Abstract: In this article, the authors discussed the economic outlook of Chinese mainland, Hong Kong, and the US in 2021. The US economy is expected to recover from a low position but will hardly resume to the pre-pandemic level in 2019. The spread of the virus remains to be the biggest obstacle to the economic recovery in the US. Chinese economy will continue to recover in 2021 and is expected to achieve a real growth rate of 7%. After seeing the deepest and most enduring recession in 2020, the Hong Kong economy in 2021 is expected to see moderate growth and achieve a growth of around 3%.

The novel coronavirus pandemic rapidly put the US economy into deep recession in 2020. In 2021, the US economy is likely to recover from low level, but unlikely to resume to the pre-pandemic level in 2019. The evolution of the pandemic remains the biggest uncertainty for the US economy. It also remains to be seen what kind of impact the incoming Biden administration will bring to the US economy, financial market and geopolitics.

Besides, there is huge gap between the performances of the US financial market and its real economy. Investors’ optimistic sentiment pervades the financial market, and trades in various asset markets are already very crowded. Once unexpected changes occur, such as in terms of movement of inflation, monetary policy or other political and economic issues, crowded trades are very likely to happen, resulting in massive fluctuations in the financial market.

Thanks to the effective control of the spread of the virus and the rapid resumption of work and production throughout the nation, China has seen a sound momentum in economic recovery. In 2021, the economy of Chinese mainland will continue to recover and is expected to achieve a growth rate higher than 7%.

Meanwhile, the transformation and upgrade of the mainland economy will further accelerate as China’s efforts on the 14th five-year plan on economic and social development and the target of carbon neutral by 2060 begin to unfold. Investors will see extensive opportunities in emerging areas such as artificial intelligence, high-end manufacture, new infrastructure, energy conservation and emission reduction, renewable energy technology and sustainable finance and so on.

Hong Kong’s economy went through the deepest and most enduring recession to date in 2020. In 2021, Hong Kong’s economy is expected to achieve a moderate growth of around 3% from a low position.

Hong Kong’s financial market is expected to see great opportunity in 2021 considering the undervaluation in the Hong Kong stock market, the strong willingness of Chinese companies now listed in the US to go public in Hong Kong, the implementation of the policies aimed at promoting the integration of the Guangdong-Hong Kong-Maco Great Bay Area, and a series of measures launched by the Hong Kong Special Administrative District aimed to strengthen the international competitiveness of Hong Kong.

