Conclusions:

1. The logic by which the novel coronavirus epidemic impacts the economy is that the stronger the infectivity is, the more stringent isolation and control measures will be needed, and therefore the greater the impact on economic activities. The infectivity of the new coronavirus appears to be stronger than that of SARS in 2003, possibly due to the virus itself, but also the improvements in social openness and convenience of traffic. The control efforts taken by the government are also stronger compared with those adopted during the 2003 SARS period. A basic judgment is that the impact of the epidemic on the economy is bigger than that of SARS.

2. However, historical experience at home and abroad shows that even the impact of a large-scale infectious epidemic on the economy is short-lived, and as the epidemic subsides, economic activities will return to normal. The 1918 influenza pandemic in the United States resulted in the abnormal death of 0.6% of the population (mainly young adults), but economic growth quickly rebounded after the epidemic receded. The ongoing epidemic will not affect the long-term trend of economic growth.

3. According to our estimation, if the epidemic is effectively controlled in a few weeks, the impact on GDP growth will manifest mainly in the first quarter and the growth will rebound in the second half of the year. If the epidemic lasts longer, its impact on the economy will be greater. Based on relatively optimistic and pessimistic scenarios, GDP growth in 2020 may be reduced by 0.4-1.0 percentage points. However, the greater the decline in economic growth is in 2020, the greater the rebound will be in 2021, probably back to above 6%.

4. The priority now is to contain the epidemic. Strict quarantine and control measures are both necessary and reasonable. To cope with the short-term impact of the epidemic, macro-policy should focus on structure rather than the aggregate amount. It is expected that monetary policy will be moderately loose, but the backbone of policy should be fiscal expansion which include tax cuts and other measures to help industries, regions and low-income groups affected. In addition to raising the budget deficit rate to 3%, special purpose bond issuance will likely exceed original expectation. There is also a possibility of issuing special construction treasury bonds and strengthening "quasi-fiscal" measures such as issuing urban investment bonds and policy bank bonds.

5. The epidemic has impact on the capital market. The significant decline in Hong Kong stock market after the Spring Festival holiday reflects panic brought about by the epidemic. But the fundamental factors that determine the general trend of the market is policy orientation and economic data. In 1-2 weeks, the spread of the epidemic will shock the market through investor sentiment; in a quarter or so, we need to pay attention to the impact of epidemic-induced changes in economic data on the market; in a year or so, the impact of the epidemic will be negligible.

6. Sector-wise, the most direct and immediate impact of major infectious diseases is on consumption. Among the industries, the pharmaceutical industry will benefit relatively, while retail, tourism, and transportation sectors will suffer greater damage. Unlike SARS in 2003, as the epidemic broke out during the Spring Festival, isolation and other prevention and control measures are significantly more timely and stronger, therefore the short-term impact on consumption is greater.

I. Introduction

The outbreak was caused by a newly discovered coronavirus, which belongs to the coronavirus family with SARS and MERS (Middle East Respiratory Symdrome), and the World Health Organization (WHO) named it 2019-nCoV. The incubation period of the new coronavirus is about 7 days on average, but can be as short as 2-3 days and as long as 10-12 days. Referring to the incubation period of other coronaviruses (1-16 days for SARS with an average of 3-5 days; 2-14 days for MERS), those who have had close contact with infected people are subject to 14 days of medical observation.

At present, there are some symptomatic treatments or other existing antiviral drugs that may be repurposed to treat the new coronavirus, but no targeted vaccine or medicine has been developed. Main ways to prevent infection include avoiding visit to epidemic hotspots and areas of high human activities, ensuring ventilation, wearing a mask, washing hands, and so on. According to news reports on some of the cured patients, the duration from admission to complete recovery is about 1-2 weeks.

Based on current fatality rate and severity of symptoms, 2019-nCoV appears to be less virulent than SARS and MERS, though the possibility of future virus mutation is not ruled out. However, the geographic distribution of confirmed cases in China indicates that the spread of the 2019-nCoV is wider than that of SARS, which may reflect higher infectivity, or faster and wider population flow compared with the SARS period due to the development of transportation.

