Abstract: Due to the huge uncertainties facing China's economy, the target GDP growth in 2020 and the macroeconomic policy package being designed have become the focus of concern. The author believes that a growth target is still needed to coordinate expectations and boost confidence, though the target has to be realistic. An effective policy package requires comprehensive innovation of macro-management theory, and accomplish the quintuple goals of pandemic control, disaster relief, resumption of economic activities, addressing downward pressure, ensuring stability as well as attaining growth targets. The author proposes to set the growth target at 5% to 5.5%, and launch a baseline policy package consisting of 3.5 trillion of tax reduction and exemption, 2 trillion of infrastructure investment, and 1 trillion of relief and subsidies.

Chinese President Xi Jinping has reiterated in many important conferences since February that the Chinese government should "strive to minimize the damage caused by COVID-19, achieve the goals for socio-economic development for 2020, and ensure that the target of eradicating poverty is met as planned so as to build a moderately prosperous society in all respects". To this end, the CPC Politico Bureau held a meeting on March 27 and proposed to roll out a macroeconomic policy package as soon as possible. A core task for scholars is therefore to work out a feasible, efficient, well-research policy package to secure economic stability and the realization of development goals.

I. Disagreements over China's GDP growth target for 2020 should be taken rationally

There have been discussions among market participants over the goals for socio-economic development in 2020. Some think it is impossible to double GDP and per-capita income from 2010 amid a global economic recession. A key argument is that under the impact of the pandemic, China's GDP grew at -10% in the first quarter, and the growth is expected to pick up to only 4% in the second quarter because a global recession would prevent the Chinese economy from getting back on track. If China is to reach its growth target of 6% for the year, the economy has to grow at over 10% in the rest of the year, which is 3 to 4 percentage points higher than the potential growth rate. That will not only call for extra stimulus in the amount of RMB 6 to 8 trillion, but also risk disrupting the country's strategy of shifting the growth model and upgrading the economic structure to achieve high-quality growth. If that happens, China will be trapped in a debt / investment-driven growth model. That's why many people have suggested giving up the growth target and the goal of doubling GDP and per-capita income this year.

However, this view is based on extreme pessimism and lax judgement of the current situation, and may not be well-grounded.

To start with, GDP measured under the expenditure or the value-added approach based on statistics of supply and demand from January to February is error-prone. Demand-side macro parameters such as the growth rates of total retail sales of consumer goods, investment in fixed assets and net exports are not equivalent to those of consumption, investment and net exports calculated in the national income accounts. Two most outstanding problems are, 1) a large amount of service consumptions and public consumptions do not count as consumer goods, and 2) nearly 30% of urban investments in fixed assets are excluded from the official measure of capital formation. Hence, we cannot infer the decline of GDP growth simply based on how much the parameters on demand and supply have slumped.

Second, even if we make corrections to the data, growth rates of GDP measured under the expenditure, value-added, and income approaches will remain divergent. GDP measured under the income approach will be much higher than those measured under the expenditure or value-added approach, because many businesses continued to pay their employees despite massive shutdowns during February to March.

Third, it remains uncertain how the global economy will perform in March and the second quarter. Many international institutions and research groups have predicted a 2% decrease in global economic growth, but this forecast is based on the assumption that countries do not roll out massive stimulus and bailout plans and international organizations fail to coordinate countries' efforts in dealing with the crisis. Therefore, it is still too early to conclude that China will suffer a plunge of over 50% in its external demand and a shock greater than in the 2008 financial crisis.

Fourth, it is incorrect to predict the speed of economic recovery in the second and the third quarter simply based on the speed at which economic activities were resumed in March. Once various sectors and regions race to realize the goal of GDP growth, economic resumption may pick up pace across the board.

Given the above considerations, it will be of great significance to accurately estimate GDP growth rate in the first quarter, objectively predict the progress of economic activity resumption, and rectify the assessment of China's external environments in the second and third quarter in a timely manner.

