Abstract: Given the economic loss in the first quarter as a result of the ongoing pandemic, even if China's growth rate is rapidly pulled to more than 5% in the next three quarters, it is difficult to achieve a growth rate of more than 3% in the whole year without the implementation of unimaginable stimulus policies, of which a large expansion of fiscal deficit is an indispensable component. On the bright side, China enjoys a few policy options other countries do not have, which are derived from its huge public savings and unmet demand for housing and cars in big cities. Whether China can recover from this shock in the short term requires more efforts, such as more active fiscal deficit policies, subsidies or tax cuts, and fairer treatments to private enterprises, to mention just a few.

I. Overseas economy has pressed the "pause button"

When China's economic data for January and February came out, the statistics turned out to be much worse than expected by many. The novel coronavirus is characterized by strong infectivity, a moderately high fatality rate with more than 10% of infections being severe cases, and a mortality rate of 1% to 2%. No country would relax its prevention and control measures for the sake of economic growth. Isolation is a must for every country.

Since March, overseas anti-pandemic efforts have been comprehensively upgraded. Many developed countries are now taking quarantine measures similar to what Wuhan did. High-frequency data are adjusting sharply, such as the rapid reduction in the number of transnational airlines. Cross-border travel/logistics, domestic transportation, and traffic activities in major cities around the world has all dropped rapidly. Domestic consumption in various countries has also been significantly impacted: restaurant consumption has basically stagnated, and hotel occupancy rate has dropped considerably since March. Based on the assumption that the outbreak will be over in hard-hit areas in the second quarter, we expect the annualized quarter-on-quarter US GDP growth rate to be at -28% in the second quarter. The Wall Street forecasts this rate to be roughly -30%. Some at the Federal Reserve are even predicting -40%, -50% growth, which alone would plunge the US into recession for the entire year. It is not yet clear whether the problems in the real economy will evolve into financial problems as a result of cash flow and internal leverage issues.

"Stress barometers" for overseas markets point to a sharp tightening in the global financial conditions. Drawing an analogy to the shadow banking, we can find that currently asset management sector's leverage and liquidity of the underlying assets are bleeding. Some indicators show that cash flow pressure from the real economy is rapidly passing through to financial markets, such as a sharp rise in bank CDS, indicating increased counterparty risk in the market. Some indicators are close to their 2008 peaks. Moreover, some niche or illiquid assets, or assets whose prices are inefficient are not observed in real time. America's fixed-income market is facing severe problems.

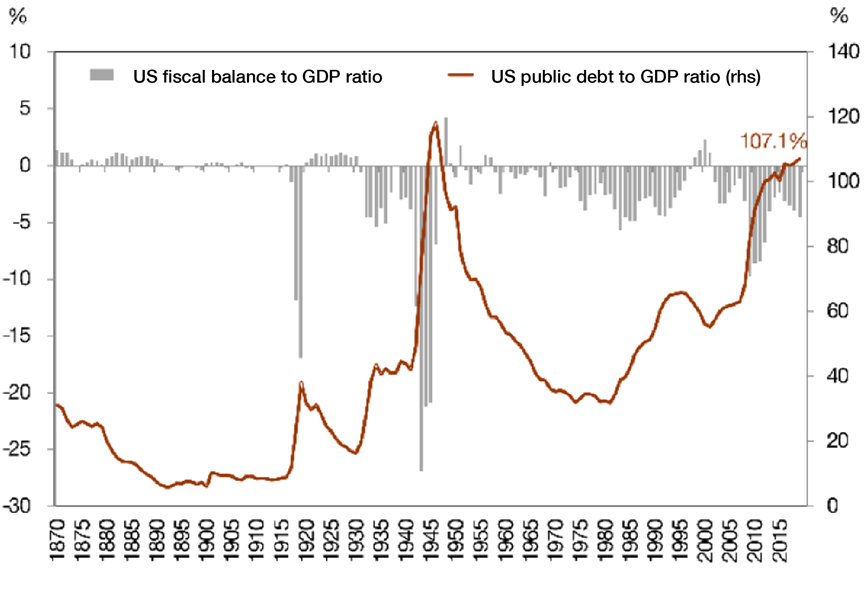

At present, the Federal Reserve is rapidly expanding its balance sheet and has launched an enhanced version of quantitative easing policy. Looking back, we can see that in the two World Wars, especially during the second World War, the US government maintained a budget deficit of more than 20%. It appears that as long as there is national credit, there is endorsement for fiscal deficit. In peacetime, the US national debt as a share of GDP is already high, but fiscal easing is expected to intensify, and the explicit fiscal deficit is expected to reach double digits this year and next.