II. Economic impact of the epidemic

Epidemic is a rare exogenous event to the macro economy and the market and brings unexpected shock to both demand and supply. Therefore, it is difficult to assess its impact based on the logic of endogenous evolution of economic variables, and there tend to be few comparable events historically. One comparable case is the SARS outbreak during 2002-2003.

1. During the SARS period, the shock to the economy and market had 3 major characteristics.

First, GDP growth fell sharply, but the decline was short-lived, and the growth rebounded rapidly once the epidemic receded. From March 2003, SARS spread from Guangdong to other provinces in Chinese mainland. China's May Day holiday was cancelled. And the year-on-year (yoy) GDP growth rate dropped from about 11% of the first quarter down to about 9% in the second quarter. But with the relief of the epidemic in July, production activities resumed, and the third quarter GDP growth rate rebounded to about 10% year on year.

Second, consumption was the main vector through which the epidemic caused economic growth fluctuations, while the impact on investment was limited. The impact on consumption concentrated in cities which were more severely hit by the SARS epidemic, as people reduced outings, which in turn reduced consumption activities linked to tourism, accommodation, and catering. By contrast, yoy growth of consumptions associated with daily necessities, and Chinese and Western medicine jumped in April 2003 due to the epidemic.

Third, the financial market volatility increased. In April 2003, the SARS epidemic significantly aggravated, which caused the market to fall rapidly. During the span of eight days between April 17th and April 25th, the Shanghai Composite Index fell by 7.8%, but then rebounded by 5% at the end of June. On the other hand, due to changes in economic expectations, the 10-year Treasury bond yields dropped significantly in May 2003 and oscillated at the bottom from June to August. But as the epidemic receded and the economy gradually recovered, the Treasury bond yields rebounded.

2. The difference between the impact of the 2019 n-CoV and the 2003 SARS – three dimensions

The first dimension is the infectivity and virulence of the viruses. The more infectious the virus, the wider its impact, and the more virulent the virus, the higher its mortality rate. In general, epidemics caused by viruses of greater virulence but less infectivity tend to have smaller economic impact, whereas those caused by viruses of greater infectivity tend to have larger economic impact. Of course, if a virus is both highly infectious and virulent, its impact on the economy will be greater.

The second dimension is the openness of the economy—the more open, the higher the population mobility, the easier the spread of the virus, and the greater its impact.

As mentioned above, the confirmed patients are more widely distributed throughout China than during the SARS period, indicating greater impact on the economy. Compared with the SARS period, population flow increased significantly, reflected in the increased urbanization rate and the number of migrant workers. In addition, the epidemic outbreak coincided with the mass population migration during the Spring Festival, and the spread of the virus was expedited by Wuhan’s status as a transportation hub in China. Population mobility is also reflected in international activities. The number of inbound tourists in China increased from 98 million in 2002 to 140 million in 2018, and the number of outbound Chinese tourists increased from 16.6 million in 2002 to 160 million in 2018. By the end of January 2020, the novel coronavirus outbreak had affected 20 countries and regions abroad, which was lower than the 29 during the SARS period, but as the epidemic is still developing, it could have some impact on China's international trade and investment.

The third dimension is the strictness of government measures to control the epidemic. In order to control the spread of the 2019 n-CoV, the government has taken measures to isolate infected people, extend the Spring Festival holiday, reduce public transport, stop public gathering, etc. While more stringent measures are more effective in controlling the spread of the disease, they may also bring greater impact on the economy in the short term.

Compared with the SARS outbreak in 2003, epidemic prevention and control measures seem to be more stringent and prompt. It took 50 days for large-scale public prevention and control measures to be taken following the first pneumonia case caused by the new coronavirus, which is much shorter than the 137 days during the SARS period. As the large-scale outbreak of SARS in April 2003 when people were generally at work, canceling the May Day holiday had smaller impact on production. As the novel coronavirus outbreak coincides with the Spring Festival, extending the holiday, delaying the opening of schools, along with city-wide lockdown of various degrees adopted in many cities and measures taken by other cities to restrict population inflow, will have greater impact on economic activities.

III. The impact of the epidemic is short-term and will not change economic fundamentals

Based on the above three dimensions, the impact of the epidemic on the economy is reflected in both demand and supply.

