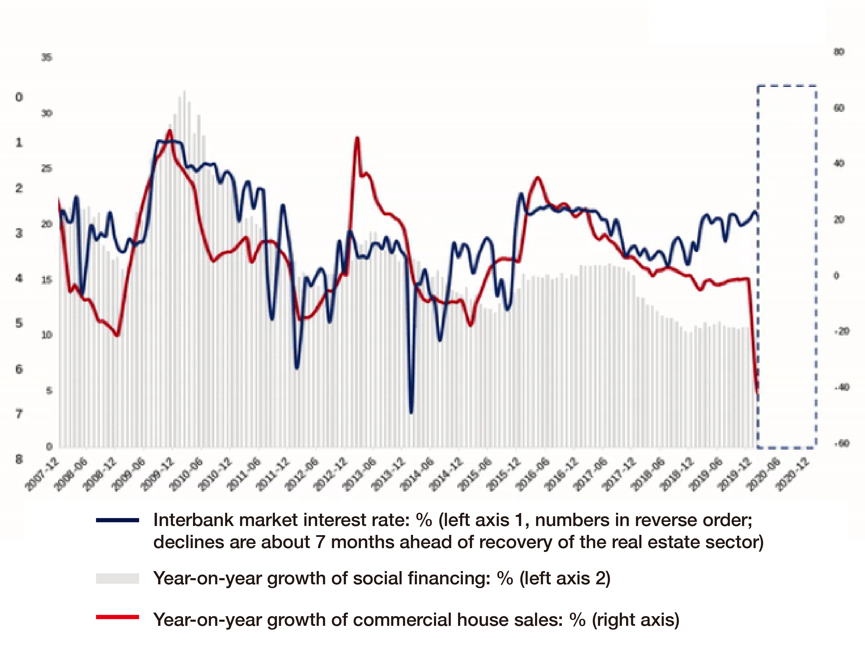

Abstract: This article discusses the factors affecting China's housing market in the post-pandemic era, and finds that the short-term drop of household income caused by COVID-19 and high debt level might not be significant constraints to home sales. Instead, city-specific policies will provide strong support for the rebound of the housing market. Besides, decline of the interbank market rate will lower interest rates and there is still room for home sales to further rebound later this year.

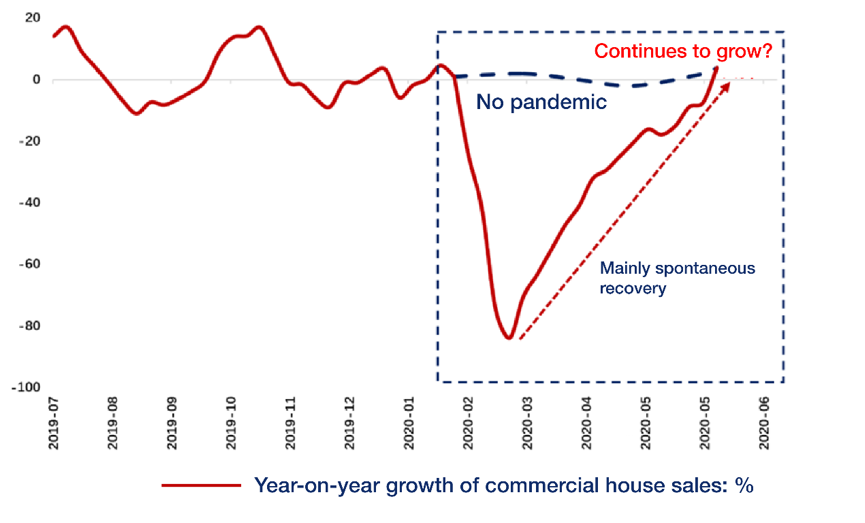

In the post-pandemic era, all economic sectors await recovery. The performance of the real estate industry, a significant endogenous driver of China's economy, has been rapidly recovering from the bottom in the first quarter as the previously constrained demand for houses quickly rebounded. The question is whether such a spontaneous recovery will sustain as China remains committed to curbing speculation in the housing market and excluding the use of real estate sector for stimulating the economy.

Figure 1: Will the recovery of the real estate market sustain in the post-pandemic era?

