Abstract: The world economy had already been vulnerable to shocks prior to the COVID-19 outbreak. Even without the outbreak, recession is inevitable, just not as intense and bitter. Central banks around the world are now implementing monetary and fiscal policies to stimulate economies, but they will have limited effect. As the current market panic is nearing the crisis level, in terms of asset allocation, it is best for investors to hold more bonds and cash. But whatever happens, holding cash is always a right thing to do.

The downside risk to the global economic outlook will be huge in 2020, and a vast majority of the economies worldwide will slip into recession within the first two quarters. A global crisis has already arrived.

The crisis is mainly manifested in the following three facets: first, the coronavirus disease (COVID-19) has evolved into a global pandemic bringing about a worldwide public health crisis; second, with some major economies recording negative growth in the fourth quarter of 2019, it is conceivable that most of the major economies are doomed to a recession within the first two quarters of 2020; third, the volatility of global financial markets has spiked to crisis levels, with nearly all asset classes undergoing violent fluctuation.

There is no doubt that a global crisis has arrived, while how the crisis would evolve, how many secondary hazards would be triggered, and which institutions would be affected remain mutable. As an old saying goes, "a wise man will never stand alongside a dilapidated wall". So from an investor's perspective, when adversity hits, survival comes first, generating returns later.

I. The global economy had been on the verge of recession before the outbreak

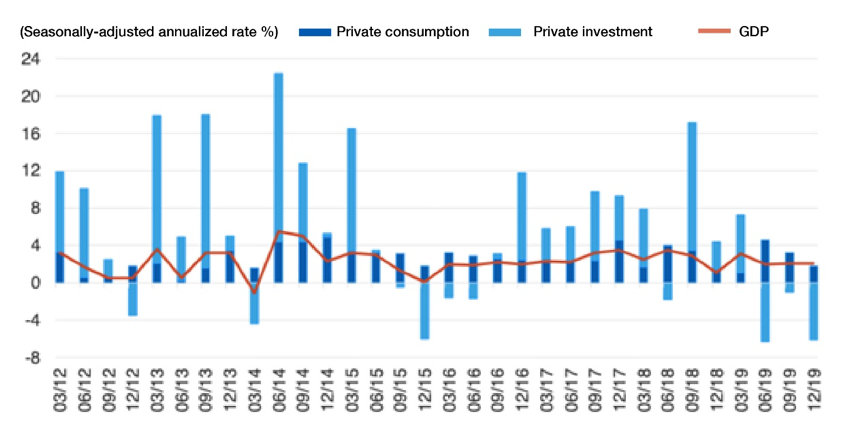

As the world's largest economy, the US economy had been growing at a rate around 2.1% for three consecutive quarters prior to the outbreak. The unemployment rate dropped to its lowest level in the past 50 years, and the inflation remained moderate. However, despite the dream combination of low unemployment and low inflation, the fact is that the American economy has been developing in an uneven manner. Private investment in the United States had registered negative growth for three consecutive quarters; meanwhile, private consumption growth had been declining for three consecutive quarters as well.

In addition, the previous tax cuts and the sharp rise in asset prices in the real estate and stock markets induced large wealth effects, which boosted consumption and employment, led to an economic upturn and further rise of stocks, thereby creating a virtuous circle. However, economic growth driven by the wealth effect is prone to overshoot and impossible to maintain. Once reversed, the wealth effect will shift from positive feedback to negative feedback, thereby weakening consumption, the only engine propping up the American economy, and resulting in a vicious cycle. Therefore, it is predicted that the US economy will see negative growth and slip into a recession within the first two quarters of 2020.

