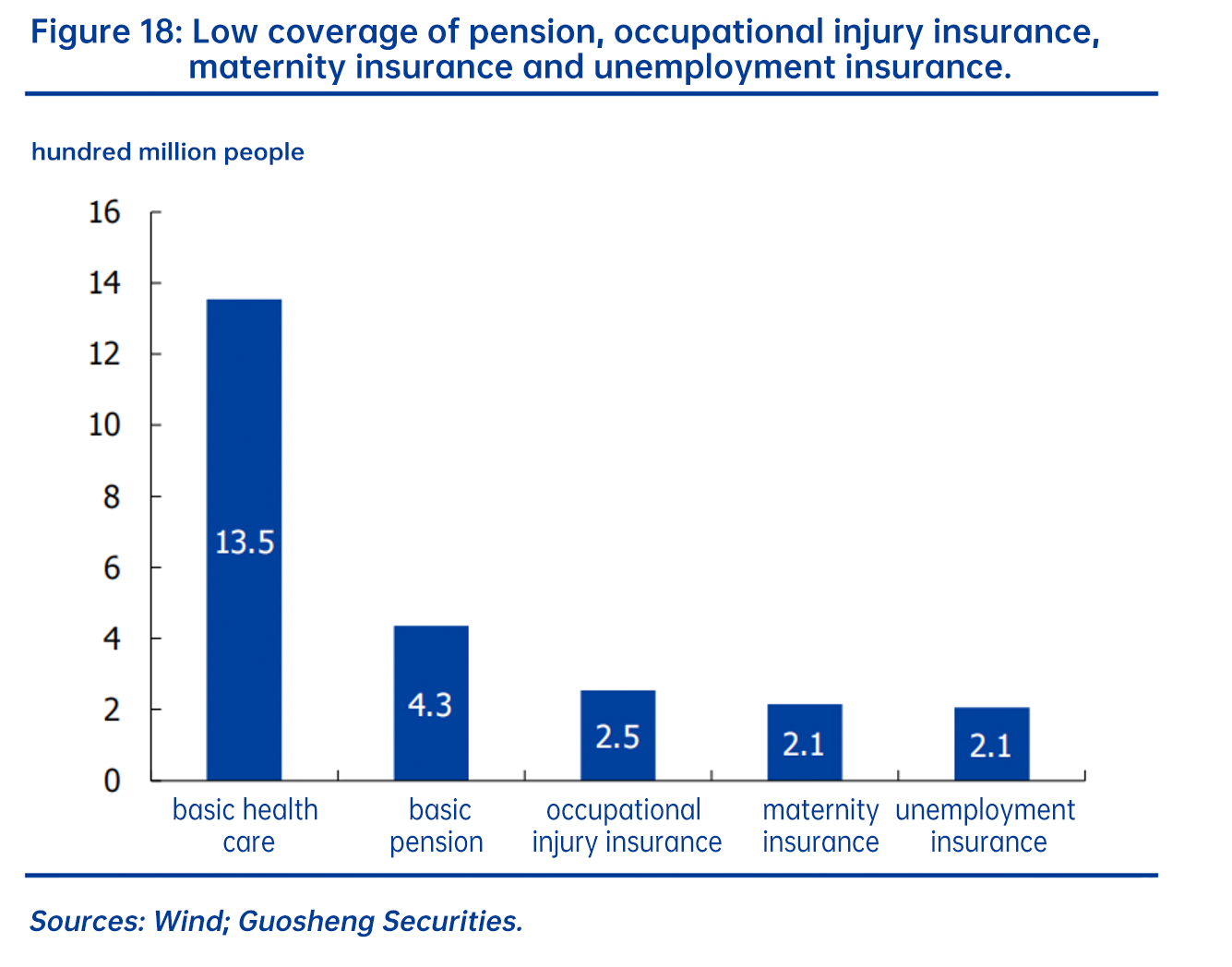

? It is necessary to expand the scope of insured population. In 2019, China has generally realized full coverage of health insurance. However, the number of insurance participants in pensions, work-related injuries, childbirth, and unemployment is still small.

Going forward, policy should be rolled out to address the above-mentioned issues. How?

? Improving financing mechanism: The 14th FYP emphasizes the need to "improve the pension insurance system and ensure the balance of basic pension insurance funds in the long run", "facilitate the transfer of state-owned capital to enrich the social security fund system, and optimize and strengthen the social security reserve fund".

? Expanding insurance coverage: The 14th FYP emphasizes the need to "relax insurance application conditions for flexible workers so that social insurance will cover the entire legally eligible population", "develop the third pillar of pension insurance and increase corporate annuity coverage", and "expand the coverage of unemployment insurance and work-related injury insurance".

3) Public services and transfer payments

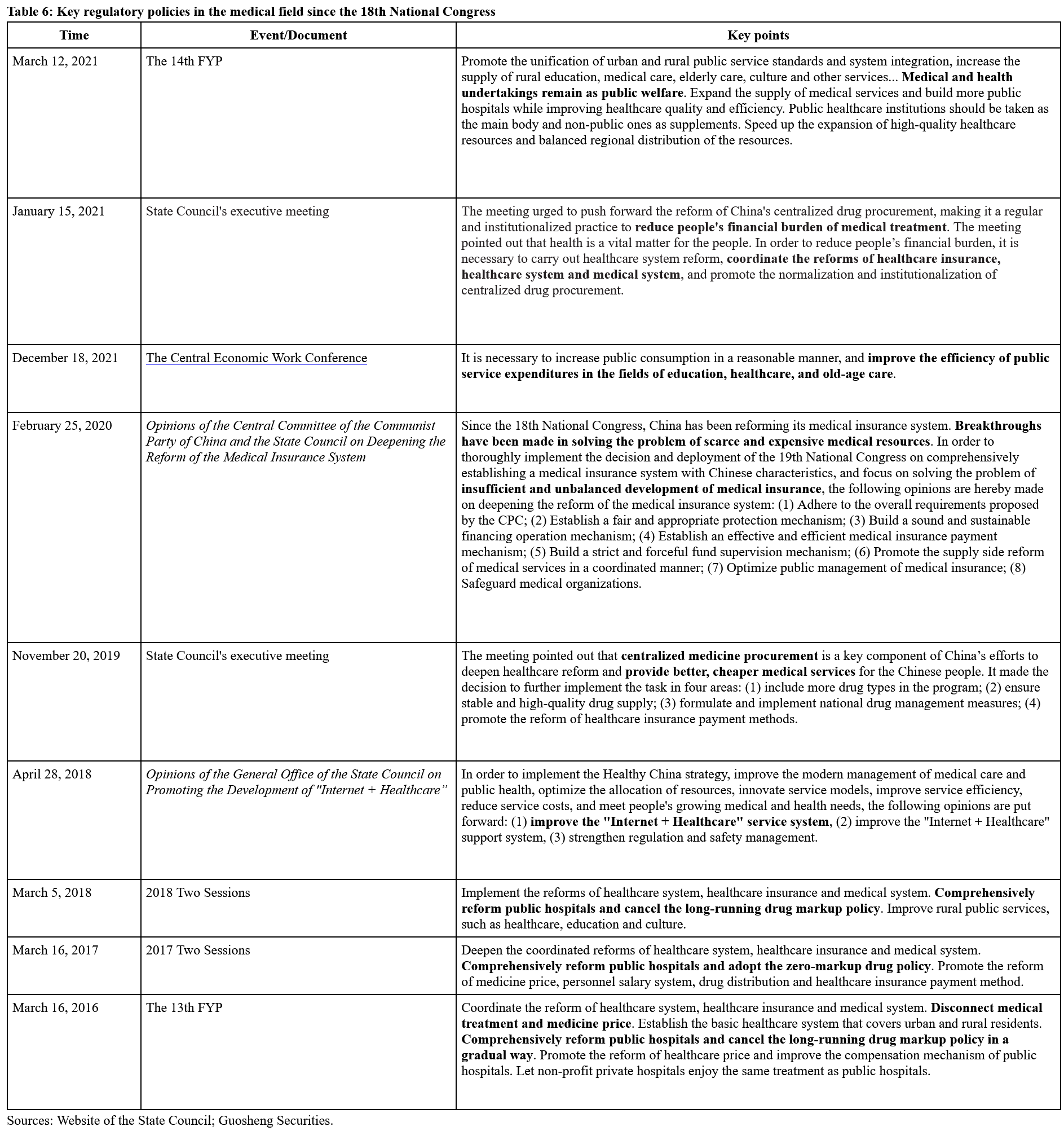

Optimizing public services is an effective means to bridge the income gap and achieve common prosperity. Public services are non-exclusive. More equally accessible and higher-level public services can directly improve the living standards of low-income groups. In particular, public services related to people’s basic livelihoods such as housing, medical care, and education are necessities. Too much reliance on the market will only widen the gap among people of different income groups. Recently, sweeping regulatory changes have been made in the three basic sectors related to people’s livelihood, including housing, medical care, and education:

