Abstract: In this article, the authors had an in-depth analysis on the inflation data of November and looked into reasons for the negative growth of CPI. They predicted that the negative growth of CPI and PPI would last until the second quarter next year.

The National Bureau of Statistics published November inflation data on December 9. CPI fell by 0.5% on a year-on-year basis, a drop of 1 percentage point from the previous month; PPI fell by 1.5% on a year-on-year basis, and the rate of decline narrowed by 0.6 percentage point from the previous month.

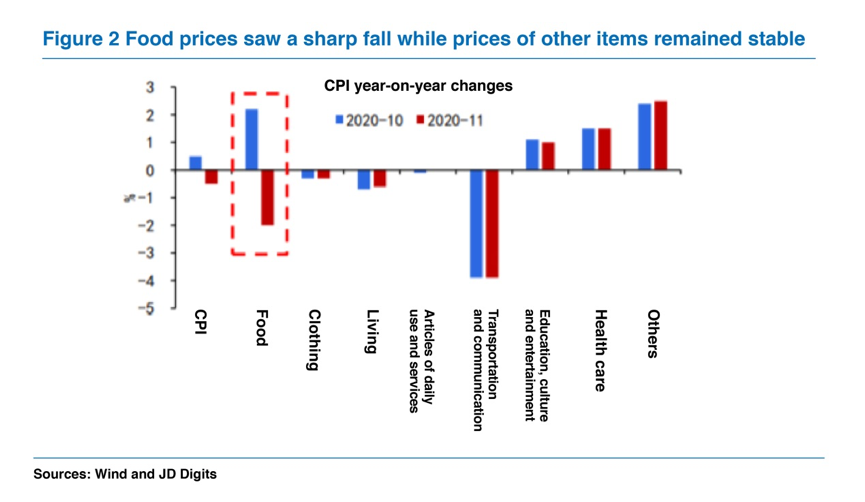

Overall, the growth of CPI has turned from positive to negative due to pork price changes, and the non-food CPI has fallen to a negative range for the first time in more than ten years, and domestic deflationary pressure has increased.

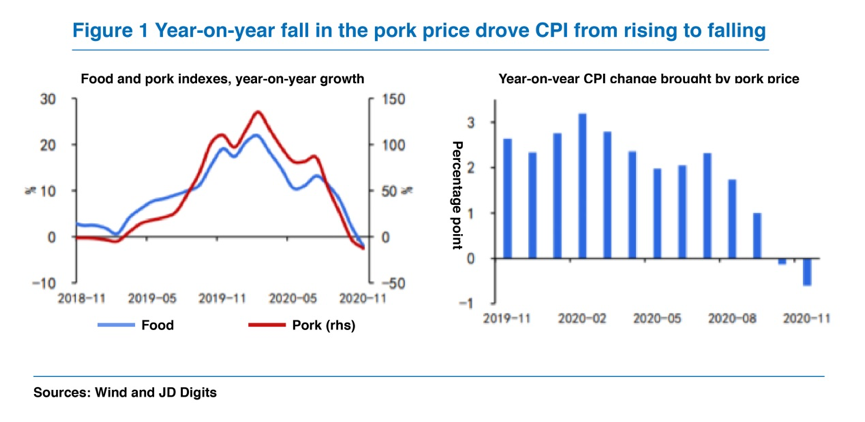

Affected by the year-on-year drop in pork prices and the high price base in the last year, the CPI has seen a change from rising to falling. Food prices in November saw a month-on-month change of -2.4% and year-on-year change of -2%. On a month-on-month basis, due to the recovery of pork production, pork prices continued to drop by 6.5%; fresh vegetables and eggs were in sufficient supply, and prices fell by 5.7% and 1.6% respectively.

Affected by the high base in the same period last year, the year-on-year growth of pork prices fell sharply from -2.8% in the previous month to -12.5%, driving CPI down by about 0.6 percentage points on a year-on-year basis, being the main reason for the sharp drop in CPI.

