Abstract: Considering the recent tumult in global economic and financial markets triggered by the pandemic, there exist quite a few pessimistic expectations that the Great Depression 2.0 is looming. The panic over a possible return of the Great Depression is misleading given the vast discrepancies between the present and the 1930's Great Depression in terms of monetary system, macro policy ideas, global trade landscape, and robustness of banking system and social security system.

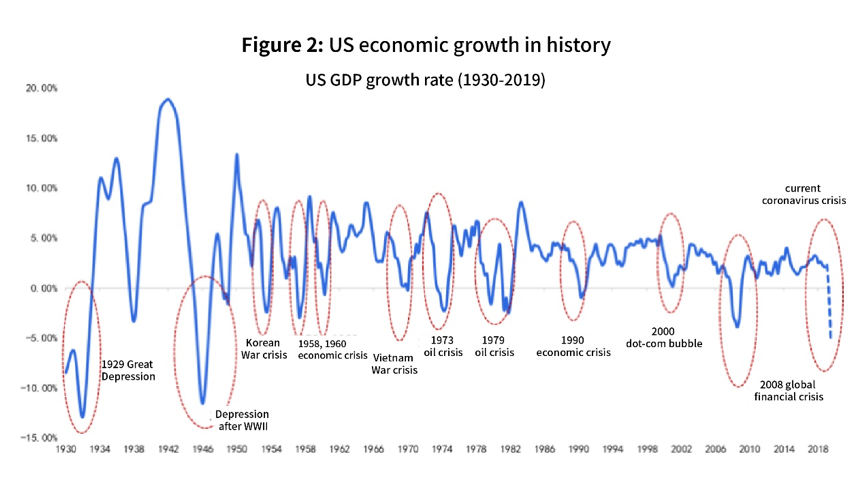

As the coronavirus continues to spread worldwide by unprecedented speed and scale, the global financial market has witnessed violent fluctuations. The US stocks tripped the market circuit breaker 4 times within 10 days, plunging over 30% in mere three weeks. The market only rallied slightly after a series of fiscal and monetary stimuli were applied. The yield on the benchmark US 10-year Treasury touched 0.4%, an all-time low in the past 150 years. The price of gold, a safe-haven asset, though incurring occasional downswings, presented an overall uptrend. Meanwhile, the US Dollar Index approached 103. The real economy also suffered a devastating blow, with the US manufacturing and service industries experiencing a sharp decline. Accordingly, the unemployment surged. Market institutions forecasted a double-digit negative growth for the American economy in the second quarter.

Considering the recent tumult in global economic and financial markets triggered by the pandemic, there exist quite a few pessimistic expectations that a Great Depression similar to the one in the 1930s is looming, unprecedented in its severity and several times more devastating than the 2008 financial crisis.

Will the global economy slip into another "Great Depression"? Though the real economy is doomed to suffer terribly from the pandemic in the short term, or even sink into recession for a while, the current tumult should be attributed in large measure to the pandemic rather than to the financial system, and thus resembles those induced by natural disasters. As said by Bernanke, a former Federal Reserve Chairman, "It's really much closer to a major snowstorm or a natural disaster than it is to a classic 1930s-style depression."

The panic over a possible return of the Great Depression is misleading, given the vast discrepancies between the present and the 1930's Great Depression in terms of monetary system, macro policies ideas, global trade landscape, robustness of banking system and social security system.

We will not undergo another Great Depression, as evidenced by the following five key differences.

