Abstract: At the 2020 CF40 Annual Conference on July 19, the author made the following comments on China's second quarter economic data. First, the rapid recovery of China's industrial sector has basically ended, while overall economic performance remains slightly lower than the pre-pandemic level; second, the recovery of SMEs are still facing many challenges with low-skilled labor market under huge pressure; third, the growths of investment, consumption and income of the private sector are significantly slower than that before the outbreak. As economic outlook remains uncertain and recovery uneven, the author suggests that policy measures be more targeted.

I. Three conclusions

First, according to economic data of the second quarter, the rapid recovery of China's industrial sector has basically ended, and overall economic activity remains slightly lower than pre-pandemic level. Data for retail sales of consumer goods above designated size and fixed asset investment have also shown similar characteristics.

Second, the recovery of China's service sector is relatively slow, and employment, especially low-skilled labor market, is under great pressure. The recovery of production and operation of small and medium-sized enterprises (SMEs) is still facing much difficulty.

Third, after excluding the impact of stimulus policies in such sectors as infrastructure, real estate and finance and the positive impact brought by the pandemic on sectors like health care, it can be seen that the growths of investment, consumption and income of the private sector are significantly slower than that before the outbreak. Even in areas where economic activity has begun to stabilize, the plateau at present is significantly lower than the pre-pandemic level. More targeted policies are urgently needed to revive the economy.

II. Recovery of the industrial sector is fast while that of the service industry is uneven

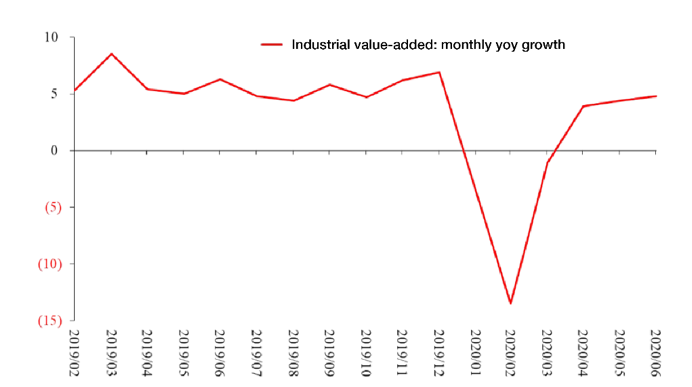

Industrial data show that the growth of industrial production rebounded to a relatively high level in April. In May and June, the growth of industrial production also witnessed recovery, the strength of which, however, was relatively small. The current level of industrial production is close to that before the outbreak.

Figure 1: Monthly year-on-year (yoy) growth of value-added of industrial enterprises above designated size (%)

Source: Wind; Essence Securities

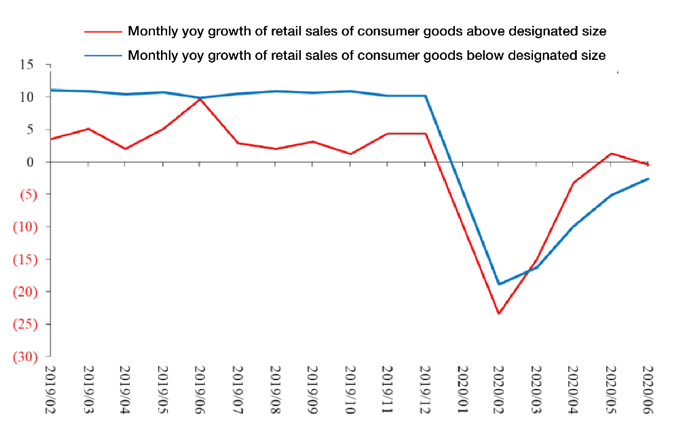

In terms of retail sales of consumer goods, the growth of retail sales above designated size in May first came close to pre-epidemic level, which, however, lost momentum later. The yoy growth of retail sales of consumer goods below designated size were still negative and significantly lower than pre-epidemic level. Although the recovery is still continuing, the momentum is getting weak, partly reflecting the difficulties being faced by many SMEs some of whom have even been forced to exit the market.