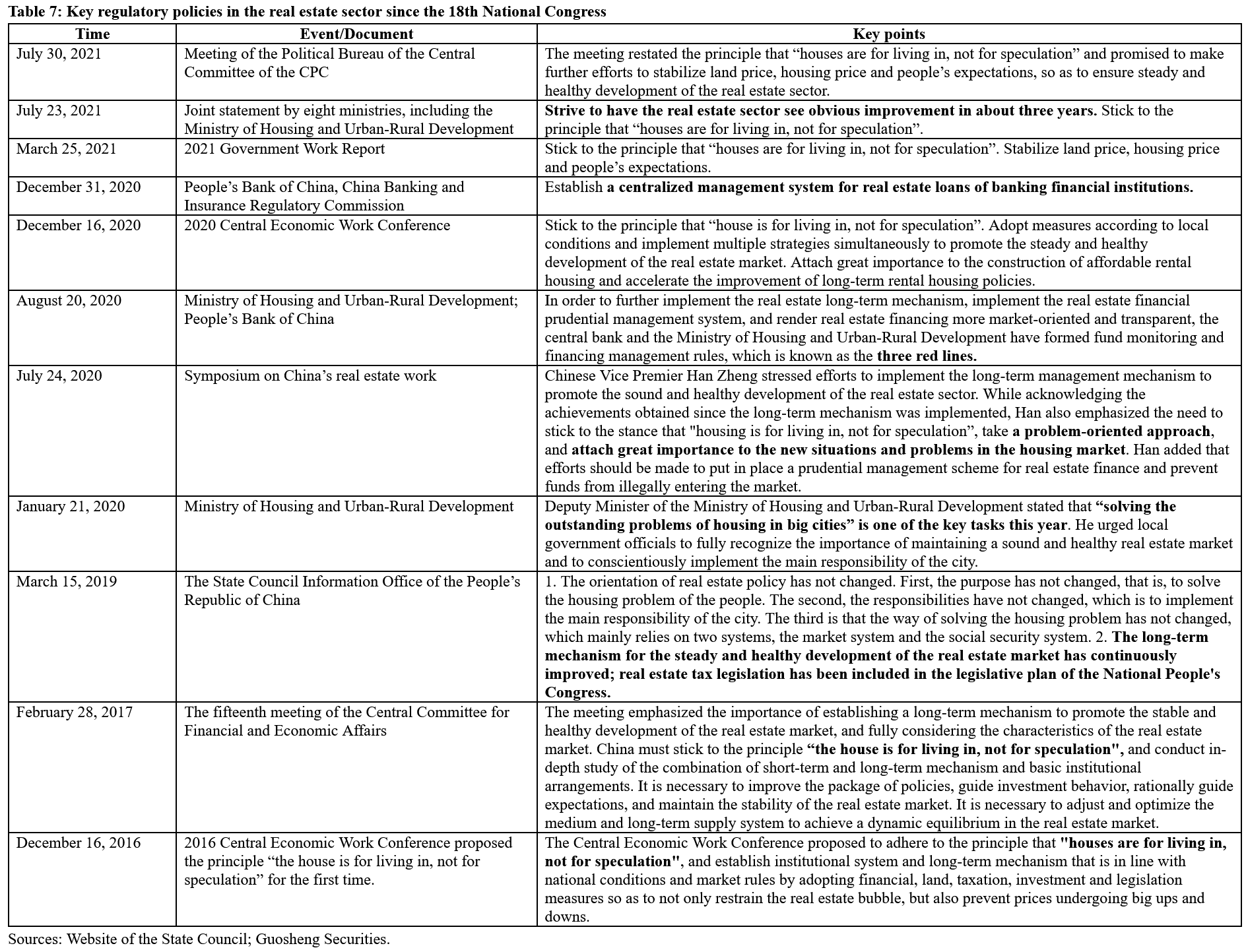

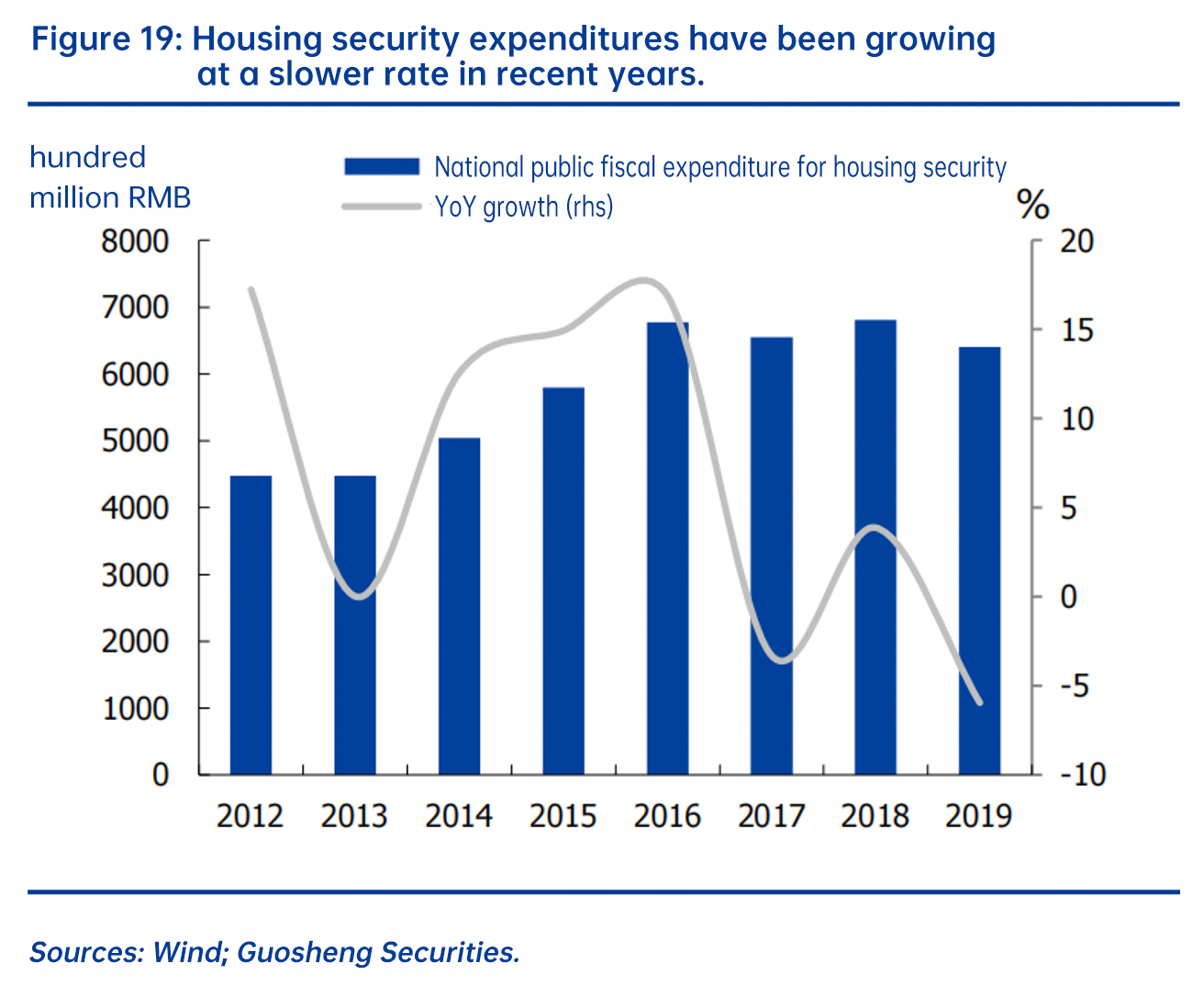

? Housing: China has kept it housing policy tight since 2016 when it set forth the principle that “houses are for living in, not for speculation”. Since the second half of 2020, long-term policies such as “three red lines” and concentrated loan management have been rolled out one after another. In July 2021, eight ministries including the Ministry of Housing and Urban-Rural Development proposed to “strive to make a significant improvement in the real estate market in about 3 years”.

