Abstract: In this paper, the author provided an in-depth analysis of China’s “dual circulation” development pattern from a historical perspective by reviewing the history of the Chinese economy since the reform and opening-up in the 1970s and discussed the adjustment China’s development strategies over the past four decades.

On July 30, 2020, China’s central leadership put forward a new development pattern with domestic circulation as main body and domestic and international markets reinforcing each other, known as the “dual circulation” strategy. We could understand “dual circulation” from different perspectives and dimensions. I myself prefer to see the proposal of “dual circulation” as an adjustment of development strategy. Before the reform and opening-up, China had implemented an independent and self-reliant development strategy. After the reform and opening-up, China began to implement an export-oriented development strategy which had two main characteristics: vigorously promote processing trade and aggressively attract foreign direct investment (FDI).

I. The “great international circulation” and an economy in need of foreign exchange

To understand the concept of “dual circulation”, it is necessary to review the history of China’s reform and opening-up.

In late 1970s and early 1980s, the shortage of foreign exchange was the most prominent bottleneck to China's economic development. First, while China wanted to introduce advanced devices from foreign economies, it did not have enough foreign exchange reserves which were only $167 million in 1978. Second, while China wanted to actively participate in global division of labor and conduct international trade to take advantage of its comparative advantage, it found it hard to start without enough foreign exchange reserves. Countries rich in natural resources, like Saudi Arabia, could export oil. They earned foreign exchanges by exporting primary commodities. By both importing and exporting, their trade expanded. Although China was rich in rare earths and endowed with some oil, overall it was a country poor in resource. China had a strong industrial manufacturing capacity, especially possessing a large, low-cost and skilled labor force. China should export labor-intensive products based on its comparative advantage. However, China did not have knowledge about overseas markets, nor did it have design drawings, necessary raw materials, and intermediate products. Therefore, it failed to produce manufactured goods that could meet the demand in overseas markets, and could only export agricultural and sideline products and a few manufactured goods. Of course, China could neither earn enough foreign exchanges without being able to export large number of manufactured goods. But without foreign exchanges, it was impossible to buy the design drawings, raw materials and intermediate goods needed to expand exports. It was a catch-22 situation.

In February 1978, China and Japan signed an agreement under which Japan exported technology and equipment to China in exchange for oil. In December 1978, China National Technical Import and Export Corporation and Nippon Steel Corporation signed an agreement regarding ordering equipment for Shanghai Baoshan Iron and Steel Corporation. In 1985, the first phase project of Baosteel was completed and put into operation, with a total investment of $8.5 billion. Between 1978 and 1985, China exported oil and coal to Japan worth a total of $10 billion to Japan. In 1978, foreign exchange reserves were less than $200 million. In 1979, China's exports totaled $13.7 billion.

China experienced trade deficit from 1979 to 1989 except for two years. A shortage of foreign exchanges prevented China from importing advanced equipment and technology from foreign countries.

In the event, China was lucky. OEM (original equipment manufacturer) emerged in East Asian countries and regions in the 1970s or even earlier. China's reform and opening up coincided with the peak of OEM. In the late 70s and early 80s, businesses specialized in PMACT (i.e. processing with supplied materials, manufacturing with supplied drawings and samples, assembling with supplied parts and compensation trade) emerged in China’s coastal areas like Guangdong. The biggest characteristic of such kind of business was that enterprises didn’t need to pay foreign exchanges to buy raw materials and intermediate products; instead, foreign suppliers provided design drawings, technology, raw materials, intermediate products and sales, while Chinese company only were responsible for processing. Such a trading method helped China deal with the problem of not being able to carry out large-scale foreign trade due to the shortage of foreign exchange reserves. By processing with materials supplied by foreign companies, China could earn foreign exchanges from the value added in export.

With the development of the PMACT, China’s foreign exchange reserves began to increase. China’s foreign trade then further updated into processing with imported materials from processing with materials supplied by foreign suppliers. In the case of "processing with imported materials", raw materials and intermediate products were purchased by the Chinese enterprises with foreign exchange, which was the main difference from "processing with supplied materials". Foreign companies who supplied raw materials and Chinese products were not necessarily buyers of Chinese exports.

Foreign trade can be divided into general trade and processing trade. The so-called processing trade refers to a trade mode in which domestic exporters process and assemble the raw materials, materials or parts imported directly or provided by importers into finished industrial products by making use of domestic labor resources, and then export to foreign countries. Both "processing with supplied materials" and "processing with imported materials" are forms of processing trade.

With the development of "processing with supplied materials" and "processing with imported materials", processing trade played an increasingly important role in China's foreign trade. By definition, processing trade must lead to trade surplus. Value-added are created as imported raw materials and intermediate products are processed and assembled before export. Although the volume of general trade was higher than that of processing trade in early years following the reform and opening up, it maintained a trade deficit until 2014. Despite various forms of trade, China's trade surplus was largely contributed by processing trade for a long time.

In 1987, Wang Jian, Secretary General of the China Society of Macroeconomics, put forward the concept of “great international circulation” under which China vigorously promoted large-scale import and export by putting the two ends of production process (the supply of raw materials and the marketing of products) on the world market. It was supported by Deng Xiaoping and Zhao Ziyang, and eventually the central government issued a document on this which became an official strategy of China. Wang Jian then put that the reason he put forward the concept of “great international circulation” was that he found it more difficult to address the lack of foreign exchange reserves than seeking funds for domestic technical transformation. It could be seen that Wang Jian's calling for encouraging large-scale import and export not only concerned processing trade, but also general trade.

In addition to actively developing processing trade, China has also vigorously introduced FDI through the establishment of joint ventures. By the end of 1982, 83 joint ventures had been established with foreign investment of $140 million (Wu Li et al.: Economic History of the People's Republic of China, p702). China once stressed two points when setting up foreign-funded enterprises. First, foreign-funded enterprises must ensure their own foreign exchange balance. Second, their product targeted international market. This was because only through participating in international market competition, could the technical level of enterprises be improved. At the same time, the products of the joint ventures were relatively high in technical content and expensive in price, so they could only be sold abroad due to limited domestic market. In short, a joint venture should earn create foreign exchange for China rather than paying with foreign exchange.

It should be noted that in the 1980s, China also tried to introduce foreign capital by borrowing. In the 1980s, FDI did not play a dominant role. Later, due to factors like the influence of the Latin American debt crisis, the Chinese government finally chose FDI as the main way to attract investment. In contrast, most developing countries chose to borrow from foreign countries.

Whether it was by carrying out foreign trade or establishing joint ventures, a guiding principle of China was to earn foreign exchange. In the 1980s and 1990s, the most popular economic slogan was developing an economy that could yield foreign exchange. Through the development of processing trade and the introduction of FDI, China's foreign exchange reserves increased rapidly from $167 million in 1978 to $105 billion in 1996, exceeding the internationally recognized safe level at that time.