Figure 2: Yoy nominal growth of retail sales of consumer goods above versus below designated size (%)

Source: Wind; Essence Securities

In terms of investment, the growth of infrastructure investment is a critical driver of China's economic recovery. In May and June, the growth of infrastructure investment was significantly higher than pre-pandemic level by about 7%. The recovery of investment in real estate has also been exceptionally strong, and basically brought the sector back to its pre-pandemic level. But in areas that are fully market-oriented, such as manufacturing and private investments, the strength of recovery has declined significantly since May. Performances of these areas have maintained or are close to new equilibrium levels of the post-pandemic era, though significantly lower than before the outbreak. Export has also had a positive impact on industrial recovery; however, for areas dominated by SMEs and substantial private investments, economic activities, though having basically stabilized, remain weak.

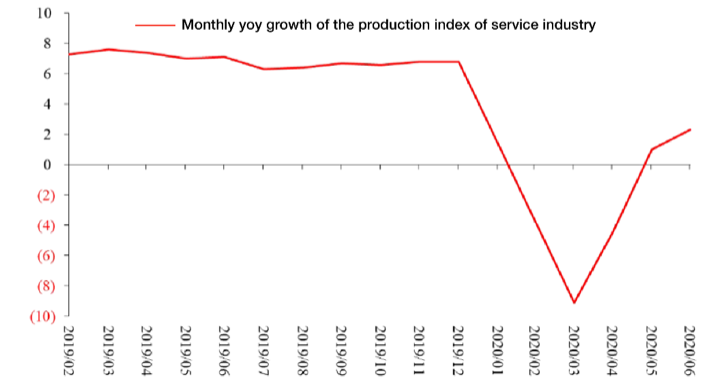

The recovery of the service sector, significantly higher than expected, was a highlight of economic data in the second quarter and could be attributed to recovery in the real estate, finance and information services sectors. This was closely related to stimulus policies and the substitution of online economic activities for offline ones. Nonetheless, the performance of the tertiary industry is significantly below before the outbreak and still recovering.

Public data show that the recovery within the tertiary industry is quite uneven. For instance, in fully market-oriented areas such as accommodation and catering, leasing and business services, the recovery has been unusually slow, with many still seeing negative growth.

Figure 3: Monthly yoy growth of the production index of service sector (%)

Source: Wind; Essence Securities

Through a deeper look into the data, one can find that the recovery of the service industry has benefited from the relatively stronger recovery of the industrial sector, such as the recovery of transportation, logistics, wholesale and retail sectors, as well as the recovery of finance and real estate sectors. However, the recovery has been weak in more market-oriented areas such as consumer services, SMEs and labor-intensive industries.

In terms of income growth, the growth of monthly average income of migrant workers dropped off cliff in the first quarter, and remained negative in the second quarter, reflecting severe decline in the demand for low-skilled labor. In addition, the growth of per capita disposable income has been similar to that of migrant workers, both of which are significantly lower than pre-pandemic level.

Regarding the surveyed urban unemployment rate, although slowly decreasing, it is still significantly higher than the level before the outbreak. What may be overlooked is the fact that labor force participation declined in the first half of the year with a significant portion of labor force possibly having left the labor market.

Employment is under great pressure, and the growths of migrant workers' income and per capita disposable income of residents throughout the country are both significantly lower than pre-pandemic level. These data suggest that measures to promote work resumption and stimulate the economy have achieved desired effects so far, but more efforts still need to be made.

III. Policy response: subsidize additional transaction cost arising from anti-virus measures

On the micro level, the most significant impact of COVID-19 is the additional transaction cost it incurs. This includes risk of infection from human contact, as well as the cost arising from measures taken to prevent infection such as wearing masks, washing hands, checking body temperature and nucleic acid tests.

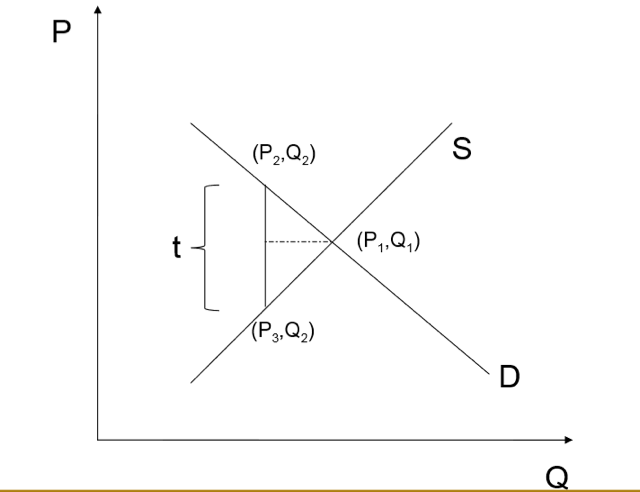

Figure 4: A sketch of transaction cost

Source: Wind; Essence Securities

This additional cost exists for transactions of all types and amounts. For theoretical analysis, it can be simplified as a fixed cost. The tax wedge in the micro supply-and-demand model can be used to explain how COVID-19 affects economic operation.