Source: Wind

I. What are the factors impeding the recovery of the housing market?

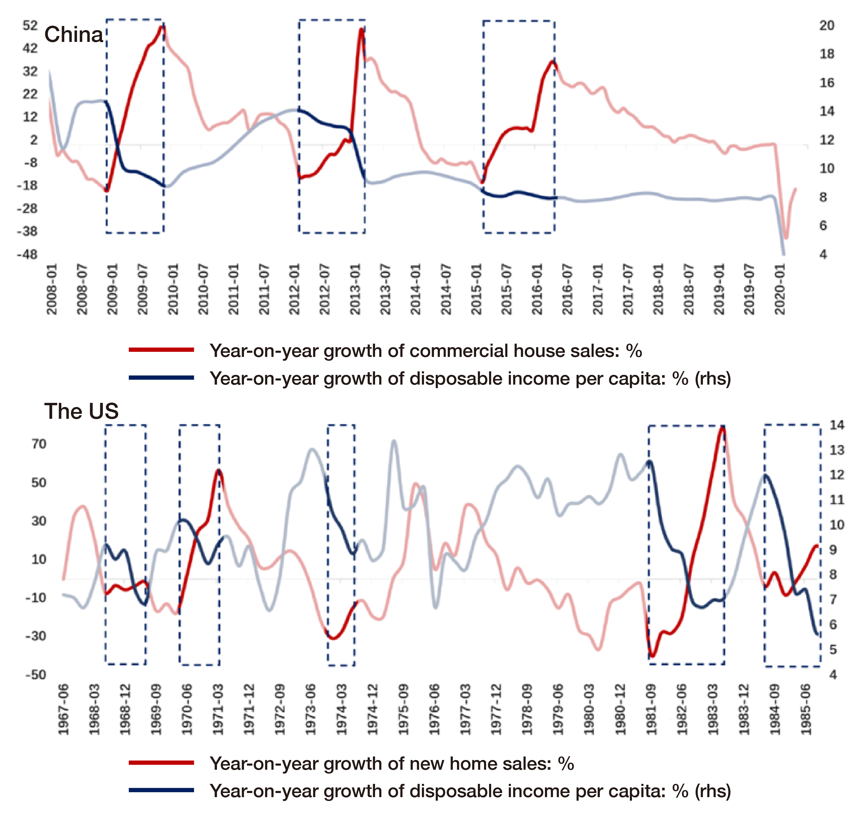

The negative impact of the COVID-19 pandemic on households' short-term income accompanied by a historically high leverage level appears to be a downside factor to home sales. However, home sales do not necessarily fall as growth of household income slows. This is evidenced by the historical data of both China and the US.

The reason is that home purchases tend to depend on households' long-term cumulative income and their outlook on economic growth, and are not that much affected by income volatility in the short term. The drop of household income in China this year is largely caused by the short-term shock of COVID-19, which is not necessarily a significant constraint to home sales.

Figure 2: Does a drop of household income curb the recovery of the housing market?