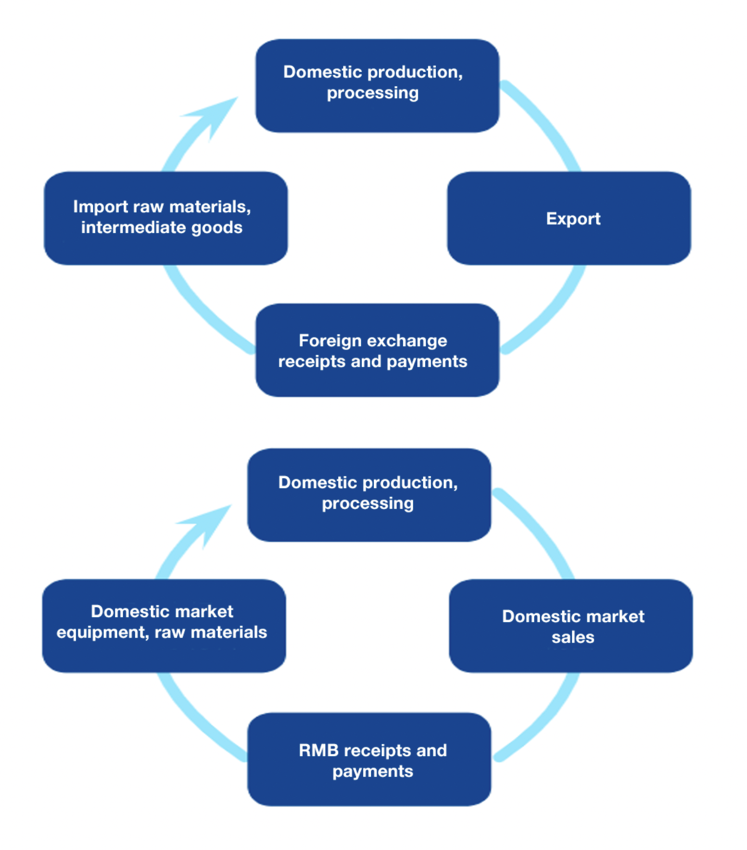

As for “dual circulation”, there must be a sort of loop to form a circulation. The international circulation with the two ends of production process (the supply of raw materials and the marketing of products) in the world market could be simply explained as this: import raw materials and intermediate products; process to export; and then repeat the process with the foreign exchange earned from export. Because processing happened in domestic market, value must be added during circulation, export volume must be greater than import volume, hence creating a net income of foreign exchange. The other circulation that coexists with the international circulation is the domestic circulation in which raw materials and intermediate products are purchased, processed and sold in domestic market. To some extent, China's economy can be seen as a combination of these two circulations (Figure 1).

Figure 1: International-domestic dual circulation

Sources: The author and Yan Bin

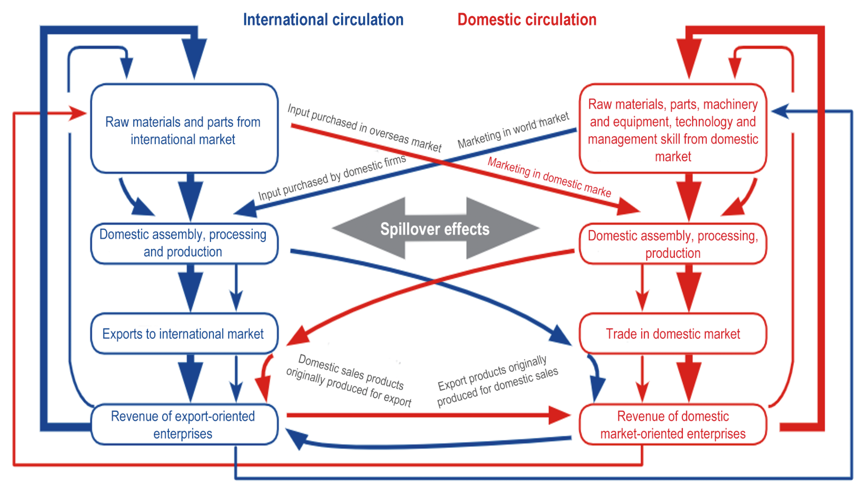

Our definition of the “great international circulation” is characterized by processing trade, so the import of equipment (capital goods) is not included in the left side of the figure that depicts “great international circulation”. In reality, though, processing trade-oriented enterprises also import machinery and equipment. However, even if this is taken into account, the conclusion that processing trade leads to the increase of foreign exchange reserves still holds, because most enterprises involved in processing trade are joint ventures and the foreign exchange used for purchasing equipment is provided by FDI. At the same time, enterprises that focus on the domestic market also have to import machinery and equipment from overseas market. It should be seen that the division of domestic and international circulations is only theoretical. A firm or an industry can hardly be simply categorized as part of domestic circulation or international circulation. In fact, domestic and international circulations influence, penetrate, complement and negate each other, while generating many smaller circulations (Figure 2).

Figure 2: International and domestic circulations affect and penetrate each other

Source: Created by the author

As shown in Figure 2, domestic firms (or products) have four basic forms of circulation.

First, in domestic-domestic circulation, both ends of production process are in domestic market, forming a closed economy. In such a circulation, foreign exchange is neither spent nor earned.

Second, in international-international circulation, both ends of production process are in world market, and foreign exchange is earned through processing trade.

In addition to these two basic forms of circulation, there are four related circulations:

1. International-domestic circulation (Type A), with one end of production process in world market and the other in domestic market, that is, importing raw materials and intermediate products in from the international market, processing and assembling in the Chinese market, and marketing the final products in domestic market. For example, most companies in the electronics industry belong to this form of circulation.

2. International-domestic circulation (Type B) which refers to domestic sales of commodities originally produced for exports. Both type A and B of the international-domestic circulation are two forms of circulation that pays foreign exchange.

3. Domestic-international circulation (Type A), with one end of production process in domestic market and one end in world market. Traditional export-oriented industries that earn foreign exchange like rare earth enterprises belong to this type.

4. Domestic-international circulation (Type B) which refers to export of financial products originally manufactured product for domestic sales.

International-international circulation, domestic-international circulation (Type A) and domestic-international circulation (Type B) all can help Chinese firms earn foreign exchange. China's top two export products in 2019 were electrical machinery and equipment (27 percent of total exports) and machinery including computers (17 percent of total exports). It could be inferred that international-international circulation was the main source for China to earn foreign exchange.

It should also be emphasized that the “great international circulation” and the “great domestic circulation” complement each other. For example, enterprises that participate in the “great international circulation” may have technology spillover effect on enterprises that participate in the “great domestic circulation”. For instance, if an employee who once worked in an enterprise that participates in international-international circulation is hired by a firm that participated in domestic-domestic circulation, (s)he may bring in the advanced management skill learned from the former enterprise. Although it is true that the two circulations have different characteristics and goals, they do influence and penetrate each other, and both are inseparable. In fact, it is hard to divide China's economy into two circulations. In addition, there is a considerable amount of economic activities that cannot be classified into either circulation. For example, pure import businesses in which imported consumer goods are sold in domestic consumer market. Since no domestic processing and assembly are involved, such kind of import business can hardly be classified into either circulation.

Foreign enterprises play a very important role in China's “great international circulation”. As a matter of fact, in processing trade which is the main carrier of international circulation, foreign-invested enterprises occupy an absolutely dominant position. Until 2019, the proportions of the import and export of foreign-invested enterprises in processing trade were still as high as 77.3 percent and 80.7 percent, respectively.

FDI enterprises or joint ventures also have four basic forms of circulation:

1. International-international circulation, with both ends of circulation production process in world market. Most foreign-funded enterprises belong to this type of circulation, for example, foreign enterprises in the electronics industry and Foxconn.

2. Domestic-domestic circulation, with both ends of production process in domestic market. Such kind of enterprises should take only a small part.

3. Domestic-international circulation, under which raw materials and parts are purchased domestically and exported, such as textile enterprises.

4. International-domestic circulation, under which raw materials, parts are imported and final products sold domestically, such as automobile enterprises.

Taking the proportion of import and export to total output in the electronic industry as an example, we could explain the position of the electronic industry enterprises in dual circulation.

First, when the export-to-total output ratio of the electronic industry is larger than 50%, it indicates that the electronic products have a high dependence on the foreign market (when compared with industries like automobile, for example). Second, when the import-to-export ratio of the electronics industry is as high as 2-5 times, it indicates that most of the electronic products are imported for domestic consumption and do not participate in the international circulation. Third, electronic products (as final and intermediate goods) are heavily dependent on imports. In fact, the proportion of import in semiconductor export is 90%. Thus, it can be inferred that the electronic products (or related enterprises) belong to international-international circulation and international-domestic circulation (Type A). At the same time, it can also be inferred that the electronic enterprises both earn (international-international circulation) and spend (international-domestic Type A) foreign exchange, while the electronic industry (for which import is greater than export) pays foreign exchange as a whole. In the electronics industry, companies involved in international-domestic (Type A) and pure importing activities (not involved in either form of circulation) are dominant. In short, in the electronics industry, China is consumer, assembler and buyer of foreign exchange.