? Medical care: China has completed five rounds of bulk government purchases of drugs, amounting to a market capacity of 220 billion yuan, and resulting in an average price drop of about 50% . The State Council executive meeting in January 2021 decided to put China’s centralized drug bulk-buying program on a regular and institutionalized basis.

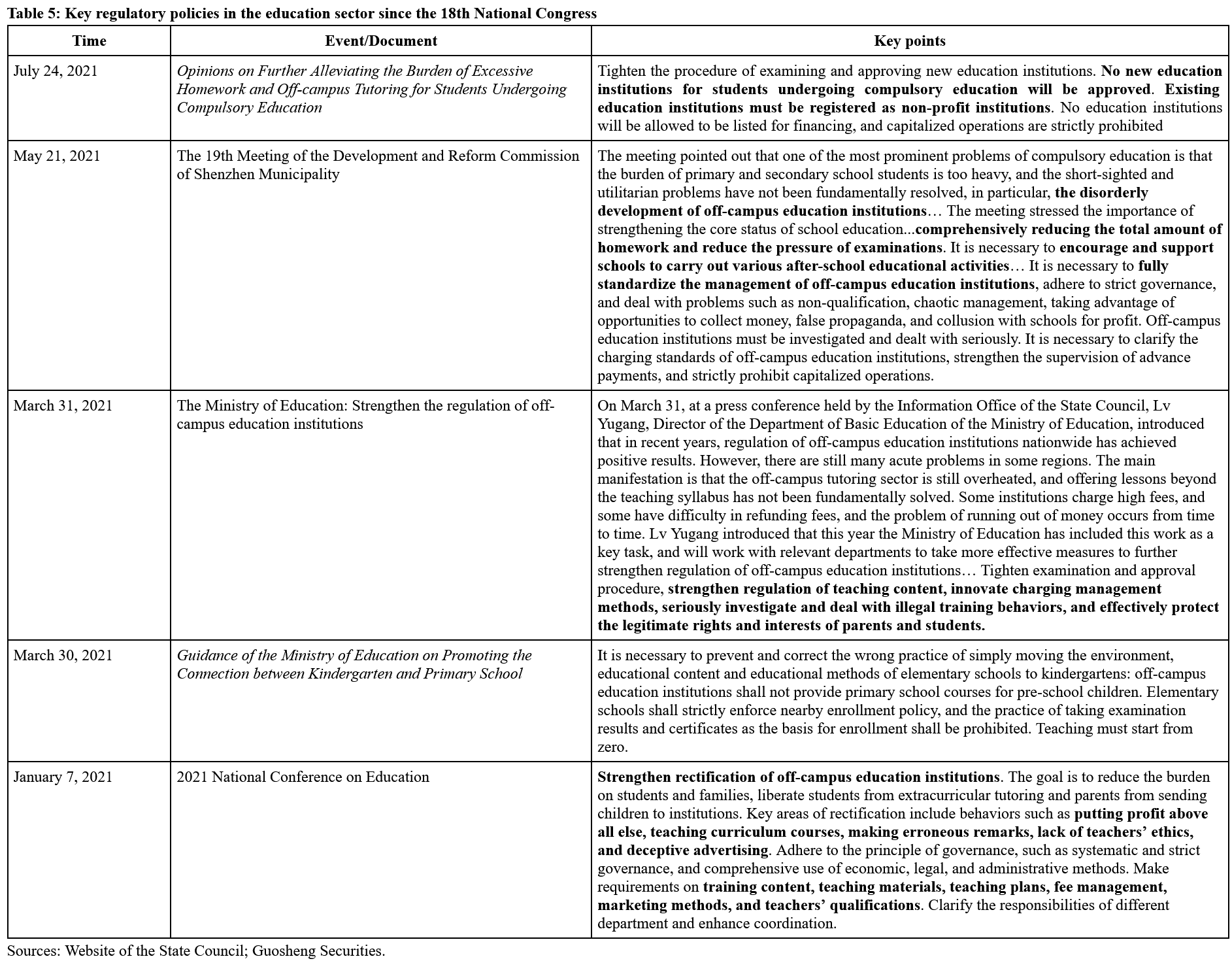

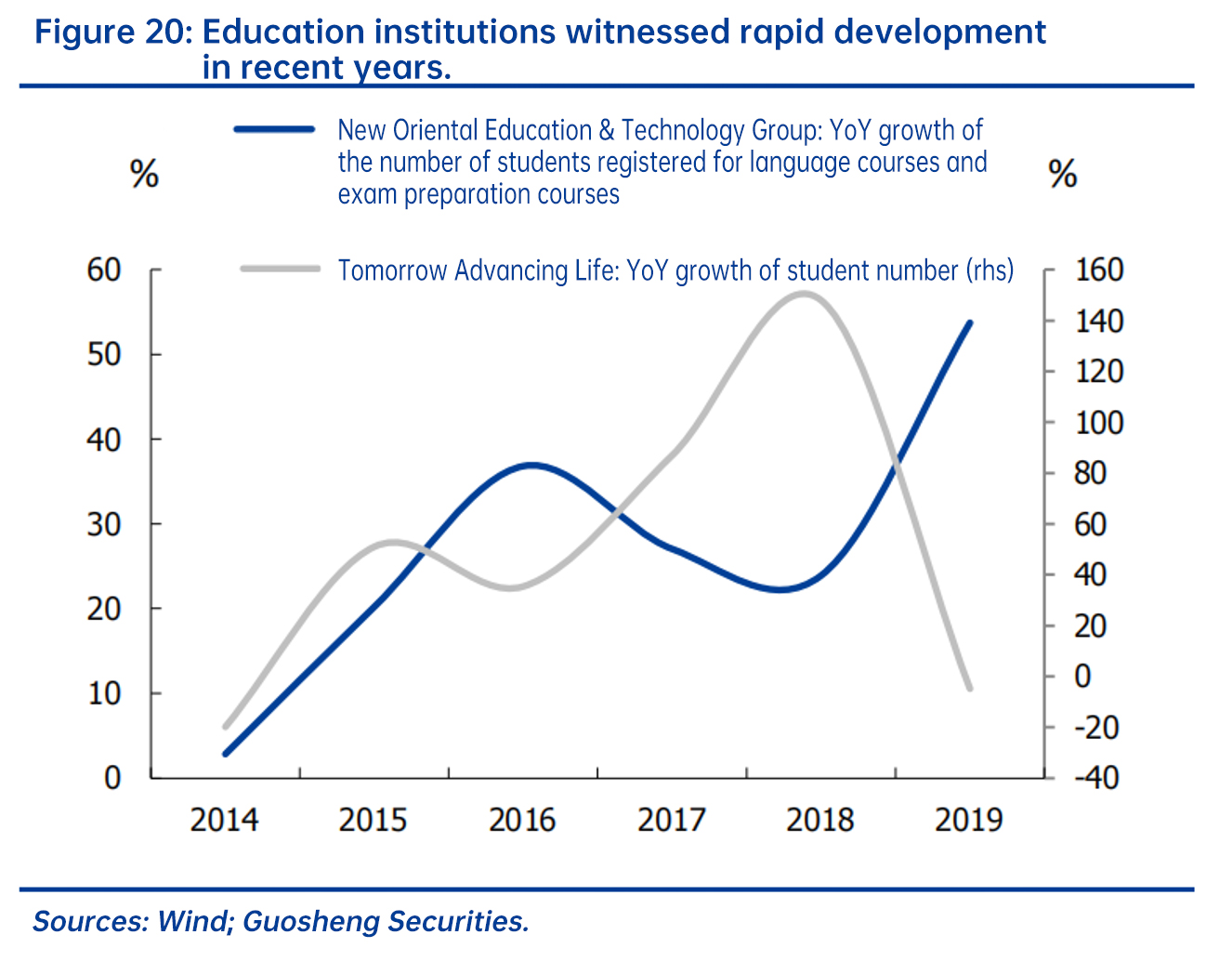

? Education: China has been overhauling its education sector since the beginning of the year. In July, Opinions on Further Alleviating the Burden of Excessive Homework and Off-campus Tutoring for Students Undergoing Compulsory Education was issued. The document requires existing education institutions to be registered as non-profit institutions and prohibits them to be listed for financing and engage in capitalized operations.