Figure 1: The US is expected to intensify fiscal expansion

Source: CICC

II. China's economic outlook in the face of a once-in-a-century pandemic

Given the economic loss in the first quarter, even if China's growth rate is rapidly pulled to more than 5% in the second, third and fourth quarters, it is difficult to achieve a growth rate of 3% or above in the whole year without the implementation of unimaginable stimulus policies. But even so, China is likely to be the only major economy to see positive growth this year.

China's work resumption rate has reached more than 80 percent. CICC's daily work resumption index shows that the national rate of work resumption is about 86.5 percent, and the daily coal consumption has reached 80.8 percent of the normal level prior to the spring festival. However, mainly due to the slow recovery of domestic demand, the growth rate has slowed down since mid-March.

The utilization rate of freight logistics capacity has been restored to over 90%, reaching 96.7% of the normal level prior to the spring festival. However, traffic in the city has been slow to resume, equivalent to 64.2% of the pre-holiday level, indicating that many enterprises still choose to work from home.

In the meantime, external demand has recently shown signs of rapid weakening. Foreign trade companies currently have only old orders, and the outlook for new orders after May is bleak. In Guangdong province, the utilization rate of heavy trucks after the spring festival holiday went all the way up before it declined recently, while import and export price index also indicates that external demand may be relatively weak. Looking back at the financial crisis, the global economic slowdown was a big drag on China's external demand. In the next three to six months, the shock on external demand would be only worse than that in 2008. In 2008, China's export growth slowed by 40 percentage points. Exports currently account for about 17% of China's GDP. Therefore, even if we use the export growth rate of 2008 as a reference, the pandemic will also have a negative impact of 4-5 percentage points on China's GDP growth within half a year.

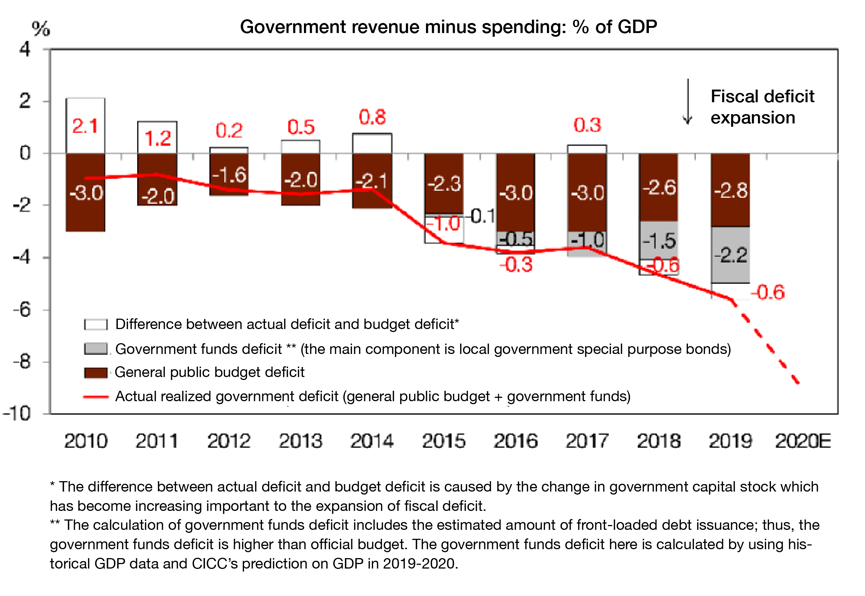

As for fiscal deficit, the reduction of government revenue will automatically expand the fiscal deficit, which means not all of China's current fiscal deficit expansion should be regarded as stimulus. China can achieve economic growth of 2.6% only if the country's explicit fiscal deficit increases by seven percentage points compared with last year. Half of that seven percentage points is the combined result of falling revenues and rising health spending. That leaves three percentage points for really boosting demand. This amount of fiscal expansion would cover half of the estimated 7% to 8% of loss in GDP for the whole year. Only under this premise, can a growth rate of 5% or so in the fourth quarter be guaranteed. Thus, deficit expansion is a must this year, and fiscal contraction should be avoided. Without a large expansion of explicit fiscal deficit, fiscal situation will fall into austerity.