Figure 1: Growth rate of US GDP, private consumption, and private investment

Data source: US National Bureau of Economics Research (NBER), Haitong International

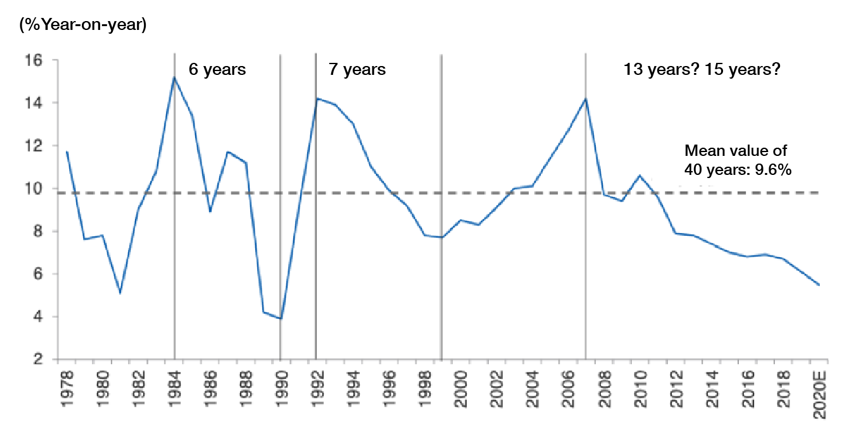

In comparison, the GDP growth rate of China, the second largest economy, has been falling for 12 consecutive years, with last year's growth rate maintained above 6%. Before the outbreak, whether to "maintain growth of 6%" this year had been in heated discussion. However, China's growth rate in 2020 will be the lowest in the past 30-40 years regardless of a 6% growth rate is realized or not.

Figure 2: China's real GDP growth rate

Data source: CEIC, Haitong International

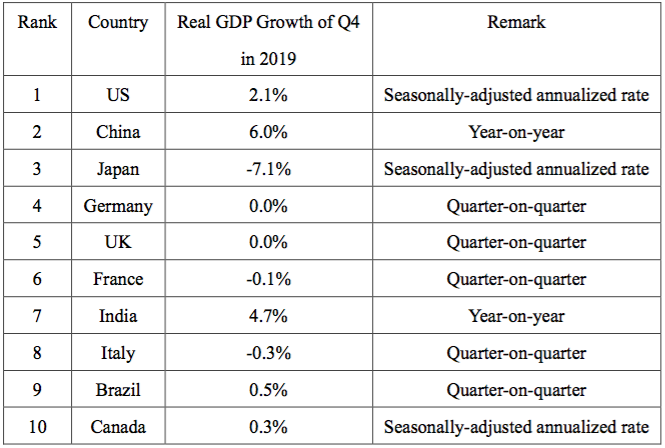

Japan, the third largest economy, experienced negative economic growth of -7.1% in the fourth quarter of 2019. The reason is Japan's consumption tax increase in October of 2019, which caused a drastic consumption deduction that significantly exceeds the consumption increase in the previous two quarters, indicating the vulnerability of Japan's economy.

Both the fourth largest economy, Germany, and the fifth largest economy, the UK, had negative growth in the second quarter of 2019. While an upturn in the third quarter saved Germany and the UK from a technical recession, both countries recorded zero growth in the fourth quarter. That being so, it is expected that Germany and the UK will register negative growth in the first quarter in 2020 and slip into recession.

In general, the majority of the top 10 largest economies are teetering on the brink of recession. Besides the foregoing five economies, the quarter-on-quarter GDP growth of France (the sixth largest economy) and that of Italy (the eighth largest economy) were both below zero in the fourth quarter of 2019. The seasonally-adjusted annualized rate of GDP of Canada (the tenth largest economy) is 0.3%, and the number will be less than 0.1% when measured quarter-on-quarter in Q4, which is statistically negligible and can be deemed as a zero growth. The quarter-on-quarter GDP growth of Brazil (the ninth largest economy), a developing country, is only 0.5%. India (the seventh largest economy) had a growth rate of 4.7%, remarkable compared to other economies. However, it is still considered as a big step backward from a few years ago when its GDP growth topped China.

To sum up, basically six out of the top ten largest economies are on the verge of recession.