I. The evolution of the pandemic remains to be the biggest obstacle to economic recovery in the US

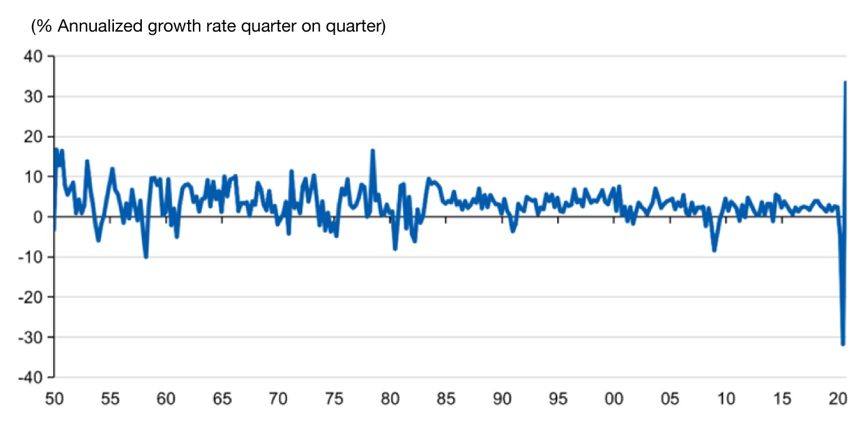

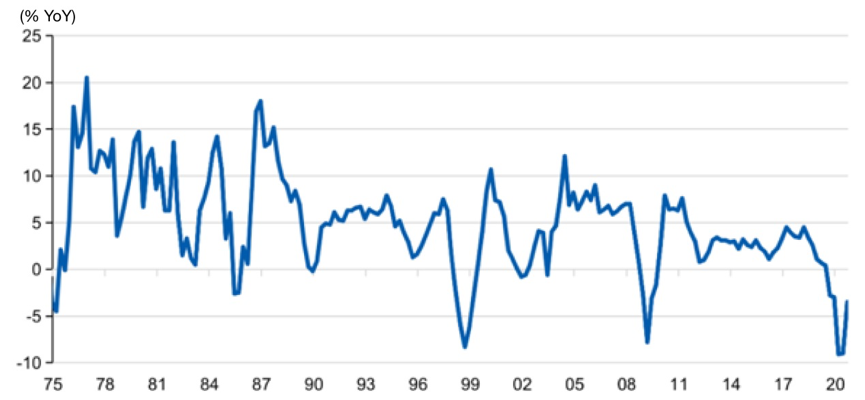

The US economy reported the largest quarter-on-quarter decline on record in the second quarter of 2020 due to the impact of the COVID-19 (Figure 1). In the third quarter, it rebounded from a low position thanks to the massive fiscal relief measures and the “unlimited” quantitative easing policy taken by the Federal Reserve. In the fourth quarter, the momentum of economic recovery was hindered due to the resurgence of the pandemic. It is anticipated that the real GDP of the US will decline by around 4.5% in 2020.

In 2021, the US economy will likely see moderate growth with a real GDP growth rate of less than 3%. In other words, by the end of 2021, the US economy would hardly recover to the pre-pandemic level at the end of 2019.

Figure 1: The growth rate of real GDP in the US

Sources: CEIC, Haitong International

The spread of the virus will be the biggest obstacle to the economic recovery in the US in 2021. The virus wasn’t controlled effectively in the US which has seen record highs in daily infected cases and hospitalization recently.

The US public is looking to vaccine in controlling the virus, which, however, would take quite a while to take effect. Besides, the pandemic already started to get out of control before the massive vaccination started, and the health care systems in some places were under huge pressure.

Many states, counties and municipal governments in the US may have to take lockdown measures to control the spread of the virus and lower the pressure of the health care system until a majority of the population is vaccinated. If this truly happens, the risk of the US economy falling into a second round of recession will rise sharply.

The two parties in the Congress compromised on the new round of relief package worth of $900 billion, which can help lower the risk of falling into a new round of recession. But it remains unclear as to whether the new round of spending is enough so that no additional relief measures are needed in the future and whether the incoming Biden administration can win support of both the upper and lower chambers of the US Congress when it comes to additional relief measures.

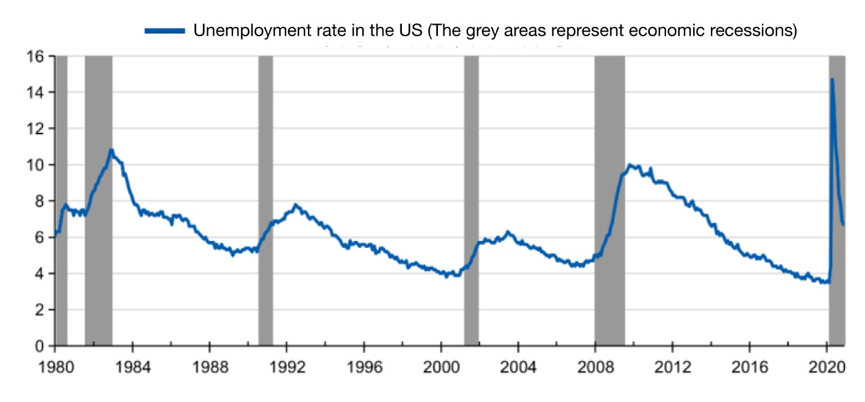

A gloomy job market will be one of the major challenges for the US in 2021. In April 2020, the US unemployment rate reached a historical high, with millions of people getting unemployed in one week at one point. Since then, although unemployment rate dropped significantly, the job market still didn’t see substantial improvement, with the unemployment rate still as high as 6.7% until November (Figure 2).