China's monetary policy also lags. Monetary easing is needed, whether in the face of downward economic and deflationary pressures or the large-scale expansion of fiscal deficits. However, Chinese central bank’s front- and back-end interest rates are too high. China's policy rate is higher than those of other major economies and the gap has further widened recently. The spread between Chinese government bond and the US Treasury bond is also at a record high.

Figure 2: "Active" fiscal expansion is somewhat limited due to the “passive” expansion of fiscal deficit

Source: CICC

After the "dollar drought", the Chinese yuan is likely to appreciate. Although driven by the "dollar shortage", yuan depreciated against the US dollar, it has appreciated significantly against a basket of currencies. In short term, the depreciation of yuan against the currencies of emerging market countries is actually a passive appreciation. Therefore, in short-term, yuan policy is difficult to predict.

III. China's policy options that other countries do not have

1. Huge and inefficient public savings

If the pandemic shock is likened to a snowstorm or a drought, the capacity of countries to cope with the disaster depends on how much savings they have and how they are distributed. China's savings rate has long been higher than that of any other major countries in the world, and its annual net savings is several times that of the United States and more than that of the G7 combined. China has a lot of public savings, which is an advantage in dealing with the current crisis. According to the Chinese Academy of Social Sciences, China has public savings equivalent to 120% of GDP, which no other country has. Savings or wealth in the United States is concentrated in some private hands, and most people and the country as a whole tend not to save, making it difficult to mobilize savings. China's high savings rate, especially the high public savings rate and inefficient resource allocation of the financial system have been widely criticized. Whether China can mobilize public savings in the COVID-19 crisis is key to whether China can perform better than it did in the 2008 crisis, and whether growth will be more efficient in the years ahead.