The short-term impact of the epidemic on the supply side is reflected in the suspension of some production activities, and once the epidemic subsides, production will return to normal accordingly.

In terms of consumption, the impact of the epidemic is closely related to the nature of consumer goods, that is, the impact on consumer goods will vary based on whether the purchase could be postponed or not. During the epidemic period, most consumption will be impacted, but once the epidemic goes away, consumption of goods and services that can be postponed will rebound as consumers will make up for the expenditure that has been cancelled as a result of the epidemic (such as car purchase). But consumptions that cannot be postponed (such as catering) will not be evened up even after the epidemic disappears.

As control measures over the epidemic came earlier compared to the SARS period, the impact on consumption also happened sooner. During the Spring Festival, consumptions related to travel, accommodation, catering, and transportation were all greatly affected. The reduction in people's outside social activities and shortage in logistics capacity during the Spring Festival also affect consumption of clothing, cosmetics, jewelries, automobiles and so on. Although medicine, communications and online consumptions may be relatively strong, this will be difficult to offset the impact on consumption in other areas.

As to investment, the new coronavirus outbreak is likely to have bigger negative impact compared to the 2003 SARS outbreak. It might be difficult for migrant workers to return to work in short term, as many provinces have postponed resumption of business to not before February 9th. Although this date is similar to those of previous years, it is likely to take longer for migrant workers to return to work this year as a number of cities are closed down, inter-provincial buses are partially suspended, and regional railway transports are reduced. From the supply side, the epidemic will lead to insufficient supply of equipment and raw materials, while from the investment side, it will delay the start of production equipment installation and plant construction.

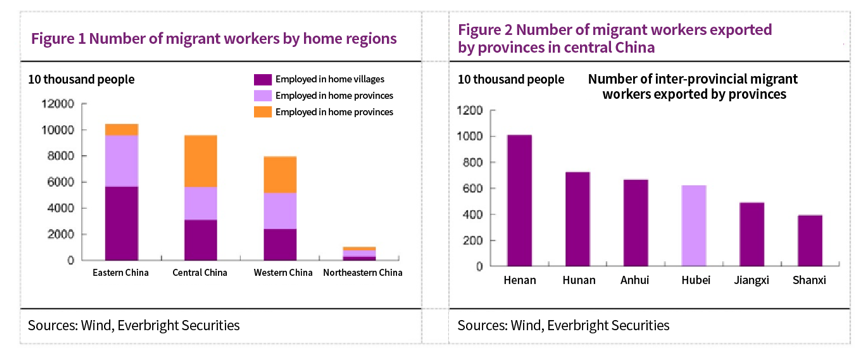

According to the data of the National Bureau of Statistics, there were 280 million migrant workers in China in 2018, of which 95 million were from the six provinces of central China. Of the 95 million, 40% were inter-provincial migrant workers, the highest proportion among eastern, central and western regions of China (Figure 1). Based on the population size of Hubei province, it is estimated that the number of migrant workers coming from Hubei province is about 6.2 million (Figure 2).

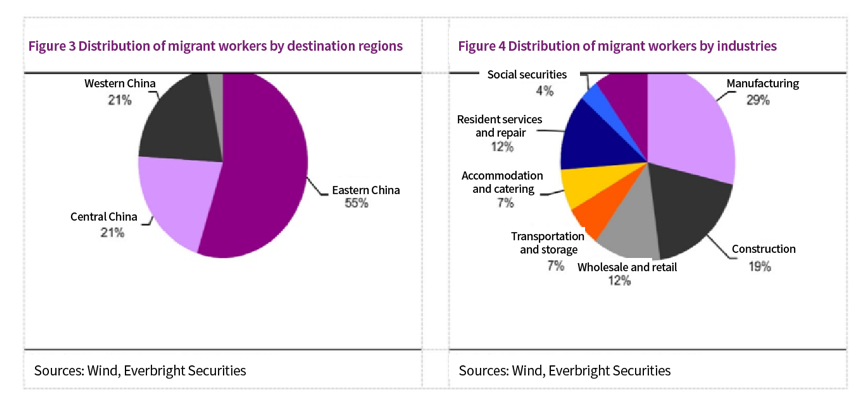

If traffic in central provinces like Hubei cannot be restored in time, combined with reduced willingness to work outside hometown among some of the migrant workers, the resumption of business operation will be negatively affected. In terms of destinations, 55% of migrant workers flow into eastern regions of China, which means that eastern, especially coastal provinces will be hit by workforce shortage after the holiday (Figure 3). Industry-wise, 29% of migrant workers are engaged in manufacturing and 19% in construction. The two industries are expected to be hit more heavily (Figure 4).