Table 1: GDP growth of the top 10 largest economies

Data sources: Bloomberg, Haitong International

Hence the world economy had already been vulnerable to shocks prior to the outbreak. Massive liquidity injection, quantitative easing and fiscal stimulus by central banks in the past 10-20 years has not lifted it out of the fragile state. A recession is inevitable even without the outbreak, just not as intense and bitter.

II. The pandemic situation in the US is worrisome

At the beginning of each month, the New York Federal Reserve announces the probability of recession in the United States, which is predicted by a quantitative model based on the yield spread between the 10-year Treasury note and the three-month Treasury bill. In August 2019 the New York Fed forecast a 38% chance of a recession in the next 12 months in the US, with a slight down-adjustment to 30% in February 2020 (there was no outbreak in February in the US). In the past 60 years, the model has predicted a probability of more than 30% for eight times, seven of which turned out to be true, and the US economy duly fell into recessions. This is further evidence that even before the outbreak, the risk of the US economy falling into recession was high. It may look strong on the surface, but has in fact long been crippled before the epidemic hits.

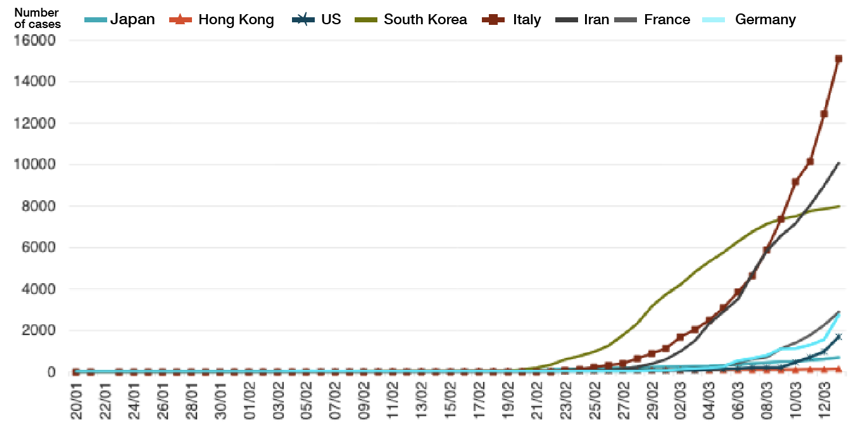

The number of confirmed cases of COVID-19 in the US has increased from more than 60 a week ago to 1,600 now (March 12). Since COVID-19 is highly contagious, the outbreak will greatly increase the demand for medical resources, and once the virus is widespread, the shortage of medical resources will cause many problems and even humanitarian crisis.

An international comparison of the number of hospital beds per thousand in 2012 shows that countries including the US, Spain, Italy, the UK and Canada, do not have a large number of beds, and their health services are characterized by high quality and low quantity. In comparison, there are more beds per 1,000 in China, Japan and South Korea. Therefore, it is still doubtful whether the European and North American countries can cope with the once-in-a-century pandemic with their current medical resources.

Figure 3: Cumulative number of COVID-19 cases confirmed overseas

Sources: Bloomberg, Haitong International

In addition, the US has more than 27 million people (8.5% of the total population) without any forms of health insurance (neither health plans provided by the government nor commercial medical insurance), and once these people become infected, they are unlikely to go to medical institutions for treatment. As a result, the number of confirmed cases will be underestimated, and the probability of severe cases or death will be raised. What's more, because of the lack of effective treatment and isolation measures, the risk of further spread of the disease will increase.

III. Monetary and fiscal stimulus has limited effect

The impact of the pandemic on the world economy is not the same as those of previous economic shocks. The most effective way to prevent and control an outbreak is to reduce activity, which has a big impact on service-led economies in Europe and the US. Central banks around the world are now implementing monetary and fiscal policies to stimulate economies, but they will have limited effect until the outbreak is contained.

Monetary policy stimulus may trigger stagflation. Both demands and supplies have taken the blow of the pandemic, if the demands spring back way more than supplies do under excessively expansionary monetary policies, it could give rise to risks of stagflation.