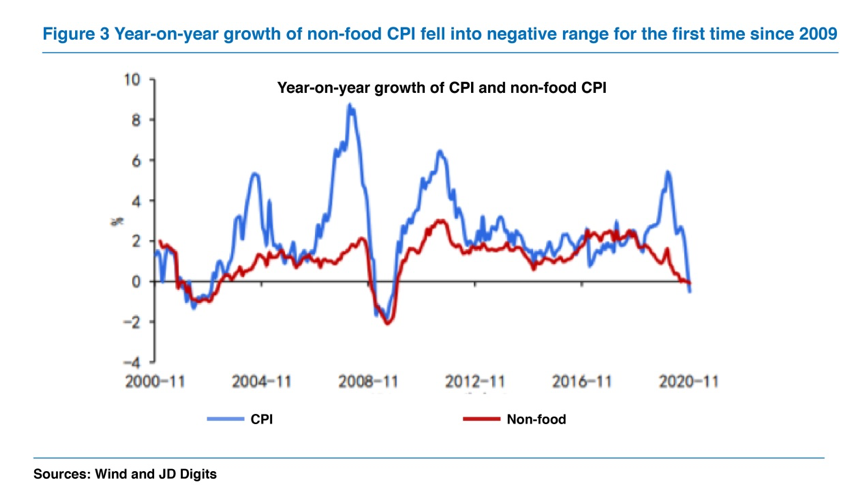

Year-on-year growth of non-food CPI fell to a negative range for the first time since 2009, and deflationary pressures increased.

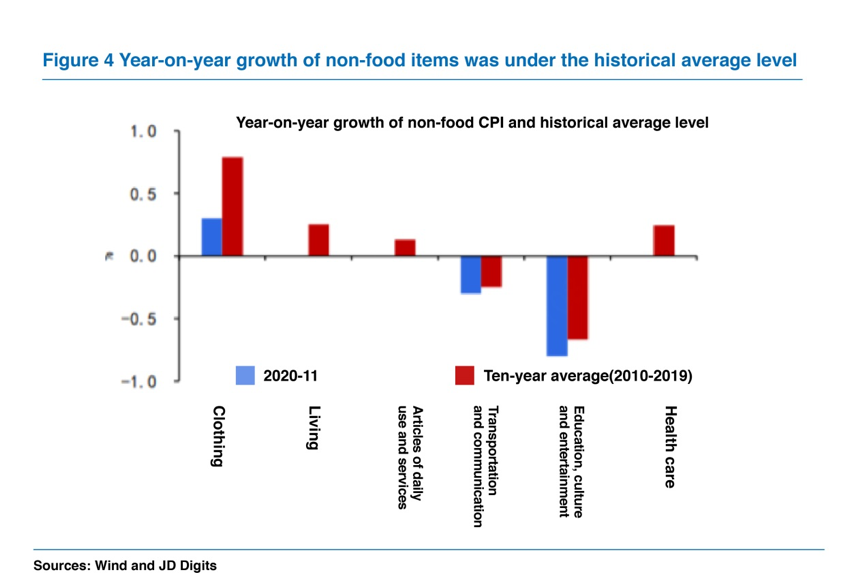

Non-food prices saw month-on-month growth of -0.1% and year-on-year growth of -0.1%. The latter fell to negative growth for the first time since November 2009. From a month-on-month comparison, off-season tourism decreased, and the prices of air tickets, tourism and accommodation fell significantly; the month-on-month growth of other sub-items was lower than the average level of the past decade. The downturn in non-food prices reflects that the recent improvement in domestic demand has not been transmitted to price indicators, and domestic deflationary pressure is more significant than expected.

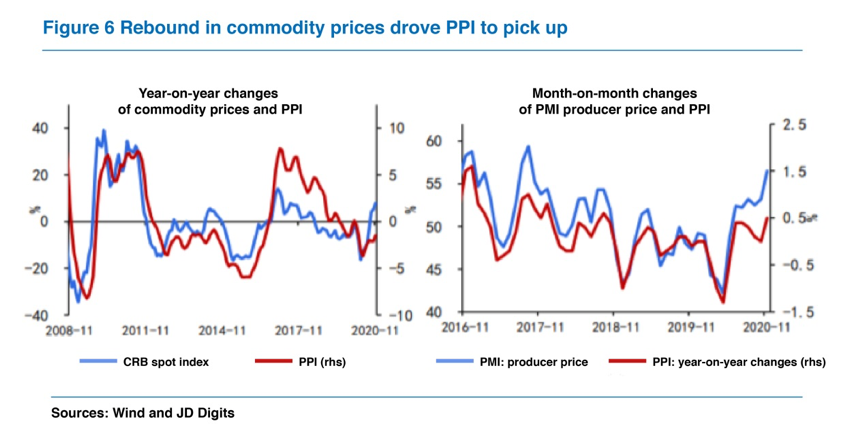

The rebound in commodity prices drove the PPI growth to pick up from a low level.

