Abstract: Although concerns over imported cases of the novel coronavirus have increased recently, the epidemic has been significantly brought under control in China after nearly two months' efforts, with the number of domestic new cases having decreased to zero except in Wuhan, the epicenter. With intertwined industrial chains, the global impact of the novel coronavirus will be very complicated. Compared with the time back in the subprime mortgage crisis, the room for policies aimed at supporting aggregate demand has significantly narrowed for many economies. Looking ahead, the global spread of the epidemic will likely accelerate. As the epidemic gradually comes to an end in China, countercyclical policies are expected to be further strengthened as internal and external pressures continue to increase.

I. Introduction

After nearly two months' fight against the novel coronavirus, the epidemic has been significantly brought under control in China, with the number of domestic new cases having decreased to zero except in Wuhan, the epicenter. Meanwhile, the focus of the anti-epidemic efforts in China has shifted to preventing new cases imported from outside China. In contrast to the improvement of the situation in China, the epidemic has rapidly spread to more than 100 countries and regions around the world. Against such a background, how will the spread of the epidemic impact the global economy? With the wild fluctuations in the international price of crude oil and the capital market in recent days, can macroeconomic policies effectively address the rising risks?

II. Global shock of the pandemic

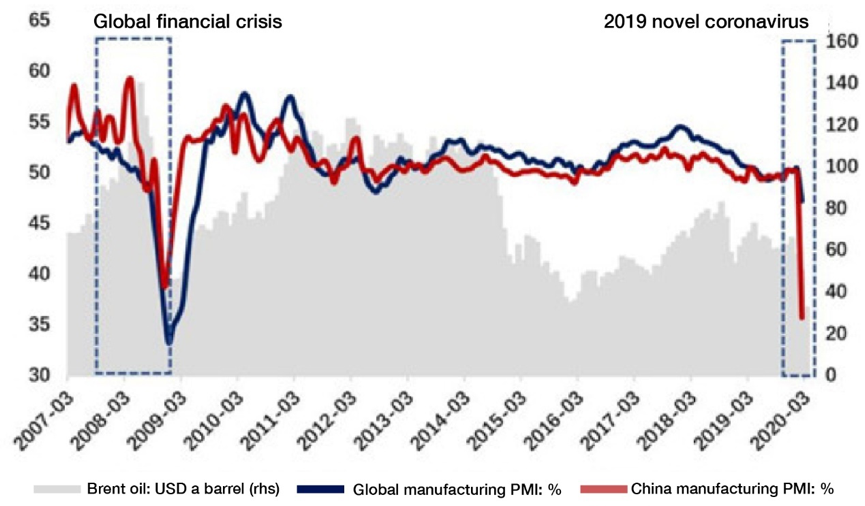

Various indicators have shown that the impact of the epidemic on the global economy is comparable to that of the subprime mortgage crisis. In terms of the purchasing managers' index (PMI), a leading indicator, China's manufacturing PMI fell to a historic low of 35.7% in February, even lower than that at the worst point in the subprime mortgage crisis. In February when the epidemic had not widely spread outside China, the global PMI hit a new low in nearly 10 years. With the aggravation of the epidemic worldwide, global PMI and world economic growth are expected to further decline.

Figure 1: The impact of the novel coronavirus outbreak might be comparable to that of the subprime mortgage crisis

