Abstract: Amid steady economic recovery, China witnessed a high revenue growth and a low expenditure growth in H1 2021. This has its positive impact as it expands fiscal space and enhances the sustainability of fiscal policy, allowing long-term considerations to be taken into account in fiscal operations. Moving forward, to cope with structural difficulties and downward pressure, policymakers should fully leverage the fiscal space to boost infrastructure investment and alleviate the plight faced by SMEs.

In the first half of 2021, China's national general public budget revenue rose 21.8% year on year, reaching 11.71 trillion yuan ($1.80 trillion), whereas expenditure saw an increase of 4.5%, reaching 12.2 trillion yuan ($1.88 trillion), the Ministry of Finance said on July 20. Amid steady economic recovery, China witnessed a forecast-beating fiscal revenue growth and a moderate expenditure growth in H1 2021.

Nationwide fiscal revenue grew significantly faster than expenditure and outpaced the latter in terms of budget completion. At the local level, 28 provinces achieved positive two-year compound annual growth rate (CAGR) in their revenues, and 13 saw negative CAGR in expenditure.

The growth rate gap allows for more flexibility and sustainability of fiscal policy, which could help the government to duly perform its function and relieve fiscal risks. It has also caused the fiscal policy to tighten marginally.

How to understand high revenue growth and slow expenditure growth in H1 2021? What factors drove this outcome? To cope with structural difficulties and downward pressure, what kind of fiscal policy actions should China take next to make full use of the additional fiscal space to expand domestic demand on top of the monetary policy moves? Based on the fiscal and national economic data in 1H21, we make the following observations.

I. Fiscal revenue outpaced expenditure at both national and local levels.

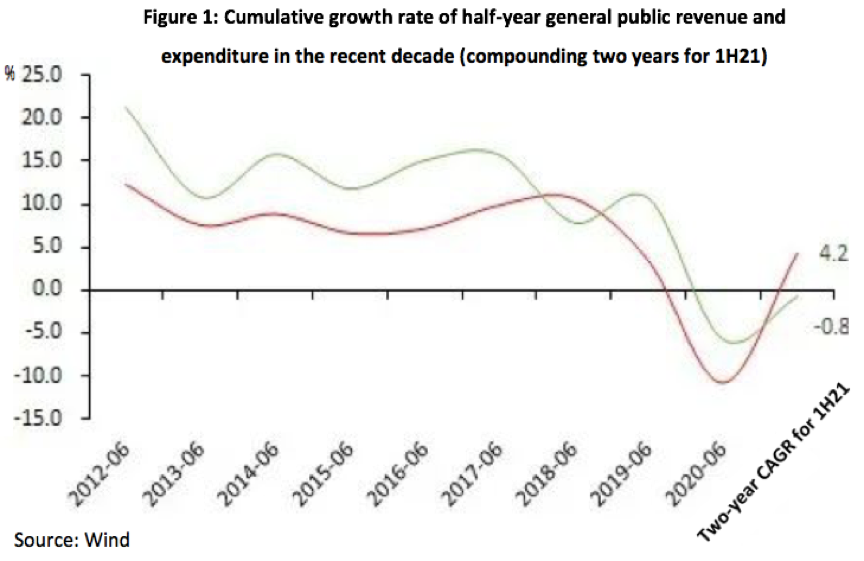

First, in H1 2021, the two-year CAGR of general public budget revenue (4.2%) is five percentage points higher than that of the expenditure (-0.8%), as shown in Figure 1. The growth rate of revenue has surpassed that of the same period in 2019 (3.4%), while expenditure slid. This is quite unusual.

If we look at the cumulative growth rate of half-year general public budget revenue and expenditure in the recent decade (Figure 1), expenditure had never grown slower than revenue before 2021 except in 2018.