3. The third distribution: The core of the third distribution lies in charitable donations. Important means include developing charity, establishing various donation methods, formulating preferential tax policies for charitable donations, and improving the reward system for charity. The third distribution is a useful supplement to redistribution.

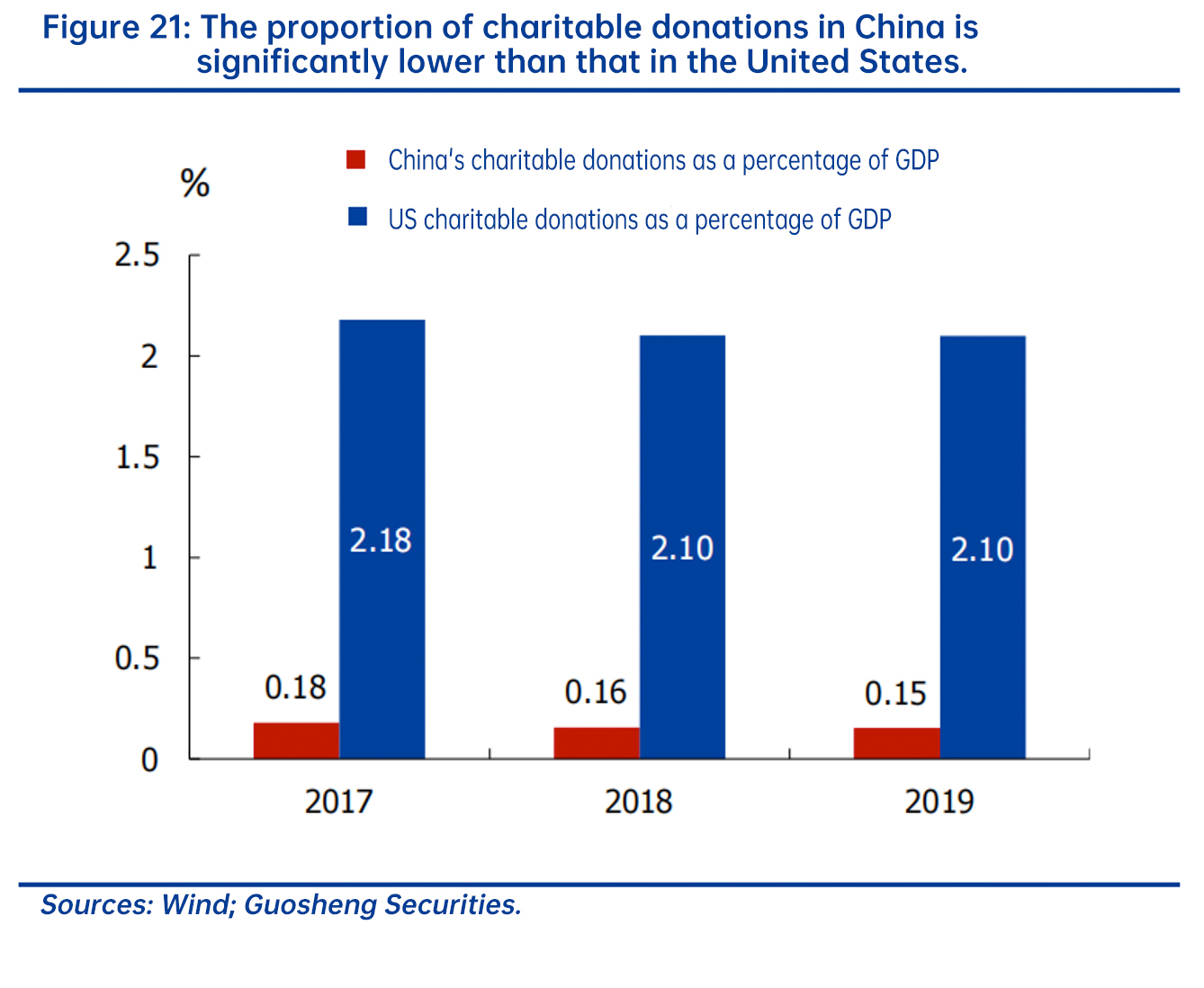

The third distribution is based on voluntary redistribution of wealth, which is a useful supplement to traditional adjustment measures. However, the scale and proportion of charitable donations in China are significantly lower than those in developed countries such as the United States, and there is huge room for future development of charity. According to the Report on China’s Charitable Donations in 2019 issued by the China Charity Federation, China's charitable donations in 2019 amounted to approximately 150.9 billion yuan, accounting for only 0.15% of GDP. According to Giving USA 2020: The Annual Report on Philanthropy for the Year 2019 issued by the Giving USA Foundation, charitable donations in the US in 2019 amounted to approximately US$449.6 billion, accounting for 2.1% of US GDP. The amount and proportion of US charitable donations in 2019 were 19 times and 14 times of that of China.