II. Understanding the necessity of having a GDP growth target as required by "ensuring the realization of social and economic development goals for 2020"

It is important to properly understand the GDP growth target set in the 13th Five-Year Plan and the goal of doubling GDP and per-capita income, and their implications for China's GDP growth rate in 2020. These cannot be oversimplified.

According to revised GDP data, China's economic growth in 2020 should not be lower than 5.5% if the target of maintaining an average growth rate at or above 6.5% as set in the 13th Five Year Plan is to be met. The 16th CPC National Congress in 2002 set the goal to quadruple China's GDP in 2020, which has been accomplished ahead of plan during 2015 and 2016, so it sets no expectations for GDP growth in 2020. If China is to achieve the goal of doubling GDP in 2020 as compared with 2010 as set forth in the 18th CPC National Congress, GDP in 2020 will only need to grow at not lower than 5.5%. From the perspective of employment, if China is to keep the unemployment rate at or under 5.5%, there must be about 11 million new urban jobs this year, and the GDP growth needs to be 5.5% or higher; if it only aims to create about 8 million new jobs and maintain the current scale of employment, GDP growth this year will only need to be 5%.

In conclusion, GDP growth rate this year will only need to reach 5.5%, rather than 6%, to secure employment and meet the growth target.

III. It's important to properly estimate quarterly GDP growth rates under the annual growth target

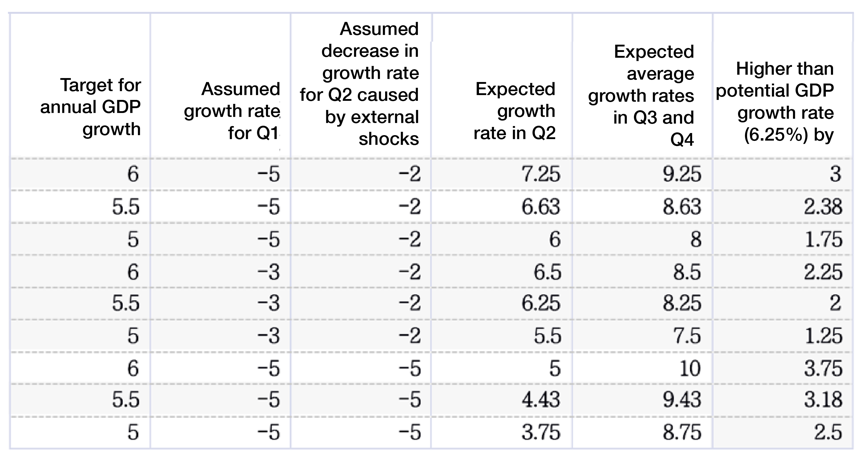

After comparing data, GDP growth in the first quarter this year, especially that measured by the income approach, is predicted to be within the range of -3% to -7% with an expected value of around -5%, which is much higher than the -10% estimate given by market participants. Given that the global spread of COVID-19 has led countries to tighten controls and introduce new stimulus and bailout policies, the external impact on China’s economic growth will be similar to that back in 2009, which may cut 2 to 5 percentage points from the GDP growth rate in the second quarter. But we tend to be more optimistic, because the external demands will have to deteriorate by as much as 30% to cause a 2 percentage point decline in China's quarterly growth. Based on these assumptions, we recalculated the target GDP growth rates for the next three quarters needed to secure the goal set by the 13th Five-Year Plan and to meet the target of doubling GDP from 2010, the results are listed below in Table 1.

Scenario 1: GDP growth rate in the first quarter measured by the income approach is -5%, while the external shock will reduce GDP growth in the second quarter by 2 percentage points. To realize an annual growth rate of 5.5%, the actual growth rate in the next three quarters will have to be 6.63%, 8.63% and 8.63%, respectively, with the third and fourth quarter seeing a rate 2.38 percentage points higher than the potential growth rate. If investment and consumption demands that were delayed in the first half of the year can get fully compensated for in the second half, realizing these target rates will be within China's capacity with the support of bailout and stimulus policies. We believe this scenario is very likely.