Source: Wind; Compiled by the author

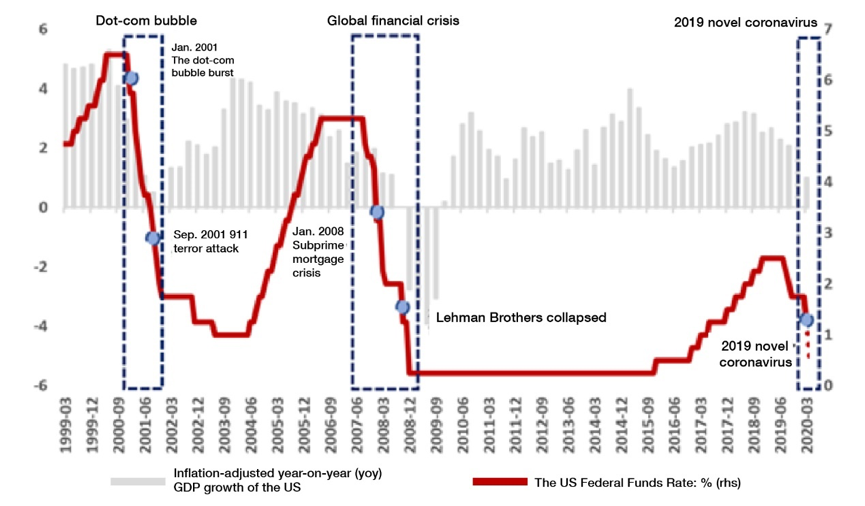

In response to the impact of the epidemic, the Federal Reserve unexpectedly announced a sharp interest rate cut of 50 basis points in between scheduled policy meetings in early March. In the past 20 years, except for the collapse of the dot-com bubble and the "911" terror attack in 2001, it was the first rate change in between scheduled Fed policy meetings since the 2008 financial crisis. Such an unconventional monetary policy operation may reflect the degree of the economic impact of the epidemic.

Figure 2: Fed's emergency rate cut may imply the seriousness of the epidemic

Source: Wind; Compiled by the author

Note: The GDP growth for the US in the first and second quarters of 2020 was averaged based on foreign financial institutions' calculation, while the target interest rate was taken from CME Fed Watch.

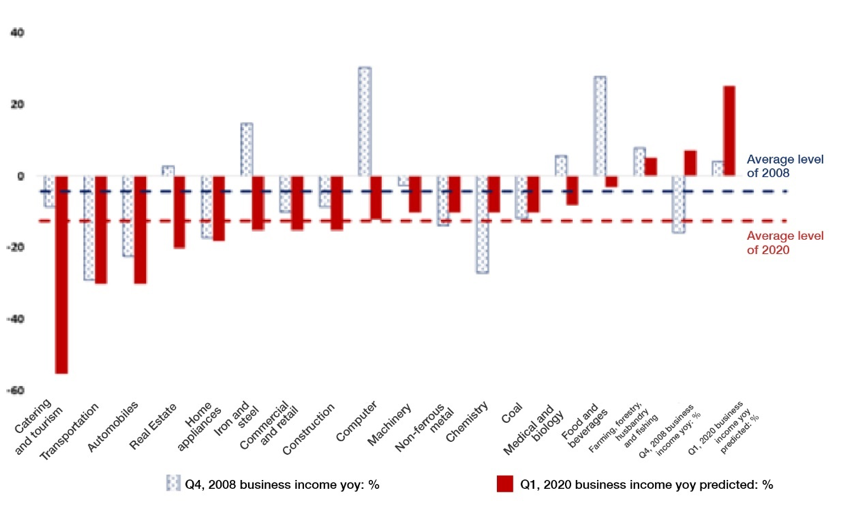

Compared with the worst period of the subprime mortgage crisis, corporate income in China in the first quarter this year will likely decline by a larger margin, especially for service sectors such as catering, tourism, retail and real estate.

Figure 3: Many sectors in China will likely be hit harder compared with the subprime mortgage crisis period

Source: Wind; Compiled based on various industry associations' calculation and market forecasts

It is worth mentioning that the degree of globalization has increased now significantly compared to the period of the subprime mortgage crisis, with the industrial chains of various countries getting integrated even deeper. Given the shocks on major manufacturing countries like China, Japan and South Korea, the impact of the novel coronavirus on global economy is likely to be more complicated than that of the subprime mortgage crisis.