In short term, the epidemic will lead to the decline in investment growth, but with the epidemic gradually getting controlled, a follow-up rush may take place to make up for the decline.

The impact of the epidemic on import and export will be more prominent in the first quarter of 2020, while full-year impact will depend on the duration of the epidemic. Overall, the impact on import will be greater than that on export. The demand for exports comes from abroad while the production happens domestically; imports reflect internal demand while production happens abroad. As the epidemic is mainly concentrated in China, external demand is not changed too much, but domestic production is greatly impacted. The impact of the epidemic on import and export depends on how long the epidemic will last. The outbreak of the epidemic coincided with the Spring Festival holiday, and many enterprises had planned to resume business around the Lantern Festival. If the epidemic could be well controlled and the enterprises could start work more or less as planned, the impact on the production of export enterprises would be smaller.

However, if the epidemic continues into May and June, the recovery of production will get delayed significantly, and the impact on exports will be significantly increased. In this pessimistic scenario, annual import growth rate could turn negative, while export growth rate could be close to zero. On January 30th, the World Health Organization declares the epidemic in China a Public Health Emergency of International Concern, which may affect international trade, especially exports, but the impact should be slight. The key determinant is still the future development of the epidemic.

There are many uncertainties in the quantitative estimation of the epidemic's impact on economic growth. Based on relatively optimistic and pessimistic scenarios, GDP growth in 2020 may be reduced by 0.4-1.0 percentage points as a result of the epidemic. What is more noteworthy is that the impact of the epidemic is temporary. After the epidemic, GDP growth will return to normal trend, which means that economic growth will have a significant rebound in 2021, probably back to the level above 6.0%. The epidemic itself will not change the long-term economic trend, and the more the economic growth declines in short term, the stronger the economy will rebound in the future.

IV. Impact on capital market

The impact of the epidemic on the capital market is reflected in two aspects - investor sentiment and economic fundamentals. Market volatility will increase, but negligible in the long run. In the early stage of diffusion, an epidemic is more likely to trigger emotional disturbance. The disease in 2003 was officially named SARS on January 21st 2003, and the Shanghai Composite Index fell by 1.87% that day. The Index fell by 1.24% on March 6th 2003, when the first SARS case in Beijing was confirmed and fell about 4% in the next six trading days. But the Shanghai Composite Index showed an oscillating upward trend overall, and hit a periodic peak on April 15th 2003, up about 24% from January 2nd.

At its peak, SARS' impact on the market was determined by the degree to which it affected economic fundamentals. On April 15th 2003, the World Health Organization listed China's provinces of Guangdong and Shanxi, as well as Hong Kong, as affected areas, following which the Shanghai Composite Index fell from its peak by about 9%. Since then the Index rebounded for a while, but did not return to the level of April 15th. The fundamental cause was weakening economic data.

When the SARS epidemic reached an end, the long-term impact on the market could be ignored. From June 24th 2003 when WHO removed the Chinese mainland from the list of affected areas, to November 18th 2003 (on which day Shanghai Composite Index was 1316) when the continuous decline (by 13% cumulatively) in Shanghai Composite Index came to an end, the Index had fallen below the low point at the beginning of 2003 when the market just started to rise (on January 3rd 2003, Shanghai Composite Index was 1319 points). This was a significant contrast to the volatile upward trend of the market which was shocked during the SARS spread period. The reason behind is that the rapid decline of economic growth in the second quarter of 2003 further led to deterioration of investor expectations. However, economic data released in October disproved this pessimism, and the market rebounded in November. From November 18th 2003 to April 6th 2004, the Shanghai Composite Index rose by 35%, which offset the decline in the third quarter of 2003, and hit a new high of 1777 points. As to the bond market performance, it went through increased volatility during the SARS period, but overall, affected by poor economic expectations, there was a clear decline in the 10-year Treasury yields in May 2003 and it oscillated at the bottom from June to August. However, as the epidemic subsided and the economy recovered, bond yields rebounded significantly, especially after the release of the third quarter economic data in October.

