Abstract: Prevention and control of the epidemic stay the most important task for the time being, and governments at all levels are still focused on it. In the meantime, policies also need to prepare for the rainy day. In addition to effectively controlling the epidemic, the government should make arrangements for production recovery in advance, so as to ensure smooth transition back to normal production and reduce the mid-term impact of the disease. first stabilize the flow of funds, get logistics back on track as soon as possible, then resume the flow of people as the epidemic situation improves, and restart production at the same time.

At 02:30, January 31 (Beijing Time), 2019, the World Health Organization (WHO) declared the outbreak of novel coronavirus (2019-nCoV) a Public Health Emergency of International Concern. But the WHO also stressed that "there is no reason for measures that unnecessarily interfere with international travel and trade" and it "doesn't recommend limiting trade and movement". The WHO applauded the extraordinary measures that the Chinese government has taken to contain the outbreak and expressed confidence in China's capacity to control it. Before the press conference was held, the international market had been so concerned about the WHO's assessment of the epidemic that the prices of gold and silver once surged. The announcement alleviated the prevailing concern, and the prices have obviously come down.

As the number of confirmed cases of pneumonia keeps rising, prevention and control of the epidemic should and have been placed as the top priority in China. However, we should also think ahead about how to restore production and reduce the negative impact of the epidemic after it is brought under control.

To this end, we must first figure out in what ways the epidemic has impacted the Chinese economy.

First, the offline service sector has been among the hardest-hit in China, especially cinemas, tourism, hotels and restaurants and educational institutions. According to a mainstream argument, compared with the SARS crisis back in 2003, the novel coronavirus may exert much more negative impact on the economy because the proportion of the service sector in the national economy is way higher than 17 years ago. However, shock to the service sector mainly comes from the demand side, and demands for services are very likely to rise again after the epidemic gets controlled and may climb even higher. This observation has raised many voices optimistic about the economic outlook. In general, the impact of the epidemic on the offline service sector is relatively limited, and the shocks will be gradually migrated. Of particular note, the virus's outbreak has offered the emerging online service industry an unexpected opportunity for development.

Second, the novel coronavirus broke out at a special time, and has dealt a significant blow to industrial production. The author has conducted surveys on multiple industries such as clothing, iron, machinery and petrochemicals across many provinces in China including Guangdong, Hubei, Zhejiang, Shanghai and Hebei. The situations vary for different industries in different regions. But in general, the productions have all been impacted to various extents across dimensions - labor input, orders, inventory management, production and transport, etc. The services sector's pressure mostly comes from declining demand, but industrial production is striken in terms of both demand and supply, so it has even harder days. Under the epidemic's shock, the imbalance between demand and supply for industrial production is ever more severe.

I. Difficulties in the short run with restoring industrial production

SARS did not spread across provinces until early February 2003 after the Spring Festival. It was in late February that the epidemic's nature and severity was confirmed and on March 12, 2003 that the WHO issued a global warning and suggested isolating suspected cases for medical treatment. In contrast, the pneumonia caused by novel coronavirus escalated right before the Spring Festival, and how to resume business after the holiday has become a big problem. Several major challenges stand out in the restoration of industrial production.

First, restart of industrial production may get postponed. The government has officially postponed the restart date of most businesses, and workers may actually return even later. Besides, it also takes time for manufacturing businesses to secure protective supplies and develop precaution standards for workers before they resume production activities.

To prevent the spread of the disease, provinces and cities across the country have issued notices requiring businesses to restart operations at a later time, mostly no earlier than February 10, except for Hubei Province (of which Wuhan is the capital city) which has set the time at no earlier than February 14. As a result, industrial activities are delayed for at least 9 days. Despite these arrangements, there are still uncertainties as to when production activities will be actually resumed because it may take even longer if the epidemic goes beyond control.

What's more, many workers are unwilling to return to work as the virus is still in spread. On January 29 and 30, the number of railway passengers decreased by 74.7% and 73.8% year-on-year respectively. Also, after returning to the cities where they are employed, workers have to be in quarantine for two weeks. Therefore, they may actually return to work two to three weeks later than in previous years, and the delay may be even longer in cities in grimmer situations. Additionally, after business is resumed, should those returning from other cities be isolated and how? Will there be enough masks and other protective supplies to ensure their safety? What standards and procedures should be followed to prevent against infection risks and handle emergencies? These are all realistic challenges facing the manufacturers, especially those employing a large number of workers.

Second, the current transportation system and logistics channels are clogged.

To contain the epidemic, it is necessary to control traffic flow at highway entrances and have the passengers' temperatures measured. But some local governments have gone to extreme, closed, blocked or even damaged their highways, in order to eliminate the possibility of admitting people infected with the disease. A county government even ordered the closure of its entrances and exits on national, provincial, county and township highways. Besides, logistics have also been hindered because transportation companies remain out of business.

According to statistics by Mysteel, by January 30, 2020, the aggregate inventories of 22 construction steel businesses in a southern province mounted to 1,375,000 tons, 379,000 tons higher than that in the first week after the Spring Festival in 2019. This was mainly because the logistics got clogged and the goods could not be shipped out as usual. Along with the inventory overstock is the piling up of raw materials in transit at ports. Businesses have expressed concerns that some steel mills will see mounting finished goods while running short of raw materials in the coming week. This problem also haunts the steel firms in a northern province, although to a lesser extent.

Third, delivery of orders will be delayed after the Spring Festival, incurring losses for manufacturers.

Normally, the production and delivery of seasonal products such as garments will be in full swing in February. However, because of the reasons stated above, these productions are still yet to be resumed and it remains uncertain when the products can be finished. As a result, manufacturers will have to pay penalty for their delay or resort to express delivery services and air transportation to ensure timely delivery, which will incur additional costs. In particular, export enterprises may suffer greater loss from delayed deliveries.

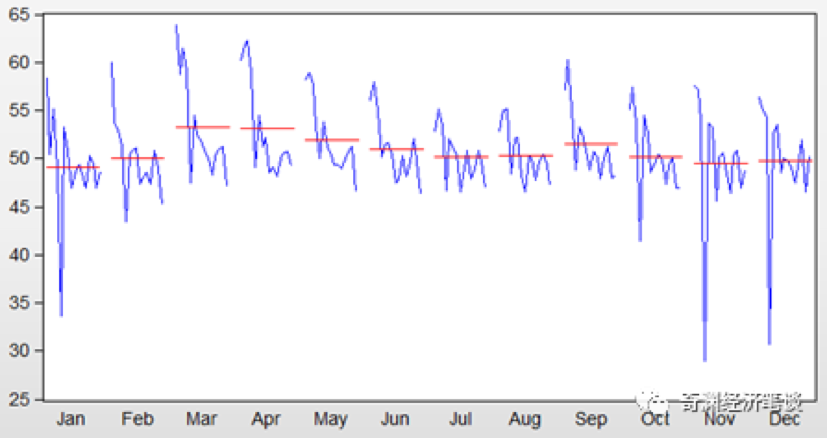

On top of that, the accumulation of orders before the Spring Festival will put higher pressure on manufacturers. From November 2019 to January 2020, the new orders index and new export orders index of the PMI both went up. Because the numbers of January are based on statistics as of the 20th of the month, they basically reflect the scenario before the epidemic escalated. In January 2020, the new orders index climbed up to 51.4, the highest in twenty months, while the new export orders index, although saw a decline to 48.7, still stood higher than that of January 2019 and the 2019 average. Furthermore, the growth of aggregate new export orders in December 2019 and January 2020 indicated great momentum. However, it's exactly these outstanding orders that are likely to put great pressure on manufacturers and even cause losses for them.

Figure 1: Rising new orders index during the end of 2019 and the start of 2020

Source: National Bureau of Statistics, January 31, 2020.

I. The impact of the epidemic on industrial production may go beyond the first quarter

The impact of the epidemic on production activities is one-time and temporary. But how long is this "temporary" shock? The author believes the impact may stay beyond the first quarter, which requires attention.

First, the temporary loss of new orders from export-oriented manufacturing firm may continue to affect the second quarter.

According to data since January 2005, export orders peak in the months of March and April, and the numbers are significantly higher than that of the third peak month, i.e. September during which Christmas orders are placed. Between March and April, the orders in March are higher. It is obvious that the export orders in March and April will determine export performance in the following months.

Figure 2: March and April as the peak months of new export orders: new export orders index

Note: based on data from January 2005 to January 2020.

Data source: National Bureau of Statistics, January 31, 2020.

At present, foreign buyers are paying close attention to the epidemic in China. However, due to the foregoing reasons, the time of delivery of the orders placed at the beginning of the year cannot be confirmed yet, and it is likely some orderly will be delayed. If there is still uncertainty regarding the recovery of industrial capacity in March, it may hit new orders for the month, which in turn will affect production activities in the following quarter.

Concerns about order loss varied for different companies and industries. Companies that are highly competitive are not worried too much. However, things are different for clothing manufacturers as their foreign buyers could purchase from multiple countries. If China's production recovery is delayed, international buyers may reallocate their orders to other countries.

In addition, although the WHO does not recommend restricting international travel and trade, some countries have already adopted restrictions on the epidemic and raised risk levels. This could have a negative impact on new orders to China as well. For instance, when a foreign buyer considers adding a Chinese company to their supplier list, it requires many steps including preliminary negotiation, product testing, factory inspection, negotiation and contract signing. Many of the steps involve international trips to China. Currently, the process may be disrupted or even suspended, which may slow down the potential growth of export orders.

Second, manufactures still incur fixed expenditures and may face liquidity problems with increased production difficulties.

First, while resumption of operation is postponed and employees quarantined, firms still need to bear fixed expenditures such as rent and interest on loans. Second, do companies still need to pay wages during this period? Standards vary from place to place, and some enterprises still need to pay. For example, the Notice on Delaying the Resumption of Work and School Opening in Shanghai issued on January 27 clearly stated that "for employees on leave, enterprises should pay wages according to the standards agreed in the labor contract." Third, for patients with novel coronavirus pneumonia, suspected cases, and close contacts who are unable to work due to quarantine measures such as isolated treatment and observation, the employers should "deem them as normal labor providers and pay for normal working hours".

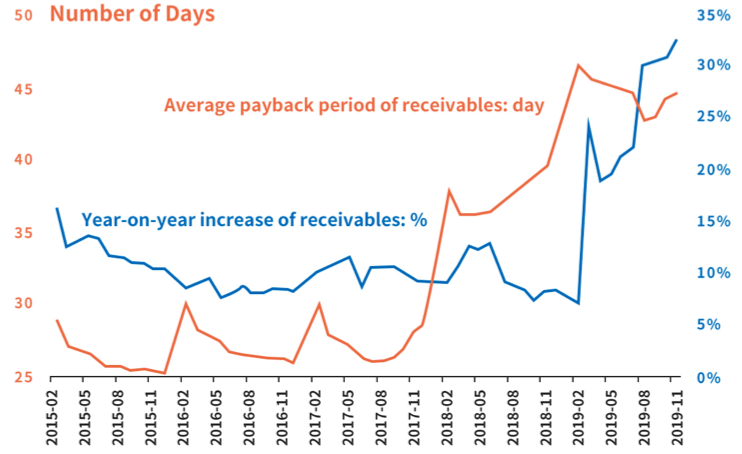

Meanwhile, we have noticed that the private industrial enterprises are already running out of cash. According to the latest data from the National Bureau of Statistics: In November 2019, the amount of bills and accounts receivable of private industrial enterprises amounted to 5.025 trillion yuan, a year-on-year growth of 32.3%, a record high since 2007. During the same period, the average payback period of receivables of private industrial enterprises reached 44.6 days, slightly dropped from the peak in 2019, but still near a historical high.

It can be seen that tight liquidity, coupled with constant fixed expenditures, additional labor costs brought by the epidemic, postponed resumption of work, delayed delivery of orders, and higher protection costs after resumption of work, will all fall onto the troubled enterprises. If they run out of liquidity, it may entail bankruptcy and unemployment, which will affect future economic development. The situation needs further attention and assessment.

Figure 3: Private industrial enterprises are running out of cash

Data source: National Bureau of Statistics, WIND data terminal, January 31, 2020.

III. Plan ahead for the resumption of production activities while dealing with the epidemic.

Needless to say, prevention and control of the epidemic stay the most important task for the time being, and governments at all levels are still focused on it. It is necessary "to rip the band-aid off quicker" and curb the epidemic within a short period of time, prevent and control the disease with scientific methods and targeted measures, and strive to eliminate it as soon as possible. Nevertheless, as mentioned at the beginning of this article, policies also need to prepare for the rainy day. In addition to effectively controlling the epidemic, the government should make arrangements for production recovery in advance, so as to ensure smooth transition back to normal production and reduce the mid-term impact of the disease.

Hence, the author's suggestions are: first stabilize the flow of funds, get logistics back on track as soon as possible, then resume the flow of people as the epidemic situation improves, and restart production at the same time.

First, stabilize the flow of funds.

Through targeted tax reductions and temporary short-term financing, liquidity assistance should be provided for the industries hit the most by the epidemic, especially the troubled private enterprises in those industries.

Second, get logistics back on track as soon as possible.

At present, the contradiction between supply and demand is significant, while surplus and shortage coexist in the market. In this context, policy measures should focus on "matching" the supply and demand instead of pursuing stimulus policies. The key is to restore unimpeded flow of goods, thus clear standards should be established to ensure smooth traffic. Meanwhile, the authorities should be fully aware of the key role of logistics and transportation in restoring economic activities, and have the industry resume normal operation as soon as possible while adhering to epidemic prevention and control standards. Moreover, before the epidemic is completely under control and the logistics bottlenecks are fully cleared, it is not appropriate to implement large-scale stimulus policies.

Third, resume flow of people and production activities.

The government should communicate more with enterprises to increase mutual understanding and stabilize the latter's expectations on resuming production. In particular, the government should learn more about their difficulties, and adopts measures according to the specific situations in various regions and industries.

Since the epidemic is still spreading, the time for resuming work is yet to be determined, but certain technical standards can be given. Based on the number of new infection cases, the moving population, how well the epidemic is managed, clear and quantifiable measures could be formulated and provided to enterprises for reference in deciding when to resume production. In the case that the epidemic has not been completely constrained, local governments should also clarify the protective measures to be adopted after production is restarted, instruct enterprises to offer necessary protection to employees and provide them with sufficient supplies of protective equipment.