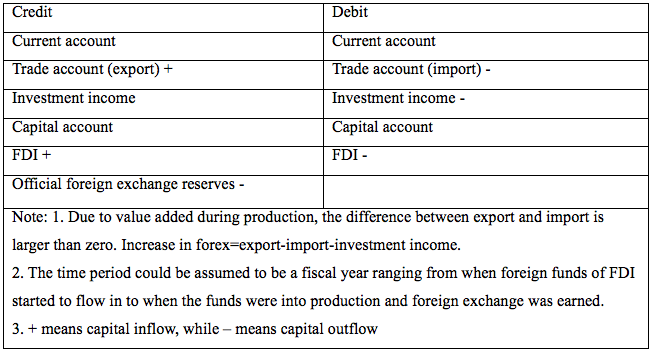

Domestic and foreign enterprises do not have many differences in the two circulations, except for the difference in the impact on the balance of payments. A foreign investor in a foreign (joint venture) enterprise owns equity of the enterprise and receives investment income as a shareholder from enterprise profit. The investment income of foreign investors is reported in the balance of payments as an outflow on the current account. But the import and export of domestic enterprises only affect the trade item in the balance of payments. Local governments and companies may welcome FDI and exchanged shares for funds without paying out too much cash. But once a company is profitable, a large amount of profits will be remitted. Any form of foreign investment has pros and cons. For instance, in borrowing, debt is clear once it is paid. But in FDI, as long as the factory is not dismantled, profits are shared (Table 1). German car companies, for example, offset their losses at home with earnings from their Chinese joint ventures. Therefore, FDI is a more costly way for China to attract foreign investment in the long run.

Table 1: The influence of FDI inflow and remittance of investment income on balance of payment

Source: Compiled by the author

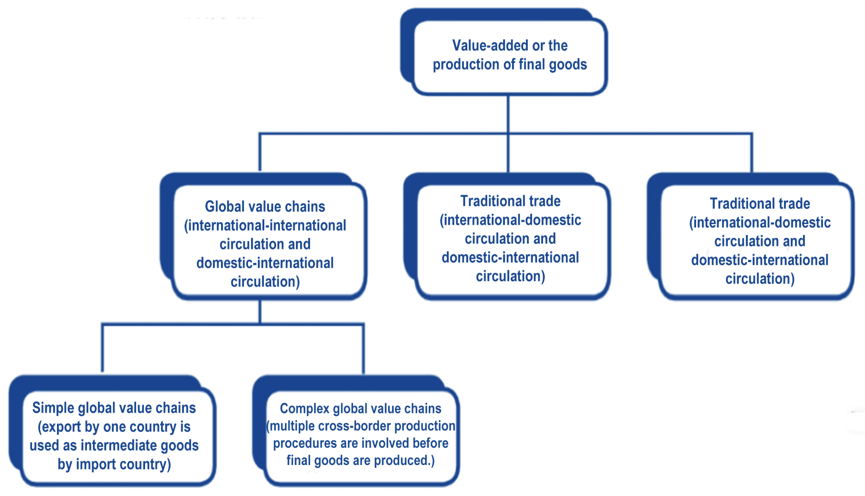

Table 2: World Bank’s classification of economic activities

Source: Compiled by the author

According to the World Bank, trade can be divided into traditional trade and GVCs (global value chains) trade. The latter can be divided into simple GVCs and complex GVCs (Table 2). In the “great international circulation” that already took into account the global value chains, the raw materials and intermediate products imported by China might already have been processed in multiple countries; they are processed in China before being exported to other countries for processing or sales as final goods. Tradable goods may have to be processed in multiple countries before becoming final goods (Figure 4).

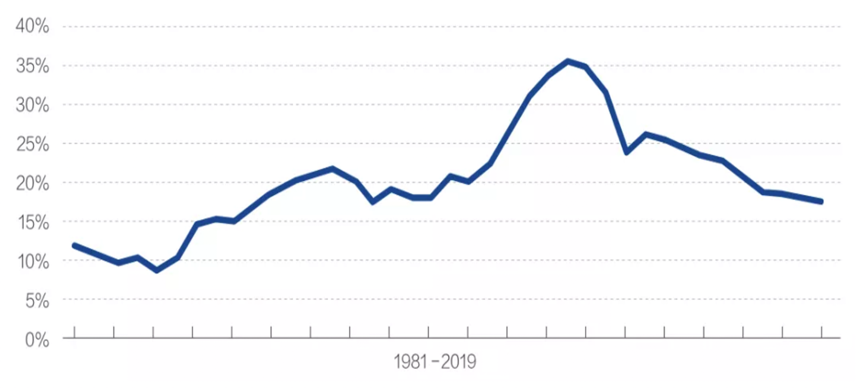

Figure 4: Export-to-GDP ratio

Source: Compiled by the author

Figure 5: The “great international circulation” of capital under the dual circulation twin surpluses

Source: Compiled by the author

Figure 5 shows the different processes an electronic product has to go through in different countries before it is introduced into the market as final good. Japan exports silicon ingots and bare wafers to the US which then manufactures wafer used for the fabrication of integrated circuits. Wafer is exported to Australia for packaging and testing, following which semiconductors are produced as final goods in Singapore before being exported to China to produce integrated circuits which are then sold in the US.

When the development strategy of “great international circulation” dominated, China’s policies ware were aimed to encourage enterprises and economic activities that could earn foreign exchange. Such policies included exchange rate policy, export tax rebate, financial support, bonded area, free trade zone among others. It should be noted that the export-oriented development strategy encouraged the development of enterprises with raw materials and sales outsourced to world market and traditional export enterprises. Meanwhile, enterprises that mainly paid in foreign exchange did not enjoy too much preferential policies.

The “great international circulation” strategy has successfully helped China overcome the bottleneck of the shortage of foreign exchange and the lack of modern capital, while making significant contribution to the high-speed development of Chinese economy. In 1979, China's GDP ranked 11th in the world following the Netherlands, with a share of only 1.79% in the world economy. In 1978, China exported $9.75 billion, representing a paltry 0.78% of world exports (Wu Li: Economic History of the People's Republic of China, p662). In 2009, China became the world's largest exporter and the world's largest trading nation in 2013. China's share of imports and exports in world trade rose from 3% in 1995 to 12.4% in 2018. In 2010, China surpassed Japan to become the world's second largest economy. In 2018, China's GDP reached $13.6 trillion, accounting for 16% of the world's GDP and 2.7 times that of Japan. It’s worth noting that China's foreign exchange reserves stood at $3.16 trillion as of August 2020. At one point in 2014, China's foreign exchange reserves stood at nearly $4 trillion, exceeding any other country in the world.

II. Strategic adjustment behind the dual circulation new development pattern

So why did China’s central leadership proposed the dual circulation development pattern “with domestic circulation as the main body and domestic and international circulations reinforcing each other"?

According to Marx, the positive understanding of any existing objective in dialectics should contain the negative understanding. There is a degree to everything, beyond which the principal aspect of contradiction will be transformed. Failure is the mother of success, but success can also be the mother of failure. China’s success has brought about a series of challenges, and if it fails to keep up with the time and manage these challenges, Chinese economy would stall.

There are multiple reasons to adjust development strategies that proved to be successful earlier. We can discuss the necessity and how to adjust the development strategy from five aspects.

1. The “great international circulation” can hardly be sustained

First, the capacity of the international market is limited. As China became the world's second largest economy, “the great international circulation” strategy can hardly sustain. China needs to further reduce the dependence of its entire economy on the outside world.