In short, as the epidemic is still spreading, it would be inevitable for the market to see some disturbance in the short-term. Take Hong Kong stocks as an example, the market resumed trading on January 29th and the Hang Seng Index fell 5.4% on the following two trading days. In medium term which lasts about a quarter, we need to observe the impact of the epidemic on economic fundamentals. In the long-term (beyond one year), the impact on the market can be ignored.

V. Policy response: focusing on structure, not aggregate amount

Under the current situation, policymaking is facing two choices. First, the more stringent the measures used to control the epidemic, the greater the impact on economic activities, so what is the trade-off? Second, how would macroeconomic policymaking balance between the aggregate amount and structure in order to effectively respond to the impact of the epidemic?

As mentioned above, the impact of the epidemic on the economy is highly possible short-term but will not change the long-term trend of economic development. Therefore, it is necessary to take strict prevention and control measures in the short term, and there is no need to consider making trade-offs between controlling the epidemic and curbing its economic impact. Take the 1918-1919 influenza pandemic in the United States as an example. It claimed 675,000 lives in the US, among which, 550,000 deaths were abnormal that should not have happened without the pandemic, and most of the deaths occurred among workforce population aging from 15 to 44. Although the influenza caused huge population loss, empirical studies show it did not change the long-term growth trend of the US economy. In the ten years following the pandemic, economic growth rapidly regressed to the potential growth rate[Endnote 1].

Some views believe that the current situation in China is different from that during the 2003 SARS period. China no longer has demographic dividend and support from the WTO, and there is a relatively big real estate bubble and downward pressure already exists. With additional shock from the coronavirus outbreak, the economy appears to be near collapse. However, the epidemic is not the cause of continued decline in economic growth because the current potential growth rate itself is lower than that of 20 years ago.

For macroeconomic policymaking, it is important to understand that the impact of the epidemic is short-term. Therefore, policy response should focus on providing targeted support to industries, regions and groups that are seriously affected, rather than flooding the market with liquidity. In other words, macroeconomic policy should focus on the structure, rather than the aggregate amount. Although monetary policy may be looser compared to normal situations, the main policy choice should be fiscal expansion including reducing revenue and increasing expenditure.

The central economic work conference at the end of 2019 relaxed the monetary policy tone to being "flexible and moderate" from the previous "moderate" stance. At the beginning of the year, the central bank released 800 billion yuan of long-term funds by easing bank reserve requirement and injected 300 billion yuan via one-year Medium-Term Lending Facility (MLF). In addition to guiding banks to provide credit support to industries and regions affected by the epidemic, the central bank is also expected to moderately increase total liquidity. However, different from the SARS period, monetary easing will be limited by the housing price and leverage ratio in China.

As to fiscal policy, as SARS had little impact on investment in 2003, government mainly used reduction and exemption of tax and government funds to support industries heavily hit such as catering, accommodation, tourism, entertainment, civil aviation, as well as other public transport including highway and waterway passenger transport, and taxis [Endnote 2].

Based on the above analysis, the 2019 n-CoV epidemic will put a drag on investment and consumption, and fiscal policy efforts are likely to be greater compared to the SARS period. The reduction of fiscal revenue may be similar to 2003, meaning that more affected industries will likely receive reduction or exemption of taxes and government funds. As to increase in government expenditure, the budget deficit rate is expected to rise to 3%, with special purpose bond issuance probably far exceeding original expectation (which was 3 trillion yuan). There is also a possibility of issuing special construction treasury bonds. "Quasi-fiscal" measures such as issuing urban investment bonds and policy bank bonds are also expected to intensify.

1. Elizabeth Brainerd, Mark V. Siegler, The Economic Effects of the 1918 Influenza Epidemic, June 2002.