Abstract: The perception that China does not have an economic growth target for 2020 is not accurate. Without a growth target, it would be difficult to set targets for other economic indicators or to coordinate policies. In fact, China does have an implicit growth target, though the government has not specified it publicly. Based on the 3.6% deficit-to-GDP ratio, it is estimated that China's nominal GDP growth target for 2020 is about 5.4% and the target for real growth is about 3.4%. The magnitude of the expansionary fiscal policies taken by the government will far exceed that reflected by the 3.6% deficit ratio. Facing various challenges ahead, China's fiscal and monetary policies must coordinate in an effective way to help China meet the implicit growth target this year.

I. China's implicit economic growth target for 2020

I would like to take this opportunity to share my views on China's economic growth.

First of all, I would like to talk about the main indicators of China's economic trend in 2020. In the 2020 Government Work Report, Premier Li Keqiang introduced several key economic indicators for 2020. Although the central government did not specify a GDP growth target for 2020, it did specify targets for some other economic indicators, such as annual CPI growth of no more than 3.5%, a deficit not exceeding 3.76 trillion yuan, and a deficit-to-GDP ratio above 3.6%. At the same time, the Two Sessions have also set employment targets, such as a registered unemployment rate of less than 5.5% and 9 million new jobs.

Among these, an important issue that has captured wide attention is the absence of an economic growth target. It is well known that China has consistently placed a strong emphasis on economic growth over the past several decades. In my view, without a target for economic growth, it would be quite difficult to determine many other important economic indicators or to coordinate various policies. Without a target for nominal GDP growth, for example, it might be hard to develop a fiscal budget. Therefore, I think the perception that China does not have an economic growth target in 2020 is not accurate.

In fact, China does have an implicit growth target, though the government has not specified it publicly. He Lifeng, head of the National Development and Reform Commission, mentioned in a speech that the key elements of a growth target have already been embedded in relevant indicators and policies, including fiscal, monetary and other policies.

Specifically, from the deficit of 3.67 trillion yuan and the deficit ratio of 3.6 percent announced by the Ministry of Finance, we could estimate that China's nominal GDP growth target for 2020 is about 5.4 percent, the corresponding value is about 104.4 trillion yuan. If inflation is assumed to be 2% in 2020, the real GDP growth target should be 3.4%.

All in all, I would emphasize that the government has in effect set an implicit growth target that could be extrapolated from other economic indicators.

Will China be able to achieve a 5.4% growth of nominal GDP in 2020? I think this question deserves careful analysis. Back in April, we made some very simple assumptions about China's economic outlook in 2020, when we learned that China's GDP growth in the first quarter was -6.8%, and the consensus among Chinese academics was that China's potential growth rate should be around 6%. If we assume that China's economic growth rate returns to its potential rate of 6% in the second, third and fourth quarters, it can be easily calculated that China's real GDP growth will be around 3.2% in 2020. Although the calculation is relatively simple, it is not difficult to see that this conclusion is highly consistent with the potential economic growth target proposed by the government.

Will we be able to achieve a real GDP growth rate of 3.2% or 3.4%? This would largely depend on the effective demand in China's economy. Assuming that China's economic growth began to gradually return to normal in May after the lockdown of Wuhan was lifted and that there is no severe relapse of the outbreak, whether China's economy can achieve a growth above 3% will largely depend on the demand side.

We know that demand is determined by consumption, capital formation and net exports. Assuming that the growth of consumption is roughly the same as that of GDP (this assumption is based on the fact that consumption is a function of income, income expectation and wealth, among which income is the most important factor), we can calculate that the contribution of consumption to GDP growth should be about 1.76 percentage points. Meanwhile, the contribution of net exports to GDP should also be taken into account. Net export growth bottomed out at -34% in 2009, and if we assume that this year's export performance is as bad as in 2009 (this assumption is fairly accurate given the -30% growth in net exports during January and April this year), net exports could cut about 0.7 percentage point off the GDP growth rate.