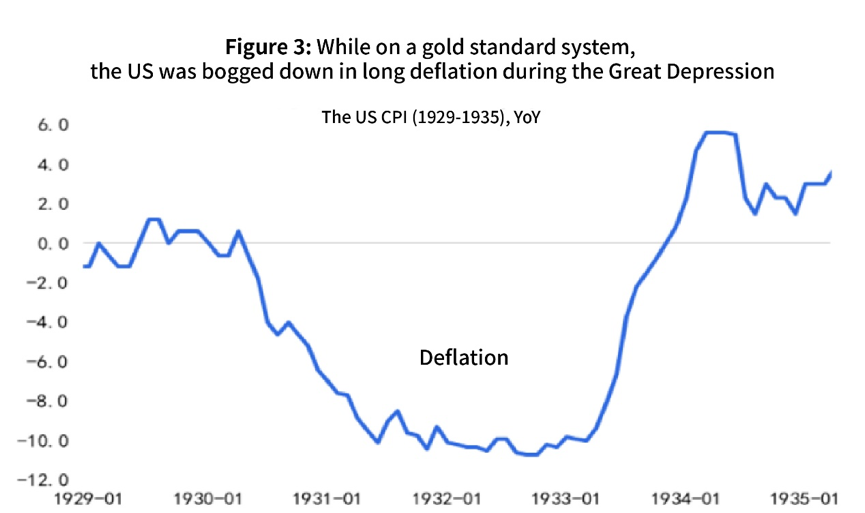

The first difference lies in the monetary system: the gold standard system during the Great Depression hampered monetary policy easing. History proves time and again that timely and effective policy responses are indispensable for deterring escalation of crises. During the Great Depression, the American government's stimulus efforts were severely handicapped by the gold standard in force. The currency of a country under the gold standard system has a value directly linked to gold, meaning that in order to stabilize the exchange rate, measures like increasing the money supply, which is a common tool of expansionary monetary policy, requires increasing corresponding amount of gold reserve. Meanwhile the central bank could hardly cut the interest rate at its own discretion, for low interest rate would trigger the outflow of gold. Therefore, monetary policies exerted few effective counteractions around 1929 at the onset of the recession in America. Due to the liquidity shortage in the financial market and the real economy, the US was bogged down in a severe deflation, with the price level dropping 30% cumulatively from 1930 to 1932. The depression didn't abate until interest cuts and currency devaluation were enforced in April 1933, when the export of gold was banned and the gold standard was abolished in the US as a part of Roosevelt's New Deal, lagging behind the UK for two years.

The room for policy maneuvers is much more spacious at present than during the Great Depression. Since March, the Fed has slashed the interest rate to zero, and implemented a series of QE policies including the Commercial Paper Funding Facility (CPFF), the Money Market Mutual Fund Liquidity Facility (MMLF) and currency swaps. The Fed even promised a QE-Infinity in order to ensure market liquidity, and to prevent the mass default by enterprises and individuals due to liquidity shortage. The Fed has learned a lesson from the hesitant response to the financial crisis in 2008 and reacted promptly, effectively allaying the panic of the investors and keeping away a possible liquidity crisis.