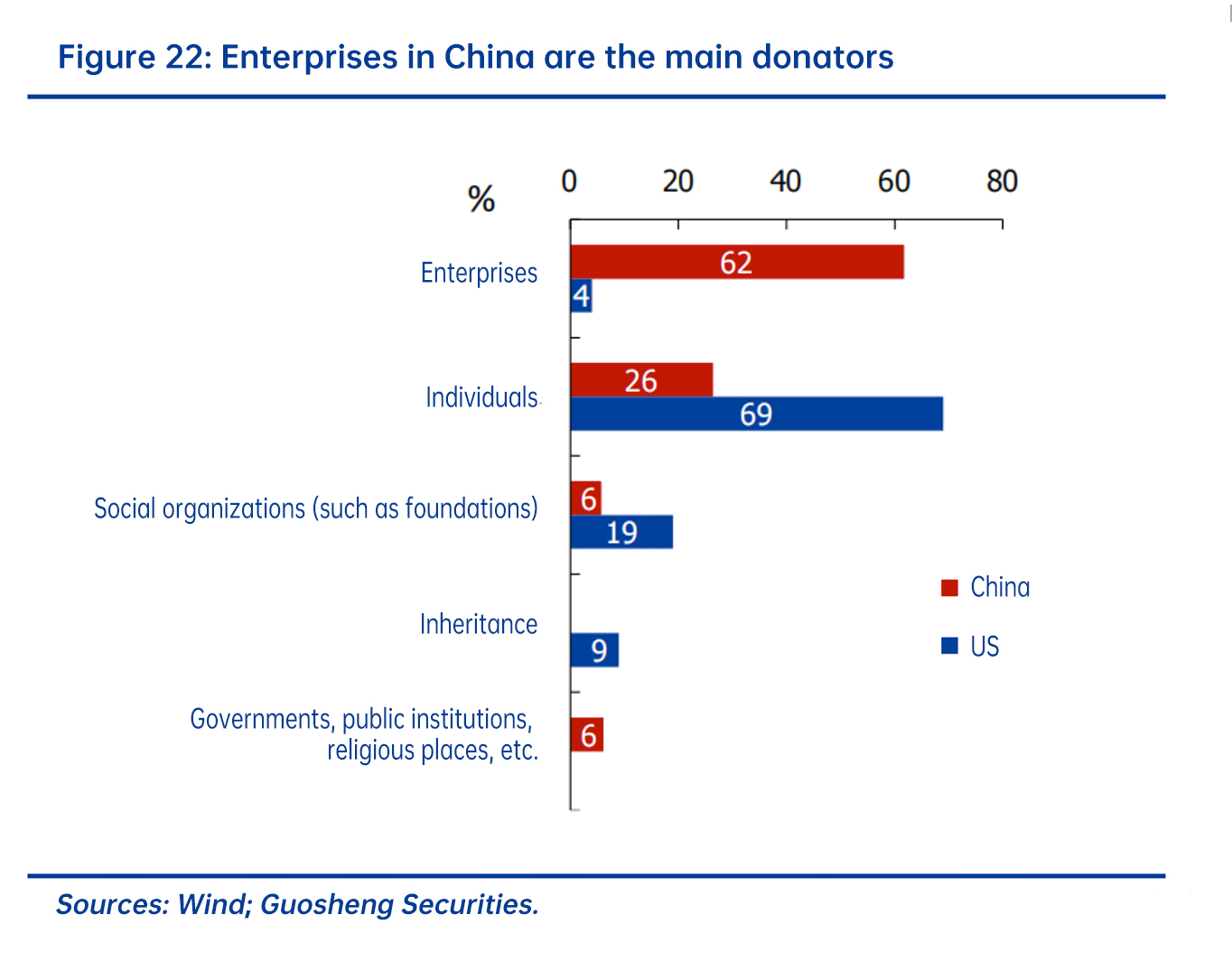

China’s corporate donations account for 60% of charitable donations, while individual donations have a relatively small proportion. From a structural point of view, Chinese enterprises are the main donors, accounting for 61.7% of the total donations, personal donations account for 26.4%, and donations of other sources are very limited. Contrary to China, individuals contribute the main part of donations in the US, accounting for about 69% of the total, while corporate donations only account for 4%. In addition, the proportion of donations from various foundations is as high as 19% in the US.

In terms of specific practices, we can refer to measures set forth in guideline on building Zhejiang into a demonstration zone for achieving common prosperity, including encouraging and guiding high-income groups and entrepreneurs to participate in and initiate social welfare undertakings; opening up channels for all walks of life to participate in charity and social assistance; exploring new means of making donations and encouraging the establishment of charitable trusts; implementing preferential tax policies for charitable donations, and improving the charity reward system. In addition, the supporting tax system needs to be improved urgently. The current charity-related incentive system still needs to be improved. For example, the lack of inheritance tax and gift tax, and the low income tax deduction ratio is not conducive to motivating wealthy people to donate. China’s current tax law stipulates that personal donation tax credit is up to 30% of the individual’s annual taxable income and cannot be carried forward. In the United States, the ratio is up to 50% and can be deferred for 5 years.

III. GOALS FOR COMMON PROSPERITY: ZHEJIANG GOALS, WITH THREE MAIN FEATURES, COULD SERVE AS A REFERENCE

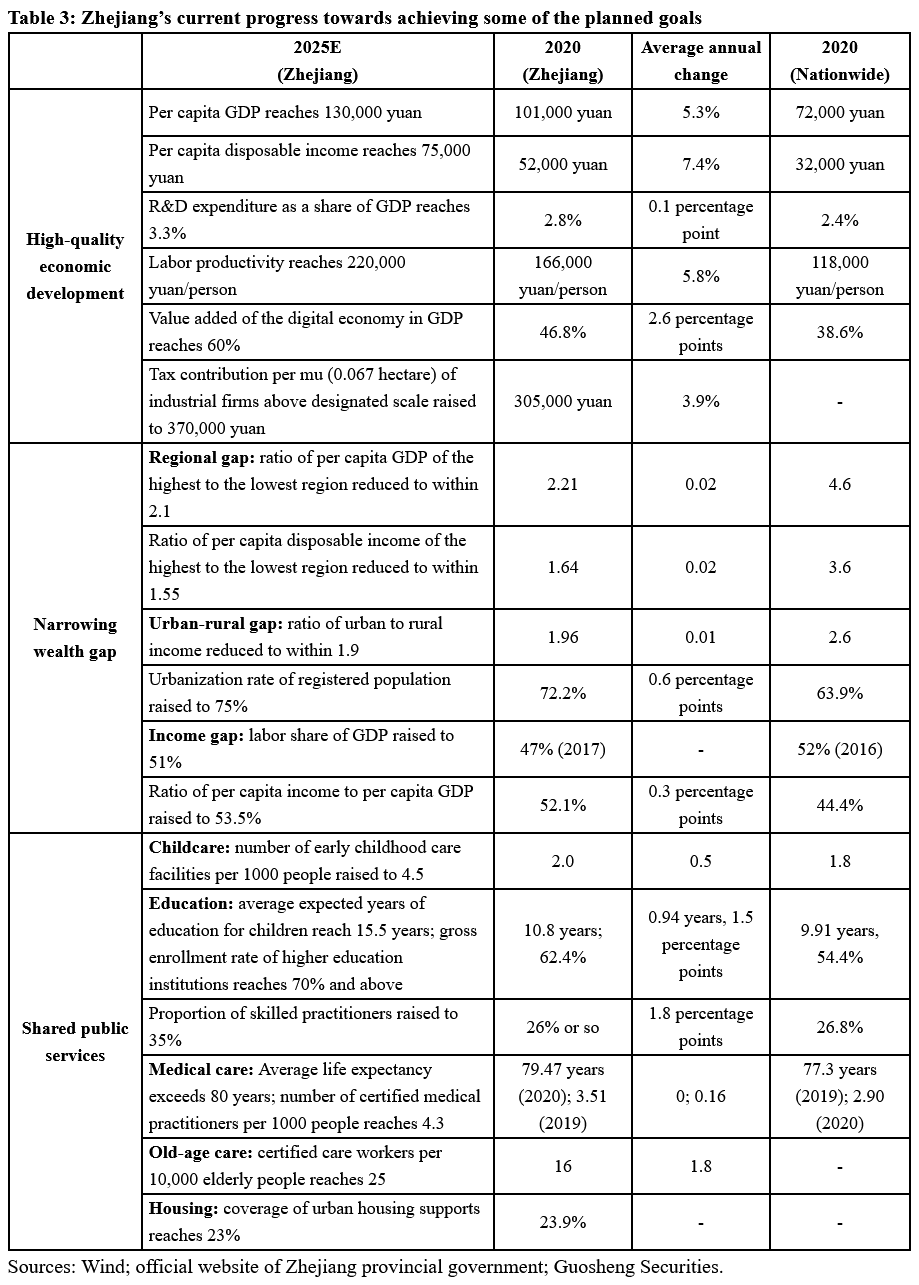

It’s expected that China will set quantitative goals for achieving common prosperity. Each province has its own targets, and those of Zhejiang, though higher than the nationwide target level, could serve as an important reference. China has proposed in the 2021 Government Work Report to adopt an action plan to promote common prosperity which is expected to come out in the next few months. In July 2021, Zhejiang Province released the plan for 2021-2025 to establish a common prosperity demonstration zone, which sets forth over 30 indicators in a total of 6 areas: economic development, wealth gap, public service, culture, ecology, and social harmony. The plan serves well as a reference for the design of the nationwide action plan.

Zhejiang’s quantitative goals for common prosperity have three main features:

First, the goals for economic development are moderate at a level slightly below that during the 13th FYP period. Based on targets set in the Zhejiang plan, the composite average growth in per capita GDP and disposable income in Zhejiang during the 14th FYP period are estimated to be 5.3% and 7.4% respectively, while the numbers were 5.3% and 8.1% during the 13th FYP period. Given that registered Zhejiang population increased remarkably after the 7th national population census and thus led to a significant downward revision in the per capita data for 2020, the actual composite growth in per capita GDP and disposable income in the 13th FYP period should have been even higher. From this, it’s clear that Zhejiang’s goals for economic development for the 14th FYP period are moderate and not difficult to realize. To be specific, the goal for growth in household income is higher than that for GDP growth, which shows the country’s growing focus on improving the weight of wage payment in primary distribution.