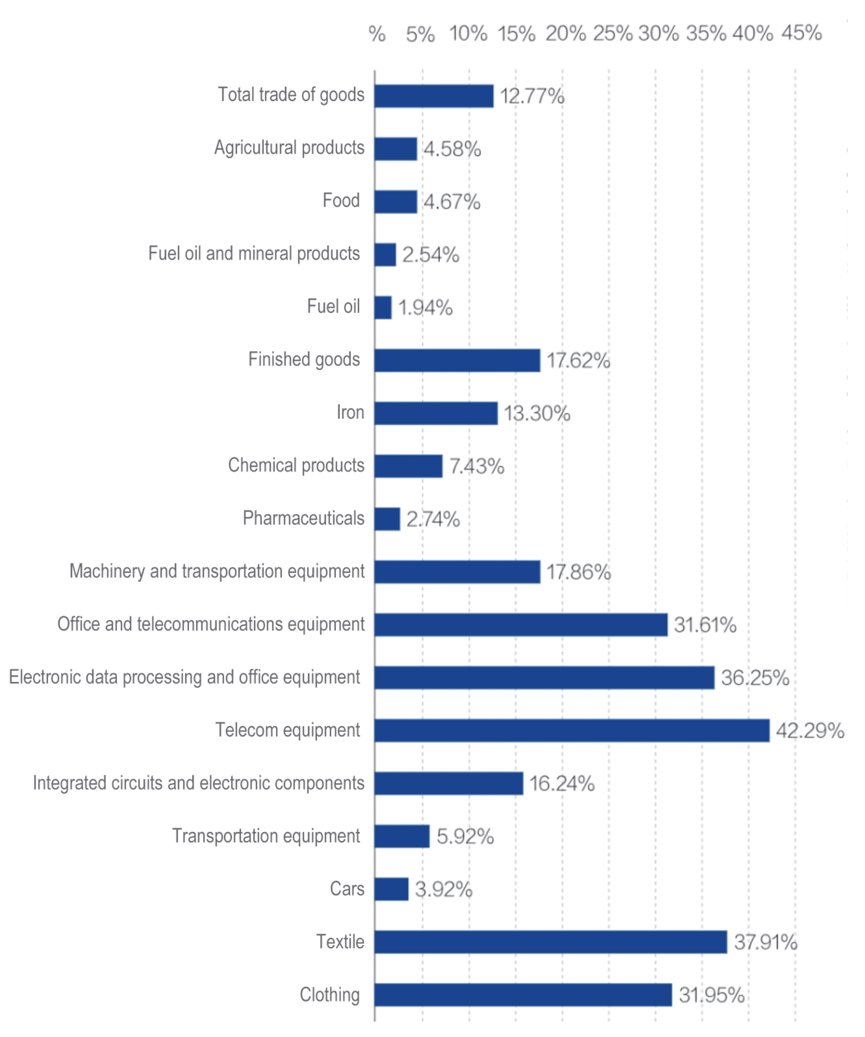

We often compare the world economy to a big ocean, and that the Pacific Ocean is big enough to accommodate all countries. In the past, when deciding trade policy, we could assume that the world market was perfectly competitive and that China's imports and exports would have little effect on the international prices of products. However, since China has become the largest trading country in the world, many of its products have occupied a pivotal position in the world market (Figure 3). As early as early 2000, there was a situation in the international market that the price of everything China bought went up, while the price of everything China sold went down. The fact that China's imports and exports have an important impact on world product prices indicates that there is an optimal level in the quantity of imports and exports.

Figure 3: Share of China’s important imports exports in the global total in 2018

Note: Index calculation: proportion (%) = (China’ sChina’s export value of the goods/ global total) *100%

Source: WTO data

Charting: Yan Bin

China has long ago got over the problem of insufficient foreign exchange reserves. As early as the late 1990s, China's foreign exchange reserves have exceeded the necessary amount measured by any international standards.

At this stage, the side effects of maintaining export-oriented policies have become more obvious: for example, worsening international trade; restraining domestic consumer market development; making Chinese economy less able to withstand external shocks. In short, China's economy has reached a new stage where the export-oriented strategy that suits economies of a small scale can no longer apply to China. The Chinese government has long been aware of the limitations of the export-oriented development strategy. At the beginning of 2006, the 11th Five-Year Plan put forward the requirement of focusing on domestic demand. In fact, China’s export-to-GDP ratio reached a peak of 35.21% in 2006, and started to decline since then (Figure 4).

After 2006, all indicators concerning China's external dependence have declined. Obviously, the model of heavy reliance on import and export has undergone changes for long, and now China starts to emphasize the urgency of making adjustments.

In general, the export-oriented development strategy is suitable for small economies in the economic take-off stage. In fact, at the beginning of reform and opening up, China's economy was smaller than the Netherlands. With the growth of China's economic volume, trade volume, and financial strength, adjustments to development strategies are inevitable. The rise of trade protectionism on a global scale and the outbreak of the Sino-US trade war have greatly strengthened the urgency of China to adjust its export-oriented policy, and focus on the strategy of dual circulation while with domestic circulation as the mainstay.

2. China must strengthen the security of its industrial system

Second, the international circulation has accelerated China's technological progress and economic growth, but it has weakened China's ability to withstand external shocks. China must strengthen the security of its industrial system.

From the natural economy to the commodity economy, from the agricultural society to the industrial society, the division of labor is an important driving force for economic development. In an industrialized society, the division of labor was first implemented inside a country, and later crossed national boundaries and expanded across the world. Leading countries hope to enable their own industries with comparative advantage to enter the markets of other countries and make full use of the benefits of economies of scale. Late comers use tariffs and other measures to protect their infant industries from failing. Everyone wants to build a relatively complete and independent industrial system. However, it contradicts with extensive participation in the international division of labor. Building one’s own autonomous and controllable industrial system means safety and independence, but it will lead to a decline in production efficiency; conversely, deep participation in the international division of labor means increase in production efficiency and economic growth, but will weaken the security and independence of the economy.

After the industrial revolution, old-brand capitalist countries such as Britain and France took the lead in establishing their own industrial system and promoted their industrial system to the world through colonial policies. Countries that started late in the process of industrialization such as Germany and the United States successfully established their own industrial system with the help of protectionist policies. The industrial system of developed countries was established in accordance with the will of the country. The international division of labor was then formed with the establishment of domestic industrial systems by developed countries. International division of labor has improved the production efficiency of various countries, and acted but has a negative effect on the formation of industrial systems. It has strengthened some industries in a number of countries, while weakened and even eliminated some completely. Correspondingly, some consumption products are provided by domestic producers, while others foreign producers.

Participation in the international division of labor and domestic industrial system adjustments should be under the precondition of not threatening the country’s economic security. For example, China adopts a development strategy focusing on "independence and self-reliance" to establish a modern industrial system that can survive and develop in the face of economic blockade by the West. While implementing export-oriented strategies after the Second World War, Asian economies such as Japan and South Korea are also committed to establishing their own industrial systems. The international division of labor and the pattern of international trade are not static. Less developed countries will seek for a more favorable position in the international division of labor and trade system, and strive to catch up. The developed countries have tried every attempt to maintain their leading position. Therefore, in addition to security considerations, large developing countries must consider how to avoid being locked in the low end of the international division of labor system and losing the ability to catch up.

In the late 1970s and early 1980s, the Flying Geese Paradigm once attracted the attention of Chinese economists. It attempts to link the formation of industrial systems in different countries with their development of international trade. According to the paradigm, a certain industry in the leading country (head goose) achieves growth through three stages, which are import, production and export. With the maturity of the industry and the decline in competitiveness of the leading country, this industry will be transferred out of the leading country and taken over by late developing countries. The leading countries then develop industries with higher capital and technology density, and produce and export more high-end products. Transfer of industries from leading countries to latecomers is generally from textiles, steel, shipbuilding, automobiles to computers. The transfer is from consumer goods to capital goods, from simple and low-level products to complicated and high-end ones. After transferring the production of unwanted industries to late developing countries, the leading countries import such products to meet their demand.