The generous $3 trillion relief package rolled out by the US government in 2020 (not including the $900 billion stimulus package at the end of 2020), provided prompt support to unemployed workers and prevented significant shocks to consumption, families’ balance sheets and the asset quality of financial institutions despite the high unemployment rate.

As the economy gradually recovers, it is unlikely that the US government will launch relief measures as massive as those in 2020. This means that many unemployed population may be less well-off in 2021 than they were in 2020 while the macro economy and unemployment rate improve. Families’ balance sheets may deteriorate which will further affect their purchasing power and even worsen the quality of assets of financial institutions.

Many enterprises (particularly small- and medium-sized enterprises) will face similar situation. Although the US economy will recover in 2021 from a low position, the absolute level of economic activities will hardly surpass that in 2019, particularly for industries that were severely hit by the pandemic (e,g, airline industry, catering, hotel, entertainment etc.). These industries stood up to the pandemic in 2020 through measures like cutting jobs, restructuring and receiving government relief, but their performance in 2021 will hardly recover to the level before the pandemic.

In the second half of 2021, as fiscal relief and monetary easing recede or even stop, the subsidies these companies can receive will decrease sharply. Many companies will likely face bigger repayment pressure and even the risk of bankruptcy. The quality of assets of financial institutions will also be largely affected.

Figure 2: Unemployment rate in the US remains high

Sources: CEIC, Haitong International

In short, in 2021, American households, businesses and financial institutions are likely to be under greater pressure to keep a healthy balance sheet. To prevent systemic risks, the US will need to rely on the Fed's unlimited QE to prevent economic or financial crises through liquidity provision. This means that it is hardly possible to avoid over-issuance of the US dollar, and the stability of the exchange rate will be threatened.

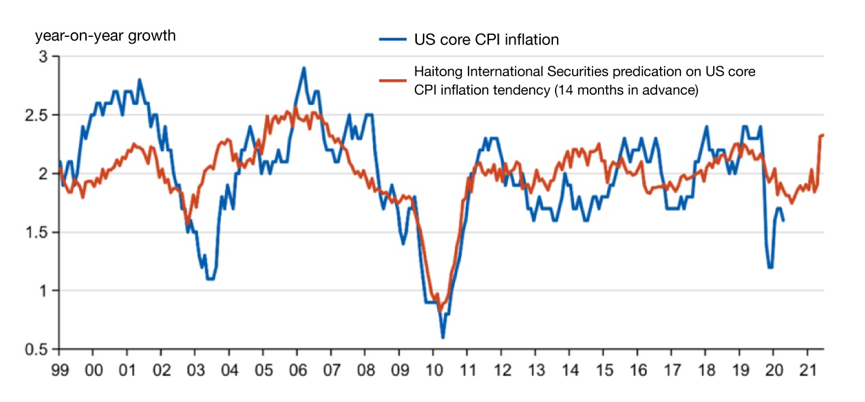

The United States will see potential inflation risk in the second half of 2021, which may impose certain constraints on the Fed’s loose monetary policy. In the first half of 2021, the worsening of the pandemic will curb inflation of core consumer price (CPI) in the country; however, in the second half of the year, inflation will face upward pressure due to rises in the housing price and import price.

Historical data shows that growth rate of US housing prices leads the housing factor of CPI inflation by about a year, and import price index leads commodity inflation by about a year. At present, housing demand in the United States continues to grow, and housing inventory is at a low level. The country has seen accelerated growth in housing prices. The import price index has continued to rise due to rising shipping prices. We predict that in the fourth quarter of 2021, core inflation may rise significantly, exceeding the Fed's 2% inflation target (Figure 3). At that time, the market may be concerned with a potential shift of the Fed's monetary policy.

Figure 3: US core inflation will face upward pressure in the second half of 2021

Sources: CEIC, Haitong International Securities

After a sharp rebound, US stocks have seen substantial overshooting compared to the recovery of the real economy, and valuations have largely deviated from the fundamentals. At present, investor optimism runs high, and transactions in all kinds of asset markets are crowded. However, once inflation, monetary policy or other political and economic fields see any unexpected change, it may trigger a shift in the crowded transactions and cause huge fluctuations in the financial market.