Second, the goals for narrowing the wealth gap are obviously too conservative, most of which are not much different from the 2020 levels. According to the Zhejiang plan, the province plans to bring down the gap between the best- and worst-paid groups in terms of per capita GDP and per capita disposable income to no higher than 2.1 and 1.55 times, and reduce the income gap between urban and rural households to no higher than 1.9 times. But the gaps in 2020 were 2.21 times, 1.64 times and 1.96 times respectively (4.6, 3.6 and 2.6 nationwide), which were already quite close to the new targets. Other indicators like labor share of GDP and the ratio of per capita income to per capita GDP were also close to the 2020 level.

Third, goals for public service are obviously proactive, most of them much higher than in 2020. The Zhejiang plan pledges to increase early childhood care facility resource per 1000 people to 4.5 by 2025 (2.0 in 2020), and the number of certified medical practitioners per 1000 to 4.3 (3.5 in 2019), both of which are much higher than the current basis. Education-wise, the plan requires that by 2025 the average expected years of education for children increase to 15.5 years, which is much higher than the nationwide target of 11.3 years. Realizing the target will require putting all eligible children in schools including high schools and institutions for higher education.

IV. IMPLICATIONS OF COMMON PROSPERITY: BOOST CONSUMER SPENDING AND INVESTMENT IN LIVELIHOOD-RELATED SECTORS, WHILE SOME OF THE OTHER SECTORS COULD BE UNDER BLOW