Therefore, a 3.2% growth rate will need to be made up by the increase of capital formation, the implied growth of which would be about 5.7 percent. The most important variable in capital formation that the government can control is infrastructure investment. Assuming that investments of real estate and manufacturing are non-endogenous where the government cannot exert influence directly, the final amount of infrastructure investment can be calculated by considering fixed asset investment in capital formation as a policy instrument. It is actually difficult to estimate this figure, but it is reasonable to predict that infrastructure investment will increase significantly this year compared with last year. Only in this way, can China achieve a growth rate of 5.7% in fixed asset investment or capital formation, which, in combination with net exports and consumption, would ensure a GDP growth rate above 3%.

Economic statistics for January-May suggest a rebound to positive growth in the second quarter, though not strong. Market consensus is that year-on-year growth of real GDP in the second quarter should be around 3%, while a more pessimistic estimation is around 1%. Taking these two figures as the lower and upper limits respectively, and assuming that the year-on-year growth of effective demand in the third and fourth quarters is 6%, the same with potential growth rate, the growth rate of real GDP in 2020 should be between 2% and 2.4%. If the government fails to drive up fixed-asset investment by stimulating growth in infrastructure investment, it will be hard to achieve a 2%-2.4% growth of real GDP, let alone the implied 5.4% growth of nominal GDP.

II. Employment and economic growth targets do not conflict with each other

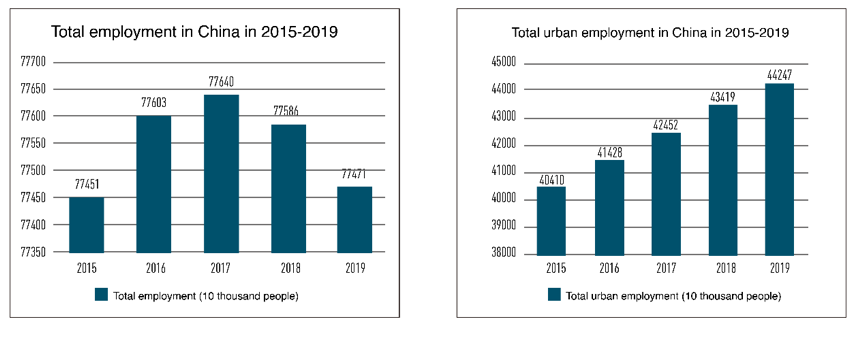

Dealing with unemployment is the key priority for the Chinese government this year, which is indeed a significant issue. I would like to briefly introduce some basic data on employment. China's employment population in 2019 was 770 million, among which 440 million were urban workers including migrant workers and 190 million were farmers working in the agricultural sector. Because of the high mobility of migrant workers, there are still quite a bit of statistical errors and omissions.

The chart below shows that from 2015 to 2019, the number of employed workers in the whole nation was approximately 770 million. The number fluctuated each year, but the change was not much. Meanwhile, urban employment has maintained at more than 400 million. Due to the impact of the COVID-19 pandemic, employment has deteriorated significantly since the beginning of this year. The situation was particularly grim in March: when including about 76.11 million furloughed workers, actually unemployed population would reach hundreds of millions. Of course, as the economy recovers, implicit unemployment has fallen rapidly from 76.11 million to 14.8 million. We believe that both implicit and explicit unemployment will drop further as the economy continues to recover.

China has set a clear employment target this year, which is to create 9 million more jobs. It is right for the government to emphasize the importance of this issue. But we should also note that because of statistical errors and omissions in data, it would be hard to assess to what extent the employment target could mitigate real unemployment. Although the growth target can be used to coordinate various economic activities, the employment target can hardly do so in China's case.

Job creation ultimately depends on economic growth or economic development, which is the fundamental approach to solving the unemployment problem. The 2020 Government Work Report mentioned that development is the key and foundation for solving all the challenges facing China, which I fully agree. Without growth and development, we would not be able to solve the unemployment problem. We should not discuss employment issues without considering economic growth.