Source: Wind

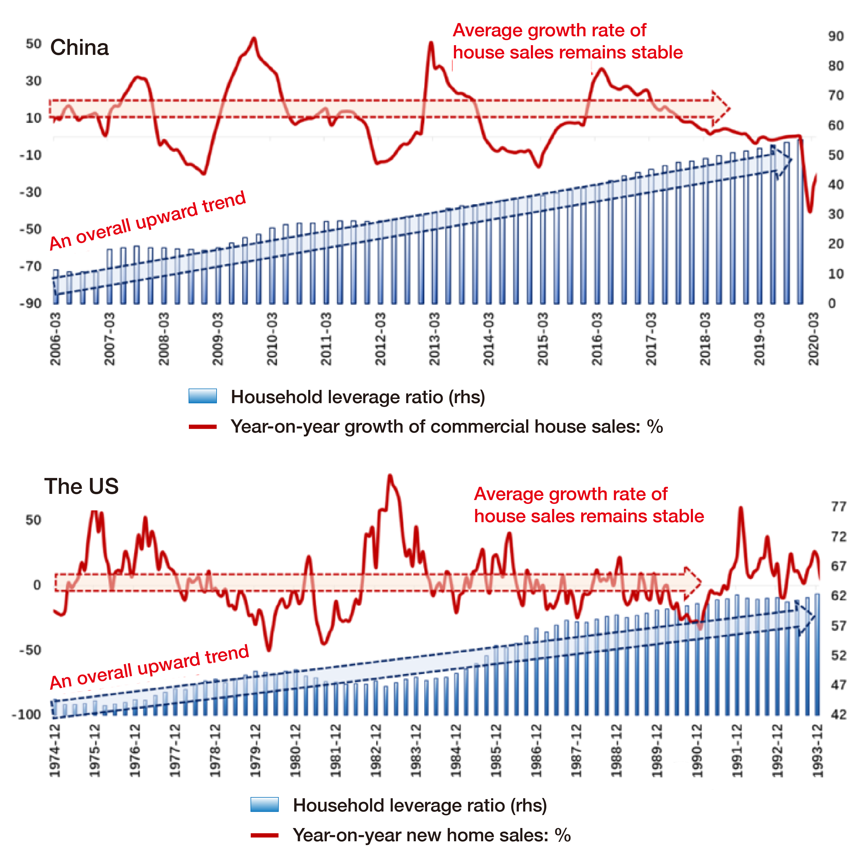

In addition, household debt level is not directly correlated with the short-term performance of the real estate market. For example, the leverage ratio of Chinese residents has been trending up for more than a decade, but the growth of commercial house sales has been oscillating within a relatively stable range. In particular, short-term changes in household leverage ratio are often slow, thus can hardly cause dramatic changes in commercial house sales. Internationally, similar features can be also observed in countries such as the United States.

Figure 3: Have high household debt levels held back the recovery of the real estate sector?

Source: Wind

II. What is supporting the real estate sector?

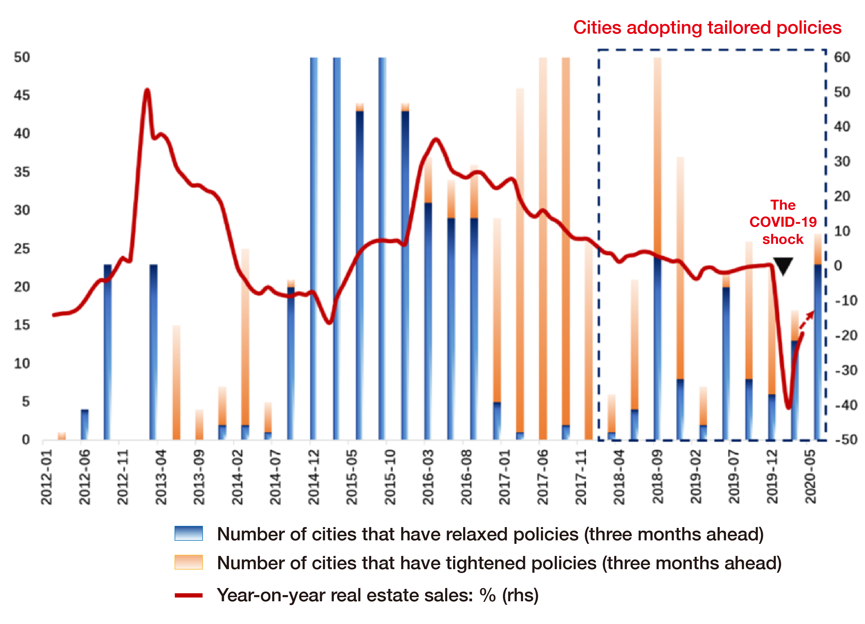

In China, policies for the real estate sector are tailored to local situations. Judging from the experience of the past two years, this approach appears to have effectively smoothed fluctuations in the sales of commercial housing across the country. This year, Shandong province and Nanjing relaxed the "hukou" rules in their cities. Cities such as Jiaxing and Nanning have relaxed restrictions on using provident funds for home purchases. These policies all provide strong support for the rebound of real estate sales in the future.

Figure 4: Cities adopt tailored policies for the real estate sector, effectively smoothing fluctuations in housing sales

Source: Wind

Note: Relevant policies include those relating to talent attraction, provident fund, loan quota, purchase restriction, and sale restriction.

The decline of the interbank market interest rate will continue to have time-lagged impact on the interest rates of borrowings and home mortgage loans. M2 and social financing have both grown much faster this year than in 2019, creating a sound financial environment to reinvigorate the real estate market. After a period of spontaneous recovery after the outbreak, real estate sales in China still enjoy room for further rebound, which will also help stabilize and boost the economy.

Figure 5: Favorable financial conditions are propping up the recovery of the real estate sector

Source: Wind

III. Conclusions

First, the pandemic has taken a bite out of short-term resident income, while the accumulated household debts have reached a historical high, both of which seem to be pessimistic factors impeding the recovery of the house market in China. However, contrary to what it may seem, house sales are not negatively affected by these factors. This has been observed in history many times.

Second, adopting city-specific policies remains the guiding principle for China's regulation of the real estate sector. Over the past two years, these policies seems to have helped flatten out drastic fluctuations in commercial house sales across the country. Many cities have relaxed the hukou rules and eased the housing provident fund policies, which will facilitate house sales in the future.

Third, the decline of the interbank market interest rate will lower the interest rates of borrowing and home mortgage loans. M2 supplies and social financing have both grown much faster this year than in 2019, creating a sound financial environment to reinvigorate the real estate market. Real estate sales in China still enjoy room for further rebound, which will help the recovery of the entire economy.