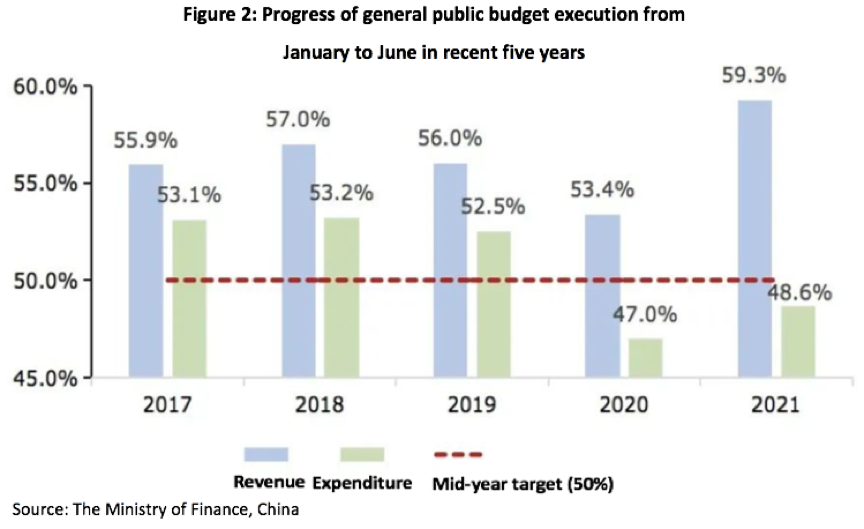

Besides, the fiscal revenue is far closer to budgetary completion than expenditure. Figure 2 shows that 59.3% of the revenue plan was achieved in 1H21, outpacing the mid-year target (50%) by 9.3 percentage points, faster than in any previous four years.

On the spending side, however, only 48.6% of the planned budget is completed, falling short of the mid-year target by 1.4 percentage points, slower than in any previous five years (except for the 47% in 2020, but the slow execution of the budget plan in 2020 due to the delay of “Two Sessions” should also be taken into account).

The rate of completion for expenditure is 10.6% lower than revenue, the largest gap in five years, echoing the abovementioned growth rate gap.

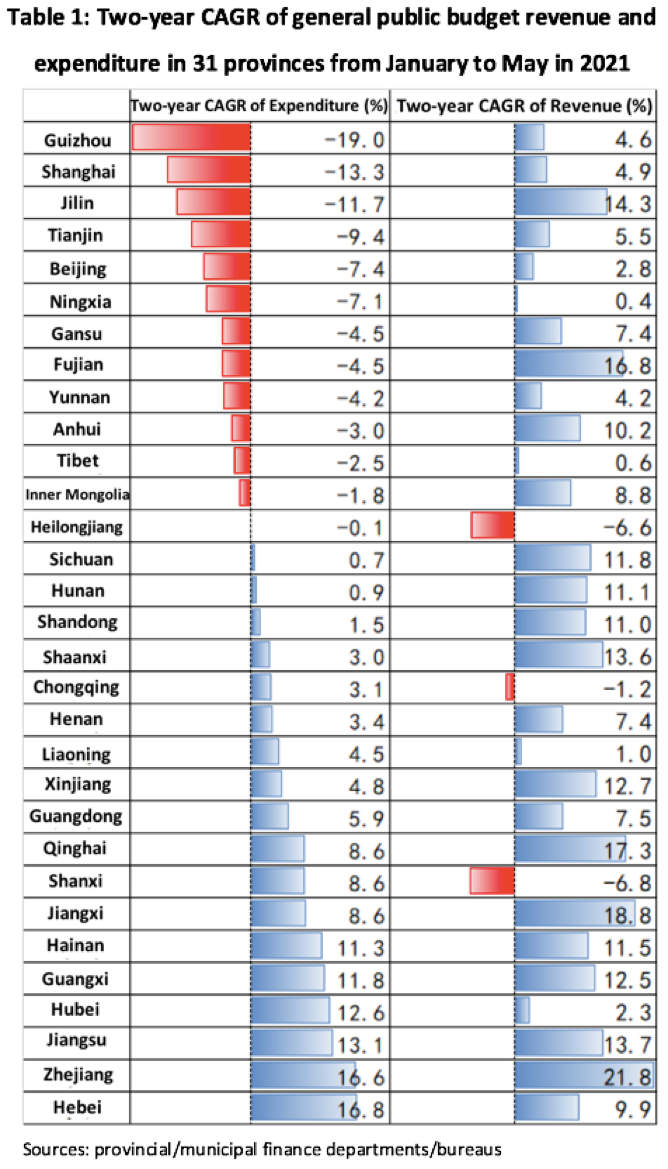

Local fiscal revenue also outpaced expenditure in 1H21. Table 1 shows the rarity that 13 out of 31 provinces recorded negative two-year CAGR in general public budget expenditure, with the top 5 declines in Guizhou (-19.0%), Shanghai (-13.3%), Jilin (-11.7%), Tianjin (-9.4%), and Beijing (-7.4%). At the same time, the 13 provinces all achieved positive two-year CAGR in revenue.

Apart from Shanxi (-6.8%). Heilongjiang (-6.6%), and Chongqing (-1.2), the rest of the 31 provinces all achieved positive two-year CAGR in revenue, 14 of which over 10%.

II. What do we know from this growth gap?

1. Change of basic tone: risk prevention requires fiscal space

Revenue growth didn’t just outperform expenditure growth overnight; it’s been reflected in the 2020 budget execution and 2021 budget plans.

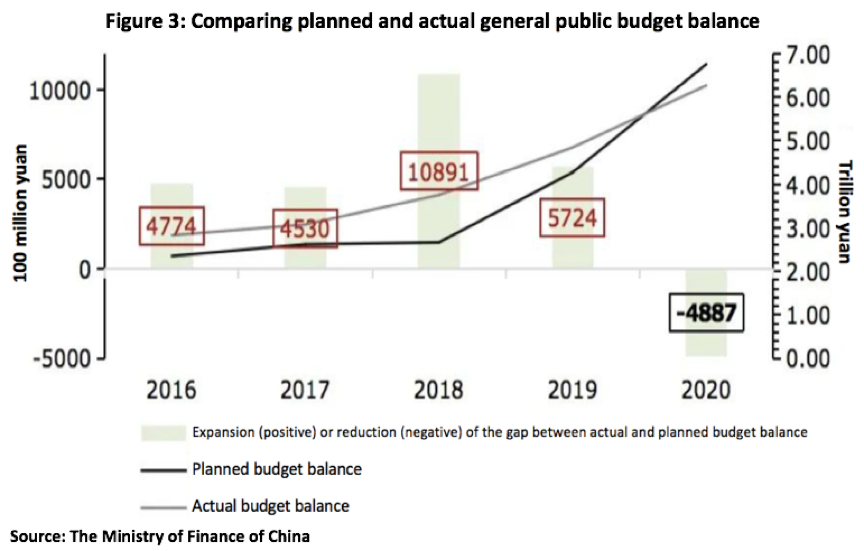

It should be rare if it happened before 2020. The actual gap between revenue and expenditure was larger than planned from 2016 to 2019 (Figure 3), but 2020 witnessed a shift.

The 2020 general public budget expected a 6.76 trillion-yuan gap, but ended up with “saving” 488.7 billion yuan, a result of the 262.5 billion extra revenue and the 226.2 billion underspending across the year. When planning for 2021 budget, the growth rate of the general public budget revenue (8.1%) was set higher than the expenditure goal (1.8%).

On the roots of the phenomenon extended from 2020 budget execution, it should be first considered that the goal of fiscal policy may have shifted from securing steady growth to risk prevention.

Considering that China no longer sets specific goals for GDP growth and given the urgency of dealing with latent debt risks arising from early measures to support local development and China’s leading role in the global recovery, risk prevention might have been prioritized in the targets of fiscal policy. The higher revenue growth and lower expenditure growth feature is reinforced by waning constraints from GDP targets, which in theory could leave margin for fiscal risk prevention.

2. Impact from persistent factors: suspension of massive tax and fee cuts and reduction in infrastructure expenditure

Fiscal policy in China has experienced two major reorientations recently: on the revenue end, tax and fee reductions are gradually phased out with increasing emphasis on stabilizing the macro tax burden; on the expenditure end, supporting people’s livelihood is replacing infrastructure as the focus of fiscal spending. Both will change the fiscal landscape featuring high revenue and low expenditure.

On one hand, China has suspended the tax and fee reduction drive which had prevailed for years, and reoriented toward stabilizing the macro tax burden.

During the 13th Five-Year Plan period, China cut down taxes and fees by over 7.6 trillion yuan, which remarkably reduced the macro tax burden and helped leash the vitality of market entities, especially small- and micro-sized ones. However, during economic downturns, this endeavor placed huge strains on fiscal revenue, and will likely be paused at least for the time being. The budget execution report issued by the Ministry of Finance of China in March 2021 did not specify any target for tax and fee reductions, the first time since 2016, which clearly reflected the policy shift.

On March 23, 2021, Han Zheng, Vice Premiere of China, presented in his speech at the Chinese Academy of Fiscal Sciences the idea to “stabilize the macro tax burden”, which marked a reorientation of fiscal policy since the meeting of the Political Bureau of the CPC Central Committee in July 2016 when policymakers proposed to “reduce the macro tax burden”.

At a State Council press conference on accelerating the establishment of a modern fiscal and taxation system in China on April 7, 2021, the Ministry of Finance said that it would strive to “stabilize the macro tax burden” in support of the goals for the 14th Five-Year Plan period, and that it was important to balance “short-term and long-term goals” as well as “needs and possibilities” in tax and fee cuts, and phase out tax and fee reductions carried out in 2020 in an orderly manner. The suspension in the cuts is an important basis for revenue growth.

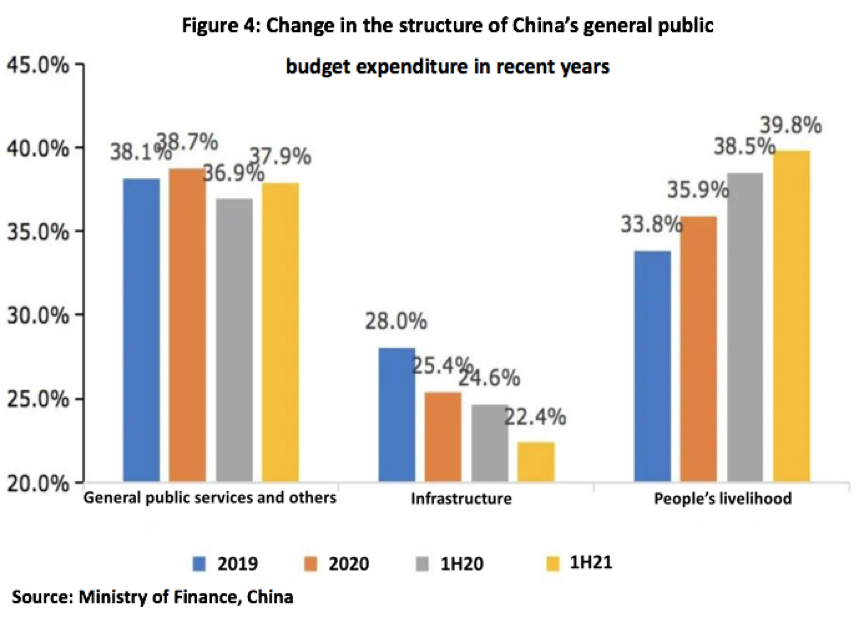

On the other hand, fiscal expenditure is tilting toward people’s livelihood from infrastructure, which now takes a much lower proportion in total government spending. At the same time, the aggregate scale of fiscal expenditure is also on the decline. As shown in Figure 4, in the first half of 2019, 2020 and 2021, infrastructure-related expenditures including those on energy saving and environmental protection, urban and rural community development, agriculture, forestry, water conservation, as well as transportation stood at 28.0%, 25.4% and 22.4% respectively, displaying a downward trend. In 1H21, infrastructure-related expenditure in the general public budget was 2.72 trillion yuan, 147.7 billion yuan short of 1H20 with an accumulated drop of 5.1%.

3. Impact from transitory factors: Commodity price hike and strong export

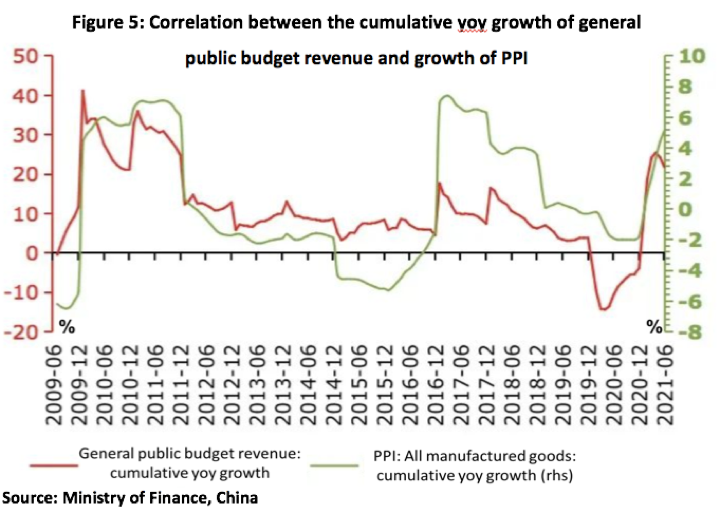

Indirect taxes such as value-added tax, which are taxed on the basis of sales revenue, take up a high proportion in China’s taxation system. The rise in commodity prices since 1H20 has further boosted China’s fiscal revenue. As seen in Figure 5, growth in general public budget revenue is to a certain extent correlated to the growth in PPI. The price hike of upstream industrial products has clearly added to fiscal revenue.

At the same time, since the outbreak of the pandemic, China’s export has maintained strong momentum and played an important role in sustaining economic growth. This has relieved the pressure to use government spending to boost the economy and thus helped maintained prudence in fiscal expenditure.

However, China’s strong export had to do with the fact that the impact of COVID-19 is different among countries: bearing the brunt of the blow was demand in China, but supply in most advanced economies, and this has greatly increased the share of supply from China in the global market. But situation has now changed.

Reopening of advanced economies is led by strong recovery in service consumption, and this could impair the momentum of China’s export growth. During April and June 2021, PMI sub-index for new export orders saw continuous month-on-month decline.

Considering all factors affecting China’s fiscal balance, the above-mentioned policy reorientations will have lasting impacts, and as a result China’s fiscal account could continue to see high revenue growth and slow expenditure growth. But such fiscal status may not be sustainable considering the marginally weakening momentum of China’s export and the transitory nature of the commodity price hike.

III. Fiscal policy can play a greater role under the current situation

Current fiscal situation featuring high revenue growth and slow expenditure growth has positive impacts as it expands fiscal space and enhances the sustainability of fiscal policy, allowing long-term considerations to be taken into account in fiscal operations. As the foundation and important pillar of national governance, public finance relies on sufficient and sustained revenue to support various government functions. Moreover, given the accumulation of fiscal risks, especially the latent debt risks of local governments, maintaining a prudent expenditure policy is essential to resolve fiscal risks.

However, in the short term, considering the downward pressure and structural problems, fiscal policy should play a greater role in supporting infrastructure investment and responding to structural challenges such as the reduction of profits of mid- and downstream enterprises.

Currently, infrastructure expenditures are declining and infrastructure investment is sluggish. The proportion of infrastructure-related expenditures in the general public budget has been declining year by year, and the scale has continued to grow negatively. Fiscal expenditure is an important source in stimulating investment, and the decline in infrastructure-related expenditure has directly led to sluggish infrastructure investment.

In 1H21, the two-year CAGR of fixed asset investment in the whole society is 4.5%, 0.4 percentage point higher than that of the same period in 2019 before the outbreak of the pandemic. The two-year CAGR of infrastructure-related investment is 2.4%, 2.1 percentage points lower than the growth of fixed asset investment, and 3.4 percentage points lower than the growth of infrastructure investment in the same period in 2019, indicating a slower recovery. The monthly year-on-year growth of infrastructure investment in May and June may have even turned negative.

The increase in commodity prices has contributed to the high fiscal revenue and restored the overall profitability of the industrial sector. However, it also slashed profits and caused operational difficulties among small and medium-sized enterprises (SMEs). Along the supply chain, rising prices of industrial materials can increase the profit margins of upstream companies with strong bargaining powers, but significantly squeeze the profits of downstream companies who often find it difficult to pass down the increased costs to end users.

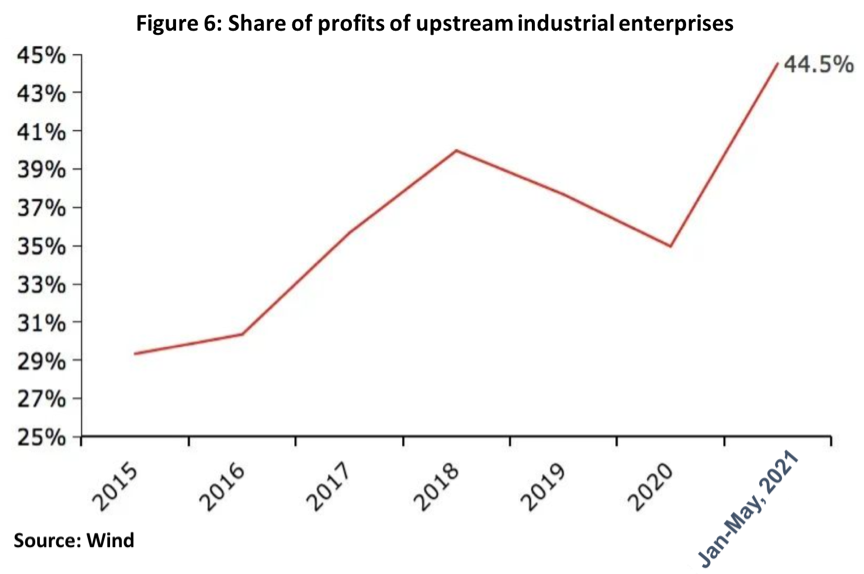

According to the classification of up-, mid- and downstream enterprises compiled by the Shanghai Stock Exchange, we can compute the proportion of profits of various industrial enterprises above designated scale. Among industrial enterprises, the share of the profits of upstream enterprises has risen significantly since 2016, despite a slight dip in 2019, and further jumped to 44.5% from January to May 2021 (Figure 6).

According to the above-mentioned classification, the upstream industries only include mining, production and supply of electricity, heat and water, metal smelting and basic chemical products. In contrast, there are more than 20 downstream sub-industries, but the profit share of these industries has dropped significantly in 2021.

Mid- and downstream industries are mainly composed of SMEs which play a significant role in creating jobs. The employment situation can materially affect the recovery of consumption through income. It is necessary to make targeted policy arrangements to alleviate difficulties faced by SMEs.

On the whole, it is essential to strengthen the coordination of fiscal and monetary policies to stabilize economic growth and alleviate the plight faced by SMEs.

In the context of weakening momentum in the export sector and feeble domestic consumption, investment must play a key role to sustain economic growth. In particular, infrastructure investment, which is led by fiscal expenditure, is most indispensable. At the same time, while the existing value-added tax system can hardly help reduce businesses’ burden, we should utilize the advantages of fiscal measures in solving structural problems and provide targeted income tax breaks to SMEs.

Monetary policy can focus more on total volume control: firstly, to maintain a loose policy environment with low interest rates and mitigate the crowding-out effect caused by government investment; secondly, to provide liquidity support for market entities and reduce financing costs. At present, the monetary policy has played its role through measures such as a comprehensive RRR cut. As the fiscal space has expanded, fiscal policy should also play a bigger role in the future.

Download PDF