III. The actual magnitude of expansionary fiscal policies this year will far exceed that reflected by the 3.6% deficit-to-GDP ratio

This year, China's fiscal deficit target is 3.6%, breaking the threshold of 3%, the value of which is estimated to be about 3.76 trillion yuan. But the actual intensity of China's expansionary policies might be higher than that reflected by this figure. About 3 trillion yuan in the total public budget revenue of 2020 is carry-forwards and transfers from the previous year. After deducting the 3 trillion yuan, the gap between public budget expenditure and actual fiscal revenue will be 6.76 trillion yuan. This figure indicates the need for a more powerful stimulus to the economy. The magnitude of stimulus implied by the 3.6% deficit ratio might not be that high, but if we take into account the aforementioned factor, it will be much higher.

Besides, the 1 trillion yuan of special government bonds to be issued this year and the 3.75 trillion yuan of special bonds to be issued by local governments will not be included in fiscal deficit. However, using World Bank's broad measure of fiscal deficit, China's deficit ratio will be 11%. Although this measure does not perfectly suit China's case, one thing for sure is that the actual degree of fiscal expansion will far exceed that reflected by the 3.6% deficit ratio.

A total of 8.51 trillion yuan of government bonds will be issued this year. What is noteworthy is the multiplier effect of fiscal deficits or fiscal spending, as a large amount of the funds injected into the economy amid the COVID-19 crisis is used to fight against the virus and help tackle people's livelihood difficulties.

For instance, if one trillion yuan of government bonds are issued mainly to improve people's livelihood and stimulate consumption, the multiplier effect will be relatively small. In the first two quarters of this year, Chinese residents largely relied on savings to pull through the crisis, and I believe Japan has had similar experience. If the one trillion yuan of government spending are mainly used to help the public overcome the difficulties, it is highly likely that people who receive the money will keep it to make up for the savings consumed during the outbreak rather than spending it. In this case, fiscal deficit or fiscal spending will not have a significant stimulus effect, nor can it act as a strong driver for the recovery of economic growth.

This is why I believe infrastructure investment is still the main driver of China's economic growth under the current situation. Infrastructure investment has a crowding-in effect, which can encourage private companies to seek investment opportunities and thus truly help stimulate the economy. If we fail to use fiscal expenditure properly and simply focus on rescue efforts, the real economic growth rate might be lower than expected. Fiscal revenue could also be lower than expected at the end of this year, leading to a much larger fiscal deficit in 2020 than originally expected. This is an issue deserving close attention.

Finally, I would love to share a few words about monetary policy. The People's Bank of China has taken very active monetary policies in the first half of this year by doing whatever it could to help businesses and families tide over the difficulties. However, the problem is that as economic recovery mainly depends on fiscal policies at present, if fiscal policies fail to take the lead in restoring economic growth, the role of monetary policies will be quite limited.

One of the commonly known transmission mechanisms of monetary policy is that by using reverse repo agreements in the open market or the medium-term lending facility, the central bank can cut rates in the interbank market to drive down the loan prime rate at which commercial banks lend to businesses. The People's Bank of China has taken a series of measures in the hope of creating a favorable monetary environment for the economy. But I would like to stress that given China's fiscal position, especially given the fact that the fiscal balance may deteriorate in the second half of the year, if economic growth cannot improve, the central bank may have to further ease the monetary policy. Furthermore, once there is difficulty in government bonds issuance, China's central bank may have to adopt quantitative easing policy as Japan and the US did. Of course, this is one of the options, and I don't think we should rule it out.

To sum up, given the potential growth of the Chinese economy, as long as fiscal and monetary policies can coordinate appropriately, China will be fully capable of achieving a positive growth rate this year, and a real growth rate of 2%-3% will be possible.