Scenario 2: If the target for annual GDP growth this year is set at 5.5%, with growth in the first quarter standing at -5% and that in the second quarter cut by 5% due to external shocks, the growth rates in the next three quarters will have to reach 4.43%, 9.43% and 9.43%, respectively. The third and fourth quarter will see a rate 3.18 percentage points higher than the potential growth rate, which means that the 5.5% goal is extremely challenging with the global economy in collapse, and risky as meeting the goal may bring negative aftereffects. In this scenario, a 5 percentage point cut to China's GDP growth induced by external shocks implies that the external demands will have significantly worsened.

Scenario 3: If the target for annual GDP growth is set at 5% with significantly worsened external demands, and the focus turns to maintaining the current level of aggregate non-agricultural employment, the target growth rate for the next three quarters would be 3.75%, 8.75 and 8.75%, respectively, with the second half of the year seeing a rate 2.5 percentage points higher than the potential growth rate. This would be within a tolerable range for China.

Table 1: Estimates of GDP growth rates in Q2-Q4 in 2020 under various assumptions

IV. Setting a realistic target for annual GDP growth

Based on the above analysis, it would be practical to set the GDP growth target for 2020 at 5-5.5%

First, setting such a goal will offer a clear signal to all that the government will introduce an expansionary policy package to secure employment and realize the target growth rate. This will guide expectations and behaviors across sectors, regions and institutions. A severe shock brought by an epidemic usually disrupts economic orders and shakes market confidence, and a clearly-defined growth target will help us to carry through.

Second, gaps between target and actual growth rates are well under control. In theory, as long as the growth rate does not exceed the potential rate by 40%, or by 2.5 percentage points, it is feasible. Based on the above estimates, the required level of quarterly GDP growth for the second half of the year in order to realize 5% - 5.5% growth does not surpass the potential growth rate by over 2.5 percentage points. Hence, overuse of resources, inflation and other distortions brought by stimulus measures should be controllable.

Third, it is necessary to understand that there are fundamental differences between the exogenous shock of a pandemic and the indigenous shocks during regular recessions. On one hand, such an exogenous shock comes and goes fast, with most of its impacts short-lived; on the other hand, as long as effective relief measures are put in place, a pandemic is not likely to overly damage economic fundamentals, and the halted consumption and investment activities will see retaliatory booms after the crisis is over. A V-shaped rebound of the economy usually occurs after a pandemic subsides.

Fourth, the amount of funds required to fill the output gap and support stimulus and bailout measures in order to meet the growth target is acceptable. According to the fiscal expenditure to GDP ratio, the fiscal deficit to effective demand ratio, and other parameters, fiscal expansion of RMB 1.2 to 1.4 trillion is needed to make up for each 1 percentage point decrease in GDP growth; thus, to fill the gap left by 3-5 percentage point decrease in GDP growth will require the government to inject RMB 4 to 7 trillion into the economy. In the face of the shocks caused by a pandemic never seen in a century, fiscal expansion in such an amount cannot be said to be much, and most of the developed countries have rolled out bailout measures to a similar extent.

V. Policy proposals must be properly evaluated

Since the U.S. rolled out its "zero interest rate + unlimited QE + USD 2 trillion fiscal stimulus" plan in late March, many have put forward suggestions with respect to China's own policy package, which can be roughly divided into the following categories: First, China's response should be commensurate with worldwide bailout schemes in scale. Second, lessons should be drawn from the stimulus package in 2008 to avoid excessive after effects. Third, emphasis should be placed on "New Infrastructure"; Fourth, expansionary policies should be aligned with fostering future structural growth drivers with development of city clusters as a top priority; Fifth, efforts should focus on social assistance and epidemic relief programs oriented towards income distribution.

Having the magnitude of China's policy measures to be similar to those of other countries is a somewhat rigid requirement. The largest stimulus packages so far were launched by Qatar and the U.S., equivalent to 13% and 10% of the GDP respectively, while the fiscal expenditure accounts for 4% of GDP on average across developed countries. The greatest stimulus plan among the emerging economies comes from Brazil, accounting for 3.5% of its GDP, while on average government spending makes up only 0.7% of GDP among the developing world. In fact, the bailout and stimulus plans of each country differ dramatically due to differences in the degrees of shocks suffered, development stage of the pandemic, and ways in which the economies are affected. Therefore, China should determine the magnitude of its policy based on the problems it faces and the depth of the shock, instead of rushing into a blind competition. Actually, in order to maintain economic growth and stability and address the impact of the pandemic, the size of China's fiscal spending could well exceed the average level of developed countries, because the country's fiscal policy space and capabilities far outstrip those of developed countries.

The aftereffects of the 4-trillion stimulus package in 2008 has caused many to "turn pale at the mention of stimulus plans", which is a rather unprofessional and irrational reaction indeed. Whether China should implement a stimulus policy is determined by the problems facing the economy and the pros and cons of such policies Under the quintuple pressures, i.e. impact of the pandemic, difficulty with work and production resumption, global economic depression, cyclical downturn pressure, as well as structural trends, we should relaunch a stimulus program without hesitation if the benefits significantly outweigh the costs.

The reasons why the 4-trillion stimulus package in 2008 caused severe side effects are as follows: First, the central bank adopted a quantitative easing policy and pumped enormous liquidity into the economy when there was no sufficient number of projects or capable entities to carry out those projects, which led to high debt levels, rampant expansion of shadow banking as well as investment and financing platforms, and financial disorder; Second, plans for revitalizing ten traditional industries conflicted with the goal of medium-term structural adjustments, and resulted in systemic overcapacity. We should draw lessons from the 4-trillion stimulus package in 2008 — that is to say, the stimulus package should be project-based, focused on fiscal measures and supported by monetary policy; moreover, it should align with the goals of medium-term structural adjustment, poverty alleviation and building a moderately prosperous society. Then the stimulus policy will not repeat the mistakes of the 4-trillion package in 2008, and people would not overreact to the proposal of a stimulus plan.

The crux of the "new infrastructure" and "city clusters" proposals does not lie in whether to carry out them or not, but in the following factors: 1) There are no enough projects to launch these programs on a large scale within a short span of time. Even if China does launch them, the size of the projects would still be too small to cope with the tremendous downward pressure; 2) It is difficult to offset losses and impacts on the supply side through demand management; 3) Demand-side management focusing on investment could hardly boost consumption which has come to a standstill; 4) Building city clusters needs to supported by a series of reforms which will take time and offer no immediate help.

However, drawing beneficial elements from these proposals will help with the formulation of an effective policy package.

VI. An effective policy package requires the comprehensive innovation of macroeconomic management theory

To develop an effective macro-policy package, policymakers must understand the key issue at present is not traditional economic / financial crisis management – the shock facing China now is not the traditional type demand shock generated by indigenous distortions, but rather a temporary economic standstill caused by a super exogenous shock. Therefore, the theoretical foundation of the policy package should not be traditional Keynesianism, simple counter-cyclical adjustment theory or the conventional crisis management theory.

The pandemic has brought shocks to both demand and supply. Moreover, the humanitarian and social crises it triggered have well exceeded expectations. To effectively deal with the various types of shocks, policymakers need to adopt a whole set of policies.

First, resource allocation must be based on the need of epidemic control. The allocation mechanism needs to shift from the market system and autonomous social system to a wartime system of first-level management and control.

Second, we need to reduce the damage the pandemic has caused to economic and social entities, and prevent the short-term shock from turning into supply loss. Therefore, providing relief to economic and social entities will provide the foundation for post-epidemic reconstruction.

Third, after the outbreak is brought under control, the resumption of work and production must be promoted by administrative measures on the supply side, and boosted demand by the market, so as to overcome various market failures during the reopening of the economy.

Fourth, we must effectively mitigate a combination of downward pressures from global economic collapse and the traditional sources.