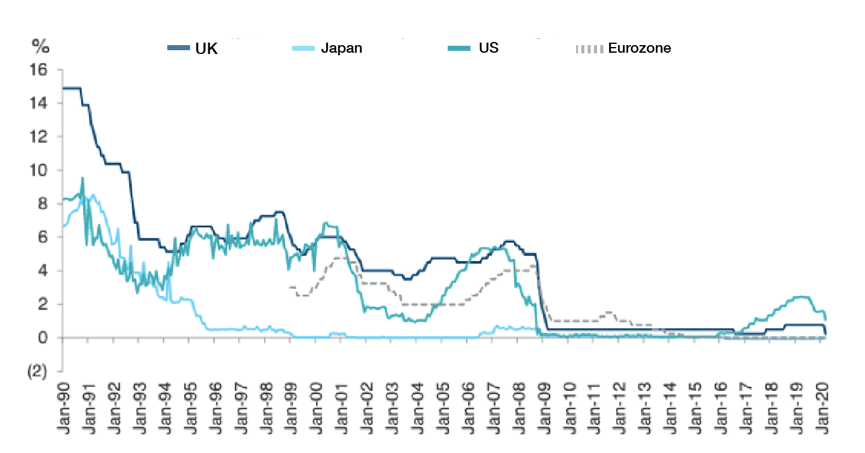

Figure 4: Policy rates of major central banks

Sources: CEIC; Haitong International

Because of high sovereign debts in many countries, except for a few including China, Singapore, Germany and Ireland, central banks do not enjoy adequate space for fiscal policy stimulus. For instance, the US debt-to-GDP ratio stands at 106%, while the debt burdens of Greece, Italy, Portugal and Spain are even higher than during the 2010 European debt crisis. Hence, fiscal policy has very limited space in these countries to achieve more than preventing the economy from being dragged further down, let alone acting as a powerful stimulant. Plus, it could touch off a new round of sovereign debt crisis. That's why it is unlikely that the global economy will pick up with either monetary or fiscal policy stimuluses rolled out by central banks.

IV. Panic looms over the global financial market

In 2019, rewards of risk assets and safe haven assets both increased, for two possible reasons. First, optimistic and pessimistic investors had strong disagreements as to the development of the capital market, and both took big bets; second, some investors who felt uncertain after purchasing risk assets turned to safe haven assets to hedge against the risks, pushing up the prices for both.

In comparison, since the start of 2020, prices of risk assets around the globe have seen declines, while those of safe haven assets have picked up, which shows that the panic has spread across the global financial market.

The global panic index proposed by Haitong International Securities Group has tumbled to -1.42, and during the past two decades, only 2.47% of the trading days have seen the index fall below that, while only amid the financial tsunami in 2008 did this percentage drop even lower. We predict that the index will continue its decline.

Moreover, when we look at the various types of assets under the global panic index, only 0.38% of trading days in history have experienced a higher level of panic in the global stock market, better only than in October and November, 2008 when the Lehman Brothers went bankrupt. This percentage for bonds, safe haven assets and currencies of emerging markets around the globe are relatively higher, which means that panic as shown by these asset classes has not peaked yet. That's why we expect the global bond market to continue to rise, dragging down bond yield rates; similarly, the price of safe haven assets will rise too; meanwhile, there is ample space for emerging market currencies to depreciate. In short, all evidence suggests that the current market panic is nearing the crisis level.

Figure 5: Global composite panic index (since 2000, weekly K-line)

Sources: Bloomberg; Haitong International

Considering the challenge facing asset allocation, I personally believe that a recession is more likely to happen than a stagflation, and that's why I suggest hold more bonds and cash. But whatever happens, holding cash is always a right thing to do. Of particular note, expect for the blow dealt by the coronavirus outbreak, many risks and uncertainties are lurking in our markets that could undermine global economic growth this year. We must also be aware that crisis in multiple areas could intertwine with each other to increase the hazards we confront—the current global public health, economic and financial crisis could evolve into domestic political crisis, global humanitarian crisis and international relation crisis.