For example, whether (and when) Biden, after taking office, will reverse some of the economic and welfare policies (such as substantial tax cuts) introduced by the Trump administration deserves close attention.

For another example, the credit spread between US high-yield corporate bonds and 10-year Treasury bonds has shrunk to the level before the outbreak of the pandemic (Figure 4), and the absolute yield level of the former has hit a record low. Risks faced by the high-yield corporate bonds are also worthy of attention at a time when the economic recovery and policy support are uncertain, and enterprises are facing deteriorated balance sheets. If the United States fails to control the new round of the pandemic, it will suffer stagnation of economic recovery, decline in corporate profitability, and deterioration of the balance sheet.

In addition, if inflation rises in the second half of next year, risk-free interest rates may rebound accordingly. It will then bring pressure on the stock and credit bond markets.

Figure 4: US bond market bears hidden risks

Sources: CEIC, Haitong International Securities

II. China: strong economic recovery

China adopted strict and decisive quarantine measures, so it quickly cut off the path of virus infection and effectively controlled the spread of the disease. Consequently production was resumed in a comprehensive and rapid manner. Economic recovery has shown good momentum, and the real GDP growth throughout the year reached about 2%, which is not easy in the context of the global recession.

With further normalization of economic activities, China's economy will continue its rising trend in 2021, achieving an actual growth rate of more than 7%. At the same time, with the implementation of the 14th Five-Year Plan and the carbon neutral target in 2060, a series of new measures will be introduced to further accelerate the transformation and upgrading of China's economy, bringing extensive opportunities to investors.

In 2021, China will start the journey to implement its 14th Five-Year Plan. The Plan highlights the need to further promote high-quality and sustainable development; to strengthen national strategic scientific and technological capabilities, aim at cutting-edge fields such as artificial intelligence, quantum information, and integrated circuits, and implement a group of forward-looking and strategic science and technology projects; to develop strategic emerging industries and promote the deep integration of various industries such as the Internet, big data, and artificial intelligence.

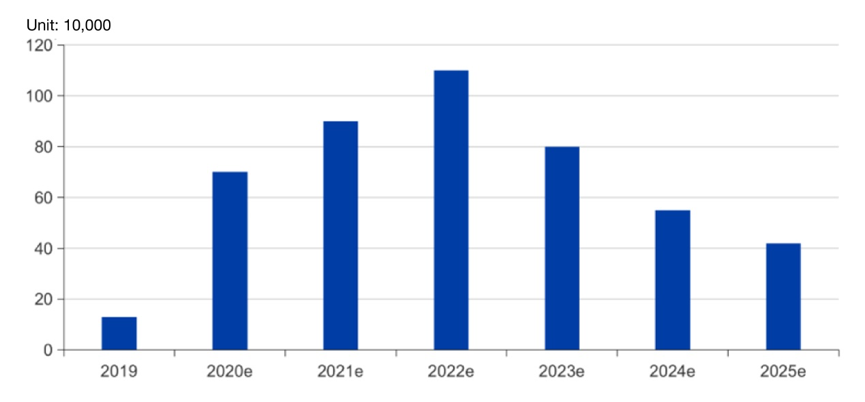

Under this background, the government and enterprises will further increase their investment in science and technology research and development, and a large amount of capital will enter the field of "new infrastructure". This will not only help stabilize investment, but will also foster the development of mid- and downstream industries. In particular, the popularization of 5G telecommunications networks (Figure 5) will further accelerate the birth and promotion of new technologies, new industries, new business models and new lifestyles, leading a new round of investment boom in the "new economy".

In terms of industrial upgrading, some leading businesses in the old economy will further integrate those inefficient and highly polluting production capacity, increase industry concentration, and improve the profitability of industry leaders; traditional industries will continue the process of technological update, applying technologies such as "Internet +" and "AI+" to improve industry efficiency and international competitiveness.

Figure 5: Number of newly-built 5G base stations according to prediction

Sources: the Ministry of Industry and Information Technology, Haitong International Securities

At the end of 2020, the Chinese government made a clear commitment to the international community to reach the peak of carbon emissions in 2030 and achieve carbon neutrality in 2060. As the world's second largest economy and the largest emitter of greenhouse gases, China is still at the stage of mid-to-high-speed economic growth. To achieve the above goals, China must act now.