After the reform and opening up, China joined the international division of labor system in two ways: first is through general trade in accordance with the Flying Geese Paradigm; second is through processing trade to join the global value chain (international production network). It this process, China has engaged in production activities outsourced by multinational companies, seeing a significant increase in the import of raw materials and intermediate products. As a result of having implemented an export-oriented strategy featuring processing trade and FDI, China has gradually formed two international trade models in which general trade and processing trade coexist. The dependence ratio of China's industrial system dependence on foreign countries rose significantly.

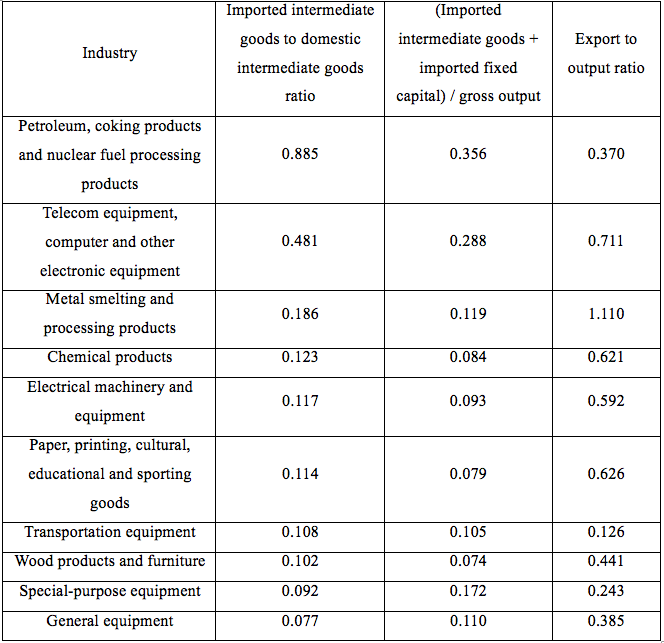

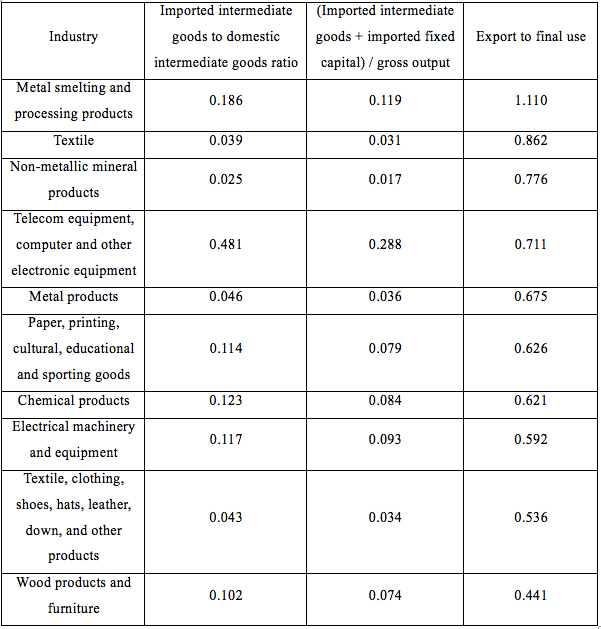

When this dependence ratio reaches a certain level, it signifies the fragility of China's industrial system. The dependence ratio can be analyzed from the supply and demand sides (Table 3).

Table 3: Ten industries featuring the highest ratio of foreign dependence of in production in 2018 (see the third column)

Calculation: Yang Hanbo

Source: Statistical yearbook

The foreign dependence of in production here refers to the extent to which domestic production depends on the supply of raw materials, intermediate products, and machinery and equipment from foreign countries. The higher the ratio, the more vulnerable the industry may be. It is somewhat unexpected that the oil industry’s production dependence is much higher than that of the communications equipment. It reminds us that energy may be the Achilles’ heel of the Chinese economy. Mr. Huang Qifan once said that “China’s energy dependence on foreign sources is as high as 7%, and energy security is ‘100 times more important than chip decoupling’” (speech at the 2020 Shanghai University of Finance and Economics Alumni Summit Forum).

Due to statistical reasons, we cannot distinguish between the parts of the same industry that have participated in the global value chain from those that have not, nor can we distinguish between traditional industries and global value chain industries at the level of sectors and sub-sectors departments and divisions. However, it is not difficult to guess that the reason for the high degree of dependence of the communications industry on foreign countries is due to the fact that the subdivisions of this sector are deeply embedded in the global value chain.

Table 4: 10 industries featuring the highest foreign market dependence of market in 2018 (see the third column)

Calculation: Yang Hanbo

Note: Exports is are part of the final use in the input-output table. That the ratio of export to final use exceeds 1 may be because of inventory adjustments.

Source: statistical yearbook

It can be seen from Table 4 that even if Chinese industries, especially manufacturing, are highly dependent on external demand, even though some are not deeply embedded in the global value chain, their dependence on external demand is generally very high. However, it is not difficult to conclude that China’s participation in the global value chain has contributed greatly to the country’s high foreign dependence in of industrial system.

The formation of international production networks or global value chains makes the international division of labor system a mixture of two different types. One is the traditional division of labor by industry. The other is the division of labor in international production networks or global value chains.

The international production network is caused by the fragmentation of the production process. Due to technological progress and trade liberalization, the production in developed countries has become fragmented. The concept of international production networks reflects the intricate interrelationships among global producers. Global value chain can be regarded as a form of international production network. If "chain" is defined more broadly, the two concepts can be regarded as the same thing (only global value chain will be used below).

Different companies have different roles in a value chain. They can be divided into leading enterprises and contract manufacturers (suppliers). Contract manufacturers are of different levels under the leading enterprises. There are first-level manufactures, under which there are second-level manufactures. Leading companies own brand trademarks and sell final products to consumers. They have the ability to dominate upstream contract manufacturers. Contract manufacturers assemble products for leading companies and don’t have much market influence. But they are often large in scale and scattered in different countries. Contract manufacturers at different levels are engaged in different production and service activities. Most of the leading companies are located in developed countries (the United States, Europe, Japan, South Korea), and contract manufacturers are generally in developing countries.

The "length" of global value chains can be measured by the number of multinational production stages from upstream to downstream industries.

China has joined the global value chain as a processor and assembler. On the one hand, it has improved the level of national welfare and technology; on the other hand, it has also increased China’s external dependence and vulnerability of its industrial system. Production activities of Chinese companies have to depend on the production performance of all links in the entire global value chain and the sales performance of the final products. The longer a global value chain, the higher the probability of production interruption due to external shocks. Moreover, China's deep participation in global value chains will inevitably impact the integrity of its original industrial system or domestic value chains. In fact, after China implemented an export-oriented strategy characterized by processing trade and FDI, while some industries have developed rapidly, some important ones have declined, and some have simply disappeared. Some of these changes are the natural result of industrial upgrading and transfer; others are a result of shocks from the global industrial chain.

A country must strike a balance between securing its industrial system and its maximum participation in the international division of labor. How to achieve the balance? The United States has provided us with useful references. President Biden is to launch a 100 day review of critical product supply chains in the US focused on those for energy, network technology, semiconductors, critical electronics, and telecommunications infrastructure, and to secure stronger and more flexible domestic supply chains. Specific measures include: increasing the manufacturing capacity of key materials through federal government purchases; encouraging enterprises to transfer the production of key materials back to the United States; expanding domestic production, increasing strategic reserves, eliminating anti-competitive behavior that threatens supply chains, implementing "smart plans" that can rapidly increase production capacity, and maintaining close cooperation with allies so as to become independent on key materials during a crisis. Biden also proposed a permanent arrangement for critical supply chains review every four years so as to enable the US to achieve "self-sufficiency," and ensure strong resilience broadly.

It should be noted that we underestimated the importance of geopolitical factors in the past. In the process of participating in the global value chain, China hasn’t had any backup. It’s easy to be caught off guard in the face of a sudden change. In fact, adjusting China's position in the global value chain has become an urgent challenge for us to improve our industrial system.

The safety or independence of China’s industrial system mainly depends on the ratio of its external dependence (the ratio of external dependence on in respect of production and sales), which on the other hand way round is determined by the integrity and resilience of the country’s industrial system.