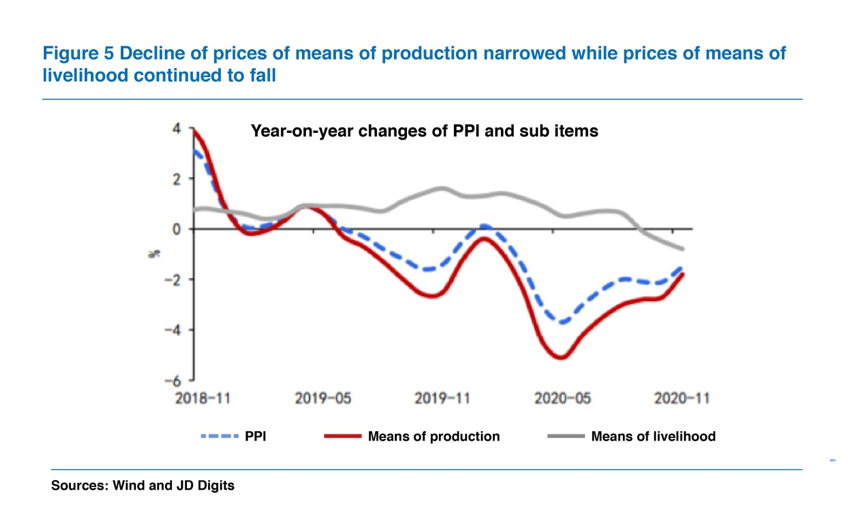

In November, the PPI saw a month-on-month growth of 0.5% and the year-on-year growth rose to -1.5%. Specifically, the decline in the prices of means of production narrowed, which made up for the decline in the prices of means of living. The main reason is that the prices of industrial products rose sharply in November. The international crude oil price, the CRB spot index, and the PPI ex-factory price index all went up significantly, driving PPI to rebound from a low level. Among the 40 industrial sectors, 24 sectors saw a rise in the price, an increase of 12 over the previous month. Among the major industries, non-ferrous and ferrous smelting and processing, oil and gas exploration, petroleum and coal processing and chemical manufacturing all picked up from the previous month.

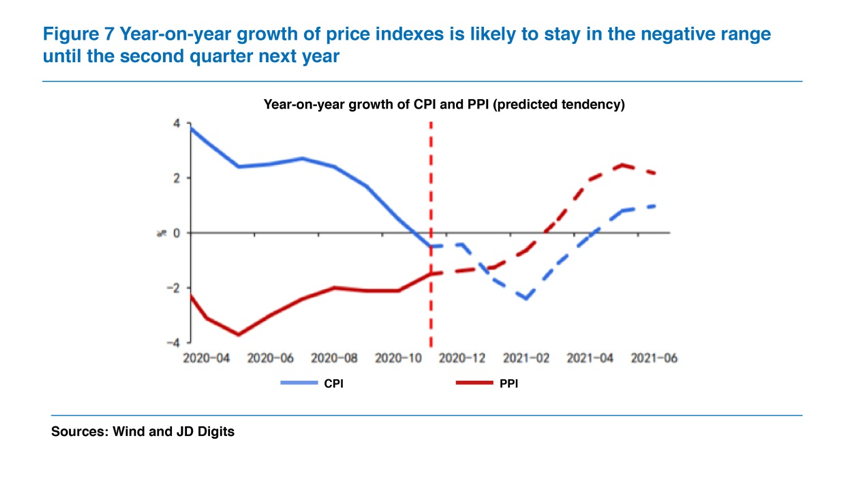

The negative growth of price indicators may persist even in the first quarter of next year.

Looking ahead to the next few months, the year-on-year growth of CPI will remain at a low level because of the high pork prices in the last year and that the transmission of improved domestic demand to non-food prices was hindered. PPI will gradually pick up because of the recovery of the global economy and the boom in domestic industrial production, but it is not likely to get out of the negative range quickly.

According to our forecast, the negative growth of CPI and PPI may continue into the first quarter of next year, after which PPI is expected to take the lead to get out of the deflationary zone and return to positive growth. Currently, prices are not a priority for monetary policy.

Download PDF at: http://new.cf40.org.cn/uploads/2020122sjg.pdf