In order to complete the above goals on time, it is expected that the Chinese government will introduce more regulatory policies and incentives in the field of green development in 2021. Companies will strengthen environmental protection, energy conservation and emission reduction, and promote clean energy, waste treatment, energy conservation and reduction. The development of such technologies and industries will create new growth engines, and bring huge opportunities to investors.

Of course, the risks and challenges China's economy is facing in 2021 cannot be ignored.

First, given the wide spread of the virus overseas, the prospects for global economic recovery in 2021 are not rosy. It is hard to predict the impact of changes in external demand on the Chinese economy.

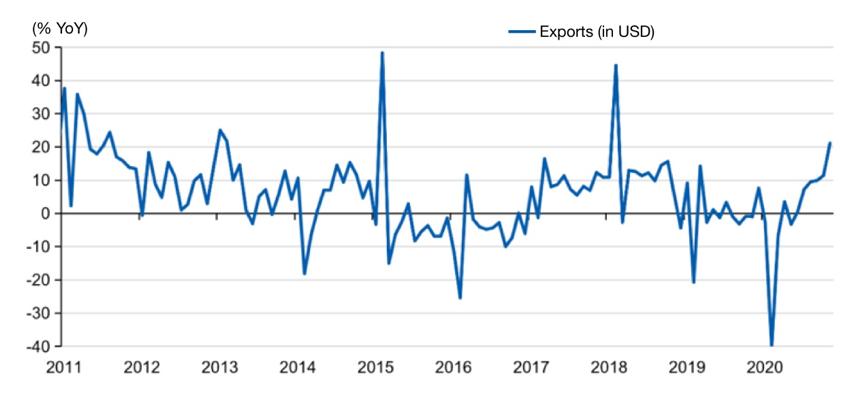

Thanks to China’s good job in controlling the virus, the manufacturing sector quickly resumed production. That production and supply chains in many countries had been injured by the pandemic forced the transfer of export orders from these countries to China, driving the strong growth of Chinese exports in the second half of 2020 (Figure 6).

If these countries can bring the pandemic under control in 2021 and gradually restore their productions and supply chains, these orders could return to them. In that case, the growth in China’s exports would slow down, but this could be made up for by faster improvements in external demands.

Figure 6: Strong rebound in China’s export growth

Sources: CEIC; Haitong International

In addition, although the Chinese economy is anticipated to see strong rebound in 2021, the picture is gloomier at the micro level. With mounting debts, many businesses and even financial institutions could struggle to make profits and improve their cash flows and balance sheets.

If fiscal supports and monetary easing exit too early, there is the risk of massive credit defaults in certain sectors or regions, which could disrupt financial market stability or even economic recovery. Therefore, coherent and stable macroeconomic policies will be critical for the sound recovery of the Chinese economy in 2021.

Third, Biden’s presidency is not likely to significantly ease the tension between China and the United States in the short run. Biden’s diplomatic team shows a much more moderate attitude than the hawk Trump administration toward international relations, trade, among other issues, but considering the American politicians’ sentiments, the strategic competition between the two countries in the long run, and the bargain with China in the short run, the new administration may not rush to reverse the adverse policies towards China put in place by it predecessor.

The Biden administration is expected to focus on containing the Covid-19 outbreak, boosting economic recovery, and addressing racial discrimination and wealth gap at home, while resuming the United States’ presence in global regimes including the WTO, Paris Climate Agreement and CPTPP. The relation with China may no longer be the priority.

China and the US enjoy possibilities for cooperation in dealing with common challenges such as climate change and pandemics, but the Biden administration is more preoccupied with political agendas like democracy and human rights, and could step up the pressure on China on issues such as those with Hong Kong. Unless certain events that can reverse the bilateral relations take place, the US is likely to continue with most of the Trump administration’s tariffs on Chinese imports, the sanctions on Chinese tech companies and financial institutions, and the hammering on China in national security-related fields such as technology.