Integrity can be seen from the perspective of the input-output matrix. All industries are interdependent, and the lack of an industry of any scale will affect other industries to varying degrees. Integrity does not mean "big and complete" and "self-sufficient", but the existence of a relatively complete industrial system is very important for a country like China. Many countries concentrate on advanced industries only, resulting in an unbalanced industrial structure. Once there is an external shock, these countries will suffer from economic fragility. In contrast, China's outstanding performance during the pandemic is largely due to China's relatively complete industrial system, especially a strong manufacturing system.

Resilience involves both efficiency and safety. For example, even if a country does not own a complete industrial system due to its participation in the international division of labor, it can quickly make up for its shortcomings when needed if it has strong manufacturing capabilities.

In the research of network security and vulnerability, scholars have developed concepts such as degree centrality and import concentration. We should come up with an index for measuring the safety of China's industrial system based on our own actual conditions, and provide guidance for the adjustment of China's industrial system.

From the perspective of the production network, we need to deal with four issues.

First, for high-tech products that have been deeply embedded in the global value chain, the Chinese government should help Chinese companies improve their independence and controllability, and remain in the value chain as much as possible in order to nurture backup industries.

Second, it is advisable for China to reduce its participation in some parts of the global value chain and keep certain production activities in the country, especially transferring them to west and north China so as to boost economic growth and reduce regional development imbalances.

Third, China must develop a domestic production network dominated by leading Chinese companies. It needs to break down local barriers and realize the optimal division of labor for the production of important products across the country. This is consistent with the view that emphasis on the internal circulation means unblocking domestic production and circulation. Facing international and domestic production networks, some Chinese companies would rather join the international production networks rather than or having no opportunity to join the domestic production networks dominated by leading Chinese companies. For this situation, government needs to intervene.

The fourth is to cultivate and expand the domestic market through reforms in the economic system, taxation policies, social security system, and public product provision, so as to have Chinese products less dependent on overseas markets.

In short, due to changes in the global economic and geopolitical situation, it is also necessary for China to conduct a national assessment of the status quo of China’s industrial system, identify weak links, and make adjustments from multiple levels of industry and products to achieve a balance between economic efficiency and industrial system security under the guidance of dual circulation strategy.

3. To have high-tech industries reach a commanding height must rely on independent innovation

Third, the international circulation strategy is not enough to enable China to catch up with the world's advanced technology.

China, though a developing country, has always made it a core development goal to catch up with the world's advanced technologies. In the early 1980s, China had two ways to achieve this goal: one was to purchase large-scale complete sets of equipment and advanced capital goods, and the other was to get establish joint ventures and let foreign partners bring us advanced technology. Since the 1990s, China found the third path as it deeply participated in the global value chain. Fundamentally, this is the same with the practice of obtaining advanced technology through FDI.

Japan and South Korea introduced advanced technology during their economic take-off stage by purchasing advanced machinery, equipment and technology licenses through borrowing. Imported machinery and equipment are mainly for independent development through reverse engineering, and the need to purchase technology licenses will only arise when independent development is carried out. Japan and South Korea’s technology import is a supplement to domestic R&D rather than a substitute. It should be noted that Japan and South Korea have strictly restricted FDI for a long period of time (Lu Feng and Yu Yongding: "The Macro and Micro Vision of Transforming Economic Development Mode", Social Sciences in China, 2012).

Since the 1990s, China has rolled out much many preferential measures for FDI, and multinational companies have flocked in. The influx of FDI has played a positive role in promoting China's economic growth. From the perspective of international production networks, FDI is an important link for multinational companies to embed Chinese companies in international production networks and global value chains. Multinational companies have transferred the production, processing, and assembly links of labor-intensive products to China, turning China into an assembly plant for final products to be exported to the United States. Although the proportion of high-tech products in China’s exports is on the rise, China’s participation in production concentrates on labor-intensive terminal assembly and relies on foreign design, marketing, and parts supply. From a macroeconomic perspective, China maintains a large trade surplus with the United States, but a large trade deficit with suppliers of intermediate products such as Japan, South Korea, and Taiwan Province as a consequence (Lu Feng and Yu Yongding: "The Macro and Micro Vision of Transforming Economic Development Mode", Social Sciences in China, 2012).

As Professor Lu Feng pointed out: “The emphasis on technology import has gradually led to the replaced replacement of independent development in practice, and has created an illusion that we can rely on the import of technology and foreign capital to develop China's economy.” China hopes to encourage foreign investors to bring equipment materialized with advanced technology to China, exchanging technology with market. However, foreign investors have no incentive to transfer technology to China, and the progress of localization does not mean an increase in technology capabilities.

Professor Lu also pointed out that many big car companies have established joint ventures with major foreign auto companies since the mid-1980s. But after 20 years, none of these companies has been able to independently develop a car model. If product development is regarded as the most important technology of the industry, we can say that joint ventures have not brought any key technologies to China’s automobile industry. In comparison, the Korean automobile industry (born in the 1960s) embarked on the road of independent development in the 1970s, and entered the international market in less than 20 years.

China's automobile industry later made some breakthroughs in product development. The reason was that around China's accession to the WTO, a number of new enterprises that focused on independent development emerged, such as Chery and Geely. Joint venture, though the original intention is to introduce technology, has actually prevented China's auto industry from achieving independent development.

It’s as difficult to acquire new technologies by getting embedded in the global value chain as by FDI. Big companies in developed countries build global value chains for purposes like bypassing tariff protection, taking advantage of cheap labors, accelerating the listing process, shortening R&D and product life cycles, etc. Geopolitical factors also have important implications for the global value chain. The only reason why developed countries encourage their businesses to help boost the host countries’ technological capacities is for them to produce up-to-standard goods.

In addition, most of the businesses from developed countries are oligarchies that are powerful enough to decide the technological routes, product standards and sales of the entire industry. Meanwhile, these behemoths can maintain their high profits by building up barriers that block newcomers out with their economies of scale, intangible investments, control over supplier networks, brand effects, sales channels and after-sales services, among others.

While businesses from emerging economies can decided by themselves whether and where to enter the market, whether they can participate and remain in the global value chain in a way as they desire or extend to the upstream and downstream is still largely determined by the dominating companies from developed countries. Of course, businesses from developing countries still enjoy opportunities to accumulate experience in the global production network, grow stronger, and improve their position in the global value chain relative to their previously dominating counterparts; in that case, the length of the global value chain and the balance of power in it could change. However, generally speaking, developing countries only have limited space for technological upgrade along the global value chain, and it’s hardly possible to foster strong high-tech industries by producing goods for foreign brands.

Can Chinese companies acquire technologies through overseas merger and acquisition? Despite some successful cases, this is in general a tough path. For example, back in around 2004, many Chinese machine tool manufacturers sought to acquire foreign companies, most of which failed (Why is China’s road to machine tools getting narrower?); the global financial crisis was followed by a wave of overseas acquisition among Chinese businesses that hardly bore any fruit. This path has almost become a dead end today considering the United States’ containment of China.

China’s progress in independent innovation has been far from satisfactory for several reasons. First, businesses, especially state-owned enterprises (SOEs), have neither the motivation nor the ability to innovate due to institutional restrictions and lack of incentives. Second, there is are no sufficient financial resources for innovation, with many projects left unfunded by any long-term loan. Those who have the gut to break new grounds are heavily indebted with short-term loans to support their long-term R&D activities. Worse still, once Chinese companies make technological breakthroughs, their foreign competitors would slash prices, leaving their efforts and investments down the drain, so many innovators are at the risk of going bankruptcy because of debts. Third, the immature Chinese capital market plays a very limited role in supporting business innovation. Fourth, there is a lack of intellectual property protection in China for reasons like localism.

Innovation is risky for the survival and development of businesses, especially when there is a lack of market support. Under this circumstance, the Chinese government needs to play its role and fill the gap.