Left to the intersection of the supply curve and the demand curve is a wedge, whose size represents the amount of transaction costs incurred by the pandemic. For producers, the costs have pared down the prices of their products and their production quantities; for consumers, the costs have suppressed their spending while pushing up the actual price they pay, which is comprised of two parts—a relatively low price paid to producers and an additional transaction fee. Under market equilibrium, the transaction cost will be shared between producers and consumers at a proportion determined by the elasticity of the supply and demand curves.

Under this circumstance, both market prices and transaction volumes drop significantly. If we assume that transaction cost is basically fixed, we can predict that the higher the unit price of a commodity, the easier its transactions will recover, while the lower its unit price, the more sluggishly the transactions will pick up. Theoretically, this prediction is based on the assumption that the transaction costs is fixed, which means the benefits that transactions bring will exceed the additional costs for commodities with high prices, therefore exchange of these commodities is easier to resume, and vice versa

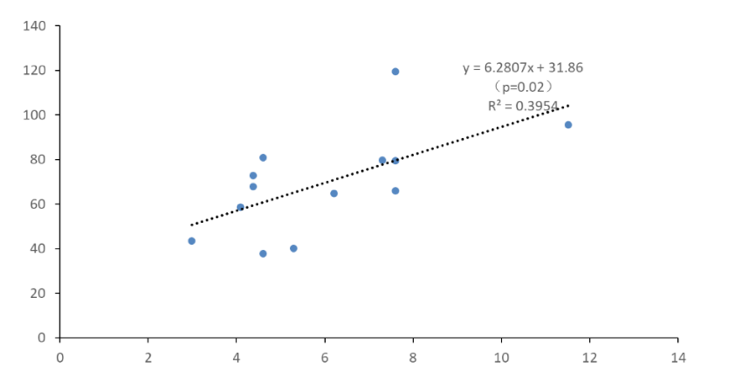

Figure 5: Consumer discretionary: Amounts of transactions and level of recovery (for 13 samples) (Unit: %)

Sources: Wind; Essence Securities

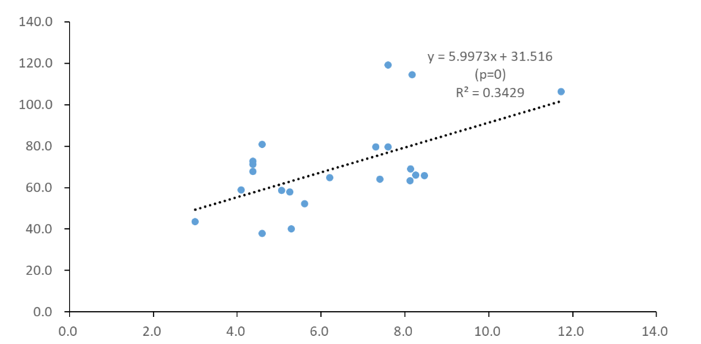

Figure 6: Consumer discretionary: Amounts of transactions and level of recovery (for 22 samples) (Unit: %)

Sources: Wind; Essence Securities

Based on this assumption, we did a simple analysis of retail sales of consumer goods above designated size. As shown in Figure 5 and 6, the horizontal axis marks the amounts of a single transaction for various types of commodities calculated as natural logarithms, while the vertical axis marks the level of recovery in the transactions of these commodities by the end of April. It's clear that transactions of commodities with higher prices bounced back more. This is in accordance with our theoretical prediction, and the conclusion remains true with an enlarged sample.

At the micro level, COVID-19 inhibits economic activity by increasing transaction cost. Assuming the additional cost is a fixed amount, the reverse charge mechanism could be used to subsidize the cost. Theoretically, if the amount of subsidy were equal to the newly added transaction cost, economic activity should return to its pre-pandemic level.

This approach is of great significance for the recovery of China's service sector, creating jobs, and boosting the domestic circulation of the economy. Given the differences among consumer goods, more detailed analysis is needed when making subsidy policies.