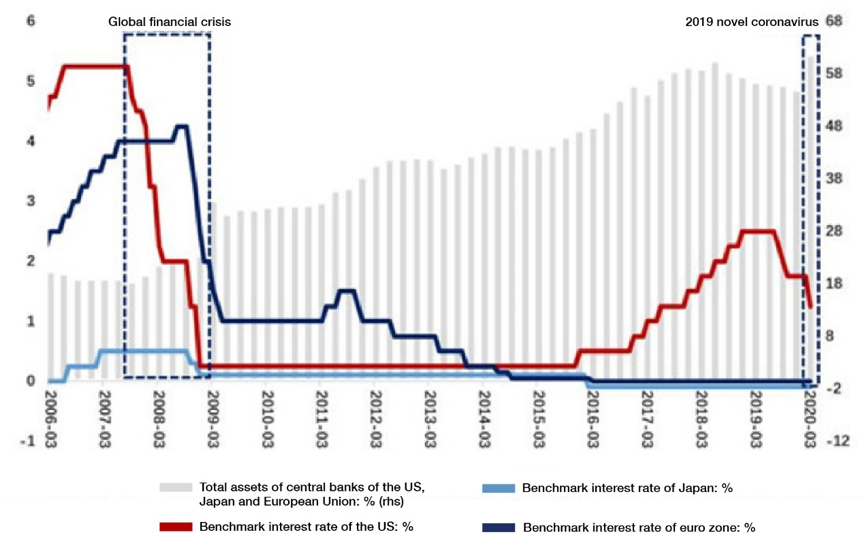

III. How much room is left for policymakers to respond?

Compared with the subprime mortgage crisis, the room for policymakers to adjust aggregate demand has significantly narrowed in many economies. From the perspective of monetary policy, the policy rates in the US and the euro area during the subprime mortgage crisis were still above 4%, and that of Japan was also positive; however, at present, the policy rates in Europe and Japan have been zero or even negative for many years, while that in the US has been cut for many times and has gotten close to zero. More and more economies are seeing government bond yields that have almost reached zero or even negative - both are unconventional. If central banks of major economies continue to pursue quantitative easing, they will likely see a diminishing marginal effect.

Figure 4: Monetary policy room in advanced economies has narrowed

Source: Wind; Compiled by author

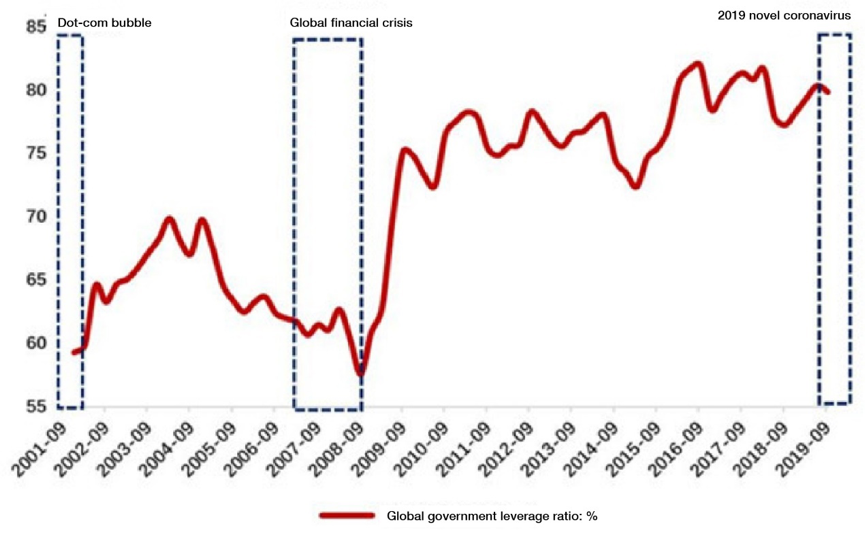

From the perspective of fiscal policy, government leverage in many countries was still low prior to the subprime mortgage crisis, after which it has remained at high levels, largely reducing the effect of fiscal policy as a result. Considering that many countries have had higher burdens associated with expenditures in pension and medical care than before, their capability to stimulate the economy through stimulus fiscal policies might be weakened.