There were intense debates in China as to whether the country should formulate industrial policies right before and after the China-US trade war broke out. Many even blamed “Made in China 2025” as an important cause for the trade war. But as a matter of fact, all developed countries have their own industrial policies with various policy supports for their pillar industries and high-tech sectors. In the U.S., the government plays an important role in the development of the high-tech industries although big companies remain the main force in R&D and the major fund provider. The Biden administration has announced that it will invest 700 billion dollars in clean energy, quantum computing, AI, 5G, high-speed railway and cancer treatment in the next four years in support of U.S. manufacturing and high-tech industries, among which 300 billion dollars will be for R&D.

We no longer hear any disagreement as to whether there should be industry policies today. The problem now is how to make and implement industry policies based on the experience and lessons at home and abroad. In China, the market plays the decisive role in resource allocation, which has two implications: on the one hand, the government should not intervene heavily in industrial and product development; on the other hand, it should play its due role in support of high-tech industries and businesses with high risks and long return periods.

In this regard, policymakers and scholars have reached the consensus that “functional” or “horizontal” industrial policies should be maintained while those targeted, “vertical” policies in support of certain selected industries should be abandoned. Two tools are important for implementing the industrial policies: one is restrictive review and approval of investment projects and production qualifications; the other is a clear definition of emerging industries by the government (Chen Xintai: What Did and Did Not China Get from Its Industrial Policies Over Two Decades). Restrictive review and approval aim at preventing project overlaps and resource wastes; but past experience suggests that they could stem the growth of emerging industries instead. Defining emerging industries has been a common practice among all countries with industrial policies, though.

Proposals on China’s 14th Five-Year Plan has laid out the goal to boost strategic emerging industries, and a series of industries have been included by the central government in this list, among which are: information technology, biotechnology, new energies, new materials, high-end equipment, new-energy vehicles, green industries, the aerospace industry, marine equipment, internet, big data and artificial intelligence. Now that these strategic emerging industries have been defined, it’s essential to put in place policies in support of their development, and industry policies will no longer be just functional as a result.

While formulating and implementing the industrial policies, it’s essential to prevent corruption, rent-seeking, undue influence from interest groups, over-decentralization, lack of coordination, and impractical policy schemes, etc. For example, the project application system needs to be improved: at present, applicants need to pay no opportunity cost, while examiners lack the required expertise and motivation. In addition, industrial policy-making lacks transparency and does not adequately incorporate public opinions and advices. The Chinese government needs to draw from experience at home and abroad to improve the guidelines for formulating and implementing industrial policies.

What roles can the government play in this regard? First is to provide financial support for R&D activities, which is a must for booming high-tech industries. Over the past decade, the U.S. invested 312 billion dollars in semiconductor R&D, twice that those of other countries, and the number was 39 billion dollars in 2018 alone. There are several kinds of research activities, including basic research, research on applied technology, and developments and experiments. The government contributes to a quarter of R&D funds in the U.S. On December 12, 2020, heads of the telecommunication departments from 17 countries in the European Union declared that they would invest in the next two to three years a total of 145 billion euros in the R&D of advanced processors and other cutting-edge semiconductor technologies.

Second, many countries have established Technology Innovation Centers to bridge the gap between R&D and application. Building institutes for generic technology research and high-tech development zones are important efforts; but immoderate construction of too many of these zones must be controlled, and those that have been established should be better managed.

Third, the central government needs to enhance the coordination between its departments. Many of the major projects cannot be accomplished without national supports; and it would be hard to make substantial breakthroughs without proper leadership at the top. The containment moves by the U.S. have taken a heavy toll on some of China’s major projects in strategic emerging industries that were based on international cooperation, which can only be addressed through coordination among various departments across the Chinese government. But as a result of a lack of coordination, they failed to communicate effectively, reach consensus, or produce a practical solution.

Fourth, the government should step up the support for high-tech education and training. As Professor Pan Yunhe noted, there are different technological paths for high-tech industries to seize existing high grounds and to explore new ones. Should they continue on the existing paths, such as to produce chips at 14 nm or 3nm? Or should they turn to explore new paths? Educating and training people for basic education and research with passion for exploration are essential whichever the choice, especially for the latter. China has to deepen educational and R&D system reforms to meet the demands for independent innovation.

Fifth, the Chinese government should boost the development of technical education and provide most of the funds needed, because the lack of technicians has hindered China’s independent innovation.

Sixth, China should provide stronger support for innovation of the business sector by government purchase or other fiscal or financial means as long as it does not break WTO rules.

Emerging industries are inevitably risky. The government should press ahead with capital market reform, build sound stop-loss and risk-sharing mechanisms, and encourage private capital to engage in venture investments.

The 14th Five-Year Plan mentioned many concepts including basic research, original innovation, business innovation capacity, the new system of pooling national resources and strengths, intellectual property rights, among others. Obviously, the core concept in high-tech competition is independent innovation, while other concepts constitute the basis for it. The idea that China should take the domestic circulation as the mainstay also demonstrates the country’s determination for independent innovation in place of technology imports amid its technological catch-up.

4. Prevent against the debt trap

Fourth, cross-border and inter-temporal resource mismatch as a result of the long-standing export-oriented policies, if unchecked, could throw China into the debt trap in the future.

China implemented preferential FDI policies while developing its processing trade, and thus has seen massive FDI inflow. As said before, processing trade itself will definitely bring trade surplus. While China has generally maintained a trade deficit in general trade for quite long, because of the high proportion of processing trade in its total trade, annually speaking, China saw trade surplus each year except for in 1993. At the same time, up until 2014, owing to FDI inflow, China has been able to maintain a capital account surplus (now called non-reserve capital and financial account).

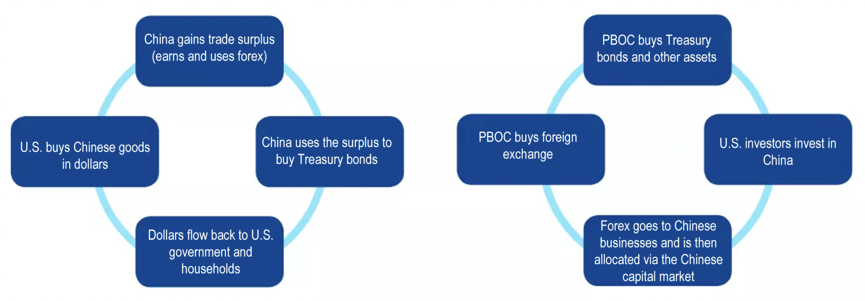

The surge in both the current account and the capital and financial account surpluses, or the twin surplus twin surpluses, has caused China’s foreign reserves to balloon. Given China’s current institutional arrangements and the external environment, increases in foreign reserves generally indicate growing holding of Treasury bills. FDI is China’s liabilities abroad, and its rise means capital import. On the balance sheet for overseas investment of China, most of the assets are foreign reserves while most of the liabilities are cumulative FDI. If the twin surplus twin surpluses of China’s balance of payments was reasonable during the start of China’s opening-up and the 1990s given the specific historic background, it’s no longer so in the 21st century since China’s foreign reserve had mounted up to trillions of dollars. The reasons for the twin surplus twin surpluses is beyond the scope of this discussion.