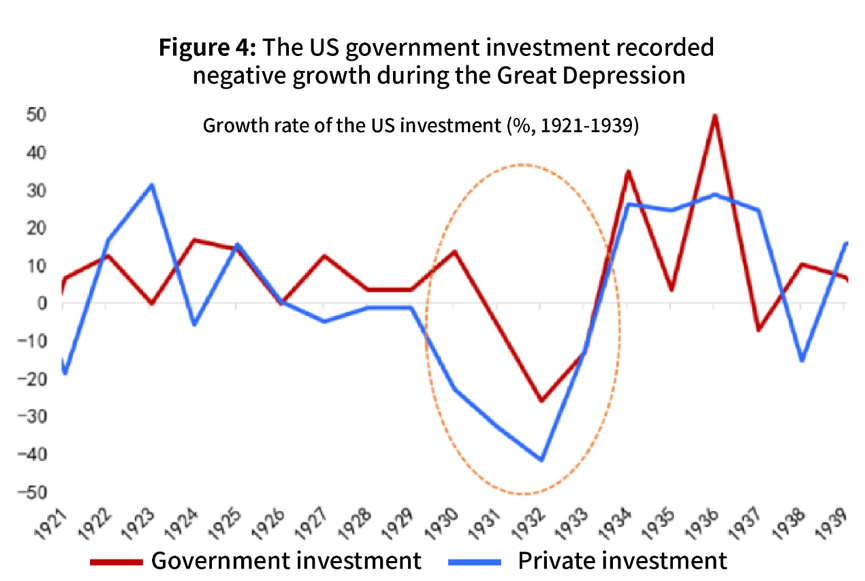

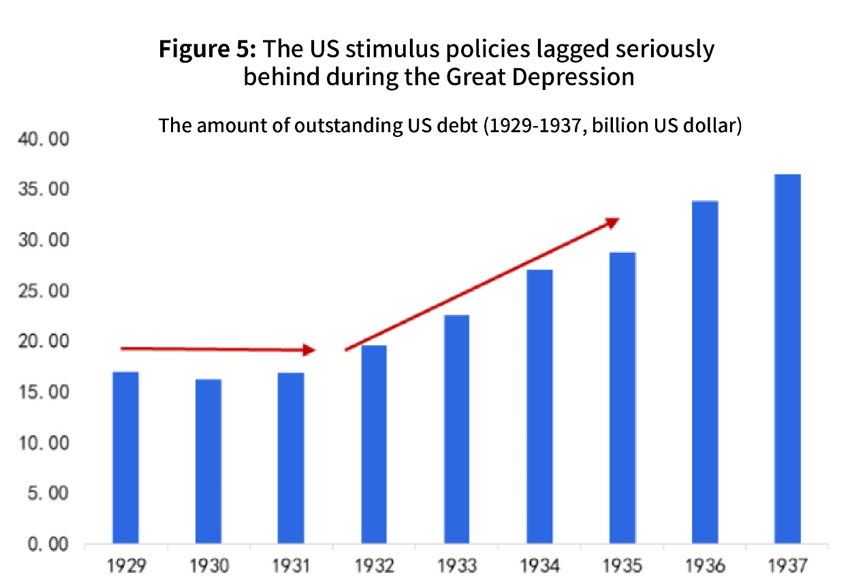

The second difference lies in the different roles fiscal policies play: the stimulus policies lagged seriously behind during the Great Depression.

During the Great Depression, the Hoover administration adhered to the Austrian school of economics, believing that only by making fiscal ends meet can the leverage ratio be reduced, and that fiscal austerity is the best way to reduce debts and mitigate the economic crisis. In the absence of effective stimulus policies, the deterioration of the American economy persisted throughout the Great Depression. Hoover's commitment to fiscal austerity exacerbated the American economic crisis. It was Roosevelt's New Deal that saved the economy. Within 100 days of taking office in 1933, Roosevelt introduced the New Deal—massive economic stimulus, abolishment of the gold standard, increase in the money supply, offering guarantees to banks, and the announcement of a large-scale government investment program—which boosted the confidence of investors and was crucial to getting the US economy back on track. The diversified and comprehensive policy mix ended up proving effective—after four years of depression, the US economy began to recover gradually in 1933.

After the Great Depression and several financial crises, macroeconomic theories flourished, and government fiscal support was incorporated into the counter-cyclical tool kit. In the face of the pandemic, the Fed and the US government quickly launched a series of emergency response policies based on lessons learned from the Great Depression. After the Fed slashed the interest rate, rolled out QE-Infinity and expanded the scope of purchases of agency mortgage-backed securities (MBS), the House of Representatives voted unanimously on March 26 in favor of the biggest fiscal stimulus bill in the American history, which amounts to $2 trillion and includes comprehensive fiscal support and relief aimed at enterprises, individuals, the medical system and local governments. As the impact of this pandemic on the economy is all-around, the coordination of monetary and fiscal policies becomes particularly important. The government fiscal support will provide direct relief to residents and enterprises affected by the pandemic, thereby reducing its impact to some extent.

The third difference lies in the trading environment: during the Great Depression, the global trading system collapsed.