Figure 5: High debt burden might constrain the effectiveness of fiscal policy

Source: Wind; Compiled by author

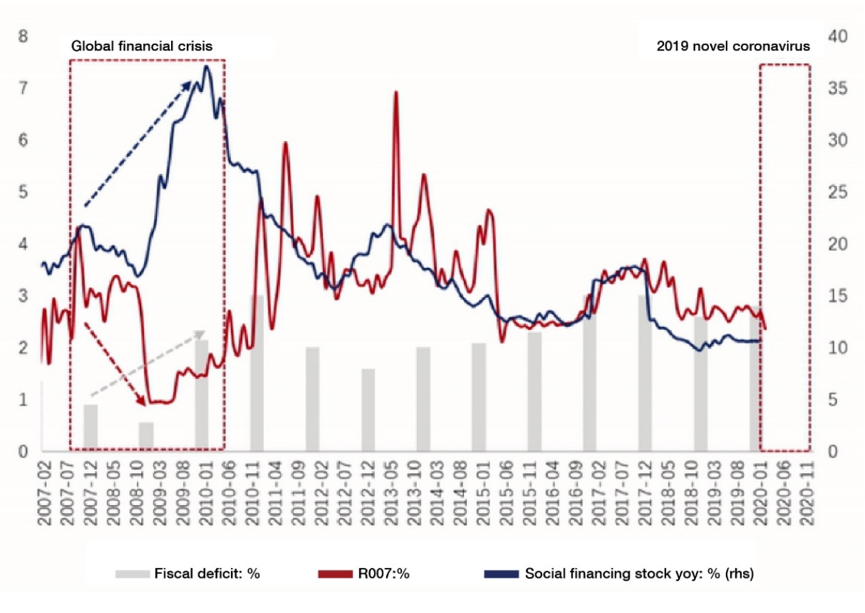

Looking ahead, features of the virus' infectivity indicate that the global spread of the epidemic is expected accelerate. Adding to this is the recent wild fluctuations in the oil price, which significantly increases the downside risk of the global economy and uncertainty in the financial market. At present, Chinese policymakers are still focusing on structural measures to promote work resumption. As the epidemic gradually comes to an end, countercyclical policies are expected to be further strengthened as internal and external economic pressures continue to increase.

Figure 6: How should China activate its demand expansion policy?

Source: Wind; Compiled by author.

IV. Conclusions

First, with intertwined industrial chains around the globe, the impact of the novel coronavirus will be more complicated than what was seen before. Many signs have shown that the impact of the epidemic on the global economy could be comparable to that of the subprime mortgage crisis. Global PMI has touched new low in nearly 10 years, and the Federal Reserve's unconventional emergency rate cuts also indicate the severity of the epidemic. Many industries in China will likely be hit harder this time than during the subprime mortgage crisis period.

Second, compared to the time back in the subprime mortgage crisis, the room for policies aimed at supporting aggregate demand has significantly narrowed for many economies. Major developed countries have entered an unconventional state of getting close to or reaching zero interest rate, causing the marginal effect of central banks' quantitative easing to diminish. The government leverage ratio has remained high in many countries since the last crisis, which may largely weaken the effectiveness of quantitative easing in the future. And there are similar concerns in China.

Third, looking ahead, the global spread of the epidemic will likely accelerate. Adding to this is the recent wild fluctuation in the oil price, which significantly increases the downside risk of the global economy and uncertainty in the financial market. At present, Chinese policymakers are still focusing on structural measures to promote work resumption. As the epidemic gradually comes to an end inside China, while internal and external economic pressures continue to increase, countercyclical policies are expected to be further strengthened.