1. Overall implications

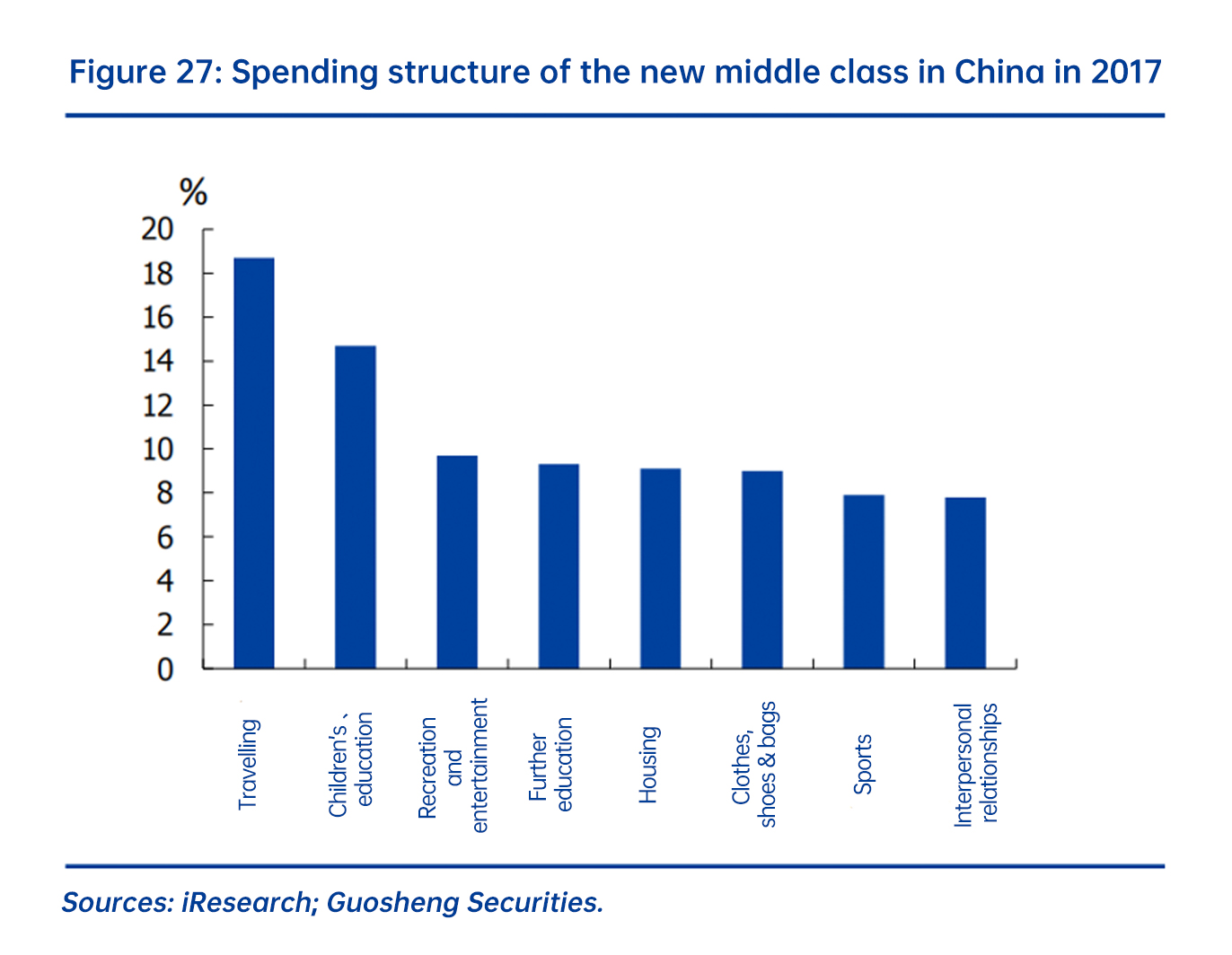

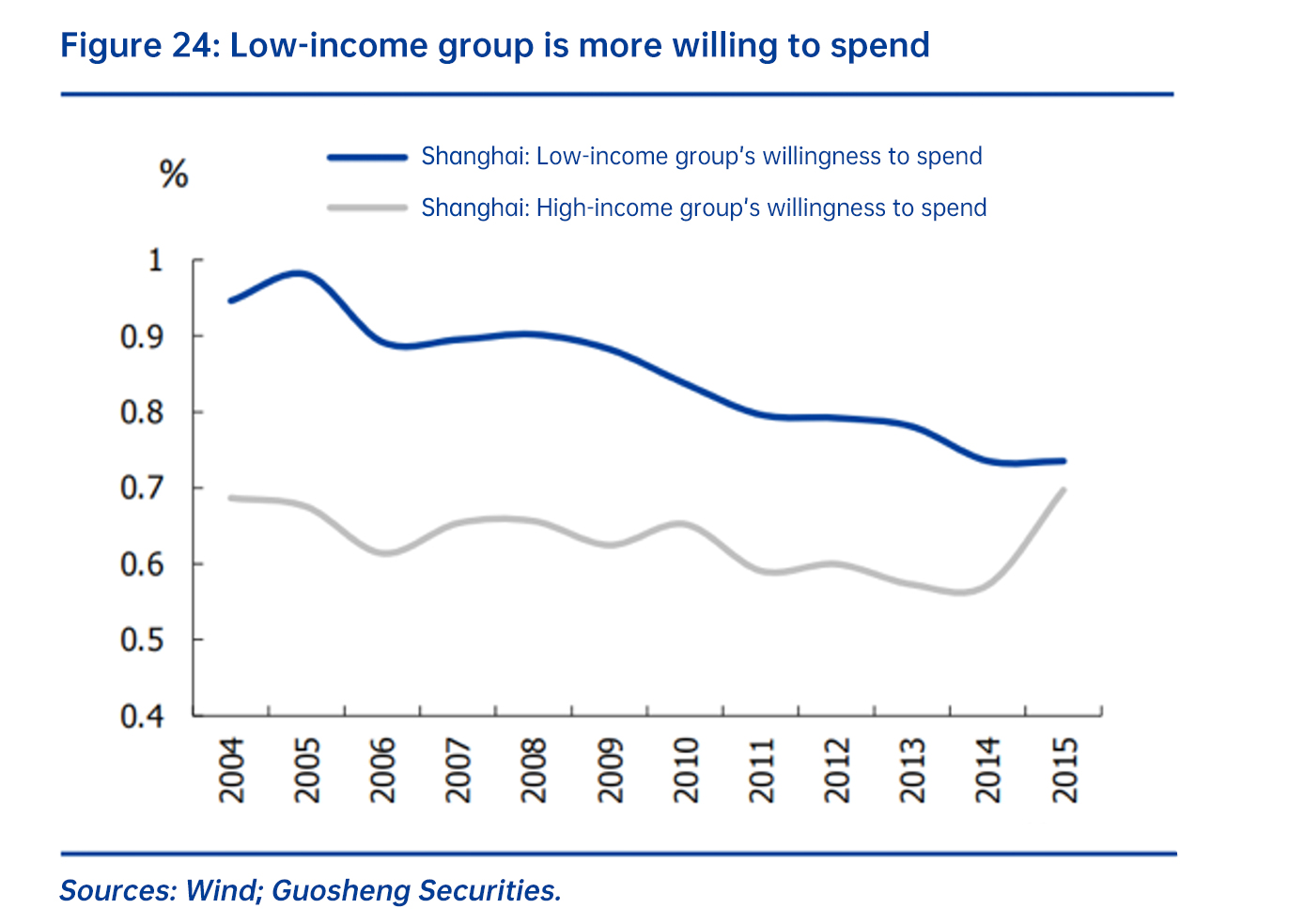

CONSUMER SPENDING: In the mid to long term, efforts toward common prosperity could help enlarge the middle-income group and boost consumer spending. According to the standard by the National Bureau of Statistics of China, a family of three should have an annual income of 100,000 to 500,000 yuan to be listed as a middle-income family. The corresponding per capita income is 33,000-167,000 yuan. In 2019, the Bureau said that back in 2017, the number of middle-income people in China has exceeded 400 million, or about 140 million families, accounting for 30% of the total population. That’s pretty far from the desirable olive-shaped income distribution structure where the middle-income group accounts for 60-70%. Data show that the low-income group is much more willing to spend than high-income group. Efforts toward common prosperity could help close the wealth gap, put more people in the middle-income rank, and thus boost consumer spending across the board.