In a word, it’s too early to be optimistic about the bilateral relations under the new administration.

III. Hong Kong: Weak economic recovery with new opportunities in the financial market

Hong Kong plunged into the deepest and most prolonged economic recession since the second half of 2019 (see Figure 7). As the number of inbound visitors slumps, retailers, hotels and tourism service providers have become bogged down. The Covid-19 outbreak has made things even worse, pressuring more businesses to downsize tremendously.

To cushion the pandemic’s blow and sustain people’s livelihood, Hong Kong has rolled out two rounds of massive fiscal supports, one being the Employment Support Scheme of HK$81 billion that provides wage subsidies for employers in exchange for their promise to retain employees.

However, after the Scheme expired in November 2020, financial strains have come back to many businesses. Amid the blow of another wave of Covid outbreak in winter, employers may have to downsize to survive, again pushing up the unemployment rate probably to record high (Figure 8).

Figure 7: Real GDP growth in Hong Kong

Sources: CEIC; Haitong International

Figure 8: Unemployment rate remains high in Hong Kong

Sources: CEIC; Haitong International

In 2021, Hong Kong’s economy is expected to grow by around 3% from a low base. If the pandemic continues to interrupt Hong Kong’s connection with the Chinese mainland and other parts of the world, its service sector may face even worse financial distress and greater risk of debt defaults. Hong Kong banks will also be affected in that case. In addition, business closures and rising unemployment risk stirring social instabilities. Hence, Hong Kong needs to introduce new financial support schemes this year to help businesses and households weather through.

That said, Hong Kong’s financial market may see immense possibilities in 2021.

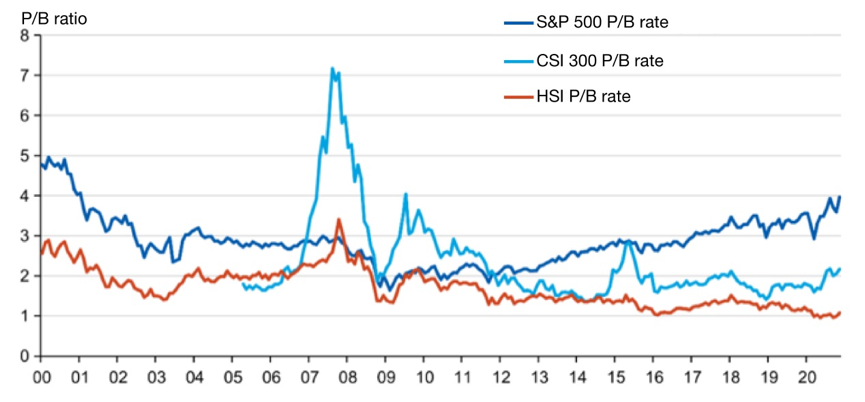

First, the valuation of Hong Kong stocks is low, whether compared with other stock markets like the US and the A-share market or with the history (Figure 9). Stocks are undervalued relative to the economic and earnings fundamentals. As the world economy picks up and investor confidence rises, Hong Kong stocks could attract more international investments, resulting in higher stock valuation and a stronger Hong Kong dollar.

Figure 9: Hong Kong stocks with low valuation are attractive to investors

Sources: CEIC; Haitong International

Second, ongoing backflow of China concepts stocks might inject new vitalities into the Hong Kong financial market. That’s what happened in 2020. Most of the companies that seek to relist in Hong Kong are in emerging sectors, and their return will improve the structure of the stock market, boost valuation, revitalize transactions, and attract more investors.

Meanwhile, enhanced regulation on the market and the accounting standards for listed companies in the US would place greater pressure on China concepts stocks listed there, especially tech companies facing sanction risks. As a result, more of them may go back to the Hong Kong stock market, expediting its structural improvements.

Third, an increasingly integrated Greater Bay Area has brought new opportunities to Hong Kong. Hong Kong strives to become a center for green finance, ESG investments and fintech in Asia, and thus investments in green bonds, Renminbi-denominated bonds, ESG and fintech as well as Renminbi cross-border investments may enjoy new spaces for returns.