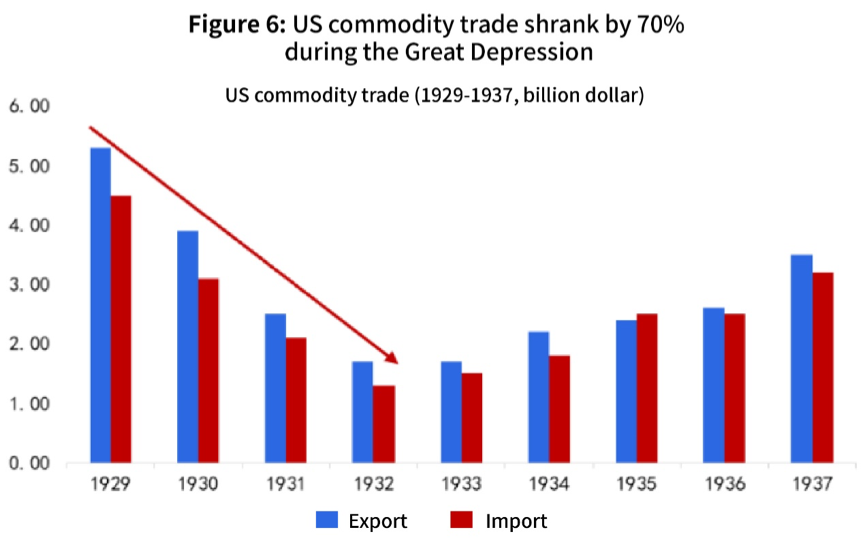

The Great Depression happened when the global economic expansion came to an end, with protectionism and populism spreading around the world and the trade wars dragging countries' economy into deeper recession. Meanwhile, the Smoot-Hawley Tariff Act of 1930, designed to mop up excess capacity in the Great Depression and protect American companies, raised tariffs on more than 20,000 imported goods to unprecedented levels. The bill provoked complaints from other countries and a scramble for retaliatory measures against the US, further exacerbating trade protectionism, hurting the real economy in export-oriented countries and contributing directly to a sharp rise in unemployment. Between 1929 and 1933, global trade shrank by more than 60% as a result of retaliatory tariffs and escalating trade wars around the world. America's share of exports also fell by 75%, from $5.3 billion to $1.3 billion.

Although the global trading landscape is undergoing drastic changes and China and the US have had on-and-off trade disputes, the severity of these tensions is a far cry from that of the global trade war during the Great Depression. In recent years, trade frictions started by the United States against many countries have halted the process of global trade integration, and the multilateral trading system under the WTO framework has been greatly challenged. However, global trade is freer than that during the Great Depression, and the level of tariffs is far lower. At the same time, despite the several escalations of the trade disputes between China and the United States in the past, a phased improvement has been achieved with the signing of the phase one trade agreement, which helped ease the bilateral economic and trade relations. It can be said that the current global economy is not expected to fall into a vicious circle of recession, trade war, intensifying depression, and escalation of trade war that once appeared during the Great Depression.

The fourth difference lies in the financial safety net and financial regulatory system.

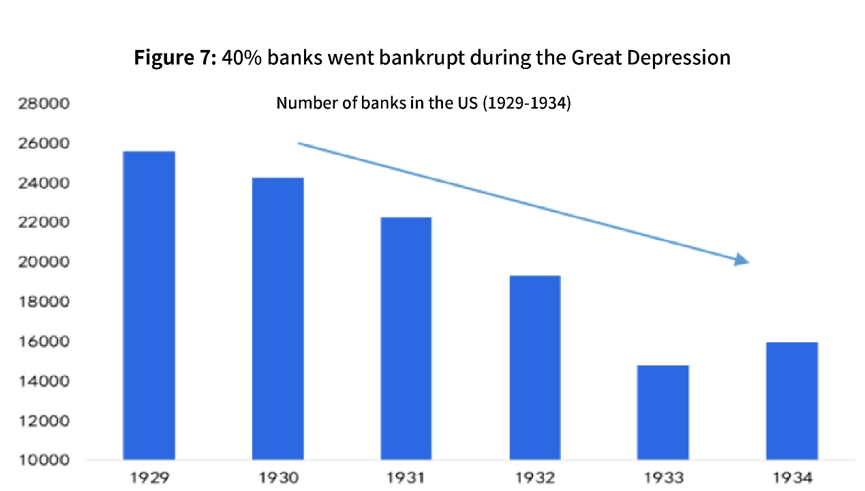

The Great Depression is an economic crisis that so far had the most far-reaching impact in the history of the world, bringing a lasting shock to the American economy. It had a lot to do with the weak regulation of the American financial market. Before 1929, there was almost no regulatory system in the US securities market. Companies issuing stocks and bonds to the public often failed to issue regular financial reporting statements, or even issued misleading false reports. Investors received very limited protection. From 1929 to 1933, since the deposit insurance system had not been established and the financial risks spread rapidly due to depositors' runs, a wave of bank failures occurred, and eventually more than 10,000 banks went bankrupt causing the complete collapse of the financial order. It can be said that during the Great Depression, the impact of the economic crisis was magnified by the lack of financial regulation and deposit insurance system.