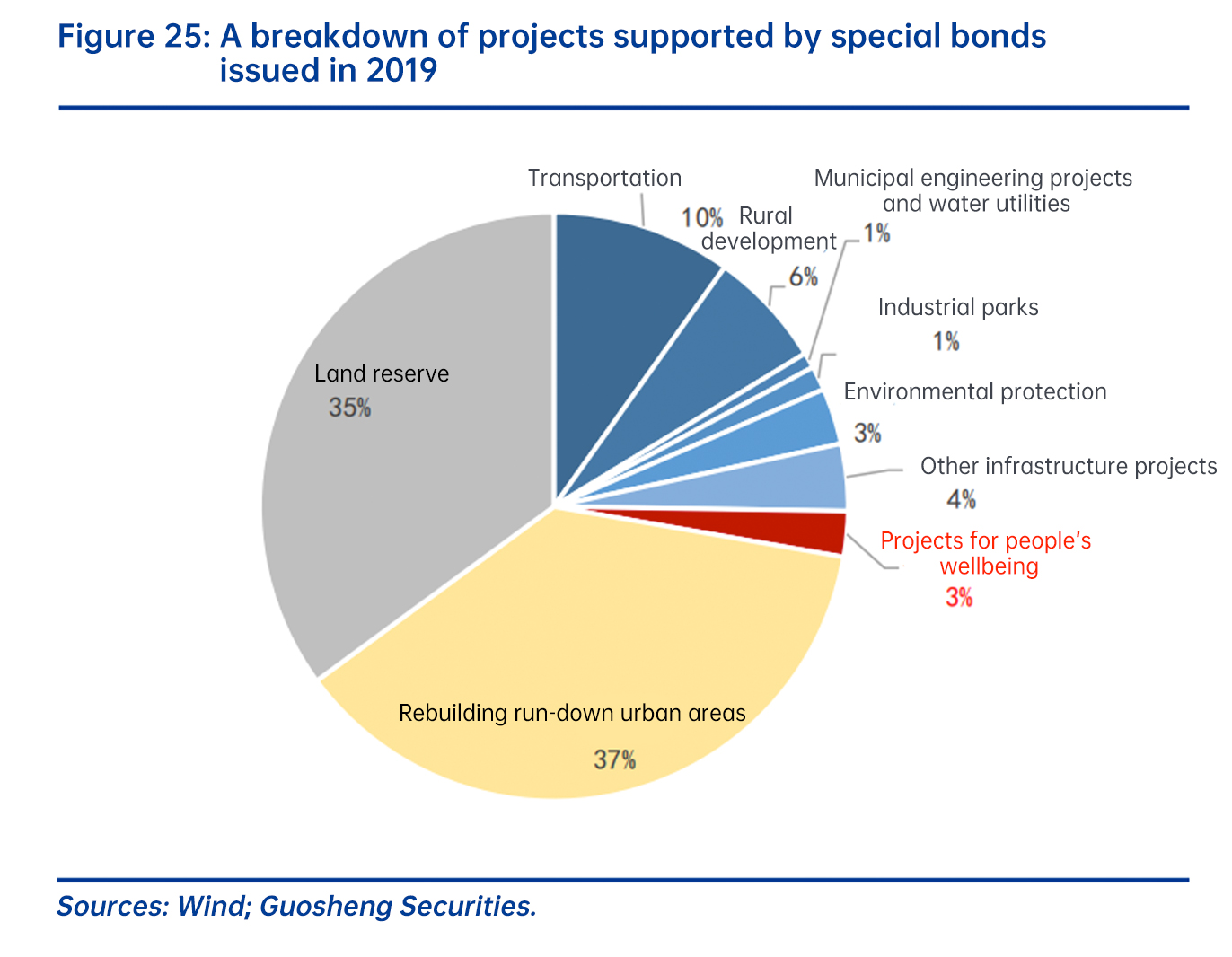

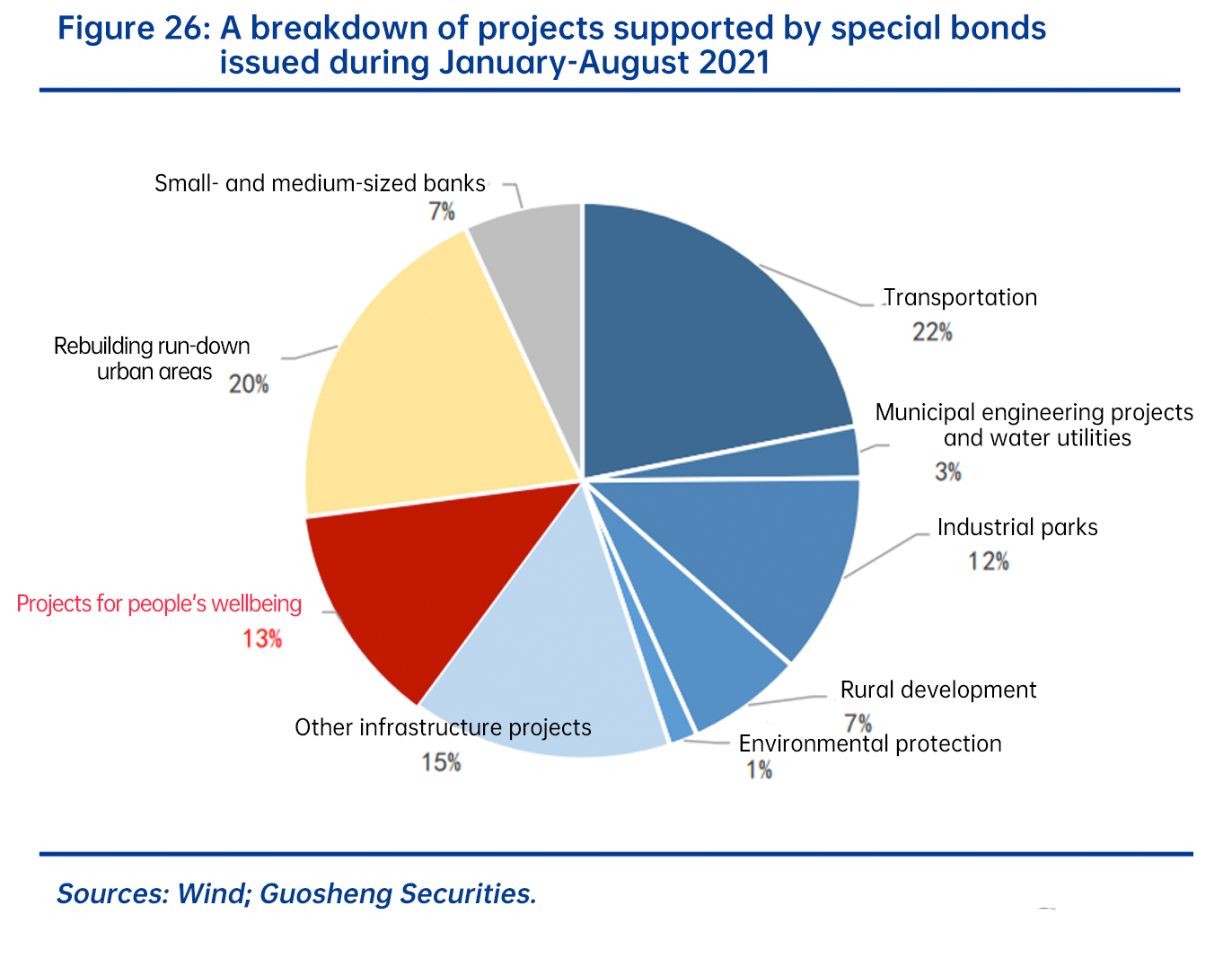

INVESTMENT: To achieve common prosperity, more investments should be directed to areas related to people’s wellbeing. Public services in these areas including housing, healthcare and education remain underdeveloped. This is an important direction of effort in China’s endeavor toward common prosperity. Many moves are underway: the 2021 Government Work Report says that “government investment will be weighted toward projects which will help significantly improve the people’s wellbeing”, and among all goals set forth in Zhejiang’s plan, those on public services are also the most proactive ones; regarding special bonds, during January-August, 2021, about 13% of the special bonds issued went to areas related to people’s wellbeing including rebuilding run-down areas, medical care and education, while back in 2019 the proportion was only 3%.

2. Sector-specific implications

Two types of sectors are facing increasing regulatory pressure at the moment:

First, sectors related to people’s basic livelihoods, such as education, medical care and real estates. The focus of regulation over these sectors is to curb excessive liberalization and facilitate equal access to basic public services, in order to reduce the cost of living and promote common prosperity.

Second, sectors with rampant capital expansion, such as internet platforms and the media industry. Regulations over these sectors are multi-pronged, including antitrust moves, standardizing their development and narrowing the income gap, etc.

Going forward, under the common prosperity goal, some of the sectors will enjoy more opportunities while others, face greater risks and uncertainties.

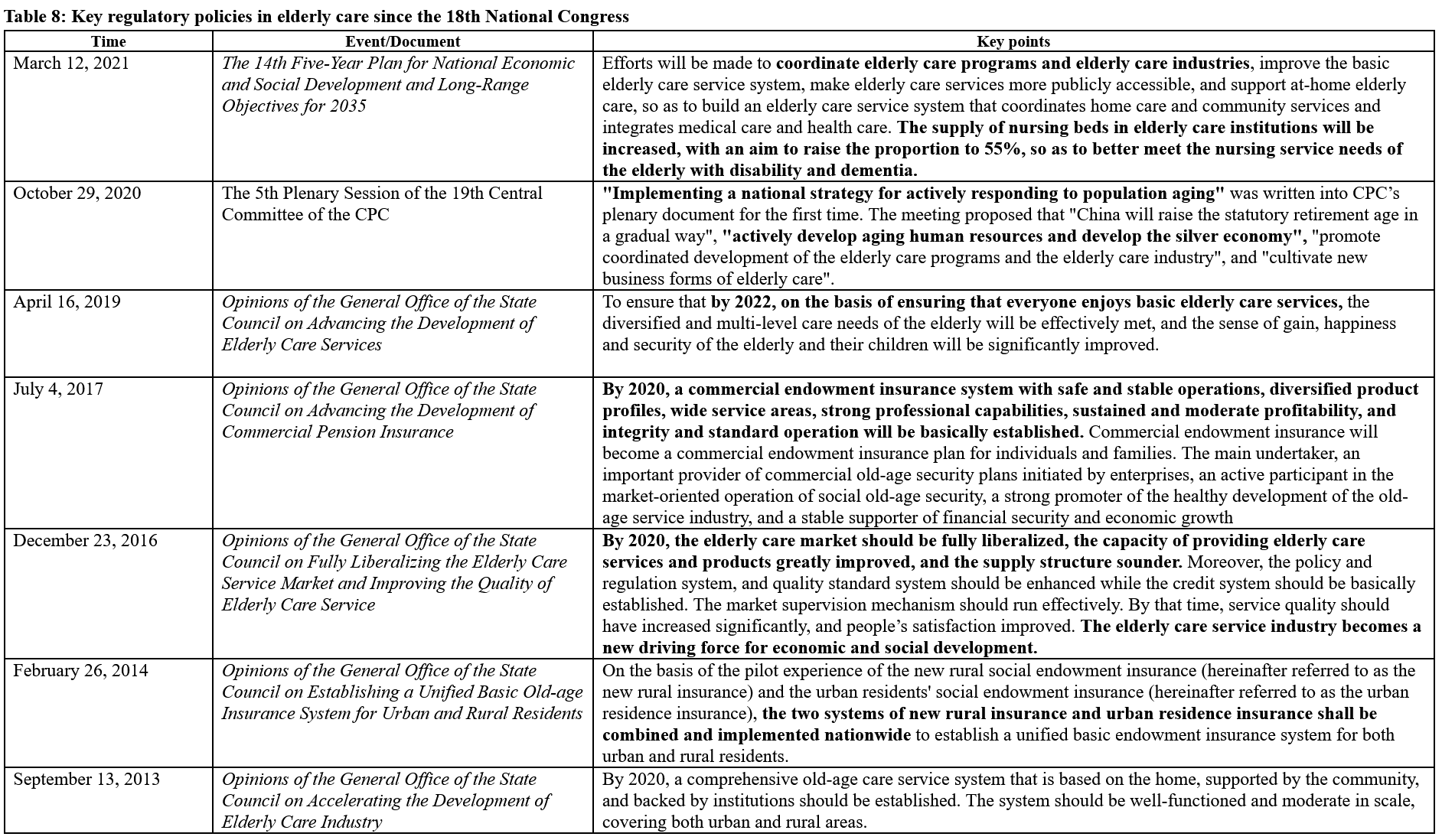

There are mainly two opportunities: 1) Policy supports for some of the underdeveloped sectors could increase. The Zhejiang Plan has placed much emphasis on enhancing public services, and policy supports are expected to tilt toward childcare, old-age care, vocational education and other sectors that have yet to fully develop; and as said above, given the low property income of households, financial institutions will enjoy great possibilities in expanding their wealth management business. 2) Expansion of the middle-income group will boost upgrade of the consumption structure: as China presses ahead toward common prosperity, the scale and weight of the middle-income group will grow, and consumer preference may change accordingly. For example, people may prefer to live a healthier and greener life, spend more on services such as culture and travel, and attach greater importance to product quality.

And there are two types of risks and uncertainties too: 1) Some of the sectors could face further regulatory reforms, such as the medical industry and especially drug procurement; in the real estate sector, school district housing and property agencies would be subject to more restrictions, and the introduction of property tax is picking up pace; and internet platforms could come under stronger supervision in terms of flexible employment and data management. 2) Some of the sectors with exceptionally high profitability could face stronger regulation, such as luxury goods and high-end liquors.