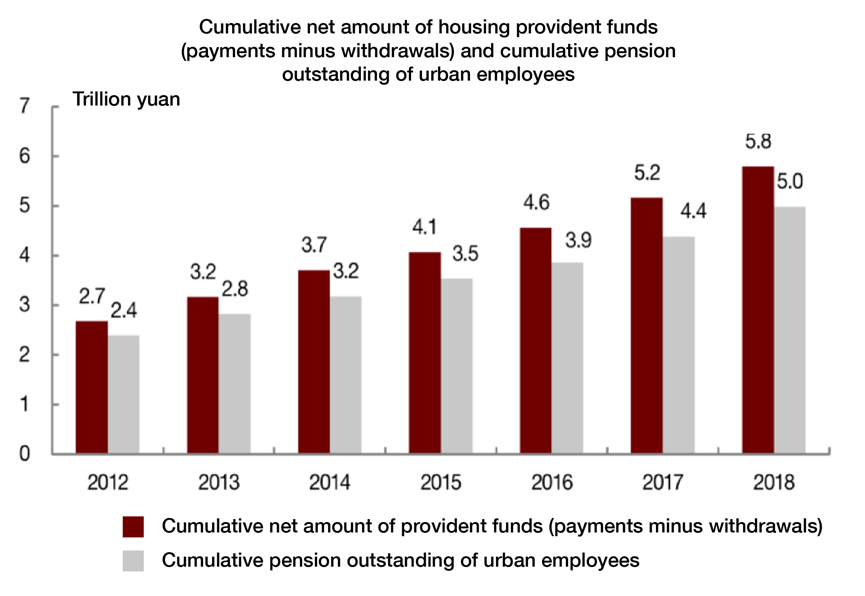

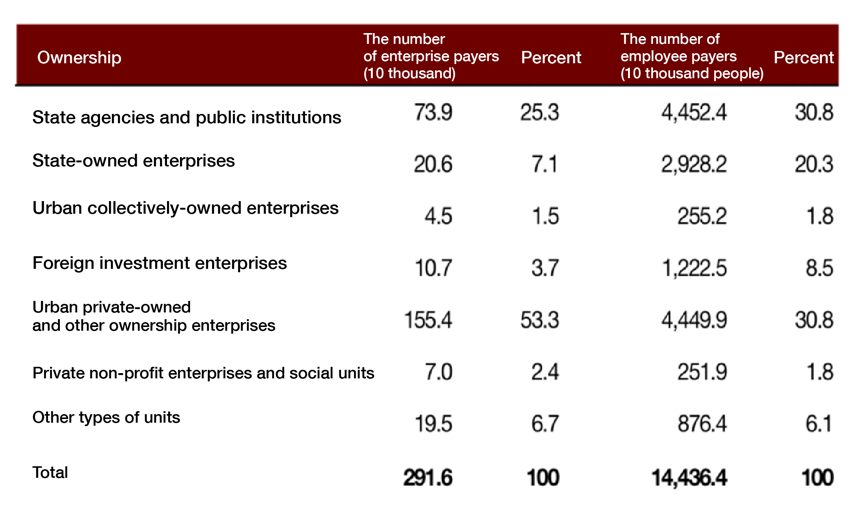

China's overly high savings rate is related to the distribution arrangement of the financial system and the forced saving mechanism. The biggest problem caused by forced saving is that China's public sector in a broad sense (especially the governments and government organizations) has a large and growing proportion of deposit savings, a lot of which are inefficient. This is mainly caused by lags in reforms in three areas: public institutions, state-owned enterprises (SOEs), and urban investment and taxation system. Most of the surplus of China's social security and housing provident funds exist in the form of bank deposits. To mobilize these stocks by taking the opportunity of the pandemic shock should be a reform focus. For example, China should speed up its efforts to put state assets under the social security funds while further reduce or waive firms’ contributions to social insurance schemes. Beyond traditional monetary and fiscal policies, there would be plenty of room for maneuver, if China could accelerate the allocation and management of savings, such as extending the social security cuts to one year, or activating the RMB 5.8 trillion provident funds currently sitting as savings.

2. Demand for housing and cars in big cities is far from being effectively supplied

China still lacks large cities, with 27 percent of people living in large cities with a population of more than 1 million and only 13 percent living in cities with more than 5 million people, less than half the share in other developed countries. Despite the housing and car demands in big cities, China is currently implementing the most stringent restrictions on purchases and loans in history. Measures have to be taken to tackle the insufficient demand in the economy. As is well known, housing land supply, urban housing areas and many other facilities are still insufficient in China. In addition, the quality of a large number of houses is low, which can hardly meet the basic requirements of housing quality.

The main reason for the high housing price is the government's land supply and tax policies. Tax and land transfer fees account for more than 60% of housing price in urban areas. In addition, urban housing construction land is also in short supply. Taking the chance brought by the COVID-19 crisis, China can develop its public rental housing system, REITS and other products, return the provident funds to individuals or use them for better long-term investments.

The provident fund system is in urgent need of reform. The balance of the provident funds exceeds the balance of national pension, with more than 50% paid by SOEs and state institutions, and high-income firms (such as financial enterprises) contributing to the majority of the share by private enterprises. Such an income distribution system is not reasonable. China has long proposed to reform this problem, and it is worth seeing whether the crisis can be used to push past the barriers of departmental interests.

Figure 3: The housing provident fund system is in urgent need of reform

Source: CICC

There is still improvement potential for car ownership per capita in China, and road construction in big cities. Per capita car ownership in China is very low compared with South Korea, Japan and Chinese Taiwan, especially in big cities. The main reason is linked to roads. Although the length of China's expressways has surpassed that of the United States and the length of China's high-speed rail leads the world, the total lengths of roads and railways in China are both lower than those of the United States, which indicates that there is still some room for infrastructure construction.

It is unlikely many investment could be made for new infrastructure, new high-tech projects in a short period of time, and the returns are slow. A more efficient approach is to invest in infrastructure and housing in big cities and urban agglomerations in need, which could bring higher returns and better solutions to the current problems.

In short, whether China can recover from this shock in the short term requires more efforts on the following three levels:

First, adopt more active explicit fiscal deficit policies; revitalize state-owned assets and launch REITs as soon as possible; accelerate the reform of state-owned public institutions; reduce fees, and activate the huge amount of deposits of government agencies and organizations; become less dependent on commercial banks; promote the reform of fiscal and tax systems and swap (or convert) outstanding debts.

Second, transfer money from government departments to enterprises and people through subsidies or tax cuts; liberalize the family planning policy; raise the retirement age; transfer state-owned assets to supplement social security funds and reduce companies' social security contributions; accelerate rural housing and land reform and improve property ownership of non-urban residents.

Third, draw lessons from 2008 and treat SOEs and private enterprises fairly in a way more efficient than did in 2008; accelerate the reform of SOEs, reduce the debt ratio, and increase the dividends of mature industries; build an effective short-term financing market for enterprises to reduce their "precautionary" savings; accelerate the reform of the equity market and make financing pricing more market-based.