America's financial system is far sounder than it was during the Great Depression when the Roosevelt administration established a series of important agencies, including the Social Security Administration, the Securities and Exchange Commission (SEC), the Federal Deposit Insurance Corporation (FDIC), and the United States Housing Authority, which are still playing important roles. Moreover, the current financial regulatory system, macro-prudential regulatory system, central bank's role as lender of last resort and deposit insurance system are all performing their respective functions. The financial safety net is becoming increasingly sophisticated, and the ability to resist risks has been greatly improved, significantly lowering the probability of another Great Depression as a result of market failure.

The fifth difference lies in the robustness of the social security system.

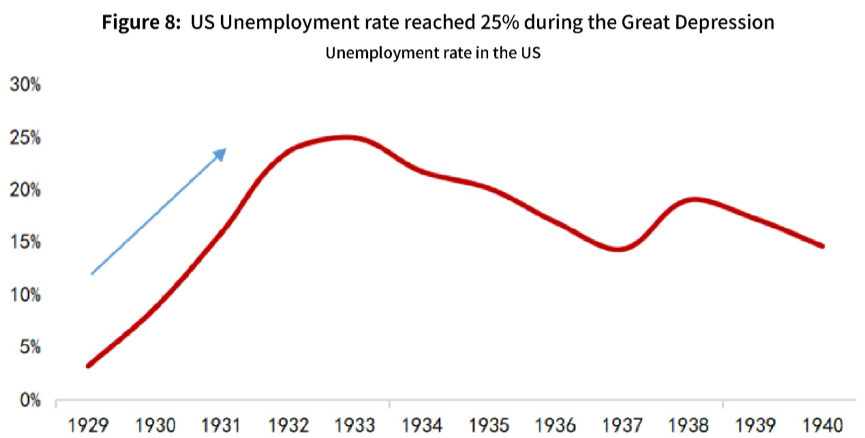

During the Great Depression, the United States had yet to establish a robust social security system, and there was neither public unemployment insurance nor social security legislation. The responsibility of relieving the poor relied mainly on households, private charities and local governments, while the country almost had no responsibility to rescue during a crisis. With the onset of the Great Depression, consumption plummeted, people were displaced, and unemployment soared, but the absence of a social safety net and government inaction meant that relief resources fell far short of the surge in demand. In 1929, the unemployment rate in the United States was only 2.5 percent. After that, the rate rose rapidly and reached a record 25 percent by 1933. Twenty-eight percent of the population could not make ends meet, and the number of homeless people reached 2 million. Yet there were no competent government agencies to respond to and solve the massive unemployment issue.

On the contrary, today, the social security system and unemployment assistance system in the United States have been operating in an orderly manner for many years, which can provide basic support to the unemployed and vulnerable groups in times of crisis. America's recent $2 trillion stimulus package will not only pay $1,200 to every eligible adult and $500 to every child in the form of tax rebates, it will also increase unemployment benefits by $600 a week for every unemployed person. Social securities are much more powerful and driven today than they were during the Great Depression.

To sum up, the author believes that the more sufficient policy space, more rapid and forceful monetary and fiscal stimulus, more moderate global trading environment, more robust regulatory and social security system, all provide favorable conditions for preventing the pandemic from evolving into a financial and economic crisis. At the same time, considering China has accumulated rich experience in its early response to the outbreak, namely to take effective measures such as isolation and expanding detection, thereby putting the epidemic basically under control within a quarter, and many countries around the world are now ramping up scientific research for vaccine, it is expected that it won’t take long to put the global outbreak under control. The duration of economic recession in the US should not be too long, likely no more than a year. A Great Depression will neither reappear.

Therefore, to cope with the impact of the pandemic, the priority in the future is still to prevent and control the spread of the virus, and to shorten the duration of the outbreak. Policy response should include compatible social policies as well as fiscal and monetary policies. In addition, rescue measures should be adopted timely to prevent a liquidity crisis caused by panic selling of financial assets, the rise of structural unemployment caused by production stoppage, and the decline of income which will trigger a series of chain reactions including dragging down consumption and investment.