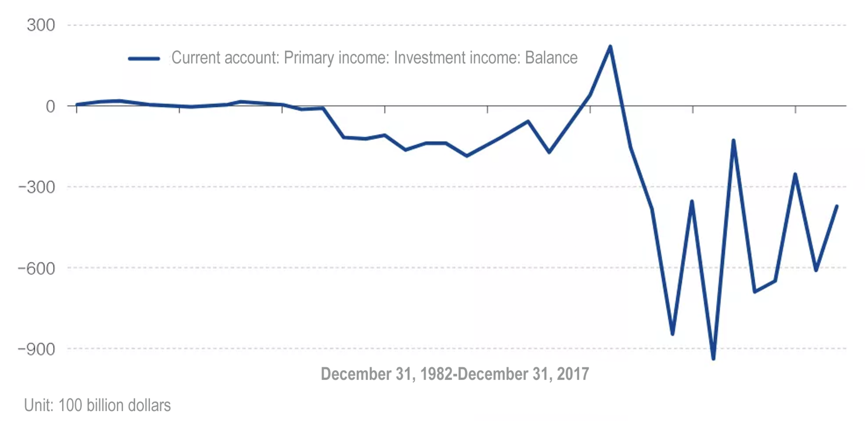

In certain senses, the twin surplus twin surpluses is a result of the export-oriented strategy featuring processing trade and FDI, and the cross-border and inter-temporal resource mismatch that it represents has worsened as China’s foreign reserve soared. An important consequence of this is: despite being a net creditor, China maintains deficits in its investment revenues. What is the problem here?

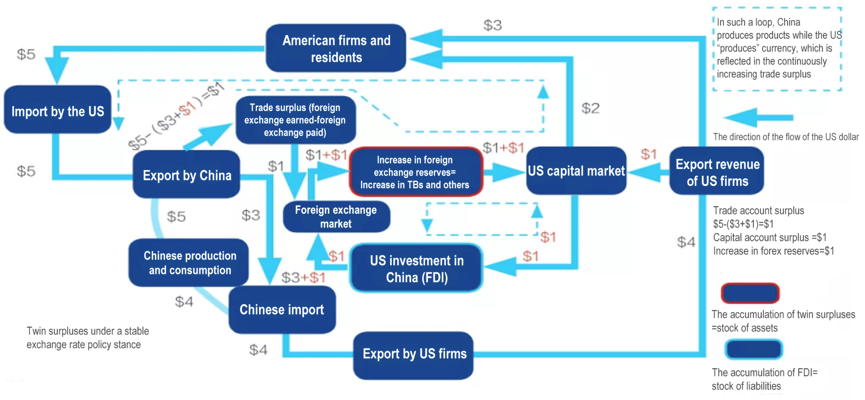

Arrows in Figure 5 point to the direction where US dollars go in the international circulation. If the U.S. imports something for 5 dollars from China, it means China exports 5 dollars to the U.S. Let’s assume that China spends 3 of that 5 dollars on importing materials for domestic production.

Meanwhile, it’s assumed that China has 1 dollar of FDI from the U.S. market. In theory, this 1 dollar will be converted to Renminbi upon entering the Chinese foreign exchange market and lead to 1-dollar rise in China’s foreign reserve. Since this 1 dollar will be spent on purchasing raw materials, intermediate goods and capital goods, it is included in the total amount of import together with the above-mentioned 3 dollars, and in aggregate China’s import is 4 dollars.

Eventually, 2 dollars will be added to China’s foreign exchange reserve, 1 of which is “earned” (through trade surplus) and the other “borrowed” (through FDI). Under normal circumstances, since China already pockets the 1 dollar of trade surplus, it is not supposed to introduce the other 1 dollar of FDI, as Chinese businesses in need of foreign exchange should have been able to borrow 1 dollar in the Chinese capital market.

Foreign reserves are China’s investments in, or capital output export to, the U.S. (by buying US Treasury bonds). In our case, China spends 2 dollars on buying Treasury bonds, and the U.S. exports 1 dollar to China in FDI. Given China’s 1 dollar of trade surplus against the U.S., the 1 dollar that the U.S. “l(fā)ends” to China via FDI could be seen as China’s own money. In other words, China injects 2 dollars in the U.S. capital market, while the U.S. injects 1 dollar in the Chinese capital market. This essentially means that the U.S. capital market has taken the place of the Chinese capital market in resource allocation in China: Chinese businesses obtain funds not from the Chinese capital market, but from the U.S. capital market.

Similarly, Chinese investors do not find the assets they need in the Chinese capital market, but the U.S. capital market. Most of China’s FDI providers are from tax havens for companies in Hong Kong, Macao and many other countries, which means that many of China’s FDI are round-tripping capital inflows; some of the Chinese businesses hope to introduce FDI not because there is no money in China, but because they cannot obtain the money in the Chinese capital market.

The circulation at large can be divided into two smaller circulations. One is the conversion of foreign exchange produced in China’s trade surplus (given that the People’s Bank of China needs to maintain stable exchange rate) into foreign reserve. Dollars that China “earned” through trade surplus will, via the U.S. capital market, go back to American households, who use the money to purchase consumer goods and investment goods from China. The other is the circulation of funds between the U.S. and the Chinese capital markets. American investors raise money from the U.S. capital market to buy the equity of Chinese businesses (which is not shown in Figure 5); and this money will flow back to the U.S. capital market if Chinese monetary authorities purchase Treasury bonds when China enjoys a trade surplus and the authorities seek to maintain stable monetary policies.

In other words, under the international circulation with the twin surplus twin surpluses, there is first a sub-circulation where the U.S. produces dollars while China produces goods, and another sub-circulation where China purchases Treasury bills while the U.S. obtains the equities of Chinese businesses (Figure 6). As a result, on the one hand, China continues to accumulate U.S. Treasury bills with mounting assets; on the other hand, China’s debts (FDI) are also piling up. The difference between China’s income from its purchase of Treasury bills and the U.S.’s income from its FDI in China is the net outflow of investment revenue for China.

Figure 6: Two sub-circulations under the twin surplus twin surpluses

Source: The author

The characteristics of the international circulation has determined the existence and continuous increase of the twin surpluses; moreover, this special form of circulation has determined the structure of China’s overseas asset allocation. As of March 2019, China owned 7.4 trillion dollars of overseas assets, the majority of which were foreign reserves after buying U.S. Treasury bonds, while there were some other types of assets such as China’s direct investments, security investments and other investments overseas. On the other hand, China’s outstanding external liabilities were 5.4 trillion dollars, mostly FDI, together with other countries’ security investments and other investments in China. Therefore, China had a net overseas asset of 2 trillion dollars.

How much income have these assets generated? If we put the 2 trillion dollars in banks at a rate of 1%, we would expect 100-200 billion dollars of interests as investment income each year, which, however, is not actually the case.

In the recent decade or so, China has been recording negative investment income except in a few years (Figure 7), the direct reason for which was simple: most of China’s overseas assets are Treasury bonds with low yields, but most of China’s liabilities are FDI with much higher returns.

Figure 7: China long records negative investment income

Source: The author

Cross-border and inter-temporal resource mismatch will have big impacts on China’s future development. Take Japan for an example. Japan had bigger surplus with investments income than with trade right after 2005; and during 2011 and 2019 (except for 2016 and 2017) it had trade deficits. It relied on its positive and increasing investment income to maintain its current account surplus. This structure of Japan’s balance of payments has to a certain extent ensured that the aging nation could reap profits rather than paying interests.

An aging country can hardly maintain a high trade surplus and would finally see trade deficits. This is the case for China. If China cannot reach a surplus in its investment that is higher than its trade deficits, it could become a debtor. If China continues with huge net overseas assets but negative investment revenues, it will have to pay interests rather than reaping profits with an increasingly older population. The Chinese economy would face huge problems if that happens. Going forward, even if the country no longer maintains the twin surpluses, it will have to restructure its international investment balance positions sheets and work towards positive investment revenue income.

5. Coping with geopolitical changes

Fifth, China has to adjust its development strategies because the geopolitical environment has changed, which is ever more urgent when the U.S. started the trade war against it trying kicking it out of the high-tech supply chain.

But at the same time China is lucky, with the largest population and a huge domestic market. Based on this market, as long as it deepens reform and adopts proper economic policies to enhance its domestic circulation and foster mutually-reinforcing dual circulations, it will continue to prosper despite the harsh external environment.

In summary, China should step up adjusting its economic development strategies and policies to forge a sound domestic circulation as the mainstay that is mutually-reinforcing with the international circulation. With this effort, despite the worsening external environment, the Chinese economy will still be able to maintain high growth for a long period to come.

Download PDF at: