Abstract: The global spread of the novel coronavirus outside China has been accelerating since the World Health Organization (WHO) declared COVID-19 a global pandemic on March 12. Now, it's essential for Chinese economic policymakers to comprehensively study the path and mode of the global spread of the pandemic, the control measures taken by other countries, and their impacts on the global economy as well as industrial and supply chains.

The global spread of the novel coronavirus outside China has been accelerating since the World Health Organization (WHO) declared COVID-19 a global pandemic on March 12. Countries like Italy, Spain, and Canada have entered nationwide lockdown, while in countries such as the United States, France and Germany, controlling measures have also been intensified in some regions. Under such a background, one important problem is that if the "herd immunity" and loose controlling measures failed in the US, Germany, and UK, politicians would have to take comprehensive controlling measures to curb the pandemic as fast as possible, which will compromise short-term economic growth, and lead the world economy to an unprecedented standstill and the universal cutoff of industrial and supply chains, rather than just financial fluctuations or a short-term recession. The economic damage and sequelae of a standstill could be larger than those of previous economic crises associated with financial fluctuations. Therefore, at present, it is essential for Chinese economic policymakers to comprehensively study the path and mode of the global spread of the pandemic, the control measures taken by other countries, and their impacts on the global economy as well as industrial and supply chains. It is also important for China to study the path and nature of external shocks to the economy amid its ongoing efforts to resume work and when its priority becomes "securing growth" and "accomplishing development targets" after the epidemic.

I. Technically global economy has entered a recession

There has been a lot of talk about whether the epic decline in global stock markets could trigger a financial crisis similar to the one in 2008 and plunge the world into a new economic crisis. But we must be rational enough to realize that the world economy has entered a full-blown recession, even without considering further financial and economic turmoil caused by the further spread of the pandemic. The core reasons are: first, the outbreak has had a huge impact on the Chinese economy amid business shutdown, while China is the number one engine of global economic growth; second, the record low of various global leading indicators indicates that various types of demand have experienced sharp contraction, in particular the global PMI has declined sharply; third, investment slump and demand contraction caused by the global stock market turmoil of nearly 30% has basically exhausted global growth last year; fourth, most econometric models have shown that current global growth has entered a negative range. For example, in early March, OECD measured the global economic impact caused by the full spread of the epidemic on the basis of four assumptions: first, other countries do not take the Chinese style control measures; second, global stock markets fall by 20% in nine months in 2020; third, investment risk premium increase by 50 basis points; fourth, a 2% decline in private consumption in the east Asian economies. The result is that: the global economy shrinks by 0.8 percentage point in the first quarter, 1.61 percentage points in the second quarter, 1.75 percentage points in the third quarter and 1.59 percentage points in the fourth quarter.

In fact, the OECD team has massively underestimated the spread of epidemic across the world. Most of the coronavirus-affected countries have not only restricted tourism, but also have started to impose full restrictions on the gathering and movement of people. The global stock market saw a rapid decline of nearly 30% within just two weeks. Furthermore, consumption in China and the East Asian Economic Group (EAEG) has fallen by over 10%. The shrinkage in regional consumption has spread across the globe. Therefore, the current situation should be much more severe than the most extreme prediction assumed by the OECD team.

For the moment, the US Bureau of Economic Analysis is planning to declare a recession. Most US research teams believe that with falling consumption and investment, the US economy has already recorded zero growth in Q1, and is likely to register negative growth of -5% in Q2. Growth rates of many European countries hovered around zero in the fourth quarter of last year, which has now been completely changed. Economic data of the worst hit European countries, i.e., Germany, France, Italy and Spain, show that they have already entered negative growth in the first quarter. Negative growth for two consecutive quarters has made a recession impossible to reverse.

Therefore, we must go beyond the traditional knowledge of economic crisis and recession in assessing the current situation. Even without a financial tsunami, even if the current market swings may not spur a global financial crisis, the economic cycle impeded by an epidemic unprecedented over the past century will still entail a rapid economic downturn.