The above four tiers of issues dictate that the expansionary policy package must accomplish the following goals: 1) pandemic control; 2) pandemic relief; 3) resumption of work; 4) addressing downward pressure; 5) ensuring economic stability as well as attainment of social and economic goals.

Considering the extreme uncertainties associated with achieving these goals, policy design needs to adopt a "bottom-line management" mentality. Policies tailored to each stage and its goals should be implemented in a progressive manner at proper timing, rather than rolled out all at once.

VII. It is critical to have an effective policy mix with an appropriate magnitude

According to the current estimate, China has allocated approximately RMB 500 billion to virus control, while the unveiled fiscal relief measures to promote the resumption of economic activities are reckoned to be about RMB 800 billion (while IMF has estimated the number to be even higher at RMB 1.3 trillion). Policymakers need to adopt measures that are of sufficient magnitude to address the pandemic’s shocks, align short-term stimulus programs with medium-term structural adjustment goals, carry out social and economic relief programs simultaneously, properly channel relief to low-income groups and those with actual need, match supply with demand, and have consumption and investment play balanced roles in boosting the economy. Future efforts should target the following areas:

First, providing massive support for small- and medium-sized enterprises as well as the self-employed in economic hardships; Second, offering subsidies to the hardest-hit low-income groups, especially those in non-standard employment; Third, introducing massive consumption stimulus and expanding government purchases to rapidly reopen the market; Fourth, providing targeted assistance to export-oriented economic entities to help them hedge against the upcoming shock; Fifth, speeding up the launch of investment programs that could boost the development of new infrastructures and city clusters.

According to the analysis above, we can compute the amount needed by a basic policy package by assuming GDP growth in the first quarter stands at -5%, and further declines to -7% due to external shocks in the second quarter, with an updated annual growth target of 5.5%.

First, in order for the real GDP growth in the second, third and fourth quarters to reach 6.63%, 8.63% and 8.63% respectively, and for the growth rate in the third and the fourth quarter to exceed the potential growth rate by 2.38 percentage points, China needs to inject another RMB 5 trillion into the economy in addition to the previously announced RMB 1.3 trillion;

Second, the overall plan could be designed as RMB 3.5 trillion of tax reduction and exemption, 2 trillion of new infrastructure investments, and 1 trillion of reliefs and subsidies. Excluding the previous package of RMB 1.3 trillion, future policies will entail RMB 5.2 trillion of expenditure. Where does the money come from? We could consider raising the budget deficit ratio from 2.8% in 2019 to 3.5%, thereby increasing the fiscal expenditure by RMB 1 trillion immediately; also, we could elevate the actual deficit ratio from 3.9% in 2019 to 6%, thus pooling another RMB 1 trillion by transferring funds from other sources and resorting to balances carried over from previous years;

Third, China could issue 2 trillion special government bonds to address the pandemic shock. Funds thus raised can be used to set up rescue funds to bail out small- and medium-sized enterprises, provide subsidies to low-income groups, and establish special funds to help boost consumption demand, so as to help out entities hit by the pandemic. In addition, the capital of the China Development Bank could be replenished.

Special-purpose bonds issued in 1998 and 2007 accounted for 3.17% and 5.56% of the GDP respectively. In comparison, the 2 trillion special-purpose bonds to be issued in 2020 will only account for 1.86% of the GDP;

Fourth, local governments could expand the size of special bonds from 2.15 trillion in 2019 to 3.35 trillion, which could directly increase fiscal expenditure by 1.2 trillion.

Certainly, given that we have assumed a real GDP growth at 5.5% and a nominal GDP growth at around 8.5% in 2020, China's fiscal revenue and revenue from government-managed funds will be significantly higher than when there is no fiscal expansion. Therefore, certain leeway exists in the above policy design.

A policy package should be rolled out immediately, in order to bring about instant effects in stabilizing expectation, boosting confidence, maintaining stability and reopening the economy, lest we miss the window of opportunity for rapid economic restart and risks control. Meanwhile, due to high uncertainties in the future, we must leave some leeway for flexible and dynamic adjustment to the package.