II. The accelerating spread of pandemic is bound to converge varied management and control models

Judging from the latest epidemic parameters, China is the only country that has successfully entered the post-peak period for recovery activities, while no other country has yet to hit an inflection point. The United States, the United Kingdom, France, Germany and Australia, in particular, have just entered the acceleration phase. The global spread and escalation of the pandemic has become a foregone conclusion. Many countries chose to take a laissez-faire or "herd immunity" approach at first out of economic and political considerations. However, once they enter the acceleration phase, soaring infections will tip the society into panic and riots. Populists will inevitably shift their laissez-faire or "herd immunity" models towards the "China model" of response. The transition basically occurs when the infection rate reaches 1 in 10,000. Massive infections will trigger panic among communities and organizations, and economic considerations will have to give way to the urgency of containing the epidemic. The Health Secretary of Britain and US President Trump have both sent clear signals of a change in strategies, particularly when the US government failed to save the US stock market despite the Federal Reserve’s interest rate cut of 150 basis points and the restart of QE, which prompted US policymakers to finally realize that the US economy and the financial sector cannot be saved without curbing the spread of coronavirus as soon as possible. Therefore, under the attack of the highly transmissible coronavirus, governments will probably raise their anti-epidemic responses to the highest level, which would not only deal a fatal blow to international tourism and the airline industry, but also cause economic shutdowns similar to the one seen in China in February. Such shutdowns will result in short-term economic downturns, as well as damaged or even completely ruptured supply and industrial chains, and eventually lead to a short-term shutdown of the world economy and global recession in the medium term.

III. The short-term impact of economic shutdowns on the global economy will surpass that of previous financial crisis

Economic shutdowns in major countries accounting for 70% of global GDP will be an unprecedented extreme case since the world entered the era of economic globalization. The old model of "external shocks-financial crisis-economic depression" is no longer applicable in our analysis of the current situation. Because even without a global financial crisis, it is highly possible that the global economy is looking at a deep and mid-term recession due to economic shutdowns. Its transmission mechanism could be roughly divided into the following paths: first, the part of economy that is contact-intensive within and across borders plummets, the associated demand and supply plunge as well; second, with the restriction on people's movement, the supply system of the epidemic-affected countries will collapse, the industrial and supply chains based on these countries will be weakened or broken, which would further lead to the simultaneous decline in global supply and demand; third, expectations of market players will cause the stock markets to slump, negative risk sentiment will lead to liquidity crunch and capital chain breaks, and companies will default under the dual pressure of decreasing profits and tightening capital, bringing on debt chain disruptions and turmoil in bond and foreign exchange markets. The above transmission mechanism distinguishes the impending g recession from previous recessions. The first difference is that there is great uncertainty in the epidemic that is unprecedented in the past 100 years, hence its impacts remain quite uncertain. Secondly, the rapid spread of coronavirus marks the economic shutdown a "gray rhino"; it would be difficult for the financial market to release the pessimistic expectations once for all in advance, and the economy will probably plummet before the occurrence of financial turbulence. Thirdly, the lack of effective international coordination makes it more difficult to bring the pandemic under control, and the post-outbreak recovery from the shutdown will cost us dearly.

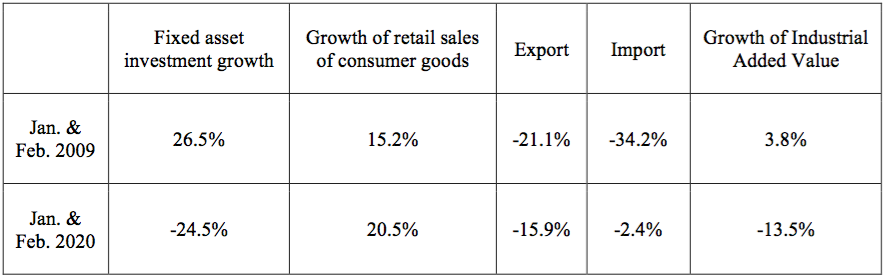

If containment measures taken by different countries eventually converge, the subsequent short-term shutdown may hit the world economy harder than a general financial crisis would, especially in the era of globalization with highly developed division of labor, vertically and horizontally. The reason lies not only in the direct loss caused by the economic shutdown, but more importantly in the extremely long time the economy will take to recover due to the asynchronous reopening of different country's economies, as well as the massive cost of restarting the halted labor division system, industrial chains and supply chains across the countries, especially considering rising populism and intensified geopolitical conflicts. A case in point so far is that the impact of economic shutdown in China due to the epidemic has surpassed the impacts of the 1997 and 2008 crises, as well as the forecasts of most economists. First, China suffered huge direct loss. After a lockdown was imposed on Wuhan on January 23, all economic and social activities came to a standstill. During January to February, China's fixed asset investment fell by 24.5%, total retail sales of consumer goods dropped by 20.5%, exports declined by 15.9%, industrial added value decreased by 13.5%, and the service production index fell by 13%. In the short term, the shock is far bigger than the one during the Spring Festival of 2008-2009. Second, it's highly costly to recover the domestic industrial chain and economic cycle. In China, resumption of work and production takes very slow despite of a large amount of administrative resources and subsidies given. Therefore, the impact of economic standstill would be more severe in countries that don't possess strong administrative coordination capabilities and could cause a domino effect around the world.

Table 1. Macroeconomic indicators for January and February in 2009 and 2020

We could see that the darkest hour of the global economy is coming if we take into consideration a potential financial crisis caused by market fluctuations and economic downturn. It will fundamentally end the "debt-driven model" that the global economy has relied on since the financial crisis in 2008, causing the collapse of the "low interest rate, low growth, low price level, and high debt" model. With global debt mounting to 253 trillion US dollars and the leverage ratio standing at as high as 322%, the global economy can hardly withstand the super shock brought by the pandemic and we should expect to see failures at the weakest points in the financial chain.

At present, adjustments in the global stock market is only the beginning of the collapse of the debt-driven model. The decline of the stock market, up to about 30%, released pessimistic expectations in advance, and was a correction to the arbitrage model popular over the past few years under which companies issued large amounts of bonds at low interest rates to buy back stocks. But the adjustment has not exceeded the declines the stock market saw during previous financial crises (for example, the US stock market fell by 54.9% in 2008-2009). With further spread of the pandemic and strengthened control measures around the world, the world economy will see a second shock from the disease - economic standstill. The rapid shutdown of the real economy will inevitably expose weak points in the global economy.

The first is the large economies that are troubled with a rapid growth of debts in the non-financial sector, disturbing spread of the virus and drastic economic downturn. France is one of such economies. The debt ratio of its non-financial sector increased from 145.2% in 2008 to 180.6% in 2018. The virus is spreading in the country at a fast pace, and economic growth has fallen to a range around zero. Another is Russia. The debt ratio of its non-financial sector increased from 118.5% in 2011 to 178.7% in 2018. The economy registered negative growth amid the sharp oil price drop. Right now, total debt of global non-financial companies has exceeded 200 trillion US dollars, and the companies' income cannot cover repayment of principal and interest expense. They have to borrow new loans to pay off the existing debt, which has become a common practice. This model is bound to collapse amid the coronavirus shock.

The second weak point is emerging economies with high debt and currency mismatch. According to statistics from the IMF and the BIS, most of the world's new financial debt lies in developing countries, and two-fifths of the world's developing countries are facing a high risk of being caught up in a debt trap. By the third quarter of 2019, the size of emerging markets' hard currency debt reached 8.3 trillion US dollars, an increase of 4 trillion US dollars compared to 10 years ago, and more than 85% of the increased debt is denominated in US dollar. By the end of 2019, the median external debt to export ratio of emerging market economies increased from 100% in 2008 to 160%. In some countries, the ratio exceeded 300%. Fluctuations in exchange rates and turmoil in international financial markets will inevitably lead to serious debt repayment problems and funding mismatches.

The third weak point is the rapid growth of corporate leveraged loans and high-yield debt in the US market, as well as bank loan funds and high-yield bond funds that hold these assets. Among US non-financial corporate debt, the proportion of high-yield debt in 2018 reached 10.8%, being100 billion US dollars, an increase of 33% over 2008; the proportion of leveraged loans was 11%, with the total amount reaching 115 billion US dollars, an increase of 109% over 2008; BBB bonds accounted for 28.2%, being 2.6111 trillion US dollars.

The fourth weak point, not easy to be observed, is the small and medium-sized enterprises around the world whose performance has continued to decline. Globalization and technological innovation have caused the “winners-take-all” effect in many sectors. Leading enterprises have been able to maintain good performance and enjoy a large share of profit and resources, rendering the SMEs extremely vulnerable. In the early days of the outbreak, most people focused their attention on large financial institutions and large enterprises, taking the failure of these systemically important institutions as a sign of a potential financial and economic crisis. However, the temporary economic shutdown would bring more serious impact on SMEs. They can easily go bankrupt amid an external shock, damaging the micro-foundation of the economy and changing the economic cycle. Even if a shock doesn’t last long, it could cause sustained loss of supply and demand. In later times, the recovery of SMEs and the economic ecosystem will be more complicated and difficult than that of large companies.

IV. We should hold a bottom-line mentality and be highly vigilant against the worst scenario

According to the principle of macroeconomic policy-making, when facing great uncertainties, it is paramount to adopt the bottom-line mentality and prepare for the worst, so as to stabilize market expectations and help market participants pull through. The novel coronavirus outbreak has evolved into a pandemic, and it is highly uncertain whether the upcoming high temperatures or advancing medical technologies can put a stop to it. Thus, it remains to be seen if most countries will do what China did and impose isolation measures across the board as the pandemic continues its global spread, and it is still too early to tell how or to what extent the global economy will slow down. That said, policymakers must stay vigilant against the uncertainties, keep up with the changes, and adjust policy responses.

First, they must be fully aware that the global economy has already entered a recession, and a financial tsunami may be on its way. The recession triggered by the pandemic is different from those in the past, and it would be unwise to lock our eyes merely on stock market turbulences. Instead, after the pandemic is brought under control, policymakers might as well steer policy priority from resumption of economic activities towards addressing the shocks of a grave recession whose magnitude is still unknown.

Second, it is important to understand that the spread of the coronavirus is only beginning to pick up pace, and it will take quite a while before it sprawls across the world or reaches a turning point. Even if the United States and the United Kingdom stick with their current ways to deal with the pandemic, most of the countries will unquestionably impose bans on cross-border movement of people, and the global economy will get bogged down for a short time. In that case, China will face severe challenges, because its current policy of keeping foreign trade and investment stable will hardly work then.

Third, despite the inactive response of the United States and the United Kingdom at the moment, it is expected that politicians in the two countries will eventually tighten control and impose across-the-board isolation measures under mounting pressure from the public as the epidemic spreads. This will shorten the time it takes before global socio-economic activities halt and cause greater losses than an average economic crisis.

Fourth, once the global economy comes to a standstill, the financial market is bound to suffer a catastrophic crash — an enormous shock that is way beyond what the financial system can weather. It would be difficult to understand such shock using traditional analytical methods, as evolvement of the financial market will depend on the development of the pandemic.

Fifth, Chinese policymakers must plan ahead to cushion the enormous blow from the pandemic's spread as well as economic and financial turbulences to the country's recovery in the coming three months. Current policies based on the assumption of a stable or slightly worsening external environment will be far from adequate to deal with a super exogenous shock in the future. 1) To start with, stimulus to domestic demand must be strong enough to offset the slump in external demand, since regular expansions can hardly sustain the economy through upheavals and a pandemic never seen before in a century. That requires repositioning of the previously discussed monetary and fiscal policies — the deficit ratio under proactive fiscal policies should not be confined to 3% (the current threshold) or 3.5% as suggested by scholars previously, while the prudent monetary policies must be readjusted in order to cushion the contraction in the economy and liquidity. 2) Besides, disruptions to the supply chain will cut off both raw material supply and product sales channels of the export-oriented businesses and industries in China and put them to a total stop for a short time. While China presses ahead with economic activity resumptions, it must pay close attention to changes in these sectors and prevent them from getting caught in a super exogenous shock after they get back on track with the government's support. 3) Moreover, economic and social standstill may give rise to populism and protectionism across the world, which may accelerate foreign companies' efforts to move supply chains further from China, as well as economic and technological decoupling between China and other countries. Guarding against these risks will be of great significance in formulating medium term policies. 4) Last, it will be a strategically-important timing for China to restructure its involvement in the global financial community after the super shock winds down, while the country needs to be more prudent in this regard for the time being.